|

|

|

报告导航:研究报告—

TMT产业—消费电子

|

|

2014年全球及中国电子连接线组行业研究报告 |

|

字数:3.2万 |

页数:112 |

图表数:79 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2150美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2450美元 |

|

编号:ZYW187

|

发布日期:2014-11 |

附件:下载 |

|

|

|

《2013-2014年全球及中国电子连接线组行业研究报告》包含以下内容:

1、电子连接线组简介

2、电子连接线组产业背景

3、电子连接线组市场与产业分析

4、24家电子连接线组厂家研究

电子连接线组(Electronic Cable Assembly)分为内部连接线组和外部连接线组,内部连接线组大多是OEM,外部连接线组可以分为OEM和零售两大市场,按应用领域可以分为数据线组、高速连接线组和传统连接线组三大类。高速连接线组对应标准包括USB 3.0/3.1、HDMI、DisplayPort、MHL、Thunderbolt、HD-SDI、DockPort、SlimPort。传统连接线组对应标准包括RF Coaxial、Composite Video、S-Video、Y/Pb/Pr、VGA(D-Sub)、DVI、IEEE 1394、BNC、USB 2.0、Audio RCA。

由于电子连接线组是劳动力密集型产业,所以绝大部分企业集中在中国大陆。目前电子连接线组产业有两种商业模式,一种是传统的OEM,为品牌厂家或整机厂家代工产品。本质意义上他们是整机厂家或品牌厂家的附属厂家,没有独立性。另一种是为欧美零售渠道代工产品,主要是电商渠道。而在国内,这些代工厂家则以自主品牌销售产品,仍然是以电商渠道销售为主。与传统OEM厂家最大的不同在于,这些代工厂家独立性很强,客户分散,数量众多,对下游客户的依赖性很低,且最终市场是零售市场,可以称之为独立电子连接线组厂家。

和独立电子连接线组厂家比,传统电子连接线组厂家客户都是整机制造厂家、品牌厂家或品牌厂家的一级供应商,第一大客户通常占其30%以上的收入,前五大客户占其75%的收入。传统厂家过分依赖单一大客户,风险很大,一旦客户取消订单,业绩就大跌。同时因为传统厂家依赖大客户,所以需要很高的成本来维持客户关系。最可怕的是传统厂家与客户地位不平等,通常需要签一份不平等的合同,一旦产品出现问题,可能被大客户索赔到倾家荡产。而独立电子连接线组厂家与客户都完全平等,客户分布广泛,不依赖单一大客户。此外,和传统电子连接线组厂家只有几百或几十种产品比,独立电子连接线组厂家的产品多达上万件,需要强大的管理能力,灵活的生产线设计和产能安排。

内部电子连接线组市场集中在笔记本电脑领域,近年来笔记本电脑市场萎缩,同时笔记本电脑设计简单化(如去掉ODD、PCMCIA),减少了内部连接线使用量,同时笔记本电脑追求轻薄,用FPC取代了部分连接线组。以上原因致使内部电子连接线组市场大幅度缩水,而从事内部电子连接线组的厂家也连续数年亏损。目前唯一的亮点是笔记本电脑的分辨率快速提高,EDP连接线组大量普及。

外部电子连接线组市场则蓬勃发展,主要驱动力来自几方面。首先是智能手机,智能手机的大量出现,智能手机耗电量大,消费者必须考虑在各种场合的充电需求,家庭、办公地、车内和外出旅行或出差是都需要数据线的场合,为了方便,就必须购买多条数据线。一般来说,智能手机本身会随赠一条数据线,但消费者还至少需要在零售市场另外购买一条数据线来满足需求。这在以前是不会有的。

其次,消费类电子产品追求轻薄,尤其是薄,为了降低产品厚度,厂家在产品外接端子高度方面花费大量精力,尤其是苹果。这包括Mini-DP、Mini-HDMI、Micro-HDMI、Micro-USB、Mini-USB、Lightning。这些端子与外部设备连接都需要特殊的线缆连接器进行转换。

再次,大量高清设备的出现,1080P的视频源大量出现,催生了规模不小的HDMI和DisplayPort连接线组零售市场。

最后,每一次接口的重大改变会强力刺激市场增加,如2013年市场大增主要是苹果采用了新的闪电接口(Lightning),而2016年Type C型的USB和Thunderbolt接口也会强力刺激市场,尤其是Type C型的USB可望在2016年大量取代传统的Micro USB接口,这将是一个巨大的市场。

2014年外部电子连接线组市场规模大约为72亿美元,预计2015年可达83亿美元,增幅为15.3%,预计2016年达106亿美元,增幅达27.7%。

Global and China Electronic Cable Assembly Industry Report, 2014 contains the following aspects:

1, Brief introduction to electronic cable assembly

2, Background of electronic cable assembly industry

3, Analysis on electronic cable assembly market and industry

4, Research on 24 electronic cable assembly companies

Electronic cable assembly is divided into internal and external ones. Internal electronic cable assembly is mostly available in the OEM market, while external electronic cable assembly can be found in OEM and retail markets. According to application, electronic cable assembly falls into data cable assembly, high-speed cable assembly and traditional cable assembly. High-speed cable assembly complies with USB 3.0 / 3.1, HDMI, DisplayPort, MHL, Thunderbolt, HD-SDI, DockPort and SlimPort standards. Traditional cable assembly accords with RF Coaxial, Composite Video, S-Video, Y / Pb / Pr, VGA (D-Sub), DVI, IEEE 1394, BNC, USB 2.0 and Audio RCA standards.

As the electronic cable assembly industry features with labor-intensive, the vast majority of enterprises are concentrated in Mainland China. Currently, the industry has two business models. First is traditional OEM. Brand companies or complete machine companies commission OEMs to produce products. Essentially, these OEMs are their affiliates without independence. Second is OEM serving American and European retail channels, mainly e-business channels. In China, these OEMs are entitled to sell products under their own brands by e-business channels mostly. Compared with the first model, the OEMs in the second model enjoy strong independence, have a large number of scattered customers, show low dependence on downstream customers, and target the terminal retail market, so they can be regarded as independent electronic cable assembly companies.

Compared to independent electronic cable assembly companies, traditional electronic cable assembly companies mainly serve complete machine companies, brand companies or the first-tier suppliers of brand companies, more than 30% of their revenue comes from the largest customer and 75% from the top five customers. The over-reliance of traditional electronic cable assembly companies on a single large customer implies great risks, namely their performance will collapse once the customer cancels orders. Meanwhile, traditional companies have to invest considerable costs in maintaining relationship with large customers. Due to the unequal status, traditional companies can't avoid signing unequal contracts with customers usually; once something is wrong with products, they may confront with huge claims of large customers, which is likely to make them go bankrupt. Independent electronic cable assembly companies and customers are equal in status. Thanks to abundant clients, independent electronic cable assembly companies are not dependent on a single large customer. In addition, independent companies provide up to 10,000 types of products, much more than traditional companies who can only offer dozens or hundreds of types, so the former need strong management capabilities, flexible production line design and production arrangements.

The internal electronic cable assembly market is primarily reflected in the laptop computer field. However, the laptop computer market has been shrinking in recent years. The simplified laptop design (for example, ODD and PCMCIA are removed) requires fewer internal connecting wires; meanwhile, FPC replaces cable assembly partly for the sake of thin and light laptops. The above reasons cause the internal electronic cable assembly market to contract dramatically, so that related companies have suffered losses for several consecutive years. The only bright spot is the popularity of EDP cable assembly incurred by the fast-growing resolution of laptop computers.

On the contrary, the external electronic cable assembly market is booming, mainly propelled by the following driving forces. Firstly, the significant emergence of smartphones. Smartphones consume much power, so users must consider the charging issue in a variety of occasions and they need data cables at home, in offices or cars, or on trip. For convenience, they must purchase many data cables. In general, a consumer will get a data cable for free when he buys a smartphone, but he still needs to purchase at least another one to meet demand. This case was not seen before.

Secondly, consumer electronic products are featured thin shape and light weight, especially thin. In order to reduce the thickness of products, companies make a lot of efforts in terms of the interface height for external terminals, especially Apple whose products include Mini-DP, Mini-HDMI, Micro-HDMI, Micro-USB, Mini-USB and Lightning. The connection between these products and external devices requires special cables.

Thirdly, the arising of numerous high-definition devices and 1080P video sources has spawned a sizeable HDMI and DisplayPort cable assembly retail market.

Finally, every major change in the interface will strongly stimulate the market to grow. For example, the market surge in 2013 was mainly attributed to Apple’s Lightning interface. In 2016, Type C USB and Thunderbolt interface will prompt the market dramatically; especially Type C USB is expected to replace the traditional Micro USB interface in large scale, which will bring a huge market.

The external electronic cable assembly market size approximates USD7.2 billion in 2014, and is expected to hit USD8.3 billion in 2015 with an increase of 15.3%, and USD10.6 billion in 2016 with a growth rate of 27.7%.

第一章、电子连接线组简介

1.1、电子连接线组定义

1.2、电子连接线组分类

1.3、电子连接线组生产流程

1.4、连接器行业简介

1.4.1、连接器上游

1.4.2、连接器中游

1.4.3、连接器下游

第二章、电子连接线组产业背景

2.1、传统接口介绍

2.1.1、射频RF

2.1.2、复合视频

2.1.3、S端子

2.1.4、色差

2.1.5、VGA

2.1.6、DVI

2.1.7、IEEE 1394

2.1.8、BNC

2.1.9、USB

2.2、新型高速接口标准

2.2.1、HDMI

2.2.2.、DisplayPort

2.2.3、Mini Displa yport

2.2.4、苹果Lightning接口

2.2.5、DockPort

2.5.6、Thunderbolt

2.2.7、SDI接口

2.2.8、MHL

2.2.9、SlimPort

2.2.10、USB 3.1

2.3、电子连接线组发展方向

2.3.1、双面接口,不分正反面

2.3.2、快速充电需要植入保护芯片或保护电阻

2.3.3、植入ESD和CMF保护

2.3.4、、厂家单独开发的特殊快速充电设备需要使用含芯片的特殊数据线

第三章、电子连接线组下游市场

3.1、电子连接线组市场驱动力

3.2、全球手机市场

3.3、全球智能手机市场

3.4、中国手机市场

3.5、平板电脑市场

3.6、笔记本电脑市场

3.7、台式机市场

3.8、高清(HD)与超高清(UHD)视频设备市场

3.9、视频流媒体设备市场

3.10、电子连接线组产业规模

3.11、独立电子连接线组厂家竞争优势

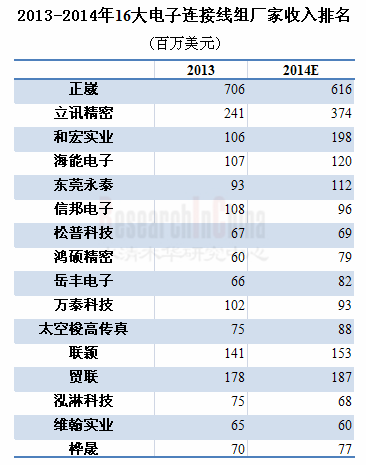

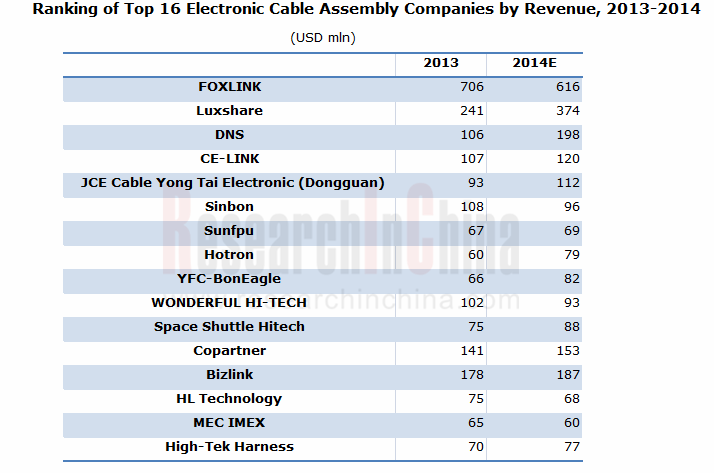

3.12、电子连接线组厂家排名

第四章、电子连接线组厂家研究

4..1、深圳市秋叶原实业

4.2、深圳市和宏实业

4.3、深圳市汉科电子

4.4、深圳市东景盛电子技术

4.5、深圳市艾森魏尔科技

4.6、深圳朗强科技

4.7、泓淋科技

4.8、贸联控股

4.9、宁波一舟

4.10、联颖

4.11、太空梭高传真

4.12、万泰科技

4.13、岳丰

4.14、鸿硕

4.15、正崴

4.16、松普科技

4.17、信邦电子

4.18、立讯精密

4.19、MICROTEK(JCE)

4.20、深圳市鹏毅实业

4.21、深圳柳川科技

4.22、海能电子

4.23、宏致科技(维翰实业)

4.24、桦晟

第五章、典型外部电子连接线组渠道研究

5.1、MONOPRICE

5.2、RADIOSHACK

5.3、DATWLYER

1 Brief Introduction to Electronic Cable Assembly

1.1 Definition

1.2 Classification

1.3 Production Process

1.4 Introduction to the Connector Industry

1.4.1 Upstream

1.4.2 Midstream

1.4.3 Downstream

2 Background of Electronic Cable Assembly Industry

2.1 Introduction to Traditional Interface

2.1.1 RF

2.1.2 Composite Video

2.1.3 S Terminal

2.1.4 Chromatic Aberration

2.1.5 VGA

2.1.6 DVI

2.1.7 IEEE 1394

2.1.8 BNC

2.1.9 USB

2.2 New-type High-speed Interface Standards

2.2.1 HDMI

2.2.2. DisplayPort

2.2.3 Mini Displayport

2.2.4 Apple’s Lightning Interface

2.2.5 DockPort

2.5.6 Thunderbolt

2.2.7 SDI Interface

2.2.8 MHL

2.2.9 SlimPort

2.2.10 USB 3.1

2.3 Development Directions of Electronic Cable Assembly

2.3.1 Double-sided Interfaces without Distinction between Front and Back Sides

2.3.2 Fast Charging Requires Implantation of Protective Chips or Resistors

2.3.3 Implantation of ESD and CMF for Protection

2.3.4 Special Fast Charging Equipment Developed by Vendors Independently Requires Special Chip-contained Data Cable

3 Electronic Cable Assembly Downstream Market

3.1 Market Drivers

3.2 Global Mobile Phone Market

3.3 Global Smartphone Market

3.4 Chinese Mobile Phone Market

3.5 Tablet PC Market

3.6 Laptop Computer Market

3.7 Desktop Market

3.8 HD and UHD Video Equipment Market

3.9 Video Streaming Media Device Market

3.10 Electronic Cable Assembly Industrial Scale

3.11 Competitive Advantages of Independent Electronic Cable Assembly Companies

3.12 Ranking of Electronic Cable Assembly Companies

4 Electronic Cable Assembly Companies

4.1 Shenzhen Choseal Industrial Co., Ltd

4.2 Shenzhen DNS

4.3 Shenzhen Hantech Electronics

4.4 Shenzhen East-Toptech Electronic Technology

4.5 Shenzhen Ask Technology

4.6 Shenzhen Lenkeng

4.7 HL Technology

4.8 Bizlink

4.9 Ningbo Ship

4.10 Copartner

4.11 Space Shuttle Hitech

4.12 Wonderful Hi-Tech

4.13 YFC-BonEagle

4.14 Hotron

4.15 FOXLINK

4.16 Sunfpu

4.17 Sinbon

4.18 Luxshare

4.19 MICROTEK(JCE)

4.20 Shenzhen PangNgai Industrial

4.21 Shenzhen LiuChuan

4.22 CE-LINK

4.23 ACES Electronics (Mec Imex)

4.24 High-Tek

5 Typical External Electronic Cable Assembly Channels

5.1 MONOPRICE

5.2 RADIOSHACK

5.3 DATWLYER

SlimPort路线图

SlimPort接线

2007-2015年全球手机出货量

2011-2014年全球3G/4G手机出货量地域分布

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

2013-2015年全球Top 13智能手机厂家出货量

2014年1-8月中国手机月度出货量

2011-2016年全球平板电脑出货量

2013年平板电脑主要品牌市场占有率

2012、2013年全球平板电脑制造厂家产量

2008-2015年笔记本电脑出货量

2010-2013年全球主要笔记本电脑ODM厂家出货量

2008-2015年Desktop PC出货量

Top 5 Vendors, Worldwide PC Shipments, Fourth Quarter 2013

Top 5 Vendors, Worldwide PC Shipments 2013

2012-2016 HDTV与UHDTV出货量

全球视频流媒体设备保有量厂家市场占有率

2012-2019年外部电子连接线组市场规模

2011-2016 HDMI 设备出货量

2013、2014年16大电子连接线组厂家收入排名

泓淋科技组织结构

2007-2014年泓淋科技收入与毛利率

2007-2014年泓淋科技收入与营业利润率

2009-2013年泓淋科技资产负债

2010-2014年泓淋科技收入下游应用分布

2012-2014年泓淋科技产品毛利率

2014年上半年泓淋科技收入业务分布

2012-2013年泓淋科技收入产品分布

2012-2014年泓淋科技成本结构

2007-2014年贸联收入与营业利润率

2013-2014年贸联收入下游分布

贸联主要产品

一舟电子科技组织结构

联颖组织结构

2006-2014年联颖收入与营业利润率

2012年9月-2014年9月联颖月度收入与增幅

太空梭高传真组织结构

2006-2014年太空梭高传真高传真收入与营业利润率

2012年9月-2014年9月太空梭高传真月度收入与增幅

万泰科技组织结构

2006-2014年万泰科技收入与营业利润率

2012年9月-2014年9月万泰科技月度收入与增幅

2012-2013年万泰科技产品分布

2012年万泰科技各项产品产量、产能、产值

2013年万泰科技各项产品产量、产能、产值

2006-2014年岳丰收入与营业利润率

2011年9月-2014年9月岳丰月度收入

2012、2013年岳丰收入产品分布

2012年岳丰产能、产量、产值

2013年岳丰产能、产量、产值

2009-2014年鸿硕收入与营业利润率

2012年9月-2014年9月鸿硕月度收入

正崴组织结构

2006-2014年正崴收入与营业利润率

正崴2012年9月-2014年9月月度收入

2013年正崴大陆主要子公司财务状况

2009-2014年松普科技收入与营业利润率

松普科技组织结构

2013年松普科技产能、产量、产值

2012年松普科技产能、产量、产值

2013年松普科技销量与销售额

2009-2014年信邦收入与营业利润率

2009-2013年信邦毛利率与净利润率

信邦业务范围

信邦主要客户

2013-2014年信邦收入下游分布

2008-2014年立讯精密收入与营业利润

2013年立讯连接线组相关业务公司简明财务数据

2014年上半年立讯连接线组相关业务公司简明财务数据

2012年维翰实业产能、产量、产值

2013年维翰实业产能、产量、产值

2013年维翰实业收入产品分布

2007-2014年桦晟收入与营业利润率

2012年9月-2014年9月桦晟月度收入与增幅

Monoprice运营模式

2010-2014年Monoprice收入与毛利率

2009-2014年上半年RadioShack收入与营业利润

SlimPort’s Roadmap

SlimPort’s Connection

Global Mobile Phone Shipment, 2007-2015E

Geographical Distribution of Global 3G / 4G Mobile Phone Shipment, 2011-2014

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Shipment of Global Top 13 Smartphone Vendors, 2013-2015E

China’s Monthly Mobile Phone Shipment, Jan-Aug 2014

Global Tablet PC Shipment, 2011-2016E

Market Share of Main Tablet PC Brands, 2013

Output of Global Tablet PC Companies, 2012-2013

Laptop Shipment, 2008-2015E

Shipment of Major Global Laptop ODM Companies, 2010-2013

Desktop PC Shipment, 2008-2015E

PC Shipments of Top 5 Vendors Worldwide, 2013Q4

PC Shipments of Top 5 Vendors Worldwide, 2013

HDTV and UHDTV Shipment, 2012-2016E

Market Share of Global Video Streaming Media Device Companies (by Ownership)

External Electronic Cable Assembly Market Size, 2012-2019E

Shipment of HDMI Devices, 2011-2016E

Ranking of Top 16 Electronic Cable Assembly Companies by Revenue, 2013-2014

Revenue and Gross Margin of HL Technology, 2007-2014

Revenue and Operating Margin of HL Technology, 2007-2014

Assets and Liabilities of HL Technology, 2009-2013

Revenue of HL Technology by Application, 2010-2014

Gross Margin of HL Technology by Product, 2012-2014

Revenue of HL Technology by Business, H1 2014

Revenue of HL Technology by Product, 2012-2013

Cost Structure of HL Technology, 2012-2014

Bizlink’s Revenue and Operating Margin, 2007-2014

Bizlink’s Revenue by Application, 2013-2014

Bizlink’s Main Products

Copartner’s Revenue and Operating Margin, 2006-2014

Copartner’s Monthly Revenue and Growth Rate, Sep 2012-Sep 2014

Revenue and Operating Margin of Space Shuttle Hitech, 2006-2014

Monthly Revenue and Growth Rate of Space Shuttle Hitech, Sep 2012-Sep 2014

Revenue and Operating Margin of Wonderful Hi-Tech, 2006-2014

Monthly Revenue and Growth Rate of Wonderful Hi-Tech, Sep 2012-Sep 2014

Product Distribution of Wonderful Hi-Tech, 2012-2013

Output, Capacity and Output Value of Wonderful Hi-Tech by Product, 2012

Output, Capacity and Output Value of Wonderful Hi-Tech by Product, 2013

YFC-BonEagle’s Revenue and Operating Margin, 2006-2014

YFC-BonEagle’s Monthly Revenue, Sep 2011-Sep 2014

YFC-BonEagle’s Revenue by Product, 2012-2013

YFC-BonEagle’s Capacity, Output and Output Value, 2012

YFC-BonEagle’s Capacity, Output and Output Value, 2013

Hotron’s Revenue and Operating Margin, 2009-2014

Hotron’s Monthly Revenue, Sep 2012-Sep 2014

FOXLINK’s Revenue and Operating Margin, 2006-2014

FOXLINK’s Monthly Revenue, Sep 2012-Sep 2014

Financial Status of FOXLINK's Major Subsidiaries in Mainland China, 2013

Sunfpu’s Revenue and Operating Margin, 2009-2014

Sunfpu’s Capacity, Output and Output Value, 2013

Sunfpu’s Capacity, Output and Output Value, 2012

Sunfpu’s Sales Volume and Revenue, 2013

Sinbon’s Revenue and Operating Margin, 2009-2014

Sinbon’s Gross Margin and Net Profit Margin, 2009-2013

Sinbon’s Business Scope

Sinbon’s Major Customers

Sinbon’s Revenue by Application, 2013-2014

Luxshare’s Revenue and Operating Profit, 2008-2014

Brief Financial Data of Luxshare’s Cable Assembly Subsidiaries, 2013

Brief Financial Data of Luxshare’s Cable Assembly Subsidiaries, H1 2014

Capacity, Output and Output Value of Mec Imex, 2012

Capacity, Output and Output Value of Mec Imex, 2013

Revenue of Mec Imex by Product, 2013

High-Tek’s Revenue and Operating Margin, 2007-2014

High-Tek’s Monthly Revenue and Growth Rate, Sep 2012-Sep 2014

Monoprice’s Operating Mode

Monoprice’s Revenue and Gross Margin, 2010-2014

RadioShack’s Revenue and Operating Profit, 2009-H1 2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|