|

|

|

报告导航:研究报告—

生命科学—制药医疗

|

|

2017-2021年中国真空采血设备行业研究报告 |

|

字数:2.1万 |

页数:98 |

图表数:107 |

|

中文电子版:10000元 |

中文纸版:5000元 |

中文(电子+纸)版:10500元 |

|

英文电子版:2400美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2700美元 |

|

编号:ZLC-057

|

发布日期:2017-09 |

附件:下载 |

|

|

|

中国真空采血设备行业经过初创期、成长期后,目前已进去快速发展期。随着中国经济环境稳步发展,人均可支配收入上升,人民对健康更为重视,卫生费用逐步提高,用于检验的收入也相应增长,对真空采血管的需求量也随之加大。2009-2016年,中国真空采血管消费量年均增速超过10%,2016年消费量达59.73亿支。

截至2017年9月20日,中国共有真空采血管生产企业115家,其中领先的企业包括阳普医疗、三力集团、拱东医疗、瑞琦医疗、康健医疗、威高股份、力因等。此外,行业广阔的发展前景也吸引了BD、积水医疗、Greiner等国外企业的布局。

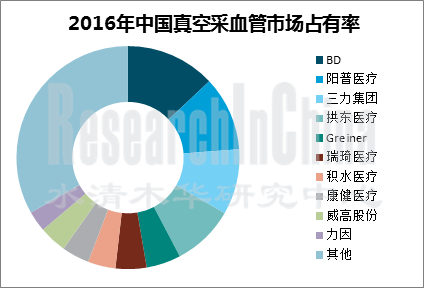

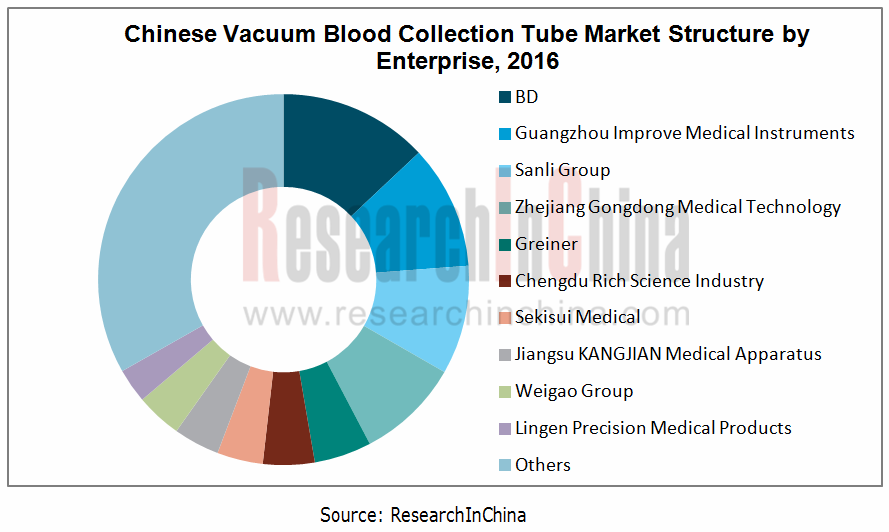

目前,中国真空采血市场主要由本土企业占据,不过由于技术相对落后等原因,只能占据中低端市场,高端市场仍由国外企业占据。2016年,中国真空采血管市场主要由BD、阳普医疗、三力集团、拱东医疗占据,合计市场份额达42.3%。

未来几年,中国真空采血市场将表现出以下三个特点:

一、真空采血管消费需求稳步增长

近几年来,国务院等相关部门先后颁布相关产业政策大力扶持医疗器械产业。作为医疗器械行业的分支,真空采血设备行业也将获益。未来5年,在下游需求以及利好政策的推动下,中国真空采血管需求量仍将保持较高增速,预计到2021年需求量有望达到106.77亿支。

二、真空采血设备行业市场集中度提高

目前,中国真空采血管企业达115家,产能严重过剩。此外受发展前景影响还吸引了千山药机、鱼跃医疗在内的上市公司布局,行业竞争加剧。但是,随着国家监管越来越严格,未来小型企业的生存空间将被压缩,生产企业数量将逐步减少,行业市场集中度将提高。

三、外资企业市场份额下降

近年来,一些本土企业一直保持稳定的研发支出,力求在技术上拉近与国外企业的差距。目前,阳普医疗、力因精准、威高股份等企业已在核酸检测的血浆准备管等高端采血管的制造上打破了垄断。同时,以BD为代表的外资企业产品因质量问题频频召回,对其在国内的发展产生了不利影响。在此情形下,外资企业的市场份额将逐步下滑。

《2017-2021年中国真空采血设备行业研究报告》主要包括以下内容:

全球真空采血设备行业发展概况,包括发展历程、发展现状等; 全球真空采血设备行业发展概况,包括发展历程、发展现状等;

中国真空采血设备行业发展分析,包括发展环境、发展现状、相关政策、竞争格局、进出口以及发展趋势分析; 中国真空采血设备行业发展分析,包括发展环境、发展现状、相关政策、竞争格局、进出口以及发展趋势分析;

国内13家、国外4家真空采血相关企业分析,包括经营情况、营收构成、真空采血业务分析等。 国内13家、国外4家真空采血相关企业分析,包括经营情况、营收构成、真空采血业务分析等。

China’s vacuum blood collection device industry now flourishes after start-up and growth stages. Along with steady improvement in economic environment, rising per-capita disposable income, greater awareness of health and larger health expenditure, the spending on examination also increases, so does the demand for vacuum blood collection tubes. The country’s consumption of vacuum blood collection tubes has shown an AAGR of over 10% between 2009 and 2016, reaching 5.973 billion pieces in 2016.

There have been 115 vacuum blood collection tube producers in China by Sept 20, 2017, led by Guangzhou Improve Medical Instruments, Sanli Group, Zhejiang Gongdong Medical Technology, Chengdu Rich Science Industry, Jiangsu KANGJIAN Medical Apparatus, Weigao Group and Lingen Precision Medical Products. In addition, the vast development potential has attracted foreign enterprises like BD, Sekisui Medical, and Greiner into China.

Local Chinese enterprises occupy primarily the mid and low-end vacuum blood collection market due to relatively outdated technologies, while foreign players still seize the high-end market. In 2016, the Chinese vacuum blood collection tube market was dominated by BD, Guangzhou Improve Medical Instruments, Sanli Group and Zhejiang Gongdong Medical Technology, holding a combined 42.3% market share.

In the coming years, the Chinese vacuum blood collection market will be characterized as follows:

1. Demand for vacuum blood collection tubes will grow steadily.

Authorities including the State Council have introduced policies to provide strong support for medical equipment industry in recent years. As a branch of the medical equipment industry, vacuum blood collection equipment will also benefit. Driven by downstream demand and favorable policies, the country’s demand for vacuum blood collection tubes is expected to maintain a higher growth rate over the next five years, hitting 10.677 billion pieces in 2021.

2. Vacuum blood collection device industry will become more highly concentrated.

Up to 115 vacuum blood collection tube manufacturers have caused severe overcapacity. Moreover, engagement of listed companies like Hunan China Sun and Jiangsu Yuyue Medical Equipment & Supply has intensified competition across the sector. However, as the country strengthens its supervision over the industry, the space for small companies will be squeezed, resulting in a gradual decrease in number of manufacturers and a higher market concentration.

3. Market share of foreign companies will decline.

Some local companies have maintained stable spending on R&D in recent years, seeking to narrow the gap with foreign peers. Guangzhou Improve Medical Instruments, Lingen Precision Medical Products and Weigao Group have broken monopoly of foreign players in manufacturing of high-end blood collection tubes like plasma preparation tube for nucleic acid test. Meanwhile, foreign companies represented by BD have frequently recalled their products due to quality problems, producing an adverse effect on their development in China. Under such circumstance, foreign players will suffer a gradual decline in market share.

China Vacuum Blood Collection Device Industry Report, 2017-2021 focuses on the followings:

Overview of global vacuum blood collection device industry (development course and status quo, etc.); Overview of global vacuum blood collection device industry (development course and status quo, etc.);

Vacuum blood collection equipment industry in China (development environment, status quo, relevant policies, competitive landscape, import & export, development trends, etc.); Vacuum blood collection equipment industry in China (development environment, status quo, relevant policies, competitive landscape, import & export, development trends, etc.);

13 domestic and 4 foreign vacuum blood collection-related enterprises (operation, revenue structure, vacuum blood collection business, etc.) 13 domestic and 4 foreign vacuum blood collection-related enterprises (operation, revenue structure, vacuum blood collection business, etc.)

第一章 概述

1.1 定义

1.2 分类

第二章 全球真空采血设备行业概况

2.1发展历程

2.2 发展现状

第三章 中国真空采血设备行业发展分析

3.1 发展环境

3.1.1 经济环境

3.1.2 人均可支配收入

3.1.3 医疗机构数量

3.1.4 诊疗人数

3.1.5 卫生费用

3.1.6 老龄化

3.1.7 检验科收入

3.2 发展现状

3.3 相关政策

3.4 进入壁垒

3.5 竞争格局

3.6 进出口分析

3.6.1 进口分析

3.6.2 出口分析

3.7 发展趋势

3.7.1 国家产业政策大力扶持

3.7.2 医疗行业需求持续增长,消费市场前景广阔

3.7.3 市场集中度提高

3.7.4 行业技术水平稳步提升

3.7.5 外资企业市场份额逐步减少

第四章 国内主要企业

4.1 阳普医疗

4.1.1 公司简介

4.1.2 经营情况

4.1.3 营收构成

4.1.4 毛利率

4.1.5 研发与投资

4.1.6 真空采血业务

4.1.7 发展预测

4.2 瑞琦科技

4.2.1 公司简介

4.2.2 经营情况

4.2.3 营收构成

4.2.4 毛利率

4.2.5 研发与投资

4.2.6 真空采血业务

4.2.7 发展预测

4.3 千山药机

4.3.1 公司简介

4.3.2 经营情况

4.3.3 营收构成

4.3.4 毛利率

4.3.5 真空采血业务

4.4 威高股份

4.4.1 公司简介

4.4.2 经营情况

4.4.3 营收构成

4.4.4 毛利率

4.4.5 真空采血业务

4.5 力因精准医疗产品(上海)有限公司

4.5.1 公司简介

4.5.2 真空采血业务

4.5.3 发展动态

4.6 浏阳市三力医用科技发展有限公司

4.6.1 公司简介

4.6.2 真空采血业务

4.7积水医疗科技(中国)有限公司

4.7.1 公司简介

4.7.2 真空采血业务

4.7.3 发展动态

4.8上海康德莱企业发展集团股份有限公司

4.8.1 公司简介

4.8.2 经营情况

4.8.3 营收构成

4.8.4 毛利率

4.8.5 真空采血业务

4.9 威海鸿宇医疗器械有限公司

4.9.1 公司简介

4.9.2 真空采血业务

4.10 浙江拱东医用塑料厂

4.10.1 公司简介

4.10.2 真空采血业务

4.11 河北鑫乐医疗器械科技股份有限公司

4.11.1 公司简介

4.11.2 经营情况

4.11.3 营收构成

4.11.4 毛利率

4.11.5 研发与投资

4.11.6 真空采血业务

4.11.7 发展预测

4.12 山东耀华医疗器械股份有限公司

4.12.1 公司简介

4.12.2 经营情况

4.12.3 营收构成

4.12.4 毛利率

4.12.5 研发与投资

4.12.6 主要客户

4.12.7 真空采血业务

4.12.8 发展预测

4.13 江苏康健医疗用品有限公司

4.13.1 公司简介

4.13.2 真空采血业务

第五章 国外主要企业

5.1 碧迪BD (Becton, Dickinson and Company)

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 真空采血业务

5.1.6 在华发展

5.2 泰尔茂Terumo

5.2.1 公司简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 真空采血业务

5.2.5 在华发展

5.3 尼洛普Nipro

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 真空采血业务

5.3.5 在华发展

5.4 Greiner Bio One

5.4.1 公司简介

5.4.2 经营情况

5.4.3 真空采血业务

5.4.4 在华发展

1 Overview

1.1 Definition

1.2 Classification

2 Overview of Global Vacuum Blood Collection Device Industry

2.1 Development Course

2.2 Status Quo

3 Development of China Vacuum Blood Collection Device Industry

3.1 Development Environment

3.1.1 Economic Environment

3.1.2 Per Capita Disposable Income

3.1.3 Number of Medical Institutions

3.1.4 Clinic Visits

3.1.5 Health Expenditure

3.1.6 Aging

3.1.7 Revenue of Clinical Laboratories

3.2 Current Development

3.3 Policies

3.4 Entry Barriers

3.5 Competitive Landscape

3.6 Import & Export

3.6.1 Import

3.6.2 Export

3.7 Development trends

3.7.1 National Industrial Policy Provides Strong Support

3.7.2 The Demand in Medical Industry Keeps Growing and Consumption Market Has Broad Prospects

3.7.3 Market Concentration Improves

3.7.4 Technical Level of the Industry Rises Steadily

3.7.5 Foreign Companies See a Decreasing Market Share

4 Major Chinese Companies

4.1 Guangzhou Improve Medical Instruments Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Gross Margin

4.1.5 R&D and Investment

4.1.6 Vacuum Blood Collection Business

4.1.7 Growth Prediction

4.2 Chengdu Rich Science Industry Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Gross Margin

4.2.5 R&D and Investment

4.2.6 Vacuum Blood Collection Business

4.2.7 Growth Prediction

4.3 Hunan China Sun Pharmaceutical Machinery Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Gross Margin

4.3.5 Vacuum Blood Collection Business

4.4 Weigao Group

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Gross Margin

4.4.5 Vacuum Blood Collection Business

4.5 Lingen Precision Medical Products Co., Ltd.

4.5.1 Profile

4.5.2 Vacuum Blood Collection Business

4.5.3 Developments

4.6 Liuyang SANLI Medical Technology Development

4.6.1 Profile

4.6.2 Vacuum Blood Collection Business

4.7 Sekisui Medical Technology (China) Co., Ltd.

4.7.1 Profile

4.7.2 Vacuum Blood Collection Business

4.7.3 Developments

4.8 Shanghai Kindly Enterprise Development Group

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.4 Gross Margin

4.8.5 Vacuum Blood Collection Business

4.9 Weihai Hongyu Medical Devices

4.9.1 Profile

4.9.2 Vacuum Blood Collection Business

4.10 Zhejiang Gongdong Medical Technology Co., Ltd.

4.10.1 Profile

4.10.2 Vacuum Blood Collection Business

4.11 Hebei Xinle Sci & Tech Co., Ltd.

4.11.1 Profile

4.11.2 Operation

4.11.3 Revenue Structure

4.11.4 Gross Margin

4.11.5 R&D and Investment

4.11.6 Vacuum Blood Collection Business

4.11.7 Growth Prediction

4.12 Shandong Yaohua Medical Instrument Corporation

4.12.1 Profile

4.12.2 Operation

4.12.3 Revenue Structure

4.12.4 Gross Margin

4.12.5 R&D and Investment

4.12.6 Major Customers

4.12.7 Vacuum Blood Collection Business

4.12.8 Growth Prediction

4.13 Jiangsu KANGJIAN Medical Apparatus Co., Ltd.

4.13.1 Profile

4.13.2 Vacuum Blood Collection Business

5 Major Overseas Companies

5.1 BD (Becton, Dickinson and Company)

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Vacuum Blood Collection Business

5.1.6 Development in China

5.2 Terumo

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Vacuum Blood Collection Business

5.2.5 Development in China

5.3 Nipro

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Vacuum Blood Collection Business

5.3.5 Development in China

5.4 Greiner Bio One

5.4.1 Profile

5.4.2 Operation

5.4.3 Vacuum Blood Collection Business

5.4.4 Development in China

表:真空采血管的分类及应用范围

图:真空采血管分类(按头盖颜色)

图:历代真空采血系统的发展特征

表:历代真空采血系统性能对比

图:2008-2016年全球真空采血管消费量

图:2012-2017年中国国内生产总值

图:2011-2016年中国居民人均可支配收入及增长率

表:2015-2017年中国医疗卫生机构数量

图:2009-2017年中国医院数量

图:2009-2017年中国医院数量(按经济类型)

表:2015-2017年中国医疗机构诊疗人次

图:2009-2017年中国医院诊疗人次

图:2012-2017年中国医院诊疗人次(按经济类型)

图:2010-2016年中国卫生总费用

图:2016-2021E中国卫生总费用

图:2009-2021E中国60岁以上人口数量

图:2010-2016年中国公立医院检查收入及占比

图:2016-2021E中国公立医院检查收入及占比

图:2009-2016年中国真空采血管消费量及同比增长率

表:2007-2017年中国医疗器械行业相关政策

表:中国真空采血系统市场格局

图:2016年中国真空采血管市场占有率

表:中国真空采血针市场格局

图:2014-2017年中国真空采血系统主要企业真空采血业务收入

图:2012-2017年中国其他针、导管、插管及类似品进口量及进口金额

表:2017年1-7月中国其他针、导管、插管及类似品进口量前十的国家地区

图:2012-2017年中国其他针、导管、插管及类似品出口量及出口金额

表:2017年1-7月中国其他针、导管、插管及类似品出口量前十的国家地区

图:2008-2016年中国医疗器械行业销售收入及工业总产值

图:2016-2021E中国真空采血管消费量及同比增长率

表:中国上市公司布局真空采血设备行业案例

图:2014-2017年中国真空采血设备行业主要企业研发支出

表:阳普医疗主要产品及应用

图:2013-2017年阳普医疗营业收入及净利润

表:2014-2017年阳普医疗营业收入(分产品)

表:2014-2017年阳普医疗营业收入构成(分产品)

表:2014-2017年阳普医疗毛利率(分产品)

图:2013-2017年阳普医疗研发支出及占比

图:2013-2016年阳普医疗真空采血系统产销及库存量

图:2014-2017年阳普医疗真空采血系统收入及占比

图:2016-2021E阳普医疗营业收入及净利润

图:2013-2017年瑞琦科技营业收入及净利润

图:2013-2017年瑞琦科技营业收入(分产品)

图:2013-2017年瑞琦科技营业收入构成(分产品)

表:2013-2017年瑞琦科技营业收入(分地区)

表:2013-2017年瑞琦科技营业收入构成(分地区)

图:2013-2017年瑞琦科技毛利率

图:2013-2017年瑞琦科技研发支出及占比

图:2013-2017年瑞琦科技真空采血业务收入及占比

图:2016-2021E瑞琦科技营业收入及净利润

图:2013-2017年千山药机营业收入及净利润

图:2014-2016年千山药机营业收入(分业务)

图:2014-2016年千山药机营业收入构成(分业务)

图:2014-2016年千山药机毛利率(分业务)

表:威高股份产品种类及主要产品

图:2004-2017年威高股份营业收入及净利润

表:2014-2017年威高股份营业收入(分产品)

表:2014-2017年威高股份营业收入构成(分产品)

图:2014-2017年威高股份毛利率

图:2014-2017年威高股份真空采血产品收入

图:力因精准股权结构

表:力因精准主要特殊应用真空采血管产品介绍

表:积水医疗真空采血产品介绍

图:2013-2017年康德莱营业收入及净利润

表:2014-2016年康德莱营业收入(分产品)

表:2014-2016年康德莱营业收入构成(分产品)

图:2014-2016年康德莱毛利率(分产品)

表:鸿宇医疗真空采血管产品介绍

表:鸿宇医疗采血针产品介绍

图:2013-2017年鑫乐医疗营业收入及净利润

图:2014-2016年鑫乐医疗营业收入(分地区)

图:2014-2016年鑫乐医疗营业收入构成(分地区)

图:2013-2017年鑫乐医疗毛利率

图:2013-2017年鑫乐医疗研发支出及占比

图:2016-2021E鑫乐医疗营业收入及净利润

表:耀华医疗主要产品

图:2014-2017年耀华医疗营业收入及净利润

图:2014-2016年耀华医疗营业收入(分产品)

图:2014-2016年耀华医疗营业收入构成(分产品)

图:2014-2017年耀华医疗毛利率

图:2014-2017年耀华医疗研发支出及占比

表:2015-2017年耀华医疗前五名客户销售额及占比

图:2014-2016年耀华医疗真空采血业务收入及占比

图:2016-2021E耀华医疗营业收入及净利润

表:康健医疗主要真空采血产品

图:FY2013-2017年BD营业收入及净利润

图:FY2013-2017年BD营业收入(分业务)

图:FY2013-2017年BD营业收入构成(分业务)

图:FY2013-2016年BD毛利率

图:FY2013-2017年BD真空采血业务收入及占比

图:BD中国主要业务

图:FY2012-2016年泰尔茂营业收入及净利润

图:FY2012-2016年泰尔茂营业收入(分业务)

图:FY2012-2016年泰尔茂营业收入构成(分业务)

图:FY2012-2016年泰尔茂血液管理部门收入及占比

表:泰尔茂中国分公司及其主要业务

图:泰尔茂中国布局

图:FY2013-2017年尼洛普营业收入及净利润

图:FY2014-2017年尼洛普营业收入(分业务)

图:FY2014-2017年尼洛普营业收入构成(分业务)

图:FY2014-2017年尼洛普营业收入(分地区)

图:FY2014-2017年尼洛普营业收入构成(分地区)

图:FY2014-2017年尼洛普医疗相关业务收入及占比

表:尼洛普在华主要子公司及其业务

图:Greiner Bio One生产基地分布

图:FY2013-2016年Greiner Bio One营业收入及同比增长率

表:Greiner Bio One真空采血产品介绍

Classification and Applications of Vacuum Blood Collection Tubes

Classification of Vacuum Blood Collection Tubes (by Cranial Color)

Development Characteristics of Vacuum Blood Collection System by Generation

Performance of Vacuum Blood Collection System by Generation

Global Consumption of Vacuum Blood Collection Tubes, 2008-2016

China’s GDP, 2012-2017

Residents’ Per-capita Disposable Income and YoY Growth in China, 2011-2016

Number of Medical and Healthcare Institutions in China, 2015-2017

Number of Hospitals in China, 2009-2017

Number of Hospitals in China by Economic Type, 2009-2017

Clinic Visits of Medical Institutions in China, 2015-2017

Clinic Visits of Hospitals in China, 2009-2017

Clinic Visits of Hospitals in China by Economic Type, 2012-2017

Health Expenditure in China, 2010-2016

Health Expenditure in China, 2016-2021E

Population Aged over 60 in China, 2009-2021E

Public Hospitals’ Inspection Revenue and % of Total Inspection Revenue in China, 2010-2016

Public Hospitals’ Inspection Revenue and % of Total Inspection Revenue in China, 2016-2021E

Vacuum Blood Collection Tube Consumption and YoY Growth in China, 2009-2016

Polices Concerning Medical Equipment Industry in China, 2007-2017

Vacuum Blood Collection Tube Market Pattern in China

Vacuum Blood Collection Tube Market Share in China, 2016

Vacuum Blood Collection Needle Market Pattern in China

Vacuum Blood Collection Revenue of Major Vacuum Blood Collection System Companies in China, 2014-2017

Import Volume and Value of Other Needles, Catheters, Cannulas and Similar Supplies in China, 2012-2017

TOP10 Import Sources of Other Needles, Catheters, Cannulas and Similar Supplies in China by Import Volume, Jan-Jul 2017

Export Volume and Value of Other Needles, Catheters, Cannulas and Similar Supplies in China, 2012-2017

TOP10 Export Destinations of Other Needles, Catheters, Cannulas and Similar Supplies in China by Export Volume, Jan-Jul 2017

Revenue and Gross Industrial Output Value of Medical Equipment Industry in China, 2008-2016

Consumption of Vacuum Blood Collection Tubes and YoY Growth in China, 2016-2021E

Cases of Listed Companies’ Layout in Vacuum Blood Collection Device Industry in China

R&D Costs of Major Vacuum Blood Collection Device Companies in China, 2014-2017

Main Products and Application of Guangzhou Improve Medical Instruments

Revenue and Net Income of Guangzhou Improve Medical Instruments, 2013-2017

Revenue Breakdown of Guangzhou Improve Medical Instruments by Product, 2014-2017

Revenue Structure of Guangzhou Improve Medical Instruments by Product, 2014-2017

Gross Margin of Guangzhou Improve Medical Instruments by Product, 2014-2017

Guangzhou Improve Medical Instruments’ R&D Costs and % of Total Revenue, 2013-2017

Output, Sales Volume and Inventory of Guangzhou Improve Medical Instruments’ Vacuum Blood Collection Systems, 2013-2016

Guangzhou Improve Medical Instruments’ Revenue from Vacuum Blood Collection Systems and % of Total Revenue, 2014-2017

Revenue and Net Income of Guangzhou Improve Medical Instruments, 2016-2021E

Revenue and Net Income of Chengdu Rich Science Industry, 2013-2017

Revenue Breakdown of Chengdu Rich Science Industry by Product, 2013-2017

Revenue Structure of Chengdu Rich Science Industry by Product, 2013-2017

Revenue Breakdown of Chengdu Rich Science Industry by Region, 2013-2017

Revenue Structure of Chengdu Rich Science Industry by Region, 2013-2017

Gross Margin of Chengdu Rich Science Industry, 2013-2017

Chengdu Rich Science Industry’s R&D Costs and % of Total Revenue, 2013-2017

Chengdu Rich Science Industry’s Revenue from Vacuum Blood Collection Business and % of Total Revenue, 2013-2017

Revenue and Net Income of Chengdu Rich Science Industry, 2016-2021E

Revenue and Net Income of Hunan China Sun Pharmaceutical Machinery, 2013-2017

Revenue Breakdown of Hunan China Sun Pharmaceutical Machinery by Business, 2014-2016

Revenue Structure of Hunan China Sun Pharmaceutical Machinery by Business, 2014-2016

Gross Margin of Hunan China Sun Pharmaceutical Machinery by Business, 2014-2016

Weigao Group’s Product Categories and Main Products

Revenue and Net Income of Weigao Group, 2004-2017

Revenue Breakdown of Weigao Group by Product, 2014-2017

Revenue Structure of Weigao Group by Product, 2014-2017

Gross Margin of Weigao Group, 2014-2017

Weigao Group’s Revenue from Vacuum Blood Collection Products, 2014-2017

Equity Structure of Lingen Precision Medical Products

Main Special-purpose Vacuum Blood Collection Tubes of Lingen Precision Medical Products

Vacuum Blood Collection Products of Sekisui Medical Technology (China)

Revenue and Net Income of Shanghai Kindly Enterprise Development Group, 2013-2017

Revenue Breakdown of Shanghai Kindly Enterprise Development Group by Product, 2014-2016

Revenue Structure of Shanghai Kindly Enterprise Development Group by Product, 2014-2016

Gross Margin of Shanghai Kindly Enterprise Development Group by Product, 2014-2016

Vacuum Blood Collection Tubes of Weihai Hongyu Medical Devices

Blood Collection Needles of Weihai Hongyu Medical Devices

Revenue and Net Income of Hebei Xinle Sci & Tech, 2013-2017

Revenue Breakdown of Hebei Xinle Sci & Tech by Region, 2014-2016

Revenue Structure of Hebei Xinle Sci & Tech by Region, 2014-2016

Gross Margin of Hebei Xinle Sci & Tech, 2013-2017

Hebei Xinle Sci & Tech’s R&D Costs and % of Total Revenue, 2013-2017

Revenue and Net Income of Hebei Xinle Sci & Tech, 2016-2021E

Main Products of Shandong Yaohua Medical Instrument

Revenue and Net Income of Shandong Yaohua Medical Instrument, 2014-2017

Revenue Breakdown of Shandong Yaohua Medical Instrument by Product, 2014-2016

Revenue Structure of Shandong Yaohua Medical Instrument by Product, 2014-2016

Gross Margin of Shandong Yaohua Medical Instrument, 2014-2017

Shandong Yaohua Medical Instrument’s R&D Costs and % of Total Revenue, 2014-2017

Shandong Yaohua Medical Instrument’s Revenue from TOP5 Clients and % of Total Revenue, 2015-2017

Shandong Yaohua Medical Instrument’s Revenue from Vacuum Blood Collection Business and % of Total Revenue, 2014-2016

Revenue and Net Income of Shandong Yaohua Medical Instrument, 2016-2021E

Main Vacuum Blood Collection Products of Jiangsu KANGJIAN Medical Apparatus

BD’s Revenue and Net Income, FY2013-FY2017

BD’s Revenue Breakdown by Business, FY2013-FY2017

BD’s Revenue Structure by Business, FY2013-FY2017

BD’s Gross Margin, FY2013-FY2016

BD’s Revenue from Vacuum Blood Collection Business and % of Total Revenue, FY2013-FY2017

BD’s Main Business in China

Terumo’s Revenue and Net Income, FY2012-FY2016

Terumo’s Revenue Breakdown by Business, FY2012-FY2016

Terumo’s Revenue Structure by Business, FY2012-FY2016

Terumo’s Revenue from Blood Management Division and % of Total Revenue, FY2012-FY2016

Terumo's Subsidiaries in China and Main Business

Terumo's Layout in China

Nipro’s Revenue and Net Income, FY2013-FY2017

Nipro’s Revenue Breakdown by Business, FY2014-FY2017

Nipro’s Revenue Structure by Business, FY2014-FY2017

Nipro’s Revenue Breakdown by Region, FY2014-FY2017

Nipro’s Revenue Structure by Region, FY2014-FY2017

Nipro’s Revenue from Medical Business and % of Total Revenue, FY2014-FY2017

Nipro's Major Subsidiaries in China and Business

Presence of Greiner Bio One’s Production Bases

Greiner Bio One’s Revenue and YoY Growth, FY2013-FY2016

Greiner Bio One’s Vacuum Blood Collection Products

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|