随着中国汽车市场快速增长,停车位问题日益凸显,停车位缺口估计已超过5000万个。同时,由于停车场智能化程度低,停车位信息较难获取,导致车位利用率偏低,使得停车难问题加剧。此外,在智能城市和智慧交通背景下,智慧停车系统需求开始扩大。

2015年,在多项利好政策的推动下,中国停车场管理系统市场规模约55.2亿元,同比增长达47.2%。预计未来几年,增速将继续保持在30%以上,到2020年市场规模有望达270.8亿元。此外,停车数据运营、互联网停车服务等新产业将带来数个百亿级别的新增市场。未来,中国智慧停车产业潜在市场规模至少上千亿,发展前景广阔。

目前,中国智慧停车行业整体格局相对分散,主要以智能停车设备商、智能停车解决方案提供商、互联网停车企业为主。

传统的智能停车软硬件供应商兼具软硬件技术实力,主要向停车场提供智能停车相关设备和解决方案。在“互联网+”大潮推动下,一些企业也开发了面向C端用户的智慧停车APP产品。代表企业包括ETCP、捷顺科技、安居宝、中兴智能交通、立方控股等。

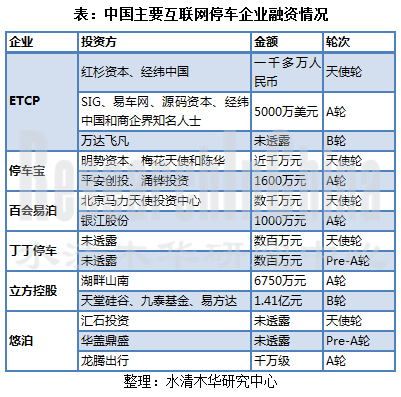

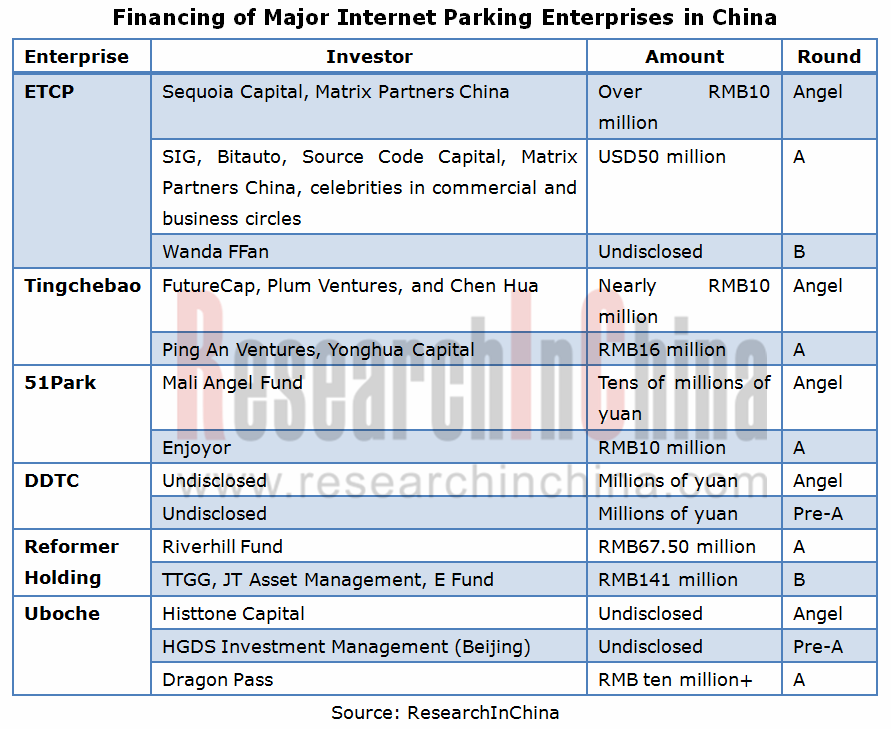

互联网停车企业具有轻资产+大数据的特点,主要通过与停车场合作的方式,将停车场实时空余车位信息在APP端呈现给用户,为用户提供车位预订、停车场导航服务、停车费用结算等功能。代表企业有停车百事通、百会易泊、停车宝、悠泊等。目前,一些互联网停车企业已获得了B轮融资,一些企业融资则相对较少。

此外,百度以“百度地图+百度钱包”、阿里以“支付宝+高德地图+立方控股”、腾讯以“微信公众号+微信支付”为切入点布局智慧停车行业,通过地图、支付应用和流量入口应用对停车APP进行整合、嵌入。未来,在多种形态企业的参与下,中国智慧停车市场竞争将更加激烈,市场也将更加成熟。

《2016年中国智慧停车行业研究报告》主要包括以下内容:

全球智慧停车行业发展概况、国外典型项目介绍;

全球智慧停车行业发展概况、国外典型项目介绍;

中国智慧停车行业发展分析,包括发展背景、发展现状、市场规模、竞争格局、发展趋势分析;

中国智慧停车行业发展分析,包括发展背景、发展现状、市场规模、竞争格局、发展趋势分析;

中国智慧停车相关行业发展分析,包括汽车行业、立体停车库、房地产、移动支付等行业的分析;

中国智慧停车相关行业发展分析,包括汽车行业、立体停车库、房地产、移动支付等行业的分析;

中国14家智慧停车相关企业分析,包括经营情况分析、融资情况分析、智慧停车业务分析等。

中国14家智慧停车相关企业分析,包括经营情况分析、融资情况分析、智慧停车业务分析等。

As the Chinese automobile market expands rapidly, parking problem becomes increasingly prominent with parking space gap exceeding an estimated 50 million. Meanwhile, the problem is exacerbated by low utilization because of difficult access to parking spot information caused by less intelligent parking lots. Additionally, as smart city and intelligent transportation emerge, the demand for smart parking system begins to rise.

In 2015, propelled by a number of favorable policies, the Chinese parking lot management system size was worth about RMB5.52 billion, up 47.2% from a year ago. It is expected the market will maintain a growth rate of over 30% over the next couple of years, arriving at RMB27.08 billion by 2020. Moreover, new sectors like parking data operation and Internet parking services will bring about new markets of RMB10 billion+. Smart parking industry enjoys a potential market of at least RMB100 billion, indicating broad prospects for development.

Smart parking industry presents a relatively fragmented pattern on the whole, consisting mainly of smart parking equipment manufacturers, smart parking solution providers, and Internet parking enterprises.

Traditional smart parking software & hardware suppliers, with technological capabilities for software and hardware, primarily provide smart parking equipment and solutions for parking lots. Actuated by “Internet+”, some enterprises, represented by ETCP, JSST, Guangdong Anjubao Digital Technology, ZTE ITS, and Reformer Holding, have launched client-based smart parking APPs.

Featuring light asset and big data, Internet parking enterprises provide users with parking spot reservation, parking lot navigation, parking fees settlement, etc. by cooperating with parking lots and presenting real-time information on spare parking spots on APPs. Representative players include Parking We, 51Park, Tingchebao, and Uboche. Some of them have secured B round of financing, while some got few.

In addition, BAT have made their presence in smart parking industry with “Baidu Map + Baidu Wallet”, “Alipay + AutoNavi + Reformer Holding”, and “WeChat Official Account + WeChat Payment”, integrating and embedding parking APPs via map, payment applications, and traffic entrance applications. With participation of various types of enterprises, the Chinese smart parking market will become highly competitive and more mature.

China Smart Parking Industry Report, 2016 focuses on the followings:

Overview of global smart parking industry and introduction to typical foreign projects;

Overview of global smart parking industry and introduction to typical foreign projects;

Smart parking industry in China (background, status quo, market size, competitive landscape, development trends);

Smart parking industry in China (background, status quo, market size, competitive landscape, development trends);

Smart parking-related industries in China (automobile, stereo garage, real estate, mobile payment);

Smart parking-related industries in China (automobile, stereo garage, real estate, mobile payment);

14 smart parking enterprises in China (operation, financing, smart parking business, etc.)

14 smart parking enterprises in China (operation, financing, smart parking business, etc.)

第一章 概述

1.1 定义

1.2 经营模式

1.3 工作原理

1.4 主要特点

1.5 发展阶段

第二章 全球智慧停车行业发展概况

2.1 发展概况

2.2 国外典型智慧停车项目

2.2.1 ZIRX

2.2.2 Luxe Valet

2.2.3 Parking In Motion

2.2.4 ParkMe

2.2.5 Parking Panda

第三章 中国智慧停车行业发展概况

3.1 发展背景

3.1.1 汽车保有量持续增长,停车难问题严重

3.1.2 停车场智能化程度低

3.1.3 各种类型停车场特点

3.1.4 政策推动智慧停车发展

3.2 发展现状

3.3 市场规模

3.4 竞争格局

3.5 BAT布局智慧停车

3.6 全国各地积极发展智慧停车

3.6.1 西安将建5万个停车位,并且接入智慧停车平台补贴0.5万元

3.6.2 上海启动智慧停车全国首个地方标准

3.6.3 北京东城区政府公布《2016年缓解交通拥堵工作方案》,力推手机停车APP

3.6.4 深圳市城管局打造公园智慧停车场

3.6.5 广州市交委推行讯通APP,助力智慧停车

3.7 发展趋势

3.7.1 互联网模式停车应用推进,挖掘停车大数据价值

3.7.2 解决方案提供商向运营服务商转型

3.7.3 智慧停车综合平台打开增值服务盈利入口

第四章 中国智慧停车相关行业发展概况

4.1 汽车行业

4.1.1 保有量

4.1.2 产销量

4.2 立体停车库

4.2.1 发展历程

4.2.2 优势及特点

4.2.3 发展现状

4.3 房地产

4.4 移动支付

4.4.1 定义

4.4.2 Industrial Chain

4.4.3 市场规模

4.4.4 竞争格局

第五章 主要企业

5.1 ETCP

5.1.1 公司简介

5.1.2 智慧停车业务

5.1.3 应用案例

5.1.4 融资情况

5.2 停车百事通

5.2.1 公司简介

5.2.2 智慧停车业务

5.2.3 发展动态

5.3 捷顺科技

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 研发投入

5.3.5 智慧停车业务

5.4 安居宝

5.4.1 公司简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 研发支出

5.4.5 布局智慧停车

5.5 百会易泊

5.5.1 公司简介

5.5.2 智慧停车业务

5.5.3 融资情况

5.5.4 先后与支付宝和百度地图达成合作

5.6 丁丁停车

5.6.1 公司简介

5.6.2 融资情况

5.6.3 智慧停车业务

5.6.4 与福特汽车达成合作

5.7 中兴智能交通股份有限公司

5.7.1 公司简介

5.7.2 智慧停车业务

5.8 立方控股

5.8.1 公司简介

5.8.2 经营情况

5.8.3 营收构成

5.8.4 研发支出

5.8.5 融资情况

5.8.6 智慧停车业务

5.8.7 发展动态

5.9 五洋科技

5.9.1 公司简介

5.9.2 经营情况

5.9.3 布局立体停车行业

5.9.4 布局智慧停车

5.10 科拓股份

5.10.1 公司简介

5.10.2 智慧停车业务

5.10.3 发展动态

5.11 停车宝

5.11.1 公司简介

5.11.2 融资情况

5.11.3 智慧停车业务

5.12 易泊时代

5.12.1 公司简介

5.12.2 智慧停车业务

5.13 PP停车

5.13.1 公司简介

5.13.2 智慧停车业务

5.14 悠泊

5.14.1 公司简介

5.14.2 融资情况

1 Overview

1.1 Definition

1.2 Business Model

1.3 Operating Principle

1.4 Main Features

1.5 Development Phase

2 Global Smart Parking Industry

2.1 Overview

2.2 Typical Smart Parking Projects

2.2.1 ZIRX

2.2.2 Luxe Valet

2.2.3 Parking In Motion

2.2.4 ParkMe

2.2.5 Parking Panda

3 Smart Parking Industry in China

3.1 Background

3.1.1 Rising Car Ownership and Severe Parking Problem

3.1.2 Less Intelligent Parking Lots

3.1.3 Features of Various Parking Lots

3.1.4 Policies to Promote Smart Parking

3.2 Status Quo

3.3 Market Size

3.4 Competitive Landscape

3.5 BAT’s Presence in Smart Parking

3.6 Local Efforts to Develop Smart Parking

3.6.1 Xi’an to Build 50,000 Parking Spots;RMB5,000 Renovation Subsidy for Parking Lots Connected to Smart Parking Platform by the End of 2017

3.6.2 Shanghai Implemented the Country’s First Local Standard for Smart Parking

3.6.3 Beijing Dongcheng District Government Issued Traffic Congestion Alleviation Plan 2016, Pushing Cellphone Parking APP

3.6.4 Shenzhen City Management Bureau Builds Smart Parking Lots in Scenic Spots

3.6.5 Guangzhou Municipal Transportation Commission Pushes “Xing Xun Tong”APP to Fuel the Development of Smart Parking

3.7 Development Trends

3.7.1 Internet Parking Applications Advance; Dig up the Value of Parking Big Data

3.7.2 Solution Providers in Transition to Operation Service Providers

3.7.3 Integrated Smart Parking Platform Opens the Portal to Make Profit from Value-added Service

4 Overview of Smart Parking-related Industries

4.1 Automobile

4.1.1 Ownership

4.1.2 Output & Sales

4.2 Stereo Garage

4.2.1 Development History

4.2.2 Advantages and Features

4.2.3 Status Quo

4.3 Real Estate

4.4 Mobile Payment

4.4.1 Definition

4.4.2 Industrial Chain

4.4.3 Market Size

4.4.4 Competitive Landscape

5 Major Enterprises

5.1 ETCP

5.1.1 Profile

5.1.2 Smart Parking Business

5.1.3 Application Cases

5.1.4 Financing

5.2 Parking We

5.2.1 Profile

5.2.2 Smart Parking Business

5.2.3 Developments

5.3 JSST

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 R&D Expenditure

5.3.5 Smart Parking Business

5.4 Anjubao

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 R&D Expenditure

5.4.5 Presence in Smart Parking

5.5 51Park

5.5.1 Profile

5.5.2 Smart Parking Business

5.5.3 Financing

5.5.4 Cooperation with Alipay and Baidu Map

5.6 DDTC

5.6.1 Profile

5.6.2 Financing

5.6.3 Smart Parking Business

5.6.4 Cooperation with Ford

5.7 ZTE ITS

5.7.1 Profile

5.7.2 Smart Parking Business

5.8 Reformer Holding

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 R&D Expenditure

5.8.5 Financing

5.8.6 Smart Parking Business

5.8.7 Developments

5.9 Wuyang Technology

5.9.1 Profile

5.9.2 Operation

5.9.3 Presence in Stereo Parking Industry

5.9.4 Presence in Smart Parking

5.10 KEYTOP

5.10.1 Profile

5.10.2 Smart Parking Business

5.10.3 Developments

5.11 Tingchebao

5.11.1 Profile

5.11.2 Financing

5.11.3 Smart Parking Business

5.12 EParking

5.12.1 Profile

5.12.2 Smart Parking Business

5.13 PP Parking (660pp)

5.13.1 Profile

5.13.2 Smart Parking Business

5.14 Uboche

5.14.1 Profile

5.14.2 Financing