经过案头研究、数据处理、调研及整理、评价分析等一整套流程,最后得到了2019Q1中国乘用车市场HUD供应商竞争力排名,电装排在全部供应商的第一位,乐驾排在国内供应商的第一位。

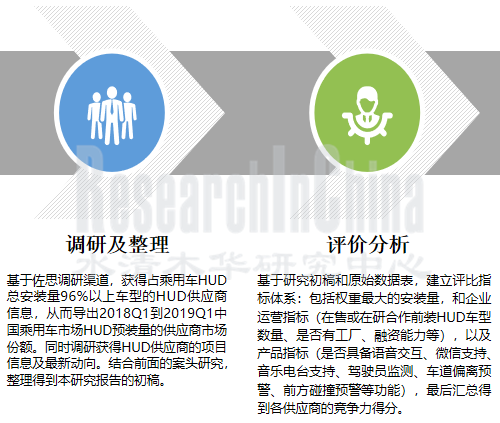

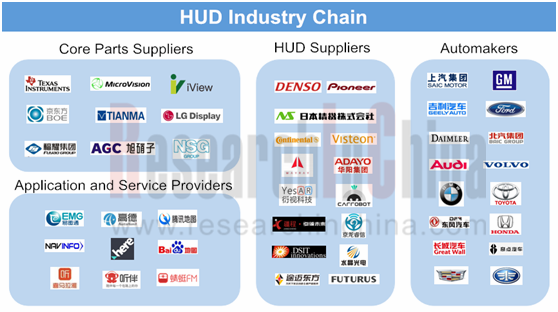

HUD产业曾经在2014-2015年兴起一波热潮,其中的代表企业就是NAVDY,但是佐思最新整理的HUD产业链全景图中,已经没有了NAVDY的身影。

NAVDY走的是DLP的技术路线,DLP HUD存在一些短板,设计过于复杂和成本过高。TI的第一代DLP芯片工作温度范围只有 -40-85℃,达不到车规级要求。Navdy从高通和其他几个风投公司成功融到了4200万美元。原本应该2015年一季度正式发售的Navdy HUD,推迟了近两年才与消费者见面。2016年10 月产品正式上市时,价格从预售的299美元飙升至 799 美元。在后装市场推广失败后,2018年,NAVDY不得不进入清算程序。

2016-2017年,众多HUD创业团队沿袭了Navdy技术路线,采用DLP来作为显示系统,但是遇到很多技术瓶颈,导致产品推出不断延期。最后,多数转而采用TFT显示技术。譬如乐驾科技的第一代HUD产品采用DLP成像方式,从第二代开始采用TFT成像方式。

2018年,TI正式推出满足车规的第二代芯片DLP 3030-Q1和DLP5530-Q1。相比较前代产品体积更小可视面积更高,满足 AR HUD 场景。DMD DLP3030-Q1在尺寸上有 65% 的降低,PGU 光引擎部分可以做得更小,工作温度范围为 -40-105℃。

从技术上讲,DLP是目前最优秀最成熟的显示技术。因此,舜宇等大厂依然看好基于DLP 技术的 HUD ,花了几千万引进自由曲面镜生产线。

2018年以来的第二波HUD热潮,主要是由于AR HUD的兴起。

AR HUD是增强现实抬头显示技术,它可以在驾驶员视线区域内合理叠加显示一些驾驶信息,并结合于实际交通路况当中。与HUD相比,AR HUD显示的范围更大,距离更远,而且更为复杂。前者只是投射并显示信息的设备,而AR HUD则需要和ADAS系统深度整合,以实现更高级的效果和功能。

正因为AR HUD能够实现与ADAS系统的深度整合,而已经成为汽车智能化刚需的ADAS发展迅猛,从而带动了对AR HUD的需求。

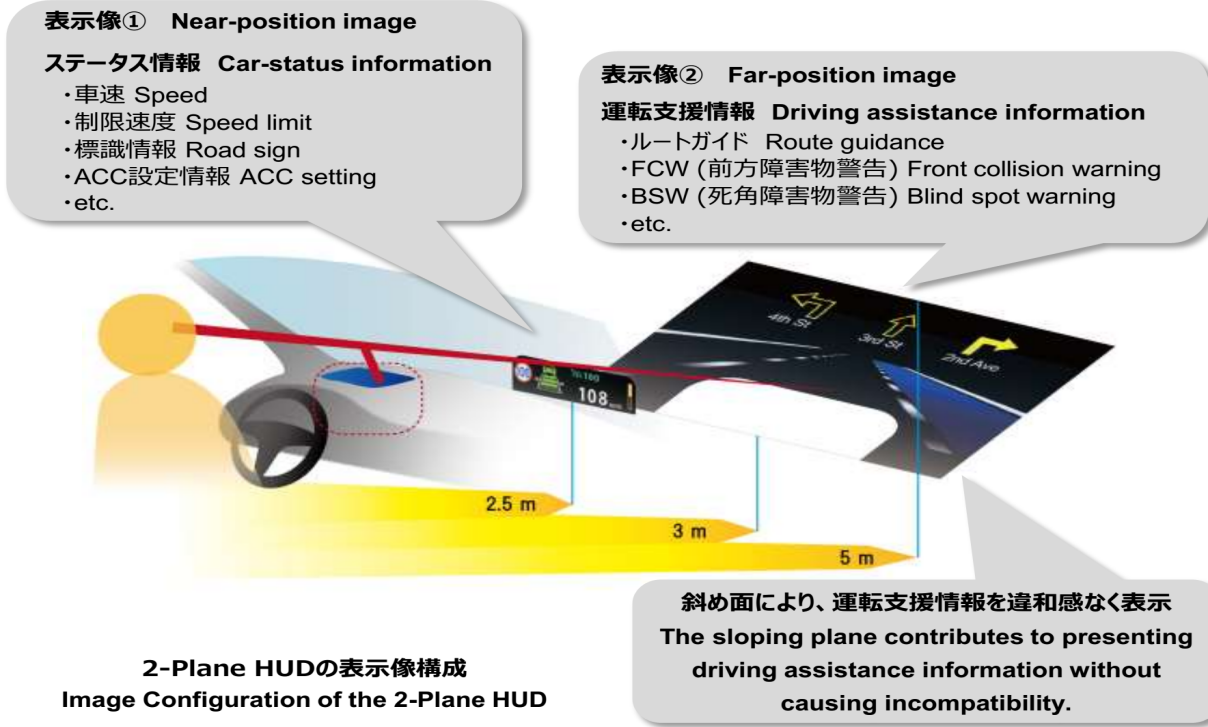

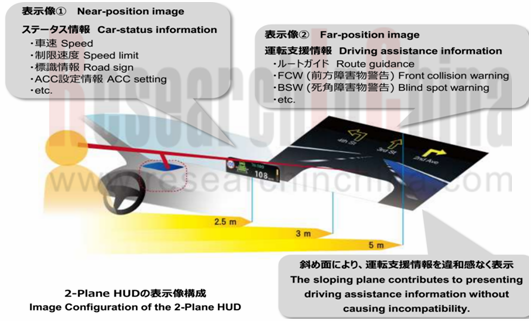

AR HUD的图像显示一般分为两层或者三层。譬如日本精机的AR-HUD分为三层显示:近场显示层、远场显示层、侧方层。近场显示层主要显示车状态信息,远场显示层显示ADAS信息,还有一个立体的侧方层,显示车道或导航信息。

在汽车智能网联化趋势下,任何汽车电子产品很难成为一个独立的存在。HUD作为一种汽车电子产品,正成为座舱电子解决方案和ADAS整体解决方案的一部分。

松下汽车在2019 CES展推出其最新SPYDR 2.0,单芯片驾驶舱域控制器解决方案,集成了HUD和驾驶员监控系统(DMS)。SPYDR 2.0可以将车载信息娱乐系统(IVI)、仪表盘、环视系统、主动降噪系统(ANC)、HUD以及4个娱乐系统显示器集成在一个平台上。

在这种集成化趋势下,传统Tier1巨头有天然竞争优势,独立HUD供应商则需要与其他产品供应商达成紧密合作关系。疆程+百度、乐驾+联通、乐驾+思必驰等合作模式,正是顺应集成化趋势的举措。

Automotive Head-up Display (HUD) Industry Report: Installation of OEM HUD for Passenger Cars Soared by 94.1% Year on Year in China in 2018

In 2018, 308,900 units of OEM HUDs were installed in passenger cars in China, a 94.1% upsurge from a year earlier, according to our recent report -- Automotive HUD Industry Report, 2018-2019.

We worked out 2019Q1 lists of passenger car HUD supplier ranking by competitiveness with efforts from secondary research, data processing, and investigation & integration to evaluation & analysis. Denso came to the top spot among all suppliers and CarRobot ranked first among Chinese suppliers.

HUD was in vogue from 2014 to 2015. NAVDY that was a typical supplier then, however, doesn’t appear on our latest HUD industry chain.

NAVDY followed a digital light processing (DLP) technology roadmap, but DLP HUD had some drawbacks like complicated design and high cost. In TI’s case, its first-generation DLP chip only worked at temperatures of -40-85℃, short of automotive standards. Navdy raised USD42 million from Qualcomm and several other venture capital firms. Navdy HUD which should have been launched in the first quarter of 2015 came out just in recent two years. In October 2016, the product was put on sale, but its price surged to USD799 from the pre-sale price of USD299. In 2018, NAVDY had to go into liquidation after its failure in aftermarket.

Many a HUD start-up applied Navdy’s technology between 2016 and 2017. Using DLP as display system only left them a range of technology bottlenecks and often deferred launch of products. Most of them then turned to thin film transistor (TFT) display technology. Examples include CarRobot who designed its first-generation HUD with DLP technology but changed to TFT for its second-generation products.

In 2018, TI officially rolled out the 2nd-generation automotive chips DLP3030-Q1 and DLP5530-Q1 featuring smaller size and wider field of view and sufficing for AR head-up display (HUD). DLP3030-Q1 sees the digital micromirror device (DMD) footprint reduction by 65%, enabling smaller picture generation unit (PGU) design. It can operate between -40°C and +105°C

Technically, DLP is the best and most mature display technology by far. Therefore, Sunny Optical and other giants are still optimistic about HUD based on DLP technology, and they even spend tens of millions of yuan on introducing free-form surface mirror production lines.

The second HUD craze since 2018 arises from the emergence of AR HUD.

AR HUD, the augmented reality head-up display technology, superimposes some driving information in the driver's field of vision reasonably and combines it with real traffic conditions. Compared with HUD, AR HUD displays a wider range from a farther distance, and it is more complex. HUD is just a device that projects and displays information, while AR HUD needs to be deeply integrated with ADAS to achieve more advanced effects and functions.

Given the deep integration of AR HUD with ADAS, the burgeoning development of ADAS as a must for automotive intelligence has driven the demand for AR HUD.

The image display of AR HUD is generally distributed in two or three layers. For instance, the AR-HUD of Nippon Seiki boasts three layers: the near field display layer, the far field display layer, and the side layer. The near field display layer is mainly a presentation of vehicle status, the far field display layer displays ADAS information, and the stereo side layer offers lane or navigation information.

Amid the intelligent connected trend of cars, any automotive electronic product is difficult to be independent. As an automotive electronic product, HUD has been an integral of the cockpit electronics solution and the overall ADAS solution.

Panasonic Automotive showcased its latest SPYDR 2.0 at CES 2019, which is a single-chip cockpit domain controller solution integrating Driver Monitoring System (DMS) with Head-Up Display (HUD). Besides, SPYDR 2.0 can integrate In-Vehicle Infotainment (IVI), dashboard, surround view system, Active Noise Control (ANC), HUD and four IVI displays on a platform

For this integration trend, traditional Tier1 giants enjoy first-mover advantages, whereas independent HUD suppliers have to establish close cooperation with other product suppliers. The collaboration modes -- Jiang Cheng + Baidu, Carrobot + China Unicom, Carrobot + AI Speech, etc. just follow the integration trend.

前言

研究背景和主要内容

研究方法

HUD供应商2019Q1竞争力排名及说明术语

第一章 汽车HUD简介

1.1 HUD的定义

1.2 HUD的分类

1.3 HUD常见概念

1.4 分辨率和瞳距

1.5 投影技术

1.6 典型CHUD

1.7 WHUD结构和光路

1.8 前装CHUD和WHUD的代表车型

1.9 奥迪A6的HUD

1.10 技术难度大

1.11 HUD发展趋势

1.12 HUD产业链全景图

第二章 汽车HUD市场

2.1 2016-2021全球汽车HUD前装市场规模及出货量

2.2 2016-2021年全球后装HUD出货量

2.3 全球主要前装HUD厂家市场占有率

2.4 2017年1月-2019年1月中国乘用车市场前装HUD渗透率

2.5 2018年中国乘用车市场HUD安装量(TOP20 车型)

2.6 2018年中国乘用车市场前装HUD安装量(TOP19 品牌)

2.7 2018年1月-2019年3月主要HUD厂商中国乘用车市场安装量

2.8 2018年及2019Q1中国乘用车HUD供应商及市场份额

2.9 2018Q1-2019Q1中国乘用车前装HUD安装量中的W型和C型占比

2.10 2018-2025全球AR HUD产量

2016-2025中国乘用车前装HUD安装量

第三章 各类HUD技术研究

3.1 DLP HUD

3.1.1 DLP简介

3.1.2 DLP是目前性能最成熟的技术

3.1.3 DLP型HUD的光路

3.1.4 Navdy的DLP HUD

3.2 激光扫描HUD

3.2.1 PicoP Laser Beam Scan Engine

3.2.2 MicroPicoP特点

3.2.3 三菱和先锋使用了MicroVision专利

3.2.4 Intersil的激光扫描型HUD

3.2.5 松下激光扫描型HUD

3.3 AR HUD

3.3.1 与ADAS完美融合的AR HUD

3.3.2 AR HUD的基本特征

3.3.3 单图层与双图层AR HUD

3.3.4 大陆的AR HUD

3.3.5 大陆AR-HUD的双图层显示

3.3.6 AR-Creater

3.3.7 日本精机的AR-HUD设计

3.3.8 AR-HUD还需解决的问题

第四章 全球HUD厂家研究

4.1 Nippon Seiki

4.1.1 Nippon Seiki简介

4.1.2 营收与主要客户

4.1.3 日本精机2018Q1-2019Q1中国乘用车前装HUD安装量

4.1.4 HUD产能和生产基地

4.2 大陆

4.2.1 公司简介

4.2.2 HUD业务布局

4.2.3 大陆HUD应用车型示例

4.2.4 大陆典型HUD产品

4.2.5 大陆2018Q1-2019Q1中国乘用车前装HUD安装量

4.3 电装

4.3.1 公司简介

4.3.2 HUD产品

4.3.3 电装2018Q1-2019Q1中国乘用车前装HUD安装量

4.4 先锋

4.4.1 Pioneer SPX-HUD100

4.4.2 Pioneer LaserScan HUD

4.5 伟世通

4.5.1 公司简介

4.5.2 HUD业务发展情况

4.5.3 伟世通的HUD产品路线图

4.5.4 伟世通2018Q1-2019Q1中国乘用车前装HUD安装量

4.6 WayRay

4.6.1 公司简介

4.6.2 产品规格和应用案例

4.7 国外HUD厂商对比分析

第五章 国内HUD厂家研究

5.1 未来黑科技

5.1.1 公司简介

5.1.2 产品参数及售价

5.1.3 技术研发、市场布局与项目案例

5.2 乐驾科技

5.2.1 公司简介

5.2.2 发展历程

5.2.3 产品参数及售价

5.3 途行者

5.4 疆程

5.5 水晶光电

5.5.1 公司简介

5.5.2 已开展HUD项目

5.6 点石创新

5.6.1 公司及产品简介

5.6.2 已开展的HUD项目

5.7 衍视科技

5.7.1 公司简介

5.7.2 主要产品规划

5.8 京龙睿信

5.8.1 公司简介

5.8.2 主要产品

5.8.3 最新HUD产品特点

5.9 华阳多媒体

5.9.1 公司简介

5.9.2 主要HUD产品

5.9.3 已开展的部分HUD项目

5.10 国内HUD供应商对比分析

第六章 HUD核心部件供应商研究

6.1 德州仪器

6.1.1 TI 全新DLP芯片支持AR HUD

6.1.2 TI 全新DLP芯片参数对比

6.2 Microvision

6.2.1 公司简介

6.2.2 采用Microvision专利的产品

6.3 广景视睿

6.4 京东方的HUD项目

6.5 天马和LGD的HUD技术投入

6.6 福耀玻璃

6.6.1 福耀的抬头显示玻璃

6.6.2 福耀HUD玻璃的主要客户

Preface

Research Background and Main Contents

Methodology

Ranking of HUD Suppliers by Competitiveness in 2019Q1 and the Instructions

Terminology

1 Automotive HUD

1.1 Definition

1.2 Classification

1.3 Common Concepts

1.4 Resolution and Pupillary Distance

1.5 Projection Technology

1.6 Typical CHUD

1.7 WHUD Structure and Light Path

1.8 Typical Vehicle Models with OEM Installation of CHUD and WHUD

1.9 HUD of Audi A6

1.10 Technical Difficulty

1.11 HUD Development Tendency

1.12 A Panorama of HUD Industry Chain

2 Automotive HUD Market

2.1 Global Automotive OEM HUD Market Size and Shipments, 2016-2021E

2.2 Global Automotive Aftermarket HUD Shipments, 2016-2021E

2.3 Market Shares of Major Global OEM HUD Vendors

2.4 Penetration of OEM HUD for Passenger Car in China, Jan 2017-Jan 2019

2.5 Installation of HUD for Passenger Car in China (Top 20 Vehicle Models), 2018

2.6 Installation of OEM HUD for Passenger Car in China (Top 19 Brands), 2018

2.7 Installation of HUD for Passenger Car by Vendor in China, Jan 2018-Mar 2019

2.8 Passenger Car HUD Suppliers in China and Their Market Shares, 2018 & 2019Q1

2.9 W/C-type HUD as a Percentage of Passenger Car OEM HUD Installation in China, 2018Q1-2019Q1

2.10 Global AR HUD Output, 2018-2025E

Installation of OEM HUD for Passenger Car in China, 2016-2025E

3 All Kinds of HUD Technologies

3.1 DLP HUD

3.1.1 Introduction to DLP

3.1.2 DLP is the Most Mature Technology

3.1.3 Light Path of DLP HUD

3.1.4 Navdy’s DLP HUD

3.2 Laser Scanning HUD

3.2.1 PicoP Laser Beam Scan Engine

3.2.2 Features of MicroPicoP

3.2.3 Mitsubishi and Pioneer Apply MicroVision’s Patent

3.2.4 Intersil’s Laser Scanning HUD

3.2.5 Panasonic’s Laser Scanning HUD

3.3 AR HUD

3.3.1 AR HUD -- a Perfect Fusion with ADAS

3.3.2 Essential Features of AR HUD

3.3.3 Single-layer and Double-layer AR HUD

3.3.4 Continental’s AR HUD

3.3.5 Double Layer Display of Continental AR-HUD

3.3.6 AR-Creater

3.3.7 AR-HUD Design of Nippon Seiki

3.3.8 Challenges for AR-HUD

4 Foreign HUD Vendors

4.1 Nippon Seiki

4.1.1 Profile

4.1.2 Revenue and Major Customers

4.1.3 Installation of Nippon Seiki’s OEM HUD for Passenger Car in China, 2018Q1-2019Q1

4.1.4 HUD Production Bases and Capacities

4.2 Continental

4.2.1 Profile

4.2.2 HUD Business Layout

4.2.3 Continental Automotive HUD Application Cases

4.2.4 Typical HUD Products

4.2.5 Installation of Continental’s OEM HUD for Passenger Car in China, 2018Q1-2019Q1

4.3 Denso

4.3.1 Profile

4.3.2 HUD Products

4.3.3 Installation of Denso’s OEM HUD for Passenger Car in China, 2018Q1-2019Q1

4.4 Pioneer

4.4.1 Pioneer SPX-HUD100

4.4.2 Pioneer LaserScan HUD

4.5 Visteon

4.5.1 Profile

4.5.2 HUD Business Development

4.5.3 HUD Product Roadmap

4.5.4 Installation of Visteon’s OEM HUD for Passenger Car in China, 2018Q1-2019Q1

4.6 WayRay

4.6.1 Profile

4.6.2 Product Specifications and Applied Cases

4.7 Comparative Analysis of Foreign HUD Vendors

5 Chinese HUD Vendors

5.1 Futurus Technology Co., Ltd.

5.1.1 Profile

5.1.2 Parameters and Selling Prices of Products

5.1.3 Technology R&D, Market Layout and Project Cases

5.2 Beijing Lejia Technology Co., Ltd. (CarRobot)

5.2.1 Profile

5.2.2 Development Course

5.2.3 Parameters and Selling Prices of Products

5.3 Shenzhen Tuxingzhe Technology Co., Ltd.

5.4 Shenzhen Jiangcheng Technology Co., Ltd.

5.5 Zhejiang Crystal-Optech Co., Ltd.

5.5.1 Profile

5.5.2 HUD Projects under Way

5.6 DSIT Innovations

5.6.1 Company Profile and Introduction to Products

5.6.2 HUD Projects under Way

5.7 YesAR Technology

5.7.1 Profile

5.7.2 Planning for Main Products

5.8 Shenzhen 3 Dragons Technology Ltd.

5.8.1 Profile

5.8.2 Major Products

5.8.3 Features of the Latest HUD Product

5.9 Foryou Multimedia Electronics

5.9.1 Profile

5.9.2 Major HUD Products

5.9.3 Some HUD Projects under Way

5.10 Comparative Analysis of Chinese HUD Suppliers

6 Suppliers of Core Components for HUD

6.1 TI

6.1.1 TI’s New DLP Chips Support AR HUD

6.1.2 Comparison of Parameters between TI’s New DLP Chips

6.2 Microvision

6.2.1 Profile

6.2.2 Products Used with Microvision Patents

6.3 iView Displays (ShenZhen) Co., Ltd.

6.4 HUD Project of BOE

6.5 HUD Investment of Tianma Microelectronics and LGD

6.6 Fuyao Glass Industry Group

6.6.1 HUD Glass

6.6.2 Major Customers for Fuyao’s HUD Glass