|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2015-2020年全球及中国ADAS摄像头产业链研究报告 |

|

字数:3.0万 |

页数:143 |

图表数:162 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2500美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2800美元 |

|

编号:ZLC032

|

发布日期:2016-06 |

附件:下载 |

|

|

|

随着全世界汽车安全标准和汽车电子化水平的不断提高,以及人们对驾驶安全需求的不断增长,全球ADAS市场进入了高速成长期,进一步推动了车载摄像头市场的快速发展。

1、全球市场:

2015年全球前置摄像头出货量达910万个,后视和环视用摄像头出货量合计达3740万个。随着ADAS系统渗透率的逐步提高,未来全球车载摄像头出货量将稳步增长。预计到2020年,全球前置摄像头出货量将达3300万个,后视及环视用摄像头出货量合计达9790万个。

2015年,全球后视系统和环视系统出货量分别达到1380万套和590万套。未来几年全球后视和环视系统出货量都将处于高速增长阶段,预计到2020年出货量将分别达到2510万套和1820万套。

目前,全球ADAS视觉系统厂商主要包括Magna、Clarion、TRW(ZF)、Continental、Autoliv、Valeo等。2015年,Magna、Hitachi、TRW(ZF)和Continental所占市场份额相对更高,分别达15%、13%、11%和10%。其中,环视系统市场主要由Clarion和Valeo占据,2015年二者占据了40%的市场份额;后视系统有20%的市场由汽车厂商内部完成,而独立供应商则以Panasonic和Magna的市场份额相对最高,2015年合计市场份额达30%。

2、中国市场:

目前,中国车载摄像头产能约2570万个。随着产能的不断扩大,预计到2020年产能有望突破1亿个,达到1.095亿个。2015年,中国车载摄像头前装市场规模达1000万个,预计到2020年将达3865万个。

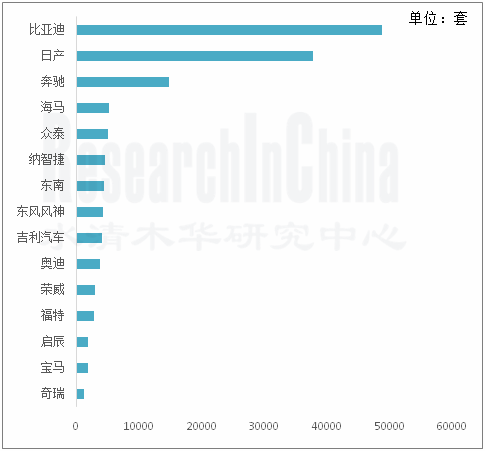

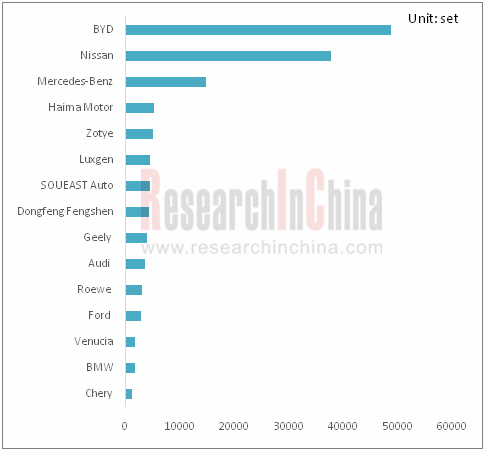

2016年1-4月,中国环视系统和疲劳监测系统预装量分别达15.2万套和13.2万套,预计全年预装量将分别达46万套和40万套。预计到2020年,中国环视系统和疲劳监测系统预装量将分别达到135万套和115万套。

表:2016年1-4月中国主要汽车厂商环视系统预装量TOP15

来源:水清木华研究中心

《2015-2020年全球及中国ADAS摄像头产业链研究报告》主要包括以下内容:

ADAS摄像头概述,包括定义、分类、特点、产业链以及应用分析;

全球及中国ADAS摄像头行业概况,包括全球市场和中国市场的发展现状、发展趋势。 全球及中国ADAS摄像头行业概况,包括全球市场和中国市场的发展现状、发展趋势。

ADAS摄像头产业链分析,包括对摄像头模组市场、CMOS传感器市场和系统集成市场的市场规模和竞争格局进行分析。 ADAS摄像头产业链分析,包括对摄像头模组市场、CMOS传感器市场和系统集成市场的市场规模和竞争格局进行分析。

ADAS摄像头产业链主要厂商分析,其中包括6家ADAS摄像头模组厂商、7家CMOS传感器厂商、6家系统集成厂商和1家芯片与算法厂商。 ADAS摄像头产业链主要厂商分析,其中包括6家ADAS摄像头模组厂商、7家CMOS传感器厂商、6家系统集成厂商和1家芯片与算法厂商。

With the enhancement of worldwide automotive safety standards and automotive electronization as well as people's growing demand for safe driving, the global ADAS market has entered a rapid growth stage, which further promotes the radical development of the car camera market.

1.Global Market:

In 2015, the global front camera shipments hit 9.1 million, and that of rear view and surround view cameras totaled37.4 million. With the gradual escalation of ADAS penetration, the global car camera shipments will grow steadily. By 2020, the global front camera shipments will reach 33 million, and that of rear view and surround view cameras will add up to 97.9 million.

In 2015, the global shipments of rear view systems and surround view systems arrived at 13.8 million and 5.9 million sets respectively. In the next few years, the figures will be in the high growth phase and will soar to 25.1 million units and 18.2 million sets by 2020 respectively.

Currently, the global ADAS vision system vendors include Magna, Clarion, TRW (ZF), Continental, Autoliv, Valeo, etc.. In 2015, Magna, Hitachi, TRW (ZF) and Continental seized the market share of 15%, 13%, 11% and 10% relatively. Wherein, the surround view system market is mainly occupied by Clarion and Valeo, which enjoyed a combined 40% market share in 2015; 20%of the rear view system market is dominated by automobile manufacturers, while independent suppliers Magna and Panasonic grasped the highest market share of 30% in 2015 jointly.

2. Chinese Market:

At present, China’s car camera capacity is about 25.7 million. With the continuous expansion, the annual capacity is expected to exceed 100 million to 109.5 million by 2020. In 2015, Chinese car camera OEM market size equaled to 10 million; by 2020, it is expected to reach 38.65 million.

From January to April of 2016, China preinstalled 152,000 sets of surround view system and 132,000 sets of fatigue monitoring system; the pre-installations in 2016 are expected to be 460,000 and 400,000 sets respectively. By 2020, the pre-installed capacity will jump to 1.35 million and 1.15 million sets separately.

TOP15 Chinese Automobile Vendors by Surround View System Pre-installation, Jan-Apr 2016

Source: ResearchInChina

The report includes the following aspects:

Overview (including definition, classification, characteristics, industry chain and application) of ADAS cameras; Overview (including definition, classification, characteristics, industry chain and application) of ADAS cameras;

Overview of global and China ADAS camera industry, including status quo and trends; Overview of global and China ADAS camera industry, including status quo and trends;

Analysis on ADAS camera industry chain, embracing market size and competitive pattern of camera modules, CMOS sensors and system integration; Analysis on ADAS camera industry chain, embracing market size and competitive pattern of camera modules, CMOS sensors and system integration;

Analysis on major ADAS camera vendors, including 6 ADAS camera module vendors, 7 CMOS sensor vendors, 6 systems integrators and a chip and algorithm vendor. Analysis on major ADAS camera vendors, including 6 ADAS camera module vendors, 7 CMOS sensor vendors, 6 systems integrators and a chip and algorithm vendor.

第一章 ADAS摄像头概述

1.1 定义

1.2 分类

1.3 特点

1.4 产业链

1.5 应用分析

1.5.1 车道偏离预警

1.5.2 自动紧急刹车系统

1.5.3 夜视系统

1.5.4 泊车辅助

1.5.5 疲劳监测预警

第二章 全球及中国ADAS摄像头行业概况

2.1 全球市场

2.2 中国市场

2.2.1 发展现状

2.2.2 市场规模

2.2.3 产能情况

2.2.4 环视系统市场

2.2.5 疲劳监测市场

2.3 发展趋势

第三章 ADAS摄像头产业链分析

3.1 摄像头模组

3.1.1 市场规模

3.1.2 竞争格局

3.2 CMOS传感器

3.2.1 市场规模

3.2.2 竞争格局

3.2.3 厂商配套情况

3.3 系统集成

3.3.1 市场规模

3.3.2 竞争格局

第四章 ADAS摄像头模组厂商

4.1 采埃孚天合

4.1.1 企业简介

4.1.2 经营情况

4.1.3 业务分析

4.2 MCNEX

4.2.1 企业简介

4.2.2 经营情况

4.2.3 业务分析

4.3 Gentex

4.3.1 企业简介

4.3.2 经营情况

4.3.3 业务分析

4.4 Fujitsu-Ten

4.4.1 企业简介

4.4.2 经营情况

4.4.3 业务分析

4.5 索尼

4.5.1 企业简介

4.5.2 经营情况

4.5.3 业务分析

4.6 比亚迪

4.6.1 企业简介

4.6.2 经营情况

4.6.3 业务分析

第五章 CMOS传感器厂商

5.1 安森美

5.1.1 企业简介

5.1.2 经营情况

5.1.3 业务分析

5.2 索尼

5.2.1 企业简介

5.2.2 业务分析

5.3 东芝

5.3.1 企业简介

5.3.2 经营情况

5.3.3 业务分析

5.4 三星电子

5.4.1 企业简介

5.4.2 经营情况

5.4.3 业务分析

5.5 Omnivision

5.5.1 企业简介

5.5.2 经营情况

5.5.3 业务分析

5.6 格科微电子

5.6.1 企业简介

5.6.2 业务分析

5.7 思比科微电子

5.7.1 企业简介

5.7.2 经营情况

5.7.3 业务分析

第六章 系统集成厂商

6.1 麦格纳

6.1.1 企业简介

6.1.2 经营情况

6.1.3 业务分析

6.2 大陆集团

6.2.1 企业简介

6.2.2 经营情况

6.2.3 业务分析

6.3 法雷奥

6.3.1 企业简介

6.3.2 经营情况

6.3.3 业务分析

6.4 奥托立夫

6.4.1 企业简介

6.4.2 经营情况

6.4.3 客户情况

6.4.4 业务分析

6.5 松下

6.5.1 企业简介

6.5.2 经营情况

6.5.3 业务分析

6.6 Clarion

6.6.1 企业简介

6.6.2 经营情况

6.6.3 业务分析

第七章 芯片与算法厂商Mobileye

7.1 企业简介

7.2 经营情况

7.3 业务分析

1 Overview of ADAS Camera

1.1 Definition

1.2 Classification

1.3 Features

1.4 Industry Chain

1.5 Applications

1.5.1 Lane Departure Warning

1.5.2 Automatic Emergency Braking System

1.5.3 Night Vision System

1.5.4 Parking Assist

1.5.5 Fatigue Monitoring and Early Warning

2 Overview of Global and Chinese ADAS Camera Industry

2.1 Global Market

2.2 Chinese Market

2.2.1 Status Quo

2.2.2 Market Size

2.2.3 Capacity

2.2.4 Surround View System Market

2.2.5 Fatigue Monitoring Market

2.3 Trends

3 ADAS Camera Industry Chain

3.1 Camera Module

3.1.1 Market Size

3.1.2 Competitive Pattern

3.2 CMOS Sensor

3.2.1 Market Size

3.2.2 Competitive Pattern

3.2.3 Supply

3.3 System Integration

3.3.1 Market Size

3.3.2 Competitive Pattern

4 ADAS Camera Module Vendors

4.1 ZF TRW

4.1.1 Profile

4.1.2 Operation

4.1.3 Business Analysis

4.2 MCNEX

4.2.1 Profile

4.2.2 Operation

4.2.3 Business Analysis

4.3 Gentex

4.3.1 Profile

4.3.2 Operation

4.3.3 Business Analysis

4.4 Fujitsu Ten

4.4.1 Profile

4.4.2 Operation

4.4.3 Business Analysis

4.5 Sony

4.5.1 Profile

4.5.2 Operation

4.5.3 Business Analysis

4.6 BYD

4.6.1 Profile

4.6.2 Operation

4.6.3 Business Analysis

5 CMOS Sensor Vendors

5.1 ON Semiconductor

5.1.1 Profile

5.1.2 Operation

5.1.3 Business Analysis

5.2 Sony

5.2.1 Profile

5.2.2 Business Analysis

5.3 Toshiba

5.3.1 Profile

5.3.2 Operation

5.3.3 Business Analysis

5.4 Samsung Electronics

5.4.1 Profile

5.4.2 Operation

5.4.3 Business Analysis

5.5 Omnivision

5.5.1 Profile

5.5.2 Operation

5.5.3 Business Analysis

5.6 GalaxyCore

5.6.1 Profile

5.6.2 Business Analysis

5.7 Superpix Micro Technology

5.7.1 Profile

5.7.2 Operation

5.7.3 Business Analysis

6 System Integration Vendors

6.1 Magna

6.1.1 Profile

6.1.2 Operation

6.1.3 Business Analysis

6.2 Continental

6.2.1 Profile

6.2.2 Operation

6.2.3 Business Analysis

6.3 Valeo

6.3.1 Profile

6.3.2 Operation

6.3.3 Business Analysis

6.4 Autoliv

6.4.1 Profile

6.4.2 Operation

6.4.3 Clients

6.4.4 Business Analysis

6.5 Panasonic

6.5.1 Profile

6.5.2 Operation

6.5.3 Business Analysis

6.6 Clarion

6.6.1 Profile

6.6.2 Operation

6.6.3 Business Analysis

7 Chip and Algorithm Vendor --- Mobileye

7.1 Profile

7.2 Operation

7.3 Business Analysis

图:Significant milestones in camera-based applications

表:双目和单目摄像头解决方案对比

表:车载摄像头与手机摄像头规格对比

表:前装与后装摄像头性能对比

图:车载摄像头产业链

表:车载摄像头主要功能

图:车载摄像头的ADAS应用

图:车道偏离预警系统原理

图:车道检测摄像头

图:自动紧急刹车系统组成

图:自动紧急刹车系统工作原理

图:2000-2015年新车中FCW系统的配置情况

图:2000-2015年新车中AEB系统的配置情况

图:夜视系统组成结构

表:夜视技术分类

图:泊车辅助系统工作原理

图:DM系统驾驶员状态检测方法

图:DM系统判定驾驶员驾驶状态的认知维度

图:2014-2020E全球前置摄像头出货量

图:2014-2020E全球后视和环视系统出货量

图:2014-2020E全球后视和环视系统用摄像头出货量

图:中国主要进军车载摄像头产业链的企业

图:2015-2020E中国车载摄像头前装市场规模

图:2014-2020E中国车载摄像头产能

表:2016年中国环视系统预装量(分厂家)

图:2016-2020E中国环视系统预装量

图:2016-2020E中国环视系统用摄像头预装量

表:2016年中国疲劳监测系统预装量(分厂家)

图:2016-2020E中国疲劳监测系统预装量

表:各国推动ADAS普及的相关政策

图:2014-2020E全球车载摄像头模组出货量

图:2015年全球汽车摄像头模组厂商市场份额

图:2015年全球CMOS图像传感器市场份额(分行业)

图:2020年全球CMOS图像传感器市场份额(分行业)

图:2014-2020E全球CMOS图像传感器市场规模

图:2015-2020E全球车用CMOS图像传感器市场规模

图:2015年全球汽车CMOS图像传感器厂商市场份额

表:日系汽车厂商与ADAS传感器供应商配套情况

图:美韩中系汽车厂家与ADAS传感器供应商配套关系

表:欧系汽车厂商与ADAS传感器供应商配套关系

图:2014-2020E全球后视和环视系统出货量

图:2015年全球ADAS视觉系统供应商市场份额

图:2015全球环视系统供应商市场份额

图:2015年全球后视供应商市场份额

图:2010-2015采埃孚天合营业收入及净利润

图:2010-2015Q1采埃孚天合(分部门)营收构成

图:2010-2014采埃孚天合(分地区)营收构成

图:2010-2014采埃孚天合(分客户)营收构成

图:2010-2015Q1采埃孚天合毛利率

表:ZF TRW车载摄像头应用

表:ZF TRW车载摄像头模组客户

图:2013-2015年MCNEX销售额

表:MCNEX销售收入(分产品)

表:MCNEX摄像头模块销售额(分地区)

表:MCNEX产品单价

图:2011-2015年Gentex营业收入及净利润

图:2013-2015年Gentex汽车产品收入(分地区)

图:2013-2015年Gentex汽车产品收入构成(分地区)

图:2011-2015年Gentex毛利率

图:2011-2015年Gentex研发支出

图:FY2012-2015E富士通天营业收入及净利润

图:FY2013-2015E富士通天营业收入(分部门)

图:FY2013-2015E富士通天营业收入构成(分部门)

图:富士通天“Multi-Angle Vision™”系统

图:富士通天360度环绕影像硬件结构

图:富士通天360度环绕影像软件系统

图:FY2014-2016年索尼营业收入及净利润

表:FY2014-2016索尼营业收入(分部门)

表:FY2014-2016索尼营业收入构成(分部门)

表:FY2014-2016索尼营业收入(分地区)

表:FY2014-2016索尼营业收入构成(分地区)

图:FY2015-2016年索尼Devices部门营业收入

图:2011-2015年比亚迪营业收入及净利润

图:2014-2015年比亚迪营业收入(分产品)

图:2014-2015年比亚迪营业收入(分地区)

图:2014-2015年比亚迪研发支出

图:比亚迪摄像头模组产品结构图

表:比亚迪摄像头模组

图:2013-2015年安森美营业收入及净利润

图:2013-2015年安森美营业收入(分部门)

图:2014-2015年安森美毛利率

表:安森美AR0135传感器产品规格

表:安森美AR0237传感器产品规格

表:安森美PYTHON25K传感器产品规格

图:FY2015-2016年索尼Devices部门营业收入

表:索尼最新CMOS影像传感器产品

表:索尼IMX253-255LLR/LQR CMOS传感器参数

图:FY2011-2015东芝营业收入及营业利润

表:FY2014-2015年东芝营业收入(分部门)

图:FY2015东芝营业收入构成(分部门)

图:FY2011-2015年东芝研发支出

图:东芝ADAS前方和四周监控解决方案

图:东芝ADAS单目摄像头前方监控解决方案

图:东芝ADAS单目摄像头后方监控解决方案

图:东芝CSA02M00PB产品规格

图:FY2014-2015三星电子营业收入及净利润

表:FY2014-2015年三星电子营业收入(分部门)

图:FY2014-2016年Omnivision营业收入及净利润

图:Omnivision的OV10642 CMOS传感器产品规格

图:Omnivision的OV10642 CMOS传感器产品特点

图:格科微电子主要CMOS图像传感器产品

表:格科微电子CMOS图像传感器发展历程

图:2013-2015年思比科营业收入及净利润

图:2013-2015年思比科毛利率

图:2013-2015年思比科研发支出

表:2013-2015年思比科微电子前五名客户

表:思比科微电子主要图像传感器产品

图:2010-2015麦格纳营业收入及净利润

图:2010-2015麦格纳(分产品)营收构成

图:2010-2015麦格纳(分地区)营收构成

图:2010-2015麦格纳(分客户)营收构成

图:2010-2015麦格纳毛利率

图:麦格纳ADAS主要基于摄像头技术

图:2013年麦格纳在全球及北美机器视觉市场份额

图:Front Camera System Gen 1.0

图:Front Camera System Gen2.0

图:Front Camera System Gen2.5

图:Front Camera System Gen3.0

图:麦格纳摄像头技术路线图

图:2009-2015 Continental营业收入&EBIT

图:2011-2015年Continental分部门营收占比

图:2011-2015年Continental分地区营收占比

图:2013-2015年大陆集团研发支出

图:2011-2015 Continental底盘与安全事业部销售收入

表:Continental ADAS全球生产基地&研发中心

图:大陆集团360度全景泊车零部件

表:大陆集团自动驾驶路线图

图:ContiGuard集成主、被动安全系统功能

图:Continental集成安全算法

图:2010-2015法雷奥营业收入及净利润

图:2010-2015法雷奥(分部门)营收构成

图:2010-2015法雷奥(分地区)营收构成

图:2010-2015法雷奥(分市场)营收构成

图:2010-2015法雷奥毛利率

图:2010-2015年法雷奥CDA部门收入

图:法雷奥ADAS用摄像头应用情况

表:法雷奥CDA摄像头产品线

图:法雷奥ADAS及摄像头解决方案发展路线

图:2010-2015奥托立夫营业收入及净利润

图:2010-2015奥托立夫毛利率

图:Autoliv全球分布

图:Autoliv全球工厂分布

图:2010-2015奥托立夫(分产品)营收构成

图:2010-2015奥托立夫(分地区)营收构成

图:2009-2014年奥托立夫各项产品产量

图:2011-2015年Autoliv销售占比超过10%的客户

图:2015年Autoliv客户销售占比

图:奥托立夫Mono-vision camera

图:FY2014-2016松下销售收入及净利润

图:FY2014-2016年松下营业收入(分部门)

图:FY2014-2016年松下营业收入构成(分部门)

图:FY2014-2016年松下研发支出

图:歌乐的下一代全景影像泊车

图:歌乐商用车360环视系统:Surroundeye

图:2011-2015Mobileye营业收入及净利润

图:2012-2015Mobileye(分部门)营收构成

图:2014-2015 Mobileye(分部门)毛利率

图:2013-2015年Mobileye营业收入(分地区)

图:2015年Mobileye营业收入构成(分地区)

图:2011-2015Mobileye毛利率

图:Mobileye产品路线图

图:2007-2016年Mobileye出货量

Significant Milestones in Camera-based Applications

Comparison of Solutions between Monocular Cameras and Binocular Cameras

Comparison of Specifications between Car Cameras and Cellphone Cameras

Comparison of Performances between Front Cameras and Rear Cameras

Car Camera Industry Chain

Main Features of Car Cameras

ADAS Applications of Car Cameras

Principles of Lane Departure Warning System

Lane Detection Cameras

Composition of Automatic Emergency Braking System

Working Principles of Automatic Emergency Braking System

FCW System Configurations in New Cars, 2000-2015

AEB System Configurations in New Cars, 2000-2015

Composition and Structure of Night Vision System

Classification of Night Vision Technology

Working Principles of Park Assist System

Method of Driver State Detection in DM System

Cognitive Dimension of Driver State Determination in DM System

Global Shipments of Front Cameras, 2014-2020E

Global Shipments of Rear View and Surround View Systems, 2014-2020E

Global Shipments of Rear View and Surround View System Cameras, 2014-2020E

Major Enterprises Entering the Car Camera Industry Chain in China

China’s Car Camera OEM Market Size, 2015-2020E

China’s Car Camera Capacity, 2014-2020E

China’s Pre-installations of Surround View Systems (by Vendor), 2016

China’s Pre-installations of Surround View Systems, 2016-2020E

China’s Pre-installations of Surround View System Cameras, 2016-2020E

China’s Pre-installations of Fatigue Detection Systems (by Vendor), 2016

China’s Pre-installations of Fatigue Detection Systems, 2016-2020E

National Policies on Promoting the Popularization of ADAS

Global Shipments of Car Camera Modules, 2014-2020E

Global Market Share of Car Camera Module Vendors, 2015

Global CMOS Image Sensor Market Share (by Sector), 2015

Global CMOS Image Sensor Market Share (by Sector), 2020E

Global CMOS Image Sensor Market Size, 2014-2020E

Global Automotive CMOS Image Sensor Market Size, 2015-2020E

Global Market Share of Automotive CMOS Image Sensor Vendors, 2015

Supporting Relationships between Japanese Automakers and ADAS Sensor Suppliers

Supporting Relationships between U.S/Korean/Chinese Automakers and ADAS Sensor Suppliers

Supporting Relationships between European Automakers and ADAS Sensor Suppliers

Global Shipments of Rear View and Surround View Systems, 2014-2020E

Global Market Share of ADAS Vision System Suppliers, 2015

Global Market Share of Surround View System Suppliers, 2015

Global Market Share of Rear View System Suppliers, 2015

ZF TRW’s Revenue and Net Income, 2010-2015

ZF TRW’s Revenue Structure (by Division), 2010-2015Q1

ZF TRW’s Revenue Structure (by Region), 2010-2014

ZF TRW’s Revenue Structure (by Customer), 2010-2014

ZF TRW’s Gross Margin, 2010-2015Q1

ZF TRW’s Car Camera Applications

ZF TRW’s Car Camera Module Customers

MCNEX’s Sales, 2013-2015

MCNEX’s Sales (by Product)

MCNEX’s Camera Module Sales (by Region)

MCNEX’s Unit Price

Gentex’s Revenue and Net Income, 2011-2015

Gentex’s Automotive Product Revenue (by Region), 2013-2015

Gentex’s Automotive Product Revenue Structure (by Region), 2013-2015

Gentex’s Gross Margin, 2011-2015

Gentex’s R&D Expenditure, 2011-2015

Fujitsu Ten’s Revenue and Net Income, FY2012-2015E

Fujitsu Ten’s Revenue Breakdown (by Division), FY2013-2015E

Fujitsu Ten’s Revenue Structure (by Division), FY2013-2015E

Fujitsu Ten’s Multi-Angle Vision™ System

Fujitsu Ten’s 360-degree Surround Video Hardware Structure

Fujitsu Ten’s 360-degree Surround Video Software System

Sony’s Revenue and Net Income, FY2014-2016

Sony’s Revenue Breakdown (by Division), FY2014-2016

Sony’s Revenue Structure (by Division), FY2014-2016

Sony’s Revenue Breakdown (by Region), FY2014-2016

Sony’s Revenue Structure (by Region), FY2014-2016

Sony Devices’ Revenue, FY2015-2016

BYD’s Revenue and Net Income, 2011-2015

BYD’s Revenue Breakdown (by Product), 2014-2015

BYD’s Revenue Breakdown (by Region), 2014-2015

BYD’s R&D Expenditure, 2014-2015

BYD’s Camera Module Product Structure

BYD’s Camera Modules

ON Semiconductor’s Revenue and Net Income, 2013-2015

ON Semiconductor’s Revenue Breakdown (by Division), 2013-2015

ON Semiconductor’s Gross Margin, 2014-2015

ON Semiconductor’s AR0135 Sensor Product Specifications

ON Semiconductor’s AR0237 Sensor Product Specifications

ON Semiconductor’s PYTHON25K Sensor Product Specifications

Sony Devices’ Revenue, FY2015-2016

Sony’s Latest CMOS Image Sensor Product

Sony’s IMX253-255LLR/LQR CMOS Sensor Parameters

Toshiba’s Revenue and Operating Income, FY2011-2015

Toshiba’s Revenue Breakdown (by Division), FY2014-2015

Toshiba’s Revenue Structure (by Division), FY2015

Toshiba’s R&D Expenditure, FY2011-2015

Toshiba’s ADAS Front and Surround Monitoring Solutions

Toshiba’s ADAS Monocular Camera Front Monitoring Solutions

Toshiba’s ADAS Monocular Camera Rear Monitoring Solutions

Toshiba’s CSA02M00PB Product Specifications

Samsung Electronics’ Revenue and Net Income, FY2014-2015

Samsung Electronics’ Revenue Breakdown (by Division), FY2014-2015

Omnivision’s Revenue and Net Income, FY2014-2016

Omnivision’s OV10642 CMOS Sensor Product Specifications

Omnivision’s OV10642 CMOS Sensor Product Features

GalaxyCore’s Main CMOS Image Sensor Products

Development Course of GalaxyCore CMOS Image Sensors

Superpix Micro Technology’s Revenue and Net Income, 2013-2015

Superpix Micro Technology’s Gross Margin, 2013-2015

Superpix Micro Technology’s R&D Expenditure, 2013-2015

Superpix Micro Technology’s Top 5 Customers, 2013-2015

Superpix Micro Technology’s Main Image Sensor Products

Magn’s Revenue and Net Income, 2010-2015

Magn’s Revenue Structure (by Product), 2010-2015

Magn’s Revenue Structure (by Region), 2010-2015

Magn’s Revenue Structure (by Customer), 2010-2015

Magn’s Gross Margin, 2010-2015

Magn’s ADAS Systems Based on Camera Technology

Magn’s Share in Global and North American Machine Vision Market, 2013

Front Camera System Gen 1.0

Front Camera System Gen2.0

Front Camera System Gen2.5

Front Camera System Gen3.0

Magn’s Camera Technology Roadmap

Continental’s Revenue and EBIT, 2009-2015

Continental’s Revenue Structure (by Division), 2011-2015

Continental’s Revenue Structure (by Region), 2011-2015

Continental’s R&D Expenditure, 2013-2015

Sales of Continental Chassis & Safety Division, 2011-2015

Continental’s ADAS Production Bases and R&D Centers Worldwide

Continental’s 360-degree Panoramic Parking Components

Continental’s Automated Driving Roadmap

ContiGuard® Integrated Active/Passive Safety System Functions

Continental’s Integrated Safety Algorithm

Valeo’s Revenue and Net Income, 2010-2015

Valeo’s Revenue Structure (by Division), 2010-2015

Valeo’s Revenue Structure (by Region), 2010-2015

Valeo’s Revenue Structure (by Market), 2010-2015

Valeo’s Gross Margin, 2010-2015

Revenue of Valeo CDA Division, 2010-2015

Valeo’s ADAS Camera Applications

Valeo’s CDA Camera Product Line

Development Route for Valeo’s ADAS and Camera Solutions

Autoliv’s Revenue and Net Income, 2010-2015

Autoliv’s Gross Margin, 2010-2015

Global Distribution of Autoliv

Global Distribution of Autoliv’s Factories

Autoliv’s Revenue Structure (by Product), 2010-2015

Autoliv’s Revenue Structure (by Region), 2010-2015

Autoliv’s Output (by Product), 2009-2014

Autoliv’s Customers with the Proportion of Sales Exceeding 10%, 2011-2015

Autoliv’s Sales Structure (by Customer), 2015

Autoliv’s Mono-vision Camera

Panasonic's Sales and Net Income, FY2014-2016

Panasonic's Revenue Breakdown (by Division), FY2014-2016

Panasonic's Revenue Structure (by Division), FY2014-2016

Panasonic's R&D Expenditure, FY2014-2016

Clarion’s Next-generation Panoramic Image Parking

Clarion’s Commercial Vehicle 360 Surround View System: Surroundeye

Mobileye's Revenue and Net Income, 2011-2015

Mobileye's Revenue Structure (by Division), 2012-2015

Mobileye's Gross Margin (by Division), 2014-2015

Mobileye's Revenue Breakdown (by Region), 2013-2015

Mobileye's Revenue Structure (by Region), 2015

Mobileye's Gross Margin, 2011-2015

Mobileye's Product Roadmap

Mobileye's Shipments, 2007-2016

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|