ECU(Electronic Control Unit)是电子控制单元,是汽车专用微机控制器。汽车电子控制器的作用是接收来自传感器的信息,进行处理,输出相应的控制指令给到执行器执行。汽车ECU的核心在于微处理器,微处理器包括MCU、MPU、DSP 和逻辑IC 等。ECU领先企业包括博世、电装、大陆、Aptiv、伟世通等。

随着车辆的电子化程度逐渐提高,ECU占领了整个汽车,从防抱死制动系统、四轮驱动系统、电控自动变速器、主动悬架系统、安全气囊系统, 逐渐延伸到了车身安全、网络、娱乐、传感控制系统等。 汽车 ECU 迅速增加,高端车型里的 ECU 平均达到 50-70 个,个别车型ECU数量超过100。

随着车载传感器数量越来越多,传感器与 ECU一一对应使得车辆整体性能下降,线路复杂性也急剧增加,此时 DCU(域控制器) 和 MDC(多域控制器)等更强大的中心化架构逐步替代了分布式架构。

域控制器(DCU,Domain Control Unit)的概念最早是由以博世、大陆为首的Tier1提出,它的出现是为了解决信息安全,以及ECU瓶颈的问题。域控制器因为有强大的硬件计算能力与丰富的软件接口支持,使得更多核心功能模块集中于域控制器内,系统功能集成度大大提高,这样对于功能的感知与执行的硬件要求降低。加之数据交互的接口标准化,会让这些零部件变成标准零件,从而降低这部分零部件开发/制造成本。也就是说,外围零件只关注本身基本功能,而中央域控制器关注系统级功能实现。

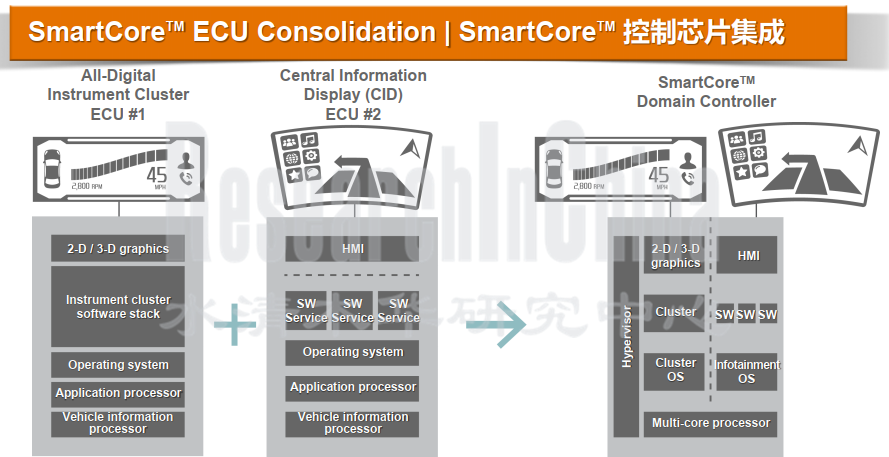

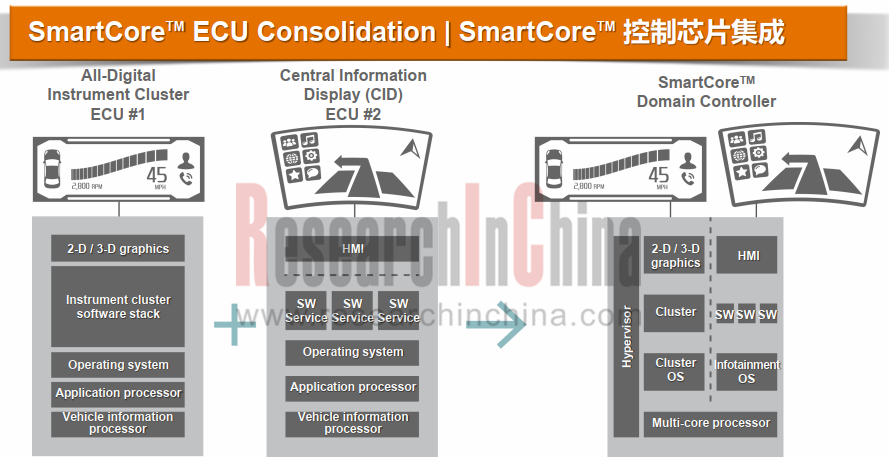

图例:伟世通将仪表ECU和车机ECU整合为座舱域控制器SmartCore

而自动驾驶域控制器的要求更高,一般要具备多传感器融合、定位、路径规划、决策控制、V2X、高速通讯的能力,通常需要外接多种摄像头(单目、双目)、多个毫米波雷达、激光雷达、IMU等设备。

由于要完成大量运算,域控制器一般都要配备一个运算力强大的核心处理器,能够提供对智能座舱和不同级别自动驾驶算力的支持,业内有NVIDIA、英飞凌、瑞萨、TI、NXP、Mobileye等多个方案。利用处理能力强大的多核 CPU/GPU 芯片相对集中的去控制每个域,以取代以前的分布式汽车电子电气架构(EEA)。

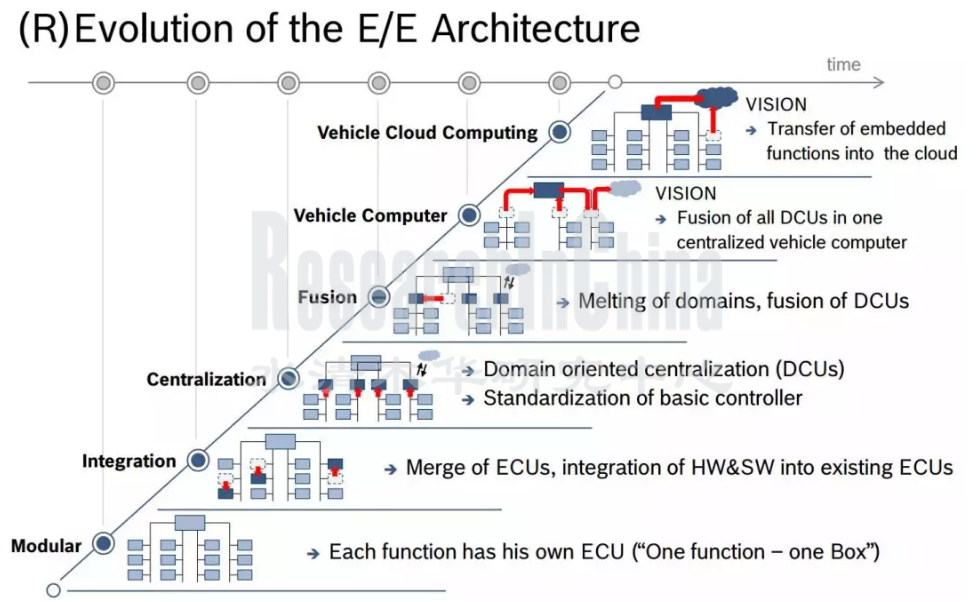

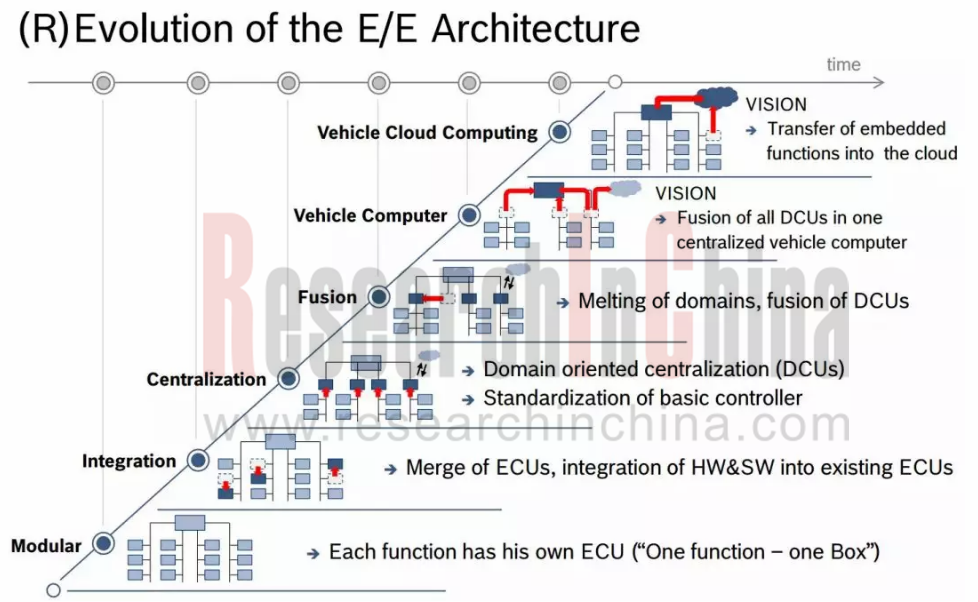

上图是博世的 汽车电子电气架构进化图,包括Modular,Integration, Centralization, Fusion, Vehicle Computer, Vehicle Cloud Computing六个层次。其中域控制器应用在第三层(Centralization),多域控制器应用在第四层(Fusion)。

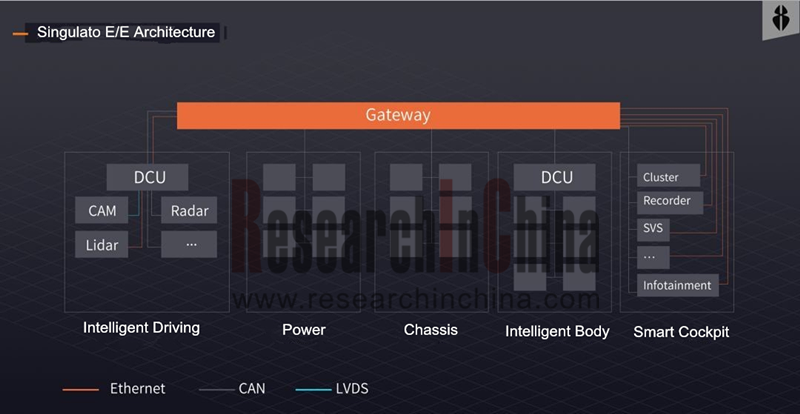

目前新车E/E架构设计已大量采用域控制器。以奇点iS6为例,采用了基于域控制器加车载以太网的网络拓扑结构,将车内电子架构划分为5个域,分别为:智能驾驶域、智能信息域、车身域、底盘域、动力域。同时奇点汽车采用集成式设计,也就是将所有传感器数据集中到智能驾驶域控制器。由智能驾驶域控制器做数据处理和决策规划,从而实现各种ADAS智能驾驶功能,包括自适应巡航、车道保持、自动泊车等。这意味着大多数ADAS/AD功能将由整车厂自己开发完成。

根据技术专家“冷酷的冬瓜”的研究:纵观特斯拉三代车型,Model S、Model X 再到 Model 3 的演变,实质是功能的重分配,不断把功能从供应商手中拿回来自行开发的过程。而Model S的E/E架构设计,早已一步跨到了第五层 (Vehicle Computer层级) 。

随着汽车E/E架构的演变进化,主机厂和汽车电子供应商的供应关系正发生深刻变革。由于汽车电子硬件走向集中化的趋势,汽车电子供应商数量将减少,同时域控制器供应商将更加重要。

以座舱域控制器为例,一般会集成仪表和车机,未来则会逐步整合空调控制、HUD、后视镜、手势识别、DMS,甚至包括T-BOX和OBU。

一辆自动驾驶汽车每小时产生的数据量将达4TB,传感器融合和3D定位等高级功能将在自动驾驶域控制器上运行。

和域控制器紧密连接的中央网关,负责发送与接收安全关键数据,将始终直接且仅连接到整车企业的后台。OTA则实现域控制器功能的不断更新,有助于开发新功能、确保网络安全,并使车企得以更快部署功能与软件。

域控制器厂商和车厂的开发合作将更加紧密。

德赛西威认为:在自动驾驶域控制器领域,预计未来Tier1与整车厂之间将采取两种合作方式。

其一,Tier1负责中间层以及硬件生产,整车厂负责自动驾驶软件部分。Tier1的优势在于以合理的成本将产品生产出来并且加速产品落地,因此整车厂和Tier1进行合作生产方式是必然,前者负责自动驾驶软件部分,后者负责硬件生产、中间层以及芯片方案整合。

其二,Tier1自己与芯片商合作,做方案整合后研发中央域控制器并向整车厂销售,例如大陆ADCU、采埃孚ProAI、麦格纳MAX4。

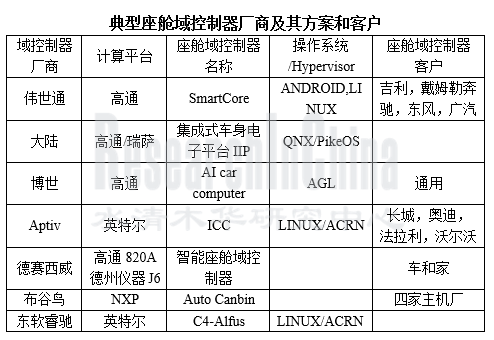

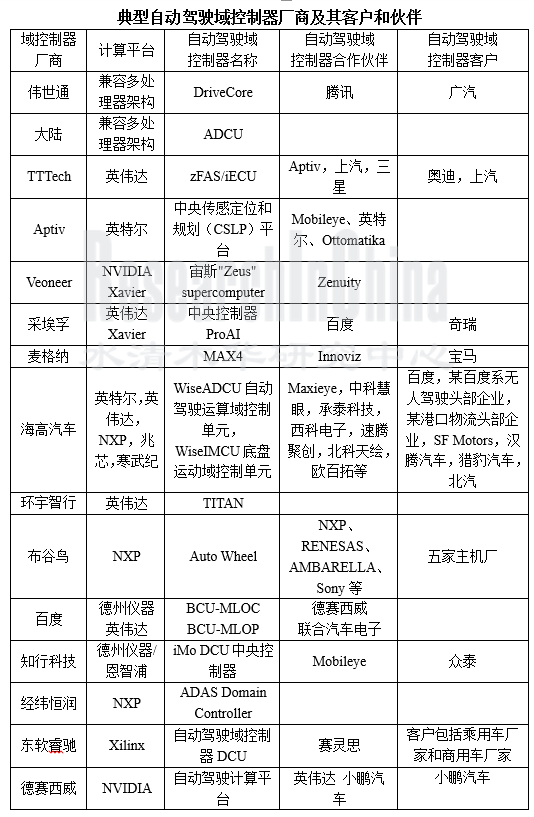

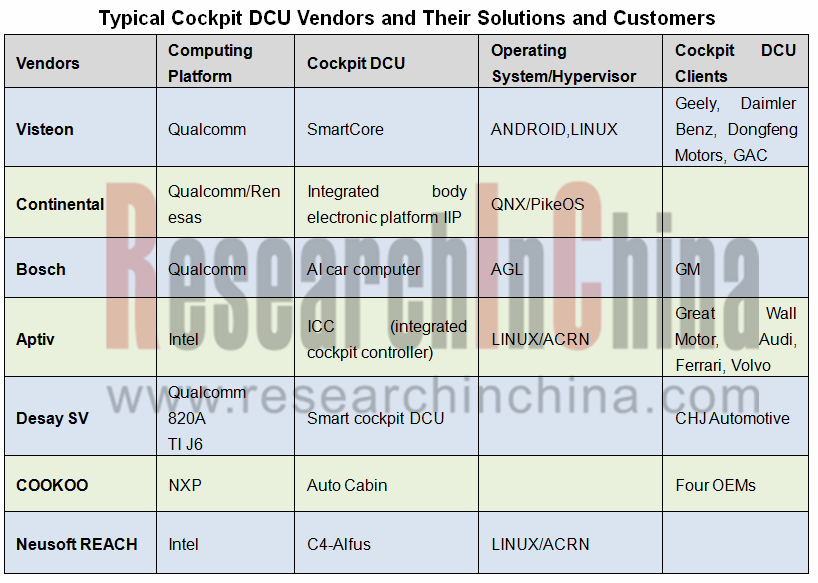

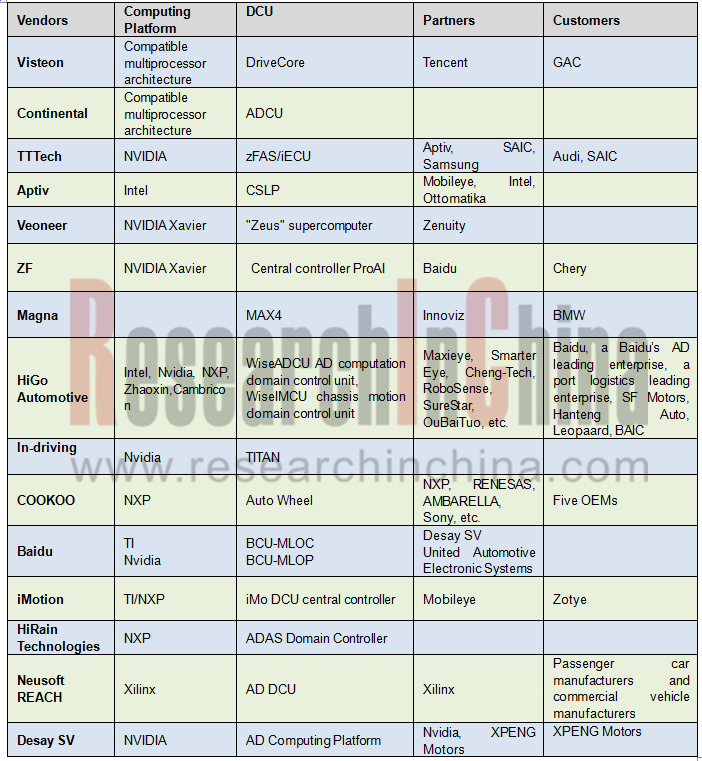

从下面两个图表,可以看到无论是座舱域控制器,还是自动驾驶域控制器,都有控制器供应商和主机厂、域控制器供应商和芯片厂商紧密合作开发的趋势。

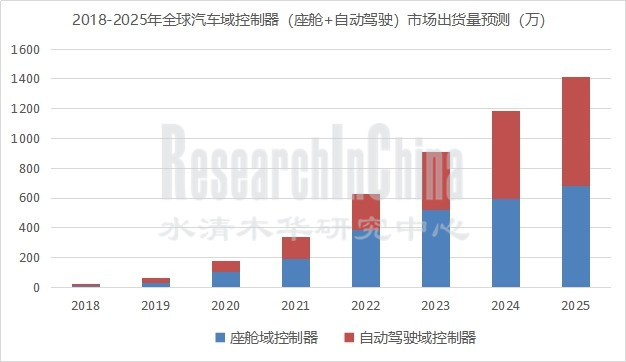

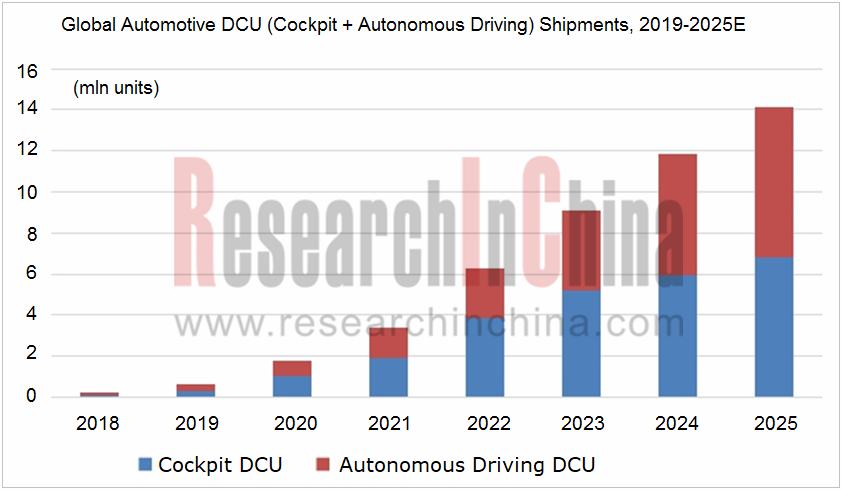

根据佐思产研的预测,2025年全球汽车域控制器(座舱+自动驾驶)出货量将超过1400万套,2019-2025年均增长50.7%。

纵观整个域控制器产业,近两年中国企业的崛起是一大特色,譬如德赛西威、百度、东软、海高汽车、布谷鸟、环宇智行、知行科技等。目前这些国内域控制器研发企业的客户主要是新兴造车企业和非一线传统车企。

Electronic control unit (ECU) serves as an automotive computer controller. Automotive electronic controller is used to receive and process signals from sensors and export control commands to the actuator to execute. Microprocessors, the core of an automotive ECU, embrace micro control unit (MCU), microprocessor unit (MPU), digital signal processor (DSP) and logic integrated circuits (IC). The global ECU leaders are Bosch, Denso, Continental, Aptiv, Visteon, among others.

As vehicle trend to use more electronics, ECU is making its way into all auto parts from anti-lock braking system, four-wheel drive system, electronically controlled automatic transmission, active suspension system and airbag system to body safety, network, entertainment and sensing and control systems. Vehicles’ consumption of ECU then booms: high-class models use 50-70 ECUs on average, and some even carries more than 100 units.

When the one-to-one correspondence between the growing number of sensors and ECUs gives rise to underperforming vehicles and far more complex circuits, more powerful centralized architectures like domain control unit (DCU) and multi-domain controller (MDC) come as an alternative to the distributed ones.

The concept of domain control unit (DCU) was initiated by tier-1 suppliers like Bosch and Continental as a solution to information security and ECU development bottlenecks. DCU can make systems much more integrated for its powerful hardware computing capacity and availability of sundry software interfaces enable integration of more core functional modules, which means lower requirements on function perception and execution hardware. Moreover, standardized interfaces for data interaction help these components turn into standard ones, thus reducing the spending on research and development or manufacture. In other words, unlike peripheral parts just playing their own roles, a central domain control unit looks at the whole system.

Figure 1: Visteon integrates instrument ECU and head unit ECU into SmartCore cockpit domain controller

Autonomous vehicle requires domain controllers not only to be integrated with versatile capabilities such as multi-sensor fusion, localization, path planning, decision making and control, V2X and high speed communication, but to have interfaces for cameras (mono/stereo), multiple radars, LiDAR, IMU, etc.

To complete number crunching, a domain control unit often needs a built-in core processor with strong computing power for smart cockpit and autonomous driving at all levels. Solution providers include NVIDIA, Infineon, Renesas, TI, NXP and Mobileye. The scheme that powerful multi-core CPU/GPU chips are used to control every domain in a centralized way can replace former distributed automotive electric/electronic architectures (EEA).

Figure 2: evolution of Bosch E/E architecture. It has six layers, i.e., Modular,Integration, Centralization, Fusion, Vehicle Computer and Vehicle Cloud Computing. DCU is applied to the third layer (Centralization), and MDC the fourth (Fusion).

In current stage, most new vehicles adopt DCU-based E/E architectures. In Singulato iS6’s case, a DCU + automotive Ethernet based network topology is used to divide E/E architecture into 5 domains: intelligent driving, smart cockpit, body, chassis and power; an integrated design allows fusion of all sensor data into the intelligent driving domain controller which is in charge of data processing and decision making to implement ADAS functions such as adaptive cruise control, lane keeping and automatic parking. All imply that automakers need to develop their own ADAS/AD systems.

The study by “Cool Wax Gourd”, a technical expert’s Twitter-like Sina Weibo account, shows that: the evolution of three generations of Tesla models from Model S to Model X to Model 3, is actually a process of functional redistribution, namely, developing capabilities based on those from suppliers; Model S E/E architecture has been a fifth-layer one (Vehicle Computer) at the start.

As automotive E/E architectures evolve, there is a big shift in relationship between OEMs and automotive electronics suppliers, too. The trend for integrated automotive electronic hardware leads to the smaller number of electronics suppliers and the more important role of DCU vendors.

Being generally integrated with instrument clusters and head unit, a cockpit domain controller for instance, will be fused with air conditioner control, HUD, rearview mirror, gesture recognition, DMS and even T-BOX and OBU in future.

An autonomous vehicle that generates 4TB data an hour, needs a domain control unit to have some advanced competencies such as multi-sensor fusion and 3D localization.

Central gateway closely tied with domain controllers, takes charge of sending and receiving key security data, and is directly and only connected to the backstage of automakers. Through OTA updates to domain controllers, carmakers can develop new capabilities and ensure network security for faster deployment of functions and software.

DCU vendors and automakers will deepen their partnerships in research and development.

Desay SV argues that: tier-1 suppliers and OEMs will collaborate in the following two ways in the area of autonomous driving domain controller:

First, tier-1 suppliers are devoted to making middleware and hardware, and OEMs develop autonomous driving software. As tier-1 suppliers enjoy edges in producing products at reasonable cost and accelerating commercialization, automakers are bound to partner with them: OEMs assume software design while tier-1 suppliers take on production of hardware and integration of middleware and chip solutions.

Second, tier-1 suppliers choose to work with chip vendors in solution design and research and development of central domain controllers, and then sell their products to OEMs. Examples include Continental ADCU, ZF ProAI and Magna MAX4.

It can be seen from the two tables below that there is a tendency towards cooperation between controller vendors and OEMs, domain controller suppliers and chip vendors, in both cockpit and autonomous driving domain controllers.

Typical Autonomous Driving DCU Vendors and Their Customers and Partners

DCU, as a kind of OEM automotive electronics, usually takes over two years from design to mass production and launch. Most of the above suppliers are still researching and developing DCU. Aptiv and Visteon are far ahead of peers and have mass-produced DCU.

The global automotive DCU (cockpit + autonomous driving) shipments will exceed 14 million sets in 2025, with the average annual growth rate of 50.7% between 2019 and 2025, according to shujubang.com.

Throughout the DCU industry, Chinese companies have emerged strikingly in the past two years, such as Desay SV, Baidu, Neusoft, HiGO Automotive, COOKOO, In-driving, iMotion, etc., all of which now takes emerging and non-first-tier traditional automakers as their key clients.

第一章 从ECU到域控制器

1.1 ECU

1.1.1 典型的汽车电子控制电路框图

1.1.2 汽车电子控制单元产业链

1.1.3 ECU的发展

1.1.4 ECU大量增加,域控制器出现

1.2 域控制器

1.2.1 典型的五大域控制器

1.2.2 为什么要用域控制器

1.2.3 域控制器共享硬件资源,实现基础软件共享

1.2.4 域控制器网络架构

1.3 域控制器相关芯片

1.3.1 英飞凌AURIX芯片

1.3.2 英飞凌AURIX TC3XX

1.3.3 NVIDIA DRIVE 系列芯片

1.3.4 TI座舱芯片

1.3.5 TI Jacinto

1.3.6 瑞萨芯片

1.3.7 高通芯片

1.3.8 NXP芯片

1.4 全球汽车域控制器(座舱+自动驾驶)市场规模预计

..............

第二章 网关与E/E架构

2.1 网关控制器

2.1.1 典型网关控制器(1)

2.1.2 典型网关控制器(2)

2.1.3 NXP的网关方案

2.1.4 ST的安全网关方案

2.2 电子电气架构(EEA)

2.2.1 典型汽车E/E架构之一

2.2.2 典型汽车E/E架构之二

2.2.3 未来可能的E/E架构(1)

2.2.4 未来可能的E/E架构(2)

2.2.5 分布式的 E/E 系统架构(大陆)

2.2.6 未来汽车电子电气架构 (NXP)

2.2.7 未来汽车电子电气架构(博世)

2.2.8 面向服务的汽车架构(SOA)

2.3 主机厂的电子电气架构示例

2.3.1 戴姆勒-奔驰第1代电子电气架构

2.3.2 戴姆勒-奔驰第2代电子电气架构

2.3.3 MAN的电子电气架构

2.3.4 斯堪尼亚的电子电气架构

2.3.5 IVECO的电子电气架构

2.3.6 特斯拉Model 3的架构

..............

第三章 座舱域控制器

3.1 传统座舱系统设计

3.2 2020之前和之后的座舱域

3.3 座舱域控制器的复杂设计示例

3.4 伟世通座舱域控制器

3.5 NXP座舱方案

3.6 iMX8 方案

3.7 TI座舱方案

3.8 座舱域控制器的发展趋势

3.9 未来座舱电子发展趋势

..............

第四章 ADAS/AD域控制器

4.1 自动驾驶域控制器

4.2 典型自动驾驶域控制器(13款)

4.3 Aptiv公司的ADAS多域控制器

4.4 Tesla Autopilot 2.0 / 2.5

4.5 Veoneer的自动驾驶ECU

..............

第五章 国外域控制器厂家研究

5.1 伟世通

5.1.1 伟世通公司简介

5.1.2 2018营收和域控制器订单情况

5.1.3 Drive Core 自动驾驶平台

5.1.4 Drive Core 自动驾驶平台架构

5.1.5 Smart Core 座舱域控制器

5.1.6 伟世通汽车电子架构

5.2 大陆

5.2.1 高性能SoC处理器促进域控制器发展

5.2.2 大陆安全域控制器 (SDCU)

5.2.3 大陆辅助及自动驾驶控制器( ADCU)

5.3 Bosch

5.3.1 Bosch域分类ECU的混合骨架

5.3.2 Bosch Cross Domain Control Unit

5.4 Veoneer

5.4.1 宙斯ADAS ECU

5.4.2 宙斯ADAS ECU功能架构

5.5 采埃孚

5.5.1 ProAI控制器

5.5.2 采埃孚与百度合作

5.5.3 ProAI第四代

5.6 麦格纳

5.6.1 麦格纳简介

5.6.2MAX4自动驾驶平台域控制器

5.6.3MAX4可实现L4级自动驾驶

5.7 Tesla自动驾驶平台

5.7.1 AutoPilot2.0域控制器功能特点

5.7.2 AutoPilot2.0域控制器技术参数

5.7.3 AutoPilot2.5域控制器功能特点

5.8 TTTech

5.8.1 TTTech简介

5.8.2 TTTech与MotionWise

5.8.3 TTTech与zFAS

5.8.4 TTTech自动驾驶控制器技术优势

5.8.5 TTTech与上汽合资

..............

第六章 国内域控制器厂家研究

6.1 海高汽车

6.1.1 海高汽车简介

6.1.2 Wise ADCU系列产品

6.1.3 Wise ADCU M6

6.1.4 Wise ADCU M6接口和参数

6.1.5 Wise ADCU X1

6.1.6 Wise ADCU X1硬件规格

6.1.7 海高客户和合作伙伴

6.2 环宇智行

6.2.1 环宇智行-TITAN域控制器

6.2.2 TITAN 3 域控制器的组成

6.2.3 TITAN-III框图

6.2.4 TITAN-III域控制器的性能指标

6.2.5 Athena

6.3 域控制器-布谷鸟

6.3.1 布谷鸟汽车计算平台架构

6.3.2 布谷鸟AutoCabin-J1架构

6.3.3 布谷鸟AutoCabin-J2架构

6.3.4 布谷鸟AutoCabin-J3架构

6.3.5 布谷鸟AutoCabin-集中域整车电子架构

6.3.6 布谷鸟智能化计算平台产品路线图

6.4 百度域控制器

6.4.1 百度自动驾驶大脑:传统IPC集中式架构

6.4.2 百度自动驾驶大脑:多域解决方案

6.4.3 BCU 计划2019年量产

6.4.4 BCU-MLOC与BCU-MLOP

6.4.5 BCU-MLOP与BCU-MLOP2

6.5 知行科技

6.5.1 知行科技简介

6.5.2 知行科技发布iMo DCU 3.0

6.6 经纬恒润

6.6.1 经纬恒润域控制器

6.6.2 经纬恒润车身域控制器架构

6.7 东软睿驰

6.7.1 东软睿驰自动驾驶中央域控制器

6.7.2 东软睿驰自动驾驶DCU功能

6.7.3 东软的座舱产品

6.8 德赛西威

6.8.1 德赛西威简介

6.8.2 德赛西威战略布局

6.8.3 新一代智能驾驶舱

6.8.4 获得智能驾驶舱订单,可实现四屏交互

6.8.5 德赛西威智能驾驶产品线布局

6.8.6 德赛西威Highway Pilot与AVP方案

6.8.7 德赛西威和电咖天际ME7

6.8.8 德赛西威与英伟达合作开发域控制器

............

1 From ECU to Domain Control Unit (DCU)

1.1 ECU

1.1.1 Block Diagram of Typical Automotive Electronic Control Circuit

1.1.2 Automotive Electronic Control Unit Industry Chain

1.1.3 ECU Evolution

1.1.4 Enormous Growth of ECU and Emergence of Domain Controller

1.2 Domain Controller

1.2.1 Typical Five Major Domain Controllers

1.2.2 Why to Use Domain Controller

1.2.3 Domain Controller Shares Hardware Resources and Realizes the Sharing of Basic Software

1.2.4 Domain Controller Network Architecture

1.3 Domain Controller Related Chip

1.3.1 Infineon AURIX Chip

1.3.2 Infineon AURIX TC3XX

1.3.3 NVIDIA DRIVE Series Chips

1.3.4 TI Cockpit Chip

1.3.5 TI Jacinto

1.3.6 Renesas Chip

1.3.7 Qualcomm Chip

1.3.8 NXP Chip

1.4 Estimated Global Market Size of Automotive Domain Controller (Cockpit + AD)

2 Gateway and E/E Architecture

2.1 Gateway Controller

2.1.1 Typical Gateway Controller (1)

2.1.2 Typical Gateway Controller (2)

2.1.3 NXP’s Gateway Solutions

2.1.4 ST’s Safety Gateway Solutions

2.2 Electrical/Electronic Architecture (EEA)

2.2.1 Typical Automotive EEA (1)

2.2.2 Typical Automotive EEA (2)

2.2.3 Potential E/E Architecture (1) in Future

2.2.4 Potential E/E Architecture (2) in Future

2.2.5 Distributed E/E System Architecture (Continental)

2.2.6 Future Automotive E/E Architecture (NXP)

2.2.7 Future Automotive E/E Architecture (Bosch)

2.2.8 Service-oriented Architecture (SOA)

2.3 E/E Architecture Samples of Automakers

2.3.1 Daimler-Benz 1st-Gen E/E Architecture

2.3.2 Daimler-Benz 2nd-Gen E/E Architecture

2.3.3 E/E Architecture of MAN

2.3.4 SCANIA’s E/E Architecture

2.3.5 IVECO’s E/E Architecture

2.3.6 Tesla Model 3 Architecture

3 Cockpit Domain Controller

3.1 Traditional Cockpit System Design

3.2 Cockpit Domain before and after 2020

3.3 Example of Complex Design of Cockpit Domain Controller

3.4 Visteon’s Cockpit Domain Controller

3.5 NXP Cockpit Solutions

3.6 iMX8 Solutions

3.7 TI Cockpit Solutions

3.8 Development Tendency of Cockpit Domain Controller

3.9 Development Trends of Future Cockpit Electronics

4 ADAS/AD Domain Controller

4.1 AD Domain Controller

4.2 Typical AD Domain Controllers (13 Models)

4.3 Aptiv’s ADAS Multi-domain Controller

4.4 Tesla Autopilot 2.0 / 2.5

4.5 Veoneer’s AD ECU

5 Foreign Domain Controller Companies

5.1 Visteon

5.1.1 Profile of Visteon

5.1.2 Revenue in 2018 and Orders for Domain Controller

5.1.3 Drive Core Autonomous Driving (AD) Platform

5.1.4 Drive Core Autonomous Driving (AD) Platform Architecture

5.1.5 Smart Core Cockpit Domain Controller

5.1.6 Visteon Automotive Electronics Architecture

5.2 Continental

5.2.1 High-performance SoC Processor Facilitates the Development of Domain Controller

5.2.2 Continental’s Safety Domain Control Unit (SDCU)

5.2.3 Continental’s Assisted & Automated Driving Control Unit (ADCU)

5.3 Bosch

5.3.1 Hybrid Architecture of Bosch Domain Classification ECU

5.3.2 Bosch Cross Domain Control Unit

5.4 Veoneer

5.4.1 Zeus ADAS ECU

5.4.2 Zeus ADAS ECU –Functional Architecture

5.5 ZF

5.5.1 ProAI Controller

5.5.2 ZF’s Collaboration with Baidu

5.5.3 4th-generation ProAI

5.6 MAGNA

5.6.1 Profile of MAGNA

5.6.2 MAX4 Autonomous Driving (AD) Platform Domain Controller

5.6.3 MAX4 Enables L4 Automated Driving

5.7 Tesla AD Platform

5.7.1 Functional Characteristics of AutoPilot2.0 Domain Controller

5.7.2 Technical Parameters of AutoPilot2.0 Domain Controller

5.7.3 Functional Characteristics of AutoPilot2.5 Domain Controller

5.8 TTTech

5.8.1 Profile of TTTech

5.8.2 TTTech and MotionWise

5.8.3 TTTech and zFAS

5.8.4 TTTech’s Technical Superiorities in Autonomous Driving (AD) Controller

5.8.5 Joint Funding of TTTech with SAIC Motor

6 Chinese Domain Controller Vendors

6.1 HiGo Automotive

6.1.1 Profile

6.1.2 Wise ADCU Series Products

6.1.3 Wise ADCU M6

6.1.4 Wise ADCU M6 Interfaces and Parameters

6.1.5 Wise ADCU X1

6.1.6 Wise ADCU X1 Hardware Specifications

6.1.7 Customers and Partners

6.2 In-Driving

6.2.1 TITAN Domain Controller

6.2.2 Composition of TITAN 3 Domain Controller

6.2.3 Block Diagram of TITAN-III

6.2.4 Performance Indices of TITAN-III Domain Controller

6.2.5 Athena

6.3 COOKOO

6.3.1 Cookoo Automotive Computing Platform Architecture

6.3.2 Cookoo AutoCabin-J1 Architecture

6.3.3 Cookoo AutoCabin-J2 Architecture

6.3.4 Cookoo AutoCabin-J3 Architecture

6.3.5 Cookoo AutoCabin-Centralized Domain Vehicle Electronics Architecture

6.3.6 Product Roadmap of Cookoo Intelligent Computing Platform

6.4 Baidu Domain Controller

6.4.1 Baidu AD Brain: Conventional IPC Centralized Architecture

6.4.2 Baidu AD Brain: Multi-domain Solutions

6.4.3 BCU Mass-production Scheduled in 2019

6.4.4 BCU-MLOC and BCU-MLOP

6.4.5 BCU-MLOP and BCU-MLOP2

6.5 iMotion

6.5.1 Profile

6.5.2 iMo DCU 3.0 Was Unveiled

6.6 HiRain Technologies

6.6.1 Domain Controller

6.6.2 Vehicle Body Domain Controller Architecture

6.7 Neusoft REACH

6.7.1 REACH Central Domain Controller for Autonomous Driving

6.7.2 REACH DCU Functions for Autonomous Driving

6.7.3 Cabin Products of Neusoft

6.8 Desay SV

6.8.1 Profile

6.8.2 Strategic Layout

6.8.3 New-generation Smart Cockpit

6.8.4 Orders for Its Smart Cockpit Capable of 4-Screen Interaction

6.8.5 Desay SV Intelligent Driving Product Lines

6.8.6 Desay SV Highway Pilot and AVP Solutions

6.8.7 Desay SV and DearCC ENOVATE ME7

6.8.8 Cooperation between Desay SV and NVIDIA in the Development of Domain Controller

6.9 ECO-EV

6.9.1 Autonomous Driving (AD) ACU

6.9.2 Technical Features