|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2016-2020年中国IGBT(轨道交通,电动汽车,风电,光伏,家电)市场研究报告 |

|

字数:4.0万 |

页数:200 |

图表数:246 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2500美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2800美元 |

|

编号:LT030

|

发布日期:2016-08 |

附件:下载 |

|

|

|

IGBT是以GTR为主导元件,MOSFET为驱动元件的达林顿结构的复合器件。其融合了BJT和MOSFET的两种器件的优点,如驱动功率小和饱和压降低等。

随着IGBT芯片技术的不断发展,芯片的最高工作结温与功率密度不断提高。未来IGBT模块技术将围绕芯片背面焊接固定与正面电极互连两方面改进:1)无焊接、无引线键合及无衬板/基板封装技术;2)内部集成温度传感器、电流传感器及驱动电路等功能元件。

受益于电动汽车市场驱动和IGBT技术成熟,预计2014-2020年间全球IGBT市场的复合年增长率将达到9%,到2020年全球IGBT市场规模将达到65亿美元。消费类和白色家电IGBT市场份额将逐渐减少。而电网、光伏、不间断电源(UPS)以及电动汽车市场,将是未来5年IGBT主要增长领域。

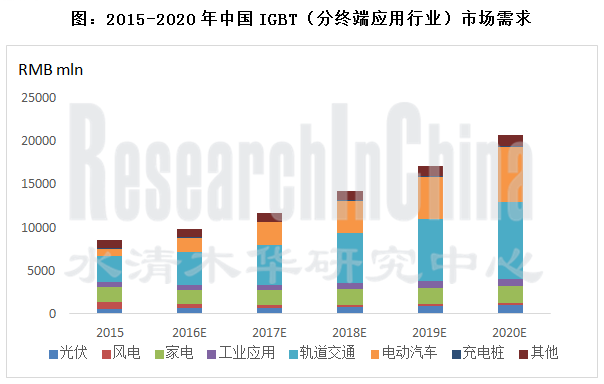

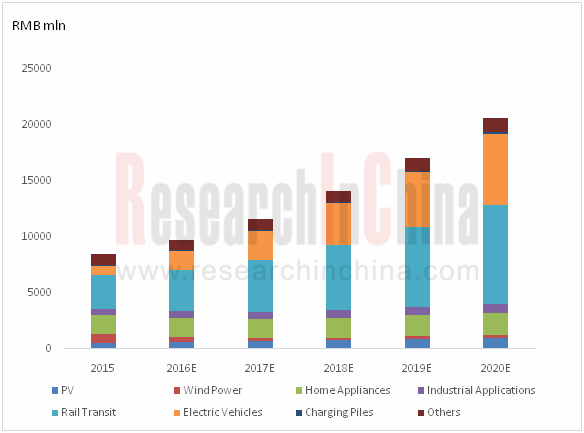

受益于分布式能源、新能源汽车及充电桩、轨道交通的快速发展,中国 IGBT需求增长空间巨大, 2015年中国IGBT市场规模为85亿元左右,约占全球市场的1∕3。预计到2020年,中国 IGBT将超200亿元,年复合成长率为19.4%,占全球市场份额近1/2。

市场竞争格局方面:

近几年中国IGBT产业在国家政策及市场牵引下得到迅速发展,已形成了IDM模式和代工模式的IGBT较为完整的产业链。但中国IGBT市场供应主要还是由国外厂商控制,2015年市场份额前五名的厂商均是国外厂商,合计市场份额为51.9%。欧美企业(如英飞凌、赛米控、飞兆等)的优势主要在电力电子和通讯行业,而日本品牌(如三菱、FUJI、东芝等)主要面向家电类产品。2015年中国IGBT市场占全球市场1/3份额,到2020年将占据全球近半市场份额,年均增速在19%左右。

细分应用行业方面:

目前中国家电市场相对饱和,未来5年增量空间较为有限。变频冰箱作为渗透率较低的白电产品,将是未来5年家电产品中对IGBT需求增速最快的产品。

受政府发展规划的影响,未来5年中国风电和光伏产业可能出现截然不同的发展路径。到2020年中国光伏累计装机量将突破160GW,对应IGBT需求规模将达到10亿元左右。而由于弃风现象严重,到2020年中国风电累计装机规划为210GW,这意味着未来5年中国风电新增装机规模增量将显著下滑,对应IGBT需求也将出现萎缩。

2010-2021年,中国主要城市轨道交通规划投资额达3.18万亿,高铁方面,到2020年中国动车组保有量将突破4300辆。预计到2020年中国轨道交通IGBT需求量将突破120万只,是2015年的4倍。

随着新能源电动汽车的发展,电子设备在整车的占比也从原来的不到20%上升到50%以上,IGBT 等功率器件模块使用数量相应大幅提升。Fairchild、英飞凌、ST 在汽车市场占据较大优势。比亚迪和上海先进合作也在做相应的配套IGBT。到2020年中国电动汽车(包括EV、PHEV、HEV、电动客/货车)销量有望突破300万辆,带动IGBT需求超60亿元。

《2016-2020年中国IGBT(轨道交通/电动汽车/风电/光伏/家电)市场研究报告》报告主要包括以下内容:

IGBT概述、技术发展历程及趋势、行业应用; IGBT概述、技术发展历程及趋势、行业应用;

中国IGBT主要细分应用市场(包括轨道交通、风电、光伏、电动汽车、UPS、家电等)发展现状及IGBT需求趋势 中国IGBT主要细分应用市场(包括轨道交通、风电、光伏、电动汽车、UPS、家电等)发展现状及IGBT需求趋势

全球及中国IGBT市场规模、竞争格局、供应链分析; 全球及中国IGBT市场规模、竞争格局、供应链分析;

中国16家IGBT相关厂商(包括IDM、模块、代工)发展概况、经营情况及IGBT技术/业务分析; 中国16家IGBT相关厂商(包括IDM、模块、代工)发展概况、经营情况及IGBT技术/业务分析;

全球主要9家IGBT厂商经营情况及IGBT技术/业务分析。 全球主要9家IGBT厂商经营情况及IGBT技术/业务分析。

An IGBT is a complex device with the Darlington configuration. Using GTR as the dominant component and MOSFET as the drive component, IGBTcombines the merits of BJT and MOSFET, such as low drive power, low saturation voltage and the like.

With the development of IGBT chip technology, the maximum operating junction temperature and power density of chips keep increasing. In future, the IGBT module technology will be improved in two aspects -- chip backside welding & fixing and front electrode interconnection: 1) the technology without welding, wire bonding or liner/substrate packaging; 2) internally integrated temperature sensors, current sensors, driving circuits and other functional components.

Benefiting from the electric vehicle market and the mature IGBT technology, the global IGBT market will grow at a compound annual rate of 9% during 2014-2020 and reach USD6.5 billion in 2020. The market share of IGBTs used for consumer and white goods will gradually decrease, while IGBTs for power grid, PV, uninterruptible power supply (UPS) as well as electric vehicle will be a major growth engine in the next five years.

Thanks to the rapid development of distributed energy, new energy vehicle, charging piles and rail transit, China’s potential IGBT demand is huge. In 2015, Chinese IGBT market size hit about RMB8.5 billion, accounting for about one-third of the global market. By 2020, Chinese IGBT market will garner over RMB20 billion with a CAGR of 19.4%, equivalent to nearly half of the global market.

Market Competition Pattern:

In recent years, China’s IGBT industry has developed rapidly under the guide of national policies and the market, and has shaped a complete industrial chain with IDM and OEM models. However, Chinese IGBT supply market is mainly controlled by foreign companies, for example, all of the top five suppliers were foreign vendors who enjoyed the combined market share of 51.9% in 2015. The advantages of European and American companies (such as Infineon, Semikron, Fairchild, etc.) are mainly reflected in power, electronics and communications, while Japanese brands (such as Mitsubishi, FUJI, Toshiba, etc.) target home appliances. China seized 1/3 of the global IGBT market share in 2015 and will master nearly 1/2 by 2020, with the AAGR of about 19%.

Subdivision of Applications:

The current saturated Chinese home appliance market will see limited incremental space in the next five years. Among white household electrical appliances, inverter refrigerators with low permeability will generate the fastest growing demand for IGBT in the next five years.

Affected by the government’s development plan, China's wind power and PV industries may follow different development paths in the next five years. By 2020, China's PV installed capacity will cumulate to above 160GW, which means the IGBT demand will value RMB1 billion or so. Given the serious wind energy curtailment, China's total wind power installed capacity is planned to be 210GW by 2020, which indicates that China's additional wind power installed capacity will witness sharp drop in the next five years, so that the demand for IGBTs will shrink.

The major cities in China plan to invest RMB3.18 trillion in rail transit in 2010-2021. As for high-speed rail, China will own over 4,300 CRH trains by 2020, which will need 1.2 million IGBTs, four times that in 2015.

With the development of new energy electric vehicles, the proportion of electronic devices in a vehicle has jumped from less than 20% to over 50%, and the application of IGBTs and other power device modules has been intensified obviously. Fairchild, Infineon and ST enjoy superiority in the automotive market. BYD and Advanced Semiconductor Manufacturing Co., Ltd (ASMC) cooperate in IGBTs. By 2020, China’s electric vehicle (including EV, PHEV, HEV, electric bus / truck) sales volume is expected to exceed 3 million, which will stimulate the IGBT demand to go beyond RMB6 billion.

The report covers the followings:

Overview, technology development course and trends, and applications of IGBT; Overview, technology development course and trends, and applications of IGBT;

Status quo and IGBT demand trends of Chinese IGBT application market segments (including rail transit, wind power, PV, electric vehicle, UPS, home appliances, etc.) Status quo and IGBT demand trends of Chinese IGBT application market segments (including rail transit, wind power, PV, electric vehicle, UPS, home appliances, etc.)

Size, competition pattern and supply chain of Global and Chinese IGBT markets; Size, competition pattern and supply chain of Global and Chinese IGBT markets;

Development, operation and IGBT technology/business of 16 Chinese IGBT companies (including IDM, modules, OEM); Development, operation and IGBT technology/business of 16 Chinese IGBT companies (including IDM, modules, OEM);

Operation and IGBT technology / business of 9 global IGBT vendors. Operation and IGBT technology / business of 9 global IGBT vendors.

China’s IGBT Market Demand (by Terminal Application), 2015-2020

第一章 IGBT概述

1.1 产品定义

1.2 工作原理

1.3 IGBT技术路线演进

1.4 IGBT主要应用领域

第二章 产业链下游应用市场分析

2.1 光伏市场

2.1.1 中国光伏市场发展概况

2.1.2 发展规划

2.1.3 主要企业

2.1.4 光伏IGBT市场需求

2.2 风电市场

2.2.1 中国风电市场发展概况

2.2.2 发展规划

2.2.3 主要企业

2.2.4 风电IGBT市场需求

2.3 家电市场

2.3.1 空调市场

2.3.2 冰箱市场

2.3.3 洗衣机

2.3.4 电磁炉

2.4 工业应用

2.4.1 电焊机市场

2.4.2 UPS不间断电源市场

2.5 轨道交通市场

2.6 电动汽车市场

2.7 充电桩市场

第三章 全球和中国IGBT市场

3.1 IGBT发展概况

3.2 市场规模

3.3 竞争格局

3.4 供应链

3.5 IGBT发展动向

第四章 中国IGBT生产商

4.1 吉林华微电子股份有限公司

4.1.1 公司简介

4.1.2 经营情况

4.1.3 客户及供应商

4.1.4 研发

4.1.5 产能及出货量

4.1.6 IGBT业务进展

4.2 华虹半导体有限公司

4.2.1 公司简介

4.2.2 经营情况

4.2.3 技术及研发

4.2.4 产能及出货量

4.2.5 IGBT业务进展

4.3株洲中车时代电气股份有限公司

4.3.1 公司简介

4.3.2 经营情况

4.3.3 IGBT业务及技术

4.3.4 汽车级IGBT业务

4.3.5 IGBT发展战略

4.4 比亚迪股份有限公司

4.4.1 公司简介

4.4.2 经营情况

4.4.3 IGBT业务

4.5 江苏宏微科技股份有限公司

4.5.1 公司简介

4.5.2 经营情况

4.5.3 商业模式

4.5.4 客户与供应商

4.5.5 IGBT业务

4.6 科达半导体有限公司

4.6.1 公司简介

4.6.2 经营情况

4.6.3 IGBT业务

4.7 杭州士兰微电子股份有限公司

4.7.1 公司简介

4.7.2 经营情况

4.7.3 IGBT业务

4.7.4 驱动系统业务动态

4.8 华润上华半导体有限公司

4.8.1 公司简介

4.8.2 核心技术

4.8.3 IGBT业务

4.9 上海先进半导体制造股份有限公司

4.9.1 公司简介

4.9.2 经营情况

4.9.3 核心技术

4.9.4 主要客户

4.9.5 IGBT业务及技术

4.9.6 产能及利用率

4.10 南京银茂微电子制造有限公司

4.10.1 公司简介

4.10.2 IGBT业务

4.11 深圳方正微电子有限公司

4.11.1 公司简介

4.11.2 主要业务及产能

4.11.3 IGBT业务

4.12 中航(重庆)微电子有限公司

4.12.1 公司简介

4.12.2 技术路线及产能

4.12.3 IGBT业务

4.13 西安永电电气有限责任公司

4.13.1 公司简介

4.13.2 经营情况

4.13.3 IGBT业务

4.14 西安爱帕克电力电子有限公司

4.14.1 公司简介

4.14.2 IGBT业务

4.15 威海新佳电子有限公司

4.16嘉兴斯达半导体股份有限公司

4.16.1 公司简介

4.16.2 IGBT业务

第五章 全球IGBT供应商

5.1 富士电机

5.1.1 公司简介

5.1.2 经营情况

5.1.3 IGBT业务

5.1.4 电动汽车IGBT

5.2 英飞凌

5.2.1 公司简介

5.2.2 经营情况

5.2.3 IGBT业务

5.2.4 电动汽车IGBT

5.3 电装

5.3.1 公司简介

5.3.2 经营情况

5.3.3 IGBT业务

5.4 ROHM

5.4.1 公司简介

5.4.2 经营情况

5.4.3 IGBT业务

5.5 IR

5.5.1 公司简介

5.5.2 经营情况

5.5.3 IGBT业务

5.6 赛米控

5.6.1 公司简介

5.6.2 经营情况

5.6.3 IGBT业务

5.7 意法半导体

5.7.1 公司简介

5.7.2 经营情况

5.7.3 IGBT业务

5.8 飞兆

5.8.1 公司简介

5.8.2 经营情况

5.8.3 IGBT业务

5.9 IXYS

5.9.1 公司简介

5.9.2 经营情况

5.9.3 IGBT业务

1. Overview of IGBT

1.1 Definition

1.2 Operating Principle

1.3 Evolution of Technology Roadmap

1.4 Main Applications

2 Application Markets

2.1 PV Market

2.1.1 Overview

2.1.2 Development Plan

2.1.3 Major Enterprises

2.1.4 Demand for IGBT

2.2 Wind Power Market

2.2.1 Overview

2.2.2 Development Plan

2.2.3 Major Enterprises

2.2.4 Demand for IGBT

2.3 Home Appliance Market

2.3.1 Air Conditioner

2.3.2 Refrigerator

2.3.3 Washing Machine

2.3.4 Induction Cooker

2.4 Industrial Applications

2.4.1 Electric Welder

2.4.2 UPS

2.5 Rail Transit

2.6 Electric Vehicle

2.7 Charging Pile

3 Global and China IGBT Market

3.1 Overview

3.2 Market Size

3.3 Competition Pattern

3.4 Supply Chain

3.5 IGBT Development Trend

4 Chinese IGBT Vendors

4.1 Jilin Sino-Microelectronics

4.1.1 Profile

4.1.2 Operation

4.1.3 Customers and Suppliers

4.1.4 R & D

4.1.5 Capacity and Shipment

4.1.6 IGBT Business

4.2 Hua Hong Semiconductor Limited

4.2.1 Profile

4.2.2 Operation

4.2.3 Technology and R & D

4.2.4 Capacity and Shipment

4.2.5 IGBT Business

4.3 Zhuzhou CRRC Times Electric Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 IGBT Business and Technology

4.3.4 Automotive IGBT Business

4.3.5 IGBT Development Strategy

4.4 BYD

4.4.1 Profile

4.4.2 Operation

4.4.3 IGBT Business

4.5 Jiangsu MacMic Science & Technology

4.5.1 Profile

4.5.2 Operation

4.5.3 Business Model

4.5.4 Customers and Suppliers

4.5.5 IGBT Business

4.6 Keda Semiconductor

4.6.1 Profile

4.6.2 Operation

4.6.3 IGBT Business

4.7 Hangzhou Silan Microelectronics

4.7.1 Profile

4.7.2 Operation

4.7.3 IGBT Business

4.7.4 Drive System Business

4.8 CSMC Technologies Corporation

4.8.1 Profile

4.8.2 Core Technologies

4.8.3 IGBT Business

4.9 Advanced Semiconductor Manufacturing Co., Ltd. (ASMC)

4.9.1 Profile

4.9.2 Operation

4.9.3 Core Technologies

4.9.4 Main Customers

4.9.5 IGBT Business and Technology

4.9.6 Capacity and Utilization

4.10 Nanjing Silvermicro Electronics

4.10.1 Profile

4.10.2 IGBT Business

4.11 Shenzhen Founder Microelectronics

4.11.1 Profile

4.11.2 Main Business and Capacity

4.11.3 IGBT Business

4.12 Skysilicon

4.12.1 Profile

4.12.2 Technology Roadmap and Capacity

4.12.3 IGBT Business

4.13 Xi'an Yongdian Electric

4.13.1 Profile

4.13.2 Operation

4.13.3 IGBT Business

4.14 Xi’An IR-PERI

4.14.1 Profile

4.14.2 IGBT Business

4.15 WeihaiSinga Electronics

4.16 JiaxingStarpowerSemiconductor

4.16.1 Profile

4.16.2 IGBT Business

5 Global IGBT Suppliers

5.1 Fuji Electric

5.1.1 Profile

5.1.2 Operation

5.1.3 IGBT Business

5.1.4 Electric Vehicle IGBT

5.2 Infineon

5.2.1 Profile

5.2.2 Operation

5.2.3 IGBT Business

5.2.4 Electric Vehicle IGBT

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 IGBT Business

5.4 ROHM

5.4.1 Profile

5.4.2 Operation

5.4.3 IGBT Business

5.5 IR

5.5.1 Profile

5.5.2 Operation

5.5.3 IGBT Business

5.6 Semikron

5.6.1 Profile

5.6.2 Operation

5.6.3 IGBT Business

5.7 STMicroelectronics

5.7.1 Profile

5.7.2 Operation

5.7.3 IGBT Business

5.8 Fairchild

5.8.1 Profile

5.8.2 Operation

5.8.3 IGBT Business

5.9 IXYS

5.9.1 Profile

5.9.2 Operation

5.9.3 IGBT Business

图:电力半导体器件分类

表:BJT、MOSFET、IGBT性能比较

图:IGBT模块结构图

图:常见IGBT模块产品

表:IGBT不同产品类型对比

图:IGBT结构简图(左)与等效电路图(右)

表:各代IGBT主要参数对比

图:IGBT结构发展趋势

表:IGBT新技术作用位置及发展趋势

图:IGBT芯片各代特点及结构

图:焊接式IGBT模块结构

图:焊接式IGBT模块封装过程

图:压接式IGBT模块

图:IGBT主要应用领域图示

图:按电压分布的IGBT应用领域

图:2009-2019E全球电容器市场规模

图:2009-2019E中国电容器市场规模

图:2010-2014年中国薄膜电容产销量

图:薄膜电容产业链

图:薄膜电容制造工艺及壁垒

图:薄膜电容主要国内外企业

图:2006-2020年中国光伏装机容量

表:2015/2020年中国太阳能光伏需求量

表:2020年中国太阳能光伏(分地区)规模布局

表:光伏逆变器IGBT品牌

表:光伏逆变器厂商IGBT配套情况

图:2015-2020年中国光伏市场IGBT需求规模

图:2006-2020年中国风电装机容量

图:2015年中国各省(区、市)新增风电装机容量

图:2015年中国各省(区、市)累计风电装机容量

图:截至2015年中国不同功率风电机组累计装机容量比例

图:2015年中国风电新增装机排名(万千瓦)

图:截至2015年底中国风电累计装机份额

图:双馈风电机组拓扑结构

图:2015-2020年中国风电市场IGBT需求规模

图:2016年1-2月空调终端零售市场表现

图:2015-2016年1季度产品结构

图:2016年1季度空调挂机市场分能效销量占比走势

图:2016年1季度空调挂机市场分能效均价走势

图:2016年1季度空调柜机市场分能效销量占比走势

图:2016年1季度空调柜机市场分能效均价走势

图:2016年1季度主要空调品牌能效销量结构同比变动

图:2016年1季度空调行业分品牌均价环比走势

图:2016年1季度空调行业分品牌均价同比走势

图:2010-2020年中国空调产量

图:2010-2020年中国变频空调渗透率

表:2015-2020年中国空调IGBT需求规模

图:2016年1-11周中国冰箱销量及销售额

图:2016年1-11周中国冰箱分门数零售额同比表现

图:2016年1-11周中国冰箱各细分市场零售额同比表现

图:2015-2016年1-11周产品结构零售额份额

图:2016年1-11周冰箱分门数均价变化

图:2015-2016年1-11周智能冰箱零售额渗透率

图:2015-2016年1-11周变频细分市场各品牌表现

图:2015-2016年1-11周风冷冰箱分门零售额渗透率

图:2016年1-11周两门/三门分价格段零售额渗透率

图:2010-2020年中国冰箱产量

图:2010-2020年中国变频冰箱渗透率

表:2015-2020年中国冰箱IGBT需求规模

图:2016年1-2月中国洗衣机销售额及销量

图:2016年1-2月中国洗衣机分洗涤类型零售额份额

图:2016年1-2月洗衣机分洗涤类型均价

图:2016年1-2月线下波轮分价格段零售额份额

图:2016年1-2月线上波轮分价格段零售额份额

图:2016年1-2月线下滚筒分价格段零售额份额

图:2016年1-2月线上滚筒分价格段零售额份额

图:2016年1-2月线上/线下分品牌零售额份额

图:免清洗在波轮市场零售额份额走势

图:2016年1-11周变频产品零售额渗透率

图:2016年1-11周波轮市场分容量零售额渗透率

图:2010-2020年中国洗衣机产量

图:2010-2020年中国变频洗衣机渗透率

表:2015-2020年中国洗衣机IGBT需求规模

图:2010-2015年中国电磁炉销售均价

图:2010-2015年中国电磁炉主要企业市场份额

图:2011-2015年中国电磁炉各级市场零售额占比

图:2010-2020年中国电磁炉产量

表:2015-2020年中国电磁炉IGBT需求规模

表:2015年中国电焊机TOP10企业

图:2010-2020年中国电焊机产量

图:2010-2020年中国大功率/重工业电焊机渗透率

表:2015-2020年中国电焊机用IGBT需求规模

表:2015年中国电焊机出口量(分地区)占比

图:2015年中国电焊机出口额(分地区)占比

图:2010-2020年中国UPS不间断电源产量

图:2015年中国UPS(分功率段)市场份额

图:2012-2020年中国UPS不间断电源行业IGBT渗透率

图:2015-2020年中国UPS不间断电源IGBT需求规模

图:2012-2020年中国地铁车辆产量

表:2015年中国动车组招投标情况

图:2010-2020年中国和谐号动车组产量

图:2016年6月中国主要动车组制造商市场保有量结构

表:2015-2020年中国轨道交通IGBT需求规模

图:2014年全球IGBT模块下游(分领域)市场分布

图:2020年全球IGBT模块下游(分领域)市场分布

图:2014-2020年全球电动汽车用IGBT市场规模

表:2015-2020年中国电动汽车电机控制器需求及市场规模

表:2015-2020年中国电动汽车IGBT模块需求规模

图:IGBT(分电压)应用分布

图:IGBT technology evolution and players involved

图:2014-2016年全球IGBT(分应用)市场规模

图:2014-2020年IGBT销售价格、出货量及市场规模演变

表:2015-2020年中国IGBT市场规模测算

图:2015-2020年中国IGBT市场规模

图:2015年全球主要IGBT厂商市场份额

图:2014年中国IGBT行业主要厂商市场份额

表:全球电动汽车用IGBT主要生产商

图:全球IGBT产业供应链

图:中国IGBT产业供应链

表:中国IGBT产业链主要本土公司及其产品

图:目前市场中可控功率半导体最高电压和电流值

图:功率模块不同集成层次

表:主要材料同硅材料的对比参数

图:不同半导体材料物理参数

图:SPT+ IGBT结构

图:沟槽栅极结构IGBT和CSTBT示意图

图:Structure of an RC-IGBT from ABB

图:华微电子实际控制人持股情况

表:2014-2016Q1华微电子主要财务指标

表:2015年华微电子(分地区)营业收入及毛利率

表:2015年华微电子(分产品)成本构成

表:2014-2015年华微电子前五大客户基本情况

图:2012-2015年华微电子研发投入

表:2014-2015年华微电子主要产品产能、产量

表:2014-2015年华微电子主要产品销售情况

表:华微电子IGBT产品

图:华微电子IGBT产品发展路线图

图:2013-2015年华虹营业收入及毛利率

图:2015Q1-2016Q1华虹(分地区)销售收入

图:2015Q1-2016Q1华虹(分技术平台)销售收入

图:2015Q1-2016Q1华虹(分技术节点)销售收入

图:2015Q1-2016Q1华虹(分技术节点)销售收入

图:华虹半导体技术路线图

图:华虹半导体SuperFlash工艺及配套逻辑工艺

图:华虹半导体SONOS Flash技术系统

图:华虹半导体电源管理工艺规格细分图

图:华虹半导体射频技术工艺

图:华虹半导体功率器件工艺

图:2015Q1-2016Q1华虹半导体各代工厂产能、产能利用率及出货量

图:2011-2015年中车时代电气营业收入及净利润

表:2014-2015年中车时代电气(分产品)营业收入

图:时代电气基于 DMOS 技术以及 DMOS+ 技术的IGBT 元胞横截面图

图:基于技术制造的 IGBT 芯片(8 英寸 wafer)及采用该芯片封装的 1 500 A/3 300 V IGBT 模块

时代电气压接式 IGBT 器件结构

图:2007-2015年比亚迪员工人数

图:2010-2015年比亚迪汽车产销量

图:2007-2016Q1比亚迪营业收入,净利润和毛利率

表:2007-2015年比亚迪(分产品)营业收入

表:2008-2015年比亚迪(分产品)毛利率

表:2008-2015H1年比亚迪(分地区)营业收入

图:宏微科技股权结构

图:2012-2015年宏微科技营业收入及净利润

表:2015年宏微科技(分产品)收入构成

图:宏微电子经营业务链条

表:2013-2014H1宏微科技委外加工商名单及加工额

表:2013-2014H1宏微电子主要外协产品成本情况

表:宏微电子主要代理商情况

表:2015年宏微科技前五名客户情况

表:2015年宏微科技前五名供应商情况

图:宏微电子IGBT产品及应用领域

图:宏微科技IGBT模块产品

图:宏微科技IGBT模块产品应用领域

图:2012-2015年科达半导体营业收入及净利润

图:2012-2015年科达半导体总资产及净资产

图:科达半导体IGBT单管产品线

图:科达半导体IGBT模块产品线

表:2011-2015年士兰微营业收入及净利润

图:2015年士兰微(分产品)收入构成

表:士兰微IGBT芯片产品

表:士兰微IGBT模块产品

图:华润上华工艺路线图

图:华润上华功率器件产品及技术路线

图:华润上华主要IGBT芯片产品

图:2003-2015年先进半导体营业收入

图:2003-2015年先进半导体资本性支出

表:2015-2016年先进半导体(分产品尺寸)收入分布

表:2015年先进半导体收入分布

图:先进半导体4大技术平台

图:2015-2019年上海先进技术路线规划

图:先进半导体主要国内外客户

图:先进半导体功率分立器件产品及技术路线

图:先进半导体功率分立器件产品参数及应用领域

图:2004-2013年先进半导体IGBT出货量

图:先进半导体IGBT主要客户

图:先进半导体与北车战略合作形成高铁IGBT完整的产业链

图:先进半导体与比亚迪战略合作新能源汽车用IGBT

图:先进半导体与国网合作开发智能电网用IGBT

图:先进半导体IGBT技术发展路线

图:先进半导体IGBT背面注入工艺

表:2015-2016年先进半导体产能

表:2015-2016年先进半导体产能利用率

表:银茂微电子主要模块产品及应用领域

图:方正微电子技术路线发展

图:中航微电子业务网络

图:中航微电子厂区概览

图:2012-2015年中航微电子技术发展路线

表:中航微电子产能扩张情况

图:中航微电子功率器件测试能力

表:中航微电子IGBT分立器件产品线

表:中航微电子IGBT模块产品线

表:永电电气主要功率半导体器件产品

图:永电电气高压IGBT芯片

图:西安爱帕克IGBT模块

图:新佳电子IGBT模块产品线

表:FY2010-2016富士电机主要财务指标

表:FY2013-2016富士电机各项业务销售额及运营利润

表:FY2011-2016富士电机各地区销售额

图:2015-2021年富士电机IGBT及SiC研发规划

表:2016-2018年富士电机7代IGBT产品规划

图:Industrial IGBT / SiC Loss Comparison, 2015-2017

图:富士电机汽车功率模块发展路线,2005-2025

图:2013年英飞凌三大业务全球排名

表:FY2013-2015年英飞凌(分地区)收入

表:FY2013-2015英飞凌(分部门)收入

图:Infineon EiceDRIVER™ Family IGBT Modules

图:2011-2015财年电装员工人数

图:FY2013-2015电装销售额及利润

图:FY2011-FY2015年Denso营业利润&净利润

图:FY2013-FY2015Q1Denso分部门营收占比

表:FY2013-FY2015Q1Denso分部门销售收入

图:FY2013-2015电装各地区销售额及运营利润

图:FY2010-FY2014年Denso(分客户)销售收入

图:FY2013-2014电装客户结构

表:日本NEDO功率电子领域项目

表:FY2010-2015 ROHM财务指标

图:FY12-FY17ROHM(分业务)销售收入

图:FY12-FY17ROHM(分地区)销售收入

图:FY12-FY17ROHM(by applicaiton)销售收入

图:ROHM车用IGBT模块主要技术参数

图:ROHM SiC 产品发展历程

图:SiC-based Power Device Lineup of ROHM

表:2012-2014财年IR各部门营业收入

图:赛米控经营情况

表:Semikron主要IGBT品牌产品

图:Product Portfolio of SEMIKRON’s SKiM modules

图:Key Features of SEMIKRON’s SKiM modules

图:Product Portfolio of SEMIKRON’s SKiiP IPM

图:Key Features of SEMIKRON’s SKiiP IPM

图:Structure of SEMIDRON’s SKAI Power Electronic Platform

图:Product Portfolio of SEMIKRON’s SKAI Power Electronic Platform

图:Key Features of SEMIKRON’s SKAI Power Electronic Platform

图:意法半导体概览

图:2011-2015年意法半导体主要财务指标

图:2015年意法半导体(分产品部门)营收结构

图:2014Q1-2016Q1意法半导体毛利率

Classification of Power Semiconductors

Performance Comparison between BJT, MOSFET and IGBT

Structure Diagram of IGBT Modules

Common IGBT Modules

Comparison between Different Types of IGBTs

IGBT Structure Sketch (Left) and Equivalent Circuit Diagram (Right)

Main Parameter Comparison between All Generations of IGBTs

Development Trend of IGBT Structure

Role and Development Trend of New IGBT Technology

Characteristics and Structure of All Generations of IGBT Chips

Structure of Welded IGBT Modules

Packaging Process of Welded IGBT Modules

Press-fit IGBT Modules

Main IGBT Applications

IGBT Applications by Voltage

Global Capacitor Market Size, 2009-2019E

China’s Capacitor Market Size, 2009-2019E

China’s Film Capacitor Output and Sales Volume, 2010-2014

Film Capacitor Industry Chain

Film Capacitor Manufacturing Processes and Barriers

Main Domestic and Overseas Film Capacitor Enterprises

China's PV Installed Capacity, 2006-2020E

China's Solar PV Demand, 2015 / 2020E

China's Solar PV Scale (by Region), 2020E

PV Inverter IGBT Brands

IGBT Supplied to PV Inverter Vendors

Demand of Chinese PV Market for IGBTs, 2015-2020E

China's Wind Power Installed Capacity, 2006-2020E

China's New Wind Power Installed Capacity by Provinces (Autonomous Regions and Municipalities), 2015

China's Cumulative Wind Power Installed Capacity by Provinces (Autonomous Regions and Municipalities), 2015

China's Cumulative Wind Power Installed Capacity by Power of Wind Turbines, by 2015

Ranking of China's New Wind Power Installed Capacity, 2015

Share of China's Cumulative Wind Power Installed Capacity, by the end of 2015

Topological Structure of Doubly Fed Wind Power Units

Demand of Chinese Wind Power Market for IGBTs, 2015-2020E

Performance of Air Conditioner Terminal Retail Market, Jan-Feb 2016

Air-conditioner Product Structure, 2015-Q1 2016

Sales Structure of Wall-hanging Air Conditioner Market by Energy Efficiency, Q1 2016

Average Price of Wall-hanging Air Conditioner Market by Energy Efficiency, Q1 2016

Sales Volume Proportion of Upright Air-conditioners by Energy Efficiency, Q1 2016

Average Price of Upright Air-conditioners by Energy Efficiency, Q1 2016

Sales Volume Proportion of Main Air-conditioner Brands by Energy Efficiency, Q1 2016

MoM Average Price of Air Conditioner Industry by Brand, Q1 2016

YoY Average Price of Air Conditioner Industry by Brand, Q1 2016

China’s Output of Air Conditioners, 2010-2020E

Penetration Rate of Inverter Air Conditioner in China, 2010-2020E

Demand of Air Conditioner for IGBTs in China, 2015-2020E

China’s Refrigerator Sales Volume and Revenue, First 11 Weeks of 2016

Retail Sales of Chinese Refrigerators by Number of Doors, First 11 Weeks of 2016

Retail Sales of Chinese Refrigerator Market Segments, First 11 Weeks of 2016

Retail Sales Share by Product, 2015-First 11 Weeks of 2016

Average Price of Refrigerators by Number of Doors, First 11 Weeks of 2016

Retail Sales Penetration Rate of Smart Refrigerators, 2015-First 11 Weeks of 2016

Performance of Inverter Market Segments by Brand, 2015-First 11 Weeks of 2016

Retail Sales Penetration Rate of Air-cooled Refrigerators by Number of Doors, 2015-First 11 Weeks of 2016

Retail Sales Penetration Rate of Two/Three-door Refrigerators by Price Range, First 11 Weeks of 2016

China’s Output of Refrigerators, 2010-2020E

Penetration Rate of Inverter Refrigerator in China, 2010-2020E

Demand of Refrigerators for IGBTs in China, 2015-2020E

China’s Washing Machine Revenue and Sales Volume, Jan-Feb 2016

Retail Sales Share of Chinese Washing Machines by Washing Type, Jan-Feb 2016

Average Price of Washing Machines by Washing Type, Jan-Feb 2016

Retail Sales Share of Offline Pulsator Washing Machines by Price Range, Jan-Feb 2016

Retail Sales Share of Online Pulsator Washing Machines by Price Range, Jan-Feb 2016

Retail Sales Share of Offline Drum Washing Machines by Price Range, Jan-Feb 2016

Retail Sales Share of Online Drum Washing Machines by Price Range, Jan-Feb 2016

Online / Offline Retail Sales Share by Brand, Jan-Feb 2016

Retail Sales Share of Cleaning-free Washing Machine in Pulsator Washing Machine Market

Retail Sales Penetration Rate of Inverter Products, First 11 Weeks of 2016

Retail Sales Penetration Rate of Pulsator Washing Machine Market by Capacity, First 11 Weeks of 2016

China's Output of Washing Machines, 2010-2020E

Penetration Rate of Inverter Washing Machine in China, 2010-2020E

Demand of Washing Machines for IGBTs in China, 2015-2020E

Average Selling Price of Induction Cookers in China, 2010-2015

Market Share of Main Chinese Induction Cooker Companies, 2010-2015

Retail Sales Proportion of All Levels of Chinese Induction Cooker Markets, 2011-2015

China's Output of Induction Cookers, 2010-2020E

Demand of Induction Cookers for IGBTs in China, 2015-2020E

TOP 10 Electric Welder Enterprises in China, 2015

China's Electric Welder Output, 2010-2020E

Electric Welder Penetration Rate of Chinese High Power/Heavy Industry, 2010-2020E

Demand of Electric Welders for IGBTs in China, 2015-2020E

China’s Electric Welder Export Volume Structure (by Region), 2015

China’s Electric Welder Export Value Structure (by Region), 2015

China’s UPS Output, 2010-2020E

China’s UPS Market Share (by Power Range), 2015

IGBT Penetration Rate of China's UPS industry, 2012-2020E

Demand of UPS for IGBTs in China, 2015-2020E

China's Metro Train Output, 2012-2020E

China’s CRH Train Bidding, 2015

China’s CRH Train Output, 2010-2020E

Ownership Structure of China's Main CRH Train Vendors, June 2016

Demand of Rail Transit for IGBTs in China, 2015-2020E

Global IGBT Module Downstream Market Distribution (by Field), 2014

Global IGBT Module Downstream Market Distribution (by Field), 2020E

Global Electric Vehicle-use IGBT Market Size, 2014-2020E

China's Electric Vehicle Motor Controller Demand and Market Size, 2015-2020E

Demand of Electric Vehicles for IGBT Modules in China, 2015-2020E

IGBT Application Distribution (by Voltage)

IGBT Technology Evolution and Players Involved

Global IGBT Market Size (by Applications), 2014-2016

IGBT Selling Price, Shipment and Market Size, 2014-2020E

China’s IGBT Market Size Estimation, 2015-2020E

China’s IGBT Market Size, 2015-2020E

Market Share of Main IGBT Vendors Worldwide, 2015

Market Share of Main IGBT Vendors in China, 2014

Main Electric Vehicle-use IGBT Vendors Worldwide

Global IGBT Supply Chain

China's IGBT Supply Chain

Main Local IGBT Vendors and Their Products in China

Maximum Voltage and Current Values of Controlled Power Semiconductors Available in Market

Different Levels of Power Module Integration

Parameter Comparison between Main Materials and Silicon Materials

Physical Parameters of Different Semiconductor Materials

SPT+ IGBT Structure

Schematic of Trench Gate Structure IGBT and CSTBT

Structure of an RC-IGBT from ABB

Shares Held by Actual Controller of Sino-Microelectronics

Main Financial Indicators of Sino-Microelectronics, 2014-2016Q1

Revenue and Gross Margin of Sino-Microelectronics (by Region), 2015

Cost Structure of Sino-Microelectronics (by Product), 2015

Top 5 Customers of Sino-Microelectronics, 2014-2015

R&D Investment of Sino-Microelectronics, 2012-2015

Capacity and Output of Main Products of Sino-Microelectronics, 2014-2015

Sales of Main Products of Sino-Microelectronics, 2014-2015

IGBT Products of Sino-Microelectronics

IGBT Development Route of Sino-Microelectronics

Revenue and Gross Margin of Hua Hong Semiconductor, 2013-2015

Revenue (by Region) of Hua Hong Semiconductor, 2015Q1-2016Q1

Revenue (by Technology Platform) of Hua Hong Semiconductor, 2015Q1-2016Q1

Revenue (by Technology Node) of Hua Hong Semiconductor, 2015Q1-2016Q1

Technology Roadmap of Hua Hong Semiconductor

SuperFlash Process and Supporting Logic Process of Hua Hong Semiconductor

SONOS Flash Technology System of Hua Hong Semiconductor

Power Management Process Specification Subdivision of Hua Hong Semiconductor

RF Process Technology of Hua Hong Semiconductor

Power Device Process of Hua Hong Semiconductor

Capacity, Capacity Utilization and Shipment of Hua Hong Semiconductor’s Foundries, 2015Q1-2016Q1

Revenue and Net Income of CRRC Times Electric, 2011-2015

Revenue of CRRC Times Electric (by Product), 2014-2015

Cellular Cross-sectional View of IGBT based on DMOS and DMOS + Technologies of CRRC Times Electric

IGBT Chips (8-inch Wafers) and 1 500 A / 3 300 V IGBT Modules with Such Chips

Press-fit IGBT Structure of CRRC Times Electric

BYD’s Workforce, 2007-2015

BYD’s Automobile Output and Sales Volume, 2010-2015

BYD’s Revenue, Net Income and Gross Margin, 2007-2016Q1

BYD’s Revenue (by Product), 2007-2015

BYD’s Gross Margin (by Product), 2008-2015

BYD’s Revenue (by Region), 2008-2015H1

Equity Structure of MacMic Science & Technology

Revenue and Net Income of MacMic Science & Technology, 2012-2015

Revenue Structure of MacMic Science & Technology (by Product), 2015

Business Chain of MacMic Science & Technology

Outsourcing Processors and Processing Amount of MacMic Science & Technology, 2013-2014H1

Main Product Outsourcing Costs of MacMic Science & Technology, 2013-2014H1

Main Agents of MacMic Science & Technology

Top 5 Customers of MacMic Science & Technology, 2015

Top 5 Suppliers of MacMic Science & Technology, 2015

IGBT Products and Applications of MacMic Science & Technology

IGBT Modules of MacMic Science & Technology

IGBT Module Applications of MacMic Science & Technology

Revenue and Net Income of Keda Semiconductor, 2012-2015

Total Assets and Net Assets of Keda Semiconductor, 2012-2015

IGBT Single-tube Product Lines of Keda Semiconductor

IGBT Module Product Lines of Keda Semiconductor

Revenue and Net Income of Silan Microelectronics, 2011-2015

Revenue Structure of Silan Microelectronics (by Product), 2015

IGBT Chips of Silan Microelectronics

IGBT Modules of Silan Microelectronics

Process Roadmap of CSMC Technologies

Power Devices and Technical Route of CSMC Technologies

Main IGBT Chips of CSMC Technologies

Revenue of ASMC, 2003-2015

Capital Expenditure of ASMC, 2003-2015

Revenue Breakdown of ASMC (by Product Size), 2015-2016

Revenue Breakdown of ASMC, 2015

Four Major Technology Platforms of ASMC

Technology Roadmap Planning of ASMC, 2015-2019E

Main Domestic and Overseas Customers of ASMC

Power Discretes and Technology Roadmap of ASMC

Parameters and Applications of ASMC’s Power Discretes

IGBT Shipment of ASMC, 2004-2013

Main IGBT Customers of ASMC

Strategic Cooperation between ASMC and CNR in Forming Complete High-speed Rail IGBT Industry Chain

Strategic Cooperation between ASMC and BYD in New Energy Vehicle-use IGBT

Cooperation between ASMC and SGCC in Development of Smart Grid-use IGBT

IGBT Technology Evolution of Advanced Semiconductor Manufacturing

IGBT Back Injection Process of Advanced Semiconductor Manufacturing

Production Capacity of Advanced Semiconductor Manufacturing, 2015-2016

Capacity Utilization of Advanced Semiconductor Manufacturing, 2015-2016

Main Modules and Applications of Silvermicro Electronics

Technology Evolution of Founder Microelectronics

Skysilicon’s Business Network

Overview of Skysilicon’s Plants

Skysilicon’s Technology Evolution, 2012-2015

Skysilicon’s Capacity Expansion

Skysilicon’s Power Device Test Capacity

Skysilicon’s IGBT Discrete Device Product Lines

Skysilicon’s IGBT Module Product Lines

Main Power Semiconductor Products of Yongdian Electric

High Voltage IGBT Chips of Yongdian Electric

IGBT Modules of Xi’An IR-PERI

IGBT Module Product Lines of WeihaiSinga Electronics

Main Financial Indicators of Fuji Electric, FY2010- FY2016

Revenue and Operating Income of Fuji Electric (by Business), FY2013- FY2016

Revenue of Fuji Electric (by Region), FY2011-FY2016

IGBT and SiC R & D Planning of Fuji Electric, 2015-2021E

7-generation IGBT Product Planning of Fuji Electric, 2016-2018E

Industrial IGBT / SiC Loss Comparison, 2015-2017

Development Path of Fuji Electric’s Automotive Power Modules, 2005-2025

Global Ranking of Infineon’s Three Main Businesses, 2013

Infineon’s Revenue (by Region), FY2013-FY2015

Infineon’s Revenue (by Division), FY2013-FY2015

Infineon’s EiceDRIVER™ Family IGBT Modules

Denso’s Workforce, FY2011-FY2015

Denso’s Revenue and Profit, FY2013-FY2015

Denso’s Operating Income & Net Income, FY2011-FY2015

Denso’s Revenue Structure (by Division), FY2013-FY2015Q1

Denso’s Revenue (by Division), FY2013-FY2015Q1

Denso’s Revenue and Operating Income (by Region), FY2013-FY2015

Denso’s Revenue (by Customer), FY2010-FY2014

Denso’s Customer Structure, FY2013-2014

Japan NEDO’s Projects in the field of Power Electronics

ROHM’s Financial Indicators, FY2010-2015

ROHM’s Revenue (by Business), FY2012-FY2017

ROHM’s Revenue (by Region), FY2012-FY2017

ROHM’s Revenue (by Application), FY2012-FY2017

Main Technical Parameters of ROHM’s Automotive IGBT Modules

Development Course of ROHM’s SiC Products

SiC-based Power Device Lineup of ROHM

IR’s Revenue (by Division), FY2012- FY2014

Semikron’s Operation

Semikron’s Main IGBT Brands

Product Portfolio of SEMIKRON’s SKiM Modules

Key Features of SEMIKRON’s SKiM Modules

Product Portfolio of SEMIKRON’s SKiiP IPM

Key Features of SEMIKRON’s SKiiP IPM

Structure of SEMIDRON’s SKAI Power Electronic Platform

Product Portfolio of SEMIKRON’s SKAI Power Electronic Platform

Key Features of SEMIKRON’s SKAI Power Electronic Platform

Overview of STMicroelectronics

Main Financial Indicators of STMicroelectronics, 2011-2015

Revenue Structure of STMicroelectronics (by Product Division), 2015

Gross Margin of STMicroelectronics, 2014Q1-2016Q1

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|