|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2016-2020年全球及中国汽车半导体行业研究报告 |

|

字数:1.9万 |

页数:153 |

图表数:197 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2200美元 |

英文纸版:2400美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZJF098

|

发布日期:2017-01 |

附件:下载 |

|

|

|

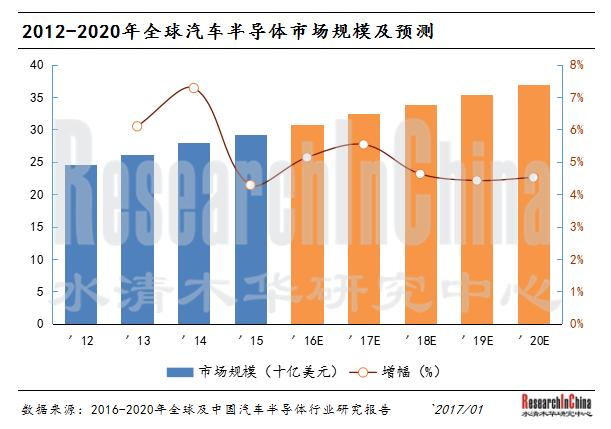

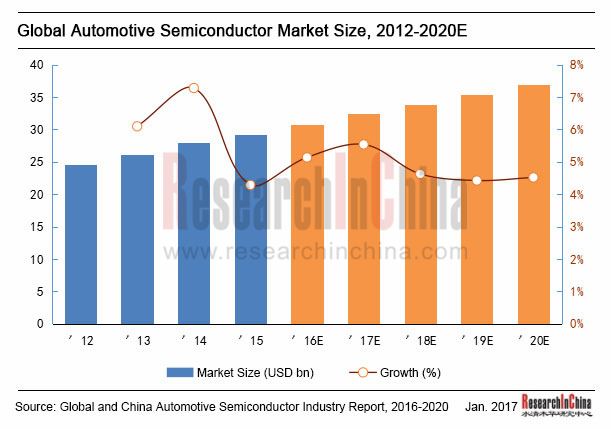

早期的汽车半导体更多应用于高端豪华车的小众市场,近年来则加速向低端市场渗透,以往的高配现在逐步成为标配,如倒车摄像头或自动紧急呼叫系统,以及无处不在的驾驶辅助系统,汽车半导体则随之逐步放量,2015年全球汽车半导体市场规模为292亿美元,较上年增长4.3%。随着汽车智能化的发展,汽车对主动安全、通讯与导航、视觉技术、识别技术、信息娱乐、舒适环保方面的要求都有所提升,安全控制、车载电子类应用汽车半导体的需求将大大提升,预计到2020年全球汽车半导体370亿美元,较2015年年均复合增长率达到4.8%。

中国已成为全球最大的汽车生产国和消费市场,得益于半导体及汽车行业的蓬勃发展,国内汽车半导体市场规模也增长迅猛,2015年该市场规模为46.22亿美元,占全球15.8%的市场份额,预计2020年将达到80.11亿美元,较2015年年均复合增长率达11.6%。

汽车半导体可以分为五大类,分别是功率半导体(Power)、传感器(Sensor)、处理器(Processor,Main for MCU)、ASSP(主要是Connectivity和Amplifier)、Logic和其他。在传统汽车里,平均每辆汽车的半导体成本大约320美元,这其中Power占26%,Sensor占16%。在HEV中,每辆HEV的半导体成本大约690美元,Power占比高达75%,在EV中,半导体成本大约700美元,Power占55%。

在应用市场方面,安全系统、动力总成、汽车影音、底盘系统以及车身电子是汽车半导体最主要应用领域,2015年全球市场规模分别为49亿美元、48亿美元、52亿美元、45亿美元以及44亿美元,占汽车半导体市场规模的比例分别为16.8%、16.4%、17.8%、15.4%以及15.1%,五项市场份额总计81.5%。

竞争格局方面,全球汽车半导体行业集中度较低,2015年前五大汽车半导体厂商(恩智浦、英飞凌、瑞萨、意法半导体以及德州仪器)市场份额合计为49.6%。其中,恩智浦市场份额为14.2%,其在汽车影音系统以及ADAS占有领先地位,收购Freescale后在处理器市场取得了一定的优势;英飞凌2015年的市场份额约为10.4%,其在汽车传感器(#2)、微控制器(#3)以及功率半导体(#1)等领域均拥有较强的竞争力;瑞萨半导体2015年市场份额为10.3%,其在处理器占据领先位置;意法半导体2015年占据7.7%的市场份额,在功率半导体,短距离雷达及视线处理等细分领域有一定的优势;德州仪器2015年市场份额约为7.0%,该公司主攻工业领域,在汽车领域虽然产品线较全,但相对并不突出。

《2016-2020年全球及中国汽车半导体行业研究报告》报告主要包括以下内容:

全球半导体行业发展状况,包括市场规模及竞争格局等; 全球半导体行业发展状况,包括市场规模及竞争格局等;

全球及中国汽车行业发展状况,包括汽车产销量、保有量、竞争格局等; 全球及中国汽车行业发展状况,包括汽车产销量、保有量、竞争格局等;

全球及中国汽车半导体发展状况,包括全球及中国市场规模、竞争格局以及细分市场; 全球及中国汽车半导体发展状况,包括全球及中国市场规模、竞争格局以及细分市场;

全球汽车半导体主要细分市场分析,包括传感器、处理器以及功率半导体市场的应用、市场规模、竞争格局等; 全球汽车半导体主要细分市场分析,包括传感器、处理器以及功率半导体市场的应用、市场规模、竞争格局等;

包括英飞凌、NXP、德州仪器、安森美、罗姆半导体、瑞萨、意法半导体、博世半导体、迈来芯、森萨塔、富士电机、村田电子、TDK等在内的13家汽车半导体主要厂商分析,包括公司简介、财务状况、产销量、主要客户、主打产品、研发状况、生产基地分布以及技术特点等。 包括英飞凌、NXP、德州仪器、安森美、罗姆半导体、瑞萨、意法半导体、博世半导体、迈来芯、森萨塔、富士电机、村田电子、TDK等在内的13家汽车半导体主要厂商分析,包括公司简介、财务状况、产销量、主要客户、主打产品、研发状况、生产基地分布以及技术特点等。

Automotive semiconductors were mostly used in niche markets like high-end luxury cars in the early days and have penetrated into the low-end markets at a faster pace in recent years. As high-end configurations become standard ones, such as reversing camera, automatic emergency call system, and ubiquitous driver assistance system, automotive semiconductor production has increased, with global automotive semiconductor market size reaching USD29.2 billion in 2015, up 4.3% from a year ago. Being more intelligent, the automobile has higher requirements on active safety, communication & navigation, vision technology, recognition technology, infotainment, comfort, and environmental friendliness, thus creating a huger demand for automotive semiconductors applied for safety control, on-board electronics and so forth. It is expected that the world’s automotive semiconductors will be worth USD 37 billion in 2020, a CAGR of 4.8% compared with 2015.

As the world’s largest automobile producer and consumer market, China has seen a ballooning automotive semiconductor market, thanks to booming semiconductor and automobile industries. Chinese automotive semiconductor market size was USD4.622 billion in 2015, sharing 15.8% of the global market, and is expected to hit USD8.011 billion in 2020, representing a CAGR of 11.6% during 2015-2020.

Automotive semiconductors can be divided into five categories: Power semiconductors, Sensors, Processors (Main for MCU), ASSP (mainly Connectivity and Amplifier), and Logic and others. In a conventional vehicle, semiconductors cost about USD320 with Power ones making up 26% and Sensors 16%; in a HEV, semiconductors cost USD690 or so with Power ones accounting for up to 75%; in an EV, semiconductors cost roughly USD700 with Power ones occupying 55%.

Globally, safety system, powertrain, automotive audio & video, chassis system, and body electronics are main application fields with a market size of USD4.9 billion, USD4.8 billion, USD5.2 billion, USD4.5 billion, and USD4.4 billion in 2015, respectively, seizing 16.8%, 16.4%, 17.8%, 15.4%, and 15.1% (81.5% in total) of automotive semiconductor market size.

Regarding competitive landscape, global automotive semiconductor industry is less concentrated with top5 automotive semiconductor companies (NXP, Infineon, Renesas, STMicroelectronics, and Texas Instruments) acquiring a combined 49.6% market share in 2015. NXP, with a 14.2% market share, finds a leading edge in automotive audio& video system and ADAS and some advantage in processor market after the acquisition of Freescale; Infineon, with an about 10.4% market share, is competitive in the fields of automotive sensor (#2), microcontroller (#3), and power semiconductor (#1); Renesas, with a 10.3% market share, enjoys a leadership in processor field; STMicroelectronics, with a 7.7% market share, is to some extent advantageous in segments like power semiconductor, short-range radar, and vision processing; Texas Instruments, with a 7.0% market share, focuses on industrial fields and doesn’t stand out in automotive field although with a more complete product line.

Global and China Automotive Semiconductor Industry Report, 2016-2020 highlights the following:

Global semiconductor industry (market size, competitive landscape, etc.); Global semiconductor industry (market size, competitive landscape, etc.);

Global and China automobile industry (automobile production and sales, ownership, competitive landscape, etc.); Global and China automobile industry (automobile production and sales, ownership, competitive landscape, etc.);

Global and China automotive semiconductor market size, competitive landscape, market segments, etc.); Global and China automotive semiconductor market size, competitive landscape, market segments, etc.);

Global automotive semiconductor segments (sensor, processor, and power semiconductor (application, market size, competitive landscape, etc.)); Global automotive semiconductor segments (sensor, processor, and power semiconductor (application, market size, competitive landscape, etc.));

13 automotive semiconductor companies (Infineon, NXP, Texas Instruments, ON Semiconductor, ROHM Semiconductor, Renesas, STMicroelectronics, Bosch Semiconductors & Sensors, Melexis, Sensata, Fuji Electric, Murata, and TDK) (profile, financial position, production & sales, major customers, main products, R&D, production bases, technological features, etc.) 13 automotive semiconductor companies (Infineon, NXP, Texas Instruments, ON Semiconductor, ROHM Semiconductor, Renesas, STMicroelectronics, Bosch Semiconductors & Sensors, Melexis, Sensata, Fuji Electric, Murata, and TDK) (profile, financial position, production & sales, major customers, main products, R&D, production bases, technological features, etc.)

第一章 全球半导体产业

1.1 半导体市场概况

1.2 半导体产业供应链

1.3 半导体产业概况

第二章 全球与中国汽车市场

2.1 全球汽车产量

2.1.1 总产量

2.1.2 区域市场

2.1.3 竞争格局

2.2 中国汽车市场

2.2.1 产量

2.2.2 汽车保有量

2.2.3市场格局

2.3 2016年中国汽车市场近况

第三章 汽车半导体行业分析

3.1 全球汽车半导体市场规模

3.2 竞争格局

3.3 中国汽车半导体市场

第四章 汽车半导体重要细分市场分析

4.1 汽车传感器

4.1.1 传感器在汽车上的应用

4.1.2 市场规模

4.1.3 竞争格局

4.1.4 汽车CMOS图像传感器

4.2 汽车处理器(Processor)

4.2.1 市场规模

4.2.2 竞争格局

4.3 汽车功率半导体

4.3.1 简介

4.3.2 HEV/EV功率半导体

4.3.3 竞争格局

第五章 汽车半导体厂家研究

5.1 英飞凌(Infineon)

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收结构

5.1.4 汽车半导体业务

5.1.5 主要客户

5.1.6 收购Wolfspeed

5.1.7 在华业务

5.2 博世半导体(Bosch Semiconductor)

5.2.1 公司简介

5.2.2 汽车半导体业务

5.3 罗姆半导体(Rohm)

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收结构

5.3.4 汽车半导体业务

5.3.5 汽车半导体收入

5.4 安森美(ON SEMI)

5.4.1 公司简介

5.4.2 营业收入

5.4.3 营收结构

5.4.5 收购Fairchild

5.5 德州仪器(TI)

5.5.1 公司简介

5.5.2 经营情况

5.5.3 营收结构

5.5.4 研发投入

5.5.5 汽车半导体业务

5.5.6 在华业务

5.6 意法半导体(STMicroelectronics)

5.6.1 公司简介

5.6.2 经营状况

5.6.3 营收结构

5.6.4 汽车半导体业务

5.7 瑞萨(Renesas)

5.7.1 公司简介

5.7.2 经营情况

5.7.3 汽车半导体业务

5.7.4 汽车半导体主要产品及解决方案

5.7.5 公司战略

5.7.6 瑞萨中国战略

5.8 恩智浦半导体(NXP)

5.8.1 公司简介

5.8.2 经营状况

5.8.3 营收结构

5.8.4 汽车半导体业务

5.8.5 在华业务

5.9 迈来芯(Melexis)

5.9.1 公司简介

5.9.2 营收结构

5.9.3 汽车半导体业务

5.10 森萨塔(Sensata)

5.10.1 公司简介

5.10.2 经营情况

5.10.3 营收结构

5.11 富士电机(Fuji Electric)

5.11.1 公司简介

5.11.2 经营情况

5.11.3 营收结构

5.11.4 半导体业务

5.12 TDK

5.12.1 公司简介

5.12.2 经营状况

5.12.3 主营业务分析

5.12.4 Product

5.12.5 R&D

5.12.6 最新进展

5.12.7 厦门TDK有限公司

5.13 村田电子

5.13.1 公司简介

5.13.2 经营状况

5.13.3 主营业务分析

5.13.4 订单与存货

5.13.5主要产品

5.13.6 无锡村田电子有限公司

5.13.7 北京村田电子有限公司

5.13.8 产能扩充计划

5.13.9 最新进展

1 Global Semiconductor Industry

1.1 Overview of Semiconductor Market

1.2 Supply Chain of Semiconductor Industry

1.3 Overview of Semiconductor Industry

2 Global and Chinese Automobile Market

2.1 Global Automobile Production

2.1.1 Total Production

2.1.2 Regional Markets

2.1.3 Competitive Landscape

2.2 Chinese Automobile Market

2.2.1 Production

2.2.2 Automobile Ownership

2.2.3 Market Pattern

2.3 Recent Developments of the Chinese Automobile Market in 2016

3 Automotive Semiconductor Industry

3.1 Global Automotive Semiconductor Market Size

3.2 Competitive Landscape

3.3 Chinese Automotive Semiconductor Market

4 Major Automotive Semiconductor Segments

4.1 Automotive Sensor

4.1.1 Application of Sensor in Automobile

4.1.2 Market Size

4.1.3 Competitive Landscape

4.1.4 Automotive CMOS Image Sensor

4.2 Automotive Processor

4.2.1 Market Size

4.2.2 Competitive Landscape

4.3 Power Semiconductor

4.3.1 Introduction

4.3.2 HEV/EV Power Semiconductor

4.3.3 Competitive Landscape

5 Automotive Semiconductor Companies

5.1 Infineon

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Automotive Semiconductor Business

5.1.5 Key Customers

5.1.6 Acquisition of Wolfspeed

5.1.7 Business in China

5.2 Bosch Semiconductors & Sensors

5.2.1 Profile

5.2.2 Automotive Semiconductor Business

5.3 ROHM Semiconductor

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Automotive Semiconductor Business

5.3.5 Automotive Semiconductor Revenue

5.4 ON Semiconductor

5.4.1 Profile

5.4.2 Revenue

5.4.3 Revenue Structure

5.4.4 Acquisition of Fairchild

5.5 TI

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R&D Investment

5.5.5 Automotive Semiconductor Business

5.5.6 Business in China

5.6 STMicroelectronics

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Automotive Semiconductor Business

5.7 Renesas

5.7.1 Profile

5.7.2 Operation

5.7.3 Automotive Semiconductor Business

5.7.4 Main Automotive Semiconductor Products and Solutions

5.7.5 Corporate Strategy

5.7.6 Strategy for China

5.8 NXP Semiconductors

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Automotive Semiconductor Business

5.8.5 Business in China

5.9 Melexis

5.9.1 Profile

5.9.2 Revenue Structure

5.9.3 Automotive Semiconductor Business

5.10 Sensata

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.11 Fuji Electric

5.11.1 Profile

5.11.2 Operation

5.11.3 Revenue Structure

5.11.4 Semiconductor Business

5.12 TDK

5.12.1 Profile

5.12.2 Operation

5.12.3 Primary Business

5.12.4 Product

5.12.5 R&D

5.12.6 Latest Developments

5.12.7 TDK Xiamen Co., Ltd.

5.13 Murata

5.13.1 Profile

5.13.2 Operation

5.13.3 Primary Business

5.13.4 Orders and Stock

5.13.5 Main Products

5.13.6 Wuxi Murata Electronics Co., Ltd.

5.13.7 Beijing Murata Electronics Co., Ltd.

5.13.8 Capacity Expansion Plans

5.13.9 Latest Developments

2013-2020年全球半导体市场规模

2013-2016年全球半导体市场产品分布

2013-2016年全球半导体产品增幅

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

2015年全球半导体销量区域分布

2015-2016年全球半导体销售前20强

2011-2020年全球汽车产量预测

2015年主要国家汽车产量(分车型)

2016年上半年全球主要国家汽车产量(分车型)

2015年主要汽车厂商市场份额

2010-2020年中国汽车产量

2007-2020年中国汽车保有量

2016年1-10月中国前十大汽车厂商排名

2016年1-10月中国前十大乘用车品牌产量排名

2016年1-10月中国前十大商用车厂商产量排名

2016年10月中国汽车产销表

2016年1-10月中国汽车产量分类型占比图

2016年1-10月中国汽车销量分类型占比图

2016年1-10月中国乘用车产销表

2016年1-10月中国轿车产销图

2016年1-10月中国多功能乘用车(MPV)产销图

2016年1-10月中国交叉型乘用车产销图

2016年1-10月中国运动型多用途乘用车(SUV)产销图

2016年1-10月中国商用车产销表

2016年1-10月中国货车产销图

2016年1-10月中国客车产销图

2012-2020年全球汽车半导体市场规模

2016年全球汽车半导体产品分布

2012-2020年全球汽车半导体市场应用分布

2014-2015年全球汽车半导体前五大厂商市场占有率

2012-2020年中国汽车半导体市场规模

汽车传感器应用分布

传感器在动力系统中的应用

传感器在安全系统中的应用

KIA的汽车CMOS图像传感器应用

2012-2020年全球汽车传感器市场规模

2014-2016年全球汽车传感器厂家收入排名

汽车CMOS图像传感器的应用

2009-2020年汽车CMOS图像传感器出货量

2015汽车CMOS图像传感器主要厂家市场占有率

2014和2019年汽车处理器市场规模

2007、2012、2020年 Automotive Processor Per Vehicles

2016年汽车MCU主要厂家市场占有率

各类汽车功率半导体的应用范围

MOSFET在电机控制上的应用

EV Vehicles Current Block Diagram

Toyota Prius使用的功率半导体器件

Toyota Lexus Ls600H使用的功率半导体器件

主要功率功率半导体及应用

2016年汽车功率半导体主要厂家市场占有率

2015年主要功率半导体产品前五大厂商市场份额

2016财年英飞凌员工地域分布

2010-2016财年英飞凌收入及毛利率

2015-2016财年英飞凌收入部门分布

2015-2016财年英飞凌收入地域分布

2015-2016财年英飞凌营业利润部门分布

英飞凌汽车半导体应用

英飞凌雷达解决方案

英飞凌摄像技术解决方案

英飞凌离合系统

英飞凌收购Innoluce进入Lidar领域

英飞凌ADAS解决方案

英飞凌电池系统解决方案

2015年英飞凌汽车半导体业务市场份额

英飞凌汽车半导体主要客户

英飞凌在全球前十大汽车厂商动力总成的装配

2010-2016财年英飞凌中国销售收入及增长率

英飞凌全球生产基地分布

博世汽车半导体业务

罗姆半导体基本资料

2011-2017财年Rohm收入及营业利润率

2011-2017财年Rohm收入部门分布

2004-2017财年Rohm收入应用分布

ROHM 汽车半导体发展重心

罗姆车载影音半导体

罗姆车身控制半导体

罗姆动力总成半导体

罗姆安全系统半导体

2016-2020财年罗姆汽车半导体主要应用领域收入走势

安森美主要业务

On Semi 主要产品

安森美半导体主要终端市场

On Semi 主要客户

2011-2016年ON Semi 收入及净利润

2012-2016年ON Semi 收入部门结构

2012-2015年ON Semi 收入地域分布

2012-2016年 ON Semi 收入应用分布

2012-2014年 On Semi汽车半导体业务收入

2014 年On Semi SPG部门应用结构

On Semi Position

2014 年On Semi SSG部门应用结构

ON SEMI ISG 部门发展历程

2012-2014年 ON SEMI APG部门汽车收入

ON SEMI收购Fairchild后的基本情况

ON SEMI收购Fairchild后的产品线扩展

ON SEMI收购Fairchild后的市场地位

ON SEMI收购Fairchild后主要终端市场营收分布

TI全球员工分布情况

TI主要业务

2010-2016年TI营业收入及净利润

2010-2016年 TI收入部门分布

2010-2016年 TI营业利润部门分布

2013-2015年TI收入地区分布

2013-2015年主要业务研发投入情况

TI的ADAS解决方案

TI汽车安全系统解决方案

TI Automotive Infotainment 框架图

TI 汽车充电点

2013-2016年 TI收入应用分布

2013-2015年TI在华营业收入

ST主要业务

2010-2016年 STMicro 收入及毛利率

2013-2016年STMicro 收入产品结构

2013-2016年STMicro收入地域结构

ST汽车半导体主要产品

ST动力总成及智能安全解决方案

ST在ADAS领域市场地位

ST车身电子解决方案

ST车载影音解决方案

ST汽车半导体主要客户

STMicro 汽车半导体市场地位

瑞萨主要业务一览

2011-2016财年 Renesas收入及净利润

2013-2016财年Renesas 季度毛利率

2014-2016财年Renesas 季度营业利润率

2015-2016 财年Renesas 汽车业务季度收入

2015-2016 财年Renesas General-purpose业务季度收入

Renesas Automotive Focus

Renesas HEV/EV Automotive Focus

Renesas HEV/EV Automotive MCU 路线图

Renesas Powertrain MCU 路线图

Renesas Chassis MCU 路线图

Renesas Airbag MCU路线图

Renesas ADAS MCU 路线图

Renesas Instrument Cluster MCU 路线图

Renesas Car Audio MCU 路线图

瑞萨中期战略目标

瑞萨中期战略实现路径

瑞萨中期战略重点投资业务

瑞萨自动驾驶业务战略

瑞萨的中国战略

Business Line, Market Positions & Key Customers of NXP

2010-2016年NXP营业收入及净利润

2014-2016年NXP收入产品分布

2015年NXP主要应用市场营收占比及市场地位

并购飞思卡尔的协同效应

2016-2019年NXP在汽车影音半导体市场的领先战略

NXP在智能车钥匙市场的地位

NXP在ADAS市场的着力点

NXP在汽车雷达领域的主要解决方案

2016-2019年NXP在汽车雷达市场的领先战略

并购Freescale给NXP在ADAS领域带来协同效应

NXP Secure V2X未来发展的主要利基

NXP汽车半导体业务和整个行业增长率对比

Melexis组织结构

2010-2016财年Melexis营业收入及净利润

2013-2015年Melexis 收入地域分布

森萨塔主要业务

2010-2016年Sensata营业收入及净利润

2013-2015年 Sensata 收入部门分布

2012-2015年Sensata收入地域分布

Fuji Electric 电子设备产品结构

2012-2017财年富士电机主营业务收入及净利润

2015-2017财年Fuji Electric主要业务收入分布

2012-2016财年Fuji Electric 主要地区营业收入

富士电机主要产品

Fuji Electric Electronic Devices Segment 新产品

TDK基本资料

TDK五大核心技术及十五大关键业务

2010-2017财年TDK主营业务收入及净利润(百万日元)

2013-2017财年TDK主要产品收入 (JPY bn)

2011-2017财年TDK主要地区收入 (JPY mln)

Main Passive Components Product of TDK

R&D Expenses to Net Sales Ratio, FY2007-2016

CGA6及CGA9主要技术指标

树脂电极系列产品主要技术指标

厦门TDK有限公司基本资料

厦门TDK主要MLCC产品

村田电子基本资料

2012-2017财年村田电子主营业务收入及净利润

2015-2017财年村田电子主要产品收入

2014-2016财年村田电子主要区域收入

2004-2016财年村田电子应用领域收入

2016财年村田电子主要产品订单情况

2016财年村田电子主要产品存货情况

村田电子汽车ECU

村田电子汽车AT半导体

村田电子汽车辅助电机

村田电子汽车TPMS

村田电子汽车ABS/ESC

无锡村田电子有限公司基本资料

北京村田电子有限公司基本资料

福井村田制作所新厂房建造计划

车用AEC-Q200电气特性

Global Semiconductor Market Size, 2013-2020E

Global Semiconductor Market Distribution by Product, 2013-2016

Growth Rate of Global Semiconductor Products, 2013-2016

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

Geographical Distribution of Semiconductor Sales Worldwide, 2015

Global Top20 Vendors by Semiconductor Sales, 2015-2016

Global Automobile Production, 2011-2020E

Automobile Production in Major Countries by Model, 2015

Automobile Production in Major Countries by Model, 2016H1

Market Share of Major Carmakers, 2015

China’s Automobile Production, 2010-2020E

China’s Automobile Ownership, 2007-2020E

Top10 Carmakers in China, Jan-Oct 2016

Top10 Passenger Car Brands in China by Production, Jan-Oct 2016

Top10 Commercial Vehicle Manufacturers in China by Production, Jan-Oct 2016

Automobile Production and Sales in China, Oct 2016

Proportion of Automobile Production in China by Type, Jan-Oct 2016

Proportion of Automobile Sales in China by Type, Jan-Oct 2016

Passenger Car Production and Sales in China, Jan-Oct 2016

Sedan Production and Sales in China, Jan-Oct 2016

MPV Production and Sales in China, Jan-Oct 2016

Cross Passenger Car Production and Sales in China, Jan-Oct 2016

SUV Production and Sales in China, Jan-Oct 2016

Commercial Vehicle Production and Sales in China, Jan-Oct 2016

Truck Production and Sales in China, Jan-Oct 2016

Bus Production and Sales in China, Jan-Oct 2016

Global Automotive Semiconductor Market Size, 2012-2020E

Global Automotive Semiconductor Market Distribution by Product, 2016

Global Automotive Semiconductor Market Distribution by Application, 2012-2020E

Market Share of Global Top5 Automotive Semiconductor Vendors, 2014-2015

Chinese Automotive Semiconductor Market Size, 2012-2020E

Applications of Automotive Sensor

Application of Sensor in Power System

Application of Sensor in Safety System

Application of Automotive CMOS Image Sensor in KIA

Global Automotive Sensor Market Size, 2012-2020E

Ranking of Global Automotive Sensor Companies by Revenue, 2014-2016

Applications of Automotive CMOS Image Sensor

Automotive CMOS Image Sensor Shipments, 2009-2020E

Market Share of Major Automotive CMOS Image Sensor Vendors, 2015

Automotive Processor Market Size, 2014&2019E

Number of Automotive Processors Per Vehicle, 2007 vs. 2012 vs.2020E

Market Share of Major Automotive MCU Vendors, 2016

Application Range of Automotive Power Semiconductors

Application of MOSFET in Motor Control

EV Vehicles Current Block Diagram

Power Semiconductor Devices in Toyota Prius

Power Semiconductor Devices in Toyota Lexus Ls600H

Main Power Semiconductors and Applications

Market Share of Major Automotive Power Semiconductor Vendors, 2016

Market Share of Top5 Power Semiconductor Vendors, 2015

Geographical Distribution of Infineon’s Employees, FY2016

Revenue and Gross Margin of Infineon, FY2010-FY2016

Revenue of Infineon by Division, FY2015-FY2016

Revenue of Infineon by Region, FY2015-FY2016

Operating Income of Infineon by Division, FY2015-FY2016

Applications of Infineon’s Automotive Semiconductors

Infineon Radar Solutions

Infineon Camera Technology Solutions

Infineon Clutch System

Infineon Entered Lidar Field via Acquisition of Innoluce

Infineon ADAS Solutions

ADAS Battery System Solutions

Market Share of Infineon’s Automotive Semiconductor Business, 2015

Major Customers for Infineon’s Automotive Semiconductors

Assembly of Infineon’s Powertrain in Global Top10 Carmakers

Infineon’s Revenue and Growth Rate in China, FY2010-FY2016

Infineon’s Production Bases Worldwide

Automotive Semiconductor Business of Bosch

Profile of ROHM Semiconductor

Revenue and Operating Margin of ROHM Semiconductor, FY2011-FY2017E

Revenue of ROHM Semiconductor by Division, FY2011-FY2017E

Revenue of ROHM Semiconductor by Application, FY2004-FY2017

Development Focus of Automotive Semiconductor Business of ROHM Semiconductor

ROHM On-board Audio & Video Semiconductor

ROHM Body Control Semiconductor

ROHM Powertrain Semiconductor

ROHM Safety System Semiconductor

Trend of ROHM’s Revenue from Automotive Semiconductor by Application, FY2016-FY2020

Main Businesses of ON Semiconductor

Main Products of ON Semiconductor

Main Terminal Markets of ON Semiconductor

Key Customers of ON Semiconductor

Revenue and Net Income of ON Semiconductor, 2011-2016

Revenue of ON Semiconductor by Business Unit, 2012-2016

Revenue of ON Semiconductor by Region, 2012-2015

Revenue of ON Semiconductor by Application, 2012-2016

ON Semiconductor’s Revenue from Automotive Business, 2012-2014

Application Structure of ON Semiconductor’s SPG Business Unit, 2014

On Semi Position

Application Structure of ON Semiconductor’s SSG Business Unit, 2014

Development History of ON Semiconductor’s ISG Business Unit

Automotive Revenue of ON Semiconductor’s APG Business Unit, 2012-2014

Basic Information of ON Semiconductor after Acquisition of Fairchild

Product Line Expansion of ON Semiconductor after Acquisition of Fairchild

Market Status of ON Semiconductor after Acquisition of Fairchild

Revenue of ON Semiconductor by End Market after Acquisition of Fairchild

Distribution of TI’s Employees Worldwide

Main Businesses of TI

Revenue and Net Income of TI, 2010-2016

Revenue of TI by Division, 2010-2016

Operating Income of TI by Division, 2010-2016

Revenue of TI by Region, 2013-2015

R&D Investment of TI in Main Businesses, 2013-2015

TI’s ADAS Solutions

TI’s Automotive Safety System Solutions

TI Automotive Infotainment Diagram

TI Car Charging Spots

Revenue of TI by Application, 2013-2016

TI’s Revenue in China, 2013-2015

Main Businesses of STMicroelectronics

Revenue and Gross Margin of STMicroelectronics, 2010-2016

Revenue Structure of STMicroelectronics by Product, 2013-2016

Revenue Structure of STMicroelectronics by Region, 2013-2016

Main Automotive Semiconductors of STMicroelectronics

Powertrain and Intelligent Safety Solutions of STMicroelectronics

Market Position of STMicroelectronics in ADAS

ST Body Electronics Solutions

ST On-board Audio & Video Solutions

Major Customers for STMicroelectronics’s Automotive Semiconductors

Market Position of STMicroelectronics in Automotive Semiconductor Field

Main Businesses of Renesas

Revenue and Net Income of Renesas, FY2011-FY2016

Quarterly Gross Margin of Renesas, FY2013-FY2016

Quarterly Operating Margin of Renesas, FY2014-FY2016

Quarterly Automotive Revenue of Renesas, FY2015-FY2016

Quarterly General-purpose Revenue of Renesas, FY2015-FY2016

Renesas Automotive Focus

Renesas HEV/EV Automotive Focus

Renesas HEV/EV Automotive MCU Roadmap

Renesas Powertrain MCU Roadmap

Renesas Chassis MCU Roadmap

Renesas Airbag MCU Roadmap

Renesas ADAS MCU Roadmap

Renesas Instrument Cluster MCU Roadmap

Renesas Car Audio MCU Roadmap

Mid-term Strategic Goals of Renesas

Paths for Realization of Renesas’ Mid-term Strategy

Key Investment Businesses of Renesas in Mid-term Strategy

Renesas’ Strategy for Autonomous Driving Business

Renesas’ Strategy for the Chinese Market

Business Line, Market Positions & Key Customers of NXP

Revenue and Net Income of NXP, 2010-2016

Revenue of NXP by Product, 2014-2016

Proportion of NXP’s Revenue from Main Application Markets and Market Position, 2015

Synergy of NXP’s Acquisition of Freescale

NXP’s Leader Strategy for Automotive Audio & Video Semiconductor Market, 2016-2019E

Position of NXP in Intelligent Car Key Market

NXP’s Focus in ADAS Market

NXP’s Main Solutions for Automotive Radar

NXP’s Leader Strategy for Automotive Radar Market, 2016-2019E

Synergy Gained from NXP’s Merger with Freescale in ADAS Field

Main Niches for Development of NXP Secure V2X

Comparison of Growth (%) in NXP’s Automotive Semiconductor Business and the Whole Industry

Organizational Structure of Melexis

Revenue and Net Income of Melexis, FY2010-FY2016

Revenue of Melexis by Region, 2013-2015

Main Businesses of Sensata

Revenue and Net Income of Sensata, 2010-2016

Revenue of Sensata by Division, 2013-2015

Revenue of Sensata by Region, 2012-2015

Fuji Electric’s Electronic Equipment

Operating Revenue and Net Income of Fuji Electric, FY2012-FY2017

Revenue of Fuji Electric by Product, FY2015-FY2017

Revenue of Fuji Electric by Region, FY2012-FY2016

Main Products of Fuji Electric

New Products of Fuji Electric’s Electronic Devices Segment

Profile of TDK

Five Core Technologies and Fifteen Key Businesses of TDK

Operating Revenue and Net Income of TDK, FY2010-FY2017 (JPY mln)

Revenue of TDK by Product, FY2013-FY2017 (JPY bn)

Revenue of TDK by Region, FY2011-FY2017 (JPY mln)

Main Passive Components Product of TDK

R&D Expenses to Net Sales Ratio of TDK, FY2007-2016

Main Technical Indicators of TDK’s CGA6 and CGA9

Main Technical Indicators of TDK’s Resin Electrodes

Profile of Xiamen TDK

Main MLCC Products of Xiamen TDK

Profile of Murata

Operating Revenue and Net Income of Murata, FY2012-FY2017

Revenue of Murata by Product, FY2015-FY2017

Revenue of Murata by Region, FY2014-FY2016

Revenue of Murata by Application, FY2004-FY2016

Orders for Main Products of Murata, FY2016

Stocks of Main Products of Murata, FY2016

Murata Automotive ECU

Murata Automotive AT Semiconductor

Murata Automotive Stand-by Motor

Murata Automotive TPMS

Murata Automotive ABS/ESC

Profile of Wuxi Murata Electronics

Profile of Beijing Murata Electronics

Fukui Murata’s Plans for Construction of New Plants

Electrical Properties of Automotive AEC-Q200

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|