2017年1-10月,中国市场乘用车车联网预装量达到409.93万辆,渗透率达到21.02%,预计全年车联网渗透率有望达到22%,产业规模达到290亿元,同比增长38.1%。未来随着智能驾驶/无人驾驶的普及商用,产业规模将进一步扩张,预计2021年将达到700亿元,乘用车车联网搭载率将达到39%。

从乘用车价格结构来看,2017年1-10月,装配率最高的是10-15万的车型,装配率为4.52%,同时在1-10月期间,25万以下车型车联网装配率一直在上升,可以看出:主机厂在大力推动车联网的普及,中低端车型搭载率逐渐上升,同时用户接受度越来越高。

车联网总体技术路线向着智能化、网联化方向演进,两条路线同步推进并走向融合。在车辆感知层方面,技术提升主要体现在新型汽车电子和操作系统方面。随着技术的提升,在汽车电子方面传感器功能融合集成、高性能计算芯片以及全新人机交互成为发展方向;车载操作系统由原来的单一功能向着层次化、模块化、平台化的智能方向发展。

《2017-2021年中国乘用车车联网行业研究报告》主要包含以下内容:

车联网概述(包括:国家支持政策、有利因素与阻碍因素、目前中国车联网市场规模、产业链结构、市场价值链、市场参与者及主要解决方案等);

车联网概述(包括:国家支持政策、有利因素与阻碍因素、目前中国车联网市场规模、产业链结构、市场价值链、市场参与者及主要解决方案等);

中国Telematics市场发展状况分析(包括:2017年中国乘用车车联网(分价格/车型/ 主机厂/Telematics品牌)预装量、搭载率及渗透率,中国汽车市场主要Telematics品牌配套情况,主要Telematics品牌业务分析(包括安全防护功能、导航功能、互联娱乐功能、资费对比)等);

中国Telematics市场发展状况分析(包括:2017年中国乘用车车联网(分价格/车型/ 主机厂/Telematics品牌)预装量、搭载率及渗透率,中国汽车市场主要Telematics品牌配套情况,主要Telematics品牌业务分析(包括安全防护功能、导航功能、互联娱乐功能、资费对比)等);

中国合资主机厂Telematics业务研究(包括:上海通用OnStar/ MyLink、丰田G-BOOK、本田HondaLink/ Honda CONNECT、沃尔沃SENSUS/ Volvo On Call、长安福特SYNC、东风日产CARWINGS智行+/ Nismo Watch、东风悦达起亚UVO、东风雪铁龙Citroën Connect、东风标致Blue-i、北京奔驰Mercedes-Benz CONNECT、北京现代BlueLink、华晨宝马ConnectedDrive,配套车型、功能与服务、套餐资费情况及中国市场用户增长等);

中国合资主机厂Telematics业务研究(包括:上海通用OnStar/ MyLink、丰田G-BOOK、本田HondaLink/ Honda CONNECT、沃尔沃SENSUS/ Volvo On Call、长安福特SYNC、东风日产CARWINGS智行+/ Nismo Watch、东风悦达起亚UVO、东风雪铁龙Citroën Connect、东风标致Blue-i、北京奔驰Mercedes-Benz CONNECT、北京现代BlueLink、华晨宝马ConnectedDrive,配套车型、功能与服务、套餐资费情况及中国市场用户增长等);

中国本土主机厂Telematics业务研究(包括:上海汽车inkaNet、长安汽车In Call、吉利汽车G-Netlink/ G-Link、奇瑞汽车Cloudrive,配套车型、功能与服务、套餐资费情况及中国市场用户增长等);

中国本土主机厂Telematics业务研究(包括:上海汽车inkaNet、长安汽车In Call、吉利汽车G-Netlink/ G-Link、奇瑞汽车Cloudrive,配套车型、功能与服务、套餐资费情况及中国市场用户增长等);

中国车联网公司(包括:四维图新、元征科技、博泰悦臻、WirelessCar、远特科技、钛马信息、凯立德、北京车网互联、九五智驾、高德等车联网厂商客户分布、经营收入、营业收入构成、产品领域等情况)。

中国车联网公司(包括:四维图新、元征科技、博泰悦臻、WirelessCar、远特科技、钛马信息、凯立德、北京车网互联、九五智驾、高德等车联网厂商客户分布、经营收入、营业收入构成、产品领域等情况)。

From January to October 2017, a total of 4.0993 million passenger cars were preinstalled with telematics in China, with market penetration standing at 21.02%, and the industrial scale will be up to RMB29 billion with a year-on-year surge of 38.1% and market penetration hitting 22% in 2017 around. As intelligent driving and autonomous driving get popular and commercialized, the telematics industry size will be developing faster in the future and is expected to report RMB70 billion in 2021 when the rate of telematics installations on passenger cars will be 39%.

As for price range of passenger cars, the models priced between RMB100,000 and RMB150,000 enjoyed the highest rate of telematics installations or 4.52% during January to October 2017, and the installation rate of telematics on the models priced below RMB250,000 is on the rise in the same period. It can be seen that OEMs are aggressively promoting the prevalence of telematics and low- and medium-end car models see a growing installation rate of telematics, which is naturally welcomed by the consumers.

Telematics is technically heading towards intelligence and networking, and the two technical routes are progressing simultaneously and making for a fusion. In respect of vehicle perception layer, the technological improvements are largely shown from novel automotive electronics and operating system. In the wake of technological advancements, automotive electronics are developing towards functional integration of sensors, high-performance computing chip and new human-computer interaction. The automotive operating system is gearing from single function towards the intelligent tiered, modularized and platform-based development.

China Passenger Car Telematics Industry Report, 2017-2021 highlights the following:

Telematics overview (national policy, favorable factors and impediments, Chinese telematics market size, industrial chains, market value chains, players and key solutions, etc.);

Telematics overview (national policy, favorable factors and impediments, Chinese telematics market size, industrial chains, market value chains, players and key solutions, etc.);

Telematics market in China (passenger car telematics in 2017 (by price/model/OEM/telematics brand) pre-installations, installation rate and penetration rate, the supporting of key telematics brands in the Chinese automotive market, business analysis of major telematics brands (like security function, navigation function, internet entertainment and comparison of charges);

Telematics market in China (passenger car telematics in 2017 (by price/model/OEM/telematics brand) pre-installations, installation rate and penetration rate, the supporting of key telematics brands in the Chinese automotive market, business analysis of major telematics brands (like security function, navigation function, internet entertainment and comparison of charges);

Study on telematics business of Joint-venture OEMs (OnStar/MyLink (SAIC-GM), G-BOOK (Toyota), HondaLink/Honda Connect (Honda), SENSUS/Volvo On Call (Volvo), SYNC (Changan Ford), CARWINGS+/ Nismo Watch (Dongfeng Nissan), UVO (Dongfeng Yueda KIA), Citroën Connect (Dongfeng Citroën), Blue-I (Dongfeng Peugeot), Mercedes-Benz CONNECT (Beijing Benz Automotive), BlueLink (Beijing Hyundai) and ConnectedDrive (BMW Brilliance), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of Joint-venture OEMs (OnStar/MyLink (SAIC-GM), G-BOOK (Toyota), HondaLink/Honda Connect (Honda), SENSUS/Volvo On Call (Volvo), SYNC (Changan Ford), CARWINGS+/ Nismo Watch (Dongfeng Nissan), UVO (Dongfeng Yueda KIA), Citroën Connect (Dongfeng Citroën), Blue-I (Dongfeng Peugeot), Mercedes-Benz CONNECT (Beijing Benz Automotive), BlueLink (Beijing Hyundai) and ConnectedDrive (BMW Brilliance), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of local Chinese OEMs (inkaNet (SAIC Motor), In Call (Changan Automobile), G-Netlink/ G-Link (Geely) and Cloudrive (Chery), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Study on telematics business of local Chinese OEMs (inkaNet (SAIC Motor), In Call (Changan Automobile), G-Netlink/ G-Link (Geely) and Cloudrive (Chery), the car models supported, functions & services, package charges as well as user growth in Chinese market);

Chinese internet firms including NavInfo, LAUNCH Tech, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Beijing Carsmart Technology, YESWAY and AutoNavi (telematics customers, products, revenue structure, etc.)

Chinese internet firms including NavInfo, LAUNCH Tech, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Beijing Carsmart Technology, YESWAY and AutoNavi (telematics customers, products, revenue structure, etc.)

第一章 车联网概述

1.1 国家对车联网支持政策(2016-2017)

1.2 中国车联网产业阻碍因素与促进因素

1.3 中国车联网发展趋势

1.4 车载终端特点呈现三大趋势

1.5 中国车联网产业规模

1.6 中国车联网渗透率

1.7 中国车联网产业链及市场参与者

1.8 车联网产业链结构图

1.8.1 车联网产业链结构图-汽车制造

1.8.2 车联网产业链结构图-汽车半导体

1.8.3 车联网产业链结构图-车载电子产品

1.8.4 车联网产业链结构图-软件、应用和服务

1.9 车联网系统架构

1.10 车联网市场价值链

1.11 车联网市场主要参与者

1.12 车联网主要解决方案

1.13 整车厂的车联网主要解决方案

第二章 中国Telematics市场发展状况分析

2.1 2017年中国乘用车车联网累计预装量及渗透率

2.2 2017年中国乘用车车联网当月车联网预装量(辆)及渗透率

2.3 截至2017年10月中国所有在售车款车联网搭载率

2.4 截至2017年10月中国所有在售车型搭载车联网车型价格分布

2.5 截至2017年10月中国所有在售车型搭载车联网分价格占比

2.6 截至2017年10月中国所有在售车型搭载车联网分车系占比

2.7 2016-2021年中国车联网系统预装量预测

2.8 2017年前10个月中国总发布新车搭载率-分价格

2.9 2017年1-10月车联网系统排名TOP15(按照主机厂)

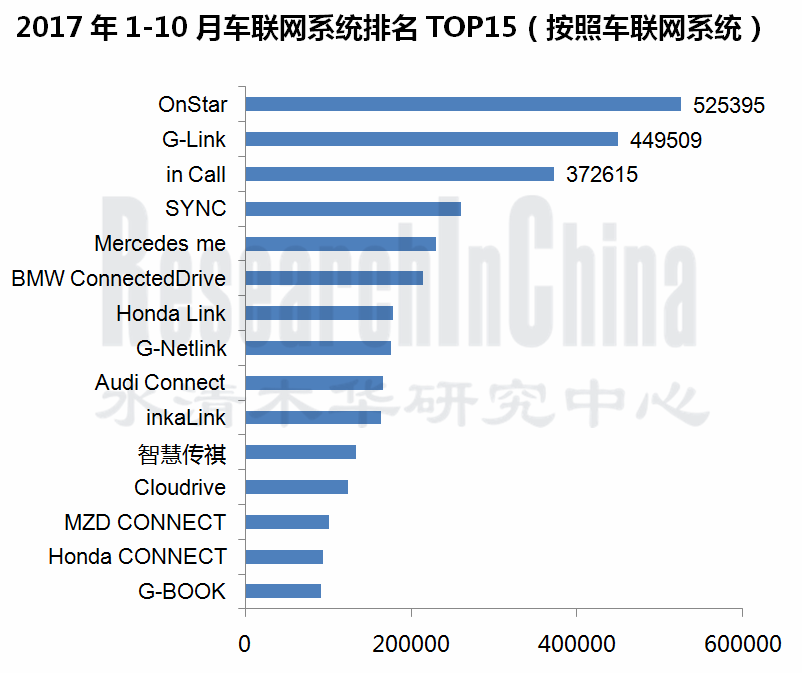

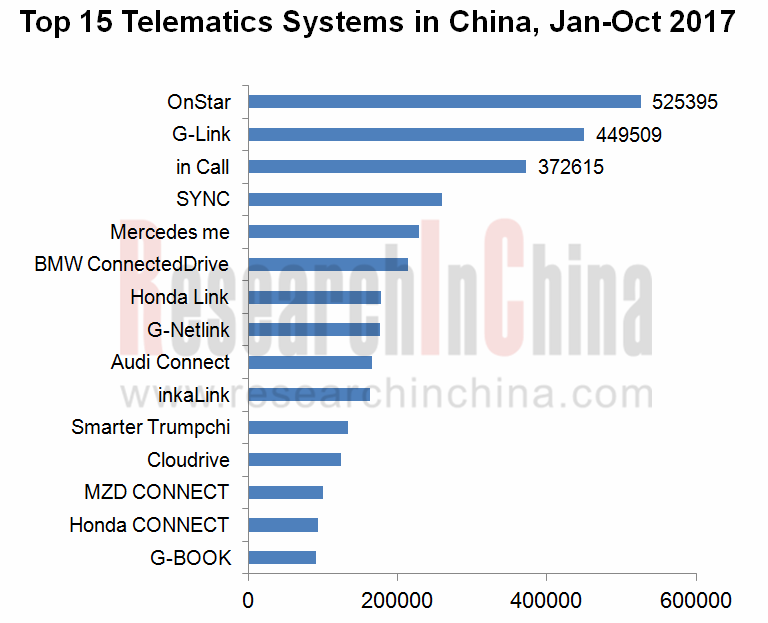

2.10 2017年1-10月车联网系统排名TOP15(按照车联网系统)

2.11 中国汽车市场主要Telematics品牌配套情况(截至2017年10月末)

2.12 主要Telematics品牌业务分析

2.12.1 主要Telematics品牌安全防护功能对比

2.12.2 主要Telematics品牌导航功能对比

2.12.3 主要Telematics品牌互联娱乐功能对比

2.12.4 主要Telematics品牌资费对比

第三章 中国合资主机厂Telematics业务研究

3.1上海通用

3.1.1 通用安吉星发展历程

3.1.2 安吉星服务介绍

3.1.3 安吉星套餐服务内容

3.1.4 安吉星通信技术路线

3.1.5 MyLink 2.0主要功能与参数

3.1.6 2016-2017年中国乘用车市场安吉星新增用户

3.2 丰田

3.2.1 手机连接G-BOOK与DCM连接G-BOOK服务对比

3.2.2 2016-2017年中国市场G-BOOK新增用户

3.3 本田

3.3.1 HondaLink主要功能与服务

3.3.2 本田新一代车联网系统Honda CONNECT(智导互联)

3.3.3 2016-2017年中国市场中国市场HondaLink/Honda Connect新增用户

3.4 沃尔沃

3.4.1 Sensus Connect功能与服务

3.4.2 Volvo On Call功能与服务

3.4.3 2016-2017年中国市场Sensus新增用户

3.5 长安福特

3.5.1 SYNC功能与服务

3.5.2 2016-2017年中国市场SYNC新增用户

3.6 东风日产

3.6.1 CARWINGS智行+服务与功能

3.6.2 Nismo Watch功能与参数

3.6.3 2016-2017年月度中国市场CARWINGS智行+新增用户

3.7 东风悦达起亚

3.7.1 UVO系统服务

3.7.2 UVO资费情况

3.7.3 2016-2017年月度中国市场UVO新增用户

3.8 东风雪铁龙

3.8.1 Citroën Connect系统功能与服务

3.8.2 2016-2017年月度中国市场Citroën Connect新增用户

3.9 东风标致

3.9.1 Blue-i系统功能与服务

3.9.2 2016-2017年月度中国市场Blue-i新增用户

3.10 北京奔驰

3.10.1 Mercedes-Benz CONNECT服务与功能

3.10.2 2016-2017年中国市场Mercedes-Benz CONNECT新增用户

3.11 北京现代

3.11.1 BlueLink资费情况

3.11.2 Blue Link系统服务

3.11.3 2016-2017年月度中国市场Blue Link新增用户

3.12 华晨宝马

3.12.1 ConnectedDrive功能与服务

3.12.2 2016-2017年月度中国市场ConnectedDrive新增用户

第四章 中国本土主机厂Telematics业务研究

4.1 上海汽车

4.1.1 inkaNet功能与服务

4.1.2 inkaNet套餐资费情况

4.1.3 2016-2017年月度中国市场inkaNet新增用户

4.2 长安汽车

4.2.1 In Call功能与服务

4.2.2 Incall系统车型配套及资费

4.2.3 2016-2017年月度中国市场Incall新增用户

4.3 吉利汽车

4.3.1 吉利车联网发展历程

4.3.2 吉利车联网系统纵向对比

4.3.3 吉利车联网主要搭载车型及搭载款数

4.3.4 2016-2017年月度中国市场G-Netlink/ G-Link用户增长情况

4.4 奇瑞汽车

4.4.1 Cloudrive简介

4.4.2 奇瑞发布Cloudrive3.0

4.4.3 2016-2017年月度中国市场Cloudrive用户增长情况

4.5 广汽集团

4.5.1 智慧传祺简介

4.5.2 智慧传祺主要搭载车型预装量

4.5.3 2015-2017H1年智慧传祺装配量及装配率

4.5.4 不同版本的对比

4.5.5 广汽联合高德地图推出“云端导航”

第五章 中国车联网公司

5.1 四维图新

5.1.1 2013-2017年四维图新经营业绩

5.1.2 2015-2016四维图新分产业经营业绩

5.1.3 研究分析——研发投入

5.1.4 前五大客户

5.1.5 车联网服务生态体系

5.1.6 研究分析——地理信息资源获取方式

5.1.7 子公司--北京图为先科技有限公司

5.1.8 子公司--中寰卫星导航通信有限公司

5.1.9 产品分析——寰游天下车辆信息综合服务平台

5.1.10 产品分析——趣驾WeDrive3.0

5.1.11 四维图新与东软签署战略合作框架协议

5.1.12 研究分析——“芯片+算法+数据+软件”的全新布局

5.1.13 近期动态汇总

5.2 元征科技

5.2.1 2011-2017年元征科技营业收入及同比增长

5.2.2 2011-2017年元征科技净利润及同比增长

5.2.3 2014-2016年元征科技营收构成(分产品)

5.2.4 2009-2016年元征科技研发支出、及其占营业收入比例

5.2.5 最近动态

5.2.6 “智能诊断”系统

5.3 博泰悦臻

5.3.1 相关公司

5.3.2 业务定位

5.3.3 产品平台体系

5.3.4 核心技术及架构

5.3.5 产品HMI特点

5.3.6 Telematics业务

5.3.7 应用案例

5.3.8 近期动态

5.4 WirelessCar

5.4.1 应用案例-Volvo On Call

5.4.2 应用案例-日产英菲尼迪InTouch和新NissanConnect

5.4.3 应用案例-观致逸云QorosQloud

5.5 远特科技

5.5.1 发展历程

5.5.2 产品结构

5.5.3 产品应用

5.5.4 产品应用案例

5.6 钛马信息网络技术有限公司

5.6.1 后装市场车联网CarNet解决方案三点功能

5.6.2 同行业车联网系统产品比较

5.6.3 钛马信息产品应用结构

5.6.4 钛马信息产品主要功能模块

5.7 凯立德

5.7.1 2012-2017年凯立德营收、净利润

5.7.2 2012-2016年研发投入

5.7.3 2015、2016年凯立德营业收入分布

5.7.4 凯立德M330联网智能后视镜导航

5.8 北京车网互联科技有限公司

5.8.1 简介

5.8.2 2010-2017年车网互联营业收入及同比增长

5.8.3 乐乘盒子及UBI业务

5.8.4 车网互联乐乘盒子

5.9 九五智驾

5.9.1 九五智驾客户

5.9.2 2011-2017年九五智驾营业收入及同比增长

5.9.3 2011-2017年九五智驾净利润及同比增长

5.9.4 前装车联网服务

5.9.5 后装车联网服务

5.9.6 智驾服务

5.9.7 2011-2016年九五智驾营收构成

5.9.8 2011-2016年九五智驾毛利率及研发投入

5.9.9 2013-2016年九五智驾来自前五大客户的销售额

5.9.10 九五智驾最近动态

5.9.11 Y-CONNECT是智驾互联系统

5.10 高德

5.10.1 地图业务

5.10.2 合作伙伴

5.10.3 高德地图与千寻位置合作“高精度地图+高精度定位”

1 Overview of Telematics

1.1 National Policies for Developing Telematics (2016-2017)

1.2 Obstacles and Stimuli to China’s Telematics Industry

1.3 Development Trends in the Chinese Telematics

1.4 Three Major Trends of Onboard Terminals

1.5 China’s Telematics Industry Size

1.6 China’s Telematics Penetration

1.7 China’s Telematics Industry Chain and Market Participants

1.8 Structure of Telematics Industry Chain

1.8.1 Telematics Industry Chain-Automobile Manufacturing

1.8.2 Telematics Industry Chain-Automotive Semiconductor

1.8.3 Telematics Industry Chain-Onboard Electronics

1.8.4 Telematics Industry Chain - Software, Applications and Services

1.9 Telematics System Architecture

1.10 Value Chain of Telematics Market

1.11 Major Telematics Market Participants

1.12 Main Solutions for Telematics

1.13 Main Solutions for OEM Telematics

2 Development of China’s Telematics Market

2.1 Cumulative Pre-installation and Penetration of Passenger Car Telematics in China, 2017

2.2 Monthly Connected Pre-installation (units) and Penetration of Passenger Car Telematics in China, 2017

2.3 Installation Rate of Telematics Installed in Vehicles for Sale in China, as of Oct. 2017

2.4 Price Structure of All Vehicles for Sale Equipped with Telematics in China, as of Oct. 2017

2.5 Percentage of All Vehicles for Sale Equipped with Telematics by Price in China, as of Oct. 2017

2.6 Percentage of Models for Sale in China Equipped with Telematics by Models, as of Oct. 2017

2.7 Pre-installation of Telematics System in China, 2016-2021E

2.8 Installation Rate of New Vehicles Released in China by Price in the First Ten Months of 2017

2.9 Top 15 Telematics Systems by OEMs, Jan.-Oct.2017

2.10 Top 15 Telematics Systems by Installation, Jan.-Oct.2017

2.11 Supporting of Telematics Brands in the Chinese Automobile Market (as of Oct. 2017)

2.12 Main Telematics Brands

2.12.1 Comparison: Safety Protection Functions

2.12.2 Comparison: Navigation Functions

2.12.3 Comparison: Interconnection and Entertainment Functions

2.12.4 Comparison: Charge Packages

3 Research on Telematics of Joint-ventured OEMs in China

3.1 SAIC-GM

3.1.1 Development History of GM Onstar

3.1.2 Introduction to Onstar Services

3.1.3 Onstar Charge Packages

3.1.4 Technology Roadmap for Onstar

3.1.5 Functions and Parameters of MyLink 2.0

3.1.6 New Onstar Users in Chinses Passenger Car Market, 2016-2017

3.2 Toyota

3.2.1 Comparison of Mobile Phone Connected G-BOOK and DCM Connected G-BOOK

3.2.2 New G-BOOK Users in China, 2016-2017

3.3 Honda

3.3.1 Functions and Services of HondaLink

3.3.2 Honda’s New-Generation Telematics Honda CONNECT

3.3.3 New HondaLink/ Honda CONNECT Users in China, 2016-2017

3.4 Volvo

3.4.1 Functions and Services of Sensus Connect

3.4.2 Functions and Services of Volvo On Call

3.4.3 New Sensus Users in China, 2016-2017

3.5 Chang'an Ford

3.5.1 Functions and Services of SYNC

3.5.2 New SYNC Users in China, 2016-2017

3.6 Dongfeng Nissan

3.6.1 Functions and Services of CARWINGS Zhixing+

3.6.2 Functions and Parameters of Nismo Watch

3.6.3 New CARWINGS Zhixing+ Users in China, 2016-2017

3.7 Dongfeng YuedaKia

3.7.1 UVO System Services

3.7.2 UVO Packages

3.7.3 New UVO Users in China, 2016-2017

3.8 Dongfeng Citroën

3.8.1 Functions and Services of Citroën Connect

3.8.2 New Citroën Connect Users in China, 2016-2017

3.9 Dongfeng Peugeot

3.9.1 Functions and Services of Blue-i System

3.9.2 New Blue-i Users in China, 2016-2017

3.10 Beijing Benz

3.10.1 Functions and Services of Mercedes-Benz CONNECT

3.10.2 New Mercedes-Benz CONNECT Users in China, 2016-2017

3.11 Beijing Hyundai

3.11.1 BlueLink Charge Packages

3.11.2 Services of Blue Link System

3.11.3 New Blue Link Users in China, 2016-2017

3.12 BMW Brilliance

3.12.1 Functions and Services of ConnectedDrive

3.12.2 New ConnectedDrive Users in China, 2016-2017

4 Research on OEM Telematics in China

4.1 SAIC Motor

4.1.1 Functions and Services of inkaNet

4.1.2 inkaNet Charge Packages

4.1.3 New inkaNet Users in China, 2016-2017

4.2 Changan Automobile

4.2.1 Functions and Services of In Call

4.2.2 Models Supported by In Call System and Charge Packages

4.2.3 New In Call Users in China, 2016-2017

4.3 Geely Automobile

4.3.1 Development Course of Geely Telematics

4.3.2 Vertical Comparison of Geely Telematics

4.3.3 Models Equipped with Geely Telematics

4.3.4 Growth of G-Netlink/ G-Link Users in China, 2016-2017

4.4 Chery Automobile

4.4.1 Profile of Cloudrive

4.4.2 Cloudrive3.0 Launched

4.4.3 Growth of Cloudrive Users in China, 2016-2017

4.5 Guangzhou Automobile Group Co., Ltd.

4.5.1 Introduction to Smarter Trumpchi

4.5.2 Smarter Trumpchi Pre-installations to Key Models

4.5.3 Installations and Installation Rate of Smarter Trumpchi, 2015-2017H1

4.5.4 Comparison between Different Versions

4.5.5 GAC Partnered with AutoNavi (amap.com) to Launch “Cloud Navigation”

5. Chinese Telematics Companies

5.1 NavInfo Co., Ltd.

5.1.1Operating Results, 2013-2017

5.1.2 Operating Results by Sector, 2015-2016

5.1.3 Research and Analysis -- R & D Investment

5.1.4 Top 5 Customers

5.1.5 Telematics Service Ecosystem

5.1.6 Research and Analysis -- Acquisition Modes of Geographic Information Resources

5.1.7 Subsidiary: Beijing Mapbar Science and Technology Co., Ltd.

5.1.8 Subsidiary: China Satellite Navigation and Communications Co., Ltd.

5.1.9 Product Analysis -- Aerohuanyou Vehicle information Comprehensive Service Platform

5.1.10 Product Analysis -- WeDrive3.0

5.1.11 Strategic Cooperation Framework Agreement with Neusoft

5.1.12 Research on New Layout “Chip+Algorithm+Data+Software”

5.1.13 Dynamics

5.2 LAUNCH Tech Company Limited

5.2.1 Revenue and YoY Growth, 2011-2017

5.2.2 Net Income and YoY Growth, 2011-2017

5.2.3 Revenue Structure (by Product), 2014-2016

5.2.4 R&D Costs and % of Total Revenue, 2009-2016

5.2.5 Latest Developments

5.2.6 “Intelligent Diagnosis” System

5.3 PATEO

5.3.1 Related Companies

5.3.2 Business Positioning

5.3.3 Product Platform System

5.3.4 Core Technologies and Architecture

5.3.5 Product HMI Features

5.3.6 Telematics Business

5.3.7 Application Cases

5.3.8 Latest News

5.4 WirelessCar

5.4.1 Application Case -Volvo On Call

5.4.2 Application Case - Nissan Infiniti InTouch and new Nissan Connect

5.4.3 Application Case - QorosQloud

5.5 China TSP

5.5.1 Development Course

5.5.2 Product Structure

5.5.3 Product Application

5.5.4 Application Cases

5.6 TimaNetworks

5.6.1 Three Functions of CarNet Telematics Solutions in Aftermarket

5.6.2 Comparison with Counterpart Telematics System Products

5.6.3 Product Application Structure

5.6.4 Main Function Modules of Products

5.7 Careland

5.7.1 Revenue and Net Income, 2012-2017

5.7.2 R & D Investment, 2012-2016

5.7.3 Revenue Distribution, 2015 & 2016

5.7.4 M330 Connected Intelligent Rearview Mirror Navigation

5.8 Beijing Carsmart Technology Co., Ltd

5.8.1 Profile

5.8.2 Revenue and YoY Growth, 2010-2017

5.8.3 Autofun and UBI Business

5.8.4 Autofun

5.9 YESWAY

5.9.1 Customers

5.9.2 Revenue and YoY Growth, 2011-2017

5.9.3 Net Income and YoY Growth, 2011-2017

5.9.4 OEM Telematics Services

5.9.5 Aftermarket Telematics Services

5.9.6 Intelligent Driving Services

5.9.7 Revenue Structure (by Business), 2011-2016

5.9.8 Gross Margin and R & D Investment, 2011-2016

5.9.9 Revenue from Top 5 Customers, 2013-2016

5.9.10 Latest News

5.9.11 Y-CONNECT is Intelligent Driving Interconnected System

5.10 AutoNavi

5.10.1 Map Business

5.10.2 Partners

5.10.3 Autonavi (amap.com) and Qianxun SI Cooperate in “HD Map+ High-accuracy Positioning”