|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2017-2021年全球及中国激光加工设备行业研究报告 |

|

字数:5.2万 |

页数:154 |

图表数:176 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:3200美元 |

英文纸版:3400美元 |

英文(电子+纸)版:3500美元 |

|

编号:BXM108

|

发布日期:2018-04 |

附件:下载 |

|

|

|

随着激光技术的快速发展和广泛应用,全球激光加工产业快速增长,到2017年市场规模已经超过100亿美元,其中工业激光器超过30亿美元,主要应用于激光材料加工、微加工和打标领域。在全球激光材料加工中,激光切割、焊接、打标占据了6成以上比重。

中国作为全球激光应用大国,近年在制造业升级,新兴产业快速增长的拉动下,激光加工需求激增,到2017年中国激光加工设备规模已超过260亿元,同比增长10.2%。其中,激光切割设备和激光焊接设备增速较快,前者增长动力主要来自OLED面板切割、3D玻璃切割、蓝宝石切割、手机异性切割等领域;后者主要来自金属中框焊接、动力电池焊接以及汽车轻量化等领域。相对而言,激光打标设备增速放缓,主要因为其技术门槛较低,市场相对比较成熟。

从激光器应用来看,光纤激光器已经成为激光加工行业的首选。近两年,全球光纤激光器在激光切割系统中的应用出现跨越式增长,尤其是在中功率切割系统中。在焊接系统中,激光焊接设备使用光纤激光器已经达到占比60%。

2017年,中国光纤激光切割设备市场最大的特点是,以大族激光、华工激光、奔腾激光、领创等为代表的生产商纷纷推出10KW级产品,有的甚至推出了12KW级产品。2018年还将出现15KW级及以上产品。随着超高功率激光切割设备的出现,材料切割的厚度极限将被不断打破,厚板的加工价格也会进一步降低,这将吸引更多企业进入这一领域。

从企业来看,2016年相干收购罗芬后,全球激光加工市场进一步集中,收入超过10亿美元只有四家,分别是德国通快、美国相干(收购罗芬后)、光纤激光器龙头IPG 以及大族激光。

2017年大族激光营业收入首次超过百亿元,为115.60亿元,同比增长66.1%,净利润为16.8亿元,同比增长122.1%,主要受消费类电子、新能源、大功率及PCB设备需求旺盛等影响。目前,公司正在深圳宝安区建设全球激光智能制造基地,建成后将成为世界最大的激光生产制造基地。

水清木华研究中心《2017-2021年全球及中国激光加工设备行业研究报告》着重研究了以下内容:

全球激光产业、激光器及激光设备市场规模及重点厂商; 全球激光产业、激光器及激光设备市场规模及重点厂商;

中国激光加工设备市场规模、市场结构、区域格局、重点企业、进出口、价格走势; 中国激光加工设备市场规模、市场结构、区域格局、重点企业、进出口、价格走势;

中国激光加工细分产品(激光切割、焊接、打标、雕刻加工设备)市场规模、主要厂商等; 中国激光加工细分产品(激光切割、焊接、打标、雕刻加工设备)市场规模、主要厂商等;

中国传统行业(半导体、PCB、汽车等)和新兴行业(智能手机、OLED、动力电池、3D打印等)下游市场规模、重点企业及对激光加工设备的需求; 中国传统行业(半导体、PCB、汽车等)和新兴行业(智能手机、OLED、动力电池、3D打印等)下游市场规模、重点企业及对激光加工设备的需求;

全球6家、中国25家激光加工设备重点企业经营情况、激光加工设备业务、重点项目、未来预测等。 全球6家、中国25家激光加工设备重点企业经营情况、激光加工设备业务、重点项目、未来预测等。

中国激光加工设备市场及企业总结与预测、行业未来发展趋势等。 中国激光加工设备市场及企业总结与预测、行业未来发展趋势等。

With the fast evolvement and wide application of laser technology, the global laser processing industry has grown by leaps and bounds. In 2017, the global laser processing market size exceeded USD10 billion, of which the global industrial laser market was worth USD3 billion. Industrial lasers are primarily used in laser material processing, laser micromachining and marking. Laser welding, laser cutting and marking account for over 60% of global laser material processing.

China, the world leader in laser applications, has seen a surge in laser processing demand under the impetus of manufacturing upgrading and the burgeoning emerging industries. In 2017, the scale of laser processing equipment in China surpassed RMB26 billion, a year-on-year increase of 10.2%. Wherein, laser cutting equipment and laser welding equipment grew dramatically. The growth of laser cutting equipment was mainly prompted by OLED panel cutting, 3D glass cutting, sapphire cutting, and mobile phone abnormity cutting; the growth of laser welding equipment was boosted by metal middle frame welding, power battery welding, automotive lightweight and other fields. Relatively speaking, the slowdown in the growth rate of laser marking equipment was largely due to low technical threshold and relatively mature market.

As concerns laser applications, fiber lasers have become the first choice for the laser processing industry. Over the past two years, the applications of fiber lasers in laser cutting systems have registered leapfrog growth globally, particularly in medium-power cutting systems. In welding systems, 60% of laser welding equipment has rendered fiber lasers.

The Chinese fiber laser cutting equipment market in 2017 was primarily characterized by 10KW and even 12KW products launched by manufacturers represented by Han's Laser Technology, HGLASER, Penta Laser and Lead Laser. And 15KW and above products will come into being in 2018. With emergence of ultra-high-power laser cutting equipment, the thickness limit of material cutting will be broke constantly and the price for plate processing will be further lowered, thus attracting more enterprises into the field.

Global laser processing market has become further concentrated after Coherent’s acquisition of Rofin in 2016. There are only four companies with revenue of more than USD1 billion, specifically, TRUMPF (Germany), Coherent (United States, after acquisition of Rofin), IPG (fiber laser leader), and Han's Laser Technology.

Han's Laser Technology achieved revenue of RMB11.56 billion (over RMB10 billion for the first time) and net income of RMB1.68 billion in 2017, soaring 66.1% and 122.1% over the previous year, respectively, largely thanks to strong demand for consumer electronics, new energy, high-power and PCB equipment. The company is building global laser smart manufacturing base in Bao’an District, Shenzhen, which will be the world’s largest laser production base upon completion.

Global and China Laser Processing Equipment Industry Report, 2017-2021 highlights the followings:

Global laser industry, laser and laser equipment market size, major companies; Global laser industry, laser and laser equipment market size, major companies;

Chinese laser processing equipment market (size, structure, regional structure, major companies, import & export, price trend, etc.); Chinese laser processing equipment market (size, structure, regional structure, major companies, import & export, price trend, etc.);

Chinese laser processing equipment market segments (laser cutting, welding, marking, and engraving) (size, major companies, etc.); Chinese laser processing equipment market segments (laser cutting, welding, marking, and engraving) (size, major companies, etc.);

Downstream markets for traditional (semiconductor, PCB, automobile, etc.) and emerging industries (smartphone, OLED, power battery, 3D printing, etc.) in China (market size, major enterprises, demand for laser processing equipment); Downstream markets for traditional (semiconductor, PCB, automobile, etc.) and emerging industries (smartphone, OLED, power battery, 3D printing, etc.) in China (market size, major enterprises, demand for laser processing equipment);

Six global and 25 Chinese laser processing equipment manufacturers (operation, laser processing equipment business, key projects, forecast, etc.) Six global and 25 Chinese laser processing equipment manufacturers (operation, laser processing equipment business, key projects, forecast, etc.)

Chinese laser processing equipment market and enterprise (summary & forecast, development trends, etc.). Chinese laser processing equipment market and enterprise (summary & forecast, development trends, etc.).

第一章 激光加工设备产业概述

1.1 产业链

1.2 激光器

1.3 激光设备

1.4 激光加工

第二章 全球市场

2.1 激光设备

2.1.1 市场规模

2.1.2 应用结构

2.2 工业激光器

2.2.1 市场规模

2.2.2 分功率

2.3 应用市场

2.3.1 微加工

2.3.2 打标

2.3.3 材料加工

2.4 主要企业

2.4.1 竞争格局

2.4.2 企业并购

第三章 中国市场

3.1 产业政策

3.2 经营模式

3.3 市场规模

3.4 主要企业

3.5 区域分布

3.6 进出口

3.6.1 出口

3.6.2 进口

3.7 价格走势

第四章 中国激光设备细分市场

4.1 激光切割设备

4.1.1 市场规模

4.1.2 光纤激光切割机

4.1.3 主要厂商

4.2 激光焊接设备

4.2.1 市场规模

4.2.2 激光焊接在汽车上的应用

4.2.3 主要厂商

4.3 激光标记设备

4.3.1 市场规模

4.3.2 光纤激光打标机

4.3.3 主要厂商

4.4 激光雕刻设备

第五章 下游市场

5.1 传统行业

5.1.1半导体

5.1.2 PCB行业

5.1.3 汽车行业

5.2 新兴行业

5.2.1 智能手机

5.2.2 OLED

5.2.3 动力电池

5.2.4 3D打印

第六章 外资企业研究

6.1通快

6.1.1 基本信息

6.1.2 运营情况

6.1.3 激光业务

6.1.4 在华发展

6.2相干(coherent)

6.2.1 基本信息

6.2.2 运营情况

6.2.3并购事件

6.2.4 激光业务

6.2.5 在华发展

6.3 IPG

6.3.1 基本信息

6.3.2 运营情况

6.3.3 主要产品

6.3.4 主要客户

6.3.5 并购事件

6.3.6 在华发展

6.4 普瑞玛(Prima Industrie)

6.4.1 基本信息

6.4.2 运营情况

6.4.3 激光业务

6.4.4 在华发展

6.5 Novanta(GSI集团)

6.5.1 基本信息

6.5.2 运营情况

6.5.3 激光业务

6.5.4 并购事件

6.5.5 在华发展

6.6 百超(Bystronic)

6.6.1 基本信息

6.6.2 运营情况

6.6.3 在华发展

第七章 中国企业研究

7.1 大族激光

7.1.1 基本信息

7.1.2 运营情况

7.1.3 营收构成

7.1.4 激光业务

7.1.5 子公司

7.1.6 重点项目

7.1.7 经营业绩预测

7.2 金运激光

7.2.1 基本信息

7.2.2 运营情况

7.2.3 激光业务

7.2.4 子公司

7.2.5 重点项目

7.2.6 经营业绩预测

7.3 华工科技

7.3.1 基本信息

7.3.2 运营情况

7.3.3 激光业务

7.3.4 子公司

7.3.5 经营业绩预测

7.4 新松机器人

7.4.1 基本信息

7.4.2 运营情况

7.4.3 激光业务

7.4.4 子公司

7.5 亚威股份

7.5.1 基本信息

7.5.2 运营情况

7.5.3 激光业务

7.6 天弘激光

7.6.1 基本信息

7.6.2 运营情况

7.6.3 激光业务

7.6.4 客户及供应商

7.7 光韵达

7.7.1 基本信息

7.7.2 运营情况

7.7.3 激光加工业务

7.7.4 子公司

7.7.5 经营业绩预测

7.8 联赢激光

7.8.1 基本信息

7.8.2 运营情况

7.8.3 激光业务

7.8.4 主要子公司

7.9 嘉泰激光

7.9.1 基本信息

7.9.2 运营情况

7.9.3 激光业务

7.9.4 主要客户及供应商

7.10楚天激光

7.11 团结激光

7.12 天琪激光

7.13 德龙激光

7.14 大恒激光

7.15 大华激光

7.16 曙光光电

7.17 博业激光

7.18 开天科技

7.19 华俄激光

7.20 苏州领创

7.21光大激光

7.22 迪能激光

7.23宏山激光

7.24盛雄激光

7.25迅镭激光

第八章 总结及预测

8.1 行业总结及预测

8.2 企业总结及预测

8.3 行业发展趋势

1 Overview of Laser Processing Equipment Industry

1.1 Industry Chain

1.2 Laser

1.3 Laser Equipment

1.4 Laser Processing

2 Global Laser Equipment Market

2.1 Laser Equipment

2.1.1 Market Size

2.1.2 Applied Structure

2.2 Industrial Laser

2.2.1 Market Size

2.2.2 By Power

2.3 Applications

2.3.1 Micro Processing

2.3.2 Marking

2.3.3 Material Processing

2.4 Major Enterprises

2.4.1 Competitive Landscape

2.4.2 M&As

3 Chinese Laser Equipment Market

3.1 Industrial Policy

3.2 Business Model

3.3 Market Size

3.4 Major Enterprises

3.5 Regional Distribution

3.6 Import and Export

3.6.1 Export

3.6.2 Import

3.7 Price Trend

4 China Laser Processing Equipment Market Segments

4.1 Laser Cutting Equipment

4.1.1 Market Size

4.1.2 Fiber Optic Laser Cutting Machine

4.1.3 Leading Manufacturers

4.2 Laser Welding Equipment

4.2.1 Market Size

4.2.2 Application of Laser Welding in Automobile

4.2.3 Leading Manufacturers

4.3 Laser Marking Equipment

4.3.1 Market Size

4.3.2 Fiber Optic Laser Marking Machine

4.3.3 Leading Manufacturers

4.4 Laser Engraving Equipment

5 Downstream Market

5.1 Traditional Sectors

5.1.1 Semiconductor

5.1.2 PCB

5.1.3 Automobile

5.2 Emerging Industries

5.2.1 Smart Phone

5.2.2 OLED

5.2.3 Power Battery

5.2.4 3D Printing

6 Foreign Companies

6.1 TRUMPF

6.1.1 Profile

6.1.2 Operation

6.1.3 Laser Business

6.1.4 Development in China

6.2 Coherent

6.2.1 Profile

6.2.2 Operation

6.2.3 M&A

6.2.4 Laser Business

6.2.5 Development in China

6.3 IPG

6.3.1 Profile

6.3.2 Operation

6.3.3 Main Products

6.3.4 Major Customers

6.3.5 M&A

6.3.6 Development in China

6.4 Prima Industrie

6.4.1 Profile

6.4.2 Operation

6.4.3 Laser Business

6.4.4 Development in China

6.5 Novanta (GSI Group)

6.5.1 Profile

6.5.2 Operation

6.5.3 Laser Business

6.5.4 M&A

6.5.5 Development in China

6.6 Bystronic

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

7 Chinese Companies

7.1 Han's Laser Technology Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Laser Business

7.1.5 Subsidiaries

7.1.6 Key Projects

7.1.7 Performance Forecast

7.2 Wuhan Golden Laser Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Laser Business

7.2.4 Subsidiaries

7.2.5 Key Projects

7.2.6 Performance Forecast

7.3 Huagong Tech Company Limited

7.3.1 Profile

7.3.2 Operation

7.3.3 Laser Business

7.3.4 Subsidiaries

7.3.5 Performance Forecast

7.4 Siasun Robot and Automation Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Laser Business

7.4.4 Subsidiaries

7.5 Jiangsu Yawei Machine Tool Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Laser Business

7.6 Suzhou Tianhong Laser Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Laser Business

7.6.4 Customers and Suppliers

7.7 Shenzhen Sunshine Laser & Electronics Technology Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Laser Processing Business

7.7.4 Subsidiaires

7.7.5 Performance Forecast

7.8 United Winners Laser Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 Laser Business

7.8.4 Main Subsidiaries

7.9 Jiatai Laser Technology Co., Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 Laser Business

7.9.4 Major Customers and Suppliers

7.10 Chutian Laser Group

7.11 Wuhan Unity Laser Co., Ltd.

7.12 Wuhan Tianqi Laser Equipment Manufacturing Co., Ltd

7.13 Suzhou Delphi Laser Co., Ltd.

7.14 Beijing Daheng Laser Equipment Co., Ltd.

7.15 Wuhan Dahua Laser Technology Co., Ltd.

7.16 Jiangsu Shuguang Photoelectricity Co., Ltd.

7.17 BOYE Laser Co., Ltd.

7.18 Beijing Kaitian Tech. Co., Ltd.

7.19 Wuhan HE Laser Engineering Co., Ltd.

7.20 Suzhou Lead Laser Technology Co., Ltd.

7.21 Shenzhen GDlaser Technology Co., Ltd.

7.22 Shenzhen DNE Laser Technology Co., Ltd. (Bystronic DNE)

7.23 Foshan Beyond Laser Co., Ltd. (HSG Laser)

7.24 Dongguan Strong Laser Equipment Co., Ltd. (Strong Laser)

7.25 Suzhou Quick Laser Technology Co., Ltd.

8 Summary and Forecast

8.1 Industry

8.2 Enterprise

8.3 Development Tendencies

图:激光加工设备产业链

表:激光器类型及适用领域

图:激光器与激光设备的关联示意图

图:2012-2021全球激光加工系统销售额

图:2016年全球激光加工系统应用结构

图:2013-2017年全球材料加工与光刻市场激光系统销售额

图:2013-2017年全球通信和光存储市场激光系统销售额

图:2013-2017年全球科学研究与军事市场激光系统销售额

图:2013-2017年全球医疗与美容市场激光系统销售额

图:2013-2017年全球娱乐显示印刷市场激光系统销售额

图:2013-2021年全球工业激光器销售额及增速

表:2013-2017年全球工业激光器(分产品)销售额

表:2016年全球工业激光器(分功率)销售额构成

图:2015-2017年全球高功率工业激光器(分产品)销售额

图:2015-2017年全球高功率工业激光器(分应用)销售额

表:2013-2017年全球工业激光器(分应用领域)销售额

表:2015-2017年全球用于微加工的激光器销售额

表:2015-2017年全球用于打标的激光器销售额

图:2016年全球用于材料加工的激光器(分应用)销售额占比

表:全球主要激光器及激光加工设备生产商

表:2015-2016年全球主要激光公司营收对比

图:2015年全球激光加工系统市场格局

图:2016年全球激光加工系统市场格局

表:2015-2018年全球激光企业并购事件

表:2006-2018年中国激光产业相关政策

图:中国激光设备行业经营模式

图:2014-2021年中国激光设备销售额

图:2014-2018年中国激光设备(分应用领域)销售额

图:2005 & 2017年中国激光加工设备市场结构对比

图:2014-2017年中国高功率激光设备销量

表:2017年中国主要激光加工设备生产商

图:2016年中国小功率激光设备市场竞争格局

图:2016年中国高功率激光设备市场竞争格局

表:中国激光产业区域特点及代表企业

表:2017年中国主要激光产业区域分布

图:2010-2016年中国激光产业出口量

表:2015-2017年中国激光产业出口产品

图:2010-2016年中国激光产业进口量

表:2015-2017年中国激光产业进口产品

图:2015-2020年中国光纤激光器价格走势

图:激光切割机在金属板材中的应用

图:2014-2021年中国激光切割设备市场规模

图:光纤激光切割与CO2激光切割速度对比

图:光纤激光切割与CO2激光切割能耗对比

图:各类激光器效率对比

图:各类激光器运行费用对比

图:2013-2016年中国大功率切割设备销量

表:2017年底中国超高功率(≥10KW)激光切割机生产商

表:中国主要激光切割设备生产商

图:2014-2021年中国激光焊接设备市场规模

图:激光焊接在汽车上的应用

图:激光拼焊板工艺与传统生产工艺的对比

表:2013-2018年中国汽车板激光拼焊机国产化大事记

图:2016-2020年中国焊接机器人市场规模

图:激光焊接在汽车锂电行业的应用

表:中国主要激光焊接机生产商

图:2014-2021年中国激光标记设备市场规模

图:2014-2024年全球激光打标机(分产品)销售额

图:2014-2021年中国激光雕刻设备市场规模

图:2009-2021年全球及中国半导体设备销售额

表:2018年中国集成电路各环节设备市场规模

图:激光在半导体制造中的应用

图:全球主要半导体用激光设备供应商

图:2011-2021年全球及中国PCB产值

图:CO2激光与UV激光在PCB切割上的比较

图:2014-2021年中国汽车制造设备行业规模

图:中国汽车制造设备(分工艺)市场规模构成

图:汽车制造中的激光应用

图:2010-2021年全球及中国智能手机出货量

图:激光技术在手机中的应用

图:2016-2017年大族激光智能手机客户订单收入

图:全面屏手机示例(三星Galaxy S8)

图:2014-2020年全球智能手机双摄像头渗透率

图:2014-2020年全球智能手机双面玻璃渗透率

图:手机金属中框加工工艺

图:AMOLED制造应用到的激光设备

图:2016-2022年全球OLED面板出货量

表:2016-2021年全球智能手机用OLED面板出货量

表:三大手机品牌均采用AMOLED

表:全球主要OLED面板生产企业布局

图:2014-2021E中国新能源汽车产销量

图:2014-2021年中国动力锂电池产量

图:2016年中国主要企业动力电池出货量份额

图:锂电池生产工艺流程及用到的激光设备

表:3D 打印技术与传统制造技术的比较

图:3D打印产业链

图:2009-2021年全球3D打印行业收入

图:2000-2017年全球金属3D打印机销量

表:2015-2017年中国3D打印相关政策

图:2012-2021年中国3D打印市场规模

图:通快全球子公司分布

图:FY2013-2017通快销售额

图:FY2016通快各部门销售额

图:FY2010-2017通快激光业务销售额

表:通快在华公司及业务

图:FY2015-2017相干营业收入

图:FY2015-2017相干EBITDA%

图:FY2014-2017相干经营指标

表:FY2015-2017相干营业收入(分部门)分布

图:FY2015-2017相干产品应用领域分布

图:FY2015年罗芬销售额、净利润、员工数量、订单金额

表:2015年罗芬全球生产基地

表:相干主要产品及激光技术

表:FY2017 相干主要生产基地分布

图:2015-2017年IPG运营指标

表:2015-2017年IPG各地区营业收入及比重

表:IPG产品线

表:2015-2017年IPG销售额分布(按应用领域分类)

图:IPG主要客户

图:2012-2017年IPG前5大客户收入及占比

图:截至2017年IPG兼并与重组大事记

图:普瑞玛业务部门

图:2014-2017年普瑞玛销售额

表:2016-2017年普瑞玛(分地区)营业收入

图:2016-2017年普瑞玛(分业务)营业收入及毛利率

图:普瑞玛工业(Prima Power)主要客户

表:2010-2017年NOVANTA销售额及毛利润

表:2015-2017年NOVANTA(分业务)销售额

表:2015-2017年NOVANTA(分业务)毛利润

表:NOVANTA激光产品线

表:2015-2017年NOVANTA主要国家/地区销售额

表:2017年百超(分地区)营业额及员工分布

表:Bystronic主要产品

图:2008-2017年大族激光营业收入及净利润

表:2012-2016年大族激光整体产销量

表:2015-2017年大族激光营收结构(分业务)

表:2013-2017年大族激光营收结构(分地区)

图:大族激光设备在蓝宝石加工中的地位

表:大族激光关键元器件的自主供应能力

表:2017年H1大族激光控股子公司运营情况

表:2018年大族激光募投项目

表:2015-2019年大族激光(分业务)营业收入及毛利率预测

图:2008-2017年金运激光营业收入及毛利率

表:2011-2016年金运激光整体产销量

表:金运激光主要产品

表:2013-2016年金运激光各地区营业收入

表:金运激光主要激光设备产品

表:2015年-2016年金运激光各项业务营业收入及毛利率

表:2017年H1金运激光各项业务营业收入及毛利率

表:2016年金运激光主要子公司运营情况

表:2014-2018年金运激光营业收入及毛利率预测

图:2007-2017年华工科技营业收入及毛利率

表:2012-2017年华工科技营收结构(分产品)

图:2007-2017年华工科技海外收入

图:2007-2017年华工科技激光加工及系列成套设备业务营业收入及毛利率

图:2007-2017年华工科技激光全息防伪系列产品营业收入及毛利率

表:2017H1年华工科技主要子公司运营情况

表:2015-2019年华工科技营业收入及毛利率预测

图:2007-2017年新松机器人营业收入及毛利率

表:2012-2017年新松机器人各业务收入比重

表:2017年新松机器人主要子公司运营情况

图:2009-2017年亚威股份营业收入及毛利率

表:亚威股份激光切割机产品

表:2012-2017年天弘激光营业收入、净利润及毛利率

表:2015-2016年天弘激光各项产品营业收入

图:2014-2016年天弘激光主要客户

图:2014-2016年天弘激光主要供应商

图:2009-2017年光韵达营业收入及毛利率

表:2016-2017年光韵达各项产品营业收入及毛利率

表:2017年光韵达主要子公司运营情况

表:2015-2019年光韵达营业收入及毛利率预测

图:2014-2017年联赢激光营业收入及净利润

表:2016-2017年联赢激光(分业务)营业收入及占比

表:2017年底联赢激光主要子公司及业务

图:2014-2017年嘉泰激光营业收入及净利润

表:2016-2017年嘉泰激光(分业务)营业收入

表:2017年嘉泰激光TOP5客户及供应商

图:楚天激光旗下子公司

表:2014-2017年中谷联创营业收入及净利润

表:天琪激光主要生产基地

表:2015-2017年大恒激光主要经营指标

图:开天激光全球用户分布

图:2014-2021年中国激光加工设备市场规模及增速

图:2017-2021年中国激光加工设备市场结构

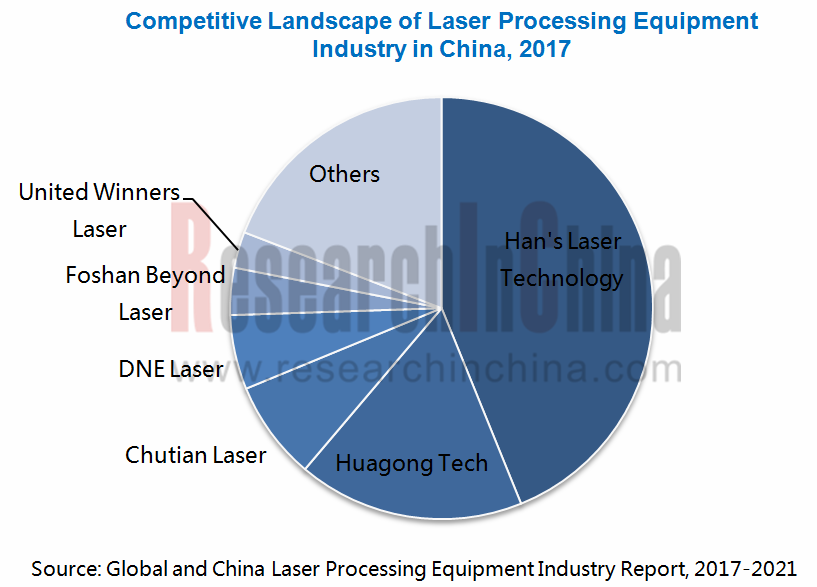

图:2017年中国主要激光加工设备企业市场份额

表:高功率激光切割与传统切割方式对比

图:未来中国大功率激光切割设备替代空间

表:大功率激光焊接设备发展趋势

Laser Processing Equipment Industry Chain

Laser Types and Applicable Areas

Correlation between Laser and Laser Equipment

Global Sales of Laser Processing Systems, 2012-2021E

Application Structure of Global Laser Processing Systems, 2016

Global Sales of Laser Systems for Materials Processing and Photo Etching, 2013-2017

Global Sales of Laser Systems for Communications and Optical Storage, 2013-2017

Global Sales of Laser Systems for Scientific Research and Military Purpose, 2013-2017

Global Sales of Laser Systems for Medical Care and Beauty, 2013-2017

Global Sales of Laser Systems for Entertainment, Display and Printing, 2013-2017

Global Industrial Laser Sales and YoY Growth, 2013-2021E

Global Industrial Laser Sales by Product, 2013-2017

Global Industrial Laser Sales Structure by Power, 2016

Global High-power Industrial Laser Sales by Product, 2015-2017

Global High-power Industrial Laser Sales by Application, 2015-2017

Global Industrial Laser Sales by Application, 2013-2017

Global Sales of Lasers for Micromachining, 2015-2017

Global Sales of Lasers for Marking, 2015-2017

Global Sales Structure of Lasers for Materials Processing by Application, 2016

Global Major Manufacturers of Laser and Laser Processing Equipment

Revenue Comparison between Global Major Laser Companies, 2015-2016

Global Laser Processing System Market Pattern, 2015

Global Laser Processing System Market Pattern, 2016

M&A Cases of Laser Companies Worldwide, 2015-2018

China’s Laser Industry Policies, 2006-2018

Business Models of Laser Equipment Industry in China

Laser Equipment Sales in China, 2014-2021E

Laser Equipment Sales in China by Application, 2014-2018

Laser Processing Equipment Market Structure in China, 2005 & 2017

Major Laser Processing Equipment Manufacturers in China, 2017

Competition Pattern of Small-power Laser Equipment Market in China, 2016

Competition Pattern of High-power Laser Equipment Market in China, 2016

High-power Laser Equipment Sales in China, 2014-2017

Regional Characteristics and Representative Companies of Laser Industry in China

Regional Distribution of Laser Industry in China, 2017

China’s Laser Exports, 2010-2016

China’s Exported Laser Products, 2015-2017

China’s Laser Imports, 2010-2016

China’s Imported Laser Products, 2015-2017

Price Trend of Optical Fiber Lasers in China, 2015-2020E

Application of Laser Cutting Machines to Sheet Metals

Laser Cutting Equipment Market Size in China, 2014-2021E

Comparison of Cutting Speed between Optical Fiber Laser and CO2 Laser

Comparison of Cutting Energy Consumption between Optical Fiber Laser and CO2 Laser

Efficiency Comparison between Lasers

Operating Expense Comparison between Lasers

Large-power Cutting Equipment Sales in China, 2013-2016

Ultrahigh Power (≥10KW) Laser Cutting Machine Manufacturers in China, 2017

Major Laser Cutting Equipment Manufacturers in China

Laser Welding Equipment Market Size in China, 2014-2021E

Application of Laser Welding to Automotive

Comparison between Tailored Blank Laser Welding Technology and Conventional Technologies

Milestones of Localization of Automotive Sheet Laser Welding Machines in China, 2013-2018

Welding Robot Market Size in China, 2016-2020E

Application of Laser Welding to Automotive Lithium Battery Industry

Major Laser Welding Machine Manufactures in China

Laser Marking Equipment Market Size in China, 2014-2021E

Global Laser Marking Machine Sales by Product, 2014-2024E

Laser Engraving Equipment Market Size in China, 2014-2021E

Global and Chinese Semiconductor Equipment Sales, 2009-2021E

Market Size of Equipment in Each Link of Integrated Circuit in China, 2018

Laser Applied in Semiconductor Fabriaction

Leading Suppliers of Semiconductor-used Laser Equipment in the World

PCB Output Value in China and the World, 2011-2021E

Comparison of CO2 Laser and UV Laser in PCB Cutting

China Automobile Manufacturing Equipment Industry Scale, 2014-2021E

China Automobile Manufacturing Equipment Market Size Structure by Process

Laser Applied in Automobile Manufacturing

Smart Phone Shipments in China and the World, 2010-2021E

Laser Technologies Applied in Mobile Phone

Han’s Laser Technology’s Revenue of Orders from Smart Phone Customers, 2016-2017

Example of Full Screen Mobile Phones (Samsung Galaxy S8)

Global Smartphone Dual Camera Penetration, 2014-2020E

Global Smartphone Double-sided Glass Penetration, 2014-2020E

Mobile Phone Metal Frame Processing Technology

Laser Equipment Used for AMOLED Fabrication

Global Shipments of OLED Panel, 2016-2022E

Global Shipments of OLED Panel for Smart Phone, 2016-2021E

AMOLED Adopted by Three Major Cellphone Brands

Layout of World’s Major OLED Panel Manufacturers

Production and Sales of New Energy Vehicle in China, 2014-2021E

Shares of Major Chinese Enterprises by Power Battery Shipment, 2016

Output of Power Lithium Battery in China, 2014-2021E

Lithium Battery Manufacturing Process and Laser Equipment Utilized

Comparison between 3D Printing Technology and Traditional Manufacturing Technology

3D Printing Industry Chain

Revenue of Global 3D Printing Industry, 2009-2021E

Global Sales of Metal 3D Printers, 2000-2017

Policies on 3D Printing in China, 2015-2017

3D Printing Market Size in China, 2012-2021E

Presence of TRUMPF’s Subsidiaries Worldwide

TRUMPF’s Revenue, FY2013-FY2017

TRUMPF’s Revenue by Division, FY2016

TRUMPF’s Revenue from Laser Business, FY2010-FY2017

TRUMPF’s Companies and Business in China

Coherent’s Revenue, FY2015-FY2017

Coherent’s EBITDA, FY2015-FY2017

Coherent’s Operating Indicators, FY2014-FY2017

Coherent’s Revenue by Division, FY2015-FY2017

Application Structure of Coherent’s Products, FY2015-FY2017

Rofin’s Revenue, Net Income, Headcount and Order Amount, FY2015

Rofin’s Manufacturing Bases Worldwide, 2015

Coherent’s Main Products and Laser Technologies

Presence of Coherent’s Key Manufacturing Bases, FY2017

IPG’s Operational Indicators, 2015-2017

IPG Revenue Structure by Region, 2015-2017

IPG’s Product Portfolios

IPG’s Revenue Structure by Application, 2015-2017

IPG’s Major Customers

IPG’s Revenue from Top 5 Clients and % of Total Revenue, 2012-2017

IPG’s M&As as of 2017

Business Segments of Prima Industrie

Prima’s Revenue, 2014-2017

Prima’s Revenue by Region, 2016-2017

Prima’s Revenue and Gross Margin by Business, 2016-2017

Major Customers of Prima Industrie

Novanta’s Revenue and Gross Profit, 2010-2017

Novanta’s Revenue by Business, 2015-2017

Novanta’s Gross Profit by Business, 2015-2017

Novanta’s Laser Product Line

Novanta’s Sales in Major Countries/Regions, 2015-2017

Bystronic’s Turnover and Staff Distribution by Region, 2017

Bystronic’s Main Products

Revenue and Net Income of Han’s Laser Technology, 2008-2017

Output and Sales of Han’s Laser Technology, 2012-2016

Revenue Structure (by Business) of Han’s Laser Technology, 2015-2017

Revenue Structure (by Region) of Han’s Laser Technology, 2013-2017

The Standing of Han’s Laser Technology’s Laser Equipment in Sapphire Processing

Han’s Laser Technology’s Self-supply Capability of Key Components

Operation of Subsidiaries Held by Han’s Laser Technology, H1 2017

The Projects Invested with Raised Funds of Han’s Laser Technology, 2018

Revenue and Gross Margin of Han’s Laser Technology, 2015-2019E

Revenue and Gross Margin of Wuhan Golden Laser, 2008-2017

Output and Sales of Wuhan Golden Laser, 2011-2016

Main Products of Wuhan Golden Laser

Revenue of Wuhan Golden Laser by Region, 2013-2016

Main Laser Equipment of Wuhan Golden Laser

Revenue and Gross Margin of Wuhan Golden Laser by Business, 2015-2016

Revenue and Gross Margin of Wuhan Golden Laser by Business, H1 2017

Operation of Main Subsidiaries under Wuhan Golden Laser, 2016

Revenue and Gross Margin of Wuhan Golden Laser, 2014-2018E

Revenue and Gross Margin of Huagong Tech, 2007-2017

Revenue Structure (by Product) of Huagong Tech, 2012-2017

Overseas Revenue of Huagong Tech, 2007-2017

Revenue and Gross Margin of Laser Processing and Complete Equipment Business of Huagong Tech, 2007-2017

Revenue and Gross Margin of Laser Holographic Anti-counterfeiting Product Series of Huagong Tech, 2007-2017

Operation of Main Subsidiaries under Huagong Tech, 2017H1

Revenue and Gross Margin of Huagong Tech, 2015-2019E

Revenue and Gross Margin of Siasun Robot and Automation, 2007-2017

Revenue Structure of Siasun Robot and Automation by Business, 2012-2017

Operation of Main Subsidiaries under Siasun Robot and Automation, 2017

Revenue and Gross Margin of Jiangsu Yawei Machine Tool, 2009-2017

Laser Cutting Machines of Jiangsu Yawei Machine Tool

Revenue, Net Income and Gross Margin of Suzhou Tianhong Laser, 2012-2017

Revenue of Suzhou Tianhong Laser by Product, 2015-2016

Major Customers of Suzhou Tianhong Laser, 2014-2016

Major Suppliers of Suzhou Tianhong Laser, 2014-2016

Revenue and Gross Margin of Shenzhen Sunshine Laser & Electronics Technology, 2009-2017

Revenue and Gross Margin of Shenzhen Sunshine Laser & Electronics Technology by Product, 2016-2017

Operation of Main Subsidiaries under Shenzhen Sunshine Laser & Electronics Technology, 2017

Revenue and Gross Margin of Shenzhen Sunshine Laser & Electronics Technology, 2015-2019E

Revenue and Net Income of United Winners Laser, 2014-2017

Revenue Structure of United Winners Laser by Business, 2016-2017

Main Subsidiaries and Business of United Winners Laser at the End of 2017

Revenue and Net Income of Jiatai Laser Technology, 2014-2017

Revenue of Jiatai Laser Technology by Business, 2016-2017

Top 5 Customers and Suppliers of Jiatai Laser Technology, 2017

Subsidiaries of Chutian Laser Group

Revenue and Net Income of Chuatian Laser Group Wuhan Lianchuang Photoelectric Technology, 2014-2017

Main Production Bases of Wuhan Tianqi Laser Equipment Manufacturing

Operational Indicators of Beijing Daheng Laser Equipment, 2015-2017

Worldwide Distribution of Customers of Beijing Kaitian Tech

China Laser Processing Equipment Market Size and Growth Rate, 2014-2021E

China Laser Processing Equipment Market Structure, 2017-2021E

Market Shares of Major Chinese Laser Processing Equipment Enterprises, 2017

Comparison between High-power Laser Cutting and Traditional Cutting Mode

Alternative Space of High-power Laser Cutting Equipment in China in the Future

Development Tendency of High-power Laser Welding Equipment

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|