《2018 ADAS与自动驾驶产业链研究——汽车雷达产业篇》共284页,包括六部分内容:

汽车雷达简介

汽车雷达市场规模与预测

汽车毫米波雷达应用趋势

汽车激光雷达应用趋势

全球汽车雷达企业研究

中国汽车雷达企业研究

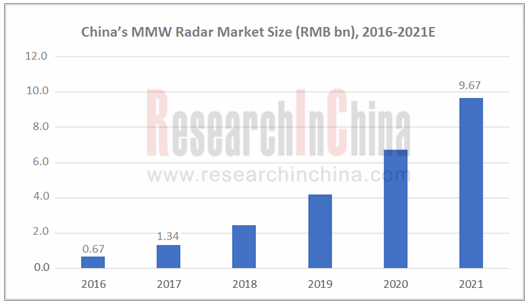

汽车雷达可以细分为毫米波雷达、激光雷达、超声波雷达等。根据佐思产研的研究,2017年中国毫米波雷达市场规模约为13.4亿元,到2021年预计能达到96.7亿元,2016-2021年均增长率约为70.6%。

2017年以来,激光雷达获得资本市场追捧。但从当前的市场来看,毫米波雷达才是增长最快的市场。根据佐思产研的统计,2018年1-5月,中国乘用车车载毫米波雷达的前装市场装车量为140.6万颗,同比大增112.7%。

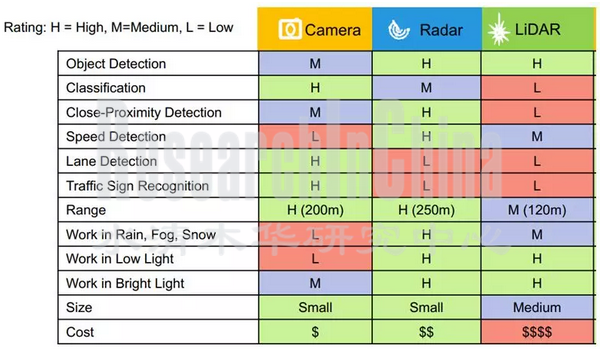

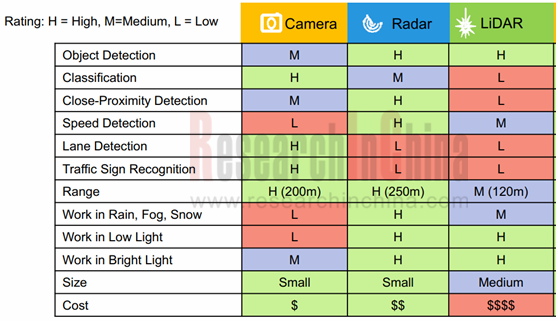

从下图的三大传感器对比来看,目前毫米波雷达的综合表现强于激光雷达。

毫米波雷达市场继续细分下去,24GHz毫米波雷达目前仍是出货量最大的类型。早期24GHz毫米波雷达主要用于中短距探测,77GHz毫米波雷达主要用于长距探测,随着技术进步与成本下降,加上性能优势,77GHz雷达有逐渐替代24GHz雷达的趋势,2017年用于LCA/RCTA的77GHz雷达出货量显著上升。

从总量上看,一方面目前侧边SRR 24GHz仍是主流,前视LRR部分主机厂如奔驰、PSA也使用24GHz雷达,短期内24GHz雷达增长依然可观;另一方面全球主流供应商如博世和大陆的下一代产品主要采用76-77GHz频段,预计到2020年左右,77GHz雷达市场规模将实现反超。

毫米波雷达市场仍是博世、大陆、海拉等传统TIER1掌控市场主要份额。国内毫米波雷达厂商从后装市场起步,然后通过国内车企,逐步进入前装市场。

木牛科技在后装市场已经获得数万台订单。森思泰克24Ghz侧后向雷达已经拿到自主品牌长丰猎豹的前装订单,到2019年预计有十余款新上市车型搭载森思泰克的毫米波雷达。

激光雷达成为国内外自动驾驶领域的创新热点,传统汽车巨头和初创企业都在该领域加大投入,投资并购频繁。技术方面,机械式多线激光雷达已经大量应用于无人驾驶原型车,但固态激光雷达更符合汽车量产需求,代表了未来发展方向。

目前,激光雷达仍存在技术路线不确定、价格高、难以满足车规级要求等问题。同时,下一代高精度成像毫米波雷达也在走向成熟,未来将与激光雷达形成一定竞争。

不过,激光雷达的技术进步神速,激光雷达厂商的信心越来越足。Quanergy联合创始人兼CEO Louay Eldada年初表示,2018年Quanergy将利用合作伙伴 Sensata 在江苏常州的工厂生产激光雷达,预计初期年产能为1000万台,后期随着市场需求的提升,该工厂产能有望逐步扩充至数亿台。

除了Quanery,速腾聚创、北科天绘、镭神智能、禾赛科技等国内激光雷达厂商也建立了自己的工厂,并在不断扩充产能。激光雷达市场预计在2021年启动大规模增长。

毫米波雷达、激光雷达和摄像头在尺寸、价格、适应场景、成像、测距、定位、物体识别等方面各有优劣,无论哪种单一传感器都无法独立支撑起未来自动驾驶汽车对外部环境感知的要求。雷达和摄像头的融合可以获得更为精确的环境数据、提升冗余,最大限度确保ADAS和自动驾驶系统的稳定性和安全性。

ADAS and Autonomous Driving Industry Chain Report 2018 – Automotive Radar at 284 pages in length highlights the followings:

Introduction to automotive radar

Automotive radar market size and forecast

Application trends of automotive MMW radar

Application trends of automotive LiDAR

Global automotive radar companies

Chinese automotive radar companies

Automotive radars mainly fall into MMW radar, LiDAR and ultrasonic radar. According to the report, China’s MMW radar market size reached approximately RMB1.34 billion in 2017, a figure projected to hit RMB9.67 billion in 2021, with an AAGR of about 70.6% between 2016 and 2021.

LiDAR has been a favorite of capital market since 2017. But as things now stand, MMW radar is the fastest-growing market. The report suggests in the first five months of 2018, installment of OEM MMW radars for passenger cars in China reached as many as 1.406 million units, a year-on-year spurt of 112.7%.

By comparing the three types of sensors in the chart below, MMW radar outperforms LiDAR synthetically at the present stage.

As concerns MMW radar market segments, 24GHz radar still prevails in shipment. In the early days, 24GHz radar was often used for short and mid-range detection, while 77GHz radar found its way into long-range detection. As the technology gets improved with lower cost and better performance, there is a tendency for 77GHz radar to replace 24GHz radar. The year 2017 saw shipments of 77GHz MMW radars for LCA/RCTA soar.

In terms of total volume, 24GHz side-looking short range radar (SRR) is now still the mainstream, for example, some OEMs like Mercedes-Benz and PSA which generally use forward-looking long range radars (LRR) also employ 24GHz radars, leaving such a type of radar with a rosy prospect in the short run; additionally, most new products of world-renowned suppliers including Bosch and Continental will have a frequency band of 76-77GHz. So it is expected that 77GHz radar will forereach 24GHz radar in market size around 2020.

Traditional tier1 suppliers such as Bosch, Continental and Hella still rule the roost in MMW radar market, taking the lion’s share of the market. Chinese MMW radar vendors foray into the OEM market in efforts to cooperate with home automakers though starting from the aftermarket.

Muniu Tech has received orders for tens of thousands of its radars from aftermarket. WHST Co., Ltd. has acquired OEM orders for its 24Ghz rear side radars from a Chinese auto brand -- Changfeng Leopaard. It is expected that at least ten new models in 2019 will utilize the MMW radars from WHST Co., Ltd.

LiDAR has been an innovation hotspot in autonomous driving area at home and abroad. Traditional auto giants and startups without exception invest more in LiDAR and stage mergers & acquisitions. As for technology, mechanical multi-beam LiDAR has been applied massively in self-driving prototype cars, but solid-state LiDAR is more applicable to mass production if used in automobiles, being a future development trend of radar.

In current stage, LiDAR still faces some challenges, for instance, uncertain technology roadmaps, high price and hard to meet automotive requirements. Meanwhile, the maturing technology, next-generation high precision MMW radar for imaging, will be a competitor of LiDAR.

LiDAR technology is and yet developing by leaps and bounds, increasingly incentivizing LiDAR suppliers. In 2018, Quanergy would produce LiDARs in its partner, Sensata’s plant in Changzhou City, Jiangsu Province, China, with capacity initially reaching estimated 10 million units and expectedly climbing to hundreds of millions of units to meet the rising market demand, said Louay Eldada, a co-founder and the CEO of Quanergy at the beginning of this year.

Apart from Quanergy, some Chinese LiDAR players like RoboSense, Surestar, Hesai and LeiShen Intelligent System also have constructed their own factories and are expanding capacity. LiDAR market is predicted to boom in 2021.

MMW radar and LiDAR each have merits and demerits in size, price, applied scene, imaging, ranging, positioning and object detection. Both of them fall short of requirements self-driving cars demand in perception of external environment. Fusion of radar and camera is a solution to acquisition of more accurate environment data and redundancy increase in a bid to secure ADAS and automated driving system’s stability and safety in full measure.

第一章 汽车雷达简介

1.1 雷达定义

1.2 我国的雷达频率划分

1.3 车载雷达的波段

1.4 汽车毫米波雷达发展历史

1.5 激光雷达基本介绍

1.6 激光雷达的构成和分类

1.7 激光雷达的工作原理

1.8 LiDAR的测距和成像技术

1.9 LiDAR四大关键技术

第二章 汽车雷达市场规模与预测

2.1 汽车新四化推动车载雷达市场

2.2 中国车载雷达市场发展将快于全球市场

2.3 ADAS应用加速促进车载雷达市场发展

2.4 中国毫米波雷达市场高速增长

2.5 用于中短距探测的77GHz毫米波雷达开始放量

2.6 中国乘用车市场SRR/LRR和24GHz/77GHz应用现状

2.7 供应商产品规划将刺激77GHz毫米波雷达加速增长

2.8 2016-2021年中国车载毫米波市场出货量与市场规模

2.9 2016-2021年全球车载毫米波雷达市场规模

2.10 2016-2021年全球车载毫米波雷达出货量

2.11 中国乘用车市场超声波雷达应用现状

2.12 2016-2021年全球车载超声波雷达市场规模与出货量

2.13 日系厂家与ADAS传感器供应商配套关系

2.14 美韩中系厂家与ADAS传感器供应商配套关系

2.15 欧系厂家与ADAS传感器供应商配套关系

2.16 2017年全球车载毫米波雷达主要厂家市场占有率

第三章 汽车毫米波雷达应用趋势

3.1 车载毫米波雷达关键技术和应用发展

3.1.1 毫米波雷达与其他传感器比较

3.1.2 汽车毫米波雷达频谱

3.1.3 毫米波雷达工作原理

3.1.4 毫米波雷达调制技术

3.1.5 77GHz汽车雷达系统构成

3.1.6 毫米波雷达核心部件——MMIC

3.1.7 毫米波雷达核心部件——天线PCB板

3.1.8 车载毫米波雷达应用发展

3.1.9 中国车载毫米波雷达系统技术路线图

3.2 毫米波雷达技术趋势

3.2.1 RF CMOS工艺

3.2.2 毫米波雷达与单目融合方案

3.2.3 毫米波雷达传感器趋势

3.2.4 毫米波雷达的集成化高精度趋势

3.3 毫米波雷达应用趋势

3.3.1 单车毫米波雷达数量增多

3.3.2 毫米波雷达逐渐从高端向中低端车型渗透

3.3.3 77GHz毫米波雷达将成为主流

3.3.4 主流供应商下一代产品多采用77GHz

第四章 激光雷达应用趋势

4.1 激光雷达的应用领域

4.1.1 激光雷达是实现自动驾驶的重要传感器

4.1.2 激光雷达配合其他传感器可准确识别物体

4.1.3 激光雷达在自动驾驶中的作用

4.1.4 激光雷达用于厘米级增强定位

4.2 激光雷达分类及应用

4.2.1 固定光束激光雷达逐步边缘化

4.2.2 大陆SRL1部分应用车型

4.2.3 机械式激光雷达代表厂商

4.2.4 机械式激光雷达产品分解(1)

4.2.4 机械式激光雷达产品分解(2)

4.2.5 机械式激光雷达目前被众多无人驾驶原型车采用(1)

4.2.5 机械式激光雷达目前被众多无人驾驶原型车采用(2)

4.2.6 机械式激光雷达已在量产车上使用

4.2.7 固态激光雷达代表厂商

4.2.8 固态激光雷达解析(1)-MEMS技术

4.2.9 固态激光雷达解析(2)-3D FLASH

4.2.10 固态激光雷达解析(3)-相控阵

4.3 激光雷达技术趋势

4.3.1 激光雷达技术路线图

4.3.2 固态激光雷达三种技术比较:MEMS有望率先应用

4.3.3 固态激光雷达代表未来车载雷达的发展方向

4.3.4 国内外主要激光雷达厂商产品规划

4.3.5 多Lidar耦合

4.3.6 VCSEL

4.3.7 激光雷达与摄像头融合

4.3.8 激光发射和接收中的扫描方法

4.4 激光雷达的量产

4.4.1 行业投资并购频繁,推进激光雷达量产进程

4.4.2 车规适应是未来激光雷达发展的基本条件

4.4.3 价格下探将推动车载激光雷达大规模应用

4.4.4 影响激光雷达价格下探的主要因素

4.4.5 代表企业率先提产降价

第五章 全球汽车雷达企业研究

5.1 大陆汽车

5.1.1 大陆简介

5.1.2 大陆ADAS业务隶属底盘与安全事业部

5.1.3 大陆ADAS产品一览

5.1.4 大陆第五代77GHz毫米波雷达

5.1.5 大陆第五代77GHz毫米波雷达优势分析

5.1.6 大陆激光雷达

5.1.7 大陆Radar和Lidar产品客户分布

5.1.8 中国市场大陆毫米波雷达主要应用情况

5.1.9 大陆自动驾驶2025展望

5.2 博世

5.2.1 博世简介

5.2.2 博世为自动驾驶开发下一代高性能传感器

5.2.3 博世ADAS产品——77GHz毫米波雷达

5.2.4 博世LRR4长距毫米波雷达

5.2.5 博世MRR4中距毫米波雷达

5.2.6 博世正在开发第五代77GHz毫米波雷达

5.2.7 博世毫米波雷达主要应用情况(自主品牌)

5.2.8 博世毫米波雷达主要应用情况(国外品牌)

5.2.9 博世在商用车领域的ADAS及自动驾驶功能规划

5.3 采埃孚

5.3.1 主动和被动安全技术部

5.3.2 采埃孚研发支出

5.3.3 天合AC1000 长距毫米波雷达

5.3.4 天合AC100 中长距毫米波雷达

5.3.5 中国市场天合毫米波雷达主要应用情况

5.4 安波福

5.4.1 安波福简介

5.4.2 安波福公司架构——大脑+神经两大部门

5.4.3 安波福客户分布&终端市场地区分布

5.4.4 安波福2016-2018年主动安全产品订单情况

5.4.5 安波福ESR毫米波雷达

5.4.6 安波福毫米波雷达+单目摄像头集成系统

5.4.7 中国市场安波福毫米波雷达主要应用情况

5.4.8 安波福激光雷达投资情况

5.5 奥托立夫

5.5.1 奥托立夫简介

5.5.2 汽车安全客户分布和产品分布

5.5.3 2012-2017年主动安全产品订单情况

5.5.4 奥托立夫主动安全技术

5.5.5 奥托立夫77GHz毫米波雷达

5.5.6 奥托立夫24GHz毫米波雷达

5.5.7 奥托立夫ADAS和自动驾驶投资收购情况

5.5.8 奥托立夫自动驾驶产品研发路线图

5.6 电装

5.6.1 电装简介

5.6.2 电装合并收入客户分布

5.6.3 电装77GHz毫米波雷达

5.6.4 电装新款24GHz亚毫米波雷达

5.6.5 中国市场电装毫米波雷达主要应用情况

5.6.6 电装自动驾驶投资情况

5.6.7 电装在ADAS和自动驾驶方面的重点研发

5.7 法雷奥

5.7.1 法雷奥简介

5.7.2 法雷奥舒适及驾驶辅助系统事业部2017年营收

5.7.3 法雷奥的OEM销售收入全球分布情况

5.7.4 法雷奥2008-2017年订单量

5.7.5 法雷奥SCALA激光雷达

5.7.6 法雷奥24GHz毫米波雷达

5.7.7 法雷奥公司自动驾驶技术路线图

5.7.8 法雷奥自动驾驶传感器应用

5.8 海拉

5.8.1 海拉经营状况

5.8.2 海拉24GHz毫米波雷达

5.8.3 海拉全新77GHz毫米波雷达

5.8.4 海拉自动驾驶发展路线图

5.8.5 海拉自动驾驶发展合作伙伴及关注要点

5.9 电装天(原富士通天)

5.9.1 电装天三类毫米波雷达

5.9.2 电装天76GHz短距毫米波雷达

5.10 Metawave

5.10.1 Metawave的WARLORD

5.10.2 WARLORD技术特点

5.11 Oculii

5.11.1 Oculii技术解析-4D雷达

5.11.2 产品应用

5.11.3 产品介绍

5.12 Velodyne

5.12.1 Velodyne产品发展路线图

5.12.2 Velodyne已量产激光雷达,应用广泛

5.12.3 Velodyne最新车用激光雷达

5.13 Quanergy

5.13.1 Quanergy 激光雷达产品

5.13.2 Quanergy M8机械式激光雷达

5.13.3 Quanergy S3固态激光雷达

5.13.4 Quanergy S3-Qi激光雷达及参数对比

5.14 LeddarTech

5.14.1 LeddarTech Vu8固态激光雷达模块

5.14.2 LeddarTech M16固态激光雷达模块

5.14.3 LeddarTech为自动驾驶开发固态激光雷达芯片

5.15 IBEO

5.15.1 Ibeo已量产激光雷达产品

5.15.2 Ibeo正在研发新款固态激光雷达

5.16 Innoviz

5.16.1 Innoviz产品路线规划

5.16.2 Innoviz固态激光雷达InnovizPro

5.16.3 Innoviz固态激光雷达InnovizOne

5.16.4 Innoviz技术路线

5.17 Luminar

5.17.1 Luminar激光雷达研发情况

5.17.2 Luminar激光雷达研发情况

5.18 TriLumina

5.18.1 TriLumina商业模式

5.18.2 TriLumina VCSEL照明模组

5.18.3 TriLumina与LeddarTech合作展示3D雷达应用

国外毫米波雷达厂商对比分析

国外激光雷达厂商对比分析

…………

第六章 中国汽车雷达企业研究

6.1 森思泰克

6.1.1 总部及分支机构一览

6.1.2 车载毫米波雷达产品汇总

6.1.3 代表产品(1)-STA24-4 盲点监测雷达

6.1.4 代表产品(2)-STA77-5 前向防撞雷达

6.1.5 代表产品(3)-STA79-3 近区探测雷达升级版

6.1.6 市场化进程处于国内领先

6.1.7 近期动向

6.2 行易道

6.3 智波科技

6.3.1 产品介绍(1)-24GHz盲点雷达

6.3.2 产品介绍(2)-77GHz汽车防撞雷达

6.3.3 24GHz和77GHz产品布局图

6.3.4 亚太机电入股智波科技

6.4 木牛科技

6.4.1 车载雷达产品定位和发展方向

6.4.2 车载雷达近期规划

6.4.3 产品解析(1)-Kanza77汽车毫米波雷达

6.4.4 产品解析(2)-Kanza79汽车毫米波雷达

6.4.5 产品解析(3)-T-79汽车角雷达

6.5 纳雷科技

6.6 莫吉娜

6.6.1 发展历程/近期规划

6.6.2 技术解析:基于TI单芯片方案

6.6.3 战略布局

6.7 苏州豪米波

6.7.1 研发进展

6.7.2 发展规划

6.7.3 产品解析(1)-24GHz中距雷达

6.7.4 产品解析(2)-24GHz远距雷达

6.7.5 已完成79GHz技术样机研发

6.7.6 与日本供应商联合量产ADAS产品

6.8 隼眼科技

6.9 意行半导体

6.10 禾赛科技

6.10.1 发展历程

6.10.2 融资情况

6.10.3 全线产品

6.10.4 产品解析(1)-Pandar 40

6.10.5 产品解析(2)-Pandar GT

6.10.6 产品解析(3)-Pandora

6.11 北科天绘

6.11.1 发展历程

6.11.2 融资情况

6.11.3 业务板块

6.11.4 产品解析(1)- R-Fans-16

6.11.5 产品解析(2)-R-Fans-32

6.11.6 产品解析(3)- C-Fans 128线激光雷达

6.11.7 近期发展规划

6.12 北醒光子

6.12.1 发展历程/市场覆盖

6.12.2 融资情况

6.12.3 发展规划

6.12.4 业务和融资

6.12.5 产品概览

6.12.6 最新产品解析-CE30

6.13 速腾聚创

6.13.1 发展历程

6.13.2 融资情况

6.13.3 产品概览/生产供货

6.13.4 产品解析(1)-RS-LiDAR-16

6.13.5 产品解析(2)-RS-LiDAR-32

6.13.6 产品解析(3)-RS-LiDAR-M1Pre

6.13.7 速腾聚创P3激光雷达感知方案

6.13.8 联手阿里推出无人物流车

6.14 镭神智能

国内毫米波雷达厂商对比分析

国内激光雷达厂商对比分析

…………

1 Introduction to Automotive Radar

1.1 Definition of Radar

1.2 Radar Frequency Division in China

1.3 Vehicular Radar Band

1.4 Development History of Automotive MMW Radar

1.5 Overview of LiDAR

1.6 Composition and Classification of LiDAR

1.7 Working Principal of LiDAR

1.8 LiDAR Ranging and Imaging Technologies

1.9 Four Key Technologies of LiDAR

2 Automotive Radar Market Size

2.1 The Four New Automotive Trends (Electrification, Connectivity, Intelligence and Sharing) Drive Automotive Radar Market

2.2 China’s Automotive Radar Market Will Grow Faster than Global Market

2.3 Application of ADAS Gives Impetus to Automotive Radar Market

2.4 China’s MMW Radar Market is Flourishing

2.5 77GHz MMW Radar for Short- and Mid-range Detection is Used More Widely

2.6 Applications of SRR/LRR and 24GHz/77GHz Radars for Passenger Cars in China

2.7 Suppliers’ Product Planning Will Spur the Growth of 77GHz MMW Radar

2.8 Automotive MMW Radar Shipments and Market Size in China, 2016-2021E

2.9 Global Automotive MMW Radar Market Size, 2016-2021E

2.10 Global Automotive MMW Radar Shipments, 2016-2021E

2.11 Applications of Ultrasonic Radars for Passenger Cars in China

2.12 Global Automotive Ultrasonic Radar Market Size and Shipments, 2016-2021E

2.13 Relationship between Japanese Automakers and ADAS Sensor Suppliers

2.14 Relationship between the US, Korean and Chinese Automakers and ADAS Sensor Suppliers

2.15 Relationship between European Automakers and ADAS Sensor Suppliers

2.16 Market Shares of Global Major Automotive MMW Radar Manufacturers, 2017

3 Application Trends of Automotive MMW Radar

3.1 Key Automotive MMW Radar Technologies and Application Trends

3.1.1 Comparison between MMW Radar and Other Sensors

3.1.2 Frequency Spectrum of Automotive MMW Radar

3.1.3 Working Principal of MMW Radar

3.1.4 MMW Radar Modulation Technology

3.1.5 Composition of 77GHz Automotive Radar System

3.1.6 Core Parts for MMW Radar - Monolithic Microwave Integrated Circuit (MMIC)

3.1.7 Core Parts for MMW Radar - Antenna PCB

3.1.8 Application Trends of Automotive MMW Radar

3.1.9 Technology Roadmaps of Automotive MMW Radar System in China

3.2 Technology Trends of MMW Radar

3.2.1 RF CMOS Technology

3.2.2 Solutions to Fusion of MMW Radar and Monocular Camera

3.2.3 Trends of MMW Radar Sensor

3.2.4 MMW Radar Develops Towards Integration and High Precision

3.3 Application Trends of MMW Radar

3.3.1 The Number of MMW Radars for a Single Automobile is Increasing

3.3.2 MMW Radar is Penetrating from High-class Models into Low/Middle-class Models

3.3.3 77GHz MMW Radar Will Be the Mainstream

3.3.4 Most New Products of Main Suppliers Will Have a Frequency Band of 77GHz

4 Application Trends of LiDAR

4.1 Application Areas of LiDAR

4.1.1 LiDAR is a Key Sensor for Automated Driving

4.1.2 LiDAR Coupled with Other Sensors Can Recognize Objects Accurately

4.1.3 What LiDAR is Used for in Automated Driving

4.1.4 LiDAR is Used for Centimeter-level Enhanced Positioning

4.2 Classification and Applications of LiDAR

4.2.1 Fixed-beam LiDAR is Being Marginalized

4.2.2 Some Models Using Continental SRL1

4.2.3 Representative Mechanical LiDAR Manufacturers

4.2.4 Analysis of Mechanical LiDAR Products (1)

4.2.4 Analysis of Mechanical LiDAR Products (2)

4.2.5 Mechanical LiDAR is Now Applied to Many a Self-driving Prototype Car (1)

4.2.5 Mechanical LiDAR is Now Applied to Many a Self-driving Prototype Car (2)

4.2.6 Mechanical LiDAR Has Found Application in Mass-produced Models

4.2.7 Representative Solid State LiDAR Manufacturers

4.2.8 Analysis of Solid State LiDAR (1) - MEMS Technology

4.2.9 Analysis of Solid State LiDAR (1) - 3D FLASH

4.2.10 Analysis of Solid State LiDAR (1) - Phased Array

4.3 Technology Trends of LiDAR

4.3.1 Technology Roadmaps of LiDAR

4.3.2 Comparison between Three Solid State LiDAR Technologies: MEMS is Expected to Be Used Firstly

4.3.3 Solid State LiDAR is a Development Trend of Future Automotive Radar

4.3.4 Product Planning of Main Chinese and Foreign LiDAR Manufacturers

4.3.5 Multi-LiDAR Coupling

4.3.6 VCSEL

4.3.7 Fusion of LiDAR and Camera

4.3.8 Scanning Methods for Laser Emission and Reception

4.4 Mass Production of LiDAR

4.4.1 Frequent Investments and Mergers & Acquisitions Accelerate the Process of Mass-producing LiDAR

4.4.2 Meeting Automotive Requirements Plays an Essential Part in the Future Development of LiDAR

4.4.3 Price Drop Will Give a Boost to Wide Application of Automotive LiDAR

4.4.4 Main Factors behind the Decline in LiDAR Price

4.4.5 Representative Companies Lead the Way in Production Increase and Price Reduction

5 Global Automotive Radar Companies

5.1 Continental Automotive

5.1.1 Overview of Continental

5.1.2 Continental’s ADAS Business is Included in its Chassis & Safety Division

5.1.3 List of Continental’s ADAS Products

5.1.4 Continental’s Fifth-generation 77GHz MMW Radar

5.1.5 Advantages of Continental’s Fifth-generation 77GHz MMW Radar

5.1.6 Continental’s LiDAR

5.1.7 Distribution of Continental’s Radar and LiDAR Clients

5.1.8 Main Applications of Continental’s MMW Radar in the Chinese Market

5.1.9 Continental’s Outlook for Automated Driving by 2025

5.2 Bosch

5.2.1 Overview of Bosch

5.2.2 Bosch is Developing Next-generation High Performance Sensors for Automated Driving

5.2.3 Bosch’s ADAS Products - 77GHz MMW Radar

5.2.4 Bosch’s Fourth-generation Long-range Radar Sensor (LRR4)

5.2.5 Bosch’s Fourth-generation Mid-range Radar Sensor (MRR4)

5.2.6 Bosch is Developing Fifth-generation 77GHz MMW Radar

5.2.7 Main Applications of Bosch’s MMW Radar (Chinese Brands)

5.2.8 Main Applications of Bosch’s MMW Radar (Foreign Brands)

5.2.9 Bosch’s Functional Planning of ADAS and Automated Driving for Commercial Vehicles

5.3 ZF

5.3.1 Active & Passive Safety Technology Division

5.3.2 ZF’s R&D Expenses

5.3.3 TRW AC1000 Long-range MMW Radar

5.3.4 TRW AC100 Mid- and Long-range MMW Radar

5.3.5 Main Applications of TRW MMW Radar in the Chinese Market

5.4 APTIV

5.4.1 Overview of APTIV

5.4.2 APTIV’s Structure - Brain and Nerve Divisions

5.4.3 Distribution of Clients and Regional Terminal Markets of APTIV

5.4.4 APTIV’s Active Safety Product Orders, 2016-2018

5.4.5 APTIV’s ESR MMW Radar

5.4.6 APTIV’s MMW Radar + Monocular Camera Integrated Systems

5.4.7 Main Applications of APTIV’s MMW Radar in the Chinese Market

5.4.8 APTIV’s Investment in LiDAR

5.5 Autoliv

5.5.1 Overview of Autoliv

5.5.2 Distribution of Automotive Safety Clients and Products

5.5.3 Active Safety Product Orders, 2012-2017

5.5.4 Autoliv’s Active Safety Technologies

5.5.5 Autoliv’s 77GHz MMW Radar

5.5.6 Autoliv’s 24GHz MMW Radar

5.5.7 Autoliv’s Investments and Acquisitions in ADAS and Automated Driving

5.5.8 Autoliv’s Research & Development Roadmap of Automated Driving Products

5.6 Denso

5.6.1 Overview of Denso

5.6.2 Distribution of Denso’s Clients Consolidated in its Revenue

5.6.3 Denso’s 77GHz MMW Radar

5.6.4 Denso’s New 24GHz Sub-MMW Radar

5.6.5 Main Applications of Denso’s MMW Radar in the Chinese Market

5.6.6 Denso’s Investments in Automated Driving

5.6.7 Denso’s Key Research & Development of ADAS and Automated Driving

5.7 Valeo

5.7.1 Overview of Valeo

5.7.2 Valeo’s Revenue from Comfort & Driving Assistance Systems Division, 2017

5.7.3 Valeo’s OEM Sales by Region

5.7.4 Valeo’s Order Intake, 2008-2017

5.7.5 Valeo’s SCALA LiDAR

5.7.6 Valeo’s 24GHz MMW Radar

5.7.7 Valeo’s Automated Driving Technology Roadmap

5.7.8 Applications of Valeo’s Automated Driving Sensors

5.8 Hella

5.8.1 Hella’s Operation

5.8.2 Hella’s 24GHz MMW Radar

5.8.3 Hella’s New 77GHz MMW Radar

5.8.4 Hella’s Automated Driving Technology Roadmap

5.8.5 Hella’s Partners and Key Concerns in Automated Driving

5.9 Denso Ten (Previously Known as Fujitsu Ten)

5.9.1 Denso’s Three Kinds of MMW Radars

5.9.2 Denso’s 76GHz Short-range MMW Radar

5.10 Metawave

5.10.1 Metawave’s WARLORD Radar

5.10.2 Technical Features of WARLORD

5.11 Oculii

5.11.1 Analysis of Oculii’s 4D Radar Technology

5.11.2 Product Application

5.11.3 Product Description

5.12 Velodyne

5.12.1 Velodyne’s Product Roadmap

5.12.2 Velodyne has Mass-produced LiDARs Which are Used Widely

5.12.3 Velodyne’s Latest Automotive LiDAR

5.13 Quanergy

5.13.1 Quanergy’s LiDAR Products

5.13.2 Quanergy’s M8 Mechanical LiDAR

5.13.3 Quanergy’s S3 Solid State LiDAR

5.13.4 Quanergy’s S3-Qi LiDAR and Comparison of Parameters

5.14 LeddarTech

5.14.1 LeddarTech’s Vu8 Solid State LiDAR Module

5.14.2 LeddarTech’s M16 Solid State LiDAR Module

5.14.3 LeddarTech Develops Solid State LiDAR Chips for Automated Driving

5.15 IBEO

5.15.1 IBEO Had Mass-Produced LiDAR Products

5.15.2 IBEO is Developing New Solid State LiDAR

5.16 Innoviz

5.16.1 Innoviz’s Product Line Planning

5.16.2 Innoviz’s Solid State LiDAR---InnovizPro

5.16.3 Innoviz’s Solid State LiDAR---InnovizOne

5.16.4 Innoviz’s Technology Roadmap

5.17 Luminar

5.17.1 Luminar’s Research and Development of LiDAR

5.17.2 Luminar’s Research and Development of LiDAR

5.18 TriLumina

5.18.1 TriLumina’s Business Models

5.18.2 TriLumina’s VCSEL Illumination Modules

5.18.3 TriLumina and LeddarTech Team up to Demonstrate the Applications of 3D Radar

Comparison between Foreign MMW Radar Manufacturers

Comparison between Foreign LiDAR Manufacturers

6 Chinese Automotive Radar Companies

6.1 Wuhu Sensortech Intelligent Technology Co., Ltd. (WHST)

6.1.1 List of Headquarter and Branches

6.1.2 Summary of Automotive MMW Radar Products

6.1.3 Representative Product (1) - STA24-4 Blind Spot Monitoring Radar

6.1.4 Representative Product (2) - STA77-5 Forward Anti-collision Radar

6.1.5 Representative Product (3) - STA79-3 Near-field Detection Radar Upgraded Version

6.1.6 The Company Stays Ahead of its Domestic Peers in Process of Commercialization

6.1.7 Recent Developments

6.2 Beijing Autoroad Tech Co., Ltd.

6.3 Hangzhou IntiBeam Technology Co., Ltd.

6.3.1 Product Description (1) - 24GHz Blind Spot Detection Radar

6.3.2 Product Description (2) -77GHz Automotive Anti-collision Radar

6.3.3 Layout of 24GHz and 77GHz Products

6.3.4 Zhejiang Asia-pacific Mechanical & Electronic Co., Ltd Bought in Hangzhou IntiBeam Technology Co., Ltd.

6.4 Beijing Muniu Pilot Technology Co., Ltd. (Muniu Technology)

6.4.1 Orientations of Automotive Radar Products

6.4.2 Recent Automotive Radar Planning

6.4.3 Product Analysis (1) - Kanza77 Automotive MMW Radar

6.4.4 Product Analysis (2) - Kanza79 Automotive MMW Radar

6.4.5 Product Analysis (2) - T-79 Automotive Corner Radar

6.5 Hunan Nanoradar Science & Technology Co., Ltd.

6.6 Shanghai Morgina Intelligent Information Technology Co., Ltd.

6.6.1 Development Course/Recent Planning

6.6.2 Technical Analysis: TI SoC Based Solutions

6.6.3 Strategic Layout

6.7 Suzhou Millimeter-wave Technology Co., Ltd.

6.7.1 R&D Progress

6.7.2 Development Plan

6.7.3 Product Analysis (1) - 24GHz Mid-range Radar

6.7.4 Product Analysis (1) - 24GHz Long-range Radar

6.7.5 The Company Has Finished the Research and Development of 79GHz Prototype

6.7.6 The Company and a Japanese Supplier Work Together on Mass Production of ADAS Products

6.8 HawkEye Technology Co., Ltd.

6.9 Xiamen Imsemi Technology Co., Ltd.

6.10 Hesai Photonics Technology Co., Ltd.

6.10.1 Development Course

6.10.2 Financing

6.10.3 Full Line of Products

6.10.4 Product Analysis (1) - Pandar 40

6.10.5 Product Analysis (2) - Pandar GT

6.10.6 Product Analysis (3) - Pandora

6.11 Beijing Surestar Technology Co., Ltd.

6.11.1 Development Course

6.11.2 Financing

6.11.3 Business Divisions

6.11.4 Product Analysis (1) - R-Fans-16

6.11.5 Product Analysis (2) - R-Fans-32

6.11.6 Product Analysis (3) - C-Fans 128-beam LiDAR

6.11.7 Recent Product Planning

6.12 Benewake (Beijing) Co., Ltd.

6.12.1 Development Course/Market Coverage

6.12.2 Financing

6.12.3 Development Plan

6.12.4 Business and Financing

6.12.5 Overview of Products

6.12.6 Analysis of Latest Product - CE30

6.13 Suteng Innovation Technology Co., Ltd. (RoboSense)

6.13.1 Development Course

6.13.2 Financing

6.13.3 Overview of Products/Production and Supply

6.13.4 Product Analysis (1) - RS-LiDAR-16

6.13.5 Product Analysis (2) - RS-LiDAR-32

6.13.6 Product Analysis (3) - RS-LiDAR-M1Pre

6.13.7 RoboSense’s P3 LiDAR Perception Solutions

6.13.8 RoboSense and Alibaba Launched Autonomous Logistics Vehicles Together

6.14 LeiShen Intelligent System Co., Ltd.

Comparison between Chinese MMW Radar Manufacturers

Comparison between Chinese LiDAR Manufacturers