|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2016-2020年中国电动汽车电机控制器行业研究报告 |

|

字数:6.0万 |

页数:246 |

图表数:256 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2700美元 |

英文纸版:2900美元 |

英文(电子+纸)版:3000美元 |

|

编号:LT029

|

发布日期:2016-07 |

附件:下载 |

|

|

|

电池、电机、电控是新能源汽车的三大核心部件,电动汽车驱动控制技术是电动汽车的核心技术之一,电机控制器的设计及其控制算法的开发是决定整个驱动系统性能的关键因素。

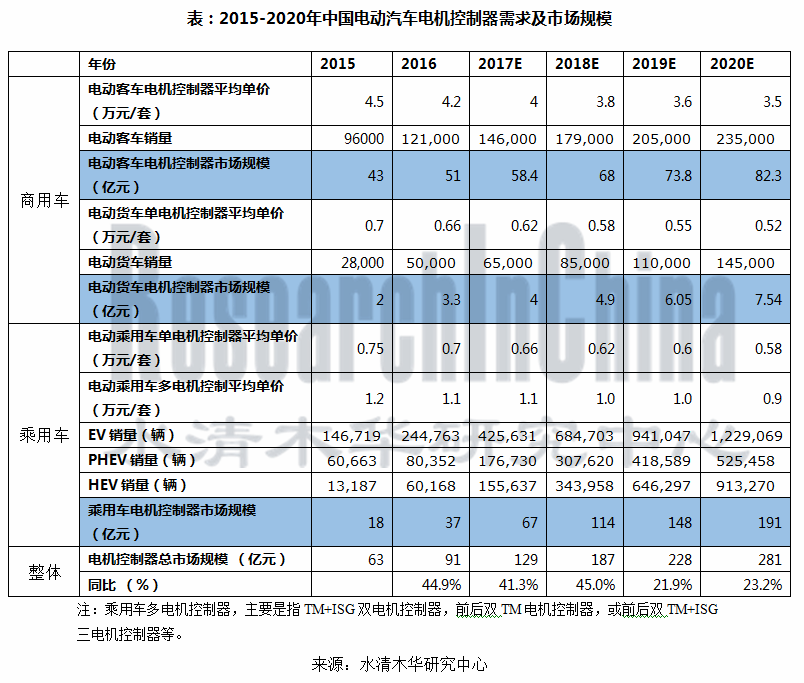

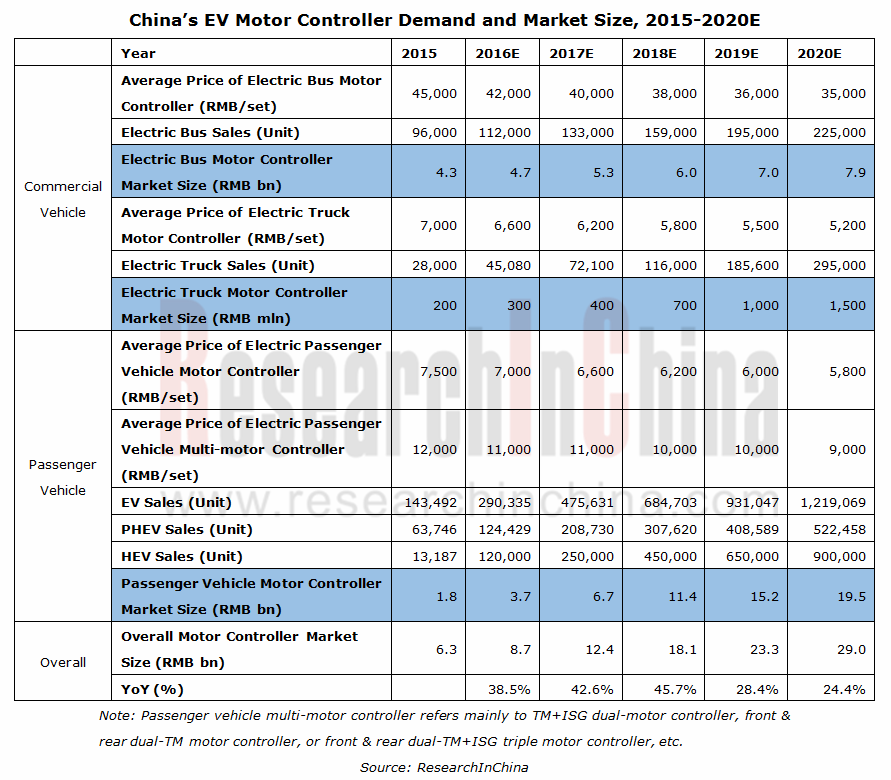

电机控制器价格根据其规格和性能要求有较大差异,目前大客车电机控制器价格一般为3~5万元,乘用车电机控制器价格一般为0.5~1.5万元。插电式混动乘用车(PHEV)和普通混合动力乘用车(HEV)一般采用多电机架构,包括TM电机和ISG电机,相应的电机控制器成本也更高。

此外,下一步电动汽车电驱动系统将逐渐向轮边电机或轮毂电机系统发展,也将提升电机控制器成本和控制策略的复杂程度。

照此估算,2015年中国电动汽车电机控制器需求量在38万套,市场规模在63亿元左右,现阶段市场集中于商用车领域;预计到2020年,在新能源汽车和普通混动动力汽车推动下,预计电动汽车电机控制器市场规模将攀升至290亿元,乘用车将占据主导地位。

尤其下一步,混合动力汽车有望实现大规模量产,无论是吉利和科力远合资的CHS系统,还是丰田THS系统实现国产化,都将推动中国本土电机控制器市场的持续扩大。

目前中国电动汽车电机控制器市场主要由国产品牌占据,外资产品因其价格较高等原因,在市场的培育和初期发展阶段所占份额较小。

2015年比亚迪以28.6%的市场占有率(按出货量计)成为中国电动乘用车电机控制器市场最大的厂商,其主要通过外购IGBT模块集成电机控制器,供应自身乘用车生产基地。其他市场份额较高的企业有大洋电机(包括上海电驱动)、英搏尔、汇川技术及联合电子等。

从产业链来看,电机控制器上游最核心的是IGBT模块。2015年全球电动汽车用IGBT模块市场规模在10亿美元左右。Fairchild、英飞凌、ST 在汽车IGBT市场占据优势。中国的比亚迪也在做相应的配套IGBT。目前,中国占全球IGBT市场约1/3的需求,但超过90%的IGBT模块需要进口。本土企业的IGBT模块主要集中在小功率应用领域,如空调、感应加热等。

目前电动汽车电机控制器主要还是采用以硅基材料为主的IGBT模块,但以SiC 为主的宽禁带半导体器件突破了硅材料半导体器件在耐压等级、工作温度、开关损耗和开关速度上的限制。例如日产Leaf,把电机、减速机、控制器一体化集成了。这代表了一个趋势,产品体积很小,可以做成标准化产品。

系统集成度的另一个方面是功能集成。未来电动汽车,有可能作为新能源电网的一个储能元件。这就要求车与电网的双向关联(V2G)。而车载的电机控制逆变器也可以用作把电池和电网双向连接的充电/回馈电网的逆变器,从而实现电机驱动和双向充电机的一体集成。

水清木华研究中心《2016中国电动汽车电机控制器行业研究报告》着重研究了以下内容:

电动汽车电机控制器主要技术路线及发展趋势; 电动汽车电机控制器主要技术路线及发展趋势;

上游IGBT、薄膜电容及下游电动汽车产业市场规模、竞争格局及主要政策分析等; 上游IGBT、薄膜电容及下游电动汽车产业市场规模、竞争格局及主要政策分析等;

电动汽车电机控制器行业政策、市场规模、供应链及竞争格局分析,全球主流电动汽车电机电控系统等; 电动汽车电机控制器行业政策、市场规模、供应链及竞争格局分析,全球主流电动汽车电机电控系统等;

中国19家电动汽车电机控制器厂商经营情况、电机控制器业务及技术; 中国19家电动汽车电机控制器厂商经营情况、电机控制器业务及技术;

全球6家IGBT厂商经营情况及电动汽车领域业务; 全球6家IGBT厂商经营情况及电动汽车领域业务;

全球8家汽车逆变器厂商经营情况及电动汽车领域业务等。 全球8家汽车逆变器厂商经营情况及电动汽车领域业务等。

Battery, motor and ECU are the three core components of new energy vehicle. EV drive control is one of core technologies for EV. Design of motor controller and development of control algorithm are critical factors determining performance of the whole drive system.

Motor controller prices vary greatly depending on specification and performance, generally RMB30,000-50,000 for large bus and RMB5,000-15,000 for passenger vehicle. PHEV and HEV usually adopt multi-motor architecture, including TM motor and ISG motor, thus resulting in higher costs of motor controller.

Furthermore, the evolution of EV e-drive system to wheel-side motor or wheel hub motor will also increase the cost of motor controller and complicate control strategy.

In such case, China’s demand for EV motor controller was 380,000 sets, generating a market size of around RMB6.3 billion (currently concentrated in commercial vehicle field) and, driven by new energy vehicle and conventional hybrid vehicle, estimated to swell to RMB29 billion in 2020 when passenger vehicle will prevail.

In particular, as hybrid vehicles are expected to be mass-produced on a large scale, either Corun Hybrid System Technology (CHS) co-funded by Geely and Hunan Corun New Energy or localization of Toyota THS will expand the market of homegrown motor controller in China.

Currently, the Chinese EV motor controller market is dominated by domestic brands, compared to fractional share of foreign products at the stage of market fostering and early development due to higher prices and other reasons.

BYD became the largest vendor in the Chinese electric passenger vehicle motor controller market with a share of 28.6% by shipment in 2015. The company purchases IGBT modules to assemble motor controllers which are supplied to its own passenger vehicle production bases. Other players with higher market share are Zhongshan Broad Ocean Motor (including Shanghai E-drive), Zhuhai Enpower Electric, Shenzhen Inovance Technology, and UAES.

From the perspective of industrial chain, IGBT module is the most core upstream component of motor controller. Global market size of EV IGBT module was about USD1 billion in 2015. Fairchild, Infineon, and ST have an upper hand in automotive IGBT market. However, Chinese BYD now is also engaged in IGBT. China accounts for about 1/3 of global IGBT demand but imports over 90% of its own demand. The IGBT modules produced by local companies are primarily used in low-power fields, such as air conditioner, induction heating, etc.

EV motor controller now employs mainly silicon-based IGBT module. However, SiC-dominated wide bandgap semiconductor devices have overcome the limitations of silicon-based semiconductor devices in terms of withstand voltage level, operating temperature, switching loss, and switching speed. For example, Nissan’s Leaf has integrated motor, speed reducer, and controller. This represents a trend in which the product can be more compact and standardized.

Another aspect of system integration is functional integration. EV may serve as an energy storage element of new energy grid in future, requiring bidirectional correlation of vehicle and grid (V2G). Vehicle-mounted motor control inverter can also be used as the inverter between battery and grid for charging and grid feedback, thus realizing integration of motor drive and bidirectional charger.

China EV (Electric Vehicle) Motor Controller Industry Report, 2016-2020 by ResearchInChina highlights the followings:

Main technology roadmaps and development trends of EV motor controller; Main technology roadmaps and development trends of EV motor controller;

Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.); Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.);

EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control system; EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control system;

19 Chinese EV motor controller enterprises (operation, motor controller business and technology, etc.); 19 Chinese EV motor controller enterprises (operation, motor controller business and technology, etc.);

6 global IGBT vendors (operation, business in EV field, etc.); 6 global IGBT vendors (operation, business in EV field, etc.);

8 global automotive inverter companies (operation, business in EV field, etc.) 8 global automotive inverter companies (operation, business in EV field, etc.)

第一章 电机控制器概述

1.1 产品定义

1.2 工作原理

1.3 产品分类

1.4 主要技术路线发展历程

1.4.1 Si IGBT Motor Conroller

1.4.2 SiC IGBT Motor Controller

1.5 技术发展趋势

1.5.1 模块化设计

1.5.2 智能化设计

1.5.3 集成化设计

第二章 产业链分析

2.1 上游IGBT市场

2.1.1 IGBT发展概况

2.1.2 市场规模

2.1.3 竞争格局

2.1.4 供应链

2.1.5 电动汽车IGBT市场

2.1.6 IGBT发展动向

2.2 上游薄膜电容市场

2.2.1 市场规模

2.2.2 产业链及制造工艺

2.2.3 竞争格局

2.2.4 电动汽车用薄膜电容市场

2.3 下游电动汽车市场

2.3.1 整体市场

2.3.2 电动乘用车

2.3.3 电动商用车

2.3.4 主要政策

第三章 电动汽车电机控制器市场

3.1 政策环境

3.2 市场规模

3.3 行业利润

3.4 供应模式

3.5 竞争格局

3.6 主要企业发展情况

3.7 全球主流新能源汽车电机电控系统

3.7.1 特斯拉Model S

3.7.2 日产聆风(Leaf)

3.7.3 三菱欧蓝德PHEV

3.7.4 宝马 i3

3.7.5 雪佛兰Volt

3.7.6 大众e-Golf

3.7.7 奥迪 A3 e-tron

3.7.8 福特 Fusion/C-Max

3.7.9丰田普锐斯(插电版和HEV版)

第四章 中国电动汽车电机控制器生产商

4.1 上海电驱动股份有限公司

4.1.1 公司简介

4.1.2 经营情况

4.1.3 电动汽车电机控制器业务

4.1.4 技术特点

4.1.5 供应链分析

4.2 深圳市汇川技术股份有限公司

4.2.1 公司简介

4.2.2 经营情况

4.2.3 电动汽车电机控制器运营及发展战略

4.2.4 电动汽车电机控制器产品及技术特点

4.3上海大郡动力控制技术有限公司

4.3.1 公司简介

4.3.2 发展历程

4.3.2 经营情况

4.3.3 业务模式

4.3.4 电动汽车电机控制器产品及技术特点

4.3.5 电动汽车领域业务

4.3.6 电动汽车领域发展战略

4.4 天津市松正电动汽车技术股份有限公司

4.4.1 公司简介

4.4.2 电动汽车业务

4.4.3 电动汽车动力系统主要产品及技术特点

4.4.4 电动汽车领域发展战略

4.5 大洋电机

4.5.1 公司简介

4.5.2 经营情况

4.5.3 电动汽车电机控制器业务

4.5.4 研发

4.5.5 发展战略

4.6 联合汽车电子有限公司

4.6.1 公司简介

4.6.2 生产&研发

4.6.3 电动汽车电机控制器业务

4.7 湖南中车时代电动汽车股份有限公司

4.7.1 公司简介

4.7.2 经营情况

4.7.3 电动汽车控制器业务

4.7.4 驱动系统业务动态

4.8 比亚迪股份有限公司

4.8.1 公司简介

4.8.2 经营情况

4.8.3 电动汽车电机控制器业务

4.9 珠海英搏尔电气股份有限公司

4.9.1 公司简介

4.9.2 销售收入及成本

4.9.3 销售模式

4.9.4 主要客户

4.9.5 电动汽车电机控制器业务

4.9.6 研发

4.9.7 电机控制器发展战略

4.10 深圳市蓝海华腾技术股份有限公司

4.10.1 公司简介

4.10.2 销售收入及成本

4.10.3 销售模式

4.10.4 主要客户

4.10.5 电动汽车电机控制器业务

4.10.6 研发

4.10.7 电机控制器发展战略

4.11 福建省福工动力技术有限公司

4.11.1 公司简介

4.11.2 对外合作

4.11.3 新能源汽车驱动总成业务

4.11.4 产能规划

4.12 致茂电子股份有限公司

4.12.1 公司简介

4.12.2 经营情况

4.12.3 电动汽车电机控制器业务

4.12.4 电动汽车领域发展战略

4.13 台达电子工业股份有限公司

4.13.1 公司简介

4.13.2 经营情况

4.13.3 电动汽车领域业务

4.14 精进电动科技(北京)有限公司

4.14.1 公司简介

4.14.2 电动汽车电机控制器业务

4.15 东方电气集团东风电机有限公司

4.15.1 公司简介

4.15.2 电动汽车控制器业务

4.16 尼得科(北京)传动技术有限公司

4.16.1 公司简介

4.16.2 经营情况

4.16.3 电动汽车电机控制器业务

4.17 时光科技有限公司

4.17.1 公司简介

4.17.2 电动汽车电机控制器业务

4.18 安徽巨一自动化装备有限公司

4.18.1 公司简介

4.18.2 电动汽车电驱动业务

4.19 山东德洋电子科技有限公司

4.19.1 公司简介

4.19.2 电动汽车电驱动业务

4.20 北京西门子汽车电驱动系统有限公司

4.21 北京佩特来电机驱动技术有限公司

第五章 IGBT供应商

5.1 富士电机

5.1.1 公司简介

5.1.2 经营情况

5.1.3 电动汽车领域业务

5.1.4 电动汽车领域发展战略

5.2 英飞凌

5.2.1 公司简介

5.2.2 经营情况

5.2.3 电动汽车领域业务

5.2.4 电动汽车领域发展战略

5.3 电装

5.3.1 公司简介

5.3.2 经营情况

5.3.3 电动汽车领域业务

5.4 ROHM

5.4.1 公司简介

5.4.2 经营情况

5.4.3 电动汽车领域业务

5.5 IR

5.5.1 公司简介

5.5.2 经营情况

5.5.3 电动汽车领域业务

5.6 赛米控

5.6.1 公司简介

5.6.2 经营情况

5.6.3 电动汽车领域业务

第六章 逆变器生产商

6.1 日立汽车系统

6.1.1 公司简介

6.1.2 经营情况

6.1.3 电动汽车领域业务

6.2 三菱电机

6.2.1 公司简介

6.2.2 经营情况

6.2.3 电动汽车领域业务

6.3 明电舍

6.3.1 公司简介

6.3.2 经营情况

6.3.3 电动汽车领域业务

6.4 东芝

6.4.1 公司简介

6.4.2 经营情况

6.4.3 电动汽车领域业务

6.5 现代摩比斯

6.5.1 公司简介

6.5.2 经营情况

6.5.3 电动汽车领域业务

6.6 德尔福

6.6.1 公司简介

6.6.2 经营情况

6.6.3 电动汽车领域业务

6.7 罗伯特博世

6.7.1 公司简介

6.7.2 经营情况

6.7.3 电动汽车领域业务

6.8 大陆

6.8.1 公司简介

6.8.2 经营情况

6.8.3 电动汽车领域业务

1 Overview of Motor Controller

1.1 Definition

1.2 Operating Principle

1.3 Classification

1.4 Development History of Main Technology Roadmaps

1.4.1 Si IGBT Motor Controller

1.4.2 SiC IGBT Motor Controller

1.5 Technology Trend

1.5.1 Modularization

1.5.2 Intelligentization

1.5.3 Integration

2 Industrial Chain

2.1 Upstream IGBT Market

2.1.1 Development of IGBT

2.1.2 Market Size

2.1.3 Competitive Landscape

2.1.4 Supply Chain

2.1.5 EV IGBT

2.1.6 Dynamics of IGBT

2.2 Upstream Thin-film Capacitor Market

2.2.1 Market Size

2.2.2 Industrial Chain and Manufacturing Process

2.2.3 Competitive Landscape

2.2.4 EV Thin-film Capacitor

2.3 Downstream EV Market

2.3.1 Overall

2.3.2 Electric Passenger Vehicle

2.3.3 Electric Commercial Vehicle

2.3.4 Main Policies

3 EV Motor Controller Market

3.1 Policy Environment

3.2 Market Size

3.3 Industry Profit

3.4 Supply Mode

3.5 Competitive Landscape

3.6 Development of Major Enterprises

3.7 Global Mainstream New-energy Vehicle Motor Electronic Control Systems

3.7.1 Tesla Model S

3.7.2 Nissan Leaf

3.7.3 Mitsubishi Outlander PHEV

3.7.4 BMW i3

3.7.5 Chevrolet Volt

3.7.6 Volkswagen e-Golf

3.7.7 Audi A3 e-tron

3.7.8 Ford Fusion/C-Max

3.7.9Toyota Prius (PHEV and HEV)

4 Chinese EV Motor Controller Enterprises

4.1 Shanghai E-drive Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 EV Motor Controller Business

4.1.4 Technical Features

4.1.5 Supply Chain

4.2 Shenzhen Inovance Technology Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 EV Motor Controller Operation and Development Strategy

4.2.4 EV Motor Controllers and Technical Features

4.3Shanghai Dajun Technologies, Inc.

4.3.1 Profile

4.3.2 Development History

4.3.2 Operation

4.3.3 Business Model

4.3.4 EV Motor Controllers and Technical Features

4.3.5 Business in EV Field

4.3.6 Development Strategy in EV Field

4.4 Tianjin Santroll Electric Automobile Technology Co., Ltd.

4.4.1 Profile

4.4.2 EV Business

4.4.3 EV Power Systems and Technical Features

4.4.4 Development Strategy in EV Field

4.5 Zhongshan Broad-Ocean Motor Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 EV Motor Controller Business

4.5.4 R&D

4.5.5 Development Strategy

4.6 United Automotive Electronic Systems Co., Ltd. (UAES)

4.6.1 Profile

4.6.2 Production and R&D

4.6.3 EV Motor Controller Business

4.7 Hunan CRRC Times Electric Vehicle Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 EV Controller Business

4.7.4 Dynamics of Drive System Business

4.8 BYD

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Motor Controller Business

4.9 Zhuhai Enpower Electric Co., Ltd.

4.9.1 Profile

4.9.2 Revenue and Costs

4.9.3 Sales Model

4.9.4 Major Customers

4.9.5 EV Motor Controller Business

4.9.6 R&D

4.9.7 Motor Controller Development Strategy

4.10 Shenzhen V&T Technologies Co., Ltd.

4.10.1 Profile

4.10.2 Revenue and Costs

4.10.3 Sales Model

4.10.4 Major Customers

4.10.5 EV Motor Controller Business

4.10.6 R&D

4.10.7 Motor Controller Development Strategy

4.11 Fujian Fugong Power Technology Co., Ltd.

4.11.1 Profile

4.11.2 Cooperation with Overseas Partners

4.11.3 New-energy Vehicle Drive Assembly Business

4.11.4 Capacity Planning

4.12 Chroma ATE Inc.

4.12.1 Profile

4.12.2 Operation

4.12.3 EV Motor Controller Business

4.12.4 Development Strategy in EV Field

4.13 Delta Electronics

4.13.1 Profile

4.13.2 Operation

4.13.3 Business in EV Field

4.14 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

4.14.1 Profile

4.14.2 EV Motor Controller Business

4.15 DEC Dongfeng Electric Machinery Co., Ltd.

4.15.1 Profile

4.15.2 EV Controller Business

4.16 Nidec (Beijing) Drive Technologies Co., Ltd.

4.16.1 Profile

4.16.2 Operation

4.16.3 EV Motor Controller Business

4.17 Time High-Tech Co., Ltd.

4.17.1 Profile

4.17.2 EV Motor Controller Business

4.18 JEE Automation Equipment Co., Ltd.

4.18.1 Profile

4.18.2 EV E-drive Business

4.19 Shandong Deyang Electronics Technology Co., Ltd.

4.19.1 Profile

4.19.2 EV E-drive Business

4.20 Beijing Siemens Automotive E-Drive System Co., Ltd.

4.21 Prestolite E-Propulsion Systems (Beijing) Limited

5 IGBT Suppliers

5.1Fuji Electric

5.1.1 Profile

5.1.2 Operation

5.1.3 Business in EV Field

5.1.4 Development Strategy in EV Field

5.2 Infineon

5.2.1 Profile

5.2.2 Operation

5.2.3 Business in EV Field

5.2.4 Development Strategy in EV Field

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 Business in EV Field

5.4 ROHM

5.4.1 Profile

5.4.2 Operation

5.4.3 Business in EV Field

5.5 IR

5.5.1 Profile

5.5.2 Operation

5.5.3 Business in EV Field

5.6 Semikron

5.6.1 Profile

5.6.2 Operation

5.6.3 Business in EV Field

6 Inverter Manufacturers

6.1 Hitachi Automotive Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Business in EV Field

6.2 Mitsubishi Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Business in EV Field

6.3 Meidensha

6.3.1 Profile

6.3.2 Operation

6.3.3 Business in EV Field

6.4 Toshiba

6.4.1 Profile

6.4.2 Operation

6.4.3 Business in EV Field

6.5 Hyundai Mobis

6.5.1 Profile

6.5.2 Operation

6.5.3 Business in EV Field

6.6 Delphi

6.6.1 Profile

6.6.2 Operation

6.6.3 Business in EV Field

6.7 Bosch

6.7.1 Profile

6.7.2 Operation

6.7.3 Business in EV Field

6.8 Continental

6.8.1 Profile

6.8.2 Operation

6.8.3 Business in EV Field

图:电动汽车电机控制器原理

表:电动汽车电机控制器分类

图:第二代Prius 用IGBT 功率模块与电机控制器

图:第三代Prius 用IGBT 功率模块与电机控制器

图:日立第一代电机控制器结构

图:日立第二代电机控制器结构

图:日立双面Pin-Fin 式IGBT 模块与第三代电机控制器产品

图:博世第三代汽车级IGBT 功率模块

图:博世电机控制器产品INV2CON

图:博世电机控制器产品INVCON2.3

图:大陆EPF2 系列电机控制器

图:大陆新一代电机控制器产品

图:丰田与电装联合研发的SiC(左)与Si(右)电机控制器

图:日本明电舍SiC电机控制器与电机一体机

图:IGBT(分电压)应用分布

IGBT technology evolution and players involved

表:1-6代IGBT技术发展进程

图:2014-2016年全球IGBT(分应用)市场规模

图:2014-2020年IGBT销售价格、出货量及市场规模演变

图:2014-2020年中国IGBT市场规模

图:2015年全球主要IGBT厂商市场份额

图:2014年中国IGBT行业主要厂商市场份额

表:全球电动汽车用IGBT主要生产商

图:全球IGBT产业供应链

图:中国IGBT产业供应链

表:中国IGBT产业链主要本土公司及其产品

图:2014年全球IGBT模块下游(分领域)市场分布

图:2020年全球IGBT模块下游(分领域)市场分布

图:2014-2020年全球电动汽车用IGBT市场规模

图:目前市场中可控功率半导体最高电压和电流值

图:功率模块不同集成层次

表:主要材料同硅材料的对比参数

图:不同半导体材料物理参数

图:SPT+ IGBT结构

图:沟槽栅极结构IGBT和CSTBT示意图

Structure of an RC-IGBT from ABB

图:2009-2019E全球电容器市场规模

图:2009-2019E中国电容器市场规模

图:2010-2014年中国薄膜电容产销量

图:薄膜电容产业链

图:薄膜电容制造工艺及壁垒

图:薄膜电容主要国内外企业

表:2013-2015年全球电动乘用车销量对比(主要国家或地区)

图:2014-2015年全球新能源车(EV&PHEV)月度销量

表:2013-2015年全球前20大电动乘用车销量对比

图:2011-2020年全球电动乘用车(EV&PHEV)销量

图:2010-2018年中国汽车保有量与产销量

图:2010-2015中国电动汽车产销量

表:2015年1-12月中国电动汽车(EV&PHEV)产量

图:2011-2020年中国电动汽车(EV&PHEV)销量

图:2012-2020年中国普通混合动力汽车(HEV)销量

图:2011-2020年中国电动乘用车(EV&PHEV)销量

表:2015年1-12月中国电动乘用车(EV、PHEV)销量

表:2015年1-12月中国新能源乘用车(EV&PHEV)(分车型)产量

图:2015年1-12月中国电动商用车产量

图:2014-2015年中国电动汽车推广计划

图:2015年1-12月中国电动客车产量

图:2015年1-12月中国纯电动货车产量

图:2011-2020年中国电动商用车(EV&PHEV)销量

表:2013-2020年电动乘用车补贴标准

表:2016年电动客车补贴标准

表:2014-2015年中国电动客车补贴标准(中央财政)

表:2016年中国燃料电池汽车补贴标准

表:新版《新能源汽车推广应用推荐车型目录》(第1-2批)车型数量统计

表:新版《新能源汽车推广应用推荐车型目录》(第1批)厂商统计

表:新版《新能源汽车推广应用推荐车型目录》(第2批)厂商统计

图:工信部前三批免购置税目录车型统计

表:中国ICE与EV税费对比

表:免征新能源汽车车辆购置税车型目录第一批

表:免征新能源汽车车辆购置税车型目录第二批

表:免征新能源汽车车辆购置税车型目录第三批

表:中国电动汽车电机控制器相关政策

表:2015-2020年中国电动汽车电机控制器需求及市场规模

表:2011-2015年汇川技术及蓝海华腾电机控制器业务毛利率

图:中国电动汽车电机控制器供应模式

图:2015年中国主要电动乘用车电机控制器厂商市场份额

表:中国主要电动客车企业电机及控制器供应商

表:中国主要乘用车企业电机及控制器供应商

表:中国电动汽车电机控制器主要生产商

图:特斯拉前驱电机控制器

图:特斯拉后驱电机控制器

图:特斯拉后驱动力总成

图:日产聆风电驱动系统前置前驱

图:日产聆风电驱动总成

表:日产聆风供应体系

图:三菱欧蓝德PHEV整车架构

图:宝马i3驱动电机和逆变器总成

图:Voltec电力驱动系统

图:大众e-golf“电动机舱”(中间为电动机,左侧为电机控制器)

图:奥迪 A3 etron整车架构

图:奥迪 A3 etron电机控制器(集成DCDC)

图:福特C-Max电机控制器

图:第四代普锐斯电控PCU

图:第四代普锐斯电控PCU

图:第四代普锐斯电控PCU

图:上海电驱动股权结构图(被收购前/后)

图:上海电驱动运营体系(被收购后)

图:大洋电机及上海电驱动主要客户

表:2009-2016年上海电驱动财务指标

表:上海电驱动主要产品

图:上海电驱动生产基地建设

表:2013-2015Q1上海电驱动电动汽车驱动电机系统出货量

表:上海电驱动核心专利技术

表:2014-2015Q1上海电驱动前五大客户

表:2014-2015Q1上海电驱动前五大供应商

图:2009-2016年Q1汇川技术营业收入及净利润

图:2009-2016年Q1汇川技术毛利率

表:2012-2015年汇川技术各类产品营业收入

表:2012-2015年汇川技术各类产品毛利率

表:2016年Q1汇川技术电动汽车电机控制器项目进展

图:汇川技术汽车电子业务合作客户

图:汇川技术插电式混合动力客车系统方案

图:汇川技术电动汽车电机控制器主要产品及应用

表:2012-2015上海大郡业绩

表:上海大郡对外采购主要物料

图:上海大郡N110WSA型电机控制器技术参数

图:上海大郡A360140J型电机控制器技术参数

表:2012-2015年上海大郡电机驱动系统产销量

表:上海大郡子公司

图:天津松正股权结构

表:2014-2015年天津松正主要财务指标

图:天津松正IV代插电式混合动力系统构造

图:中国典型城市公交循环工况(CCBC)的纯电动时间占比

图:纯电动天津803路公交线路运营实测纯电动占比

图:松正5代电控单元

图:大洋电机股权结构

图:2012-2015年大洋电机新能源汽车动力总成业务营收

图:大洋电机30KW电机(YTD030W04)+控制器(KM6025W05)驱动电机系统

表:大洋电机在建新能源汽车电驱动系统项目情况

图:大洋电机新能源汽车市场布局

图:大洋电机十年发展战略

图:UAES生产基地及研发中心分布

图:UAES研发中心概况

图:UAES电力驱动业务员产品线

图:UAES电力驱动业务测试设备概览

图:UAES电力电子控制器产品规划

图:UAES电力电子控制器产品研发能力

图:UAES单电机控制产品结构及规格

图:UAES双电机控制产品结构及规格

表:2011-2015年中车时代电动财务指标

表:中车时代电动电机控制器产品

图:2007-2014年比亚迪员工人数

图:2010-2015H1年比亚迪汽车产销量

图:2007-2016Q1比亚迪营业收入,净利润和毛利率

表:2007-2015年比亚迪(分产品)营业收入

表:2008-201年比亚迪(分产品)毛利率

表:2008-2015H1年比亚迪(分地区)营业收入

图:双向逆变充放电驱动电机控制器

图:比亚迪双向逆变充放电技术

图:比亚迪电机控制器工艺能力

图:比亚迪电机控制器重要产线及关键设备

表:2011-2015年蓝海华腾营业收入及净利润

表:2011-2015年蓝海华腾各项产品销售收入

表:2012-2015年1-9月蓝海华腾电机控制器主要原材料采购数量及采购价格

表:2011-2014年蓝海华腾产品销售模式

表:2011-2014年蓝海华腾前五大客户

表:蓝海华腾电动汽车电机控制器主要客户

图:蓝海华腾电动汽车电机控制器平均单价,2012-2015

图:蓝海华腾电动汽车电机控制器产能及产能利用率,2012-2015

图:蓝海华腾电动汽车电机控制器销量,2012-2015

表:蓝海华腾电机控制器主要核心技术

表:蓝海华腾上市募投项目

表:2014-2015年10月福工动力主要财务指标

图:CHS双模混合动力系统构架

图:CHS混合动力传动箱内部结构图

图:CHS混合动力系统适用车型

图:致茂电子全球分布

表:2009-2015年致茂电子(集团合并)财务指标

表:2014-2015年致茂电子各事业部营业收入

表:致茂电子CR系列电机控制器产品线

表:致茂电子CR系列电机控制器主要技术参数

表:2009-2015年台达电子财务指标

表:2013-2015年台达电子各类产品产能、产量及产值

表:2014-2015年台达电子各类产品销量

图:精进电动研发关键设备

表:精进电动150KW车用电机控制器性能参数

表:东方电气集团东风电机公司电动汽车电机控制器产品

表:中纺锐力机新能源汽车SRD电机

图:时光科技纯电动动力及控制系统总成

图:时光科技电动汽车动力控制系统组成方案

图:时光科技电动汽车电机控制器主要技术参数

表:FY2010-2016富士电机主要财务指标

表:FY2013-2016富士电机各项业务销售额及运营利润

表:FY2011-2016富士电机各地区销售额

图:2015-2021年富士电机IGBT及SiC研发规划

表:2016-2018年富士电机7代IGBT产品规划

Industrial IGBT / SiC Loss Comparison, 2015-2017

图:富士电机汽车功率模块发展路线,2005-2025

图:2013年英飞凌三大业务全球排名

表:FY2013-2015年英飞凌(分地区)收入

表:FY2013-2015英飞凌(分部门)收入

Infineon EiceDRIVER™ Family IGBT Modules

图:2011-2015财年电装员工人数

图:FY2013-2015电装销售额及利润

图:FY2011-FY2015年Denso营业利润&净利润

图:FY2013-FY2015Q1Denso分部门营收占比

表:FY2013-FY2015Q1Denso分部门销售收入

图:FY2013-2015电装各地区销售额及运营利润

图:FY2010-FY2014年Denso(分客户)销售收入

图:FY2013-2014电装客户结构

表:日本NEDO功率电子领域项目

表:FY2010-2015 ROHM财务指标

图:FY12-FY17ROHM(分业务)销售收入

图:FY12-FY17ROHM(分地区)销售收入

图:FY12-FY17ROHM(by applicaiton)销售收入

图:ROHM车用IGBT模块主要技术参数

图:ROHM SiC 产品发展历程

图:SiC-based Power Device Lineup of ROHM

表:2012-2014财年IR各部门营业收入

图:赛米控经营情况

表:Semikron主要IGBT品牌产品

Product Portfolio of SEMIKRON’s SKiM modules

Key Features of SEMIKRON’s SKiM modules

Product Portfolio of SEMIKRON’s SKiiP IPM

Key Features of SEMIKRON’s SKiiP IPM

Structure of SEMIDRON’s SKAI Power Electronic Platform

Product Portfolio of SEMIKRON’s SKAI Power Electronic Platform

Key Features of SEMIKRON’s SKAI Power Electronic Platform

表:FY2011-FY2015日立汽车系统营业收入

表:日立汽车系统电动汽车逆变器主要客户

表:FY2010-2015三菱电机财务指标

图:2015财年三菱电机各项业务销售额

表:三菱电机电动汽车逆变器主要客户

表:2012-2016财年明电舍财务指标

表:2014-2015财年明电舍各部门销售额及利润

表:明电舍电动汽车逆变器主要客户

表:FY2011-2015东芝销售额及净利润

表:FY2011-2015东芝销售结构(分业务)

表:FY2011-2015东芝Electronic Devices & Components部门销售额

表:东芝电动汽车逆变器主要客户

图:2006-2015财年现代摩比斯收入与营业利润率

表:现代摩比斯电动汽车逆变器主要客户

图:2011-2015年德尔福员工人数

图:2004-2015H1年德尔福收入与毛利率

图:2013-2015年德尔福主要财务指标

图:2011-2015年Delphi分部门营收占比

表:2010-2015年德尔福(分部门)毛利率

图:2013-2016年Delphi各部门主要增长领域

表:2010-2014年德尔福(分地区)营业收入

图:Delphi主要客户及区域分布

表: 2015年德尔福主要客户及收入贡献率

图:德尔福在电动汽车领域产品分布

表:德尔福电动汽车逆变器技术特点

表:德尔福电动汽车逆变器主要客户

图:2010-2015年罗伯特博世员工人数

图:2010-2015年Bosch营业收入&EBIT

图:2012-2014年Bosch分部门营收占比

图:2012-2014年Bosch汽车部门销售收入&EBIT

图:2012-2014年Bosch分地区营收占比

表:2012-2014年博世在主要国家销售额

表:博世电动汽车逆变器主要客户

图:2009-2014年大陆集团员工人数

图:2009-2015H1年Continental营业收入&EBIT

图:2008-2013年大陆集团分部门营收占比

图:2008-2013年大陆集团分地区营收占比

表:大陆电动汽车逆变器主要客户

Principle of EV Motor Controllers

Classification of EV Motor Controllers

IGBT Power Module and Motor Controller for 2nd-generation Prius

IGBT Power Module and Motor Controller for 3rd-generation Prius

Structure of Hitachi 1st-generation Motor Controller

Structure of Hitachi 2nd-generation Motor Controller

Hitachi Double-sided Pin-Fin IGBT Module and 3rd-generation Motor Controller

Bosch’s 3rd-generation Automotive IGBT Power Module

Bosch’s Motor Controller- INV2CON

Bosch’s Motor Controller- INVCON2.3

Continental’s EPF2 Series Motor Controllers

Continental’s New Generation of Motor Controllers

SiC (Left) and Si (Right) Motor Controllers Co-developed by Toyota and Denso

Meidensha’s SiC Motor Controller and Motor AIO (All-In-One)

Application of IGBT by Voltage

IGBT Technology Evolution and Players Involved

Development History of 1st-6th-generation IGBT Technologies

Global IGBT Market Size by Application, 2014-2016

Selling Price, Shipments, and Market Size Change of IGBT, 2014-2020E

Chinese IGBT Market Size, 2014-2020E

Market Share of Global Major IGBT Vendors, 2015

Market Share of Major Enterprises in China’s IGBT Industry, 2014

Global Major EV IGBT Vendors

Global IGBT Industry Supply Chain

China’s IGBT Industry Supply Chain

Local Companies in China’s IGBT Industry Chain and Their Products

Global Downstream Market of IGBT Module by Field, 2014

Global Downstream Market of IGBT Module by Field, 2020E

Global EV IGBT Market Size, 2014-2020E

Maximum Voltage and Current of Controllable Power Semiconductor on the Market

Level of Power Module Integration

Comparison of Parameters of Major Materials and Silicon

Physical Parameters of Different Semiconductor Materials

SPT+ IGBT Structure

Diagram of Trench-gate IGBT and CSTBT

Structure of an RC-IGBT from ABB

Global Capacitor Market Size, 2009-2019E

Chinese Capacitor Market Size, 2009-2019E

China’s Film Capacitor Output and Sales Volume, 2010-2014

Film Capacitor Industry Chain

Film Capacitor Manufacturing Process and Barriers

Major Film Capacitor Vendors at Home and Abroad

Comparison of Electric Passenger Vehicle Sales Volume Worldwide (Major Countries/Regions), 2013-2015

Monthly Sales Volume of New Energy Vehicles (EV&PHEV) Worldwide, 2014-2015

Comparison of Global Top20 Electric Passenger Vehicles by Sales Volume, 2013-2015

Sales Volume of Electric Passenger Vehicles (EV&PHEV) Worldwide, 2011-2020E

Car Ownership, Output and Sales Volume in China, 2010-2018E

China’s Output and Sales Volume of Electric Vehicles, 2010-2015

China’s Output of Electric Vehicles (EV&PHEV), Jan-Dec 2015

China’s Sales Volume of Electric Vehicles (EV&PHEV), 2011-2020E

China’s Sales Volume of Conventional HEV, 2012-2020E

China’s Sales Volume of Electric Passenger Vehicles (EV&PHEV), 2011-2020E

China’s Sales Volume of Electric Passenger Vehicles (EV&PHEV), Jan-Dec 2015

China’s Output of New Energy Passenger Vehicles (EV&PHEV) by Model, Jan-Dec 2015

China’s Output of Electric Commercial Vehicles, Jan-Dec 2015

China’s Electric Vehicle Promotion Schemes, 2014-2015

China’s Output of Electric Bus, Jan-Dec 2015

China’s Output of Battery Electric Truck, Jan-Dec 2015

China’s Sales Volume of Electric Commercial Vehicles (EV&PHEV), 2011-2020E

Subsidy Standard for Electric Passenger Vehicle in China, 2013-2020E

Subsidy Standards for Electric Bus in China, 2016

Subsidy Standards for Electric Bus in China, 2014-2015 (Central Finance)

Subsidy Standards for Full-cell Vehicle in China, 2016

Models among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (1st-2nd Batches)

Carmakers among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (1st Batch)

Carmakers among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (2nd Batch)

Models among 1st Three Batches of Purchase Duty-Free Catalog Approved by MIIT

Comparison of Taxes on ICE and EV in China

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (1st Batch)

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (2nd Batch)

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (3rd Batch)

Policies on EV Motor Controller in China

EV Motor Controller Demand and Market Size in China, 2015-2020E

Gross Margin of Shenzhen Inovance Technology and Shenzhen V&T Technologies’ Motor Controller Business, 2011-2015

Supply Modes of EV Motor Controller in China

Market Share of Major Electric Passenger Vehicle Motor Controller Manufacturers in China, 2015

Motor and Controller Suppliers of Major Electric Bus Manufacturers in China

Motor and Controller Suppliers of Major Passenger Vehicle Manufacturers in China

Major EV Motor Controller Manufacturers in China

Tesla Front-drive Motor Controller

Tesla Rear-drive Motor Controller

Tesla Rear-drive Powertrain

Nissan Leaf E-drive System FF

Nissan Leaf E-drive Assembly

Nissan Leaf Supply System

Architecture of Mitsubishi Outlander PHEV

BMW i3 Drive Motor and Inverter Assembly

Voltec E-drive System

Volkswagen e-golf “Electric Engine Room” (Electric Motor (Middle), Motor Controller (Right))

Architecture of Audi A3 etron

Audi A3 etron Motor Controller (Integrating DCDC)

Ford C-Max Motor Controller

4th-generation Prius Electronic Control PCU

Equity Structure of Shanghai E-drive (Before/After being Acquired)

Operation System of Shanghai E-drive (After being Acquired)

Major Customers of Zhongshan Broad-Ocean Motor and Shanghai E-drive

Financial Indices of Shanghai E-drive, 2009-2016

Main Products of Shanghai E-drive

Production Base Construction of Shanghai E-drive

EV Drive Motor System Shipments of Shanghai E-drive, 2013-2015Q1

Core Patented Technologies of Shanghai E-drive

Top5 Customers of Shanghai E-drive, 2014-2015Q1

Top5 Suppliers of Shanghai E-drive, 2014-2015Q1

Revenue and Net Income of Shenzhen Inovance Technology, 2009-2016

Gross Margin of Shenzhen Inovance Technology, 2009-2016

Revenue of Shenzhen Inovance Technology by Product, 2012-2015

Gross Margin of Shenzhen Inovance Technology by Product, 2012-2015

Progress of Shenzhen Inovance Technology’s EV Motor Controller Projects, 2016Q1

Partners of Shenzhen Inovance Technology’s Automotive Electronics Business

Shenzhen Inovance Technology’s System Solutions for Plug-in Hybrid Bus

Main EV Motor Controllers and Their Applications of Shenzhen Inovance Technology

Business Performance of Shanghai Dajun Technologies, 2012-201

Main Materials Purchased by Shanghai Dajun Technologies

Technical Parameters of Shanghai Dajun Technologies’ N110WSA Motor Controller

Technical Parameters of Shanghai Dajun Technologies’ A360140J Motor Controller

Motor Drive System Output and Sales Volume of Shanghai Dajun Technologies, 2012-2015

Subsidiaries of Shanghai Dajun Technologies

Equity Structure of Tianjin Santroll Electric Automobile Technology

Main Financial Indices of Tianjin Santroll Electric Automobile Technology, 2014-2015

Structure of Santroll IV-generation Plug-in Hybrid System

Ratio of Battery Electric to CCBC in Typical Chinese Cities

Proportion of Actual Battery Electric Duration of Battery Electric Bus 803 in Tianjin

Santroll V-generation ECU

Equity Structure of Zhongshan Broad-Ocean Motor

New Energy Vehicle Powertrain Revenue of Zhongshan Broad-Ocean Motor, 2012-2015

Zhongshan Broad-Ocean Motor’s 30KW Motor (YTD030W04) + Controller (KM6025W05) Drive Motor System

Zhongshan Broad-Ocean Motor’s New Energy Vehicle E-drive System Projects under Construction

Zhongshan Broad-Ocean Motor’s Presence in New Energy Vehicle Market

10-year Development Strategy of Zhongshan Broad-Ocean Motor

Production Bases and R&D Centers of UAES

R&D Centers of UAES

UAES’ E-drive Product Line

Test Equipment for UAES’ E-drive Business

UAES’ Planning for Power Electronic Controllers

UAES’ R&D Capability for Power Electronic Controllers

Structure and Specifications of UAES’ Single-motor Control Products

Structure and Specifications of UAES’ Dual-motor Control Products

Financial Indices of Hunan CRRC Times Electric Vehicle, 2011-2015

Motor Controllers of Hunan CRRC Times Electric Vehicle

BYD’s Workforce, 2007-2014

Car Output and Sales Volume of BYD, 2010-2015H1

Revenue, Net Income & Gross Margin of BYD, 2007-2016Q1

Revenue Breakdown of BYD by Product, 2007-2015

Gross Margin of BYD by Product, 2008-2015

Revenue Breakdown of BYD by Region, 2008-2015H1

Bidirectional-inversion Charging/Discharging Drive Motor Controller

BYD’s Bidirectional-inversion Charging/Discharging Technology

BYD’s Process Capability for Motor Controller

Main Motor Controller Production Lines and Key Equipment of BYD

Revenue and Net Income of Shenzhen V&T Technologies, 2011-2015

Revenue of Shenzhen V&T Technologies by Product, 2011-2015

Procurement and Purchase Prices of Main Raw Materials for Motor Controller of Shenzhen V&T Technologies, 2012-Jan-Sept 2015

Product Sales Model of Shenzhen V&T Technologies, 2011-2014

Top5 Customers of Shenzhen V&T Technologies, 2011-2014

Major Customers for Shenzhen V&T Technologies’ EV Motor Controllers, 2011-2014

Average Unit Price of Shenzhen V&T Technologies’ EV Motor Controllers, 2012-2015

EV Motor Controller Capacity and Utilization of Shenzhen V&T Technologies, 2012-2015

EV Motor Controller Sales Volume of Shenzhen V&T Technologies, 2012-2015

Shenzhen V&T Technologies’ Core Technologies for Motor Controller

Shenzhen V&T Technologies’ Projects with Raised Funds via IPO

Main Financial Indices of Fujian Fugong Power Technology, 2014-Oct 2015

Architecture of CHS Dual-mode Hybrid System

Diagram of Internal CHS Hybrid Transmission Case

Auto Models with CHS Hybrid System

Global Presence of Chroma ATE Inc.

Financial Indices of Chroma ATE Inc. (Group’s Consolidation), 2009-2015

Revenue Breakdown (by Division) of Chroma ATE Inc., 2014-2015

CR Series Motor Controller Product Line of Chroma ATE Inc.

Key Technical Parameters of CR Series Motor Controller of Chroma ATE Inc.

Financial Indices of Delta Electronics, 2009-2015

Capacity, Output and Output Value (by Product) of Delta Electronics, 2013-2015

Sales Volume (by Product) of Delta Electronics, 2014-2015

Jing-Jin Electric Technologies’ R&D of Key Equipment

Performance Parameters of 150KW Vehicle-used Motor Controller of Jing-Jin Electric Technologies

EV Motor Controllers of DEC Dongfeng Electric Machinery Co., Ltd

New Energy Vehicle SRD Motor of China Tex MEE

Battery Electric Power & Control System Assemblies of Time High-Tech

EV Power Control System Composition Solution of Time High-Tech

Key Technical Parameters of EV Motor Controller of Time High-Tech

Fuji Electric’s Financial Indices, FY2010-FY2016

Fuji Electric’s Revenue and Operating Income (by Business), FY2013-FY2016

Fuji Electric’s Revenue Breakdown (by Region), FY2011-FY2016

IGBT and SiC R&D Planning of Fuji Electric, 2015-2021

7th-generation IGBT Product Planning of Fuji Electric, 2016-2018

Industrial IGBT / SiC Loss Comparison, 2015-2017

Automotive Power Module Development Roadmap of Fuji Electric, 2005-2025

Global Rankings of Infineon’s Three Major Businesses, 2013

Infineon’s Revenue (by Region), FY2013-FY2015

Infineon’s Revenue (by Division), FY2013-FY2015

Infineon EiceDRIVER™ Family IGBT Modules

Denso’s Workforce, FY2011-FY2015

Denso’s Sales and Profits, FY2013-FY2015

Denso’s Operating Income and Net Income, FY2011-FY2015

Denso’s Revenue Structure (by Division), FY2013-FY2015Q1

Denso’s Revenue Breakdown (by Division), FY2013-FY2015Q1

Denso’s Sales and Operating Income (by Region), FY2013-FY2015

Denso’s Revenue Breakdown (by Customer), FY2010-FY2014

Denso’s Client Structure, FY2013-FY2014

Power Electronics Projects of Japanese NEDO

ROHM’s Financial Indices, FY2010-FY2015

ROHM’s Revenue Breakdown (by Business), FY2012-FY2017

ROHM’s Revenue Breakdown (by Region), FY2012-FY2017

ROHM’s Revenue Breakdown (by Application), FY2012-FY2017

Main Technical Parameters of ROHM’s Vehicle-used IGBT Module

Development History of ROHM’s SiC Products

SiC-based Power Device Lineup of ROHM

IR’s Revenue Breakdown (by Division), FY2012-FY2014

Operation of Semikron

Key IGBT Brands of Semikron

Product Portfolio of Semikron’sSKiM modules

Key Features of Semikron’sSKiM modules

Product Portfolio of Semikron’sSKiiP IPM

Key Features of Semikron’sSKiiP IPM

Structure of Semidron’s SKAI Power Electronic Platform

Product Portfolio of Semikron’s SKAI Power Electronic Platform

Key Features of Semikron’s SKAI Power Electronic Platform

Revenue of Hitachi Automotive Systems, FY2011-FY2015

Hitachi Automotive Systems’ Major Customers for Its EV Inverters

Mitsubishi Electric’s Financial Indices, FY2010-FY2015

Mitsubishi Electric’s Revenue (by Business), FY2015

Mitsubishi Electric’s Major Customers for Its EV Inverters

Meidensha’s Financial Indices, FY2012-FY2016

Meidensha’s Revenue and Profits (by Division), FY2014-FY2015

Meidensha’s Major Customers for Its EV Inverters

Toshiba’s Revenue and Net Income, FY2011-FY2015

Toshiba’s Revenue Structure (by Business), FY2011-FY2015

Revenue of Toshiba’s Electronic Devices & Components Division, FY2011-FY2015

Toshiba’s Major Customers for Its EV Inverters

Revenue and Operating Margin of Hyundai Mobis, FY2006-FY2015

Hyundai Mobis’ Major Customers for Its EV Inverters

Delphi’s Workforce, 2011-2015

Delphi’s Revenue and Gross Margin, 2004-2015H1

Delphi’s Financial Indices, 2013-2015

Delphi’s Revenue Structure (by Division), 2011-2015

Delphi’s Gross Margin (by Division), 2010-2015

Main Growth Fields of Delphi’s Divisions, 2013-2016

Delphi’s Revenue Breakdown (by Region), 2010-2014

Delphi’s Major Customers and Regional Distribution

Delphi’s Major Customers and Revenue Contribution Rates, 2015

Delphi’s Product Distribution in EV Field

Technical Features of Delphi’s EV Inverters

Major Customers of Delphi’s EV Inverters

Bosch’s Workforce, 2010-2015

Bosch’s Revenue and EBIT, 2010-2015

Bosch’s Revenue Structure (by Division), 2012-2014

Revenue and EBIT of Bosch Automotive Division, 2012-2014

Bosch’s Revenue Structure (by Region), 2012-2014

Bosch’s Sales in Major Countries, 2012-2014

Bosch’s Major Customers for Its EV Inverters

Continental’s Workforce, 2009-2014

Continental’s Revenue and EBIT, 2009-2015H1

Continental’s Revenue Structure (by Division), 2008-2013

Continental’s Revenue Structure (by Region), 2008-2013

Continental’s Major Customers for Its EV Inverters

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|