ADAS and Autonomous Driving Industry Chain Report 2018 - Automotive Vision, about 240 pages, highlights the followings:

Overview of the automotive camera industry;

Overview of the automotive camera industry;

Lane detection function;

Lane detection function;

Autonomous Emergency Braking (AEB);

Autonomous Emergency Braking (AEB);

Night vision system and intelligent headlight;

Night vision system and intelligent headlight;

Driver monitoring system (DMS);

Driver monitoring system (DMS);

Study into foreign automotive vision companies;

Study into foreign automotive vision companies;

Study into Chinese automotive vision companies

Study into Chinese automotive vision companies

Automotive vision enterprises fall into two parts: car camera-related companies; the enterprises that are engaged in visual software development based on car camera to help achieve specific ADAS and autonomous driving functions.

Car camera is the one installed on the car to realize sundry image acquisition and video recording functions, mainly covering inner-view camera, rear-view camera, front-view camera, side-view camera, and surround-view camera. As a main sensor of ADAS autonomous driving era, the camera is widely used in lane detection, traffic sign recognition, obstacle monitoring, pedestrian recognition, fatigue driving monitoring, occupant monitoring, rear-view mirror replacement, reverse image, 360-degree panorama and so forth.

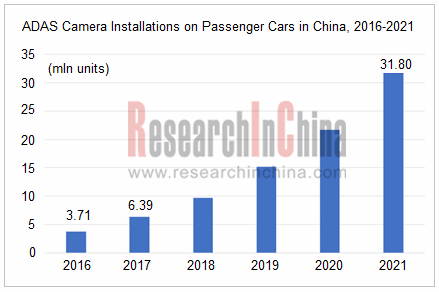

Camera installations amounted to 6.39 million units in the Chinese passenger car market in 2017, and the figure is expected to grow to 31.80 million units by 2021 with an AAGR of 49.3%, according to ResearchInChina.

The camera is mainly used for reverse image (rear view) and 360-degree panoramic view (surround view). And then forward- and inner-view cameras will become the main growth drivers. Major applications of the front-view camera are FCW, LDW and AEB, while the inner-view camera the driver monitoring system.

Being capable of capturing static images and videos, the camera, the most important imaging device, is primarily made up of lens, motor, filter, image sensor, and image signal processor (ISP).

Lens: Sunny Optical Technology, a leading automotive lens manufacturer in the world, shipped 18 million lenses in the first half of 2018. It has been a supplier of automotive lens for Magna, Continental, Delphi, Mobileye, Autoliv, Steel-mate, TTE, Panasonic and Fujitsu. The company also forays into the field of LiDAR optical parts.

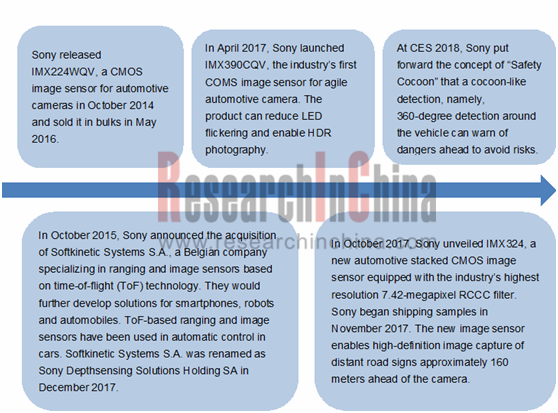

Image sensor: ON Semiconductor and Sony are leaders, with the former sweeping a 44% share of the automotive image sensor market. Getting back into black ink by virtue of image sensor, Sony has continued to expand image sensor production capacity in recent years with heavy investment in automotive image sensor.

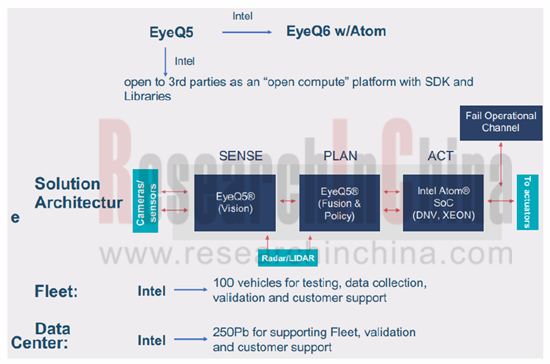

As an ADAS vendor, Mobileye stays far ahead of its global peers. The company has not only developed eyeQ series vision-based ADAS chips but made layout of REM map and RSS model, leaving its rivals far behind.

To keep its competitive edges in ADAS field, Mobileye also improves its layout in the autonomous driving field by integrating with Intel system. Mobileye’s ADAS solutions in 2018 feature 8 cameras and an improved redundancy design for perception link, leaving interfaces for LiDAR and MMW radar, and therefore realizing full perception for automated driving.

Mobileye Integration with Intel

The majority of Chinese vision ADAS vendors are the followers of Mobileye which has successfully turned to a provider of autonomous driving solutions from an ADAS supplier by way of being acquired by Intel. Having to seek for a transition, Chinese vision ADAS vendors can take the following three paths into account.

Firstly, the providers of partial ADAS function solutions grow to become providers of comprehensive autonomous driving and intelligent connected vehicle solutions (TIER 1) by means of mergers. Suzhou INVO Automotive Electronics, a leading player in vision ADAS, is hard to sustain growth and hit the ceiling if it develops on its own. TUS International (872.HK) with the background of Tsinghua University forays into intelligent and connected business through acquiring Suzhou INVO Automotive Electronics and taking over Telit’s in-vehicle communication business for USD105 million. TUS International is anticipated to become an important Tier1 vendor in the intelligent connected field in China if it continues to stage mergers and acquisitions in fields like sensor and chip, and to enrich its product portfolios.

Next, vision ADAS vendors may become providers of mobility service technology solutions like ZongMu Technology which starts from surround-view business to tap into automated parking and then foray into mobility services. The OEMs are successively transferring to be providers of mobility services, to which ZongMu Technology supplies mobility service technology solutions. ZongMu Technology attempts to break through the technical chains about autonomous driving mobility and service eco-system.

Last, products with core technologies are focused. For instance, Horizon Robotics prioritizes AI chip and Beijing SmarterEye has binocular stereo camera as its hit product. Most suppliers boasting core technologies will be ultimately either merged or acquired by the listed companies, while those that fail to forge core competitiveness will be knocked out.