|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2016-2020年全球及中国动力电池管理系统(BMS)行业研究报告 |

|

字数:3.7万 |

页数:155 |

图表数:151 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2400美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2700美元 |

|

编号:YS015

|

发布日期:2016-08 |

附件:下载 |

|

|

|

电池管理系统(BMS)是纯电动和混合动力汽车的一个关键组成部分,主要由电池电子部件(Battery electronics)和电池控制单元(Battery control unit)组成,BE负责采集电池的电流、电压、温度等相关数据并传输给BCU进行控制,BCU还负责与其他控制单元进行信息交互。

BMS最核心的三大功能为电芯监控、荷电状态(SOC)估算以及单体电池均衡。BMS监测到单体锂电池芯的工作温度和电量,并自动采取措施均衡单体锂电池芯的充放电电流和防止过温现象发生。能使电动汽车动力电池在各种工作条件下获得最佳的性能、最长的使用寿命,是发展电动汽车的关键技术之一。

2015年全球电动乘用车销量达54.9万辆,同比2014年增长67.4%,主要的增长点来自于中国和欧洲。国外动力电池BMS普遍采用主动均衡技术,单车成本较高,2015年全球BMS市场规模达到19.8亿美元,预计2022年将达到72.5亿美元,2016-2022年间复合增长率高达20.5%,发展潜力巨大。

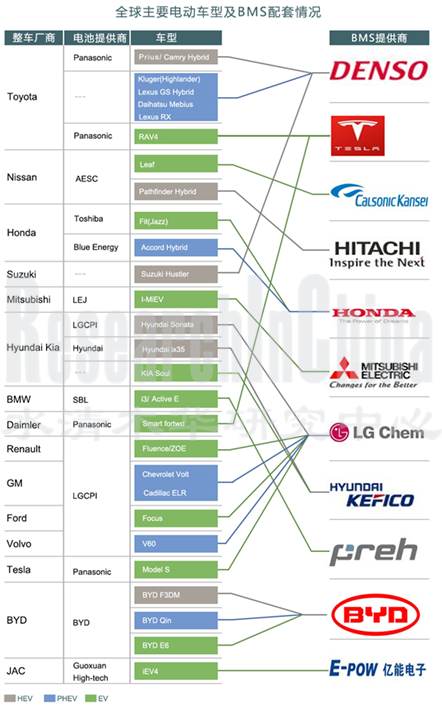

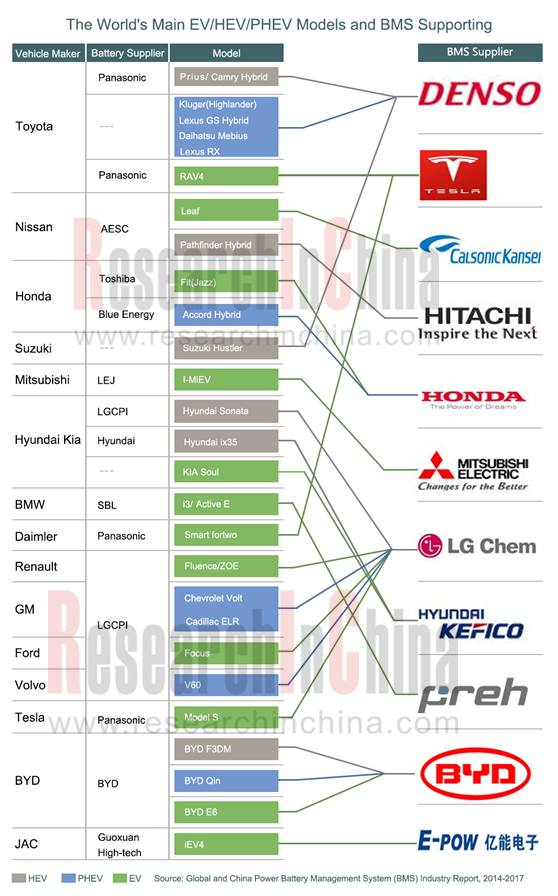

以Denso、Preh为代表的传统汽车零部件厂商凭借在整车厂供应链中的重要地位,已经抢占了先机。前者作为丰田汽车最重要的零部件供应商,先后为Prius、Camry Hybrid等车型提供电池管理模块;后者除了为宝马i系列纯电动车配套之外,还借助母公司均胜电子的资源开拓中国市场。

电芯厂如LGC在于原有客户保持合作的基础上,试图通过逐渐收缩BMS的功能范围,使其简单和通用化,并将软件及数据服务单独剥离出来单独提供给整车厂。整车企业中,特斯拉的BMS成熟且复杂,其下一代技术将转为适用于更大的单体电芯。

2015年中国电动汽车生产340,471辆,销售331,092辆,同比分别增长3.3倍和3.4倍。带动2015 年中国动力电池 BMS 市场规模暴增至约 40 亿,预计2020 年销售规模将进一步增长至140-150亿;

未来5年,中国动力电池BMS市场面临以下发展趋势:

(1)政策层面,出于对新能源汽车安全性的要求,中汽研旗下全国汽车标准化委员会正在制定中国电池管理系统(BMS)国标,BMS技术标准将日趋严格;

(2)随着三元锂电池渗透率提升,对于电池安全性管理要求更高;

(3)BMS 核心在主动式电池均衡和 SOC 估算算法设计,轻资产硬件设计公司将有较高盈利能力;

(4)整车厂和电芯厂都有向 BMS 产业链延伸规划,技术壁垒和研发投入制约,上下游企业延伸难度高, BMS 整体解决外包是一种合理市场行为。

竞争格局方面,中国BMS市场主要进入三类企业:

(1)第三方BMS厂商,如亿能电子、科列技术、华霆动力、金杯新能源等。其中亿能电子进入较早,其BMS产品配套了长安、东风、北汽、福田、江淮、众泰等多款型号的电动汽车;这类厂商规模占整体市场的45%;

(2)电池模组以及PACK封装企业,如国轩高科、CATL、沃特玛、欣旺达等通过自主研发或者合作进入市场;这类厂商规模占整体市场的31%;

(3)整车厂商,比亚迪和北汽新能源布局较完善,比亚迪集电池、BMS、电动汽车研发于一身,在成本和效率方面拥有优势,而北汽新能源收购Atieva后拥有了BMS研发能力,不再需要第三方BMS厂商为其供应;这类厂商规模占整体市场的24%;

水清木华研究中心《2016-2020年全球及中国动力电池管理系统(BMS)行业研究报告》主要内容包括:

全球及中国电动汽车市场发展概况(包括概况、市场规模、整车产量、销量等) 全球及中国电动汽车市场发展概况(包括概况、市场规模、整车产量、销量等)

全球BMS行业发展概况(包括发展现状及预测、市场规模、技术趋势等) 全球BMS行业发展概况(包括发展现状及预测、市场规模、技术趋势等)

中国BMS行业发展概况(包括发展现状及预测、价格成本、市场规模、竞争格局、供应配套、技术趋势等) 中国BMS行业发展概况(包括发展现状及预测、价格成本、市场规模、竞争格局、供应配套、技术趋势等)

全球BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新动态、在华业务等) 全球BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新动态、在华业务等)

中国BMS行业主要生产企业,分独立第三方、电芯厂商、OEM整车厂商等三类(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新项目等) 中国BMS行业主要生产企业,分独立第三方、电芯厂商、OEM整车厂商等三类(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新项目等)

BMS芯片行业主要生产企业(包括公司营业收入、营收构成、净利润、BMS芯片解决方案等) BMS芯片行业主要生产企业(包括公司营业收入、营收构成、净利润、BMS芯片解决方案等)

Battery management system (BMS), a key integral of battery electric vehicle (BEV) and hybrid electric vehicle (HEV), consists mainly of battery electronics (BE) and battery control unit (BCU), with the former responsible for acquiring data on electric current, voltage, and temperature of battery and sending them to BCU for control and the latter also in charge of communicating information with other control units.

Three core functions of BMS are cell monitoring, state of charge (SOC) estimation, and single-cell battery balancing. BMS monitors the operating temperature and electric quantity of single lithium battery cell, and automatically takes steps to balance charge/discharge current and prevent occurrence of over-temperature. Making automotive power battery deliver best performance and longest service life under various working conditions is one of key technologies to develop electric vehicle.

Global electric passenger vehicle sales amounted to 549,000 units in 2015, a 67.4% surge from a year ago, with growth coming primarily from China and Europe. Power battery BMS used in foreign countries commonly adopts active balancing technology, resulting in a higher cost for single vehicle. Global BMS market was valued at USD1.98 billion in 2015 and is expected to hit USD7.25 billion in 2022 at a CAGR of up to 20.5% during 2016-2022, showing huge development potential.

Traditional auto parts makers represented by Denso and Preh have gotten a head start by virtue of their important positions in OEMs’ supply chain. As Toyota’s the most important parts supplier, Denso has provided battery management modules for Prius, Camry Hybrid and other models. Besides serving BMW i-series BEV, Preh also explores the Chinese market with the help of its parent company- Ningbo Joyson Electronic Corp.

Cell makers like LGC attempt to, on the basis of cooperation with existing customers, simplify and generalize BMS by gradually narrowing the scope of functionality, and spin off software and data services which are provided alone to OEMs. Among OEMs, Tesla has mature and sophisticated BMS, and its next-generation BMS technology will get applied to battery packs with larger single cells.

China produced 340,471 and sold 331,092 electric vehicles in 2015, a 3.3-fold and 3.4-fold increase on a year-on-year basis, respectively. Thanks to booming EV market, the Chinese power battery BMS market size swelled to about RMB4 billion in 2015 and is expected to further soar to RMB14-15 billion in 2020.

Chinese power battery BMS market will present the following trends over the next five years:

1) At the policy level, the National Technical Committee of Auto Standardization under China Automotive Technology & Research Center, with the aim of increasing safety of new energy vehicle, is developing national BMS standard which will contribute to more stringent standards on BMS;

2) Management requirements on safety of battery will become stricter along with a higher penetration of ternary lithium battery;

3) The core of BMS lies in the design of active battery balancing and SOC estimation algorithms. Asset-light hardware design houses will enjoy a higher profitability.

4) Both OEMs and cell makers have plans to expand to BMS industrial chain. Constrained by technical barriers and limited R&D spending, it is difficult for upstream and downstream enterprises to move into BMS. Hence, outsourcing of BMS integrated solutions is a rational market behavior.

There are three types of companies in the Chinese BMS market.

1) Third-party BMS vendors, such as Epower Electronics, Shenzhen Klclear Technology, SINOEV Technologies, and Gold Up New Energy. Epower Electronics enters the industry early with its BMS products having been installed in multiple EV models of Chang’an, Dongfeng Motor, BAIC Motor, Foton, JAC, and ZOTYE. These vendors occupy a 45% share of the overall market.

2)Battery module and PACK packaging companies, like Guoxuan High-tech Power Energy, CATL, Shenzhen OptimumNano Energy, and Sunwoda Electronic, which enter the market via independent R&D or cooperation. These businesses seize a 31% share of the overall market.

3)OEMs represented by BYD and BAIC BJEV, which have relatively perfect layout in the sector, with the former integrating R&D of battery, BMS and EV, thus giving it advantages in terms of cost and efficiency, and the latter boasting research capability for BMS after acquisition of Atieva and no longer needing supplies from third-party BMS companies. These companies take up a 24% of the overall market.

Global and China Battery Management System (BMS) Industry Report, 2016-2020 focuses on the followings:

Overview of global and Chinese EV markets (overview, market size, vehicle output, sales, etc.); Overview of global and Chinese EV markets (overview, market size, vehicle output, sales, etc.);

Overview of global BMS industry (status quo & forecast, market size, technology trends, etc.); Overview of global BMS industry (status quo & forecast, market size, technology trends, etc.);

Overview of BMS industry in China (status quo & forecast, price & cost, market size, competitive landscape, supporting, technology trends, etc.); Overview of BMS industry in China (status quo & forecast, price & cost, market size, competitive landscape, supporting, technology trends, etc.);

Major vendors in global BMS industry (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest developments, business in China, etc. of vendors and their subsidiaries); Major vendors in global BMS industry (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest developments, business in China, etc. of vendors and their subsidiaries);

Major vendors in BMS industry in China (independent third parties, cell makers, OEMs) (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest projects of companies and their subsidiaries); Major vendors in BMS industry in China (independent third parties, cell makers, OEMs) (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest projects of companies and their subsidiaries);

Major makers in BMS cell industry (revenue, revenue structure, net income, BMS cell solutions, etc.) Major makers in BMS cell industry (revenue, revenue structure, net income, BMS cell solutions, etc.)

1 BMS电池管理系统概述

1.1 动力电池系统定义

1.2 电池管理系统定义

1.2.1 BMS定义

1.2.2 BMS分类和技术特性

1.2.3 BMS核心功能

2 BMS电池管理系统政策

2.1 已发布政策

2.1.1 《汽车动力蓄电池行业规范条件》

2.1.2 《新能源汽车生产企业及产品准入管理规则》

2.1.3 动力电池国标(GB/T)

2.2 制定中政策

2.2.1 电池管理系统(BMS)国标

3 全球BMS市场发展概况

3.1 全球电动车市场

3.2 市场规模和发展趋势

3.3 技术趋势

3.4 供应配套

4 中国BMS市场发展概况

4.1 中国电动汽车市场

4.2 价格成本

4.3 市场规模

4.4 竞争格局

4.5 供应配套关系

4.6 技术路线

4.7 发展趋势

5 全球BMS厂商研究

5.1 Denso (Japan)

5.1.1 企业简介

5.1.2 BMS业务

5.2 Calsonic Kansei (Japan)

5.2.1 企业简介

5.2.2 BMS业务

5.3 Hitachi Automotive Systems (Japan)

5.3.1 企业简介

5.3.2 BMS业务

5.4 Mitsubishi Electric (Japan)

5.4.1 企业简介

5.4.2 BMS业务

5.5 Hyundai Kefico (Korea)

5.5.1 企业简介

5.5.2 BMS业务

5.6 LG Chem (Korea)

5.6.1 企业简介

5.6.2 BMS业务

5.7 SK Innovation (Korea)

5.7.1 企业简介

5.7.2 BMS业务

5.8 TeslaMotors (USA)

5.8.1 企业简介

5.8.2 BMS业务

5.9 Lithium Balance (Denmark)

5.9.1 企业简介

5.9.2 产品介绍

5.9.3 产品应用

5.9.4 在华布局

5.10 Vecture (Canada)

5.10.1 企业简介

5.10.2 产品介绍

5.10.3 产品应用

5.10.4 产业布局

5.11 RimacAutomobili (Croatia)

5.11.1 企业简介

5.11.2 产品介绍

5.11.3 产品应用

5.12 创扬科技股份有限公司(台湾)

5.12.1 企业简介

5.12.2 产品介绍及应用

5.13 Clayton Power (Denmark)

5.13.1 企业简介

5.13.2 产品介绍

6 中国BMS厂商(独立第三方)

6.1 惠州亿能

6.1.1 企业简介

6.1.2 BMS业务

6.2 科列技术

6.2.1 企业简介

6.2.2 BMS业务

6.3 华霆(合肥)动力

6.3.1 企业简介

6.3.2 BMS产品

6.4 均胜汽车电子(德国普瑞Preh)

6.4.1 企业简介

6.4.2 BMS业务

6.5 哈尔滨冠拓电源

6.5.1 企业简介

6.5.2 BMS产品

6.6 安徽力高

6.6.1 企业简介

6.6.2 BMS业务

6.7 宁波拜特

6.7.1 企业简介

6.7.2 BMS业务

6.8 宁波远道

6.8.1 企业简介

6.8.2 BMS产品

6.9 深圳市安泰佳科技

6.9.1 企业简介

6.9.2 BMS产品

6.10 芜湖天元

6.10.1 企业简介

6.10.2 BMS产品

6.11 深圳市派司德

6.11.1 企业简介

6.11.2 BMS业务

7 中国BMS厂商(整车类)

7.1 比亚迪(BYD)

7.1.1 企业简介

7.1.2 BMS业务

7.2 北汽新能源

7.3 杭州杰能

7.3.1 企业简介

7.3.2 BMS业务

8 中国BMS厂商(动力电池类)

8.1 北京普莱德

8.1.1 企业简介

8.1.2 BMS业务

8.2 ATL

8.2.1 企业简介

8.2.2 BMS业务

8.3 国轩高科

8.3.1 企业简介

8.3.2 BMS业务

8.4 中航锂电

8.4.1 企业简介

8.4.2 BMS业务

8.5 欣旺达

8.5.1 企业简介

8.5.2 BMS业务

8.6 温斯顿电池

8.6.1 企业简介

8.6.2 BMS产品

9 全球BMS芯片厂商

9.1 Analog Devices (USA)

9.1.1 企业简介

9.1.2 经营情况

9.1.3 营收构成分析

9.1.4 毛利率分析

9.1.5 BMS解决方案

9.2 Texas Instruments (USA)

9.2.1 企业简介

9.2.2 经营情况

9.2.3 营收构成分析

9.2.4 毛利率分析

9.2.5 BMS芯片业务现状及展望

9.3 Infineon (Germany)

9.3.1 企业简介

9.3.2 经营情况

9.3.3 营收构成分析

9.3.4 毛利率分析

9.3.5 BMS芯片业务现状及展望

1 Overview of BMS

1.1 Definition of Power Battery

1.2 Definition of BMS

1.2.1 Definition

1.2.2 Classification and Technical Features

1.2.3 Core Functions

2 Policies on BMS

2.1 Promulgated Policies

2.1.1 Standard Conditions for Automotive Power Battery Industry

2.1.2 Regulations on New Energy Vehicle Manufacturers and Products Access

2.1.3 National Standards for Power Battery (GB/T)

2.2 Policies Being Made

2.2.1 National Standards for BMS

3 Global BMS Market

3.1 Global EV Market

3.2 Market Size and Development Trends

3.3 Technology Trends

3.4 Supporting

4 Chinese BMS Market

4.1 Chinese EV Market

4.2 Price & Cost

4.3 Market Size

4.4 Competitive Landscape

4.5 Supporting

4.6 Technology Roadmap

4.7 Development Trends

5 Global BMS Vendors

5.1 Denso (Japan)

5.1.1 Profile

5.1.2 BMS Business

5.2 Calsonic Kansei (Japan)

5.2.1 Profile

5.2.2 BMS Business

5.3 Hitachi Automotive Systems (Japan)

5.3.1 Profile

5.3.2 BMS Business

5.4 Mitsubishi Electric (Japan)

5.4.1 Profile

5.4.2 BMS Business

5.5 Hyundai Kefico (Korea)

5.5.1 Profile

5.5.2 BMS Business

5.6 LG Chem (Korea)

5.6.1 Profile

5.6.2 BMS Business

5.7 SK Innovation (Korea)

5.7.1 Profile

5.7.2 BMS Business

5.8 Tesla Motors (USA)

5.8.1 Profile

5.8.2 BMS Business

5.9 Lithium Balance (Denmark)

5.9.1 Profile

5.9.2 Products

5.9.3 Application of Products

5.9.4 Presence in China

5.10Vecture (Canada)

5.10.1 Profile

5.10.2 Products

5.10.3 Application of Products

5.10.4 Industrial Layout

5.11 RimacAutomobili (Croatia)

5.11.1 Profile

5.11.2 Products

5.11.3 Application of Products

5.12Digi-Triumph Technology (Taiwan)

5.12.1 Profile

5.12.2 Products and Application

5.13 Clayton Power (Denmark)

5.13.1 Profile

5.13.2 Products

6 Chinese BMS Vendors (Independent Third Parties)

6.1 Huizhou E-power Electronics

6.1.1 Profile

6.1.2 BMS Business

6.2 Shenzhen Klclear Technology

6.2.1 Profile

6.2.2 BMS Business

6.3 SINOEV (Hefei) Technologies

6.3.1 Profile

6.3.2 BMS Products

6.4 Ningbo Joyson Electronic Corp. (German Preh GmbH)

6.4.1 Profile

6.4.2 BMS Business

6.5 Harbin Guantuo Power Equipment Co., Ltd.

6.5.1 Profile

6.5.2 BMS Products

6.6 Anhui LIGOO New Energy Technology Co., Ltd.

6.6.1 Profile

6.6.2 BMS Business

6.7 Ningbo Bate Technology Co., Ltd.

6.7.1 Profile

6.7.2 BMS Business

6.8 Ningbo Longway Electrical Co., Ltd.

6.8.1 Profile

6.8.2 BMS Products

6.9 Shenzhen Antega Technology Co., Ltd.

6.9.1 Profile

6.9.2 BMS Products

6.10Wuhu Tianyuan Automobile Electric Co., Ltd.

6.10.1 Profile

6.10.2 BMS Products

6.11 Shenzhen Battsister Tech. Co., Ltd.

6.11.1 Profile

6.11.2 BMS Business

7 Chinese BMS Vendors (OEMs)

7.1 BYD

7.1.1 Profile

7.1.2 BMS Business

7.2 BAIC BJEV

7.3 Hangzhou Genwell-Power Co., Ltd.

7.3.1 Profile

7.3.2 BMS Business

8 Chinese BMS Vendors (Power Battery)

8.1 Beijing Pride New Energy Battery Technology Co., Ltd.

8.1.1 Profile

8.1.2 BMS Business

8.2 ATL

8.2.1 Profile

8.2.2 BMS Business

8.3 Hefei Guoxuan High-tech Power Energy Co., Ltd.

8.3.1 Profile

8.3.2 BMS Business

8.4 China Aviation Lithium Battery Co., Ltd.

8.4.1 Profile

8.4.2 BMS Business

8.5 Sunwoda Electronic Co., Ltd.

8.5.1 Profile

8.5.2 BMS Business

8.6 Winston Battery

8.6.1 Profile

8.6.2 BMS Products

9 Global BMS Chip Vendors

9.1 Analog Devices (USA)

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 BMS Solutions

9.2 Texas Instruments (USA)

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 Status Quo and Prospects of BMS Chip Business

9.3 Infineon (Germany)

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 Status Quo and Prospects of BMS Chip Business

图:动力电池系统

图:动力电池系统全生产环节成本分解

图:电池系统中BMS成本占比

图:典型电池厂商的动力电池包系统

图:电池管理系统的硬件系统示意图

表:BMS系统四大模块构成和功能

表:符合《汽车动力蓄电池行业规范条件》企业目录(第一批)

表:符合《汽车动力蓄电池行业规范条件》企业目录(第二批)

表:符合《汽车动力蓄电池行业规范条件》企业目录(第三批)

表:符合《汽车动力蓄电池行业规范条件》企业目录(第四批)

图:中国已形成完善的电动汽车标准体系

表:2015年新发布的动力电池国标

表:GB/T 31467动力电池系统标准

图:电池系统测试通用流程(CARTAC)

表:2013-2015年全球电动乘用车销量对比(主要国家或地区)

图:2014-2016H1全球新能源车(EV&PHEV)月度销量

图:2011-2020年全球电动乘用车(EV&PHEV)销量

图:全球54款外资主流新能源汽车(EV&PHEV)动力电池供应供应商

图:2014-2025全球电池管理系统(BMS)行业规模趋势

表:全球BMS主动均衡和被动均衡技术成本、应用分析

图:2010-2018年中国汽车保有量与产销量

图:2010-2016H1中国电动汽车产量

图:2011-2020年中国电动乘用车(EV&PHEV)产量

图:2011-2020年中国电动客车产量

图:2013-2020年中国纯电动货车/物流车(EV)产量

表:乘用车/商用车BMS售价在动力电池价格中所占比例

图:2013-2020年中国BMS市场规模(分乘用车、客车、物流车)趋势

表:2020年中国新能源乘用车BMS分产品市场规模

图:国内BMS市场竞争格局

表:国内主要BMS公司汇总

表:2015年中国新能源汽车BMS厂商市场份额

表:2015年中国新能源乘用车BMS供应商

表:2015年中国纯电动乘用车BMS供应商(分厂商类型)市场份额

表:2015年中国纯电动乘用车BMS供应商(分内资、外资)市场份额

表:2015年中国新能源客车BMS供应商

图:国内前五大纯电动客车BMS供应商装机量统计

表:国内外主流BMS供应商的技术参数对比

图:主动均衡和被动均衡技术对比

表:国内主要BMS厂均衡技术情况

表:2016电动汽车电池管理系统BMS专利排行榜(分企业)

图:FY2015-FY2016Denso汽车业务销售构成

图:FY2016Denso分客户销售构成

表:2013-2015年Denso电池管理系统配套车型

图:FY2012-FY2016Denso研发投入情况

图:2010-2016财年Calsonic营业收入和近利润

图:2016财年Calsonic分地区营收情况

表:2012-2015年Calsonic Kansei电池管理系统配套车型

图:FY2016三菱电机分业务销售情况

图:2010-2015年Kefico营业收入和净利润

图:2015年LG化学股权结构图

图:2007-2015H1年LGC经营业绩

图:2015年LGC营业收入分区域

图:LG化学动力电池业务框架

图:LG化学BMS

图:2010-2015年LG化学动力电池及BMS应用现状

表:SKI动力锂电池及BMS技术参数

图:2011-2014年Tesla动力系统及相关组件业务营收情况

图:smart fortwo电动车

图:丰田RAV4 EV

图:可扩展电池管理系统(s-BMS)

图:集成电池管理系统(i-BMS)

图:英国Tennant 500ZE

图:TMHE电动叉车

图:ECOTRUCK7500型电动垃圾收集卡车

图:锂平衡客户

表:锂平衡中国地区代理商概况

图:Vecture公司的BMS

图:Vecture产品的应用领域

图:社区智能电网项目

图:“夏娃”项目

图:Rimac 的R-BMS2

图:Rimac Concept_One

图:创扬科技BMS产品应用领域

表:创扬科技主要合作伙伴

图:Clayton BMS

图:2011-2015年亿能电子营业收入及净利润

表:亿能电子BMS产品

图:亿能电子部分合作伙伴

图:2012-2015科列技术经营业绩

表:2015年科列技术BMS分应用类型营收

图:纯电动客车BMS

表:科列技术BMS模块功能

图:科列技术部分合作伙伴

表:母公司均胜电子事业部及产品情况

图:宝马i3电池管理系统

图:2005-2015年德国普瑞营业收入

表:德国普瑞全球分部情况

图:BF101型电池管理系统

图:防水系列(BC111/BS111/BS113/BS313)

表:冠拓电源BMS主要参数

图:力高技术部分客户

图:EK-FT-12商用车BMS(增强型)

图:拜特测控主要客户

图:上汽荣威750HEV电池管理系统

表:拜特测控BMS主要参数

图:宁波远道BMS- 200 LF

图:宁波远道BMS- 36 LF

图:24V100AH动力锂电池管理系统

图:芜湖天元BMS

表:芜湖天元BMS主要参数

图:BMS-108电动车辆电池管理系列

图:派司德合作伙伴

图:力高技术轻型车用BMS

图:力高技术大中型车用BMS

图:力高技术矿用型车用BMS

图:2008-2015H1比亚迪经营业绩

图:2012-2015H1比亚迪(分业务)营收构成

图:2009-2015H1比亚迪(分业务)毛利率

图:2011-2020年比亚迪电动汽车销量

图:杰能动力ABM-BMS主动均衡BMS

图:2015年北京普莱德股权结构图

图:2011-2015 年北京普莱德经营业绩

表:北京普莱德主要客户及合作领域

图:2008-2015年ATL经营业绩

表:ATL客户配套情况

图:2009-2015国轩高科经营业绩

图:国轩高科BMS

图:2016年中航锂电股权结构图

图:2010-2015年中航锂电经营业绩

图:2010-2015年欣旺达经营业绩

表:欣旺达电池管理系统主要指标

图:2010-2015欣旺达营收与净利润

图:2015年欣旺达(按产品)营收占比

图:GTBMS005A-MC 11彩屏BMS

图:2007-2015年ADI营业收入及毛利率

图:2007-2015年ADI净利润及净利润率

图:2010-2015年ADI(分地区)营业收入情况

图:2015ADI(分行业)营业收入情况

图:2008-2015年ADI毛利率增长情况

图:ADI公司HEV/ EV锂电池管理解决方案(≤150 V)

图:ADI公司HEV/ EV锂电池管理解决方案(≥300 V)

图:2007-2015年TI营业收入及毛利率

图:2007-2015年TI净利润及净利润率

图:2007-2015年TI(分产品)营业收入情况

图:2010-2015年TI(分地区)营业收入情况

图:2007-2015年TI毛利率增长情况

图:2007-2015年TI主要产品营业利润率

图:TI混合动力和纯电动汽车解决方案

图:TI电池管理系统解决方案

图:TI的电池管理系统

图:FY2009-FY2015IFX营业收入及毛利率

图:FY2009-FY2015IFX净利润及净利润率

图:FY2009-FY2015IFX(分部门)营业收入情况

图:FY2009-FY2015IFX(分地区)营业收入情况

图:FY2009-FY2015IFX毛利率增长情况

图:2014年全球汽车半导体主要公司市场份额

图:FY2009-FY2015IFX汽车电子部门营收情况

图:IFX汽车电子全球主要客户

图:IFX的BMS解决方案

图:FY2009-FY2015IFX中国市场营收情况

图:2009-2015年福田汽车营业收入与新能源汽车销量情况

Power Battery System

Production Cost Breakdown of Power Battery System

BMS Cost Proportion of Battery System

Power Battery Pack System of Typical Battery Manufacturers

Hardware System Diagram of BMS

Four Modules and Functions of BMS

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (First Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Second Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Third Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Fourth Batch)

China's Perfect Electric Vehicle Standard System

Newly Released National Standards on Power Battery, 2015

GB / T 31467 Power Battery System Standards

General Flow (CARTAC) for Battery System Test

Global Electric Passenger Vehicle Sales Volume Comparison (Major Countries or Regions), 2013-2015

Global New Energy Vehicle (EV & PHEV) Monthly Sales Volume, 2014-2016H1

Global Electric Passenger Car (EV & PHEV) Sales Volume, 2011-2020E

Power Battery Suppliers of 54 Foreign Mainstream New Energy Vehicle (EV & PHEV) Models

Scale of Global BMS Industry, 2014-2025E

Costs and Applications of Global BMS Active and Passive Balancing Technologies

China's Vehicle Ownership, Output and Sales Volume, 2010- 2018E

China's Electric Vehicle Output, 2010-2016H1

China's Electric Passenger Vehicle (EV & PHEV) Output, 2011-2020E

China's Electric Bus Output, 2011-2020E

China's Battery Electric Truck / Logistics Vehicle (EV) Output, 2013-2020E

Proportion of Passenger Vehicle/Commercial Vehicle BMS Price in Power Battery Price

China's BMS Market Size (by Passenger Car, Bus, Logistics Vehicle), 2013-2020E

China's New Energy Passenger Vehicle BMS Market Size by Product, 2020

Competitive Landscape of China BMS Market

Main BMS Companies in China

Market Share of New Energy Vehicle BMS Manufacturers in China, 2015

New Energy Passenger Vehicle BMS Suppliers in China, 2015

Market Share of Battery Electric Passenger Vehicle BMS Suppliers (by Type) in China, 2015

Market Share of Battery Electric Passenger Vehicle BMS Suppliers (by Nationality) in China, 2015

New Energy Bus BMS Suppliers in China, 2015

Installed Capacity of China's Top Five Battery Electric Bus BMS Suppliers

Technical Parameter Comparison between Mainstream Chinese and Foreign BMS Suppliers

Comparison between Active and Passive Balancing Technologies

Balancing Technologies of Main BMS Vendors in China

Ranking of Electric Vehicle BMS Patents (by Company), 2016

Sales Structure of Denso’s Automotive Business, FY2015-FY2016

Denso’s Sales Structure by Client, FY2016

Vehicle Models Supported by Denso's BMS, 2013-2015

Denso’s R & D Investment, FY2012-FY2016

Calsonic’s Revenue and Net Income, FY2010-FY2016

Calsonic’s Revenue by Region, FY2016

Vehicle Models Supported by Calsonic Kansei's BMS, 2012-2015

Revenue of Mitsubishi Electric by Business, FY2016

Kefico’s Revenue and Net Income, 2010-2015

Equity Structure of LG Chemical, 2015

LGC’s Operating Results, 2007-2015H1

LGC’s Revenue by Region, 2015

Power Battery Business Framework of LG Chemical

BMS of LG Chemical

Power Batteries and BMS Application of LG Chemical, 2010-2015

Power Lithium Batteries and BMS Technical Parameters of SKI

Tesla’s Revenue from Power System and Related Components, 2011-2014

Smart fortwo Electric Vehicles

Toyota’s RAV4 EV

Scalable BMS (s-BMS)

Integrated BMS (i-BMS)

British Tennant 500ZE

TMHE Electric Forklifts

ECOTRUCK7500 Electric Garbage Collection Trucks

Customers of Lithium Balance

Overview of Lithium Balance’s Agents in China

Vecture's BMS

Application of Vecture's Products

Community Smart Grid Projects

‘Eve’ Project

Rimac’s R-BMS2

Rimac’sConcept_One

Application of JustPower’s BMS Products

JustPower’s Main Co-partners

Clayton’s BMS

Revenue and Net Income of Epower Electronics, 2011-2015

BMS Products of Epower Electronics

Some Partners of Epower Electronics

Operating Results of Klclear Technology, 2012-2015

BMS Revenue of Klclear Technology by Application, 2015

Battery Electric Bus BMS

BMS Function Modules of Klclear Technology

Some Partners of Klclear Technology

Electronics Division and Products of Joyson Electronics

BMW’s i3BMS

Preh’s Revenue, 2005-2015

Preh’s Global Divisions

BF101 BMS

Waterproof Series (BC111 / BS111 / BS113 / BS313)

Main Parameters of Guantuo Power’s BMS

Some Customers of LIGOO New Energy Technology

EK-FT-12 Commercial Vehicle BMS (Enhanced)

Major Customers of Ningbo Bate Technology

BMS of SAIC Roewe 750HEV

Main Parameters of Ningbo Bate Technology’s BMS

BMS- 200 LF of Ningbo Longway Electrical

BMS- 36 LF of Ningbo Longway Electrical

24V100AH Power Lithium BMS

BMS of Wuhu Tianyuan

Main Parameters of Wuhu Tianyuan’s BMS

BMS-108 Electric Vehicle Battery Management Series

Battsister’s Co-partners

LIGOO New Energy Technology’s BMS for Light Vehicles

LIGOO New Energy Technology’s BMS for Large and Medium-sized Vehicles

LIGOO New Energy Technology’s BMS for Mine-use Vehicles

BYD’s Operating Results, 2008-2015H1

BYD’s Revenues Structure (by Business), 2012-2015H1

BYD’s Gross Margin (by Business), 2009-2015H1

BYD’s EV Sales Volume, 2011-2020E

ABM-BMS Active Balancing BMS of Hangzhou Genwell-power

Equity Structure of Beijing Pride New Energy Battery Technology, 2015

Operating Results of Beijing Pride New Energy Battery Technology, 2011-2015

Customers and Cooperation Areas of Beijing Pride New Energy Battery Technology

ATL’s Operating Results, 2008-2015

Customers Supported by ATL

Business Performance of Hefei Guoxuan High-tech Power Energy, 2009-2015

Guoxuan’s High-tech BMS

Equity Structure of China Aviation Lithium Battery, 2016

Business Performance of China Aviation Lithium Battery, 2010-2015

Business Performance of Sunwoda Electronic, 2010-2015

Major Indicators of SunwodaElectronic’s BMS

Revenue and Net Income of Sunwoda Electronic, 2010-2015

Revenue Structure of Sunwoda Electronic by Product, 2015

GTBMS005A-MC 11 Color-screen BMS

ADI’s Revenue and Gross Margin, 2007-2015

ADI’s Net Income and Net Profit Margin, 2007-2015

ADI’s Revenue (by Region), 2010-2015

ADI’s Revenue (by Industry), 2015

ADI’s Gross Margin Growth, 2008-2015

ADI’s HEV/ EV Lithium Battery Management Solutions (≤150 V)

ADI’s HEV/ EV Lithium Battery Management Solutions (≥300 V)

TI’s Revenue and Gross Margin, 2007-2015

TI’s Net Income and Net Profit Margin, 2007-2015

TI’s Revenue (by Product), 2007-2015

TI’s Revenue (by Region), 2010-2015

TI’s Gross Margin Growth, 2007-2015

Operating Margin of TI’s Main Products, 2007-20151

TI’s Hybrid and Battery Electric Vehicle Solutions

TI’s BMS Solutions

TI’s BMS

IFX’s Revenue and Gross Margin, FY2009-FY2015

IFX’s Net Income and Net Profit Margin, FY2009-FY2015

IFX’s Revenue (by Division), FY2009-FY2015

IFX’s Revenue (by Region), FY2009-FY2015

IFX’s Gross Margin Growth, FY2009-FY2015

Market Share of Major Global Automotive Semiconductor Companies, 2014

Revenue of IFX’s Automotive Electronics Division, 2009-2015

Major Clients of IFX’s Automotive Electronics Division

IFX’s BMS Solutions

IFX’s Revenue in China, FY2009-FY2015

Foton’s Revenue and New Energy Vehicle Sales Volume, 2009-2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|