|

|

|

报告导航:研究报告—

生命科学—制药医疗

|

|

2016年中国养老产业研究报告 |

|

字数:7.5万 |

页数:136 |

图表数:108 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2100美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2400美元 |

|

编号:ZLC-042

|

发布日期:2016-12 |

附件:下载 |

|

|

|

中国早于1999年便进入了老龄化社会,截至2015年底,中国60岁以上老年人口已达到2.22亿人,老年人口抚养比达13.9%。预计到2020年中国60岁以上老年人口数量将达2.43亿人,老年人口抚养比将达15.8%,老龄化趋势进一步加剧。

2016年,中国政府颁布了《关于金融支持养老服务业加快发展的指导意见》、《民政事业发展第十三个五年规划》、《关于全面放开养老服务市场 提升养老服务质量的若干意见》等政策推进养老服务设施建设,积极发展医养相结合的养老服务体系。同时,中国养老保障系统逐步完善,覆盖范围进一步扩大。截至2015年底,中国养老保险参保人数达85833万人,其中城镇职工基本养老保险参保人数35361万人,城乡居民基本养老保险参保人数50472万人。预计到2020年,中国养老保险参保人数将达92380万人。

养老产业主要包括老年公寓建设、家政服务产业、金融服务产业以及医疗就诊、医药保健品、家用器械、健康管理等老人医疗健康服务等。本报告主要研究养老地产市场。

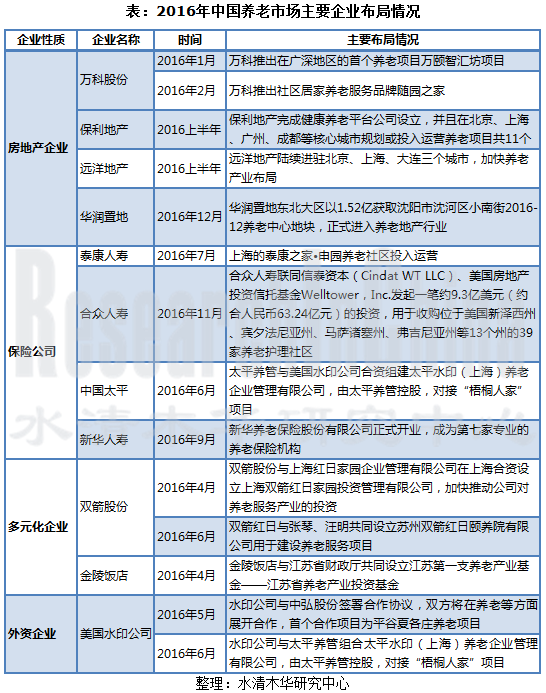

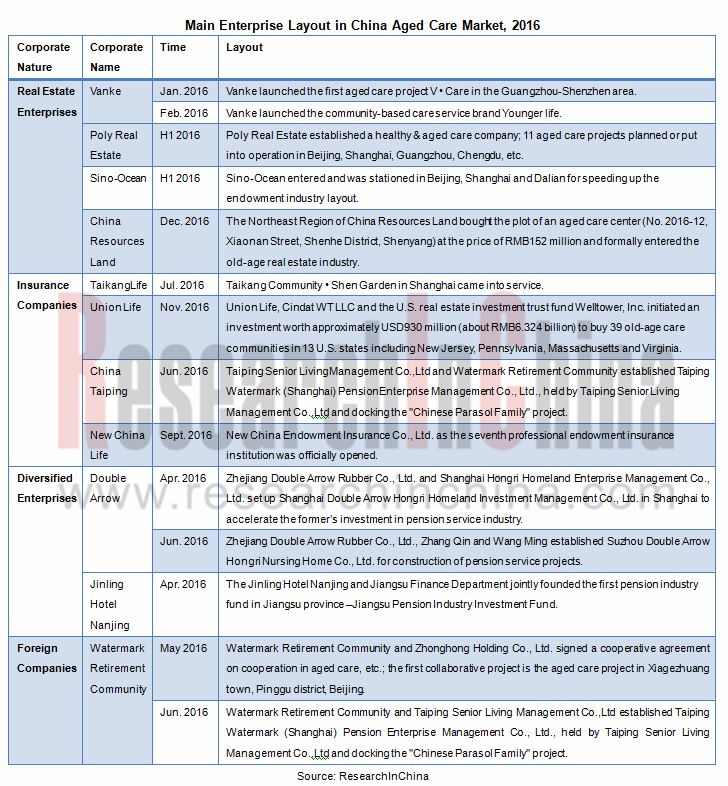

目前,中国养老市场存在4万亿元左右的商机,到2030年有望增加到13万亿元,发展前景可观。在潜在利益及利好政策的推动下,部分房地产企业、保险公司和多元化企业,以及一些外资企业开始在中国布局养老项目。

未来,中国养老产业将呈现以下几大趋势:

一、医养结合成为主要模式:由于老年人群体的特殊性,同时在政策的支持下,医养相结合的养老服务模式将成为中国养老产业的主要发展方向。养老机构将开办老年病院、康复院、医务室等机构,以满足老年人的医养需求。

二、竞争更加激烈:在政策的推动下,中国养老服务市场门槛进一步降低,外资准入标准也进一步放宽。这意味着未来将有更多的本土企业和外资企业进入养老市场,中国养老市场竞争将更为激烈,同时经营模式也将逐步发展成熟。

三、中端消费市场逐步扩大:目前中国大多数资金都流入了高端养老市场,但高端养老机构价格不菲,只有极少数的高收入人群才消费得起。中端消费水平的老人数量占比相对最高,中端消费市场将逐步成为市场的主体力量。随着养老需求的进一步增长,未来中端养老市场将逐步打开。

《2016-2020年中国养老产业研究报告》主要包括以下内容:

中国养老保障体系分析,包括政策支持、养老保障、医疗保障、金融保障; 中国养老保障体系分析,包括政策支持、养老保障、医疗保障、金融保障;

中国养老市场分析,包括市场需求、市场供给、发展趋势等; 中国养老市场分析,包括市场需求、市场供给、发展趋势等;

中国养老地产行业分析,包括发展现状、竞争格局、行业盈利模式、行业投资风险; 中国养老地产行业分析,包括发展现状、竞争格局、行业盈利模式、行业投资风险;

19家企业经营情况分析以及在养老产业的布局情况和发展战略分析。 19家企业经营情况分析以及在养老产业的布局情况和发展战略分析。

China entered the aging society early in 1999. By the end of 2015, China’s population aged over 60 reached 222 million and the old-age dependency ratio 13.9%. By 2020, China’s population aged over 60 is expected to hit 243 million and the old-age dependency ratio 15.8%, accompanied by a further intensified aging trend.

In 2016, the Chinese government promulgated the Guiding Opinions on Financially Supporting the Accelerated Development of Old-age Service Industry, 13th Five-Year Plan for the Development of Civil Undertakings, Several Opinions on Opening up Old-age Service Market and Improving Old-age Service Quality, and other policies to promote the construction of old-age service facilities and actively develop the medical-nursing combined old-age service system. At the same time, China's old-age security system has been gradually improved, with coverage further expanded. By the end of 2015, the number of people participating in the basic endowment insurance amounted to 858.33 million, including 353.61 million urban employees and 504.72 million urban and rural residents. By 2020, the number of people participating in the basic endowment insurance is estimated to hit 923.8 million.

Aged care industry mainly involves old-age apartment construction, household management service, and financial service industry as well as treatment, pharmaceutical & health-care products, home appliances, health management and other medical and health services for the elderly. This report mainly focuses on the old-age real estate market.

There are business opportunities worth approximately RMB4 trillion in the Chinese aged care market and expected to grow to RMB13 trillion by 2030, showing promising prospects. Under the impetus of potential benefits and favorable policies, some real estate developers, insurance companies and diversified enterprises as well as a number of foreign companiesare starting layout for aged care projects in China.

China’s aged care industry will present the following development trends in the future:

First, medical-nursing combined care becomes the dominant mode. Because of the particularity of the elderly and with the support of policies, the “medical-nursing combined” service for the aged will become the main development direction of aged care industry in China. Elderly hospitals, convalescent homes and infirmaries will be opened by aged care institutions to satisfy the elderly's medical-nursing needs.

Second, the market is more competitive. Under the impetus of policies, China will further lower aged care market access thresholds and relax foreign capital access standards. It means there will be more domestic and foreign companies to enter the Chinese aged care market in the future, resulting in more intense competition and gradually matured business model.

Third, mid-end consumer market is expanding. Currently, most of the funds in China have flowed into high-end aged care market, but only high-income groups can afford expensive nursing homes. Relatively, the number of mid-level elderly consumersaccounts for the highest proportion and mid-end consumer market will gradually become the leading force. With the growing demand for old-age provision, China will gradually open mid-end aged care market in the future.

The report highlights the following:

Old-age security system in China, including policy support, old-age security, medical security, financial guarantee, etc.; Old-age security system in China, including policy support, old-age security, medical security, financial guarantee, etc.;

Aged care market in China, including market demand, market supply, trends, etc.; Aged care market in China, including market demand, market supply, trends, etc.;

Old-age real estate industry in China, including development status, competitive landscape, profit models, investment risk; Old-age real estate industry in China, including development status, competitive landscape, profit models, investment risk;

19 enterprises’ operation as well as their layout and development strategies for aged care industry. 19 enterprises’ operation as well as their layout and development strategies for aged care industry.

第一章 概述

1.1 定义

1.2 产业链

1.3 养老模式

1.3.1 家庭养老

1.3.2 机构养老

1.3.3 社区居家养老

1.4 基本特点

1.4.1 综合性

1.4.2 福利性

1.4.3 公益性

1.4.4 营利性

第二章 中国养老保障体系分析

2.1 政策支持

2.1.1 十三五规划

2.1.2 其他政策法规

2.2 养老保障

2.2.1 养老保险

2.2.2 社会救助

2.3 医疗保障

2.3.1 城镇基本医疗保险

2.3.2 新型农村合作医疗

2.3.3 卫生服务

2.4 金融保障

2.4.1 养老金融

2.4.2 商业养老保险

2.4.3 护理保险

2.4.4 养老机构综合责任保险

第三章 中国养老市场分析

3.1 市场需求

3.1.1 中国老龄化速度加快

3.1.2 老年人口抚养比逐年上升

3.1.3 劳动年龄人口占比下降

3.1.4 平均家庭户规模缩小

3.2 市场供给

3.2.1 养老格局

3.2.2 居家养老

3.2.3 机构养老

3.3 国外养老产业发展现状

3.3.1 美国

3.3.2 英国

3.3.3 日本

3.3.4 德国

3.4 发展趋势

3.4.1 医养相结合是主要发展方向

3.4.2 中端服务市场将成未来行业主体

3.4.3 轻资产重服务的模式拥有巨大优势

3.4.4 资金雄厚的企业更具优势

3.4.5 准入门槛降低竞争将加剧,市场逐步发展成熟

第四章 中国养老地产行业分析

4.1 发展现状

4.1.1 简介

4.1.2 国外经验借鉴

4.2 竞争格局

4.2.1 总体情况

4.2.2 房地产企业

4.2.3 保险公司

4.2.4 多元化企业

4.2.5 外资企业

4.3 行业盈利模式

4.3.1 持有经营

4.3.2 出售+出租

4.3.3 出售

4.4 行业投资风险

4.4.1 销售方式

4.4.2 盈利模式

4.4.3 配套支持政策

4.4.4 养老地产选址

4.4.5 盈利水平

第五章 中国养老产业主要企业

5.1 万科企业股份有限公司

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 销售情况

5.1.6 养老地产业务

5.2 保利房地产(集团)股份有限公司

5.2.1 公司简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 布局情况

5.2.6 投资动向

5.2.7 养老地产业务

5.2.8 和熹会

5.2.9 发展战略

5.3 首创置业股份有限公司

5.3.1 公司简介

5.3.2 经营情况

5.3.3 毛利率

5.3.4 销售情况

5.3.5 养老地产业务

5.4 远洋地产控股有限公司

5.4.1 公司简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 毛利率

5.4.5 销售情况

5.4.6 养老地产业务

5.5 泰康人寿保险股份有限公司

5.5.1 公司简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 养老业务

5.6 新华人寿保险股份有限公司

5.6.1 公司简介

5.6.2 经营情况

5.6.3 营收构成

5.6.4 养老业务

5.6.5 发展战略

5.7 中国平安保险(集团)股份有限公司

5.7.1 公司简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 养老业务

5.8 合众人寿保险股份有限公司

5.8.1 公司简介

5.8.2 经营情况

5.8.3 营收构成

5.8.4 养老业务

5.9 亲和源股份有限公司

5.9.1 公司简介

5.9.2 经营情况

5.9.3 养老地产业务

5.9.4 宜华健康收购亲和源58.33%股权

5.10 北京汇晨养老机构管理有限公司

5.10.1 公司简介

5.10.2 光大控股收购汇晨养老67.27%的股权

5.10.3 经营情况

5.10.4 发展动态

5.11 天津鹤童老年福利协会

5.11.1 公司简介

5.11.2 经营情况

5.12 夕阳红连锁老人公寓

5.12.1 背景介绍

5.12.2 运营方式

5.12.3 江苏江阴夕阳老年康乐中心

5.12.4 平顶山市夕阳红老年公寓

5.12.5 福建莆田市夕阳红老人公寓

5.13 上海恒晖医疗技术发展有限公司

5.13.1 公司简介

5.13.2 日月星连锁养老院

5.13.3 收费标准

5.14 浙江双箭橡胶股份有限公司

5.14.1 公司简介

5.14.2 养老业务

5.15 河北三河燕达实业集团有限公司

5.15.1 公司简介

5.15.2 养老业务

5.15.3 经营方式

5.16 光明食品(集团)有限公司

5.16.1 公司简介

5.16.2 养老业务

5.17 中国太平保险集团有限责任公司

5.17.1 公司简介

5.17.2 养老业务

5.18 金陵饭店

5.18.1 公司简介

5.18.2 养老业务

5.19 朗高养老

5.19.1 公司简介

5.19.2 经营情况

5.19.3 营收构成

5.19.4 毛利率

5.19.5 养老业务

5.19.6 发展规划

1 Overview

1.1 Definition

1.2 Industry Chain

1.3 Aged Care Models

1.3.1 Home-based Care

1.3.2 Institution-based Care

1.3.3 Community-based Care

1.4 Basic Characteristics

1.4.1 Comprehensiveness

1.4.2 Welfare

1.4.3 Commonweal

1.4.4 Profitability

2 China Old-age Security System

2.1 Policy Support

2.1.1 13th Five-Year Plan

2.1.2 Other Policies and Regulations

2.2 Old-age Security

2.2.1 Endowment Insurance

2.2.2 Social Assistance

2.3 Medical Security

2.3.1 Urban Basic Medical Insurance

2.3.2 New Rural Cooperative Medical System

2.3.3 Health Services

2.4 Financial Guarantee

2.4.1 Pension Finance

2.4.2 Commercial Endowment Insurance

2.4.3 Care Insurance

2.4.4 Comprehensive Liability Insurance of Aged Care Institutions

3 China Aged Care Market

3.1 Market Demand

3.1.1 Population Aging Enters the Accelerated Phase

3.1.2 Dependency Ratio of Elderly Population Rises Year by Year

3.1.3 Proportion of Working-age Population Declines

3.1.4 Size of Average Household Shrinks

3.2 Market Supply

3.2.1 Aged Care Pattern

3.2.2 Home-based Care

3.2.3 Institution-based Care

3.3 Development Status of Foreign Aged Care Industry

3.3.1 USA

3.3.2 UK

3.3.3 Japan

3.3.4 Germany

3.4 Trends

3.4.1 Medical-Nursing Combined Care is the Main Development Direction

3.4.2 Mid-end Service Market Becomes the Main Body

3.4.3 The “Asset-Light and Service-Heavy” Mode Has Great Advantages

3.4.4 Financially Strong Enterprises Have More Superiorities

3.4.5 Reducing Access Thresholds Intensifies Competition and the Market Matures

4 China Old-age Real Estate Industry

4.1 Development Status

4.1.1 Introduction

4.1.2 Foreign Experience

4.2 Competitive Landscape

4.2.1 Overall Conditions

4.2.2 Real Estate Enterprises

4.2.3 Insurance Companies

4.2.4 Diversified Enterprises

4.2.5 Foreign Enterprises

4.3 Profit Models

4.3.1 Self-operation

4.3.2 Sale + Lease

4.3.3 Sale

4.4 Investment Risk

4.4.1 Sales Mode

4.4.2 Profit Model

4.4.3 Supportive Policies

4.4.4 Site Selection

4.4.5 Profitability

5 Key Enterprises in China Aged Care Industry

5.1 China Vanke

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Sales

5.1.6 Old-age Real Estate Business

5.2 Poly Real Estate

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Layout

5.2.6 Investment Trend

5.2.7 Old-age Real Estate Business

5.2.8 Hexihui

5.2.9 Development Strategy

5.3 Beijing Capital Land

5.3.1 Profile

5.3.2 Operation

5.3.3 Gross Margin

5.3.4 Sales

5.3.5 Old-age Real Estate Business

5.4 Sino-Ocean

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Sales

5.4.6 Old-age Real Estate Business

5.5 Taikang Life

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Aged Care Business

5.6 New China Life

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Aged Care Business

5.6.5 Development Strategy

5.7 Ping An Insurance

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Aged Care Business

5.8 Union Life

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Aged Care Business

5.9 Cherish-Yearn

5.9.1 Profile

5.9.2 Operation

5.9.3 Old-age Real Estate Business

5.9.4Yihua Health Care Acquiring 58.33% Stake in Cherish-Yearn

5.10 Huichen Life

5.10.1 Profile

5.10.2 China Everbright Limited Acquiring 67.27% Stake in Huichen Life

5.10.3 Operation

5.10.4 Developments

5.11 Tianjin Hetong Senior Citizens' Welfare Association

5.11.1 Profile

5.11.2 Operation

5.12 Sunset Glow Chain Seniors’ Apartment

5.12.1 Background Information

5.12.2 Operation Modes

5.12.3 Jiangyin Sunset Glow Seniors’ Recreation Center

5.12.4Pingdingshan Sunset Glow Seniors’ Apartment

5.12.5 Putian Sunset Glow Seniors’ Apartment

5.13 Shanghai Henghui Medical Treatment Technique Progress

5.13.1 Profile

5.13.2Riyuexing Chain Nursing Home

5.13.3 Charging Standards

5.14 Zhejiang Double Arrow Rubber

5.14.1 Profile

5.14.2 Aged Care Business

5.15 Hebei SanheYanda Industrial Group

5.15.1 Profile

5.15.2 Aged Care Business

5.15.3 Operation Modes

5.16 Bright Food

5.16.1 Profile

5.16.2 Aged Care Business

5.17 China Taiping

5.17.1 Profile

5.17.2 Aged Care Business

5.18 Jinling Hotel Nanjing

5.18.1 Profile

5.18.2 Aged Care Business

5.19 Wuxi Langgao Elderly Service

5.19.1 Profile

5.19.2 Operation

5.19.3 Revenue Structure

5.19.4 Gross Margin

5.19.5 Aged Care Business

5.19.6 Development Plan

图:养老产业相关产业链

表:中国部分地区老龄事业十三五规划

表:2001-2016年中国养老服务行业主要政策

图:2010-2020年中国养老保险参保人数

图:2010-2020E年中国城镇职工基本养老保险参保人数

图:2010-2020E中国城乡居民基本养老保险参保人数

图:2009-2015年中国城镇职工基本养老保险参保人数(分类型)

图:2009-2015年中国基本养老保险基金收入及支出

图:2009-2015年中国城镇职工基本养老保险基金累计结存

图:2009-2015年中国城乡最低生活保障人数

图:2009-2015年中国城乡最低生活保障补助水平

图:2009-2015年中国农村五保供养人数

图:2009-2015年中国农村五保供养标准

表:中国部分地区高龄津贴政策汇总

图:2009-2015年中国城镇基本医疗保险参保人数(分类型)

图:2009-2015年中国城镇基本医疗保险基金收入及支出

图:2009-2015中国城镇基本医疗保险基金累计结存

图:2009-2015年中国新农合参合人数及参合率

表:2014-2015年中国医疗卫生机构数及床位数

图:2010-2015年中国企业年金概况

图:2009-2020E中国60岁以上人口数量

图:2009-2020E中国老年人口抚养比

图:2009-2020E中国15-64岁人口占比

表:中国主要养老模式及其特点

表:中国养老机构分类

图:2008-2015年中国各类养老机构床位数

图:2008-2015年中国各类养老机构每千名老年人拥有床位数

图:英国养老金制度

表:日本“两代居”类型

表:国外养老模式(社区)对比

表:2010-2016年中国房地产企业所开发的养老地产项目及模式

表:2010-2016年中国保险公司养老地产项目

表:2010-2016年中国多元化企业养老地产项目

表:2012-2016年外资企业在中国养老产业布局情况

表:中国持有经营式养老地产项目案例及经营特点

表:中国出租+出售式养老地产项目案例及经营特点

表:中国出售式养老地产项目案例及经营特点

图:2012-2016年万科股份营业收入及净利润

图:2012-2016年万科股份营业收入(分业务)

图:2012-2016年万科股份营业收入构成(分业务)

图:2012-2016年万科股份营业收入(分区域)

图:2012-2016年万科股份营业收入构成(分区域)

图:2012-2016年万科股份房地产业务毛利率

图:2012-2016年万科股份房地产销售面积

图:2012-2016年万科股份房地产结算面积

图:2012-2016年保利地产营业收入及净利润

图:2012-2016年保利地产营业收入(分业务)

图:2012-2016年保利地产营业收入构成(分业务)

图:2012-2016年保利地产毛利率

图:2012-2016年保利地产毛利率(分业务)

图:保利地产养老战略规划

表:保利地产养老品牌简介

表:保利地产主要和熹会项目

图:2012-2016年首创置业营业收入及净利润

图:2012-2016年首创置业毛利率

表:2015年首创置业销售情况

表:2016上半年首创置业销售情况

图:2016上半年首创置业销售金额区域分布

图:2012-2016年远洋地产营业收入及净利润

图:2012-2016年远洋地产营业收入(分业务)

图:2012-2016年远洋地产营业收入构成(分业务)

图:2013-2016年远洋地产营业收入(分地区)

图:2013-2016年远洋地产营业收入构成(分地区)

图:2012-2016年远洋地产毛利率

图:2013-2015年远洋地产协议销售额(分类型)

图:2013-2015年远洋地产协议销售面积(分类型)

图:2012-2015年泰康人寿营业收入及净利润

图:2012-2015年泰康人寿营业收入(分业务)

图:2012-2015年泰康人寿营业收入构成(分业务)

图:泰康之家都市医养社区布局情况

表:泰康之家都市养老社区简介

图:2012-2016年新华人寿营业收入及净利润

图:2012-2016年新华人寿营业收入(分业务)

图:2012-2016年新华人寿营业收入构成(分业务)

表:新华保险主要健康管理子公司

图:2012-2016年中国平安营业收入及净利润

图:2012-2016年中国平安营业收入(分业务)

图:2012-2016年中国平安营业收入构成(分业务)

图:2012-2015年合众人寿营业收入及净利润

图:2012-2015年合众人寿营业收入(分业务)

表:合众人寿主要养老社区项目简介

表:上海亲和源会员卡类别及其费用和权益

表:2014-2015年亲和源资产状况

表:2014-2015年新和源财务数据

表:亲和源主要养老社区简介

表:亲和源股权结构

表:亲和源工商变更后的股权结构

表:汇晨养老发展历程

表:北京汇晨主要养老公寓简介

表:夕阳工程主要内容

表:江阴市夕阳红爱心护理院收费标准

表:日月星连锁养老院布局情况

表:上海静安区日月星养老院收费标准

表:上海徐汇区日月星养老院收费标准

表:上海宜川日月星养老院收费标准

表:上海杨浦日月星养老院收费标准

表:上海浦东日月星养老院收费标准

表:宁波日月星养老院收费标准

表:上海日月星护理院收费标准

表:上海爱以德护理院收费标准

表:2015-2016年桐乡和济颐养院有限公司财务指标

表:2013-2016年中国太平养老产业布局

图:朗高养老发展历程

图:2014-2016年朗高养老营业收入及净利润

表:2014-2016年朗高养老营业收入(分业务)

表:2014-2016年朗高养老主要客户

图:2014-2016年朗高养老毛利率

表:朗高养老机构养老业务服务内容

Aged Care Related Industry Chains

China’s 13th Five-Year Plan for Old-age Programs in Some Areas

China’s Policies on Aged Care, 2001-2016

Number of People Participating in Endowment Insurance in China, 2010-2020E

Number of Urban Employees Participating in Basic Endowment Insurance in China, 2010-2020E

Number of Urban and Rural Residents Participating in Basic Endowment Insurance in China, 2010-2020E

Number of Urban Employees Participating in Basic Endowment Insurance in China (by Type), 2009-2015

Income and Expenses of Basic Endowment Insurance Fund in China, 2009-2015

Cumulative Balance of Urban Employees' Basic Endowment Insurance Fund in China, 2009-2015

Number of Minimum Living Guarantee in Urban and Rural China, 2009-2015

Subsidies for Minimum Living Guarantee in Urban and Rural China, 2009-2015

Population Enjoying Five Guarantees Subsistence in Rural China, 2009-2015

Standards for Five Guarantees Subsistence in Rural China, 2009-2015

Summary of Old Age Allowance Policies in Some Areas of China

Number of Urban Residents Participating in Basic Medical Insurance in China (by Type), 2009-2015

Income and Expenses of Basic Medical Insurance Fund in Urban China, 2009-2015

Cumulative Balance of Basic Medical Insurance Fund in Urban China, 2009-2015

Number of Participants and Participation Rate of New Rural Cooperative Medical System in China, 2009-2015

Number of Medical and Health Institutions and Beds in China, 2014-2015

Overview of Enterprise Annuity in China, 2010-2015

Population of People Aged 65 and Over in China, 2009-2020E

Dependency Ratio of Aged Population in China, 2009-2020E

Proportion of People Aged 15-64 in China, 2009-2020E

Characteristics of Major Aged Care Models in China

Classification of Aged Care Institutions in China

Number of Beds in China’s Aged Care Institutions (by Type), 2008-2015

Number of Beds per 1,000 Aged People in China’s Aged Care Institutions (by Type), 2008-2015

Pension System in the UK

“Two-generation Housing” in Japan

Comparison of Foreign Aged Care Models (Communities)

Old-age Real Estate Projects Developed by Chinese Real Estate Enterprises and Their Modes, 2010-2016

Old-age Real Estate Projects Developed by Chinese Insurance Companies, 2010-2016

Old-age Real Estate Projects Developed by Chinese Diversified Enterprises, 2010-2016

Layout of Foreign Enterprises in China’s Aged Care Industry, 2012-2016

Cases and Operational Characteristics of “Self-operation” Type Old-age Real Estate Project in China

Cases and Operational Characteristics of “Sale + Lease” Type Old-age Real Estate Project in China

Cases and Operational Characteristics of “Sale” Type Old-age Real Estate Project in China

Revenue and Net Income of Vanke, 2012-2016

Revenue Breakdown of Vanke (by Business), 2012-2016

Revenue Structure of Vanke (by Business), 2012-2016

Revenue Breakdown of Vanke (by Region), 2012-2016

Revenue Structure of Vanke (by Region), 2012-2016

Gross Margin of Vanke’s Real Estate Business, 2012-2016

Real Estate Sales Area of Vanke, 2012-2016

Real Estate Clearing Area of Vanke, 2012-2016

Revenue and Net Income of Poly Real Estate, 2012-2016

Revenue Breakdown of Poly Real Estate (by Business), 2012-2016

Revenue Structure of Poly Real Estate (by Business), 2012-2016

Gross Margin of Poly Real Estate, 2012-2016

Gross Margin of Poly Real Estate (by Business), 2012-2016

Aged Care Strategic Planning of Poly Real Estate

Introduction to Poly Real Estate’s Aged Care Brands

Major Hexihui Projects of Poly Real Estate

Revenue and Net Income of Beijing Capital Land, 2012-2016

Gross Margin of Beijing Capital Land, 2012-2016

Sales of Beijing Capital Land, 2015

Sales of Beijing Capital Land, 2016H1

Sales of Beijing Capital Land (by Region), 2016H1

Revenue and Net Income of Sino-Ocean, 2012-2016

Revenue Breakdown of Sino-Ocean (by Business), 2012-2016

Revenue Structure of Sino-Ocean (by Business), 2012-2016

Revenue Breakdown of Sino-Ocean (by Region), 2013-2016

Revenue Structure of Sino-Ocean (by Region), 2013-2016

Gross Margin of Sino-Ocean, 2012-2016

Agreed Sales of Sino-Ocean (by Type), 2013-2015

Agreed Sales Area of Sino-Ocean (by Type), 2013-2015

Revenue and Net Income of Taikang Life, 2012-2015

Revenue Breakdown of Taikang Life (by Business), 2012-2015

Revenue Structure of Taikang Life (by Business), 2012-2015

Distribution of Taikang Community • Urban Medical-Nursing Community

Introduction to Taikang Community • Urban Old-age Community

Revenue and Net Income of New China Life, 2012-2016

Revenue Breakdown of New China Life (by Business), 2012-2016

Revenue Structure of New China Life (by Business), 2012-2016

Major Health Management Subsidiaries of New China Life

Revenue and Net Income of Ping An Insurance, 2012-2016

Revenue Breakdown of Ping An Insurance (by Business), 2012-2016

Revenue Structure of Ping An Insurance (by Business), 2012-2016

Revenue and Net Income of Union Life, 2012-2015

Revenue Breakdown of Union Life (by Business), 2012-2015

Introduction to Union Life’s Major Old-age Community Projects

Membership Card Categories, Expenses and Equities of Cherish-Yearn

Assets Condition of Cherish-Yearn, 2014-2015

Financial Data of Cherish-Yearn, 2014-2015

Introduction to Cherish-Yearn’s Major Old-age Communities

Ownership Structure of Cherish-Yearn

Ownership Structure of Cherish-Yearn after Industrial and Commercial Changes

Development History of Huichen Life

Introduction to Huichen Life’s Major Senior Apartments

Main Content of Sunset Project

Charging Standards ofJiangyin Sunset Glow Love Nursing Home

Distribution of Riyuexing Chain Nursing Home

Charging Standards of Jing’anRiyuexing Nursing Home

Charging Standards of XuhuiRiyuexing Nursing Home

Charging Standards of YichuanRiyuexing Nursing Home

Charging Standards of YangpuRiyuexing Nursing Home

Charging Standards of PudongRiyuexing Nursing Home

Charging Standards of Ningbo Riyuexing Nursing Home

Charging Standards of Shanghai Riyuexing Nursing Home

Charging Standards of Shanghai Aiyide Nursing Home

Financial Indicators of TongxiangHeji Nursing Home

China Taiping’s Layout for Aged Care Industry, 2013-2016

Development History of Wuxi Langgao Elderly Service

Revenue and Net Income of Wuxi Langgao Elderly Service, 2014-2016

Revenue Breakdown of Wuxi Langgao Elderly Service (by Business), 2014-2016

Major Customers of Wuxi Langgao Elderly Service, 2014-2016

Gross Margin of Wuxi Langgao Elderly Service, 2014-2016

Service Content of Wuxi Langgao Elderly Service’s Institution-based Care Business

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|