|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2017-2021年中国汽车防抱死系统(ABS)行业研究报告 |

|

字数:4.2万 |

页数:163 |

图表数:148 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:2800美元 |

英文纸版:3000美元 |

英文(电子+纸)版:3100美元 |

|

编号:ZJF104

|

发布日期:2017-07 |

附件:下载 |

|

|

|

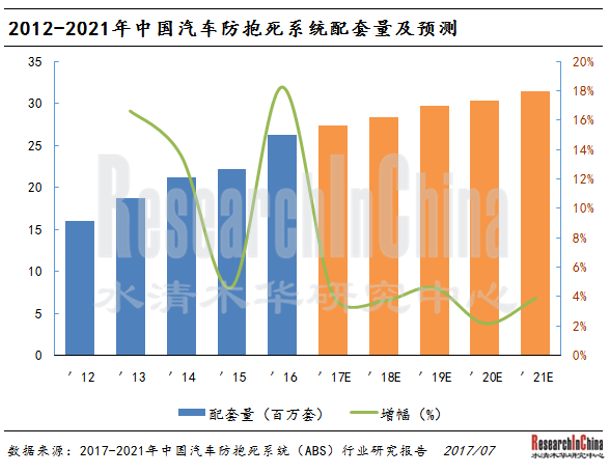

随着中国汽车工业的不断发展,人们对行车安全性能的要求也越来越高,推动了中国汽车防抱死系统(ABS)需求的增长。此外,近年来中国液压ABS系统已基本实现从中高端乘用车向低端车型的普及,《机动车安全运行技术条件》(GB7258)等标准及相关配套文件的出台,有效地提高了ABS在商用车领域的安装率。2016年,中国汽车ABS系统装配量达到2,628万套,同比增长18.3%。预计到2021年中国ABS需求量将达到3,149万套,年均复合增长率将达3.7%。

在产品细分方面,乘用车及小型商用车装配的ABS系统基本上都是液压型,大中型商用车装配的ABS系统为气压型。中国乘用车的产销量明显超过商用车,加之乘用车厂商及消费者对于安全系统的重视一直高于商用车,导致乘用车ABS装配率远高于商用车,2016年中国乘用车ABS装配量达到2258万套,装配率达到92.5%;而商用车ABS装配量为370万套,装配率达到39%,随着GB7258标准的实施日趋严厉,预计未来几年商用车的ABS装配率会有大幅的增长。

在竞争格局方面,和其他汽车零部件一样,汽车ABS系统的配套市场相对较为稳定。其中,乘用车ABS配套市场基本上被外资品牌所垄断,由大陆集团投资的上海汽车制动系统有限公司于1997年开始在国内生产ABS,2004年后BOSCH、MANDO、NISSIN等开始陆续进入国内,配套对应的合资品牌以及部分自主品牌;本土企业(如万向钱潮及亚太电机等)的实力近年虽有长足进步,但整体而言还比较弱,在产品质量和技术上还无法达到国外企业的先进水平,主要配套对象为自主汽车品牌,近年随着国内自主品牌产销量上涨,本土ABS配套厂商也取得不俗的成绩。商用车ABS配套仍以威伯科一家独大,占据约半壁江山,而国内厂商科密、万安、聚能等企业逐渐崛起,有望进一步提高市场占有率。

水清木华研究中心《2017-2021年中国汽车防抱死系统(ABS)行业研究报告》报告主要包括以下内容:

中国汽车防抱死系统行业概况(包括定义及分类,发展趋势等); 中国汽车防抱死系统行业概况(包括定义及分类,发展趋势等);

中国汽车行业发展以及防抱死系统行业总体概况(汽车产销量、保有量、ABS装配量、配套关系等) 中国汽车行业发展以及防抱死系统行业总体概况(汽车产销量、保有量、ABS装配量、配套关系等)

中国汽车防抱死系统细分市场分析(包括液压ABS、气压ABS的市场规模、竞争格局、发展趋势等); 中国汽车防抱死系统细分市场分析(包括液压ABS、气压ABS的市场规模、竞争格局、发展趋势等);

博世、大陆、采埃孚、爱德克斯、万都、日信工业、现代摩比斯、威伯科、KNORR在内的9家国际厂商以及亚太股份、华域汽车、万安科技、伯特利、万向钱潮、富奥股份、瑞立科密、重庆聚能、东风科技在内的9家国内主要厂商分析,包括公司简介、财务状况、主打产品、研发状况、生产基地分布以及技术特点等。 博世、大陆、采埃孚、爱德克斯、万都、日信工业、现代摩比斯、威伯科、KNORR在内的9家国际厂商以及亚太股份、华域汽车、万安科技、伯特利、万向钱潮、富奥股份、瑞立科密、重庆聚能、东风科技在内的9家国内主要厂商分析,包括公司简介、财务状况、主打产品、研发状况、生产基地分布以及技术特点等。

With the continuous development of the automobile industry in China, people have higher requirements on driving safety, thus fueling the demand for automotive anti-lock braking system (ABS). In addition, hydraulic ABS has virtually spread from mid-to high-end passenger cars to low-end models and the introduction of “Safety Specifications for Power-driven Vehicles Operating on Roads” (GB7258) and other relevant documents have boosted the installation rate of ABS in commercial vehicle field in recent years. 24.03 million sets of automotive ABS were installed in China in 2016, up by 18.3% from a year ago and driven by both policy incentives and a year-on-year 14.5% growth in auto sales. As the country’s auto production rose by only 4.6% in the first half of 2017, ABS growth also slowed correspondingly. China's demand for ABS is expected to hit 30.68 million sets in 2021 at a CAGR of 5.0%.

Product segments: the ABS on passenger cars and small commercial vehicles are largely hydraulic ones and the ABS on large and medium-sized commercial vehicles pneumatic ones. As the output and sales volume of passenger cars obviously exceed that of commercial vehicles, combined with passenger car makers’ and consumers’ greater emphasis on safety system, the installation rate of ABS in passenger cars is far higher than that in commercial vehicles. In 2016, 22.58 million sets of ABS were installed in passenger cars, representing an installation rate of 92.5%. As the standard GB7258 is implemented in a stricter manner, the installation rate of ABS in commercial vehicles is predicted to rise significantly over the next couple of years.

Competitive landscape: like other automotive parts, the automotive ABS market is more stable. Passenger car ABS market is practically monopolized by foreign brands. Continental-invested Shanghai Automotive Brake Systems Co., Ltd. (SABS) started local production of ABS in 1997 and BOSCH, MANDO and NISSIN began entering the Chinese market from 2004 to serve JV brands and some homegrown brands. Chinese enterprises (like Wanxiang Qianchao and Zhejiang Asia-pacific Mechanical & Electronic) have made remarkable headway in recent years but are still weak as a whole, lagging behind foreign counterparts in terms of product quality and technology. They serve mainly homegrown car brands whose sales rise in recent years and which have helped local ABS suppliers achieve exceptional performance. About half of commercial vehicle ABS market is occupied by WABCO, while emerging Chinese players like Kormee, VIE, and JuNeng will, hopefully, further raise their market share.

China Anti-lock Braking System (ABS) Industry Report, 2017-2021 focuses on the following:

Automotive ABS industry in China (definition and classification, development trends, etc.); Automotive ABS industry in China (definition and classification, development trends, etc.);

Automobile industry and ABS industry in China (auto output, sales, and ownership, ABS installations, supporting relationship, etc.); Automobile industry and ABS industry in China (auto output, sales, and ownership, ABS installations, supporting relationship, etc.);

Chinese automotive ABS market segments (hydraulic ABS and pneumatic ABS (market size, competitive landscape, development trends, etc.)); Chinese automotive ABS market segments (hydraulic ABS and pneumatic ABS (market size, competitive landscape, development trends, etc.));

Nine international players (Bosch, Continental, ZF, ADVICS, Mando, Nissin Kogyo, Hyundai Mobis, WABCO, KNORR) and nine Chinese peers (Zhejiang Asia-pacific Mechanical & Electronic, HUAYU Automotive Systems, Zhejiang Vie Science & Technology, Wuhu Bethel Automotive Safety Systems, Wanxiang Qianchao, Fawer Automotive Parts, Guangzhou Ruili Kormee Automotive Electronic, Chongqing JUNENG, and Dongfeng Electronic Technology) (profile, financials, main products, R&D, distribution of production bases, technical characteristics, etc.) Nine international players (Bosch, Continental, ZF, ADVICS, Mando, Nissin Kogyo, Hyundai Mobis, WABCO, KNORR) and nine Chinese peers (Zhejiang Asia-pacific Mechanical & Electronic, HUAYU Automotive Systems, Zhejiang Vie Science & Technology, Wuhu Bethel Automotive Safety Systems, Wanxiang Qianchao, Fawer Automotive Parts, Guangzhou Ruili Kormee Automotive Electronic, Chongqing JUNENG, and Dongfeng Electronic Technology) (profile, financials, main products, R&D, distribution of production bases, technical characteristics, etc.)

第一章 行业简述

1.1 定义

1.2 发展历程

1.3 政策环境

1.4 供应链

1.5 汽车ABS发展前景

1.5.1 气压ABS

1.5.2 液压ABS

第二章 中国汽车ABS市场概况

2.1 中国汽车市场

2.1.1 产量

2.1.2 汽车保有量

2.2 汽车ABS市场规模

第三章 中国液压ABS发展情况

3.1 乘用车市场规模

3.2 液压ABS市场

3.3 竞争格局

3.4 配套情况

第四章 中国气压ABS市场分析

4.1 商用车市场规模

4.2 市场规模

4.3 竞争格局

4.4 配套情况

第五章 全球企业研究

5.1 博世

5.1.1 公司简介

5.1.2 运营情况

5.1.3 营收结构

5.1.4 制动系统业务

5.1.5 在华业绩

5.1.6 生产基地

5.1.7 研发

5.2 大陆

5.2.1 公司简介

5.2.2 运营情况

5.2.3 制动系统业务

5.2.4 在华业务

5.2.5 大陆汽车电子(长春)有限公司

5.2.6 最新发展动态

5.3 采埃孚

5.3.1 公司简介

5.3.2 运营情况

5.3.3 制动系统业务

5.3.4 在华业务

5.3.5 研发

5.3.6 最新进展

5.4 爱德克斯

5.4.1 公司简介

5.4.2 运营情况

5.4.3 制动系统业务

5.4.4 在华业务

5.4.5 爱徳克斯(天津)汽车零部件有限公司

5.4.6 爱徳克斯(广州)汽车零部件有限公司

5.5 万都中国

5.5.1 公司简介

5.5.2 经营情况

5.5.3 主要产品

5.5.4 配套关系

5.5.5 生产布局

5.6 日信工业

5.6.1 公司简介

5.6.2 运营情况

5.6.3 制动系统业务

5.6.4 主要客户

5.6.5 在华业务及生产基地

5.6.6 中山日信扩产项目动态

5.7 现代摩比斯

5.7.1 公司简介

5.7.2 运营情况

5.7.3 制动系统业务

5.7.4 在华业务

5.7.5 无锡摩比斯汽车零部件有限公司

5.7.6 天津摩比斯汽车零部件有限公司

5.8 威伯科(WABCO)

5.8.1 公司简介

5.8.2 运营情况

5.8.3 制动系统业务

5.8.4 在华业务

5.8.5 生产基地

5.9 KNORR

5.9.1 公司简介

5.9.2 运营情况

5.9.3 制动系统业务

5.9.4 在华业务

第六章 中国企业研究

6.1 亚太股份

6.1.1 公司简介

6.1.2 运营情况

6.1.3 营收结构

6.1.4 主要客户

6.1.5 制动电子业务

6.1.6 智能汽车业务布局

6.1.7 募投汽车制动系统电子控制模块技术改造项目

6.1.8 发展预测

6.2华域汽车系统股份有限公司

6.2.1 公司简介

6.2.2 运营情况

6.2.3 营收结构

6.2.4 产量

6.2.5 上海汽车制动系统有限公司

6.2.6 华域大陆重庆公司投入运行

6.3 万安科技

6.3.1 公司简介

6.3.2 运营情况

6.3.3 营收结构

6.3.4 主要客户

6.3.5 生产基地及配套关系

6.3.6 新建项目

6.3.7 智能汽车布局

6.4 芜湖伯特利汽车安全系统股份有限公司

6.4.1 公司简介

6.4.2 运营情况

6.4.3 主要客户

6.4.4 原材料供应

6.4.5 生产能力

6.4.6 销售情况

6.4.7 募投项目

6.5 万向钱潮

6.5.1 公司简介

6.5.2 运营情况

6.5.3 营收结构

6.5.4 制动系统业务

6.5.5 研发

6.5.6 配套关系

6.5.7 募投项目

6.6 富奥股份

6.6.1 公司简介

6.6.2 运营情况

6.6.3 营收结构

6.6.4主要产品及客户

6.6.5 生产基地

6.7 瑞立科密

6.7.1 公司简介

6.7.2 运营情况

6.7.3 营收结构

6.7.4 ABS业务

6.7.5 子公司情况

6.8 重庆聚能

6.8.1 公司简介

6.8.2 ABS业务

6.9 东风科技

6.9.1 公司简介

6.9.2 运营情况

6.9.3 制动系统业务

1 Overview of Industry

1.1 Definition

1.2 Development History

1.3 Policy Environment

1.4 Supply Chain

1.5 Automotive ABS Outlook

1.5.1 Pneumatic ABS

1.5.2 Hydraulic ABS

2 Chinese Automotive ABS Market

2.1 Chinese Automobile Market

2.1.1 Output

2.1.2 Ownership

2.2 Automotive ABS Market Size

3 China Hydraulic ABS Market

3.1 Passenger Car Market Size

3.2 Hydraulic ABS Market

3.3 Competitive Landscape

3.4 Supporting

4 Chinese Pneumatic ABS Market

4.1 Commercial Vehicle Market Size

4.2 Market Size

4.3 Competitive Landscape

4.4 Supporting

5 Global Companies

5.1 Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Braking System Business

5.1.5 Performance in China

5.1.6 Production Base

5.1.7 R&D

5.2 Continental

5.2.1 Profile

5.2.2 Operation

5.2.3 Braking System Business

5.2.4 Business in China

5.2.5 Continental Automotive Changchun Co., Ltd.

5.2.6 Latest Developments

5.3 ZF

5.3.1 Profile

5.3.2 Operation

5.3.3 Braking System Business

5.3.4 Business in China

5.3.5 R&D

5.3.6 Latest Developments

5.4 ADVICS

5.4.1 Profile

5.4.2 Operation

5.4.3 Braking System Business

5.4.4 Business in China

5.4.5 ADVICS Tianjin Automobile Parts Co., Ltd.

5.4.6 ADVICS Guangzhou Automobile Parts Co., Ltd.

5.5 Mando China

5.5.1 Profile

5.5.2 Operation

5.5.3 Main Products

5.5.4 Supporting Relationship

5.5.5 Production Layout

5.6 Nissin Kogyo

5.6.1 Profile

5.6.2 Operation

5.6.3 Braking System Business

5.6.4 Major Customers

5.6.5 Business in China and Production Bases

5.6.6 Capacity Expansion of Zhongshan Nissin Industry

5.7 Hyundai Mobis

5.7.1 Profile

5.7.2 Operation

5.7.3 Braking System Business

5.7.4 Business in China

5.7.5 Wuxi Mobis Automotive Parts Co., Ltd.

5.7.6 Tianjin Mobis Automotive Parts Co. Ltd.

5.8 WABCO

5.8.1 Profile

5.8.2 Operation

5.8.3 Braking System Business

5.8.4 Business in China

5.8.5 Production Bases

5.9 KNORR-BREMSE

5.9.1 Profile

5.9.2 Operation

5.9.3 Braking System Business

5.9.4 Business in China

6 Chinese Companies

6.1 Zhejiang Asia-pacific Mechanical & Electronic

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Major Customers

6.1.5 Braking Electronics Business

6.1.6 Layout in Intelligent Car Business

6.1.7 Technological Transformation of Automotive Braking System ECU with Raised Funds

6.1.8 Development Forecast

6.2 HUAYU Automotive Systems

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Output

6.2.5 Shanghai Automotive Brake Systems Co., Ltd. (SABS)

6.2.6 Continental Huayu Brake Systems (Chongqing) Went into Operation

6.3 Zhejiang Vie Science & Technology

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Major Customers

6.3.5 Production Bases and Supporting Relationship

6.3.6 New Projects

6.3.7 Layout in Intelligent Vehicle

6.4 Wuhu Bethel Automotive Safety Systems

6.4.1 Profile

6.4.2 Operation

6.4.3 Major Customers

6.4.4 Supply of Raw Materials

6.4.5 Production Capacity

6.4.6 Sales

6.4.7 Projects with Raised Funds

6.5 Wanxiang Qianchao

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Braking System Business

6.5.5 R&D

6.5.6 Supporting Relationship

6.5.7 Projects with Raised Funds

6.6 Fawer Automotive Parts

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Major Products and Customers

6.6.5 Production Bases

6.7 Guangzhou Ruili Kormee Automotive Electronic

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 ABS Business

6.7.5 Subsidiaries

6.8 Chongqing JUNENG

6.8.1 Profile

6.8.2 ABS Business

6.9 Dongfeng Electronic Technology

6.9.1 Profile

6.9.2 Operation

6.9.3 Braking System Business

中国汽车ABS系统相关政策及标准

中国汽车制动系统主要部件供应链

2010-2021年中国汽车产量

2007-2021年中国汽车保有量

2014-2021年中国汽车ABS装配率

2014-2021年中国汽车ABS装配量

中国ABS系统主要生产商及配套客户

2008-2017年中国乘用车产销量

2017-2021年中国乘用车产量预测

2008-2016年中国乘用车ABS装配量

2016-2021年中国乘用车ABS装配量预测

2016年中国乘用车ABS配套市场主要品牌占有率

中国乘用车企业ABS市场配套情况

2008-2017年中国商用车产销量

2016-2021年中国商用车产量预测

2009-2016年中国商用车ABS装配量

2016-2021年中国商用车ABS装配量预测

2016年中国商用车ABS配套市场占有率情况

中国主要商用车企业ABS配套厂商情况

2010-2016年博世销售收入

2016年博世销售收入区域结构

2016年博世销售收入业务结构

博世底盘控制系统主要产品

博世汽车电子业务发展历程

博世制动系统及电子控制系统产品主要配套车型

2012-2016年博世在华销售额

博世中国主要ABS生产基地

博世中国汽车相关主要研发中心

2011-2017年Continental营业收入&EBIT

2016年Continental各部门营业收入及员工数量

2017年第一季度Continental底盘与安全部门营业收入、EBIT及员工数量

大陆底盘与安全部门主要产品

大陆制动系统及电子控制系统产品主要配套车型

大陆集团在中国基地分布图

大陆汽车电子(长春)有限公司概况

采埃孚主要业务一览

2015-2016年采埃孚营业收入

2016年采埃孚营业收入地区分布

2015-2016年采埃孚营业收入业务分布

采埃孚天合底盘系统部和电子件部主要产品

采埃孚制动系统及电子控制系统产品主要配套车型

采埃孚在华主要ABS生产基地

TRW在华研发中心

爱德克斯全球据点分布及员工数量

FY2014-2016爱德克斯销售额及利润

FY2014-2016爱德克斯员工数量

爱德克斯主要产品

爱德克斯制动系统及电子控制系统产品主要配套车型

爱德克斯在华子公司

2012-2016年万都中国员工人数

Revenue of Mando China, 2012-2016

Net Income of Mando China, 2012-2016

Key Products of Mando China

万都制动系统及电子控制系统产品主要配套车型

Key facilities Layout for Mando China

万都(北京)汽车底盘系统有限公司基本信息(股权、客户、产品等)

万都底盘部件(苏州)有限公司基本信息(股权、客户、产品等

万都(宁波)汽车零部件有限公司基本信息(股权、客户、产品等)

FY2015-2017日信工业销售额及净利润

FY2017日信工业各地区销售额

FY2016-2017日信工业各项业务销售额

日信工业ABS系统产品主要配套车型

2016-2017财年日信工业主要客户销售占比

日信在华主要生产基地

中山日信主要产品一览

中山日信目前主要产品产能(2016年11月)

2015-2016年现代摩比斯收入与营业利润率

2016年现代摩比斯分区域经营数据

2016年现代摩比斯分业务经营数据

现代摩比斯制动系统核心零部件

现代摩比斯韩国生产基地

现代摩比斯制动系统及电子控制系统产品主要配套车型

现代摩比斯在华子公司

无锡摩比斯基本信息

天津摩比斯基本信息

威伯科全球据点分布

2014-2016年威伯科销售额及营业利润

2015-2016年威伯科销售额分布

威伯科主要产品

威伯科在华子公司

WABCO在华主要生产基地

山东威名汽车产品有限公司基本信息及配套

威伯科汽车控制系统(中国)有限公司

2012-2016年克诺尔销售额及净利润

2016年克诺尔销售收入区域分布

2016年克诺尔销售收入业务分布

克诺尔商用车系统部主要产品

克诺尔商用车辆系统部在华子公司

2011-2016年亚太股份营业收入及净利润

2014-2016年亚太股份各类产品营业收入

2012-2016年亚太股份部分重要产品及综合毛利率

2015-2016年亚太股份前五名客户销售额

亚太股份电子制动系统配套企业及车型

亚太股份在智能汽车产业链上的布局

前向启创产品

“钛马星(Tima Cloud)”车联网综合应用系统

2017年亚太股份发行可转换公司债券募投项目

2016-2021年亚太股份营业收入、净利润及毛利率

华域汽车系统股份有限公司主要业务

2014-2016年华域汽车营业收入及净利润

2015-2016年华域汽车主要产品营业收入

2016年华域汽车主要产品产销量

上海汽车制动系统有限公司股东构成

SABS的ABS产品配套关系

上海汽车制动系统有限公司冬季测试中心

2011-2016年万安科技营业收入及净利润

2014-2016年万安科技各类产品营业收入

2014-2016年万安科技各类产品毛利率

万安科技商用车主要产品

万安科技乘用车主要产品

万安科技主要客户

万安科技主要生产基地及配套

万安科技2016年非公开发行股票募投项目一览

2013-2016年伯特利运营指标

2014-2016年伯特利各项产品主营收入

2013-2016年伯特利前五大客户

2014-2016年伯特利主要原材料采购额

2013-2016年伯特利前五名原材料供应商

2014-2016年伯特利生产线及生产能力

伯特利气压ABS生产工艺

伯特利液压ABS/ESC生产工艺

2014-2016年伯特利主要产品产销情况

2014-2016年伯特利主要产品价格变化

2017年伯特利IPO募投项目一览

2013-2016年万向钱潮营业收入、净利润及毛利率

2014-2016年万向钱潮主要业务主营收入及毛利率

2014-2016年万向钱潮主要地区主营收入及毛利率

万向钱潮ABS子公司

2014-2016年万向钱潮各项产品产销量

万向研究院

万向钱潮制动系统配套关系

2017年万向钱潮配股募投项目一览

2013-2016年富奥股份营业收入、净利润及毛利率

2014-2016年富奥股份主要地区主营收入及毛利率

2014-2016年富奥股份主要业务主营收入及毛利率

富奥股份主要区域分布及客户

2014-2016年富奥股份各项产品产销量

富奥股份制动系统子公司

2014-2016年瑞立科密营业收入、毛利率及净利润

2015-2016年瑞立科密主要产品营业收入

瑞立科密ABS主要配套关系

2015-2016年瑞立科密控股子公司营业收入及净利润

重庆聚能ABS主要配套关系

2013-2016年东风科技营业收入、净利润及毛利率

2014-2016年东风科技各项业务主营收入及毛利率

2014-2016年东风科技各类产品产销量

2016年东风科技主要产品配套市场销量

2016年东风科技主要产品产能及产能利用率

Policies and Standards for Automotive ABS in China

Supply Chain of Main Parts of Automotive Braking System in China

Automobile Output in China, 2010-2021E

Automobile Ownership in China, 2007-2021E

Installation Rate of Automotive ABS in China, 2014-2021E

Installations of Automotive ABS in China, 2014-2021E

Major ABS Suppliers and Their Supported Customers in China

Passenger Car Output and Sales in China, 2008-2017

Passenger Car Output Forecast in China, 2017-2021E

Installations of ABS for Passenger Cars in China, 2008-2016

Estimated Installations of ABS for Passenger Cars in China, 2016-2021E

Market Share of Major Brands in ABS Supporting Market of Passenger Car in China, 2016

ABS Matching of Passenger Car Makers in China

Commercial Vehicle Output and Sales in China, 2008-2017

Commercial Vehicle Output Forecast in China, 2016-2021E

Installations of ABS for Commercial Vehicle in China, 2009-2016

Estimated Installations of ABS for Commercial Vehicle in China, 2016-2021E

Market Share of Major Brands in ABS Supporting Market of Commercial Vehicle in China, 2016

ABS Matching of Major Commercial Vehicle Makers in China

Revenue of Bosch, 2010-2016

Revenue Structure of Bosch by Region, 2016

Revenue Structure of Bosch by Business, 2016

Main Chassis Control System Products of Bosch

Development History of Bosch’s Automotive Electronics Business

Main Supported Models of Bosch’s Braking System and Electronic Control System Products

Bosch’s Revenue in China, 2012-2016

Main ABS Production Bases of Bosch in China

Main Automotive-related R&D Centers of Bosch in China

Revenue and EBIT of Continental, 2011-2017

Revenue and Employees of Continental by Division, 2016

Revenue, EBIT, and Employees of Continental’s Chassis & Safety Division, 2017Q1

Main Products of Continental’s Chassis & Safety Division

Main Models Supported by Continental’s Braking System and Electronic Control System Products

Presence of Continental’s Bases in China

Profile of Continental Automotive Changchun Co., Ltd.

List of ZF’s Main Businesses

Revenue of ZF, 2015-2016

Revenue of ZF by Region, 2016

Revenue of ZF by Business, 2015-2016

Main Products of ZF TRW’s Chassis System and Electronic Parts Divisions

Main Models Supported by ZF’s Braking System and Electronic Control System Products

Main ABS Production Bases of ZF in China

R&D Centers of TRW (Acquired by ZF) in China

Global Footprints and Workforce of ADVICS

Revenue and Profit of ADVICS, FY2014-FY2016

Workforce of ADVICS, FY2014-FY2016

Main Products of ADVICS

Main Models Supported by ADVICS’ Braking System and Electronic Control System Products

ADVICS’ Subsidiaries in China

Workforce of Mando in China, 2012-2016

Revenue of Mando China, 2012-2016

Net Income of Mando China, 2012-2016

Key Products of Mando China

Main Models Supported by Mando’s Braking System and Electronic Control System Products

Key Facilities Layout for Mando China

Basic Information (equity, customers, products, etc.) of Mando (Beijing) Automotive Chassis System Co., Ltd.

Basic Information (equity, customers, products, etc.) of Mando (Suzhou) Automotive Chassis System Co., Ltd.

Basic Information (equity, customers, products, etc.) of Mando (Ningbo) Automotive Parts Co., Ltd.

Revenue and Net Income of Nissin Kogyo, FY2015-FY2017

Revenue of Nissin Kogyo by Region, FY2017

Revenue of Nissin Kogyo by Business, FY2016-FY2017

Main Models Supported by Nissin Kogyo’s ABS Products

Revenue Structure of Nissin Kogyo by Customer, FY2016-FY2017

Main Production Bases of Nissin Kogyo in China

Main Products of Zhongshan Nissin Industry

Capacity of Main Products of Zhongshan Nissin Industry (as of Nov. 2016)

Revenue and Operating Margin of Hyundai Mobis, 2015-2016

Operating Data of Hyundai Mobis by Region, 2016

Operating Data of Hyundai Mobis by Business, 2016

Key Parts of Braking System of Hyundai Mobis

Production Bases of Hyundai Mobis in South Korea

Main Models Supported by Hyundai Mobis’ Braking System and Electronic Control System Products

Hyundai Mobis’ Subsidiaries in China

Basic Information of Wuxi MOBIS Automotive parts Co., Ltd.

Basic Information of Tianjin MOBIS Automotive Parts Co., Ltd.

Global Presence of Operations of WABCO

Revenue and Operating Income of WABCO, 2014-2016

Revenue of WABCO by Region/Business, 2015-2016

Main Products of WABCO

WABCO’s Subsidiaries in China

Main Production Bases of WABCO in China

Basic Information and Supported Customers of Shandong Weiming Automotive Products Co., Ltd.

Overview of WABCO Vehicle Control Systems (China) Co., Ltd.

Revenue and Net Income of Knorr-Bremse, 2012-2016

Revenue of Knorr-Bremse by Region, 2016

Revenue of Knorr-Bremse by Business, 2016

Main Products of Knorr-Bremse’s Commercial Vehicle Systems Division

Subsidiaries of Knorr-Bremse’s Commercial Vehicle Systems Division in China

Revenue and Net Income of Zhejiang Asia-Pacific Mechanical & Electronic, 2011-2016

Revenue of Zhejiang Asia-Pacific Mechanical & Electronic by Product, 2014-2016

Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2012-2016

Revenue from Top 5 Customers of Zhejiang Asia-Pacific Mechanical & Electronic, 2015-2016

Enterprises and Models Supported with EBS of Zhejiang Asia-Pacific Mechanical & Electronic

Layout of Zhejiang Asia-Pacific Mechanical & Electronic in Intelligent Vehicle Industry Chain

Products of Shenzhen Forward Innovation Digital Technology

“Tima Cloud” Telematics Integrated Application System

Fundraising Projects of Zhejiang Asia-Pacific Mechanical & Electronic by Issuing Convertible Bonds, 2017

Revenue, Net Income and Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2016-2021E

Main Business of HUAYU Automotive Systems

Revenue and Net Income of HUAYU Automotive Systems, 2014-2016

Revenue of HUAYU Automotive Systems by Product, 2015-2016

Output and Sales Volume of HUAYU Automotive Systems by Product, 2016

Equity Structure of Shanghai Automotive Brake Systems

ABS Supply Relationship of Shanghai Automotive Brake Systems

Winter Test Center of Shanghai Automotive Brake Systems

Revenue and Net Income of Zhejiang Vie Science & Technology, 2011-2016

Revenue of Zhejiang Vie Science & Technology by Product, 2014-2016

Gross Margin of Zhejiang Vie Science & Technology by Product, 2014-2016

Main Commercial Vehicle Products of Zhejiang Vie Science & Technology

Main Passenger Car Products of Zhejiang Vie Science & Technology

Main Customers of Zhejiang Vie Science & Technology

Main Production Bases and Supported Customers of Zhejiang Vie Science & Technology

List of Fundraising Projects of Zhejiang Vie Science & Technology by Non-public Offering of Shares, 2016

Operating Indices of Wuhu Bethel Automotive Safety Systems, 2013-2016

Operating Revenue of Wuhu Bethel Automotive Safety Systems by Product, 2014-2016

Top 5 Customers of Wuhu Bethel Automotive Safety Systems, 2013-2016

Procurement of Main Raw Materials of Wuhu Bethel Automotive Safety Systems, 2014-2016

Top 5 Raw Material Suppliers of Wuhu Bethel Automotive Safety Systems, 2013-2016

Production Lines and Capacity of Wuhu Bethel Automotive Safety Systems, 2014-2016

ABS Pneumatic Production Technology of Wuhu Bethel Automotive Safety Systems

ABS/ESC Hydraulic Production Technology of Wuhu Bethel Automotive Safety System

Output and Sales Volume of Wuhu Bethel Automotive Safety System by Product, 2014-2016

Prices of Main Products of Wuhu Bethel Automotive Safety System, 2014-2016

Fundraising Projects of Wuhu Bethel Automotive Safety System by Initial Public Offering, 2017

Revenue, Net Income and Gross Margin of Wangxiang Qianchao, 2013-2016

Operating Revenue and Gross Margin of Wangxiang Qianchao by Business, 2014-2016

Operating Revenue and Gross Margin of Wangxiang Qianchao by Region, 2014-2016

ABS Subsidiaries of Wangxiang Qianchao

Output and Sales Volume of Wangxiang Qianchao by Product, 2014-2016

Overview of Wanxiang Research Institute

Braking System Supply Relationship of Wangxiang Qianchao

Fundraising Projects of Wangxiang Qianchao by Allotment of Shares, 2017

Revenue, Net Income and Gross Margin of FAWER Automotive Parts, 2013-2016

Operating Revenue and Gross Margin of FAWER Automotive Parts by Region, 2014-2016

Operating Revenue and Gross Margin of FAWER Automotive Parts by Business, 2014-2016

Regional Distribution and Customers of FAWER Automotive Parts

Output and Sales Volume of FAWER Automotive Parts by Product, 2014-2016

Braking System Subsidiaries of FAWER Automotive Parts

Revenue, Gross Margin and Net Income of Guangzhou Kormee Automotive Electronic Control Technology, 2014-2016

Revenue of Guangzhou Kormee Automotive Electronic Control Technology by Product, 2015-2016

ABS Supply Relationship of Guangzhou Kormee Automotive Electronic Control Technology

Revenue and Net Income of Holding Subsidiaries of Guangzhou Kormee Automotive Electronic Control Technology, 2015-2016

ABS Supply Relationship of Chongqing Juneng Automotive Technology

Revenue, Net Income and Gross Margin of Dongfeng Electronic Technology, 2013-2016

Operating Revenue and Gross Margin of Dongfeng Electronic Technology by Business, 2014-2016

Output and Sales Volume of Dongfeng Electronic Technology by Product, 2014-2016

Sales Volume of Main Products of Dongfeng Electronic Technology in Supporting Market, 2016

Capacity of Main Products and Utilization Rate of Dongfeng Electronic Technology, 2016

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|