《2018-2019全球自动驾驶仿真产业链研究报告》,对自动驾驶仿真产业进行了细分,包括仿真平台、车辆动力学仿真、传感器仿真、场景仿真、场景库等。

仿真技术离普通人生活很远,也非常难以理解,却正是中国汽车产业,以及中国智能制造需要重点突破的领域之一,也是值得重点投资的方向。

仿真技术是应用仿真硬件和仿真软件通过仿真实验,借助某些数值计算和问题求解,反映系统行为或过程的仿真模型技术。仿真技术在20世纪初已有了初步应用。如在实验室中建立水利模型,进行水利学方面的研究。20世纪40-50年代,航空、航天和原子能技术的发展推动了仿真技术的进步。20世纪60年代计算机技术的突飞猛进提供了先进的仿真工具,加速了仿真技术的发展。

自上世纪90年代起,模拟仿真和数字虚拟化技术已经成为汽车研发过程的关键手段和核心技术,基于数学模型的开发平台和基于数字模拟的开发方法已经成为了当今世界汽车技术研发的先进理念,并被广泛地采纳。

随着汽车智能化程度的不断提升,汽车研发的复杂程度也在不断增加,对汽车开发成本和开发周期的压力也随着不断增加,许多涉及汽车安全的新技术研发受外界环境影响和试验安全制约,难以有效地开展,传统的研发、测试和验证手段已不能适应。

自动驾驶要获得足够的安全验证,需要大规模可扩展的,能进行十亿级甚至上百亿公里的模拟测试服务。在实际测试过程中,由于真实道路测试效率较慢,目前很多车企都倾向于选择自动驾驶仿真测试。

一次行业论坛上,某位演讲嘉宾指出,自动驾驶测试的90%将通过仿真完成,9%通过测试场完成,只有1%到实际道路上进行。

所谓自动驾驶仿真测试,指通过传感器仿真、车辆动力学仿真、高级图形处理、交通流仿真、数字仿真、道路建模等技术模拟路测环境,并添加算法,搭建相对真实的驾驶场景,来完成自动驾驶汽车测试工作的一种形式。

开发一个自动驾驶的系统,要经历软件仿真、硬件在环仿真、车辆在环仿真,再到室内实验室测试,到室外受控场地测试,最后到公共道路大规模道路测试。

德国美国主导汽车仿真行业

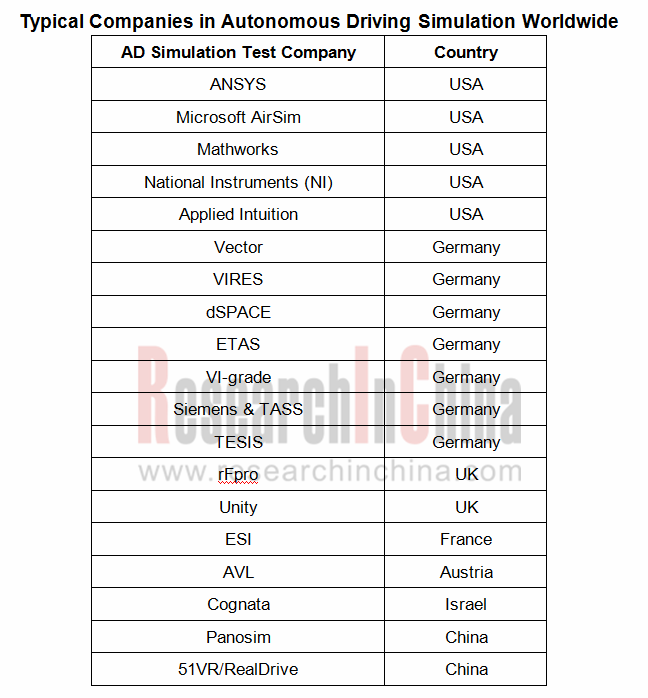

全球有数十家仿真测试公司,数量上以美国居首,在汽车领域德国企业最多。

自动驾驶仿真产业代表公司及所属国家

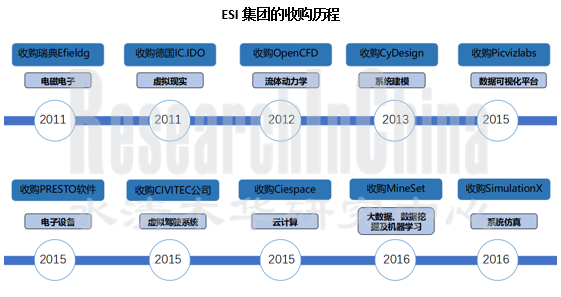

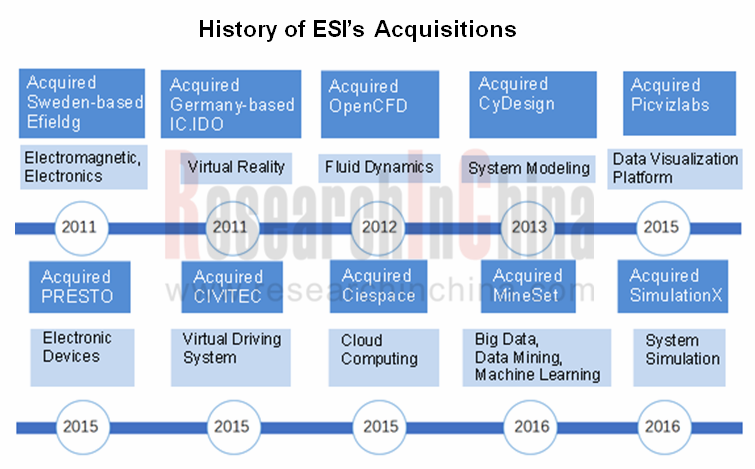

纵观仿真产业发展历程,不断产生新兴机会,不断涌现各种新兴公司。仿真巨头们均通过不断收购兼并,得以发展壮大,形成几十个甚至数百个产品类别,应用于数十个行业。

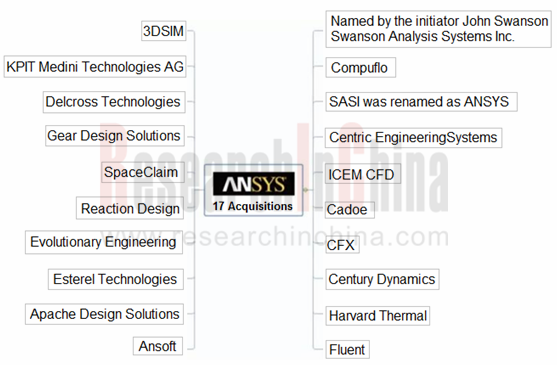

ANSYS通过十多次收购行业内外的公司,主导CFD市场、开发嵌入式代码,加强芯片封装设计、丰富内燃机仿真产品,并在2018年收购光学Optics公司,增强了激光雷达、摄像头和雷达等传感器的仿真技术,成为自动驾驶仿真市场的重量级企业。

自动驾驶仿真的市场潜力,吸引了汽车行业外的众多企业进入

自动驾驶测试需要各种交通场景仿真工具和海量的场景库,这是一个全新的市场,传统仿真巨头和初创公司、新进入者处于同一起跑线,因此吸引了游戏公司、VR/AR公司、互联网公司的进入。

2018年10月,以色列自动驾驶仿真初创公司Cognata完成1850万美元B轮融资,公司利用人工智能、深度学习和计算机视觉的结合,在其3D 模拟平台上重现了城市,为客户提供各种模拟现实世界测试驾驶的测试场景。奥迪通过旗下的奥迪智能驾驶公司(AID),与Cognata达成合作。

51VR成立于2015年,主要业务为三维仿真重建,从房地产垂直行业起步,之后业务拓展至汽车、教育和游戏等领域。2017年12月,51VR完成B轮2.1亿元融资。目前51VR在汽车领域的投入已接近100人,涵盖模拟驾驶体验(VR汽车)、汽车可视化、自动驾驶仿真平台三大模块,其中仿真平台团队占比过半。

百度Apollo仿真平台内置高精地图的仿真场景,支持感知、规划、控制多算法模块验证,让自动驾驶算法验证更为严谨。Apollo从1.5版本开始开放仿真平台,智行者等自动驾驶公司通过Apollo云端仿真能力提升效率、加快研发速度。李彦宏披露,百度Apollo未来可以卖高精度地图、卖仿真平台、卖计算硬件ACU,因此仿真平台将是百度无人驾驶平台的赢利点之一。

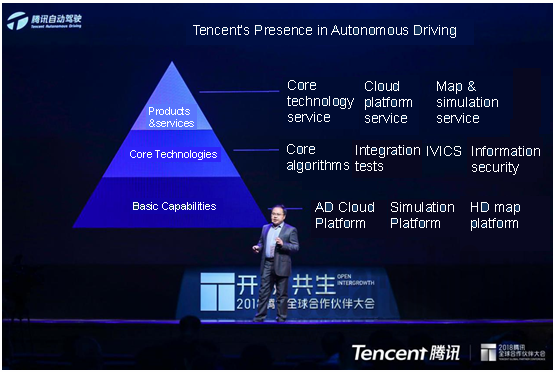

根据腾讯披露的自动驾驶布局,仿真平台是其三大基础能力之一,地图和仿真服务也是腾讯未来的三大赢利点之一。基于游戏引擎、虚拟现实、云游戏技术等优势,腾讯打造了虚实结合的模拟仿真系统TAD Sim,可以完成感知、决策、控制算法等实车上全部模块的闭环仿真验证。腾讯希望其模拟仿真平台可以帮助车企缩短开发时间,提高开发效率,帮助车企降低测试成本。

由于仿真软件涉及数百种产品类别,其中的切入机会很多。相较于底盘、汽车芯片等难关,以自动驾驶仿真为代表的(汽车)工业软件,或许是IT/AI/VR企业的绝佳投资入口。

It is in this report that the autonomous driving simulation industry is analytically expounded, ranging from simulation platform, vehicle dynamics simulation, sensor simulation, scenario simulation to scenario library.

Simulation technologies seem afar to people’s lives and are hard to understand for them, but it is a key domain in which breakthroughs are to be made for automotive sector, even intelligent manufacturing in China and it deserves heavy investments.

Simulation technology is the simulation model technology that reveals the system behaviors and process by way of simulation experiments and numerical computing with simulation hardware and software. Simulation technology found initial application in the early 20th century, taking example for the building of water conservancy model in laboratories for research of hydraulics. In 1940s-1950s, the burgeoning aviation & aerospace and atomic energy technologies conduced to advances in simulation technology. In 1960s, the computer technology flourished and the advanced simulation tools became available, which expedited evolution of simulation technology.

From 1990s on, simulation and digital virtualization technologies has been an integral crucial to the R&D of automobiles. The advanced idea to develop cars based on mathematical model and digital simulation has prevailed among the automakers worldwide.

The vehicle R&D becomes ever sophisticated as cars are going smarter and smarter, causing higher costs of vehicle development and a prolonged development cycle. Lots of new technologies about vehicle security are subject to external environment and test security restraints and are hard to be carried out effectively. Yet, the traditional means for R&D, tests and validation are out of date.

For adequate security validation, autonomous driving requires a great deal of scalable simulation testing service (billions of km and even to tens of billions of km). Actually, the real road test is featured with low efficiency, and many automakers favor selecting autonomous driving simulation tests.

It is pointed out by a guest speaker on an automobile forum that, 90 percent of autonomous driving tests will be done by simulation, 9 percent done in test fields, and 1 percent on real roads.

The so-called autonomous driving simulation tests are to test autonomous cars with technologies such as sensor simulation, vehicle dynamics simulation, advanced graphics processing, traffic flow simulation, numerical simulation and road modeling, and with algorithms to build the comparatively real driving scenarios.

Such processes must be undergone to develop an autonomous driving system, as software simulation, hardware in the loop (HiL), vehicle in the loop (VIL), indoors lab tests, outdoor test field, and to ultimately the massive tests on public roads.

The Vehicle Simulation Industry Dominated by German and American Companies

There are dozens of simulation test companies around the globe, among which America ranks first by the number of companies but Germany boast most simulation firms in the automotive sector.

It can be seen from the development course of simulation industry that new opportunities emerge all the time and the emerging companies have sprung up incessantly. Simulation tycoons have grown ever competitive through mergers and acquisitions and have developed dozens of and even hundreds of product categories which are applied in tens of industries.

Through over ten acquisitions on companies inside and outside the industry, ANSYS dominates the CFD market, develops the embedded codes, beefs up chip encapsulation design, and enriches internal combustion engine simulation products. ANSYS purchased OPTIS in 2018 and improved the simulation technologies about sensors like LiDAR, camera and radar.

The potentiality of the autonomous driving simulation market has allured the inrush of many enterprises outside the automotive sector.

Autonomous driving tests call for various traffic scenarios simulation tool and massive scenario library. This is a totally new market, bringing traditional simulation companies, startups and new entrants on a par, and attracting the inroads of game firms, VR/AR firms and internet firms.

In October 2018, Cognata -- the Israel-based autonomous driving simulation startup -- completed the B-round funding of $18.5 million. Cognata reproduces the cities on its 3D simulation platform by fusing artificial intelligence, deep learning and computer vision, and provides the customers with a variety of the driving test scenarios simulating the real world. AID (Autonomous Intelligent Driving GmbH) under Audi reached cooperation with Cognata.

Founded in 2015, 51VR was grown from real property market and then made its foray in automobile, education, games and other fields, and is now primarily focused on 3D simulation reconstruction. In December 2017, 51VR conducted its B-round funding of RMB210 million. For now, 51VR boasts nearly 100 talents in the automotive business covering three modules, i.e., simulated driving experience (VR car), vehicle visualization, and autonomous driving simulation platform, of which simulation platform team accounts for more than a half of its workforce.

Baidu Apollo simulation platform is in-built with simulation scenarios with HD maps in favor of multi-algorithm (sensing, planning and control) module verification, making the autonomous driving algorithm verification more rigorous. Apollo 1.5 version began to open its simulation platform, empowering autonomous driving companies like Idriverplus to significantly improve their efficiency in R&D via Apollo cloud simulation capabilities. Baidu Apollo could sell HD map, simulation platform, computing hardware ACU in future, said by Li Yanhong, the chairman of Baidu. So, simulation platform will be one of the profit points of Baidu self-driving platform.

In line with Tencent’s layout in autonomous driving, simulation platform is one of the three basic competencies; maps and simulation services will be one of three profit engines of Tencent in future. Thanks to its superiorities in game engine, virtual reality, cloud games technologies, etc., Tencent has successfully built the simulation system TAD Sim (virtual + real combination) that is capable of verifying the closed-loop simulation of all modules (like sensing, decision, control algorithm) of a real car. Tencent wishes its simulation platform can help the automakers shorten development cycle, improve development efficiency, and reduce the costs of tests.

Since simulation software involves with hundreds of product categories, into which there are many ways to go. In comparison with difficulties in chassis and vehicle chip, the (automotive) industrial software represented by autonomous driving simulation is possibly the best field where IT/AI/VR firms can make investments.

一、汽车仿真与自动驾驶仿真简介

1.1仿真技术概述

1.1.1 仿真技术的发展

1.1.2 汽车仿真技术

1.1.3 自动驾驶测试与仿真

1.1.4 驱动仿真测试发展的动力

1.2自动驾驶测试与仿真

1.2.1 仿真技术将成为自动驾驶的奠基技术

1.2.2 基于场景的ADAS/AD测试和验证工具链

1.2.3 自动驾驶仿真产业链构成

1.2.4 自动驾驶仿真涵盖内容

1.2.5 自动驾驶系统仿真模型

1.2.6 仿真测试系统的组成

1.2.7 仿真测试如何代替真实驾驶

1.2.8 引入仿真替代真实世界

1.3硬件在环和软件在环

1.3.1 硬件在环测试HIL

1.3.2 软件在环仿真流程

1.3.3 大众的软件在环仿真

1.3.4 宝马的软件在环仿真

1.3.5 奔驰的软件在环仿真

........................

二、自动驾驶仿真平台及公司研究

2.1 仿真测试平台介绍

2.1.1 仿真测试平台的组成

2.1.2 传统仿真企业和IT企业在仿真平台的竞争

2.2 驾驶模拟器

2.2.1 驾驶模拟器特点

2.2.2 驾驶模拟器在ADAS及AD的测试项目

2.2.3 驾驶模拟器与其他仿真测试工具的结合

2.3 ANSYS

2.3.1 ANSYS公司简介

2.3.2 ANSYS通过跨行业收购完善仿真行业产业链

2.3.3 ANSYS收购公司的背景

2.3.4 ANSYS自动驾驶相关产品

2.3.5 ANSYS收购OPTIS

2.3.6 ANSYS SCADE可生成满足ISO26262标准的认证代码

2.3.7 ANSYS Scade Suite—驾驶场景模型

2.3.8 ANSYS Scade Suite自动驾驶控制的仿真方案

2.3.9 ANSYS Scade Suite自动驾驶控制的仿真方案流程

2.3.10 ANSYS自动驾驶控制的仿真方案闭环

2.3.11 SCADE Suite自动驾驶控制的仿真测试展示

2.4 TASS PreScan

2.4.1 西门子收购Tass

2.4.2 西门子在自动驾驶测试方面的产品

2.4.3 TASS PreScan

2.4.4 PreScan 新版特征

2.4.5 PreScan仿真平台部分功能

2.4.6 PreScan支持的传感器类型和部分场景

2.4.7 Prescan支持的外部工具和软件

2.5 NVIDIA仿真平台

2.6 Gazebo

2.6.1 开源仿真模拟平台Gazebo

2.6.2 Gazebo功能和使用

2.7 Carla

2.7.1 Carla简介

2.7.2 Carla最新发布版本

2.8 中汽中心场景仿真平台

2.8.1 中汽中心驾驶仿真平台

2.8.2 中汽中心驾驶场景平台

2.9 Apollo仿真平台

2.9.1 Apollo分布式仿真平台

2.9.2 Apollo仿真引擎

2.9.3 Apollo开发资源数据集

2.9.4 Apollo仿真平台未来规划

2.10 Panosim

2.10.1 PanoSim 公司简介

2.10.2 主要产品

2.10.3 PanoSim基于物理模型和数值仿真

2.10.4 PanoSim 界面和功能

2.10.5 用PanoSim创建仿真实验的流程

2.10.6 新增雷达模型和GPS物理模型

2.10.7V2X和真值传感器功能升级

2.11.8 优化Simulink模型

2.10.9PanoSim总结

2.11 AirSim

2.11.1 AirSim简介

2.11.2 开源仿真模拟平台

2.12 VI-grade

2.12.1 VI-grade公司介绍

2.12.2 VI-grade产品体系

2.12.3 VI-grade在汽车行业的应用

2.12.4 VI-CarRealTime 汽车动力学实时仿真工具

2.12.5 汽车驾驶模拟器 VI-DriveSim

2.12.6 VI-grade与日本鹭宫制作所

2.12.7 Applus+ IDIADA采用DiM250

..................

三、车辆动力学仿真研究

3.1 MATLAB/Simulink

3.1.1 Mathworks简介

3.1.2 Matlab 与 Simulink

3.1.3 基于Simulink 的 AEB与FCW系统

3.1.4 ADST - 自动驾驶系统工具箱

3.1.5 Simulink 模型

3.1.6 Driving Scenario Designer

3.1.7 Vehicle Dynamics Blockset

3.1.8 Vehicle Dynamics Blockset的模块化行驶场景

3.1.9 Vehicle Dynamics Blockset用于闭环仿真测试的案例

3.1.10 在Voyage的应用案例

3.2 Simpack

3.2.1 Simpack实时仿真工具

3.2.2 Simpack Automotive 开放的建模结构及特点

3.2.3 Simpack Automotive 建模的特点

3.2.4 Simpack 的ADAS应用案例

3.3 TESIS DYNAware

3.3.1 德国TESIS公司介绍

3.3.2 ve-DYNA模型

3.3.3 DYNA4软件

3.3.4 DYNA4与enDYNA,veDYNA无缝对接

3.3.5 DYNA4软件功能

3.3.6 DYNA4的仿真场景

3.4 IPG Carmaker

3.5 AVL

3.5.1 AVL公司简介

3.5.2 AVL汽车测试仿真平台

3.5.3 AVL model.Connect

3.5.4 提供基于实际场景的ADAS仿真测试

四、HIL硬件在环仿真研究

4.1 NI国家仪器

4.1.1 NI 汽车解决方案

4.1.2 NI VRTS

4.1.3 NI 摄像头和V2X测试

4.2 ETAS

4.2.1ETAS的HiL系统

4.2.2ETAS虚拟仿真方案和工具

4.3 Vector

4.3.1VECTOR的ADAS开发工具链

4.3.2VECTOR的模型在环虚拟测试案例

4.4 dSPACE

4.4.1 dSPACE公司简介

4.4.2 dSPACE实时仿真系统简介

4.4.3 主要产品

4.4.4 dSPACE仿真工具链

五、场景仿真公司研究

5.1 场景库简介

5.1.1 智能驾驶汽车仿真测试对交通场景仿真的要求

5.1.2 标准化测试场景

5.1.3 标准化测试场景测量若干参数

5.2VTD

5.2.1 德国VIRES公司

5.2.2 VTD仿真工具

5.2.3 基于VTD环境模拟的三个标准

5.2.4 OPEN DRIVE标准的组成和优势

5.2.5 Open Drive的使用情况

5.2.6 OpenDrive格式地图数据解析

5.2.7 在Open Drive 中建立地图坐标系

5.2.8 OpenDrive-Reference Line建设

5.2.9 OpenDrive-Lane建设

5.2.10 OpenDrive-完整道路模型展示

5.2.11 Open CRG的仿真应用在车辆控制、驾驶舒适度等方面

5.2.12 Open CRG-工作流程

5.2.13 Open–SCENARIO标准

5.3 Pro-SiVIC

5.3.1 ESI公司简介

5.3.2 ESI 公司产品

5.3.3 ESI集团通过收购和整合,增强仿真核心技术

5.3.4 Pro-SiVIC简介

5.3.5 Pro-SiVIC提供的交通场景和传感器模型

5.3.6 使用Pro-ViSIC仿真对合成图像处理的过程

5.3.7 使用Pro-ViSIC仿真对合成图像处理的结果

5.4 rFpro

5.4.1 rFpro公司简介

5.4.2 rFpro对试验场的高精度虚拟建模

5.4.3 rFpro研发高精度虚拟建模

5.5 Cognata

5.5.1 Cognata简介

5.5.2 Cognata自动驾驶仿真平台

5.5.3 Cognata与英伟达达成合作

5.651VR/RealDrive

5.6.1 51VR简介

5.6.2 51VR团队介绍

5.6.3 51VR自动驾驶仿真平台虚拟仿真的途径

5.6.4 51World战略

5.6.5 RealDrive瞄准无人驾驶仿真测试

5.7 Parallel Domain

5.7.1 Parallel Domain简介

5.7.2 Parallel Domain仿真平台

5.7.3 Parallel Domain虚拟世界如何生成

5.8 Metamoto

5.9 AAI

5.10 Applied Intuition

...................

六、传感器仿真公司研究

6.1 MonoDrive

6.1.1 MonoDrive公司简介

6.1.2 monoDrive的传感器模拟器

6.1.3 MonoDrive的仿真测试的流程

6.2 RightHook

6.2.1 RightHook简介

6.2.2 回放式模拟和高精度地图模拟

6.2.3 基于高精度地图的模拟仿真系统

6.3 OPTIS

6.4 Claytex

...............

七、场景库研究

7.1 德国GIDAS

7.2 中国CIDAS

7.3 ADAC

7.4 iVista场景库

7.5 昆仑计划场景库

7.6 中汽中心场景库

...............

1. Introduction to Vehicle Simulation and Autonomous Driving Simulation

1.1 Overview of Simulation Technology

1.1.1Development of Simulation Technology

1.1.2 Vehicle Simulation Technology

1.1.3 Autonomous Driving Testing and Simulation

1.1.4 Drivers for Development of Simulation Testing

1.2 Autonomous Driving Testing and Simulation

1.2.1 Simulation Technology Will be the Foundation of Autonomous Driving

1.2.2 Scenario-based ADAS/AD Testing and Verification Tool Chain

1.2.3 Composition of Autonomous Driving Simulation Industry Chain

1.2.4 Content of Autonomous Driving Simulation

1.2.5 Simulation Models of Autonomous Driving System

1.2.6 Composition of Simulation Testing System

1.2.7 How Simulation Testing Replaces Real Driving

1.2.8 Simulation Is Introduced to Replace the Real World

1.3 HIL and SIL

1.3.1 HIL Testing

1.3.2 Process of SIL Simulation

1.3.3 SIL Simulation of Volkswagen

1.3.4 SIL Simulation of BMW

1.3.5 SIL Simulation of Mercedes-Benz

2.Autonomous Driving Simulation Platforms and Companies

2.1 Introduction to Simulation Testing Platforms

2.1.1 Composition of Simulation Testing Platforms

2.1.2 Competition between Traditional Simulation Enterprises and IT Firms in Simulation Platforms

2.2 Driving Simulator

2.2.1 Features

2.2.2 ADAS and AD Testing Project

2.2.3 Combination with Other Simulation Testing Tools

2.3 ANSYS

2.3.1 Profile

2.3.2 Improve Simulation Industry Chain through Cross-industry Acquisitions

2.3.3 Background of Acquired Companies

2.3.4 Autonomous Driving-related Products

2.3.5 Acquisition of OPTIS

2.3.6 ANSYS SCADE Can Generate an Authentication Code that Meets the ISO26262 Standard

2.3.7 ANSYS Scade Suite—Driving Scenario Model

2.3.8 ANSYS Scade Suite- Autonomous Driving Controlled Simulation Solution

2.3.9 ANSYS Scade Suite Autonomous Driving Controlled Simulation Solution Process

2.3.10 ANSYS Autonomous Driving Controlled Simulation Solution Closed Loop

2.3.11 ANSYS Scade Suite Autonomous Driving Controlled Simulation Testing Display

2.4 TASS PreScan

2.4.1 Siemens’ Acquisition on Tass

2.4.2 Siemens’ Products in Autonomous Driving Testing

2.4.3 TASS PreScan

2.4.4 Features of New PreScan

2.4.5 Some Features of PreScan Simulation Platform

2.4.6 Sensor Types and Some Scenarios Supported by PreScan

2.4.7 External Tools and Software Supported by PreScan

2.5 NVIDIA Simulation Platform

2.6 Gazebo

2.6.1 Open Source Simulation Platform

2.6.2 Features and Usage

2.7 Carla

2.7.1 Introduction

2.7.2 Latest version

2.8 Scenario Simulation Platform of CATARC

2.8.1 Driving Simulation Platform

2.8.2 Driving Scenario Platform

2.9 Apollo Simulation Platform

2.9.1 Distributed Simulation Platform

2.9.2 Engine

2.9.3 Development Resource Dataset

2.9.4 Future Planning

2.10 Panosim

2.10.1 Profile

2.10.2 Main Products

2.10.3 Simulation Based on Physical Models and Numbers

2.10.4 Interface and Features

2.10.5 Process of Creating a Simulation Experiment with PanoSim

2.10.6 New Radar Model and GPS Physical Model

2.10.7 Feature Upgrade of V2X and True Value Sensor

2.10.8 Optimization of Simulink Model

2.10.9 Summary

2.11 AirSim

2.11.1 Profile

2.11.2 Open Source Simulation Platform

2.12 VI-grade

2.12.1 Profile

2.12.2 Product System

2.12.3 Application in the Automotive Sector

2.12.4 VI-Car RealTime: Automotive Dynamics Real-Time Simulation Tool

2.12.5 Automotive Driving Simulator: VI-DriveSim

2.12.6 VI-grade and SAGLNOMIYA

2.12.7 Applus+ IDIADA Adopts DiM250

3. Vehicle Dynamics Simulation

3.1 MATLAB/Simulink

3.1.1 Introduction to Mathworks

3.1.2 Matlab and Simulink

3.1.3 Simulink-based AEB and FCW System

3.1.4 ADST - Autonomous Driving System Kit

3.1.5 Simulink Model

3.1.6 Driving Scenario Designer

3.1.7 Vehicle Dynamics Blockset

3.1.8 Modular Driving Scenario of Vehicle Dynamics Blockset

3.1.9 Cases of Vehicle Dynamics Blockset in Closed Loop Simulation Testing

3.1.10 Application in Voyage

3.2 Simpack

3.2.1 Real-time Simulation Tool

3.2.2 Open Modeling Structure and Features

3.2.3 Features of Modeling

3.2.4 ADAS Application

3.3 TESIS DYNAware

3.3.1 Profile

3.3.2 ve-DYNA Model

3.3.3 DYNA4 Software

3.3.4 Seamless Connection between DYNA4 and enDYNA/veDYNA

3.3.5 Features of DYNA4 Software

3.3.6 Simulation Scenario of DYNA4

3.4 IPG Carmaker

3.5 AVL

3.5.1 Profile

3.5.2 Vehicle Testing Simulation Platform

3.5.3 AVL model. Connect

3.5.4 ADAS Simulation Testing Based on Actual Scenarios

4. HIL Simulation

4.1 NI

4.1.1 Automotive Solutions

4.1.2 VRTS

4.1.3 Cameras and V2X Testing

4.2 ETAS

4.2.1 HiL System

4.2.2 Simulation Solutions and Tools

4.3 Vector

4.3.1 ADAS Development Tool Chain

4.3.2 MIL Simulation Testing

4.4 dSPACE

4.4.1 Profile

4.4.2 Real-time Simulation System

4.4.3 Main Products

4.4.4 Simulation Tool Chain

5. Scenario Simulation Companies

5.1 Introduction to Scenario Library

5.1.1 Requirements of Intelligent Vehicle Simulation Testing on Traffic Scenario Simulation

5.1.2 Standardized Testing Scenarios

5.1.3 Measurement Parameters of Standardized Testing Scenarios

5.2 VTD

5.2.1 VIRES

5.2.2 VTD Simulation Tool

5.2.3 Three Standards Based on VTD Environment Simulation

5.2.4 Composition and Advantages of Open Drive Standard

5.2.5 Application of Open Drive

5.2.6 Open Drive Map Data Analysis

5.2.7 Establishment of a Map Coordinate System in Open Drive

5.2.8 Open Drive-Reference Line Construction

5.2.9 Open Drive-Lane Construction

5.2.10 Open Drive-Complete Road Models

5.2.11 Open CRG Simulation Applied in Vehicle Control, Driving Comfort, etc.

5.2.12 Open CRG- Workflow

5.2.13 Open–Scenario Standard

5.3 Pro-SiVIC

5.3.1 Profile of ESI

5.3.2 ESI’s Products

5.3.3 ESI Enhances Core Simulation Technology through Acquisition and Integration

5.3.4 Profile of Pro-SiVIC

5.3.5 Traffic Scenarios and Sensor Models of Pro-SiVIC

5.3.6 Process of Composograph Processing with Pro-ViSIC Simulation

5.3.7 Result of Composograph Processing with Pro-ViSIC Simulation

5.4 rFpro

5.4.1 Profile

5.4.2 HD Virtual Modeling for Test Fields

5.4.3 R&D of HD Virtual Modeling

5.5 Cognata

5.5.1 Profile

5.5.2 Autonomous Driving Simulation Platform

5.5.3 Cooperation with Nvidia

5.6 51VR/RealDrive

5.6.1 Profile

5.6.2 Team

5.6.3 Simulation Approaches of Autonomous Driving Simulation Platform

5.6.4 51World Strategy

5.6.5 RealDrive Aims at Autonomous Driving Simulation Testing

5.7 Parallel Domain

5.7.1 Profile

5.7.2 Simulation Platform

5.7.3 How to Generate a Virtual World

5.8 Metamoto

5.9 AAI

5.10 Applied Intuition

6. Sensor Simulation Companies

6.1 MonoDrive

6.1.1 Profile

6.1.2 Sensor Simulator

6.1.3 Process of Simulation Testing

6.2 RightHook

6.2.1 Profile

6.2.2 Playback Simulation and HD Map Simulation

6.2.3 Simulation System Based on HD Map

6.3 OPTIS

6.4 Claytex

7. Scenario Library

7.1 Germany GIDAS

7.2 China CIDAS

7.3 ADAC

7.4 iVista

7.5 Kunlun Plan

7.6 CATARC