|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2018-2022年全球及中国汽车座椅电机行业研究报告 |

|

字数:2.5万 |

页数:106 |

图表数:134 |

|

中文电子版:11000元 |

中文纸版:5500元 |

中文(电子+纸)版:11500元 |

|

英文电子版:3000美元 |

英文纸版:3200美元 |

英文(电子+纸)版:3300美元 |

|

编号:ZHP072

|

发布日期:2018-06 |

附件:下载 |

|

|

|

汽车需求的持续增长带动汽车座椅产业稳步增长。2017年全球汽车座椅市场规模约759亿美元,同比增长3.1%。其中,中国作为全球最大的汽车生产国,2017年汽车座椅市场规模为1231亿元(约182亿美元,美元兑人民币平均汇率1:6.7518),全球占比24.0%,同比增长14.6%;预计2018-2022年的年均增速在10.0%以上。

汽车座椅市场容量持续增长,加之座椅电动化趋势明显,因此汽车座椅电机市场得到了快速增长。2017年全球汽车座椅电机出货量1.3亿只,2012-2017年的年均复合增长率为10.6%, 2022年可突破1.9亿只。2017年中国座椅电机出货量约2950万只,同比增长11.3%,全球占比21.6%;受中国乘用车市场快速增长的带动(增速高于全球平均增速),2022年中国汽车座椅电机的出货量可突破5000万只。

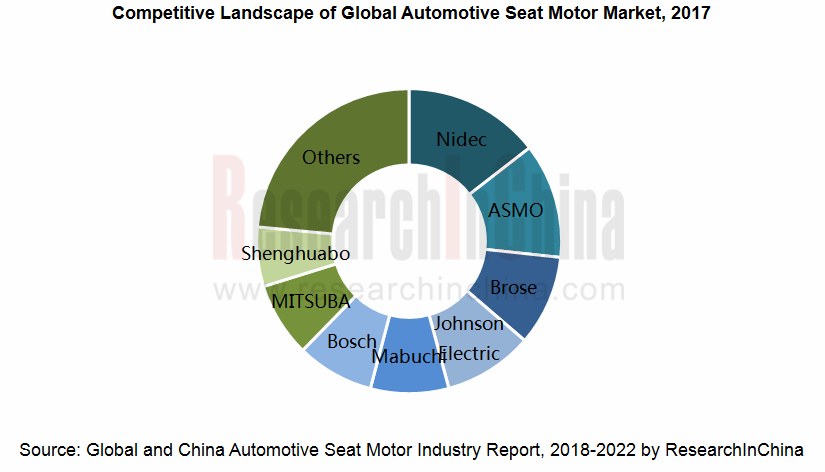

全球汽车座椅电机市场竞争格局相对稳定,主要制造商包括日本的ASMO、Nidec、Mitsuba、Mabuchi,德国的Bosch、Brose,中国的德昌电机、胜华波以及方正电机。2017年全球前三大汽车座椅电机制造商分别是Nidec、ASMO以及Brose,市场份额合计为36.3%。而中国最大的制造商是香港的德昌电机,2017年市场份额约9.5%。

中国大陆的本土厂商中仅胜华波集团和方正电机具备一定的市场竞争力。其中胜华波集团是大陆最大的座椅电机生产商,产品60%左右用于出口,目前正在进行上市准备;而方正电机也已正式成为特斯拉的二级供应商,为其供应汽车座椅电机。

目前,汽车产业正在发展节能技术,轻量化是主要的发展方向之一。因此汽车座椅电机正在向着紧凑型、轻量化的方向发展。

水清木华研究中心《2018-2022年全球及中国汽车座椅电机行业研究报告》着重研究了以下内容:

汽车座椅电机的定义、分类、技术标准等情况; 汽车座椅电机的定义、分类、技术标准等情况;

全球汽车座椅电机发展现状、市场规模、竞争格局等情况; 全球汽车座椅电机发展现状、市场规模、竞争格局等情况;

中国汽车座椅电机发展环境、市场规模、竞争格局、发展趋势等情况; 中国汽车座椅电机发展环境、市场规模、竞争格局、发展趋势等情况;

下游(汽车、汽车座椅)市场规模、竞争格局等情况; 下游(汽车、汽车座椅)市场规模、竞争格局等情况;

国外5家、中国9家汽车座椅电机制造商的经营情况、座椅电机业务等情况。 国外5家、中国9家汽车座椅电机制造商的经营情况、座椅电机业务等情况。

The growing demand for automobiles has driven the steady growth of the automotive seat industry whose market size reached approximately USD75.9 billion worldwide in 2017 with a year-on-year increase of 3.1%. China, the world's largest car producer, saw the automotive seat market size of RMB123.1 billion (about USD18.2 billion as per the average exchange rate 1:6.7518) in 2017, accounting for 24.0% of the world's total and jumping by 14.6% from a year earlier; the average annual growth rate in 2018-2022 is expected at above 10.0%.

As the automotive seat market keeps ballooning and the trend of motorized seats becomes obvious, the market for automotive seat motors has grown remarkably. In 2017, the global shipments of automotive seat motors reached 130 million units, with the CAGR of 10.6% during 2012-2017, and the figure in 2022 outnumber 190 million units. China's automotive seat motor shipments ascended 11.3% year on year to roughly 29.5 million units in 2017, sweeping 21.6% of the world; thanks to the fast-growing Chinese passenger car market (whose growth rate is higher than the global average), China's automotive seat motor shipments will go beyond 50 million units in 2022.

Amid the relatively stable competitive landscape in the global automotive seat motor market, leading manufacturers include Japan’s ASMO, Nidec, Mitsuba and Mabuchi, Germany’s Bosch and Brose, China’s Johnson Electric, Shenghuabo Group and Founder Motor. In 2017, the world's top three automotive seat motor manufacturers -- Nidec, ASMO and Brose enjoyed the combined market share of 36.3%. Hong Kong-based Johnson Electric, the largest producer of automotive seat motor in China, seized the market share of 9.5% or so in 2017.

Of the local manufacturers in Mainland China, only Shenghuabo Group and Founder Motor are quite competitive. Shenghuabo Group is the largest seat motor manufacturer in Mainland China, exports about 60% of its products, and is preparing for IPO now. Founder Motor has officially become a second-tier supplier of automotive seat motors for Tesla.

At present, the automakers are developing energy-saving technologies. Lightweight is one of the major development directions. In this sense, automotive seat motors tend to be compact and lightweight.

The report focuses on the following:

Definition, classification, technical standards and the like of automotive seat motors; Definition, classification, technical standards and the like of automotive seat motors;

Status quo, market size, competitive landscape, etc. of the global seat motors; Status quo, market size, competitive landscape, etc. of the global seat motors;

Development environment, market size, competitive landscape, development trend, etc. of Chinese seat motors; Development environment, market size, competitive landscape, development trend, etc. of Chinese seat motors;

Market size, competitive landscape, etc. of downstream automobiles and automotive seats; Market size, competitive landscape, etc. of downstream automobiles and automotive seats;

Operation, automotive seat motor business, etc. of 9 Chinese and 5 foreign automotive seat motor companies. Operation, automotive seat motor business, etc. of 9 Chinese and 5 foreign automotive seat motor companies.

第一章 汽车座椅电机概述

1.1 汽车电动座椅

1.2 汽车座椅电机的定义及分类

1.3 汽车座椅电机的技术标准

第二章 全球汽车座椅电机产业

2.1 发展现状

2.2 市场现状

2.2.1 市场规模

2.2.2 竞争格局

第三章 中国汽车座椅电机产业

3.1 发展环境

3.2 市场现状

3.2.1 市场规模

3.2.2 竞争格局

3.3 发展趋势

第四章 下游汽车座椅产业

4.1 汽车

4.1.1 全球

4.1.2 中国

4.2 汽车座椅

4.2.1 市场规模

4.2.2 竞争格局

第五章 国外汽车座椅电机制造商

5.1 电产

5.1.1 公司简介

5.1.2 经营情况

5.1.3 汽车座椅电机业务

5.2 万宝至

5.2.1 公司简介

5.2.2 经营情况

5.2.3 汽车座椅电机业务

5.3 博泽

5.3.1 企业简介

5.3.2 经营情况

5.3.3 汽车座椅电机业务

5.3.4 上海博泽电机有限公司

5.4 阿斯莫

5.4.1 公司简介

5.4.2 经营情况

5.4.3 汽车座椅电机业务

5.4.4 天津阿斯莫汽车微电机有限公司

5.4.5 阿斯莫(杭州萧山)微电机有限公司

5.5 博世

5.5.1 企业简介

5.5.2 经营情况

5.5.3 汽车座椅电机业务

5.5.4 博世汽车部件(长沙)有限公司

5.6 三叶电机

5.6.1 公司简介

5.6.2 经营情况

5.6.3 汽车座椅电机业务

5.6.4 广州三叶电机(武汉)有限公司

第六章 中国汽车座椅电机制造商

6.1 德昌电机

6.1.1 企业简介

6.1.2 经营情况

6.1.3 汽车座椅电机业务

6.2 胜华波集团

6.2.1 集团介绍

6.2.2 汽车座椅电机业务

6.2.3 上海胜华波汽车电器有限公司

6.2.4 安徽胜华波汽车电器有限公司

6.3 方正电机

6.3.1 企业简介

6.3.2 经营情况

6.3.3 汽车座椅电机业务

6.4 其它

6.4.1 科锋电机

6.4.2 江苏一东航空机械有限公司

6.4.3 张家港合力电机有限公司

6.4.4 深圳市标马电机

6.4.5 上海铭士达实业

6.4.6 宁波双林汽车部件股份有限公司

1. Overview of Automotive Seat Motor

1.1 Automotive Power Seat

1.2 Definition and Classification

1.3 Technical Standards

2. Global Automotive Seat Motor Industry

2.1 Status Quo

2.2 Market Situation

2.2.1 Market Size

2.2.2 Competitive Landscape

3. China Automotive Seat Motor Industry

3.1 Development Environment

3.2 Market Situation

3.2.1 Market Size

3.2.2 Competitive Landscape

3.3 Development Trend

4. Downstream Automotive Seat Industry

4.1 Automobile

4.1.1 Global

4.1.2 China

4.2 Automotive Seat

4.2.1 Market Size

4.2.2 Competitive Landscape

5. Foreign Automotive Seat Motor Manufacturers

5.1 Nidec

5.1.1 Profile

5.1.2 Operation

5.1.3 Automotive Seat Motor Business

5.2 Mabuchi

5.2.1 Profile

5.2.2 Operation

5.2.3 Automotive Seat Motor Business

5.3 Brose

5.3.1 Profile

5.3.2 Operation

5.3.3 Automotive Seat Motor Business

5.3.4 Shanghai Brose Electric Motors Co., Ltd.

5.4 ASMO

5.4.1 Profile

5.4.2 Operation

5.4.3 Automotive Seat Motor Business

5.4.4 Tianjin ASMO Automotive Small Motor Co., Ltd.

5.4.5 ASMO (Hangzhou Xiaoshan) Small Motor Co., Ltd.

5.5 Bosch

5.5.1 Profile

5.5.2 Operation

5.5.3 Automotive Seat Motor Business

5.5.4 Bosch Automotive Products (Changsha) Co., Ltd.

5.6 MITSUBA

5.6.1 Profile

5.6.2 Operation

5.6.3 Automotive Seat Motor Business

5.6.4 Guangzhou Mitsuba Electric (Wuhan) Co., Ltd.

6. Chinese Automotive Seat Motor Manufacturers

6.1 Johnson Electric

6.1.1 Profile

6.1.2 Operation

6.1.3 Automotive Seat Motor Business

6.2 Shenghuabo Group

6.2.1 Profile

6.2.2 Automotive Seat Motor Business

6.2.3 Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

6.2.4 Zhejiang SHB Automotive Appliance, Anhui Co., Ltd.

6.3 Founder Motor

6.3.1 Profile

6.3.2 Operation

6.3.3 Automotive Seat Motor Business

6.4 Others

6.4.1 Zhejiang Kefon Auto-Electric Co., Ltd.

6.4.2 Jiangsu Yidong Aviation Machinery Co., Ltd.

6.4.3 Zhangjiagang Heli Motor Co., Ltd.

6.4.4 Shenzhen Puda Motor Co., Ltd.

6.4.5 Shanghai Mansda Industrial Co., Ltd.

6.4.6 Ningbo Shuanglin Auto Parts Co., Ltd.

图:汽车座椅的构成

图:典型8向调节电动座椅按钮

图:典型10向调节的电动座椅

图:汽车座椅的电机分布原理图

图:汽车座椅调节系统及所用电机

图:2012-2017年全球汽车座椅用直流有刷电机市场增速

图:2011-2022年全球汽车电动座椅电机出货量

图:2011-2022年全球汽车座椅电机销售收入

图:2017年全球座椅电机市场竞争格局

表:全球主要座椅电机厂商整车厂配套情况

图:2012-2022年中国汽车座椅电机出货量

图:2012-2022年中国汽车座椅电机销售收入

图:2012-2022年中国汽车座椅电机销量全球占比

表:全球主要座椅电机企业在中国的工厂

表:2017年中国主要座椅电机厂商产量

表:全球主要国家乘用车燃料消耗量标准

图:汽车座椅机构件轻量化趋势

图:汽车座椅调节电机轻量化趋势

图:汽车座椅腰托轻量化趋势

图:2012-2022年全球汽车产量

图:2010-2017年全球汽车产量结构

表:2012-2017年全球汽车(分地区)产量

表:2017年全球主要国家汽车产量TOP20

图:2012-2022年全球汽车销量

表:2012-2017年全球汽车(分地区)销量

表:2012-2017年全球主要国家汽车销量TOP10

图:2012-2022年中国汽车销量及增速

图:2010-2018年中国乘用车销量

图:2010-2018年中国商用车销量

图:2016-2017年中国SUV(分价格)销量构成

图:2016-2017年中国轿车(分价格)销量构成

图:2017年中国乘用车生产企业销量Top10

表:2017年中国乘用车(分车型)品牌销量Top10

图:2017年中国乘用车(分国别)销量构成

表:2017年全球销量前十B级轿车电动座椅配套

表:全球乘用车(分排量)电动座椅配置

图:2013-2022年全球汽车座椅市场规模

图:2015-2022年中国汽车座椅市场规模

表:2014-2017年全球主要汽车座椅厂商销售收入

图:2017年北美乘用车汽车座椅市场竞争格局

图:2017年欧洲乘用车汽车座椅市场竞争格局

图:2017年日本乘用车汽车座椅市场竞争格局

图:2017年Toyota汽车座椅供应商分布

图:2017年Honda汽车座椅供应商分布

图:2017年Nissan汽车座椅供应商分布

图:2017年VW汽车座椅供应商分布

图:2017年BMW汽车座椅供应商分布

图:2017年BENZ汽车座椅供应商分布

图:2017年GM汽车座椅供应商分布

图:2017年Ford汽车座椅供应商分布

图:2017年HYUNDAI汽车座椅供应商分布

表:中国主要汽车座椅厂家与整车厂配套

图:2017年中国乘用车汽车座椅市场竞争格局

图:2017年SAIC汽车座椅供应商分布

图:2017年FAW汽车座椅供应商分布

图:2017年CHANGAN汽车座椅供应商分布

图:2017年Dongfeng汽车座椅供应商分布

图:2017年BAIC汽车座椅供应商分布

图:电产业务结构

图:2011-2017财年电产收入

图:2008-2017财年电产分产品收入

图:2013-2015财年电产分地区收入

图:201-2017财年电产分地区收入

图:电产电机在汽车上的应用

表:电产主要汽车电机研发基地

图:2016-2017财年电产汽车及工业应用部门营业收入及营业利润

图:2016-2020财年电产汽车电机细分产品出货量

图:日本电产生产的座椅电机

表:日本电产生产的座椅电机参数

图:日本电产大连工厂生产的座椅电机

图:万宝至i主要电机产品

图:万宝至全球布局

图:2012-2018年万宝至收入及营业利润

表:2018年万宝至发展规划

图:2013-2017年万宝至分产品收入构成

图:2013-2017年万宝至分地区收入构成

图:万宝至微电机在汽车电装领域的应用

图:万宝至微电机在车载用AV领域的应用

图:2016-2017年万宝至汽车微电机产品收入

图:2016-2017年万宝至汽车中型电机产品收入

图:2014-2018年万宝至中型汽车电机收入

表:2017年万宝至在华主要电机生产基产能

图:万宝至座椅调节电机

表:万宝至座椅调节电机参数

图:2011-2018年Mabuchi座椅电机收入

图:2006-2017年博泽收入

图:2013-2017年博泽分业务收入构成

图:2017年博泽(分地区)营业收入构成

图:2009-2017年博泽在华销售收入

表:博泽在华主要分支机构

表:博泽集团座椅电机及参数

图:阿斯莫海外布局

图:2012-2017财年阿斯莫净收入

表:阿斯莫在华子公司

表:阿斯莫电机在汽车上的应用

图:2013年东京车展上阿斯莫展出的座椅电机

表:2017年天津阿斯莫汽车微电机有限公司主要产品产能

图:2009-2017年博世收入及增长率

图:2009-2017年博世在华收入

图:2009-2017年博世净利润

图:2017年博世分部门收入

图:2011-2017年博世(分地区)营收占比

图:2012-2017财年三叶电机营收

图:Y2017财年三叶电机分业务收入构成

图:2015-2017财年三叶电机分地区收入构成

图:2012-2017财年三叶电机在华收入及全球占比

图:三叶电机汽车电机的应用

图:三叶电机主要汽车电机产品

表:三叶电机生产座椅电机的工厂/子公司

图:德昌电机全球生产基地分布

图:德昌电机发展历程

图:2011-2018财年德昌电机收入及净利润

图:2011-2018财年德昌电机分业务收入构成

图:2018财年德昌电机分地区收入构成

图:德昌电机座椅调节电机

图:德昌电机轻量型座椅电机产品

图:德昌汽车座椅电机重量

图:德昌电机紧凑型座椅电机产品

图:德昌电机腰部支撑调节电机

图:德昌电机座椅安全带预紧驱动电机

图:胜华波集团主要业务

表:胜华波集团座椅电机发展历程

表:胜华波集团座椅电机主要配套车型

表:胜华波集团座椅电机参数及外观

图:上海胜华波汽车电器有限公司座椅电机产品

图:2008-2018年上海胜华波汽车电器有限公司座椅电机产量

图:2017年上海胜华波汽车电器有限公司座椅电机(分地区)销量结构

表:上海胜华波汽车电器有限公司座椅电机(分地区)主要客户

图:2010-2018年方正电机收入及净利润

图:2010-2017年方正电机分产品收入构成

图:2010-2017年方正电机分地区收入构成

表:2017年前5大客户收入

图:2011-2017年方正电机毛利率

表:科锋电机汽车座椅电机参数及外观

Composition of Automotive Seat

Typical 8-way Adjustable Power Seat Buttons

Typical 10-way Adjustable Power Seat

Schematic Diagram for Motor Distribution of Automotive Seating

Automotive Seat Regulating System and Motors Used

Growth Rate of Global Automotive Seat-use DC Brush Motor Market, 2012-2017

Global Automotive Power Seat Motor Shipment, 2011-2022E

Global Automotive Seat Motor Revenue, 2011-2022E

Competitive Landscape of Global Seat Motor Market, 2017

Supply Relationship between Global Major Seat Motor Manufacturers and Automakers

China’s Automotive Seat Motor Shipment, 2012-2022E

China’s Automotive Seat Motor Revenue, 2012-2022E

Global Share of China’s Automotive Seat Motor Sales Volume, 2012-2022E

Lightweight Trend of Automotive Seat Mechanical Parts

Lightweight Trend of Automotive Seat Adjustment Motors

Lightweight Trend of Automotive Seat Lumbar Support

Global Automobile Output, 2012-2022E

Global Automobile Output Structure, 2010-2017

Global Automobile Output (by Region), 2012-2017

Top 20 Countries by Automobile Output, 2017

Global Automobile Sales Volume, 2012-2022E

Global Automobile Sales Volume (by Region), 2010-2017

Top 10 Countries by Automobile Sales Volume, 2012-2017

China’s Automobile Sales Volume and Growth Rate, 2012-2022E

China’s Passenger Car Sales Volume, 2011-2018E

China’s Commercial Vehicle Sales Volume, 2010-2018E

China’s SUV Sales Volume Structure (by Price), 2016-2017

China’s Sedan Sales Volume Structure (by Price), 2016-2017

Top 10 Passenger Car Manufacturers in China by Sales Volume, 2017

Top 10 Passenger Car Brands (by Model) in China by Sales Volume, 2017

China’s Passenger Car Sales Volume Structure (by Country), 2017

Global Top 10 Power Seats for Midsize Cars by Sales Volume, 2017

Global Automotive Seat Market Size, 2013-2022E

China’s Automotive Seat Market Size, 2015-2022E

Competitive Landscape of Passenger Car Seating Market in North America, 2017

Competitive Landscape of Passenger Car Seating Market in Europe, 2017

Competitive Landscape of Passenger Car Seating Market in Japan, 2017

Distribution of Toyota’s Automotive Seat Suppliers, 2017

Distribution of Honda’s Automotive Seat Suppliers, 2017

Distribution of Nissan’s Automotive Seat Suppliers, 2017

Distribution of VW’s Automotive Seat Suppliers, 2017

Distribution of BMW’s Automotive Seat Suppliers, 2017

Distribution of BENZ’s Automotive Seat Suppliers, 2017

Distribution of GM’s Automotive Seat Suppliers, 2017

Distribution of Ford’s Automotive Seat Suppliers, 2017

Distribution of HYUNDAI’s Automotive Seat Suppliers, 2017

Competitive Landscape of Chinese Passenger Car Seating Market, 2017

Distribution of SAIC’s Automotive Seat Suppliers, 2017

Distribution of FAW’s Automotive Seat Suppliers, 2017

Distribution of Changan’s Automotive Seat Suppliers, 2017

Distribution of Dongfeng’s Automotive Seat Suppliers, 2017

Distribution of BAIC’s Automotive Seat Suppliers, 2017

Nidec’s Business Structure

Nidec’s Net Revenue, FY2011-FY2017

Nidec’s Net Revenue (by Product), FY2008-FY2017

Nidec’s Revenue and Structure (by Region), FY2013-FY2015

Nidec’s Revenue and Structure (by Region), FY2016-FY2017

Application of Nidec’s Motors in Automobiles

Nidec’s Major Automotive Motor R & D Bases

Revenue and Operating Income of Nidec’s Automobile and Industrial Application Division, FY2016-FY2017

Automotive Motor Shipments of Nidec by Product, FY2016-FY2020

Seat Motors Produced by Nidec

Seat Motors Produced by Nidec’s Dalian Factory

Mabuchi’s Major Motor Products

Mabuchi’s Global Footprint

Mabuchi’s Revenue and Operating Income, 2012-2018

Mabuchi’s Development Plan, 2018E

Mabuchi’s Revenue Structure (by Product), 2013-2017

Mabuchi’s Revenue Structure (by Region), 2013-2017

Application of Mabuchi’s Micro-motors in Automotive Electrical Equipment Field

Application of Mabuchi’s Micro-motors in Automotive AV Field

Revenue Structure of Mabuchi’s Automotive Micro-motors (by Product), 2016-2017

Revenue Structure of Mabuchi’s Automotive Medium Motors (by Product), 2016-2017

Revenue of Mabuchi’s Medium Automotive Motors, 2014-2018E

Output of Mabuchi’s Major Motor Production Bases in China, 2017

Mabuchi’s Seat Adjustment Motors

Parameters of Mabuchi’s Seat Adjustment Motors

Mabuchi’s Seat Motor Revenue, 2011-2018E

Brose’s Revenue, 2006-2017

Brose’s Revenue Structure (by Business), 2013-2017

Brose’s Revenue Structure (by Business), 2017

Brose’s Revenue in China, 2009-2017

ASMO’s Overseas Footprint

ASMO’s Net Sales, FY2012-FY2017

Seat Motors Displayed by ASMO on Tokyo Auto Show, 2013

Capacity of Main Products of Tianjin ASMO Automotive Small Motor Co., Ltd., 2017

Bosch’s Revenue and Growth Rate, 2009-2017

Bosch’s Revenue and Growth Rate in China, 2009-2017

Bosch’s Net Income, 2009-2017

Bosch’s Revenue (by Division), 2017

Bosch’s Revenue Structure (by Region), 2011-2017

MITSUBA’s Operation, FY2012-FY2017

MITSUBA’s Revenue Structure (by Business), FY2017

MITSUBA’s Revenue (by Region), FY2015-FY2017

MITSUBA’s Revenue in China and Global Share, FY2012-FY2017

Application of MITSUBA’s Automotive Motors

MITSUBA’s Main Automotive Motors

Global Distribution of Johnson Electric’s Production Bases

Development Course of Johnson Electric

Revenue and Gross Profit of Johnson Electric, FY2011-FY2018

Revenue of Johnson Electric (by Business), FY2011-FY2018

Revenue Structure of Johnson Electric (by Region), FY2018

Seat Adjustment Motors of Johnson Electric

Lightweight Seat Motors of Johnson Electric

Automotive Seat Motor Weight of Johnson Electric

Compact Seat Motors of Johnson Electric

Lumbar Support Adjustment Motors of Johnson Electric

Seat Belt Pretensioner Drive Motors of Johnson Electric

Key Business of Shenghuabo Group

Seating Motor Products of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

Output of Seating Motor of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd., 2008-2018E

Sales Volume Structure of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd. b Region, 2017

Major Clients of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd. by Region

Revenue and Net Income of Founder Motor, 2010-2018

Revenue of Founder Motor (by Product), 2010-2017

Revenue Structure of Founder Motor (by Region), 2010-2017

Revenue from Top 5 Customers of Founder Motor, 2017

Gross Margin of Founder Motor, 2011-2017

Plants of Global Major Seat Motor Enterprises in China

Output of Major Seat Motor Manufacturers in China, 2017

Passenger Car Fuel Consumption Standards in Major Countries

Power Seat Configuration for Global Passenger Car (by Displacement)

Revenue of Global Major Automotive Seat Manufacturers, 2014-2017

Relationship between Chinese Major Automotive Seat Manufacturers and Automakers

Parameters of Seat Motors Produced by Nidec

Brose’s Major Branches in China

Brose’s Seat Motors and Parameters

ASMO’s Subsidiaries in China

Application of ASMO’s Motors in Automobiles

MITSUBA’s Seat Motor Factories / Subsidiaries

Seat Motor Development Course of Shenghuabo Group

Main Vehicle Models Supported by Seat Motors of Shenghuabo Group

Parameters and Appearance of Seat Motors of Shenghuabo Group

Parameters and Appearance of Automotive Seat Motors of Kefon Auto-Electric

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|