|

|

|

报告导航:研究报告—

金融与服务业—金融业

|

|

2017-2021年中国融资租赁行业研究报告 |

|

字数:6.7万 |

页数:154 |

图表数:177 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:2800美元 |

英文纸版:3000美元 |

英文(电子+纸)版:3100美元 |

|

编号:BXM106

|

发布日期:2017-08 |

附件:下载 |

|

|

|

2014 年以来,在一系列利好政策的推动下,中国融资租赁业步入快速发展的轨道。截至2017年6月,中国融资租赁企业数达到8,218家,业务总量达到56,000亿元,分别是2013年底的8倍和2.7倍。

按照监管部门不同,中国融资租赁公司可以分为金融租赁公司、内资租赁公司和外资租赁公司,其中外资租赁公司数量最多,2017年6月底已经接近8,000家,数量占比达到96.5%,但金融租赁公司由于资金实力雄厚,业务量最多,业务量占比为37.8%(2017年6月底)。预计未来,金融租赁公司依然为行业主要力量。

分行业看,2014年以前中国的融资租赁业务主要集中在交通运输、通用装备、工业装备等传统行业,近年受经济转型,供给侧结构性改革等因素影响,中国传统装备制造业融资租赁需求下滑,而航空航天、汽车、医疗卫生、海洋工程、绿色能源等行业需求则显著增加,特别是能源装备,其融资租赁资产已经由2014年的300多亿元迅速增加至2016年的2000多亿元。

分地区看,目前中国融资租赁业务主要集中在北京、天津、上海、广东,这主要得益于各自区位优势及政策。截至2016年底,这四地的融资租赁公司数量合计超过全国的80%。

目前中国融资租赁公司的资金来源主要包括资本金、银行贷款、同业拆借、股东定期存款等,其中股东的资本金和银行贷款占据主导地位,整体融资渠道较为单一。自2014年交易所ABS改为备案和负面清单制度后,融资租赁ABS一跃而起,成为融资租赁公司的重要融资渠道之一。

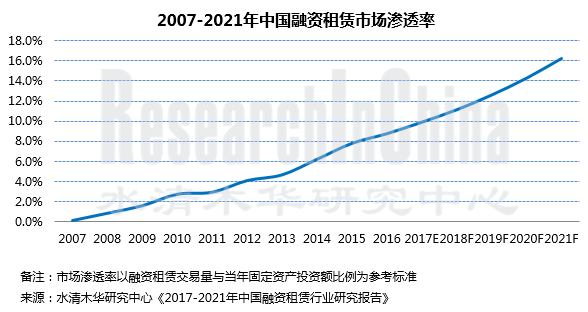

总体来说,中国融资租赁业还处于起步阶段,存在法律法规、税收政策不完善,区域发展不平衡,融资渠道单一等多个问题,但发展前景却非常广阔。2016年中国融资租赁市场渗透率在8%左右,这与欧美等国15-30%的渗透率相比,还有很大提升空间。

水清木华研究中心《2017-2021年中国融资租赁行业研究报告》着重研究了以下内容:

全球及主要国家融资租赁发展现状; 全球及主要国家融资租赁发展现状;

中国融资租赁政策环境、经济环境; 中国融资租赁政策环境、经济环境;

中国融资租赁发展历程,市场规模、竞争格局、融资渠道、盈利模式及发展趋势; 中国融资租赁发展历程,市场规模、竞争格局、融资渠道、盈利模式及发展趋势;

中国主要行业融资租赁发展情况,包括航空、船舶、工程机械、医疗设备、印刷设备、铁路运输设备、汽车、农业机械、电力等; 中国主要行业融资租赁发展情况,包括航空、船舶、工程机械、医疗设备、印刷设备、铁路运输设备、汽车、农业机械、电力等;

中国主要地区融资租赁发展情况,包括天津、北京、广东、上海; 中国主要地区融资租赁发展情况,包括天津、北京、广东、上海;

中国主要融资租赁企业(含10家金融租赁公司、8家内资公司和10家外资租赁公司)经营状况、融资租赁业务、融资渠道及发展战略等。 中国主要融资租赁企业(含10家金融租赁公司、8家内资公司和10家外资租赁公司)经营状况、融资租赁业务、融资渠道及发展战略等。

Since 2014, a series of favorable policies have prompted China's financial leasing industry to develop rapidly. As of June 2017, there had been 8,218 financial leasing enterprises in China, which conducted the transactions worth RMB5.6 trillion; the figures were 8 times and 2.7 times those at the end of 2013 respectively.

In accordance with regulatory authorities, financial leasing companies in China can be divided into banking leasing companies, domestic-funded leasing companies and foreign-funded leasing companies; wherein, the foreign-funded leasing companies accounted for as high as 96.5% of the total at the end of June 2017, with the number of nearly 8,000; but, banking leasing companies contributed 37.8% to the business volume at the end of June 2017 thanks to strong financial strength, outperforming the other two types of companies. In the future, banking leasing companies will still be the main force for the industry.

Before 2014, China’s financial leasing operations happened mainly in transportation, general equipment, industrial equipment and other traditional industries. Affected by economic restructuring, supply-side structural reform and other factors, the demand from traditional equipment manufacturing in China for financial leasing has declined in recent years, while the demand from aerospace, automotive, medical and health, marine engineering, green energy and other sectors has surged, especially energy equipment saw its financial leasing assets rise from more than RMB30 billion in 2014 to over RMB200 billion in 2016.

By region, China's financial leasing services are mainly available in Beijing, Tianjin, Shanghai and Guangdong, which is the result of their geographical advantages and policies. As of the end of 2016, the combined number of financial leasing companies in the four places had exceeded 80% of the country’s total.

In China, the funds of financial leasing companies chiefly source from capital, bank loans, interbank borrowing (lending) and shareholders' deposits, among which shareholders' capital and bank loans play the leading role, reflecting relatively simple financing channels. Since China Securities Regulatory Commission adopted the record and negative list system for ABS (Asset-backed Securitization) in 2014, the financial leasing ABS was put in the spotlight by financial leasing companies as one of important financing channels.

In general, China's financial leasing industry is still in its infancy, facing problems like imperfect laws and regulations, incomplete tax policy, regional development imbalance, and monotonous financing channel, but with broad development prospects. In 2016, China's financial leasing market penetration rate was about 8%, far below 15-30% in Europe and the United States.

China Financial Leasing Industry Report, 2017-2021 by ResearchInChina focuses on the following:

Global financial leasing development, and status quo of financial leasing in the world's major countries; Global financial leasing development, and status quo of financial leasing in the world's major countries;

Policy and economic environments for financial leasing in China; Policy and economic environments for financial leasing in China;

Development history, market size, competitive landscape, financing channels, profit models and development trends of financial leasing in China; Development history, market size, competitive landscape, financing channels, profit models and development trends of financial leasing in China;

Development of financial leasing in main industries, including aviation, shipping, construction machinery, medical equipment, printing equipment, rail transportation equipment, automobile, agricultural machinery, electric power, etc.; Development of financial leasing in main industries, including aviation, shipping, construction machinery, medical equipment, printing equipment, rail transportation equipment, automobile, agricultural machinery, electric power, etc.;

Development of financial leasing in major regions of China, including Tianjin, Beijing, Guangdong and Shanghai; Development of financial leasing in major regions of China, including Tianjin, Beijing, Guangdong and Shanghai;

Operation, financial leasing services, financing channels, development strategies, etc. of major financial leasing enterprises in China (including 10 banking leasing companies, 8 domestic-funded leasing companies and 10 foreign-funded leasing companies). Operation, financial leasing services, financing channels, development strategies, etc. of major financial leasing enterprises in China (including 10 banking leasing companies, 8 domestic-funded leasing companies and 10 foreign-funded leasing companies).

第一章 行业概述

1.1基本定义和特点

1.2业务形式

1.3 产业链

第二章 全球融资租赁发展现状

2.1 发展概况

2.2 主要国家

2.2.1 美国

2.2.2 日本

2.2.3 德国

第三章 中国融资租赁发展环境

3.1政策环境

3.2经济环境

3.2.1 GDP 增速

3.2.2 固定资产投资

3.2.3 资金供应量

第四章 中国融资租赁发展现状

4.1 发展历程

4.2 行业规模

4.2.1企业类型及数量

4.2.2 业务总量

4.2.3 注册资金

4.3 竞争格局

4.3.1 分地区

4.3.2 分企业

4.3.3 分应用行业

4.3.4 分业务形式

4.4 融资渠道

4.4.1 概述

4.4.2融资租赁ABS

4.5 盈利模式

4.6 发展趋势

第五章 中国主要行业融资租赁发展现状

5.1 航空融资租赁

5.1.1 航空运输业发展情况

5.1.2 飞机融资租赁现状

5.1.3 主要飞机融资租赁公司

5.1.4 主要航空公司飞机融资租赁情况

5.2 船舶融资租赁

5.2.1 船舶业发展情况

5.2.2 船舶租赁方式

5.2.3 船舶融资租赁现状

5.2.4 主要船舶融资租赁公司

5.3 汽车行业融资租赁

5.3.1 汽车行业发展情况

5.3.2 汽车融资租赁现状

5.3.3 汽车融资租赁细分市场

5.3.4 主要汽车融资租赁公司

5.4铁路运输设备融资租赁

5.4.1 铁路运输设备行业发展情况

5.4.2 铁路运输设备融资租赁现状

5.5 工程机械融资租赁

5.5.1 工程机械业发展情况

5.5.2 工程机械融资租赁现状

5.5.3 主要工程机械租赁公司

5.6 医疗设备融资租赁

5.6.1 医疗设备业发展情况

5.6.2 医疗设备融资租赁现状

5.6.3 主要医疗设备融资租赁公司

5.7 印刷设备融资租赁

5.7.1 印刷设备行业发展情况

5.7.2 印刷设备融资租赁现状

5.8其他

5.8.1 农业机械融资租赁

5.8.2电力行业融资租赁

第六章 中国主要地区融资租赁发展现状

6.1 天津

6.2 广东

6.3 北京

6.4 上海

第七章 中国主要金融租赁公司

7.1工银金融租赁有限公司

7.1.1 公司简介

7.1.2 经营状况

7.1.3 融资租赁业务

7.1.4 融资渠道

7.1.5 发展战略

7.2 国银金融租赁股份有限公司

7.2.1 公司简介

7.2.2 经营状况

7.2.3 融资租赁业务

7.2.4 融资渠道

7.3 交银金融租赁有限责任公司

7.3.1 公司简介

7.3.2 经营状况

7.3.3 融资租赁业务

7.3.4 融资渠道

7.4 昆仑金融租赁有限责任公司

7.4.1 公司简介

7.4.2 经营状况

7.4.3 融资租赁业务

7.4.4 发展战略

7.5 民生金融租赁股份有限公司

7.5.1 公司简介

7.5.2 经营状况

7.5.3 融资租赁业务

7.5.4 融资渠道

7.5.5发展战略

7.6 兴业金融租赁有限责任公司

7.6.1 公司简介

7.6.2 经营状况

7.6.3 融资租赁业务

7.6.4 融资渠道

7.6.5 发展战略

7.7 建信金融租赁股份有限公司

7.7.1 公司简介

7.7.2 经营状况

7.7.3 融资租赁业务

7.7.4 融资渠道

7.8 招银金融租赁有限公司

7.8.1 公司简介

7.8.2 经营状况

7.8.3 融资租赁业务

7.8.4 融资渠道

7.9 华融金融租赁股份有限公司

7.9.1 公司简介

7.9.2 经营状况

7.9.3 融资租赁业务

7.9.4 融资渠道

7.10 太平石化金融租赁有限责任公司

7.10.1 公司简介

7.10.2 经营状况

7.10.3 融资租赁业务

7.10.4 融资渠道

第八章 中国主要内资租赁公司

8.1 天津渤海租赁有限公司

8.1.1 公司简介

8.1.2 经营状况

8.1.3 融资租赁业务

8.1.4 融资渠道

8.1.5 子公司——皖江金租

8.1.6 子公司——横琴租赁

8.2 长江租赁有限公司

8.2.1 公司简介

8.2.2 经营状况

8.2.3 融资租赁业务

8.3 浦航租赁有限公司

8.3.1 公司简介

8.3.2 经营状况

8.3.3 融资租赁业务

8.4 国泰租赁有限公司

8.4.1 公司简介

8.4.2 经营状况

8.4.3 融资租赁业务

8.4.4 融资渠道

8.5 汇通信诚租赁有限公司

8.5.1 公司简介

8.5.2 经营状况

8.5.3 融资租赁业务

8.6 中航国际租赁有限公司

8.6.1 公司简介

8.6.2 经营状况

8.6.3 融资租赁业务

8.6.4 融资渠道

8.6.5 发展战略

8.7丰汇租赁有限公司

8.7.1 公司简介

8.7.2 经营状况

8.7.3 融资租赁业务

8.7.4 融资渠道

8.8 中建投租赁股份有限公司

8.8.1 公司简介

8.8.2 经营状况

8.8.3 融资租赁业务

8.8.4 融资渠道

第九章 中国主要外资租赁公司

9.1 远东国际租赁有限公司

9.1.1 公司简介

9.1.2 经营状况

9.1.3融资租赁业务

9.1.4 融资渠道

9.2 平安国际融资租赁有限公司

9.2.1 公司简介

9.2.2 经营状况

9.2.3 融资租赁业务

9.2.4 融资渠道

9.3 山东晨鸣融资租赁有限公司

9.3.1 公司简介

9.3.2 经营状况

9.3.3 融资租赁业务

9.4中垠融资租赁有限公司

9.4.1企业简介

9.4.2 经营状况

9.4.3 融资租赁业务

9.5中国环球租赁有限公司

9.5.1 企业简介

9.5.2 经营状况

9.5.3 融资租赁业务

9.6 海通恒信国际租赁股份有限公司

9.6.1 企业简介

9.6.2 经营状况

9.6.3 融资租赁业务

9.7 其他

9.7.1 中金国际融资租赁(天津)有限公司

9.7.2 芯鑫融资租赁有限责任公司

9.7.3 中交建融租赁有限公司

9.7.4 中民国际融资租赁股份有限公司

第十章 总结与预测

10.1 市场

10.2 企业

1. Overview of Financial Leasing Industry

1.1 Definition and Characteristics

1.2 Business Forms

1.3 Industry Chain

2. Global Financial Leasing Development

2.1 Overview

2.2 Major Countries

2.2.1 USA

2.2.2 Japan

2.2.3 Germany

3. Environments for Financial Leasing Development in China

3.1 Policy

3.2 Economy

3.2.1 GDP Growth Rate

3.2.2 Fixed Asset Investments

3.2.3 Capital Supply

4. Financial Leasing Development in China

4.1 Development History

4.2 Industrial Scale

4.2.1 Types and Number of Enterprises

4.2.2 Business Volume

4.2.3 Registered Capital

4.3 Competitive Landscape

4.3.1 by Region

4.3.2 by Enterprise

4.3.3 by Application

4.3.4 by Business Form

4.4 Financing Channels

4.4.1 Overview

4.4.2 Financial Leasing ABS

4.5 Profit Model

4.6 Development Trend

5. Development of Financial Leasing in Key Industries in China

5.1 Aviation Industry

5.1.1 Industrial Development

5.1.2 Status Quo of Financial Leasing

5.1.3 Major Aircraft Leasing Companies

5.1.4 Financial Leasing of Major Airlines

5.2 Shipping Industry

5.2.1 Industrial Development

5.2.2 Ship Leasing Modes

5.2.3 Status Quo of Financial Leasing

5.2.4 Major Ship Leasing Companies

5.3 Automobile Industry

5.3.1 Industrial Development

5.3.2 Status Quo of Financial Leasing

5.3.3 Automobile Financial Leasing Market Segments

5.3.4 Major Automobile Leasing Companies

5.4 Railway Transportation Equipment

5.4.1 Industrial Development

5.4.2 Status Quo of Financial Leasing

5.5 Construction Machinery

5.5.1 Industrial Development

5.5.2 Status Quo of Financial Leasing

5.5.3 Major Leasing Companies

5.6 Medical Equipment

5.6.1 Industrial Development

5.6.2 Status Quo of Financial Leasing

5.6.3 Major Leasing Companies

5.7 Printing Equipment

5.7.1 Industrial Development

5.7.2 Status Quo of Financial Leasing

5.8 Others

5.8.1 Agricultural Machinery

5.8.2 Electric Power

6. Development of Financial Leasing in Major Regions of China

6.1 Tianjin

6.2 Guangdong

6.3 Beijing

6.4 Shanghai

7. Key Banking Leasing Enterprises in China

7.1 ICBC Leasing Co. Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Financial Leasing Services

7.1.4 Financing Channels

7.1.5 Development Strategy

7.2 China Development Bank Financial Leasing Co. Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Financial Leasing Services

7.2.4 Financing Channels

7.3 Bank of Communications Financial Leasing Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Financial Leasing Services

7.3.4 Financing Channels

7.4 Kunlun Financial Leasing Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Financial Leasing Services

7.4.4 Development Strategy

7.5 Minsheng Financial Leasing Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Financial Leasing Services

7.5.4 Financing Channels

7.5.5 Development Strategy

7.6 Industrial Bank Financial Leasing Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Financial Leasing Services

7.6.4 Financing Channels

7.6.5 Development Strategy

7.7 CCB Financial Leasing Co. Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Financial Leasing Services

7.7.4 Financing Channels

7.8 CMB Financial Leasing Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 Financial Leasing Services

7.8.4 Financing Channels

7.9 China Huarong Financial Leasing Co., Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 Financial Leasing Services

7.9.4 Financing Channels

7.10 Taiping & Sinopec Financial Leasing Co., Ltd.

7.10.1 Profile

7.10.2 Operation

7.10.3 Financial Leasing Services

7.10.4 Financing Channels

8. Key Domestic-funded Financial Leasing Enterprises in China

8.1 Tianjin Bohai Leasing Co., Ltd.

8.1.1 Profile

8.1.2 Operation

8.1.3 Financial Leasing Services

8.1.4 Financing Channels

8.1.5 Subsidiary - Wanjiang Financial Leasing Co., Ltd.

8.1.6 Subsidiary - Hengqin International Leasing Co., Ltd.

8.2 Changjiang Leasing Co., Ltd.

8.2.1 Profile

8.2.2 Operation

8.2.3 Financial Leasing Services

8.3 Pu Hang Leasing Co., Ltd.

8.3.1 Profile

8.3.2 Operation

8.3.3 Financial Leasing Services

8.4 Guotai Leasing Limited Company

8.4.1 Profile

8.4.2 Operation

8.4.3 Financial Leasing Services

8.4.4 Financing Channels

8.5 ALL Trust Leasing Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Financial Leasing Services

8.6 AVIC International Leasing Co., Ltd

8.6.1 Profile

8.6.2 Operation

8.6.3 Financial Leasing Services

8.6.4 Financing Channels

8.6.5 Development Strategy

8.7 Fenghui Leasing Co., Ltd.

8.7.1 Profile

8.7.2 Operation

8.7.3 Financial Leasing Services

8.7.4 Financing Channels

8.8 JIC Leasing Co., Ltd.

8.8.1 Profile

8.8.2 Operation

8.8.3 Financial Leasing Services

8.8.4 Financing Channels

9. Key Foreign-funded Financial Leasing Companies in China

9.1 International Far Eastern Leasing Co., Ltd.

9.1.1 Profile

9.1.2 Operation

9.1.3Financial Leasing Services

9.1.4 Financing Channels

9.2 Ping An International Financial Leasing Co., Ltd.

9.2.1 Profile

9.2.2 Operation

9.2.3 Financial Leasing Services

9.2.4 Financing Channels

9.3 Shandong Chenming Financial Leasing Co., Ltd.

9.3.1 Profile

9.3.2 Operation

9.3.3 Financial Leasing Services

9.4 Zhongyin Financial Leasing Co., Ltd.

9.4.1 Profile

9.4.2 Operation

9.4.3 Financial Leasing Services

9.5 China Universal Leasing Co., Ltd.

9.5.1 Profile

9.5.2 Operation

9.5.3 Financial Leasing Services

9.6 Haitong UniTrust International Leasing Corporation

9.6.1 Profile

9.6.2 Operation

9.6.3 Financial Leasing Services

9.7 Others

9.7.1 Zhongjin International Financial Leasing (Tianjin) Co., Ltd.

9.7.2 Xinxin Financial Leasing Co., Ltd.

9.7.3 CCCC Financial Leasing Co., Ltd.

9.7.4 CMIG International Financial Leasing Co., Ltd.

10. Summary and Forecast

10.1 Market

10.2 Enterprises

表:融资租赁业务主要特征

表:融资租赁与经营租赁的区别

表:融资租赁业务主要形式

图:直接租赁和售后回租对比

图:融资租赁产业链

图:1995-2015年全球融资租赁交易额

图:1995-2015年全球(分地区)融资租赁交易额

图:2015年全球(分地区)融资租赁交易额构成

表:2015年全球(分国家/地区)融资租赁交易额及渗透率

图:1988-215年美国融资租赁交易额在全球占比

图:美国融资租赁企业结构

图:2000-2016年日本融资租赁交易额

图:2016年日本租赁业务结构(分应用领域)

表:2014-2017年中国融资租赁行业相关政策

表:2015-2017年中国主要省市融资租赁相关政策

图:2001-2021年中国GDP年度增速

图:2011-2021年中国固定资产投资额

图:2010-2017年中国货币供应量

图:2007-2017年中国融资租赁企业数量和业务总量

表:2007-2017年中国融资租赁渗透率

表:三类融资租赁公司对比

表:2007-2017年中国融资租赁企业数量(分类型)

表:2007-2017年中国融资租赁业务总量(分企业类型)

表:2007-2017年中国融资租赁企业注册资金(分企业类型)

表:2017年6月底中国金融租赁公司(分地区)分布

表:2016年底中国外资融资租赁公司(分地区)分布

表:2016年底中国内资试点融资租赁公司(分地区)分布

表:2016年底中国融资租赁企业TOP10

表:2016年底中国金融租赁公司TOP10

表:2016年底中国外资金融租赁公司TOP10

表:2016年底中国内资试点金融租赁公司TOP10

图:2016年中国融资租赁资产(分行业)分布

图:2015年中国融资租赁资产(分行业)分布

图:2014年中国融资租赁资产(分行业)分布

表:2014-2016年中国融资租赁业务结构

表:不同融资租赁渠道比较

图:2006-2016年中国融资租赁ABS发行数量及金额

图:2016年三类融资租赁公司发行ABS数量、金额分布

表:2016年融资租赁ABS发行金额排名前十的发行机构

表:2006-2016年全球航空运输业主要生产

表:2011-2017年中国航空运输业主要生产指标

图:2006-2017年中国民航额运输飞机数量

图:2016中国国内民航运输机队TOP10

表:主要国家飞机融资租赁模式

图:1970-2015年全球租赁飞机占比

表:2017年6月底中国C919飞机订单分布

图:2015年全球前十大飞机租赁公司

表:2016-2017年底中银航空机队规模

图:2016年中银航空营业收入构成

表:2016年渤海金控营业收入构成

表:2012-2016年中国飞机租赁公司机队规模

表:2016年中国飞机租赁公司营业收入构成

表:2013-2016年国银租赁营业收入构成

表:2015-2016年国银租赁融资租赁收入(分业务)构成

表:2015-2016年国银租赁经营租赁收入(分业务)构成

表:2016年底中国国航机队规模

表:2016年底东方航空机队规模

表:2016年底南方航空机队规模

表:2016年底海航航空机队规模

表:2016年底春秋航空机队规模

表:2011-2017年中国造船工业主要生产指标

表:中国几种船舶租赁融资方式优劣势对比

表:2014 & 2016年中国船舶融资租赁市场份额

表:2010-2021年中国汽车产量

图:2007-2021年中国汽车保有量

表:汽车金融贷款与融资租赁比较

图:2016年全球主要国家汽车融资租赁渗透率

图:2011-2017年中国二手车交易量及同比增长率

表:中国汽车融资租赁公司分类

表:中国主要汽车融资租赁公司

表:铁路运输设备分类

表:2011-2021年中国铁路固定资产投资额

表:2013-2021年中国铁路机车车辆投资额

图:2013-2021年中国工程机械行业主营业务收入及同比增长

表:2016年中国工程机械企业(按营业收入)TOP15

图:2010-2021年中国工程机械融资租赁业务额

表:中国主要工程机械融资租赁公司

图:2009-2021年中国医疗器械市场规模

图:2007-2021年中国医疗设备融资租赁额及租赁渗透率

表:中国主要医疗设备融资租赁公司

图:2014-2021年中国印刷行业固定资产投资

图:2015年中国印刷设备制造业主要经济指标

表:2011-2017年中国农业机械主要经济指标

表:中国主要农机融资租赁公司

表:2011-2017年中国电力投资额

表:2013-2016年中国(分能源)发电装机容量

表:2016年天津市融资租赁企业数量及同比增长

表:2016年天津市融资租赁企业注册资金及同比增长

表:2016年天津市融资租赁业务总量及同比增长

表:2016年底天津市融资租赁企业TOP10

表:广东三大片区融资租赁业务规划

表:2016年底广东融资租赁企业TOP10

表:2016年底北京市融资租赁企业TOP10

表:2016年底上海市融资租赁企业TOP10

表:2010-2016年工银租赁主要运营指标

表:2013-2016年国银租赁主要经济指标

表:2016年国银租赁主要业务板块总资产及营业收入

图:2013-2016年国银租赁融资租赁业务额及占比

表:2015-2016年国银租赁(分业务)营业额及占比

表:2014-2016年交银租赁主要运营指标

图:2011-2016年交银租赁租赁资产余额

表:2014-2016年交银租赁融资租赁业务(分行业)构成

表:2014-2017年昆仑金融租赁主要经济指标

表:2014-2016年昆仑金融租赁(分业务)租赁资产余额

表:2014-2016年昆仑金融租赁融资租赁资产TOP5行业分布

表:2014-2016年昆仑金融租赁融资租赁业务客户集中度

表:2017年民生租赁股权结构

表:2014-2017年民生租赁主要经济指标

表:2014-2016年民生租赁融资租赁资产TOP5行业分布

表:2014-2016年民生融租赁融资租赁业务客户集中度

表:2014-2016年兴业租赁主要经济指标

表:2014-2016年兴业租赁租赁项目投放情况

表:2014-2016年兴业租赁融资租赁业务(分行业)

表:2014-2016年建信租赁主要经济指标

表:2016年底建信租赁(分行业)租赁资产构成

表:2014-2016年招银租赁主要经济指标

表:2016年招银租赁(分业务)租赁资产总额

表:2014-2016年招银租赁应收融资租赁款余额(分行业)结构

表:2016年华融金融租赁主要经济指标

表:2015-2016年华融金融租赁应收融资租赁款

表:2015-2016年华融金融租赁(分行业)应收融资租赁款

表:2015-2016年华融金融租赁(分地区)应收融资租赁款

表:2014-2016年天津渤海租赁主要经济指标

表:渤海租赁主要子公司

截至2017年3月底天津渤海本部主要存续项目情况

截至2017年3月底天津渤海租赁本部租赁项目分布情况

表:2015-2017年天津渤海融资渠道构成

表:2015-2017年皖江金租(分行业)融资租赁项目合同余额

表:2015-2017年皖江金租(分地区)融资租赁项目合同余额

表:2015-2016年横琴租赁项目签约情况

表:2014-2016年长江租赁主要经济指标

表:浦航租赁主要经济指标

表:2014-2017年国泰租赁主要经济指标

表:2014-2017年国泰租赁营业收入构成

表:2014-2017年国泰租赁租赁业务收入构成

表:2014-2017年国泰租赁(分行业)应收融资租赁款

表:2015-2016年汇通信诚租赁主要经济指标

表:2017年6月底中航租赁股东结构

表:2014-2017年中航租赁主要经济指标

表:2014-2017年中航租赁(分租赁模式)租赁资产构成

表:2014-2017年中航租赁(分行业)租赁资产构成

表:2017年3月末中航租赁主要融资来源构成

表:2015-2016年丰汇租赁主要经济指标

表:2015-2016年丰汇租赁(分业务)营业收入

表:2015-2016年丰汇租赁(分业务)成本及毛利率

表:2015-2016年丰汇租赁融资租赁业务额

表:2015-2016年丰汇租赁融资租赁存续资产(分行业)构成

截至2016年末丰汇租赁资金来源

表:2014-2017年中建投租赁主要经济指标

表:2014-2017年中建投租赁融资租赁资金投放情况

表:2014-2017年中建投租赁融资租赁资产余额情况

表:2014-2017年中建投租赁(分租赁模式)租赁业务开展情况

表:2014-2017年中建投租赁(分地区)应收融资租赁款

表:2014-2017年远东国际租赁主要经济指标

表:2014-2017年远东国际租赁主营业务收入构成

表:2014-2017年远东国际租赁主营业务成本构成

表:2014-2017年远东国际租赁融资租赁业务情况

表:2014-2017年远东国际租赁应收融资租赁款(分行业)构成

表:2016年远东国际租赁融资来源构成

表:2014-2017年平安租赁主要经济指标

表:2014-2016年平安租赁租赁业务资产余额(分行业)构成

表:2014-2016年平安租赁租赁业务资产余额(分地区)构成

表:2016-2017年晨鸣租赁主要经济指标

表:2015-2016年中垠融资租赁主要经济指标

表:2014-2017年环球租赁主要经济指标

表:2014-2016年环球租赁(分业务)营业收入构成

表:2014-2016年环球租赁(分行业)应收融资租赁款净额

表:2014-2016年环球租赁(分地区)新签租赁合同金额分布

表:2014-2016年海通恒信主要经济指标

表:2014-2016年海通恒信(分业务)营业收入及占比

表:2014-2016年海通恒信(分租赁模式)应收融资租赁总额构成

表:2014-2016年海通恒信(分租赁模式)租赁业务投放金额构成

表:2016年海通恒信租赁资产余额(分行业)构成

图:2016-2021年中国融资租赁业务总量及市场渗透率

表:2016年中国主要地区融资租赁企业数量

表:2016年中国主要金融租赁公司经济指标对比

Main Features of Financial Leasing Services

Difference between Financial Leasing and Operating Leasing

Main Forms of Financial Leasing Services

Contrast between Direct Leasing and Sale-leaseback

Financial Leasing Industry Chain

Global Financial Leasing Turnover, 1995-2015

Global Financial Leasing Turnover (by Region), 1995-2015

Global Financial Leasing Turnover Structure (by Region), 2015

Global Financial Leasing Turnover and Penetration Rate (by Country / Region), 2015

Share of USA in Global Financial Leasing Turnover, 1988-2015

Structure of Financial Leasing Enterprises in the United States

Financial Leasing Turnover in Japan, 2000-2016

Leasing Business Structure (by Application) in Japan, 2016

Policies on China’s Financial Leasing Industry, 2014-2017

Policies about Financial Leasing in Major Provinces and Municipalities of China, 2015-2017

Growth Rate of China’s GDP, 2001-2021E

China’s Fixed Asset Investments, 2011-2021E

China’s Currency Supply, 2010-2017

Number and Business Volume of Financial Leasing Enterprises in China, 2007-2017

Financial Leasing Penetration Rate in China, 2007-2017

Comparison between Three Types of Financial Leasing Companies

Number of Financial Leasing Enterprises in China (by Type), 2007-2017

Business Volume of China’s Financial Leasing Services (by Corporate Type), 2007-2017

Registered Capital of Financial Leasing Enterprises in China (by Corporate Type), 2007-2017

Distribution of Banking Leasing Companies in China (by Region), end of Jun 2017

Distribution of Foreign-funded Financial Leasing Companies in China (by Region), end of 2016

Distribution of Domestic-funded Pilot Financial Leasing Companies in China (by Region), end of 2016

Top 10 Financial Leasing Enterprises in China, end of 2016

Top 10 Banking Leasing Companies in China, end of 2016

Top 10 Foreign-funded Banking Leasing Companies in China, end of 2016

Top 10 Domestic-funded Pilot Banking Leasing Companies in China, end of 2016

China’s Financial Leasing Assets (by Sector), 2016

China’s Financial Leasing Assets (by Sector), 2015

China’s Financial Leasing Assets (by Sector), 2014

China’s Financial Leasing Business Structure, 2014-2016

Comparison between Different Financial Leasing Channels

Number and Amount of Financial Leasing ABS Issued in China, 2006-2016

Distribution of ABS Issued by Three Types of Financial Leasing Companies by Number and Amount, 2016

Top10 Financial Leasing ABS Issuers by Amount, 2016

Main Production Indexes of Global Air Transport Industry, 2006-2016

Main Production Indexes of Air Transport Industry in China, 2011-2017

Number of Civilian Transport Aircrafts in China, 2006-2017

Top10 Civilian Transport Aircraft Fleets in China, 2016

Aircraft Financial Leasing Models in Major Countries

Proportion of Leased Aircrafts Worldwide, 1970-2015

Distribution of Orders for China’s C919 at the End of Jun 2017

Top10 Aircraft Leasing Companies Worldwide, 2015

BOC Aviation’s Fleet, 2016-2017

Revenue Structure of BOC Aviation, 2016

Revenue Structure of Bohai Capital Holding, 2016

Fleets of Aircraft Leasing Companies in China, 2012-2016

Revenue Structure of Aircraft Leasing Companies in China, 2016

Revenue Structure of China Development Bank Financial Leasing, 2013-2016

Financial Lease Revenue Structure of China Development Bank Financial Leasing by Business, 2015-2016

Operating Lease Revenue Structure of China Development Bank Financial Leasing by Business, 2015-2016

Fleet of Air China at the End of 2016

Fleet of China Eastern Airlines at the End of 2016

Fleet of China Southern Airlines at the End of 2016

Fleet of Hainan Airlines at the End of 2016

Fleet of Spring Airlines at the End of 2016

Main Production Indexes of Shipbuilding Industry in China, 2011-2017

Advantages and Disadvantages of Several Ship Lease Financing Forms in China

China’s Ship Financial Leasing Market Share, 2014 & 2016

China’s Automobile Output, 2010-2021E

China’s Automobile Ownership, 2007-2021E

Comparison between Financial Loan and Financial Leasing of Automobiles

Penetration Rate of Automobile Financial Leasing in Main Countries, 2016

China’s Used Car Trading Volume and YoY Growth Rate, 2011-2017

Classification of Automobile Financial Leasing Companies in China

Major Automobile Financial Leasing Companies in China

Classification of Railway Transport Equipment

China’s Fixed Asset Investments in Railways, 2011-2021E

China’s Investments into Railway Locomotives & Vehicles, 2013-2021E

Operating Revenue and YoY Growth of Construction Machinery Industry in China, 2013-2021E

Top15 Construction Machinery Enterprises in China by Revenue, 2016

Construction Machinery Financial Leasing Turnover in China, 2010-2021E

Major Construction Machinery Financial Leasing Companies in China

Chinese Medical Equipment Market Size, 2009-2021E

Financial Leasing Value of Medical Equipment and Penetration Rate in China, 2007-2021E

Major Medical Equipment Financial Leasing Companies in China

Fixed Asset Investments in Printing Industry in China, 2014-2021E

Main Economic Indicators of Printing Equipment Manufacturing in China, 2015

Main Economic Indicators of Agricultural Machinery Industry in China, 2011-2017

Major Agricultural Machinery Financial Leasing Companies in China

Investments in Electric Power in China, 2011-2017

Installed Power-generation Capacity in China by Energy, 2013-2016

Number of Financial Leasing Enterprises and YoY Growth in Tianjin, 2016

Registered Capital of Financial Leasing Enterprises and YoY Growth in Tianjin, 2016

Business Volume of Financial Leasing and YoY Growth in Tianjin, 2016

Top 10 Financial Leasing Enterprises in Tianjin, end of 2016

Planning of Guangdong’s Three Major Districts for Financial Leasing Services

Top 10 Financial Leasing Enterprises in Guangdong, end of 2016

Top 10 Financial Leasing Enterprises in Beijing, end of 2016

Top 10 Financial Leasing Enterprises in Shanghai, end of 2016

Main Operational Indicators of ICBC Leasing, 2010-2016

Main Economic Indicators of China Development Bank Financial Leasing, 2013-2016

Total Assets and Revenue of China Development Bank Financial Leasing’s Main Business Segments, 2016

Financial Leasing Value and Proportion of China Development Bank Financial Leasing, 2013-2016

Turnover and Proportion of China Development Bank Financial Leasing (by Business), 2015-2016

Main Operational Indicators of Bank of Communications Financial Leasing, 2014-2016

Balance of Leasing Assets of Bank of Communications Financial Leasing, 2011-2016

Financial Leasing Business Structure of Bank of Communications Financial Leasing (by Industry), 2014-2016

Main Economic Indicators of Kunlun Financial Leasing, 2014-2017

Balance of Leasing Assets of Kunlun Financial Leasing (by Business), 2014-2016

Top 5 Industries of Kunlun Financial Leasing by Financial Leasing Assets, 2014-2016

Customer Concentration of Kunlun Financial Leasing’s Financial Leasing Services, 2014-2016

Equity Structure of Minsheng Financial Leasing, 2017

Main Economic Indicators of Minsheng Financial Leasing, 2014-2017

Top 5 Industries with Financial Leasing Assets of Minsheng Financial Leasing, 2014-2016

Customer Concentration of Minsheng Financial Leasing’s Financial Leasing Services, 2014-2016

Main Economic Indicators of Industrial Bank Financial Leasing, 2014-2016

Leasing Projects of Industrial Bank Financial Leasing, 2014-2016

Financial Leasing Services of Industrial Bank Financial Leasing (by Sector), 2014-2016

Main Economic Indicators of CCB Financial Leasing, 2014-2016

Structure of CCB Financial Leasing’s Leasing Assets (by Sector), end of 2016

Main Economic Indicators of CMB Financial Leasing, 2014-2016

Total Leasing Assets of CMB Financial Leasing (by Business), 2016

Structure of CMB Financial Leasing’s Receivables from Financial Leasing (by Sector), 2014-2016

Main Economic Indicators of China Huarong Financial Leasing, 2016

Receivables of China Huarong Financial Leasing from Financial Leasing, 2015-2016

Receivables of China Huarong Financial Leasing from Financial Leasing (by Sector), 2015-2016

Receivables of China Huarong Financial Leasing from Financial Leasing (by Region), 2015-2016

Main Economic Indicators of Tianjin Bohai Leasing, 2014-2016

Major Subsidiaries of Bohai Leasing

Main Existing Projects of Tianjin Bohai Leasing’s Headquarters, as of the end of Mar 2017

Distribution of Leasing Projects of Tianjin Bohai Leasing’s Headquarters, as of the end of Mar 2017

Financing Channels Structure of Tianjin Bohai Leasing, 2015-2017

Financial Leasing Project Contract Balance of Wanjiang Financial Leasing (by Sector), 2015-2017

Financial Leasing Project Contract Balance of Wanjiang Financial Leasing (by Region), 2015-2017

Project Contracts of Hengqin International Leasing, 2015-2016

Main Economic Indicators of Changjiang Leasing, 2014-2016

Main Economic Indicators of Pu Hang Leasing

Main Economic Indicators of Guotai Leasing, 2014-2017

Revenue Structure of Guotai Leasing, 2014-2017

Leasing Revenue Structure of Guotai Leasing, 2014-2017

Receivables of Guotai Leasing from Financial Leasing (by Sector), 2014-2017

Main Economic Indicators of ALL Trust Leasing, 2015-2016

Shareholder Structure of AVIC International Leasing, end of Jun 2017

Main Economic Indicators of AVIC International Leasing, 2014-2017

Structure of AVIC International Leasing’s Leasing Assets (by Leasing Mode), 2014-2017

Structure of AVIC International Leasing’s Leasing Assets (by Sector), 2014-2017

Structure of AVIC International Leasing’s Main Financing Sources, end of Mar 2017

Main Economic Indicators of Fenghui Leasing, 2015-2016

Revenue of Fenghui Leasing (by Business), 2015-2016

Cost and Gross Margin of Fenghui Leasing (by Business), 2015-2016

Financial Leasing Value of Fenghui Leasing, 2015-2016

Structure of Fenghui Leasing’s Existing Assets for Financial Leasing (by Sector), 2015-2016

Sources of Fenghui Leasing’s Funds, as of the end of 2016

Main Economic Indicators of JIC Leasing, 2014-2017

Financial Leasing Capital Disbursement of JIC Leasing, 2014-2017

Financial Leasing Asset Balance of JIC Leasing, 2014-2017

Operation of Leasing Business of JIC Leasing by Leasing Model, 2014-2017

Financial Leasing Receivable of JIC Leasing by Region, 2014-2017

Main Economic Indicators of International Far Eastern Leasing, 2014-2017

Operating Revenue Structure of International Far Eastern Leasing, 2014-2017

Operational Cost Structure of International Far Eastern Leasing, 2014-2017

Financial Leasing Services of International Far Eastern Leasing, 2014-2017

Financial Leasing Receivable Structure of International Far Eastern Leasing by Industry, 2014-2017

Financing Source Structure of International Far Eastern Leasing, 2016

Main Economic Indicators of Ping An International Financial Leasing, 2014-2017

Leasing Business Asset Balance Structure of Ping An International Financial Leasing by Sector, 2014-2016

Leasing Business Asset Balance Structure of Ping An International Financial Leasing by Region, 2014-2016

Main Economic Indicators of Shandong Chenming Financial Leasing, 2016-2017

Main Economic Indicators of Zhongyin Financial Leasing, 2015-2016

Main Economic Indicators of China Universal Leasing, 2014-2017

Revenue Structure of China Universal Leasing by Business, 2014-2016

Net Financial Leasing Receivable of China Universal Leasing by Industry, 2014-2016

Distribution of New Leasing Contracts of China Universal Leasing by Region, 2014-2016

Main Economic Indicators of Haitong UniTrust International Leasing, 2014-2016

Revenue Structure of Haitong UniTrust International Leasing by Business, 2014-2016

Total Net Financial Leasing Receivable Structure of Haitong UniTrust International Leasing by Leasing Model, 2014-2016

Disbursement Structure of Haitong UniTrust International Leasing’s Leasing Business by Leasing Model, 2014-2016

Leasing Asset Balance Structure of Haitong UniTrust International Leasing by Industry, 2016

Financial Leasing Services and Market Penetration Rate in China, 2016-2021E

Number of Financial Leasing Enterprises in Major Regions of China, 2016

Comparison of Economic Indicators of Major Financial Leasing Companies in China, 2016

Comparison of Economic Indicators of Major Domestically-funded Leasing Companies in China, 2016

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|