目前排名第二位的乘用车车联网品牌是福特SYNC。2014年前8月, 福特SYNC在中国新增用户数约4.8万。

未来,Telematics不应该仅仅作为车企提升汽车销量的营销手段,它应该成为用户真正需要的产品。为了能使用户买单,各个厂家需要加快整合车载信息设备与移动互联网设备,为用户提供丰富的移动互联增值服务,大力推广手机映射以及连接智能穿戴设备,使产品更加贴近用户。

随着大批互联网公司的加入,车联网服务种类的增加,中国乘用车市场的车联网功能激活率有望不断提升,车联网的用户群也将迅速扩大。

水清木华研究中心《2014-2017年中国乘用车车联网行业研究报告》主要内容包括:

l 中国乘用车车联网市场发展概况(包括市场概况、产业链、市场规模、服务对比、产品配套情况等)

l 中国乘用车车联网品牌分析(包括业务分析、资费情况、新增用户数、车型配套、发展战略、技术趋势等);

l 中国乘用车车联网的TSP企业(包括产品分析、业务分析、应用案例、客户构成、发展模式等)。

Since GM OnStar and Toyota G-Book officially embarked on China’s market in 2009, passenger car brands have launched their own Telematics products, such as Ford SYNC, Nissan CARWINGS, SAIC InKaNet, HondaLink, Geely G-NetLink, Mercedes-Benz CONNECT, Volvo Sensus, BMW ConnectedDrive, Yueda KIA UVO, Dongfeng Citro?n Connect, Dongfeng Peugeot Blue-i, Hyundai Blue Link, Changan in Call, Chery Cloudrive and so on.

In order to occupy "the fourth screen" in the mobile Internet era, domestic and foreign Internet giants begin to highlight Internet of Vehicles (IOV) in 2014, for example, Apple has released CarPlay vehicle system, Google has launched Android Auto, Alibaba has acquired AutoNavi and cooperated with SAIC to develop connected vehicles, Tencent unveiled Lubao Box and held stake in Navinfo, Baidu collaborated with TimaNetworks to launch CARNET. As China's position in the global automotive market becomes more important, the competition in the Chinese passenger car telematics market will turn to be more intense.

Chinese passenger car telematics market falls into OEM market and aftermarket. The traditional OEM market focuses on traffic safety, such as remote assistance and other functions; the aftermarket emphasizes entertainment and other personalized services. However, OEM brands have paid more attention to the combination with mobile Internet and hope to make users have better experience; coupled with their inherent advantages in the industrial chain, they expect to master higher market share in the future.

There were more than 4,000 enterprises engaged in telematics aftermarket in China around 2012, but most of them have closed down or been struggling to survive now. For now, even large suppliers (like PATEO and Chinatsp) linked with considerable automobile companies see unsatisfying profitability. The fundamental reason lies in the lack of eye-catching telematics applications which users are eager to pay for. Navigation and radio of the traditional vehicle information system are the most frequently used functions for users. Telematics vendors intend to introduce a variety of innovative applications to intensify user viscosity, but they see little effect, which directly makes the telematics activation rate of new cars remain at less than 30%.

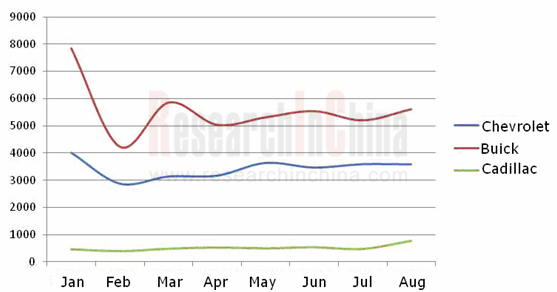

In the Chinese passenger car telematics market, GM OnStar has always played a leading role. In the first eight months of 2014, OnStar developed about 77,000 new passenger car users in China, and the majority of them were Buick owners.

Number of New Users of OnStar in China, Jan-Aug 2014

Source: ResearchInChina

Currently, the second-ranked passenger car telematics brand is Ford SYNC. In the first eight months of 2014, Ford SYNC attracted about 48,000 new users in China.

In the future, Telematics should not only function as a marketing tool for automobile enterprises to enhance sales volume, but also a product that users really need. In order to stimulate consumption, all manufacturers need to accelerate the integration of IVI and mobile Internet devices to provide users with diversified mobile Internet value-added services, as well as vigorously promote mobile mapping and connection with smart wearable devices to serve customers considerately.

With the participation of a large number of Internet companies and enriched telematics services, the activation rate of passenger car telematics services in China is expected to keep rising, and the telematics user base will also expand rapidly.

The report includes the following aspects:

Overview of Chinese passenger car telematics market (including market profile, industry chain, market size, service contrast, product support, etc.)

Overview of Chinese passenger car telematics market (including market profile, industry chain, market size, service contrast, product support, etc.)

Analysis on Chinese passenger car telematics brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Analysis on Chinese passenger car telematics brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).