佐思产研对2019年1月中国乘用车市场带毫米波雷达的近90款车型的供应商进行了调查,这些车型毫米波雷达的总安装量占全部毫米波雷达安装量的96%以上。安装量是指已经到达消费者手中的车辆中的毫米波雷达前装数量。

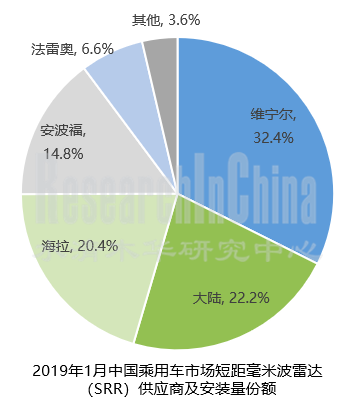

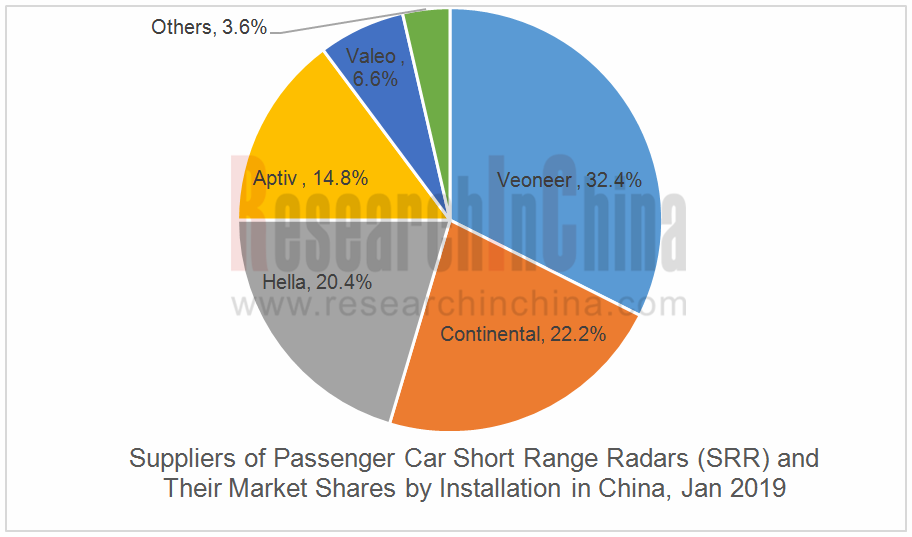

根据供应商调研和毫米波雷达安装量研究结果,2019年1月中国乘用车短距毫米波雷达(SRR)市场,维宁尔份额排在第一占32.4%,大陆、海拉、安波福、法雷奥分列第二到第五位,市场份额分别是22.2%、20.4%、14.8%、6.6%。

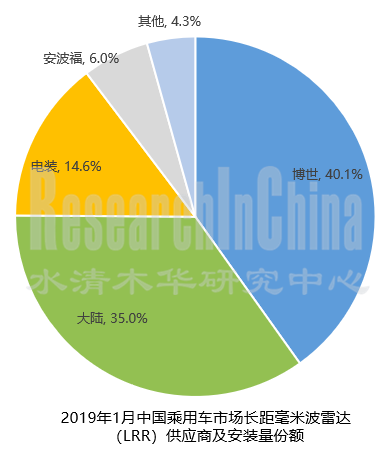

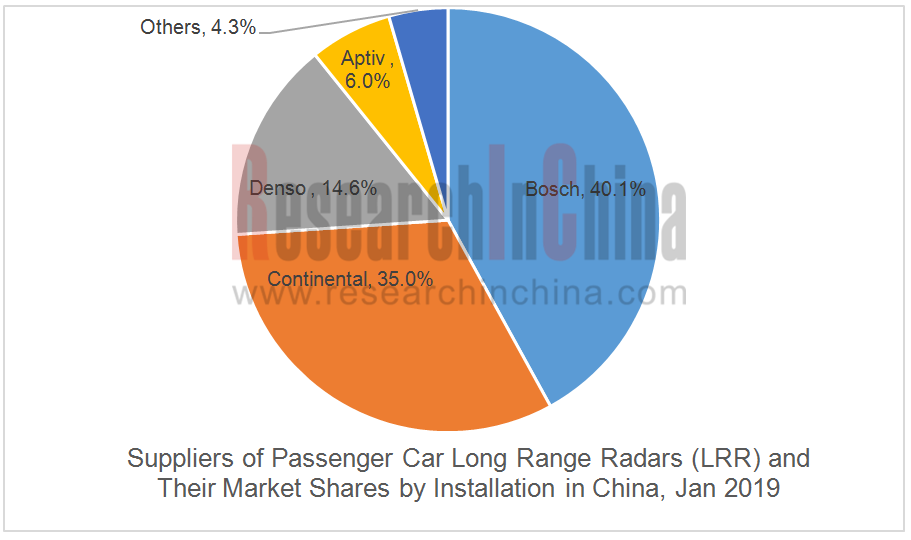

2019年1月中国乘用车长距毫米波雷达(LRR)市场,博世份额排在第一占40.1%,大陆、电装、安波福分列第二到第四位,市场份额分别是35.0%、14.6%、6.0%。

2019年前两个月,中国乘用车产销量为313.7万辆和324.3万辆,同比下降16.8%和17.5%。但毫米波雷达安装量保持逆势增长。2019年1-2月,中国乘用车毫米波雷达累计安装量同比增长20.5%。其中,77GHz雷达增长迅速,同比增长64.1%,而24GHz雷达同比下降了2.2%。

佐思产研持续跟踪毫米波雷达市场,每月发布市场份额和安装量分析报告。同时开展的市场份额和安装量研究项目还包括:HUD、环视系统、T-BOX、前视摄像头等。欢迎关注或垂询。

Veoneer was the Champion in the SRR Field with a Share of 32.4% and Bosch Ruled the LRR Segment with 40.1% Shares in the Chinese Millimeter Wave Radar Market in January 2019.

It is shown from our survey of suppliers who provide radars for nearly 90 passenger car models in the Chinese market in January 2019 that these car models swept over 96% of total radar installations -- the number of OEM radars mounted on cars consumers have bought.

In January 2019, Veoneer grabbed the largest share of 32.4% in the Chinese short-range radar (SRR) market; and Continental, Hella, Aptiv and Valeo were in the second to fifth places, with a respective share of 22.2%, 20.4%, 14.8% and 6.6%.

In January 2019, Bosch came to the top spot with a share of 40.1% in the Chinese long-range radar (LRR) market; and Continental, Denso and Aptiv which commanded 35.0%, 14.6% and 6.0% of the market, respectively, were positioned at the second to fourth places.

In the first two months of 2019, China produced 3.137 million passenger cars and sold 3.243 million units, slumping by 16.8% and 17.5% from the same period last year, respectively. Yet radar market bucked the downtrend during the period, with installations in passenger cars surging by 20.5%, of which 77GHz radars enjoyed a 64.1% spurt while the 24GHz ones shrank by 2.2%.

We will follow up the developments of the Chinese radar market and release a report on supplier’s market share and installation each month. We also have concurrent research topics for you in the form of market share and installation reports, such as head-up display (HUD), surround view system, T-BOX and forward-looking camera. Your interest in us or consultation is well welcome.

第一章 毫米波雷达市场分析

1.1 2019年1月中国乘用车毫米波雷达安装量

1.2 带毫米波雷达车款的安装量(分品牌,车型)

1.3 各厂商短距毫米波雷达(SRR)安装量及市场份额

1.4 各厂商短距毫米波雷达(SRR)单价、销售额及市场份额

1.5 各厂商长距毫米波雷达(LRR)安装量及市场份额

1.6 各厂商长距毫米波雷达(LRR)单价、销售额及市场份额

1.7 不同价格区间的毫米波雷达安装量

1.8 不同供应商24G/77G毫米波雷达的安装量分布(按价格区间)

1.9 2019年1-2月累计毫米波雷达累计安装量,及24G/77G雷达装车量

1.10 2019年1-2月中国新车24GHz毫米波雷达安装量分价格占比 & 安装量TOP20品牌

1.11 2019年1-2月中国新车77 LRR和77SRR安装量增长情况

1.12 2019年1-2月中国新车77GHz毫米波雷达安装量分价格占比 & 安装量TOP20品牌

..........................................

第二章 毫米波雷达主要供应商分析

2.1 维宁尔

2.2 安波福

2.3 博世

2.3.1 博世LRR4雷达和MRR4雷达

2.3.2 博世第五代77GHz毫米波雷达

2.4 大陆

2.5 法雷奥

2.6 海拉

2.7 电装

..........................................

第三章 毫米波雷达芯片市场规模及份额

3.1 雷达系统供应商与雷达芯片厂商的供货关系

3.2 2019年1月乘用车市场毫米波雷达芯片安装量及市场份额

3.3 英飞凌

3.4 NXP

3.5 ST

3.6 TI

..........................................

第四章 毫米波雷达行业动向

4.1 加特兰微电子发布第二代Radar芯片SoC- ALPS系列

4.2 联发科发布已量产毫米波雷达平台Autus R10

4.3 岸达科技发布相控阵77GHz CMOS毫米波雷达芯片

4.4 行易道今年计划量产数万个 77GHz 中程毫米波雷达

..........................................

1 Millimeter Wave Radar Market Analysis

1.1 Radar Installations to Passenger Cars in China in January 2019

1.2 Radar-mounted Vehicle Models’ Installations (by Brand/by Vehicle Model)

1.3 Vendors’ SRR Installations and Their Market Shares

1.4 Vendors’ SRR Unit Price, Sales and Market Shares

1.5 Vendors’ LRR Installations and Their Market Shares

1.6 Vendors’ LRR Unit Price, Sales and Market Shares

1.7 Installations of Radars by Price

1.8 Installation Structure of 24GHz/77GHz Radars of Vendors by Price

1.9 Total Radar Installations and 24GHz/77GHz Radar Installations, Jan-Feb 2019

1.10 Installation Structure of 24GHz Radars for New Vehicles by Price and Top 20 Brands by Installation in China, Jan-Feb 2019

1.11 Growth in Installations of 77GHz LRR/SRR for New Vehicles in China, Jan-Feb 2019

1.12 Installation Structure of 77GHz Radars for New Vehicles by Price and Top 20 Brands by Installation in China, Jan-Feb 2019

..........................................

2 Millimeter-wave Radar Suppliers

2.1 Veoneer

2.2 Aptiv

2.3 Bosch

2.3.1 Bosch LRR4 Radar and MRR4 Radar

2.3.2 Bosch 5th-generation 77GHz Radar

2.4 Continental

2.5 Valeo

2.6 Hella

2.7 Denso

..........................................

3 Millimeter-wave Radar Chip Market Size and Share

3.1 Supply Relation between Radar System Suppliers and Radar Chip Vendors

3.2 Radar Chip Installations to Passenger Cars and Market Shares in January 2019

3.3 Infineon

3.4 NXP

3.5 ST

3.6 TI

..........................................

4 Millimeter-wave Radar Industry Dynamics

4.1 Calterah Unveiled Its 2nd-generation Radar Chip SoC-ALPS Series

4.2 MediaTek Launched the Mass-produced Radar Platform -- Autus R10

4.3 ANDAR Technologies Rolled Out Phased Array 77GHz CMOS Radar Chip

4.4 Beijing Autoroad Tech Is Scheduled to Mass-produce Tens of Thousands of 77GHz Medium Range Radars

..........................................