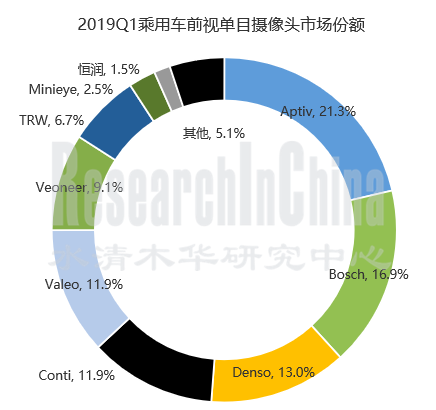

《2019第一季度中国乘用车摄像头市场跟踪报告》,报告显示:中国乘用车市场前视摄像头需求以单目为主,2019年1-3月前视单目摄像头安装量同比增长71.7%。

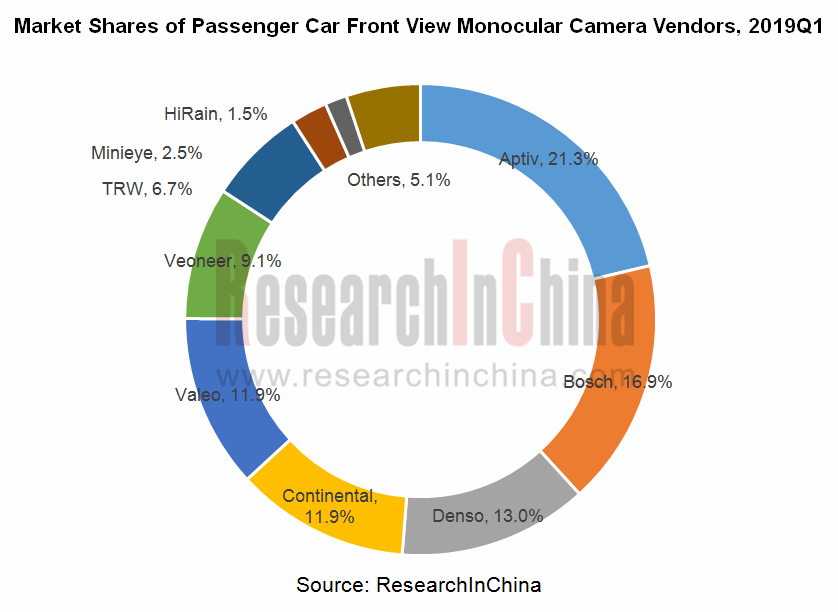

其中安波福、博世、电装分列前三位,市场份额分别为21.3%,16.9%,13.0%。

与毫米波雷达市场由ABCD四强垄断相比,中国国内厂商在ADAS摄像头领域取得突破,Minieye和恒润都进入了前视单目摄像头市场的前十,份额分别为2.5%和1.5%。

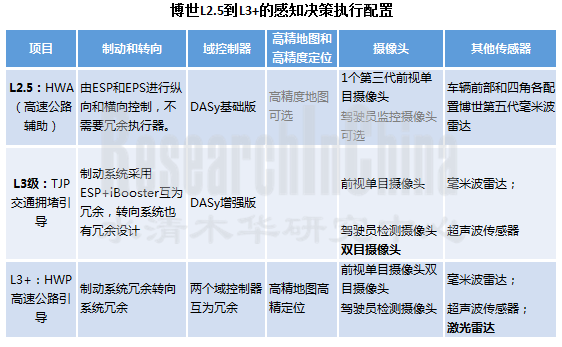

博世视觉ADAS产品在中国市场增长很快,其前视单目产品的市场份额从2018年的不到10%,增长到2019Q1的16.9%。博世支持的L2级别已量产自主品牌车型有:吉利博瑞GE、长安CS55、长城VV6、吉利缤瑞、上汽Marvel X、上汽通用五菱 新宝骏RS-5等。博世预计,2019年会有40+款搭载其L2级自动驾驶功能的车型上市。

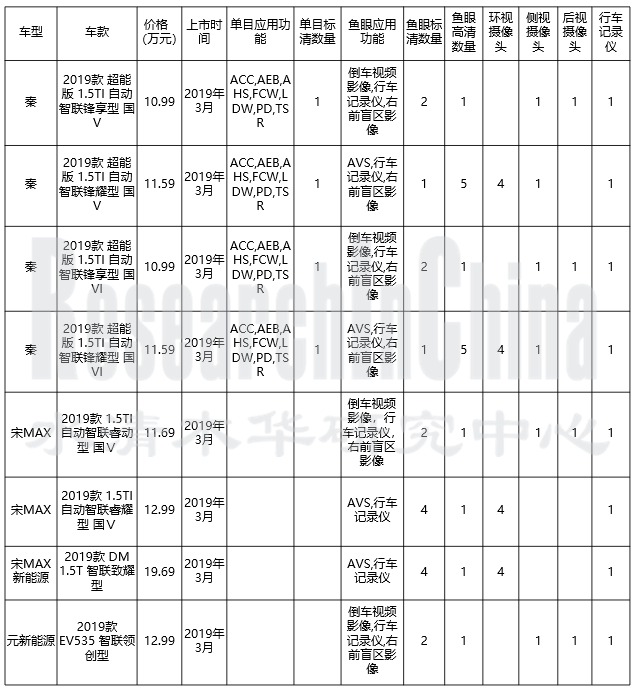

2019Q1中国乘用车市场推出的572新车中(注:同一车型不同配置按不同款计),上汽大众推出最多,达66款;比亚迪其次,达41款。但是比亚迪的车载摄像头配置最为全面。

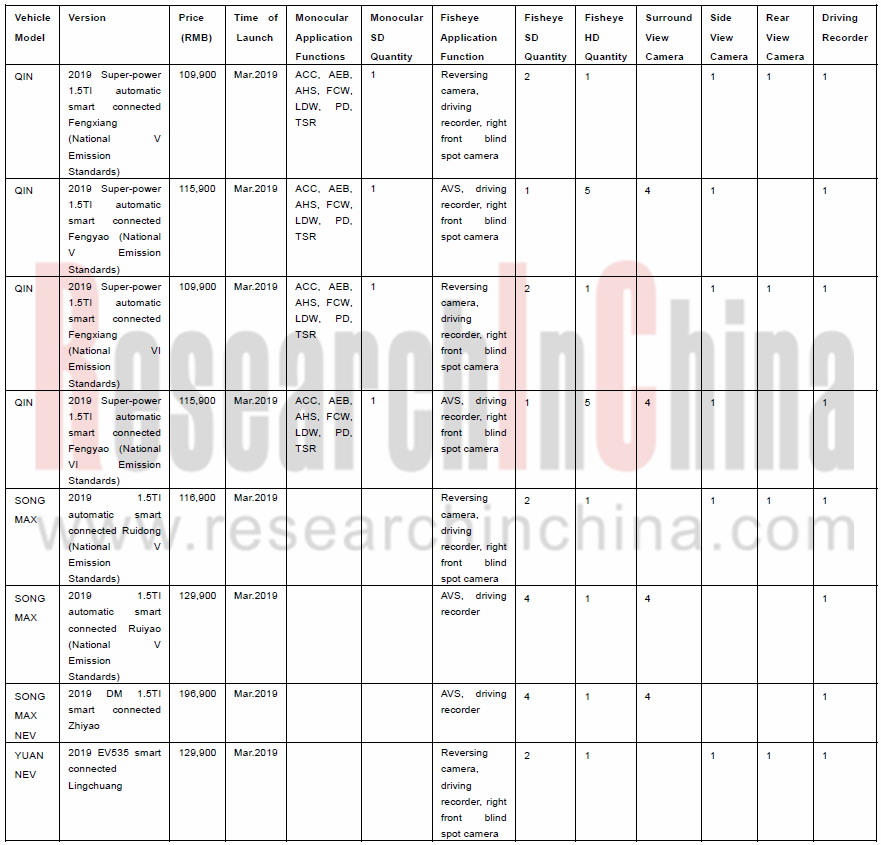

2019年第一季度,比亚迪共发布了7个车型41个车款,其中有8款配备了单目标清摄像头,有32款配了鱼眼标清摄像头,26款配了鱼眼高清摄像头;8款带环视功能,24款带侧视功能,28款带倒车影像功能,26款带行车记录仪功能。以下为部分车型视觉传感器配置情况:

Passenger Car Camera Market: Front-view Monocular Camera Installation Soared by 71.7% in 2019Q1 from the Same Period Last Year.

In China, front view monocular camera is the one largely demanded in passenger car market, with its installations in 2019Q1 surging by 71.7% from the same period of 2018, according to our recent report -- China Passenger Car Camera Market Report, 2019Q1.

The top three players Aptiv, Bosch and Denso commanded 21.3%, 16.9% and 13.0% of the market, respectively.

Chinese vendors have made headway in ADAS camera field, among which Minieye and HiRain Technologies have entered the top ten monocular camera vendor list where the four radar monopolists, Aptiv, Bosch, Continental and Denso are also ranked, with respective market share of 2.5% and 1.5%.

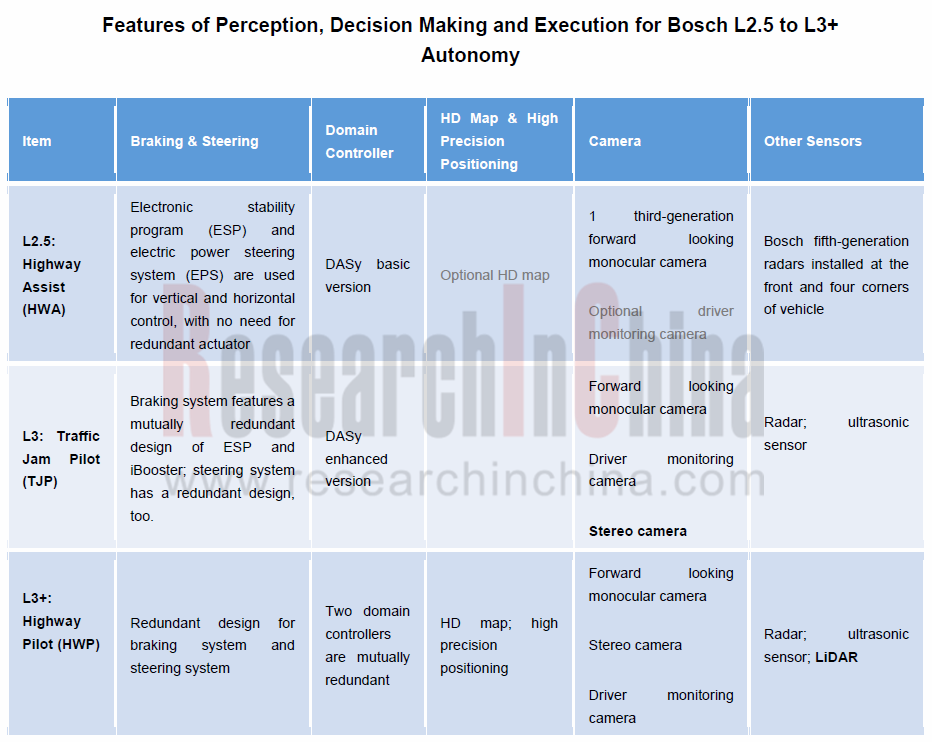

Bosch vision-based ADAS products grow fast in the Chinese market. In 2019Q1, the market share of its forward looking monocular cameras jumped to 16.9% compared with less than 10% in 2018. The mass-produced Chinese vehicle models packing Bosch L2 autonomy technology include: Geely Borui GE, Changan CS55, Great Wall VV6, Geely Binrui, SAIC Marvel X and SGMW New Baojun RS-5. Bosch expects more than 40 models with its L2 capability will be available on market in 2019.

Of the 572 new car models launched in China in 2019Q1 (note: the number of models is counted based on configuration), SAIC rolled out the most, 66 models; BYD followed with 41 models having the most complete camera configurations.

In 2019Q1, BYD released 7 new cars in 41 models, including: 8 with monocular SD camera; 32 with fisheye SD camera; 26 with fisheye HD camera; 8 with around view camera; 24 with side view camera; 28 with reversing camera; 26 with driving recorder. Vision sensor configurations of some models are shown below.

前言

研究背景和主要内容

研究方法

术语

第一章 中国乘用车摄像头市场

2019Q1中国乘用车市场前视单目和双目摄像头安装量及增长率

2018年1月-2019年3月中国新车前视单目及双目摄像头安装量(颗) 2019Q1中国乘用车新车前视单目装配量分价格占比

2019Q1中国乘用车新车前视单目装配量TOP20品牌(辆) 2019Q1中国乘用车新车前视单目安装量TOP30车型 2019Q1中国乘用车新车前视单目供应商及安装量份额 2018Q1-2019Q1中国乘用车新车前视单目供应商及安装量、安装量占比 2019年Q1中国新车摄像头安装量&按位置安装量(颗)

2019年Q1中国新车摄像头安装量占比(按个数&按位置) 2019年1-3月中国新车后视摄像头安装量及增长率(分倒车影像和流媒体后视镜)

2018年1月-2019年3月中国新车后视倒车影像及流媒体摄像头安装量

2019Q1中国新车倒车影像装配量分价格占比(%)

2019Q1中国新车倒车影像装配量TOP20品牌

2018年1月至2019年3月中国新车环视摄像头月度安装量(颗)

2019Q1中国新车环视系统装配量分价格占比(%)

2019Q1中国新车环视系统装配量TOP20品牌(辆)

2019年1-3月中国新车侧视摄像头安装量及增长率

2018年1月-2019年3月中国新车侧视摄像头安装量(颗)

…………………………………………

第二章 汽车视觉供应商安装量及动向

2.1 安波福

2.1.1 2018Q1-2019Q1 Aptiv前视单目在中国乘用车市场安装量及份额

2.1.2 安波福近期发展动向 2.2 博世

2.2.1 2018Q1-2019Q1 博世前视单目在中国乘用车市场安装量及份额

2.2.2 博世供货车型情况及近期发展方向

2.3 2018Q1-2019Q1 电装 前视单目在中国乘用车市场安装量及份额

2.4 大陆 前视单目在中国乘用车市场安装量及份额

2.5 2018Q1-2019Q1 法雷奥 前视单目在中国乘用车市场安装量及份额

2.6 2018Q1-2019Q1 Veoneer 前视单目在中国乘用车市场安装量及份额

2.7 2018Q1-2019Q1 TRW 前视单目在中国乘用车市场安装量及份额

2.8 2018Q1-2019Q1 镜泰 前视单目在中国乘用车市场安装量及份额

2.9 2018Q1-2019Q1 恒润科技 前视单目在中国乘用车市场安装量及份额

2.10 Minieye

2018Q3-2019Q1 Minieye 前视单目在中国乘用车市场安装量及份额

Minieye近期发展动向

…………………………………………

第三章 国内整车厂视觉传感器配置及功能分析

3.1 长城汽车

2019Q1 长城新发布车型的视觉传感器配置情况

2019Q1 长城新发布车型的视觉ADAS功能情况

3.2 吉利汽车

2019Q1 吉利新发布车型的视觉传感器配置情况

2019Q1 吉利新发布车型的视觉ADAS功能情况

3.3 比亚迪

2019Q1 比亚迪新发布车型的视觉传感器配置情况

2019Q1 比亚迪新发布车型的视觉ADAS功能情况

3.4 上汽乘用车

2019Q1 上汽乘用车新发布车型的视觉传感器配置情况

2019Q1 上汽乘用车新发布车型的视觉ADAS功能情况

3.5 长安汽车

2019Q1 长安汽车新发布车型的视觉传感器配置情况

2019Q1 长安汽车新发布车型的视觉ADAS功能情况

3.6 汉腾汽车

2019Q1 汉腾汽车新发布车型的视觉传感器配置情况

2019Q1 汉腾汽车新发布车型的视觉ADAS功能情况

3.7 零跑汽车

2019Q1 零跑汽车新发布车型的视觉传感器配置情况

2019Q1 零跑汽车新发布车型的视觉ADAS功能情况

第四章 合资品牌视觉传感器配置及功能分析

4.1 北京奔驰

2019Q1 北京奔驰新发布车型的视觉传感器配置情况

2019Q1 北京奔驰新发布车型的视觉ADAS功能情况

4.2 广汽丰田

2019Q1 广汽丰田新发布车型的视觉传感器配置情况

2019Q1 广汽丰田新发布车型的视觉ADAS功能情况

4.3 华晨宝马

2019Q1 华晨宝马新发布车型的视觉传感器配置情况

2019Q1 华晨宝马新发布车型的视觉ADAS功能情况

4.4 上汽大众

2019Q1 上汽大众新发布车型的视觉传感器配置情况

2019Q1 上汽大众新发布车型的视觉ADAS功能情况

4.5 上汽通用

2019Q1 上汽通用新发布车型的视觉传感器配置情况

2019Q1 上汽通用新发布车型的视觉ADAS功能情况

4.6 一汽大众

2019Q1 一汽大众新发布车型的视觉传感器配置情况

2019Q1 一汽大众新发布车型的视觉ADAS功能情况

4.7 一汽丰田

2019Q1 一汽丰田新发布车型的视觉传感器配置情况

2019Q1 一汽丰田新发布车型的视觉ADAS功能情况

4.8 东风悦达起亚

2019Q1 东风悦达起亚新发布车型的视觉传感器配置情况

2019Q1 东风悦达起亚新发布车型的视觉ADAS功能情况

4.9 奇瑞捷豹路虎

2019Q1 奇瑞捷豹路虎新发布车型的视觉传感器配置情况

2019Q1 奇瑞捷豹路虎新发布车型的视觉ADAS功能情况

4.10 长安马自达

2019Q1 长安马自达新发布车型的视觉传感器配置情况

2019Q1 长安马自达新发布车型的视觉ADAS功能情况

4.11 东风神龙

2019Q1 东风神龙新发布车型的视觉传感器配置情况

2019Q1 东风神龙新发布车型的视觉ADAS功能情况

4.12 江铃福特

2019Q1 江铃福特新发布车型的视觉传感器配置情况

2019Q1 江铃福特新发布车型的视觉ADAS功能情况

第五章 视觉传感器行业发展动向

5.1 视觉处理芯片发展动向

5.2 软件和算法发展动向

Preface

Research Background and Contents

Methodology

Terminology

1 Chinese Passenger Car Camera Market

Front-view Monocular and Stereo Camera Installations and Growth Rate in Chinese Passenger Car Market, 2019Q1

Front-view Monocular and Stereo Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Front-view Monocular Camera Installations to New Passenger Cars in China by Price, 2019Q1

Top 20 Brands by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Top 30 Models by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Share by Installations in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Installations and Share in China, 2018Q1-2019Q1

Camera Installations to New Cars and Installations by Position in China, 2019Q1

Proportion of Camera Installations to New Cars in China by Number & by Position, 2019Q1

Rear-view Camera Installations to New Cars and Growth Rate in China by Reversing Camera and Streaming Rear-view Mirror, Jan-Mar 2019

Rear-view Reversing Camera and Streaming Media Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Reversing Camera Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Reversing Camera Installations to New Cars in China, 2019Q1

Monthly Surround-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Surround-view System Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Surround-view System Installations to New Cars in China, 2019Q1

Side-view Camera Installations to New Cars and Growth Rate in China, Jan-Mar 2019

Side-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

2 Installations and Dynamics of Automotive Vision Suppliers

2.1 Aptiv

2.1.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.1.2 Recent Developments

2.2 Bosch

2.2.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.2.2 Models Supported and Recent Developments

2.3 Denso’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.4 Continental’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.5 Valeo’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.6 Veoneer’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market

2.7 TRW’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.8 Gentex’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.9 HiRain’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.10 Minieye

Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

Recent Developments

3 Vision Sensor Configuration and Features of Chinese Automakers

3.1 Great Wall Motor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.2 Geely

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.3 BYD

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.4 SAIC Passenger Vehicle

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.5 Chang'an Automobile

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.6 Hanteng Autos

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.7 Leapmotor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4 Vision Sensor Configuration and Features of Joint Venture Brands

4.1 Beijing Benz

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.2 GAC Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.3 BMW Brilliance

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.4 SAIC Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.5 SAIC-GM

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.6 FAW-Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.7 FAW Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.8 Dongfeng Yueda Kia

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.9 Chery Jaguar Land Rover

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.10 Chang’an Mazda

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.11 Dongfeng Peugeot Citro?n

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.12 JMC Ford

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

5 Development Trends of Vision Sensor Industry

5.1 Development Trends of Visual Processing Chips

5.2 Development Trends of Software and Algorithms