|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2016-2020年全球及中国CMOS相机系统产业研究报告 |

|

字数:3.5万 |

页数:188 |

图表数:200 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2600美元 |

英文纸版:2800美元 |

英文(电子+纸)版:2900美元 |

|

编号:ZYW231

|

发布日期:2017-02 |

附件:下载 |

|

|

|

《2016-2020年全球及中国CMOS相机系统产业研究报告》包含以下内容:

1、CMOS图像传感器产业与市场分析,7个相关厂家研究。

2、CMOS相机镜头产业与市场分析,14个相关厂家研究。

3、CMOS相机模组产业与市场,24个相关厂家研究。

4、手机市场分析与手机相机发展方向。

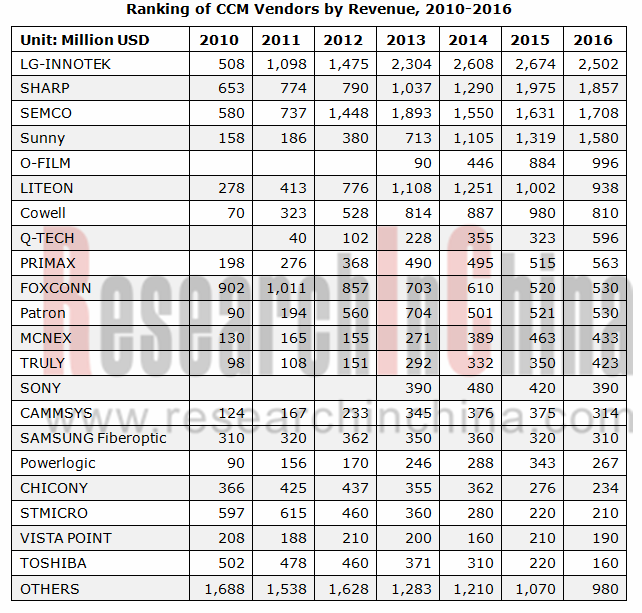

2015年全球CCM(CMOS Camera Module)市场规模为16611百万美元,比2014年增长3.8%,是自2010年以来最低的增速,2016年因为CCM单价最高的苹果手机出货量下滑,导致全球市场则小幅度衰退,下滑0.5%,2017年受双摄像头驱动,大幅度反弹,增速为4.3%,市场规模为17232百万美元。预计到2020年市场规模为18512百万美元。

2016年中国厂家都取得了不错的成绩,韩国厂家由于过份依赖苹果和三星,收入都下滑或略微增长。中国厂家中以Q-Tech增速最高,达84.5%,主要由于其大客户OPPO和VIVO表现出色。其次是Truly,也是拜大客户OPPO和VIVO所赐。

预计未来同像素黑白双摄像头可能会成为苹果以外的主流,主要是成本略低,夜景有明显提升,消费者看得见的效果提升。而苹果则会坚持增加景深的双摄像头设计。智能手机高度同质化,即便消费者对双摄像头满意度不高,但在卖场竞争的情境下,双摄像头会比单摄像头更容易打动消费者,所以预计高端智能手机会把双摄像头作为标准配置。到2020年渗透率可达30-40%。

2016年CIS(CMOS Image Sensor)市场规模大约10516百万美元,比2015年增长5.6%,和2015年13.5%的增速相比大大降低了,主要原因是中高端产品被索尼一家垄断,中低端领域厂家无法突破索尼打造的技术门槛,只能展开价格战,即便是车载领域都是如此。而索尼虽然遭遇了地震、日元升值等因素干扰,但依靠压倒性的性能优势,在中高端领域的绝对垄断地位继续加强,收入继续大爆发,2016年收入大增32.9%,其余厂家除松下、Hynix外都出现了衰退。预计2017年CIS市场增长4.0%,索尼仍然有10%以上的增长,大部分厂家可能继续衰退。虽然手机市场都不被看好,但手机市场仍然是最重要的市场,索尼仍然垄断高端手机市场。

2016年大立光由于过份依赖苹果订单而出现了10年以来第一次收入下滑,但大立光的毛利率进一步上升,从2015年的57.4%提高到2016年的66.2%。显示出大立光的技术实力进一步提升。舜宇在中国市场进一步称霸,收入大增52%,毛利率从32.5%提高到38.2%(2016年上半年),仍然远低于大立光,有进一步提升的空间。大立光吸取过份依赖苹果的教训,积极拓展客户,对舜宇来说压力不小。舜宇的车载镜头虽然目前市场占有率高达33%,稳居全球第一,但未来不仅会受到来自大立光的挑战,也会受到来自韩国Sekonix的挑战。

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:

1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.

2. Analysis of CMOS Camera Lens Industry and Market, with 14 vendors involved.

3. Analysis of CMOS Camera Module (CCM) Industry and Market, with 24 vendors involved.

4. Analysis of Mobile Phone Market and Development Orientation of Mobile Phone Camera

In 2015, the global CCM (CMOS Camera Module) market size reported USD16.611 billion, up 3.8% from a year earlier but the lowest growth rate since 2010. In 2016, as the shipment of Apple phones with the highest single price of CCM fell, the world CCM market was at low ebb and down 0.5%. Due to the dual-camera stimulus in 2017, the global market rebounds substantially with the growth rate of 4.3% and the size estimated to be USD17.232 billion in 2017 and USD18.512 billion in 2020.

In 2016, Chinese manufacturers made remarkable achievements, while South Korean counterparts saw a drop or slight rise in revenue due to their heavy reliance on Apple and Samsung. Among Chinese players, Q-Tech enjoys the highest growth rate up to 84.5%, followed by Truly, both of which benefited from the outstanding performance of big customers OPPO and VIVO.

It is anticipated that monochrome dual-camera with same pixel will be the mainstream for smart phone brands except Apple in the future, as it is more affordable and can improve nightscape significantly (visible effect betterment for consumers), while Apple will persist in duel-camera design enriching depth of focus. Smart phones tend to be highly homogenized. Although they are still not quite satisfied with the dual-cameras, consumers are more impressed with dual-cameras than mono-camera. So, dual-camera is expected to be a standard configuration in high-end smart phones, and the penetration rate till 2020 would be as high up to 30-40%.

In 2016, the CIS (CMOS Image Sensor) market size approximated USD10.516 billion, rising by 5.6% from a year ago, but with an obvious fall in the speed of growth compared with the growth rate of 13.5% in 2015, mainly because medium- and high-end products are monopolized by Sony and the manufacturers in low- and medium-end fields are hard to break through the technological barriers and do nothing but hit the price war even in the vehicle field. Although influenced by factors like the Earthquake and the Appreciation of Japanese Yen, Sony still monopolized the medium- and high-end fields by dint of its overwhelming performance superiority and saw an upsurge of 32.9% in its revenue in 2016; by contrast, other players excluding Panasonic and Hynix saw decline. It is expected that, in 2017, the CIS market will grow 4.0%, Sony will see a growth rate of at least 10%, and most others will continue to suffer losses. In spite of being not much expected, the mobile phone market is still the most important market and Sony still monopolizes the high-end mobile phone market.

In 2016, Largan Precision’s revenue dropped for the first time over the ten years due to its excessive dependence on Apple’s orders, but Largan saw its gross margin further rise from 57.4% in 2015 to 66.2%, showing the strengthened technical competence. Sunny consolidated its hegemony in Chinese market with its revenue surging 52% and gross margin rising from 32.5% to 38.2% (in the first half of 2016), still far behind Largan’s but space left for improvement. Largan earnestly draws lessons from heavy reliance on Apple and actively develop new customers, which poses great pressure on Sunny. Currently holding a 33% market share and ranking first in the vehicle camera field worldwide, Sunny is probable to be challenged by Largan and S.Korean Sekonix in the future.

第一章、CMOS相机模组产业

1.1、CMOS相机模组产业链

1.2、CMOS图像传感器行业

1.3、CIS图像传感器市场

1.4、CMOS IMAGE SENSOR厂家市场占有率

1.5、中国CIS市场

1.6、光学镜头行业

1.7、CMOS相机模组行业

1.8、CMOS相机模组与品牌厂家供应关系

1.9、AFA(VCM)简介

1.10、AFA(VCM)行业格局

1.11、中国VCM产业研究

1.12、OIS简介

1.13、手机OIS市场

1.14、汽车摄像模组Automotive Camera 市场

1.15、主要汽车摄像模组厂家市场占有率

第二章、CMOS相机模组市场

2.1、全球手机市场

2.2、全球智能手机市场

2.3、中国手机市场

2.4、手机摄像发展趋势

2.4.1、提升对焦(Focusing)速度

2.4.2、提升暗光拍摄效果

2.4.3、4K

2.4.4、旋转、阵列

2.4.5、曲面CMOS Sensor

2.5、双摄像头手机

2.5.1同像素平行双摄像头

2.5.2不同像素立体摄像头

2.5.3同像素黑白双摄像头

2.5.4三维扫描双摄像头

第三章、CMOS图像传感器厂家研究

3.1、三星电子

3.2、Omnivision

3.3、APTINA(ON-SEMI)

3.4、索尼

3.5、东芝

3.6、格科微电子

3.7、思比科微电子

第四章、光学镜头厂家研究

4.1、大立光电

4.2、玉晶光电

4.3、亚洲光学

4.4、新钜科技

4.5、先进光电

4.6、KANTATSU

4.7、日立万胜

4.8、DIOSTECH

4.9、SEKONIX

4.10、高丽光学

4.11、FUJINON

4.12、光耀光电GLORY

4.13、KMOT

4.14、Digital Optics

第五章、相机模组厂家研究

5.1、群光

5.2、Vista Point Technologies

5.3、鸿海

5.4、LG INNOTEK

5.5、三美电机

5.6、信利国际

5.7、比亚迪光电

5.8、光宝科技LITEON

5.9、致伸科技

5.10、SEMCO

5.11、Partron

5.12、Sunny Optical

5.13、CAMMSYS

5.14、Powerlogics

5.15、MCNEX

5.16、Cowell

5.17、欧菲光

5.18、昆山丘钛微电子Q-TECH

5.19、Globaloptics

5.20、深圳盛泰光电Shine Tech

5.21、夏普

5.22、STMicroelectronics

5.23、其他

5.23.1、深圳市金康光电KingCome

5.23.2、广州大凌实业Darling

第六章、AFA(VCM)厂家研究

6.1、HYSONIC

6.2、韩国磁化电子JAHWA

1 CMOS Camera Module Industry

1.1 CMOS Camera Module Industry Chain

1.2 CMOS Image Sensor Industry

1.3 CIS Market

1.4 Market Share of CIS Vendors

1.5 China CIS Market

1.6 Optical Lens Industry

1.7 CMOS Camera Module Industry

1.8 Supply Relationship between CMOS Camera Module and Brand Vendors

1.9 Introduction to AFA (VCM)

1.10 AFA (VCM) Industry Pattern

1.11 China VCM Industry

1.12 Introduction to OIS

1.13 Mobile Phone OIS Market

1.14 Automotive Camera Module Market

1.15 Market Share of Major Automotive Camera Module Vendors

2 CMOS Camera Module Market

2.1 Global Mobile Phone Market

2.2 Global Smart Phone Market

2.3 China Mobile Phone Market

2.4 Trends of Mobile Phone Camera

2.4.1 Improving Focusing Speed

2.4.2 Improving Dim Light Shooting Effect

2.4.3 4K

2.4.4 Rotation, Array

2.4.5 Curved CMOS Sensor

2.5 Dual Camera Phone

2.5.1 Parallel Dual Camera with Same Pixels

2.5.2 Stereo Camera with Different Pixels

2.5.3 Monochrome Dual Camera with Same Pixels

2.5.4 3D Scanner Dual Camera

3 CMOS Image Sensor Vendors

3.1 Samsung Electronics

3.2 OmniVision

3.3 Aptina (ON-Semi)

3.4 Sony

3.5 Toshiba

3.6 Galaxycore Microelectronics

3.7 SuperPix Micro Technology

4 Optical Lens Vendors

4.1 Largan Precision

4.2 GeniuS Electronic Optical (GSEO)

4.3 Asia Optical

4.4 Newmax Technology

4.5 Ability Opto-Electronics Technology

4.6 Kantatsu

4.7 Hitachi Maxell

4.8 Diostech

4.9 Sekonix

4.10 Korea Optical

4.11 Fujinon

4.12 Glory

4.13 KMOT

4.14 Digital Optics

5 Camera Module Vendors

5.1 Chicony

5.2 Vista Point Technologies

5.3 Hon Hai

5.4 LG Innotek

5.5 Mitsumi Electric

5.6 Truly International

5.7 BYD Optical

5.8 Lite-On Technology

5.9 Primax

5.10 SEMCO

5.11 Partron

5.12 Sunny Optical

5.13 CammSys

5.14 PowerLogics

5.15 MCNEX

5.16 Cowell

5.17 O-Film

5.18 Q-Tech

5.19 Global Optics

5.20 Shinetech

5.21 Sharp

5.22 STMicroelectronics

5.23 Others

5.23.1 Shenzhen KingCome Optoelectronics

5.23.2 Guangzhou Darling Industrial

6 AFA (VCM) Vendors

6.1 Hysonic

6.2 Jahwa Electronics

CMOS相机模组产业链

2009-2015年8MP CCM成本结构

2012-2015年13MP CCM成本结构

IMAGE SENSOR厂家供应链

2011-2020年CIS(CMOS IMAGE SENSOR)市场规模

2014-2017年CIS(CMOS IMAGE SENSOR)市场规模下游分布

2013-2016年GLOBAL CIS VENDOR MARKET SHARE BY REVENUE

2012年全球主要CMOS IMAGE SENSOR厂家市场占有率

2012年全球主要CMOS IMAGE SENSOR厂家市场占有率(量)

2012年PC领域全球主要CMOS IMAGE SENSOR厂家市场占有率(量)

2010-2018 GLOBAL AND CHINA CIS MARKET VOLUME FOR MOBILE PHONE

2010-2018 GLOBAL AND CHINA CIS MARKET BY PIXEL COUNT

2010-2013 CHINA CIS VENDOR MARKET SHARE BY VOLUME

2010-2013 CHINA CIS VENDOR MARKET SHARE BY REVENUE

2016年全球CMOS相机模组镜头主要厂家出货量市场占有率

2011-2016年全球主要CMOS相机光学镜头厂家收入排名

2010-2020年全球CMOS相机模组市场规模

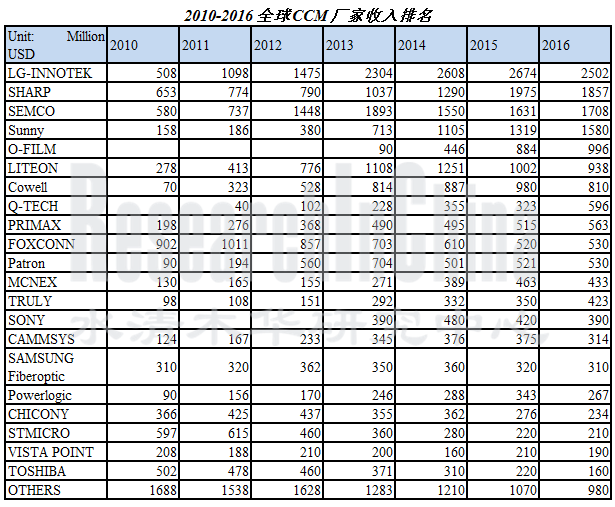

2010-2016全球CCM厂家收入排名

2014年10月中国十大CCM厂家出货量

2016年三星相机模组供应商分布

2016年苹果相机模组供应商分布

2016年ZTE相机模组供应商分布

2016年华为相机模组供应商分布

2013-2014年联想相机模组供应商分布

2016年小米相机模组供应商分布

2016年OPPO相机模组供应商分布

2016年VIVO相机模组供应商分布

VCM直观图

VCM剖面图

VCM结构

2016年全球VCM主要厂家市场占有率(出货量)

AFA与相机模组厂家之间供应关系

2015年全球主要AFA厂家市场占有率

2015年最具竞争力的国产VCM马达10强

OIS结构图

OIS原理图

2012-2017年采用OIS的手机出货量

2015年OIS主要厂家市场占有率

2009-2020年全球AUTOMOTIVE CAMERA MODULE 出货量

2010年主要汽车摄像模组厂家市场占有率

2011年主要汽车摄像模组厂家市场占有率

2012年主要汽车摄像模组厂家市场占有率

2016年全球汽车CCM主要厂家市场占有率

2016年全球汽车VISION SYSTEM主要厂家市场占有率

2016年全球汽车LENS主要厂家市场占有率

2007-2020年全球手机出货量

2015年4季度-2016年4季度全球主要智能手机厂家市场占有率

2016年全球智能手机厂家市场占有率

2014年中国智能手机市场主要厂家市场占有率

2016年中国智能手机市场主要厂家市场占有率

2016年中国智能手机出货量市场占有率

2016 年主流双摄机型及供货模组厂商

三星 8MP以上 CMOS IMAGE SENSOR产品一览

FY2009-FY2016 OMNIVISION收入与毛利率

FY2009-FY2016 OMNIVISION收入与运营利润率

FY2009-FY2015 OMNIVISION出货量

FY2009-FY2015 OMNIVISION收入地域分布

FY2009-FY2015 OMNIVISION资产地域分布

FY2011-FY2014 OMNIVISION收入下游应用分布

FY2013-FY2014 OMNIVISION收入RESOLUTION分布

2014 OVT各领域市场占有率

OMNINVISION 供应链

2014年3季度-2016年4季度 ON SEMICONDUCTOR QUARTERLY SALES AND GROSS MARGIN

3Q14-3Q16 ON SEMICONDUCTOR IMAGE SENSOR GROUP QUARTERLY REVENUES

索尼半导体事业部组织结构

索尼图像传感器产能扩展计划

IMAGE SENSOR应用分布

2011-2014年GALAXYCORE收入与毛利率

2011-2014年GALAXYCORE收入产品分布

2011-2014年GALAXYCORE收入像素分布BY PIXEL

2011-2014年GALAXYCORE产品出货量

2011-2014年GALAXYCORE资产、负债与现金流

2006-2017年大立光收入与毛利率

2006-2017年大立光收入与运营利润率

2014年12月-2016年12月大立光月度收入

2014-2016年大立光出货量像素分布

2011-2014年大立光电出货量

大立光电大陆子公司2015年财务数据

大立光电大陆子公司2014年财务数据

大立光电大陆子公司2012年财务数据

大立光电大陆子公司2013年财务数据

2005-2016年玉晶光电收入与毛利率

2005-2016年玉晶光电收入与运营利润率

2014年12月-2016年12月玉晶光月度收入

2007-2016年亚光收入与毛利率

2007-2016年亚光收入与运营利润率

2014年12月-2016年12月亚洲光学月度收入

2007-2016年新钜科技收入与毛利率

2014年12月-2016年12月新钜科技月度收入

2006-2016年先进光电收入与毛利率

2014年12月-2016年12月先进光电每月收入

KANTATSU手机相机模组产品一览

2013年DIOSTECH收入业务分布

2013年DIOSTECH产能、产量、产能利用率

DIOSTECH组织结构

DIOSTECH生产线

DIOSTECH客户

2012年DIOSTECH收入像素分布

2005-2016年SEKONIX收入与运营利润率

2009-2016年SEKONIX收入产品分布

2012-2014年SEKONIX HANDSET LENS业务收入像素分布

2007-2016年高丽光学收入与运营利润率

高丽光学路线图

2006-2016年光耀科技收入与运营利润率

2014年12月-2016年12月光耀科技每月收入

KMOT主要业务

2011-2012财年 KMOT OPTICAL UNITS FOR CELL PHONES 收入

2007-2016年DIGITAL OPTICS收入与运营利润率

2011-2014年DIGITAL OPTICS原材料成本分布

2005-2016年群光收入与毛利率

2014年12月-2016年12月群光月度收入

2011年群光主要大陆子公司财务数据

2012年群光主要大陆子公司财务数据

鸿海光学领域主要子公司2013年财务数据

鸿海光学领域主要子公司2014年财务数据

鸿海光学领域主要子公司2015年财务数据

2006-2017年LG INNOTEK收入与运营利润率

2008-2018 LG INNOTEK NET PROFIT

2013-2017年LG INNOTEK 收入业务分布

2011-2015年LG INNOTEK 运营利润业务分布

2014年1季度-2016年4季度LG INNOTEK OPTICAL季度收入与营业利润率

2014年1季度-2016年4季度LG INNOTEK AUTOMOTIVE&ELECTRONICS季度收入与营业利润率

2014年1季度-2016年4季度LG INNOTEK CCM像素分布

2006-2016财年三美电机收入与运营利润率

2006-2016财年三美电机收入产品分布

HOLDING STRUCTURE OF TRULY INTERNATIONAL'S SUBSIDIARIES

2005-2016年信利国际收入与运营利润率

2014-2018年信利收入BY SEGMENT

2014- 2018 SALES AND ASP OF TRULY'S AUTOMOTIVE PRODUCTS

信利手机LCD主要客户

信利汽车显示器主要客户

信利触摸屏产能

信利CCM主要客户

光宝集团

光宝广州科技园

光宝CCM技术路线图

2005-2015年光宝收入与运营利润率

致伸科技KEY MILESTONE

2008-2016年致伸科技收入与营业利润率

2007-2015年致伸科技收入部门分布

2014年12月-2016年12月致伸科技每月收入

致伸全球分布

致伸科技产品范围

2011-2016年SEMCO收入与营业利润

2014-2017年SEMCO收入部门分布

2015-2017年SEMCO运营利润部门分布

2013年1季度-2016年4季度SEMCO CCM业务收入

2007-2017年PARTRON收入与运营利润率

2013-2016年PARTRON收入客户分布

2004-2016年舜宇收入与毛利率

2014-2016舜宇收入BY SEGMENT

2009-2015年财务概要 FINANCIAL SUMMARY

舜宇主要客户

2013-2016舜宇各项产品出货量

2014-2018舜宇汽车LENS出货量与ASP

2010-2016年舜宇收入部门分布

2010-2016年舜宇各部门毛利率

舜宇工厂分布

CAMMSYS组织结构图

2009-2017年CAMMSYS收入与营业利润率

2011-2014年CAMMSYS原材料价格

2009-2016年POWERLOGIC收入与营业利润

2012-2014年POWERLOGIC CCM ASP

2012-2014年POWERLOGIC CCM COMPONENT ASP

2012-2014年POWERLOGIC CCM产能

2012-2014年POWERLOGIC CCM产量

2009-2016年MCNEX收入与营业利润

2013年MCNEX收入客户分布

2010-2016年MCNEX收入应用分布

MCNEX 手机领域主要产品

MCNEX 产能地域分布

东莞高伟2011-2017年收入与毛利率

2011-2016 COWELL REVENUE BREAKDOWN BY SEGMENT

2011-2015 COWELL SHIPMENTS VS ASP

2014年10月31日COWELL 产能

2013-2014 COWELL成本结构

2007-2017年欧菲光收入与运营利润率

2009-2017年欧菲光收入产品分布

2012-2014年欧菲光客户结构

2011-2017年Q-TECH收入与毛利率

2013-2017年Q-TECH CCM出货量

2015年1季度-2016年4季度 Q-TECH 季度出货量

2015-2018年Q-TECH CCM ASP

2015-2016 Q-TECH CCM ASP BY PIXELS

2015年Q-TECH客户分布

FY2009-FY2015年GAI收入与营业利润

FY2008-FY2017 SHARP 收入与营业利润率

2015年2季度-2016年4季度夏普CCM业务季度收入与营业利润率

夏普OIS路线图

FY2014 STMICRO REVENUE BY PRODUCT

3Q/2015 STMICRO REVENUE BY PRODUCT

HYSONIC结构

2006-2016年HYSONIC收入与运营利润

2014年3月底PERSONNEL ORGANIZATION OF HYSONIC

HYSONIC 主要产品

2012-2013年HYSONIC收入最终客户分布

2012-2013年HYSONIC收入客户分布

2005-2017年JAHWA收入与运营利润率

1Q13-4Q15 JAHWA季度收入产品分布

磁化电子海外子公司一览

CMOS Camera Module Industry Chain

8MP CCM Cost Structure, 2009-2015

13MP CCM Cost Structure, 2012-2015

Supply Chain of Image Sensor Vendors

CIS Market Size, 2011-2020E

CIS Market Size by Application, 2014-2017

Market Share of Global CIS Vendors by Revenue, 2013-2016

Market Share of Major Global CIS Vendors (by Revenue), 2012

Market Share of Major Global CIS Vendors (by Shipment), 2012

Market Share of Major Global CIS Vendors in PC Field, 2012

Global and China CIS Market Volume for Mobile Phone, 2010-2018E

Global and China CIS Market by Pixel Count, 2010-2018E

Market Share of Chinese CIS Vendors by Volume, 2010-2013

Market Share of Chinese CIS Vendors by Revenue, 2010-2013

Market Share of Major Global CCM Vendors by Shipment, 2016

Global CMOS Optical Camera Lens Vendor Rankings by Revenue, 2011-2016

Global CCM Market Size, 2010-2020E

Global CCM Vendor Rankings by Revenue, 2010-2016

Top 10 CCM Vendors by Revenue in China, Oct. 2014

Distribution of Samsung’s Camera Module Suppliers, 2016

Distribution of Apple’s Camera Module Suppliers, 2016

Distribution of ZTE’s Camera Module Suppliers, 2016

Distribution of Huawei’s Camera Module Suppliers, 2016

Distribution of Lenovo’s Camera Module Suppliers, 2013-2014

Distribution of Xiaomi’s Camera Module Suppliers, 2016

Distribution of OPPO’s Camera Module Suppliers, 2016

Distribution of VIVO’s Camera Module Suppliers, 2016

VCM Visual View

VCM Sectional View

VCM Structure

Market Share of Major Global VCM Vendors (by Shipment) , 2016

Supply Relationship between AFA and Camera Module Vendors

Market Share of Major Global AFA Vendors, 2015

Top 10 Most Competitive China-made VCM Motors, 2015

OIS Structural Diagram

OIS Schematic Diagram

Shipment of Mobile Phones with OIS, 2012-2017E

Market Share of Major OIS Vendors, 2015

Global Automotive Camera Module Shipment, 2009-2020E

Market Share of Major Automotive Camera Module Vendors, 2010

Market Share of Major Automotive Camera Module Vendors, 2011

Market Share of Major Automotive Camera Module Vendors, 2012

Market Share of Major Global Automotive CCM Vendors, 2016

Market Share of Major Global Automotive Vision System Vendors, 2016

Market Share of Major Global Automotive Lens Vendors, 2016

Global Mobile Phone Shipment, 2007-2020E

Market Share of Major Global Smartphone Vendors, 2015Q4-2016Q4

Market Share of Global Smartphone Vendors, 2016

Market Share of Major Smartphone Vendors in China, 2014

Market Share of Major Smartphone Vendors in China, 2016

Market Share of Major Smartphone Vendors in China by Shipment, 2016

Mainstream Dual-Camera Phones and Supply Module Vendors, 2016

Samsung 8MP- above CMOS Image Sensor Products List

OmniVision’s Revenue and Gross Margin, FY2009-FY2016

OmniVision’s Revenue and Operating Margin, FY2009-FY2016

OmniVision’s Shipment, FY2009-FY2015

OmniVision’s Revenue by Region, FY2009-FY2015

OmniVision’s Assets by Region, FY2009-FY2015

OmniVision’s Revenue by Application, FY2011-FY2014

OmniVision’s Revenue by Resolution, FY2013-FY2014

OmniVision’s Market Share by Field, 2014

OmniVision’s Supply Chain

ON Semiconductor’s Quarterly Sales and Gross Margin, 2014Q3-2016Q4

ON Semiconductor Image Sensor Group’s Quarterly Revenue, 2014Q3-2016Q3

Sony Semiconductor Solutions’ Organizational Structure

Sony’s Image Sensor Capacity Expansion Plan

Image Sensor Applications

Revenue and Gross Margin of Galaxycore, 2011-2014

Revenue Breakdown of Galaxycore by Product, 2011-2014

Revenue Breakdown of Galaxycore by Pixel, 2011-2014

Galaxycore’s Product Shipment, 2011-2014

Galaxycore’s Assets, Liabilities and Cash Flow, 2011-2014

Largan Precision’s Revenue and Gross Margin, 2006-2017

Largan Precision’s Revenue and Operating Margin, 2006-2017

Largan Precision’s Monthly Revenue, Dec. 2014-Dec. 2016

Largan Precision’s Shipment by Pixel, 2014-2016

Largan Precision’s Shipment, 2011-2014

Financial Data of Largan Precision’s Subsidiaries in Mainland China, 2015

Financial Data of Largan Precision’s Subsidiaries in Mainland China, 2014

Financial Data of Largan Precision’s Subsidiaries in Mainland China, 2012

Financial Data of Largan Precision’s Subsidiaries in Mainland China, 2013

GSEO’s Revenue and Gross Margin, 2005-2016

GSEO’s Revenue and Operating Margin, 2005-2016

GSEO’s Monthly Revenue, Dec. 2014-Dec. 2016

Asia Optical’s Revenue and Gross Margin, 2007-2016

Asia Optical’s Revenue and Operating Margin, 2007-2016

Asia Optical’s Monthly Revenue, Dec. 2014-Dec. 2016

Newmax Technology’s Revenue and Gross Margin, 2007-2016

Newmax Technology’s Monthly Revenue, Dec. 2014-Dec. 2016

Ability Opto-Electronics Technology’s Revenue and Gross Margin, 2006-2016

Ability Opto-Electronics Technology’s Monthly Revenue, Dec. 2014-Dec. 2016

Kantatsu Mobile Phone Camera Module Products List

Diostech’s Revenue by Business, 2013

Diostech’s Capacity, Output and Capacity Utilization, 2013

Diostech’s Organizational Structure

Diostech’s Production Line

Diostech’s Customers

Diostech’s Revenue by Pixel, 2012

Sekonix’s Revenue and Operating Margin, 2005-2016

Sekonix’s Revenue by Product, 2009-2016

Sekonix’s Handset Lens Revenue by Pixel, 2012-2014

Korea Optical’s Revenue and Operating Margin, 2007-2016

Korea Optical’s Roadmap

Optivision Technology’s Revenue and Operating Margin, 2006-2016

Optivision Technology’s Monthly Revenue, Dec. 2014-Dec. 2016

KMOT’s Main Businesses

Revenue of KMOT’s Optical Units for Cell Phones, FY2011-FY2012

Digital Optics’ Revenue and Operating Margin, 2007-2016

Distribution of Digital Optics’ Raw Material Costs, 2011-2014

Chicony’s Revenue and Gross Margin, 2005-2016

Chicony’s Monthly Revenue, Dec. 2014-Dec. 2016

Financial Data of Chicony’s Major Subsidiaries in Mainland China, 2011

Financial Data of Chicony’s Major Subsidiaries in Mainland China, 2012

Financial Data of Hon Hai’s Major Subsidiaries in Optical Field, 2013

Financial Data of Hon Hai’s Major Subsidiaries in Optical Field, 2014

Financial Data of Hon Hai’s Major Subsidiaries in Optical Field, 2015

LG Innotek’s Revenue and Operating Margin, 2006-2017

LG Innotek’s Net Profit, 2008-2018E

LG Innotek’s Revenue by Business, 2013-2017

LG Innotek’s Operating Income by Business, 2011-2015

LG Innotek’s Optical Revenue and Operating Margin by Quarter, 2014Q1-2016Q4

LG Innotek’s Automotive & Electronics Revenue and Operating Margin by Quarter, 2014Q1-2016Q4

LG Innotek’sCCM Distribution by Piexel, 2014Q1-2016Q4

Mitsumi Electric’s Revenue and Operating Margin, FY2006-FY2016

Mitsumi Electric’s Revenue by Product, FY2006-FY2016

Holding Structure of Truly International’s Subsidiaries

Truly International’s Revenue and Operating Margin, 2005-2016

Truly International’s Revenue by Segment, 2014-2018

Sales and ASP of Truly International’s Automotive Products, 2014-2018

Truly International’s Mobile Phone LCD Customers

Truly International’s Car Display Customers

Truly International’s Touch Screen Capacity

Truly International’s CCM Customers

Lite-On Technology Corporation

Lite-on Science Park, Guangzhou

Lite-on’s CCM Technology Roadmap

Lite-on’s Revenue and Operating Margin, 2005-2015

Primax’s Key Milestones

Primax’s Revenue and Operating Margin, 2008-2016

Primax’s Revenue by Division, 2007-2015

Primax’s Monthly Revenue, Dec. 2014-Dec. 2016

Primax’s Global Distribution

Primax’s Product Scope

Revenue and Operating Income of SEMCO, 2011-2017

Revenue of SEMCO by Division, 2014-2017

Operating Income of SEMCO by Dision, 2015-2017

Quarterly CCM Business Revenue of SEMCO, 2013Q1-2016Q4

Revenue and Operating Margin of Partron, 2007-2017

Revenue of Partron by Customer, 2013-2016

Revenue and Gross Margin of Sunny Optical, 2004-2016

Revenue of Sunny Optical by Segment, 2014-2016

Financial Summary of Sunny Optical, 2009-2015

Key Customers of Sunny Optical

Shipments of Sunny Optical by Product, 2013-2016

Automotive Lens Shipment and ASP of Sunny Optical, 2014-2018E

Revenue of Sunny Optical by Division, 2010-2016

Gross Margin of Sunny Optical by Division, 2010-2016

Distribution of Sunny Optical’s Plants

Organization Structure of CammSys

Revenue and Operating Margin of CammSys, 2009-2017

Raw Material Prices of CammSys, 2011-2014

Revenue and Operating Income of PowerLogic, 2009-2016

CCM ASP of PowerLogic, 2012-2014

CCM Component ASP of PowerLogic, 2012-2014

Production Capacity of PowerLogic CCM, 2012-2014

CCM Output of PowerLogic, 2012-2014

Revenue and Operating Income of MCNEX, 2009-2016

Revenue of MCNEX by Customer, 2013

Revenue of MCNEX by Application, 2010-2017

Major Products of MCNEX in Mobile Phone Field

Production Capacity of MCNEX by Region

Revenue and Gross Margin of Cowell, 2011-2017

Revenue of Cowell by Segment, 2011-2016

Shipments VS ASP of Cowell, 2011-2015

Production Capacity of Cowell, Oct 31, 2014

Cost Structure of Cowell, 2013-2014

Revenue and Operating Margin of O-Film, 2007-2017

Revenue of O-Film by Product, 2009-2017

Client Structure of O-Film, 2012-2014

Revenue and Gross Margin of Q-TECH, 2011-2017

CCM Shipment of Q-TECH, 2013-2017E

Quarterly Shipment of Q-TECH, 2015Q1-2016Q4

CCM ASP of Q-TECH, 2015-2018E

CCM ASP of Q-TECH by Pixels, 2015-2016

Client Structure of Q-TECH, 2015

Revenue and Operating Income of GAI, FY2009-FY2015

Revenue and Operating Margin of Sharp, FY2008-FY2017

CCM Business Revenue and Operating Margin of Sharp, 2015Q2-2016Q4

OIS Roadmap of Sharp

Revenue of STMicro by Product, FY2014

Revenue of STMicro by Product, 3Q/2015

Structure of Hysonic

Revenue and Operating Income of Hysonic, 2006-2016

Personnel Organization of Hysonic, end-March 2014

Major Products of Hysonic

Revenue of Hysonic by Ultimate Client, 2012-2013

Revenue of Hysonic by Customer, 2012-2013

Revenue and Operating Margin of Jahwa, 2005-2017

Quarterly Revenue of Jahwa by Product, 2013Q1-2015Q4

Overseas Subsidiaries of Jahwa

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|