《2018 ADAS与自动驾驶产业链研究——商用车自动驾驶产业篇》共约195页,包括下面的内容:

商用车自动驾驶产业综述

商用车自动驾驶产业综述

商用车自动驾驶技术,阶段和成本

商用车自动驾驶技术,阶段和成本

卡车编队自动驾驶

卡车编队自动驾驶

国外商用车自动驾驶方案供应商

国外商用车自动驾驶方案供应商

国内商用车自动驾驶方案供应商

国内商用车自动驾驶方案供应商

国外商用车企业的自动驾驶布局

国外商用车企业的自动驾驶布局

国内商用车企业的自动驾驶布局

国内商用车企业的自动驾驶布局

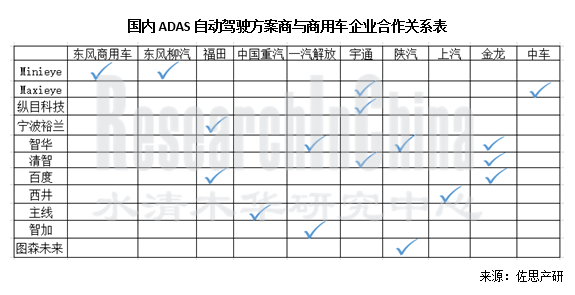

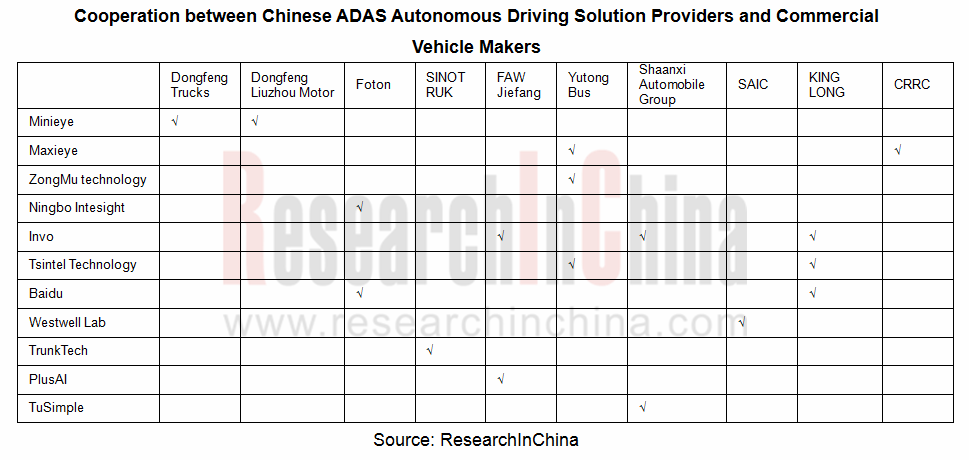

随着《营运客车安全技术条件》新标准的推行,中国商用车ADAS市场开始起飞,径卫视觉、Maxieye、Minieye、智华等初创企业开始获得数千万甚至上亿的营收。

商用车自动驾驶方面,国内涌现了西井、主线、智加、图森未来、飞步等方案公司,他们大多数投身于港口卡车无人化, 提供无人驾驶集装箱卡车解决方案。国内港区集卡市场超过2万辆,一位集装箱卡车司机每年成本约30万,存在自动驾驶替代的刚需。

自动驾驶进入任何一个特定场景,都存在着各种各样的挑战,譬如无人驾驶集卡需按照港区内生产逻辑和码头管理系统直接对接,与桥吊、轮胎吊等设备交互。听起来是固定路线无人驾驶,实际上港口码头堆放的集装箱被来来回回吊装之后,不到半天就会变成全新的行驶环境。

商用车自动驾驶率先落地于港口集卡,这和低速自动驾驶率先落地于无人配送,有着相同的内在逻辑。封闭区域、低速行驶、人工成本压力、中国发达的电商和物流大环境,都是推动因素。

商用车自动驾驶方案公司往往和商用车制造企业合作,共同进军某个特定市场。

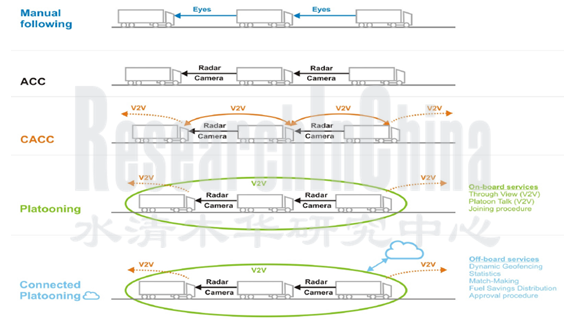

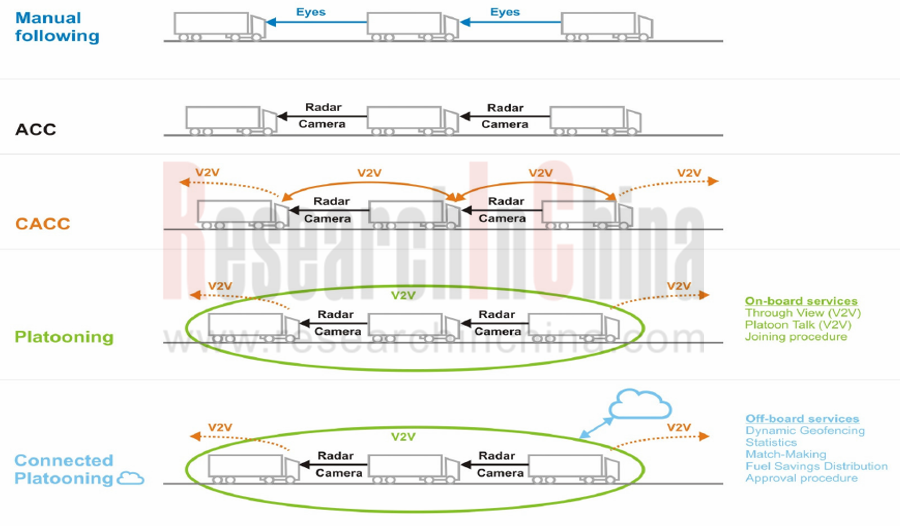

货运的最初几公里和最后几公里无人驾驶市场起步之后,规模庞大得多的高速公路无人驾驶卡车市场也将缓慢启动。而卡车自动驾驶的最初实现方式就是编队行驶——头车有司机,后面跟随的卡车可以没有司机。

而编队行驶将经历CACC、Platooning、Connected Platooning等阶段。

欧洲在编队行驶方面是领先者,不仅单个车企开展Platooning测试,多车企也组织跨品牌卡车的编队行驶测试,甚至还举办了欧洲卡车编队挑战赛。中国企业在编队行驶方面亟需迎头赶上。

自动驾驶市场惊人的庞大,但是落地之路充满各种困难和挑战,商业化进程比预想的缓慢。可喜的是,中国市场涌现了全球数量最多的自动驾驶初创团队,他们和传统车企密切合作,切入各个细分领域,正日以继夜的解决各种技术难题。如同中国电动汽车市场已经成为全球最大,中国的自动驾驶市场也必然是全球最大的市场。

ADAS and Autonomous Driving Industry Chain Report 2018 - Commercial Vehicle Automated Driving, about 195 pages, covers the following:

Overview of autonomous commercial vehicle industry

Overview of autonomous commercial vehicle industry

Technologies, stages and costs of autonomous commercial vehicle

Technologies, stages and costs of autonomous commercial vehicle

Truck platooning autonomous driving

Truck platooning autonomous driving

Foreign commercial vehicle automated driving solution providers

Foreign commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Layout of foreign commercial vehicle makers in autonomous driving

Layout of foreign commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

With the enforcement of the new standard Safety Specifications for Commercial Bus, the commercial vehicle ADAS market in China springs up, and start-ups such as Roadefend, Maxieye, Minieye and INVO have earned the revenue of tens of millions or even hundreds of millions of yuan.

In terms of autonomous commercial vehicle, solution providers such as Westwell Lab, TrunkTech, PlusAI, TuSimple and FABU Technology have arisen. Most of them are committed to unmanned port trucks with autonomous container truck solutions. In China, there are more than 20,000 container trucks at ports, and each driver is paid about RMB300,000 per year, an opportunity for autonomous driving replacement.

There are many challenges for the access of autonomous driving to any particular scenario. For instance, driverless container trucks need to be in line with the production logic and dock management system of ports and interact with bridge cranes, tire cranes and other equipment. It sounds like autonomous driving along fixed routes. In fact, a new driving environment will be created in less than half a day after the containers stacked at ports are hoisted back and forth.

Autonomous commercial vehicles are first seen as port container trucks, which is quite similar to low-speed automated vehicle applied for driverless delivery. Closed areas, low-speed driving, the rising labor costs as well as the developed e-commerce and logistics in China are all driving factors.

Commercial vehicle automated driving solution providers often partner with commercial vehicle manufacturers to enter a target market.

After the first-kilometers and last-kilometers unmanned freight market starts, the much larger freeway autonomous truck market will grow in a progressive way. Initially, autonomous trucks will be realized through platooning -- the first truck is manipulated by a driver while the following trucks are not.

Platooning will go through CACC, Platooning, Connected Platooning and other stages.

Europe is a leader in platooning. Individual carmakers conduct Platooning tests, and multiple automakers organize cross-brand trucks for driving tests and even hold European Truck Platooning Challenge. There is an urgent need for Chinese companies to catch up in this field.

The amazingly huge autonomous driving market is full of difficulties and challenges to ground, and the commercialization process is slower than expected. Fortunately, the Chinese market has witnessed the world's largest number of autonomous driving start-ups that work closely with traditional automakers to step into various segments and solve all technical problems around the clock. Like Chinese electric vehicle market which is the largest in the world, China's autonomous driving market is bound to be the biggest one around the globe.

第一章 商用车自动驾驶产业综述

1.1 主动安全与ADAS成为法规强制要求

1.2 《2018营运货车安全技术新标准》

1.3 国内主动安全/ADAS法规迅速推进

1.4 商用车自动驾驶参考架构

1.5 商用车自动驾驶演进路线

1.6 商用车自动驾驶典型应用场景

1.7 商用车典型应用场景技术解决方案

1.8 商用卡车自动驾驶路线图

1.9 商用车自动驾驶关键挑战

1.10 多数卡车行业问题都可以通过自动驾驶来解决

1.11 港口无人驾驶卡车

………………

第二章 商用车自动驾驶技术,阶段和成本

2.1 商用车自动驾驶的技术和发展阶段

2.1.1 商用车自动驾驶技术:从感知、决策到控制

2.1.2 自动驾驶卡车的关键技术

2.1.3 自动驾驶商用车的预期发展路径

2.1.4 卡车自动驾驶分阶段进行

2.1.5 L0-L5每个阶段需要哪些功能

2.2商用车需要的ADAS功能

2.2.1 卡车最基础的ADAS功能

2.2.2 Volvo商用车ADAS

2.3 卡车自动驾驶成本分析

2.3.1 卡车自动驾驶对营运成本的影响

2.3.2 卡车自动驾驶的三个应用案例

2.3.3 应用案例中的自动驾驶系统投资回收期计算

2.3.4 车辆编队对投资回收期的影响

2.4 自动驾驶卡车面临挑战和影响

2.4.1 对卡车行业利益相关者的影响

2.4.2 不同利益相关者的技术推动和拉动

………………

第三章 商用车编队自动驾驶

3.1卡车编队简介

3.1.1 自动驾驶卡车编队关键部件

3.1.2 卡车编队技术:卡车连接

3.1.3 卡车编队技术:CACC(Cooperative Adaptive Cruise Control)

3.1.4 车辆编队技术:从ACC、CACC到Connected Platooning

3.1.5 卡车CACC 系统设计结构

3.1.6 协同卡车编队空气动力学

3.2 卡车编队行驶的参与者

3.2.1 大型车队运营商在编队行驶中有竞争优势

3.2.2 编队行驶领域的参与者一览

3.3 卡车编队的商业价值和社会价值

3.4 卡车编队的实施步骤

3.5 欧洲卡车编队发展情况

3.5.1 欧洲卡车编队自动驾驶的路线图

3.5.2 欧洲卡车编队挑战赛ETPC

3.5.3 欧洲的多品牌卡车编队项目

3.5.4 欧洲的卡车编队项目:Sweden4Platooning

3.5.5 欧洲的卡车编队项目:ENSEMBLE项目

3.5.6 芬兰挪威合作卡车编队测试

3.6 美国的卡车编队项目

3.6.1 美国FHWA-FMCSA卡车编队项目

3.6.2 美国九个州允许测试,20多个州有兴趣

………………

第四章 国外商用车自动驾驶方案供应商

4.1 Starsky Robotics

4.1.1 Starsky Robotics技术方案

4.2 Embark

4.2.1 Embark的Embark AI系统

4.3 Peloton Technology

4.3.1 Peloton 团队

4.3.2 Peloton 卡车编队行驶系统

4.3.3 Peloton PlatoonPRO

4.3.4 Peloton + Omnitracs加强了车队管理和编队编排

4.3.5 行业领导者对Peloton技术的投资

4.3.6 FCAM可减少71%的追尾事故发生

4.4 BestMile

4.4.1 BestMile移动出行平台核心引擎

4.4.2 BestMile移动出行平台体系架构

4.4.3 BestMile移动出行平台应用APP

4.4.4 BestMile自动驾驶车队管理解决方案

4.4.5 BestMile产品应用于自动驾驶巴士

4.4.6 BestMile具体解决方案:约车和微交通

4.4.7 多模态环境下的集成

4.4.8 BestMile价值链,客户及合作伙伴

4.4.9 BestMile合作项目

4.5 Oxbotica

4.5.1 Oxbotica产品

4.5.2 Oxbotica的自动驾驶项目

4.6 Einride

4.6.1 Einride产品T-Pod和T-Log

4.7 KeepTruckin

4.7.1 KeepTruckin产品

4.8 INRIX

4.8.1 INRIX自动驾驶道路规则平台

4.9 WABCO威伯科

4.9.1 WABCO公司发展轨迹

4.9.2 WABCO自动驾驶产品布局

4.9.2 WABCO自动驾驶产品布局

4.9.3 WABCO的OnGuardACTIVE

4.9.4 WABCO的ADAS系统

4.9.5 WABCO行业领先地位

4.10 Kodiak

………………

第五章 国内商用车自动驾驶方案供应商

5.1 清智科技

5.1.1 清智科技商用车AEB

5.1.2 清智科技商用车AEB系统结构及应用案例

5.1.3 清智科技特定场景自动驾驶

5.2 图森未来

5.2.1 图森未来核心技术和定位

5.2.2 进入港内集卡无人驾驶水平运输领域

5.3 西井科技

5.3.1 西井科技核心技术

5.3.2 西井科技产品及应用领域

5.4 逐影/飞步

5.4.1 核心技术

5.4.2 产品及发展战略

5.5 智加科技 Plus AI

5.5.1 智加科技核心技术和应用场景

5.5.2 智加科技产品应用案例

5.6 主线科技

5.6.1 主线科技无人驾驶电动卡车

5.7 长沙智能驾驶研究院——智能物流车及系统提供商

5.7.1 长沙智能驾驶研究院重型卡车自动驾驶

5.8 护航实业

5.8.1 护航实业客车应用方案

5.8.2 护航实业公交车应用方案

5.8.3 护航实业危化品运输车应用方案

5.8.4 护航实业货车应用方案

5.8.5 护航实业教练车应用方案

5.9 G7

………………

第六章 国外商用车企业的自动驾驶布局

6.1 德国大众汽车

6.1.1 大众推动的自动驾驶项目

6.1.2 AdaptIVe项目

6.1.3 L3PILOT项目

6.1.4 德国大众出行服务产品线路图

6.1.5 德国大众MaaS商用车辆

6.1.6 德国大众自动驾驶卡车布局

6.1.7 曼恩集团为高速公路施工研发的无人驾驶卡车

6.2 PACCAR

6.2.1 PACCAR重载卡车市场份额和行业排名

6.2.2 PACCAR财务数据

6.2.3 PACCAR新产品和新技术

6.2.4 PACCAR自动驾驶技术和卡车编队

6.3 Volvo

6.3.1 Volvo各部门财务状况

6.3.2 Volvo量产的主动安全系统

6.3.3 Volvo未来的卡车

6.3.4 Volvo商用车自动驾驶布局

6.4 戴姆勒

6.4.1 戴姆勒商用车自动驾驶布局

6.4.2 戴姆勒SuperTruck 1发展路线图

6.4.3 戴姆勒SuperTruck 1项目概览

6.4.4 戴姆勒SuperTruck 2项目挑战

6.4.5 戴姆勒SuperTruck 2项目发展步骤

6.4.6 戴姆勒SuperTruck 2项目阶段

6.4.7 戴姆勒自动驾驶卡车布局及合作伙伴

6.4.8 戴姆勒自动驾驶卡车ADAS路线图

6.5 SCANIA

6.5.1 SCANIA 2013-2017财务状况

6.5.2 SCANIA主营业务及市场状况

6.5.3 SCANIA自动驾驶解决方案

6.5.4 SCANIA自动驾驶卡车和巴士解决方案

6.5.5 SCANIA自动驾驶矿车、卡车和公共汽车

6.5.6 SCANIA自动驾驶测试

6.5.7 SCANIA自动驾驶卡车编队

………………

第七章 国内商用车企业的自动驾驶布局

7.1 福田汽车

7.1.1 福田汽车战略客户和全球合作伙伴

7.1.2 福田与百度合作推出自动驾驶卡车

7.1.3 福田获得国内首张商用车自动驾驶路测牌照

7.1.4 福田汽车智能驾驶布局

7.1.5 福田汽车商用车生态系统

7.2 东风汽车

7.2.1 东风汽车商用车应用场景规划

7.2.2 东风柳汽智能车规划

7.3 中国重汽

7.4 一汽解放

7.5 陕汽

7.6 上汽红岩

7.7 宇通客车

7.8 金龙客车

7.9 中车

………………

1 Overview of Commercial Vehicle Automated Driving Industry

1.1 Active Safety and ADAS Become Mandatory Requirements

1.2 Safety Specifications for Commercial Vehicle for Cargo Transportation (2018)

1.3 Domestic Laws on Active Safety and ADAS

1.4 Reference Architecture of Commercial Vehicle Automated Driving

1.5 Evolution of Commercial Vehicle Automated Driving

1.6 Typical Application Scenarios of Commercial Vehicle Automated Driving

1.7 Technical Solutions for Typical Application Scenarios of Commercial Vehicle Automated Driving

1.8 Roadmap of Commercial Truck Automated Driving

1.9 Key Challenges of Commercial Vehicle Automated Driving

1.10 Most Problems in Truck Industry Can Be Solved via Automated Driving

1.11 Port Driverless Truck

2 Technology, Stages and Costs of Commercial Vehicle Automated Driving

2.1 Technology and Development Stages of Commercial Vehicle Automated Driving

2.1.1 Commercial Vehicle Automated Driving Technology: Perception, Decision-making and Control

2.1.2 Key Technologies of Autonomous Truck

2.1.3 Expected Development Paths of Automated Commercial Vehicle

2.1.4 Truck Automated Driving by Stage

2.1.5 Functions in L0-L5

2.2 ADAS Functions Required by Commercial Vehicle

2.2.1 The Most Fundamental ADAS Functions on Truck

2.2.2 ADAS on Volvo Commercial Vehicles

2.3 Costs of Truck Automated Driving

2.3.1 Impact of Truck Automated Driving on Operating Costs

2.3.2 Three Application Cases of Truck Automated Driving

2.3.3 Calculation of Payback Period of Automated Driving in Application Cases

2.3.4 Impact of Vehicle Platooning on Payback Period

2.4 Challenges and Influence of Automated Truck

2.4.1 Impact on Stakeholders in Truck Industry

2.4.2 Technology Push of Different Stakeholders

3 Commercial Vehicle Platooning Autonomous Driving

3.1 Overview of Truck Platooning

3.1.1 Key Components for Autonomous Truck Platooning

3.1.2 Truck Platooning Technology: Truck Connection

3.1.3 Truck Platooning Technology: CACC (Cooperative Adaptive Cruise Control)

3.1.4 Vehicle Platooning Technology: from ACC, CACC to Connected Platooning

3.1.5 Design Structure of Truck CACC System

3.1.6 Cooperative Truck Platooning Aerodynamics

3.2 Participants in Truck Platooning

3.2.1 Competitive Edges of Large Fleet Operators in Platooning

3.2.2 List of Participants in Platooning Field

3.3 Business and Social Value of Truck Platooning

3.4 Procedures of Truck Platooning

3.5 Development of Truck Platooning in Europe

3.5.1 Roadmap of Truck Platooning Automated Driving in Europe

3.5.2 European Truck Platooning Challenge (ETPC)

3.5.3 Multi-brand Truck Platooning Programs in Europe

3.5.4 Truck Platooning Program in Europe: Sweden4Platooning

3.5.5 Truck Platooning Program in Europe: ENSEMBLE

3.5.6 Finland-Norway Truck Platooning Test

3.6 Truck Platooning Programs in the United States

3.6.1 FHWA-FMCSA Truck Platooning Program

3.6.2 Nine States Allow Tests and Over 20 States Are Interested in It

4 Foreign Providers of Commercial Vehicle Automated Driving Solutions

4.1 Starsky Robotics

4.1.1 Technology Solutions

4.2 Embark

4.2.1 Embark AI System

4.3 Peloton Technology

4.3.1 Peloton Team

4.3.2 Peloton Truck Platooning System

4.3.3 Peloton PlatoonPRO

4.3.4 Peloton + Omnitracs Strengthen Fleet Management and Platooning

4.3.5 Industry Leaders’ Investment into Peloton Technology

4.3.6 FCAM Reduces Rear-end Collisions by 71%

4.4 BestMile

4.4.1 Core Engine of BestMile Mobility Platform

4.4.2 System Architecture of BestMile Mobility Platform

4.4.3 APP of BestMile Mobility Platform

4.4.4 BestMile’s Solutions for Autonomous Fleet Management

4.4.5 Application of BestMile’s Products to Autonomous Bus

4.4.6 BestMile’s Specific Solutions: Ride-hailing and Micro-transit

4.4.7 Integration under Multi-mode Environment

4.4.8 Value Chain, Customers and Partners of BestMile

4.4.9 Cooperative Projects of BestMile

4.5 Oxbotica

4.5.1 Oxbotica’s Products

4.5.2 Oxbotica’s Automated Driving Programs

4.6 Einride

4.6.1 T-Pod and T-Log

4.7 KeepTruckin

4.7.1 KeepTruckin’s Products

4.8 INRIX

4.8.1 INRIX AV Road Rules Platform

4.9 WABCO

4.9.1 Development Course

4.9.2 Layout in Automated Driving Products

4.9.3 OnGuardACTIVE

4.9.4 ADAS System

4.9.5 Industry Leader

4.10 Kodiak

5 Chinese Commercial Vehicle Automated Driving Solution Providers

5.1 Tianjin Tsintel Technology Co., Ltd.

5.1.1 Tsintel’s Commercial Vehicle AEB

5.1.2 Architecture and Application Cases of Tsintel’s Commercial Vehicle AEB Systems

5.1.3 Tsintel’s Automated Driving Solutions for Specific Scenarios

5.2 Beijing TuSimple Future Technology Co., Ltd.

5.2.1 Core Technologies and Position

5.2.2 TuSimple Makes Inroad into the Field of Port Container Truck Autonomous Transportation

5.3 Shanghai Westwell Information Technology Co., Ltd.

5.3.1 Core Technologies

5.3.2 Products and Applications

5.4 Hangzhou Zhuying Technology Co., Ltd./Fabu Technology Limited

5.4.1 Core Technologies

5.4.2 Products and Development Strategy

5.5 PlusAI Inc.

5.5.1 Core Technologies and Application Scenarios

5.5.2 Application Cases

5.6 TrunkTech

5.6.1 TrunkTech’s Autonomous Electric Trucks

5.7 Changsha Intelligent Driving Research Institute – A Supplier of Intelligent Logistics Vehicles and Systems

5.7.1 Heavy Truck Automated Driving Solutions

5.8 Henan Huhang Industry Co., Ltd.

5.8.1 Coach Application Solution

5.8.2 Bus Application Solution

5.8.3 Hazardous Chemicals Transport Vehicle Application Solution

5.8.4 Truck Application Solution

5.8.5 Learner-driven Vehicle Application Solution

5.9 G7

6 Automated Driving Layout of Foreign Commercial Vehicle Companies

6.1 Volkswagen (VW)

6.1.1 VW’s Automated Driving Projects

6.1.2 AdaptIVe Project

6.1.3 L3PILOT Project

6.1.4 Roadmap of Mobility Services and Products

6.1.5 MaaS Commercial Vehicles

6.1.6 Autonomous Truck Layout

6.1.7 MAN SE’s Autonomous Trucks for Highway Construction

6.2 PACCAR

6.2.1 Share in Heavy Truck Market and Industry Ranking

6.2.2 Financial Data

6.2.3 New Products and Technologies

6.2.4 Automated Driving Technologies and Truck Platooning

6.3 Volvo

6.3.1 Financial Status by Division

6.3.2 Mass-produced Active Safety Systems

6.3.3 Future Trucks

6.3.4 Layout of Commercial Vehicle Automated Driving

6.4 Daimler

6.4.1 Layout of Commercial Vehicle Automated Driving

6.4.2 SuperTruck 1 Project – Development Roadmap

6.4.3 SuperTruck 1 Project – Overview

6.4.4 SuperTruck 2 Project – Challenges

6.4.5 SuperTruck 2 Project – Development Steps

6.4.6 SuperTruck 2 Project – Stages

6.4.7 Autonomous Truck Layout and Partners

6.4.8 Autonomous Truck ADAS Roadmap

6.5 SCANIA

6.5.1 Financial Status, 2013-2017

6.5.2 Operating Business and Market Status

6.5.3 Automated Driving Solutions

6.5.4 Autonomous Trucks and Bus Solutions

6.5.5 Autonomous Tramcar, Truck and Bus

6.5.6 Automated Driving Test

6.5.7 Autonomous Truck Platooning

7 Automated Driving Layout of Chinese Commercial Vehicle Companies

7.1 Beiqi Foton Motor Co., Ltd.

7.1.1 Strategic Clients and Global Partners

7.1.2 Foton and Baidu Cooperated to Launch Autonomous Trucks

7.1.3 Foton Acquired China’s First Commercial Vehicle Automated Driving Test License

7.1.4 Foton’s Intelligent Driving Layout

7.1.5 Foton’s Commercial Vehicle Ecosystem

7.2 Dongfeng Motor Corporation

7.2.1 Dongfeng’s Commercial Vehicle Application Scenario Planning

7.2.2 Intelligent Vehicle Planning of Dongfeng Liuzhou Motor Co., Ltd.

7.3 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUCK)

7.4 FAW Jiefang Automotive Co., Ltd.

7.5 Shaanxi Automobile Holdings Limited

7.6 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd.

7.7 Zhengzhou Yutong Bus Co., Ltd.

7.8 Xiamen King Long United Automotive Industry Co., Ltd.

7.9 CRRC Corporation Limited