水清木华研究中心《2016年全球及中国高精度地图行业研究报告》着重研究了以下内容:

高精度地图采集方式介绍及技术分析;

高精度地图采集方式介绍及技术分析;

全球自动驾驶汽车市场情况,包括自动驾驶组成、划分,以及国内外市场、政策环境;

全球自动驾驶汽车市场情况,包括自动驾驶组成、划分,以及国内外市场、政策环境;

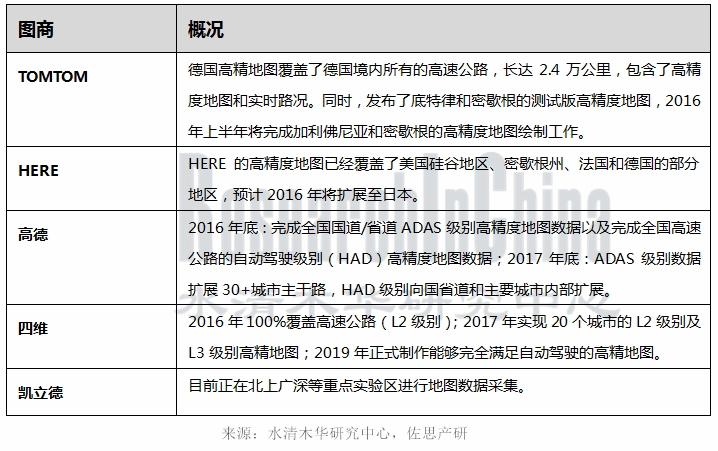

从发展现状、布局以及趋势分析全球高精度地图市场情况;

从发展现状、布局以及趋势分析全球高精度地图市场情况;

高精度地图产业链分析,包括激光雷达、摄像头、定位系统、IMU以及算法等;

高精度地图产业链分析,包括激光雷达、摄像头、定位系统、IMU以及算法等;

国内外主要的7家高精度地图厂商分析,包括技术分析,高精度地图业务发展现状以及未来趋势等。

国内外主要的7家高精度地图厂商分析,包括技术分析,高精度地图业务发展现状以及未来趋势等。

目前高精地图领域主要有四种企业布局方式:互联网企业主导、车企主导、传感器厂商主导、图商企业主导。

第一类:互联网企业主导

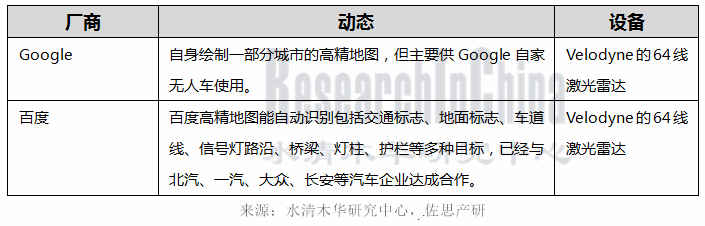

互联网企业通过收购的方式获得地图数据资源,然后结合自身算法、云计算能力生产高精度地图,如谷歌、UBER等,其中谷歌大量收购了图商如Keyhole、skybox、waze等。而国内地图测绘属于高机密行业,进入门槛较高,因此给予了国内图商极大的优势,断绝了国外企业进入道路。目前国内拥有地图测绘资质的互联网企业有166家,百度、阿里巴巴等互联网巨头也通过收购的方式占据国内地图产业重要地位,其中百度收购瑞图万方,阿里巴巴收购高德地图。

第二类:车企主导

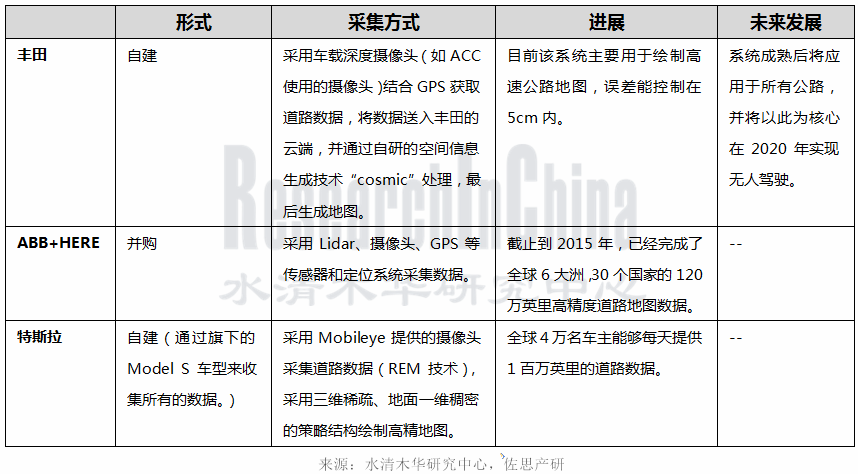

车企主要是通过收购合并和自建的方式布局高精度地图,比如丰田采用车载摄像头数据以众包的形式建立高精度地图,奔驰、奥迪、宝马联合收购诺基亚旗下地图公司HERE。车企主导的方式更有利于高精度地图与自动驾驶系统数据之间的交流,车企内部可以完全开放CAN总线接口,有利于基于高精度地图的自动驾驶方案测试。

第三类:传感器企业主导

Mobileye正在通过众包的方式,利用已经装载在汽车上的摄像头芯片采集数据,制作三维地图。其采用的Road Experience Management软件能识别路标等特定道路信息,所需带宽每公里大约只需10KB。Mobileye进入高精地图的目的是为了其未来提供自动驾驶整体解决方案做准备。

第四类:图商企业主导

这种布局方式能够在成本最低化的情况下实现优势互补,国外如苹果和TomTom,国内如腾讯和四维图新,小米和凯立德。

综合来看,目前自动驾驶还是以车企为主导,未来整车企业也不会将车辆的底层数据完全向高精地图企业开放,所以现在很多车企(如ABB)都通过收购图商的方式将高精地图数据资源掌握在自己手中。互联网企业由于在车辆容错性和底层数据等方面的经验太少,最终还将是会采取与车企合作的模式。

Global and China HD Map Industry Report, 2016 by ResearchInChina is mainly concerned with the following:

Acquisition modes and technical analysis of HD maps;

Acquisition modes and technical analysis of HD maps;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global HD maps, including status quo, layout, and development trends;

Market situation of global HD maps, including status quo, layout, and development trends;

HD map industry chain, involvinglidar, cameras, positioning systems, IMU, and algorithms, etc.;

HD map industry chain, involvinglidar, cameras, positioning systems, IMU, and algorithms, etc.;

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

At present, there are mainly four types of enterprises that dominate the layout in the HD map field: internet firms, auto makers, sensor vendors, and digital map providers.

I) Internet Firms

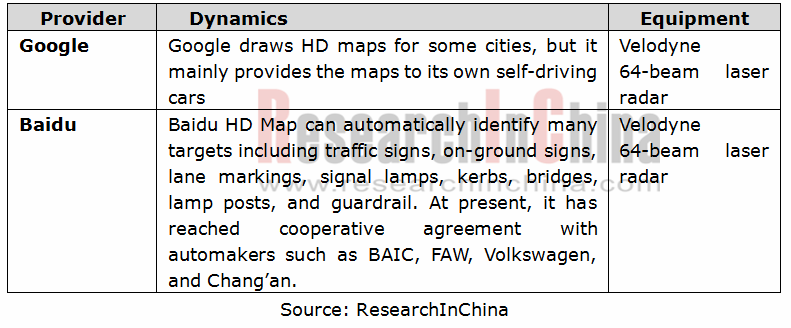

Internet tycoons like Google and UBER have, through acquisitions, obtained map data resources before producing HD maps based on their own algorithms and cloud computing capabilities. Google acquired a large number of digital map providers like Keyhole, Skybox, and Waze. In China, however, ground mapping is a highly confidential sector and therefore sets a higher entry threshold, which gives a big advantage to the Chinese digital map providers and turns away foreign players. Currently, there are 166 internet companies with mapping qualifications in China, and Internet giants like Baidu and Alibaba have through acquisitions occupied an important position in the Chinese map industry. Among them, Baidu purchased RITU and Alibaba bought AutoNavi.

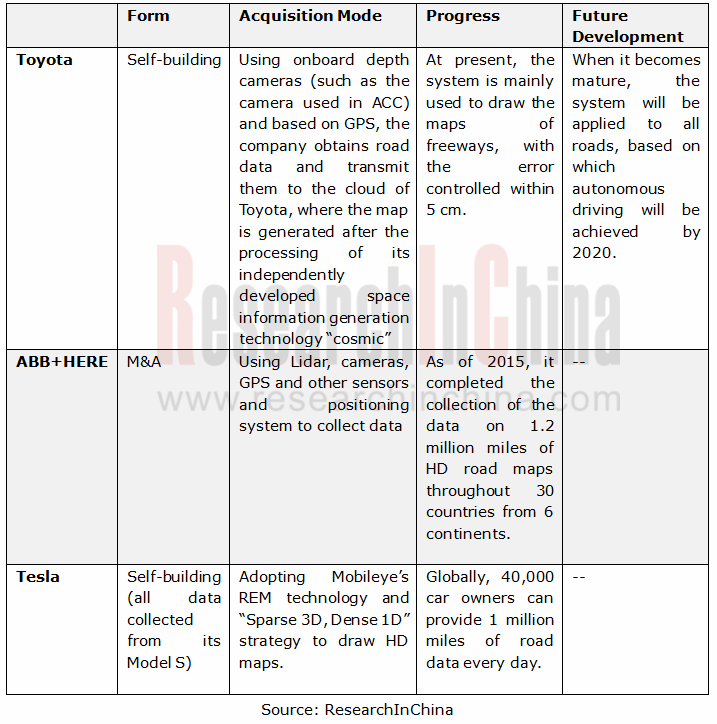

II) Auto Makers

Car makers make their presence in HD maps mainly through M&As and self-building. For example, Toyota adopted onboard camera data to build HD maps via crowdsourcing, while Mercedes-Benz, Audi, and BMW jointly acquired HERE, a map provider under Nokia. Automakers-led layout could help promote the data traffic between HD maps and autonomous driving. Moreover, auto makers can fully open CAN bus port internally, which would bring benefits to the testing of HD map-based autonomous driving scheme.

III) Sensor Vendors

Using camera chips installed in cars, Mobileye is collecting data through crowdsourcing to make 3D maps. Its Road Experience Management software can identify specific road information like road markings. The bandwidth that it needs is only about 10KB per kilometer. Mobileye’s entry into HD map is to provide turnkey autonomous driving solutions for its future development.

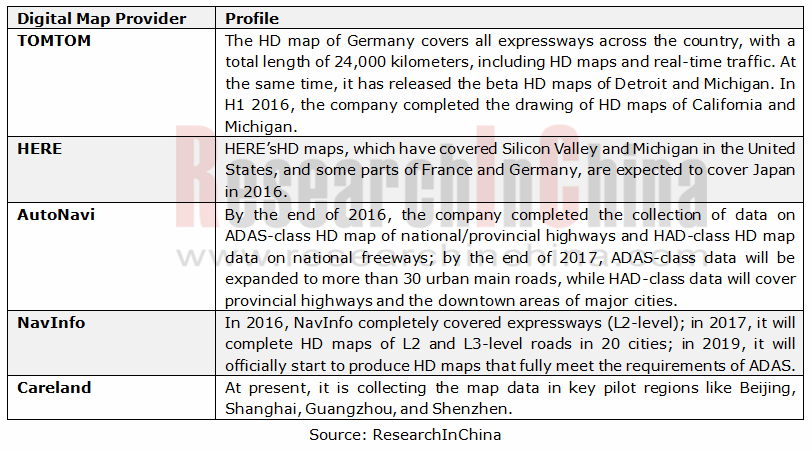

IV) Digital Map Providers

Digital map providers, including foreign companies like Apple and TomTom and domestic ones such as Tencent, NavInfo, Xiaomi, and Careland, can complement each other's advantages at a minimum cost.

Overall, autonomous driving is now dominated by automakers, and they will not completely open their underlying data on vehicles to HD map providers. Thus, many auto makers (likeAudi, Mercedes-Benz, and BMW), obtain HD map data sources by acquiring digital map providers. In contrast, due to a lack of experience in fault tolerance and underlying data of vehicles, Internet companies end up cooperating with automakers.

第一章 高精度地图概述

1.1 定义

1.2 组成

1.3 特点

1.4 优点

1.5 分类

第二章 地图采集方案

2.1 普通地图采集方式

2.1.1 步行采集

2.1.2 背包采集

2.1.3 自行车采集

2.1.4 其他采集方式

2.2 高精地图采集方式

2.2.1 专用车采集

2.2.2 众包采集

第三章 全球高精地图市场情况

3.1自动驾驶概况

3.1.1 定义及概况

3.1.2 全球无人驾驶发展趋势

3.2 全球及中国高精地图发展现状

3.2.1 全球

3.2.2 中国

3.3 发展趋势

第四章 高精度地图上游产业链分析

4.1 激光雷达(Lidar)

4.1.1 工作原理

4.1.2 组成

4.1.3 在高精度地图中应用

4.1.4 市场规模

4.2 摄像头

4.2.1 工作原理

4.2.2 在高精度地图中的应用

4.2.3 市场规模

4.3 定位系统

4.3.1 工作原理

4.3.2 在高精度地图中的应用

4.4 惯性导航系统

4.4.1 工作原理

4.4.2 在高精度地图中的应用

4.4.3 市场规模

4.5 算法

4.5.1 路径规划算法

4.5.2 SLAM算法

第五章 国外主要高精度地图厂商

5.1 Google

5.1.1 公司简介

5.1.2 运营情况

5.1.3 Google无人驾驶汽车

5.1.4 高精度地图业务

5.2 TomTom

5.2.1 公司简介

5.2.2 运营情况

5.2.3 高精度地图业务

5.2.4 高精度地图采集车

5.3 HERE

5.3.1 公司简介

5.3.2 运营情况

5.3.3 高精度地图业务

5.4 Mobileye

5.4.1 公司简介

5.4.2 运营情况

5.4.3 产品

5.4.4 高精度地图业务

第六章 国内主要高精度地图厂商

6.1 百度

6.1.1 公司简介

6.1.2 运营情况

6.1.3 产品

6.1.4 高精度地图业务

6.2 高德

6.2.1 公司简介

6.2.2 高精度地图业务

6.3 四维图新

6.3.1 公司简介

6.3.2 运营情况

6.3.3 产品

6.3.4 高精度地图业务

6.3.5 核心竞争力

1 Overview of HD Map

1.1 Definition

1.2 Composition

1.3 Features

1.4 Merits

1.5 Classification

2 Map Acquisition Schemes

2.1 Acquisition Modes of General Map

2.1.1 Collection by Walking

2.1.2 Collection by Backpack

2.1.3 Collection by Bicycle

2.1.4 Other Collection Means

2.2 Acquisition Modes of HD Map

2.2.1 Collection by Special Vehicle

2.2.2 Collection by Crowdsourcing

3 Global HD Map Market

3.1 Overview of Autonomous Driving

3.1.1 Definition and Overview

3.1.2 Development Trend of Autonomous Driving in the World

3.2 Development of HD Map in the World and China

3.2.1 Global

3.2.2 China

3.3 Development Trend

4 Upstream Industry Chain of HD Map

4.1 Lidar

4.1.1 Operating Principle

4.1.2 Composition

4.1.3 Application in HD Map

4.1.4 Market Size

4.2 Camera

4.2.1 Operating Principle

4.2.2 Application in HD Map

4.2.3 Market Size

4.3 Positioning System

4.3.1 Operating Principle

4.3.2 Application in HD Map

4.4 Inertial Navigation System

4.4.1 Operating Principle

4.4.2 Application in HD Map

4.4.3 Market Size

4.5 Algorithms

4.5.1 Path Planning Algorithm

4.5.2 SLAM Algorithm

5 Major Foreign HD Map Providers

5.1 Google

5.1.1 Profile

5.1.2 Operation

5.1.3 Google’s Self-Driving Cars

5.1.4 HD Map Business

5.2 TomTom

5.2.1 Profile

5.2.2 Operation

5.2.3 HD Map Business

5.2.4 HD Map Acquisition Vehicle

5.3 HERE

5.3.1 Profile

5.3.2 Operation

5.3.3 HD Map Business

5.4 Mobileye

5.4.1 Profile

5.4.2 Operation

5.4.3 Products

5.4.4 HD Map Business

6 Key HD Map Providers in China

6.1 Baidu

6.1.1 Profile

6.1.2 Operation

6.1.3 Products

6.1.4 HD Map Business

6.2 AutoNavi

6.2.1 Profile

6.2.2 HD Map Business

6.3 NavInfo

6.3.1 Profile

6.3.2 Operation

6.3.3 Products

6.3.4 HD Map Business

6.3.5 Core Competitiveness