|

|

|

报告导航:研究报告—

金融与服务业—零售与日用

|

|

2014-2017年全球及中国服饰类奢侈品行业研究报告 |

|

字数:2.8万 |

页数:135 |

图表数:123 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2450美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2750美元 |

|

编号:CYH029

|

发布日期:2014-12 |

附件:下载 |

|

|

|

随着人民经济水平的提高,以及代购、送礼等风潮的兴盛,近年中国(特指中国大陆)奢侈品市场实现了稳步增长,2004-2011年间,中国奢侈品消费总额复合增长率达到了20.9%。但自2012年开始,受反腐倡廉、抑制公款送礼或消费等政策影响,中国奢侈品消费增速迅速减弱,2013年其消费总额达到1160.0亿元,同比仅增2.1%,较2012年下滑5.1个百分点。

目前,中国奢侈品大都停留在穿戴领域,其中服饰类占到60%以上的比重。2013年,中国服饰类奢侈品消费总额为761.3亿元,占奢侈品总消费额的65.6%,预计至2017年其消费总额约为890.4亿元。

腕表类、箱包类和男士服装类是中国主要服饰类奢侈品消费产品,2013年其共占中国服饰类奢侈品消费总额的72.9%。其中,腕表类占比最高,为35.0%。

因看好中国奢侈品市场发展前景,近年Louis Vuitton(LV)、Hermes、Burberry、Gucci、Prada、Fendi、Thomas Pink等世界各大服饰类奢侈品品牌均已布局中国。

LV:2014年全球服饰类奢侈品价值最高的品牌。截止到2014年6月底,LV在中国大陆33个城市共有50家专卖店,较2013年同期新布局城市1个(济南市),新增专卖店5家。

Hermès:2014年中国最受欢迎的奢侈品品牌,其品牌价值达218.4亿美元。在华战略方面,Hermès通过旗下“上下”品牌来贴近中国消费者,打造中式奢侈品,目前“上下”在上海和巴黎各有一家门店。

Burberry: 2014年全球第八大奢侈品品牌。近几年,Burberry在积极加强与百度、优酷、阿里等公司合作的同时,新增了在线私人定制服务。2014年4月,Burberry成功入驻天猫网上商城,成为首家在中国B2C网店上开业的顶级奢侈品。

水清木华研究中心《2014-2017年全球及中国服饰类奢侈品行业研究报告》着重研究了以下内容:

全球及中国奢饰品行业市场规模、地区结构、中国海外消费等; 全球及中国奢饰品行业市场规模、地区结构、中国海外消费等;

中国服饰类奢侈品税收政策、市场规模、产品结构、地区结构及品牌发展情况等; 中国服饰类奢侈品税收政策、市场规模、产品结构、地区结构及品牌发展情况等;

服装类、腕表类、箱包类、鞋类等服饰类细分产品市场规模及品牌在华布局发展情况等; 服装类、腕表类、箱包类、鞋类等服饰类细分产品市场规模及品牌在华布局发展情况等;

中国服饰类奢侈品消费者特征、信息渠道、购买倾向等研究; 中国服饰类奢侈品消费者特征、信息渠道、购买倾向等研究;

中国服饰类奢侈品网购市场规模、网购特点及网商格局等; 中国服饰类奢侈品网购市场规模、网购特点及网商格局等;

全球8家奢侈品重点企业(共17个品牌)经营情况、在华发展情况等; 全球8家奢侈品重点企业(共17个品牌)经营情况、在华发展情况等;

2014-2017年全球及中国奢侈品、中国服饰类奢侈品市场规模预测等。 2014-2017年全球及中国奢侈品、中国服饰类奢侈品市场规模预测等。

With the improvement of people’s income as well as the prosperity of agent purchasing and gifting, the luxury market in China (especially Mainland China) has achieved steady growth over the recent years. During 2004-2011, China's total consumption of luxury goods showed a CAGR of 20.9%. However, since 2012, influenced by the policies of anti-corruption, suppression of gifting and consumption with public funds, the growth rate of luxury consumption in China has been slowing down rapidly. In 2013, total luxury consumption in China was RMB 116 billion, up by only 2.1% YoY, falling 5.1 points compared to the growth rate in 2012.

At present, most luxuries in China are concerned about dressing, of which apparel account for over 60%. In 2013, China's total consumption of luxury apparel was RMB 76.13 billion, accounting for 65.6% of the total consumption of luxury goods, and it is expected to reach about RMB 89.04 billion in 2017.

Wristwatches, bags & suitcases and men's wear are major luxury apparel consumer products in China, which accounted for 72.9% of total consumption of luxury apparel in China in 2013. Among them, wristwatches made up the highest proportion 35.0%.

Being optimistic about the prospects of China's luxury market, the world's major apparel brands such as Louis Vuitton (LV), Hermes, Burberry, Gucci, Prada, Fendi and Thomas Pink all have begun their layout in China in recent years.

LV: a global luxury apparel brand with the highest value in 2014. As of the end of June, 2014, LV has a total of 50 specialty stores in 33 cities in Chinese Mainland, adding one city (Jinan) and 5 specialty stores compared with the numbers in 2013.

Hermès: the most popular luxury brand in China in 2014, with brand value reaching USD 21.84 billion. As for its strategy in China, Hermès draws close to the Chinese consumers through its "Shang Xia" brand and through building Chinese-style luxury. Currently, there are two "Shang Xia" brand stores each in Shanghai and Paris.

Burberry: the eighth largest luxury brand worldwide in 2014. In recent years, while actively strengthening partnership with Baidu, Youku and Alibaba, Burberry also opens the new online private customization service. In April 2014, Burberry online store successfully settled in www.tmall.com and became the first top luxury shop to open in China's B2C online stores.

Global and China Luxury Apparel Industry Report, 2014-2017 by ResearchInChina focuses on the following:

Scale and regional structure of Global and China luxury markets, and overseas consumption of Chinese consumers, etc; Scale and regional structure of Global and China luxury markets, and overseas consumption of Chinese consumers, etc;

Tax policies, size, product structure, regional structure and brand development status, etc of China luxury apparel market; Tax policies, size, product structure, regional structure and brand development status, etc of China luxury apparel market;

Size of clothing, wristwatch, bag & suitcase, shoes and other apparel market segments and development and layout of various brands in China, etc.; Size of clothing, wristwatch, bag & suitcase, shoes and other apparel market segments and development and layout of various brands in China, etc.;

Research of characteristics, information channel, purchase propensity of Chinese luxury apparel consumers; Research of characteristics, information channel, purchase propensity of Chinese luxury apparel consumers;

Online shopping market size and online shopping features of luxury apparel and patterns of netrepreneursin China; Online shopping market size and online shopping features of luxury apparel and patterns of netrepreneursin China;

Operation and development in China of 8 key global luxury companies (including 17 brands); Operation and development in China of 8 key global luxury companies (including 17 brands);

Forecast of Global and China luxury and China luxury apparel market size in 2014-2017.

第一章 服饰类奢侈品行业概述

1.1 奢侈品行业界定

1.2 行业特征

1.2.1 奢侈品行业特征

1.2.2 服饰类奢侈品特征

1.3 服饰类奢侈品消费在中国发展历程

第二章 全球及中国奢侈品行业发展现状

2.1 全球

2.1.1 市场规模

2.1.2 地区结构

2.2 中国

2.2.1 市场规模

2.2.2 境外消费

2.2.3 轻奢侈品品牌在中国发展现状

2.3 发展趋势

第三章 中国服饰类奢侈品行业发展现状

3.1 税收政策

3.2 市场规模

3.3 产品结构

3.4 地区结构

3.4.1 地区分布

3.4.2 北京

3.4.3 上海

3.5 品牌发展

第四章 中国服饰类奢侈品细分产品发展情况

4.1 服装类奢侈品

4.1.1 市场规模

4.1.2 服装类奢侈品品牌在中国布局

4.1.3 童装类奢侈品

4.2 腕表类奢侈品

4.2.1 市场规模

4.2.2 腕表类奢侈品品牌中国布局

4.3 箱包类奢侈品

4.3.1 市场规模

4.3.2 价格

4.4 鞋类奢侈品

第五章 中国服饰类奢侈品消费者

5.1 消费者特征

5.2 消费者类型

5.3 购买潜力

5.4 购买原因

5.5 信息渠道

5.6 购买倾向

第六章 中国服饰类奢侈品网购现状

6.1 奢侈品网购规模

6.2 中国网民奢侈品网购特点

6.3 网商格局

6.3.1 发展现状

6.3.2 尚品网

6.3.3 魅力惠

6.3.4 第五大道

6.3.5 美西时尚

6.3.6 走秀网(奢侈品)

6.4 发展趋势

第七章 全球主要服饰类奢侈品生产企业分析

7.1 LVMH

7.1.1 企业简介

7.1.2 经营情况

7.1.3 营收构成

7.1.4 时装与皮革制品业务

7.1.5 Louis Vuitton

7.1.6 FENDI

7.1.7 Dior

7.1.8 Givenchy

7.1.9 Thomas Pink

7.2 Richemont

7.2.1 企业简介

7.2.2 经营情况

7.2.3 营收构成

7.2.4 销售渠道

7.2.5 Dunhill

7.2.6 Shanghai Tang

7.3 Kering

7.3.1 企业简介

7.3.2 经营情况

7.3.3 营收构成

7.3.4 奢侈品业务

7.3.5 Gucci

7.3.6 Saint Laurent Paris

7.3.7 Bottega Veneta

7.4 Chanel

7.5 Hermès

7.5.1 企业简介

7.5.2 经营情况

7.5.3 营收构成

7.5.4 在华发展

7.6 Burberry

7.6.1 企业简介

7.6.2 经营情况

7.6.3 营收构成

7.6.4 在华发展

7.7 Versace

7.8 Prada

7.8.1 企业简介

7.8.2 经营情况

7.8.3 营收构成

7.8.4 销售渠道

7.8.5 在华发展

7.8.6 Prada Brand

7.8.7 MiuMiu

7.8.8 Church’s

第八章 结论与预测

8.1 市场

8.2 主要品牌

1 Overview of Luxury Apparel Industry

1.1 Definition of the Luxury Industry

1.2 Industry Characteristics

1.2.1 Characteristics of the Luxury Industry

1.2.2 Characteristics of Luxury Apparel

1.3 Development History of Apparel Luxury Consumption in China

2 Development of Global and China Luxury Industry

2.1 Global Luxury Industry

2.1.1 Market Size

2.1.2 Regional Structure

2.2 China Luxury Industry

2.2.1 Market Size

2.2.2 Consumption in Overseas

2.2.3 Development Status of Affordable Luxury Brands in China

2.3 Development Trend

3 Development of China Luxury Apparel Industry

3.1 Tax Policy

3.2 Market Size

3.3 Product Structure

3.4 Regional Structure

3.4.1 Regional Distribution

3.4.2 Beijing

3.4.3 Shanghai

3.5 Brand Development

4 Development of China Luxury Apparel Segmented Products

4.1 Luxury Apparel

4.1.1 Market Size

4.1.2 Layout of Luxury Apparel Brands in China

4.1.3 Children's Wear Luxury

4.2 Luxury Wristwatch

4.2.1 Market Size

4.2.2 Layout of Luxury Watch Brands in China

4.3 Luxury Bag & Suitcase

4.3.1 Market Size

4.3.2 Price

4.4 Luxury Footwear

5 Chinese Consumers of Luxury Apparel

5.1 Consumer Characteristics

5.2 Types of Consumers

5.3 Purchase Potential

5.4 Reasons for Purchase

5.5 Information Channels

5.6 Propensity of Purchase

6 Status Quo of Luxury Apparel Online Shopping in China

6.1 Size of Luxury Online Shopping

6.2 Features of Chinese Netizens in Luxury Online Shopping

6.3 Patterns of Netrepreneurs

6.3.1 Status Quo

6.3.2 www.shangpin.com

6.3.3 www.glamour-sales.com.cn

6.3.4 www.5lux.com

6.3.5 www.meici.com

6.3.6 www.xiu.com

6.4 Development Trend

7 Leading Luxury Apparel Production Enterprises

7.1 LVMH

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Fashion and Leather Goods Business

7.1.5 Louis Vuitton

7.1.6 FENDI

7.1.7 Dior

7.1.8 Givenchy

7.1.9 Thomas Pink

7.2 Richemont

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Sales Channels

7.2.5 Dunhill

7.2.6 Shanghai Tang

7.3 Kering

7.3.1 Profile

7.3.2 Operation

7.3.3Revenue Structure

7.3.4 Luxury Business

7.3.5 Gucci

7.3.6 Saint Laurent Paris

7.3.7 Bottega Veneta

7.4 Chanel

7.5 HermèS

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Development in China

7.6 Burberry

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Development in China

7.7 Versace

7.8 Prada

7.8.1 Profile

7.8.2 Operation

7.8.3Revenue Structure

7.8.4 Sales Channels

7.8.5 Development in China

7.8.6 Prada Brand

7.8.7 Miumiu

7.8.8 Church’s

8 Conclusion and Forecast

8.1 Market

8.2 Major Brands

图:2001-2014年全球奢侈品消费总额及同比增长

图:2013年全球奢侈品(分地区)消费总额构成

图:2008-2014年中国消费者奢侈品消费总额

图:2009-2013年中国消费者(分地区)奢侈品消费额构成

图:中国消费者境外消费奢侈品的主要原因

图:中国消费者最喜欢购买奢侈品的地点

图:2012-2013年全球免税消费最多的前十大国家/地区的游客及占比

表:2014年全球主要轻奢侈品品牌在中国门店数量

图:2013-2017年全球奢侈品消费总额及同比增长

图:2013-2017年中国消费者奢侈品消费总额及同比增长

表:中国服饰类奢侈品税收政策演变

表:2014年中国部分服饰类奢侈品进口相关税率

图:2004-2014年中国服饰类奢侈品消费总额及同比增长

图:2013-2014年中国大陆服饰类奢侈品(分品类)消费总额构成

表:截止到2014年6月底全球主要50个服饰类奢侈品品牌在中国大陆店面布局最多的15个城市店面数量及占比

图:2013年中国千万富豪(分省/市)构成

图:2013年中国(分城市)富豪构成

图:2011-2013年北京新光天地销售额

图:2006-2013年北京市社会消费品零售总额

图:2006-2013年北京城镇居民人均可支配收入

图:2006-2012年上海社会消费品零售总额

图:2006-2013年上海城镇居民人均可支配收入

图:2014年全球(按品牌价值)服饰类奢侈品品牌Top10

图:2014年中国奢侈品消费者(分性别)10大最想拥有的奢侈品品牌

图:2009-2017年中国服装类奢侈品(分类别)消费总额

表:2014年全球主要服装类奢侈品品牌在中国店面分布

图:2009-2017年中国腕表类奢侈品消费总额及同比增长

表:2014年全球主要腕表类奢侈品品牌在中国店面分布

图:2009-2017年中国箱包类奢侈品消费总额及同比增长

图:2014年中国箱包类奢侈品消费者(分价格区段)构成

图:2009-2017年中国鞋类奢侈品消费总额及同比增长

表:2014年中国奢侈品消费者主要消费行为特征

表:2014年中国奢侈品消费者类别及主要特征

图:2013年中国奢侈品消费者分类消费额构成

图:2009-2013年中国千万富豪人数及同比增长

表:2010&2015年中国城市家庭年收入占比和奢侈品消费占比

图:2013年中国奢侈品消费者购买奢侈品用途构成

图:2013年中国消费者购买奢侈品主要考虑因素

图:2013年中国消费者奢侈品信息的来源构成

图:2013年中国奢侈品消费者主要购买奢侈品类别

图:2010-2017年中国奢侈品网络购物市场交易规模

表:奢侈品购物网站分类

表:主要奢侈品品牌直营网站

图:不同奢侈品品牌电子商务运营模式

图:魅力惠拥有授权的奢侈品品牌

表:2014年LVMH集团(分业务)品牌及品牌数量

表:2011-2013年LVMH集团(分国家/地区)专卖店数量

表:2011-2013年LVMH集团(分业务)专卖店数量

图:2008-2014年LVMH集团营业收入及同比增长

图:2008-2014年LVMH集团(分业务)营业收入

图:2010-2014年LVMH集团(分地区)营业收入构成

图:2012-2013年LVMH集团(分收据币种)营业收入构成

图:2011-2013年LVMH集团时装与皮革制品业务经营情况

表:2011-2014年路易威登中国大陆专卖店

表:2013-2014年芬迪中国大陆精品店分布

表:2013-2014年迪奥时尚与配饰中国大陆专卖店分布

表:2014年6月底纪梵希在中国大陆店铺分布

表:2013-2014年纪梵希中国大陆专柜

表:2013-2014年Thomas Pink中国大陆专卖店分布

图:2011-2014财年历峰集团销售额与净利润

图:2012-2014财年历峰集团(分业务)销售额及构成

图:2013-2014财年历峰集团(分产品线)销售额构成

图:2013-2014财年历峰集团(分地区)销售额及构成

图:FY2012-FY2014年历峰集团(分渠道)销售额构成

表:截止到2014年6月底登喜路中国大陆门店

表:2013-2014年上海滩中国大陆门店数量

图:2014年开云集团(分业务)品牌布局

图:2011-2014年开云集团营业收入与净利润

图:2011-2014年开云集团(分业务)营业收入构成

图:2011-2013年开云集团(分地区)营业收入及构成

图:2012-2013年开云集团奢侈品业务(分地区)直营店数量

图:2011-2014年开云集团奢侈品业务营业收入与营业利润

图:2013年开云集团奢侈品业务(分品牌)营业收入构成

图:2013年开云集团奢侈品业务(分业务)营业收入构成

图:2013年开云集团奢侈品业务(分地区)营业收入构成

图:2012-2013年Gucci品牌(分地区)直营店

图:2011-2014年Gucci营业收入与营业利润

图:2013年Gucci品牌(分产品)营业收入构成

图:2013年Gucci品牌(分地区)营业收入构成

表:2011-2014年古琦中国大陆专卖店分布

图:2012-2013年圣罗兰(分地区)直营店

图:2011-2014年圣罗兰营业收入与营业利润

图:2013年圣罗兰(分产品)营业收入构成

图:2013年圣罗兰(分地区)营业收入构成

表:2014年圣罗兰中国大陆专卖店

图:2012-2013年葆碟家(分地区)直营店

图:2011-2014年葆碟家营业收入与营业利润

图:2013年葆碟家(分产品)营业收入构成

图:2013年葆碟家(分地区)营业收入构成

表:2013-2014年葆蝶家中国大陆专卖店分布

表:2011-2014年香奈儿中国大陆时尚与眼镜精品店分布

图:2014年爱马仕公司业务结构

表:2013年爱马仕(分地区/分国家)零售店分布

图:2009-2014年爱马仕营业收入与净利润

图:2008-2013年爱马仕独家零售店数量

图:2011-2014年爱马仕(分产品)营业收入

图:2011-2014年爱马仕(分地区)营业收入及构成

表:2011-2014年爱马仕中国大陆专卖店分布

表:2010-2014财年博柏利(分地区)直营店及旗舰店数量

图:2010-2014财年博柏利营业收入与净利润利润

图:2010-2014财年博柏利(分产品)营业收入

表:2010-2014财年博柏利(分地区)营业收入及构成

图:2010-2014财年博柏利(分销售方式)营业收入

表:2013-2014年博柏利中国大陆门店分布

表:2011-2014年范思哲中国大陆门店分布

表:2012-2014年Prada集团(分品牌/分地区)门店数量

图:截止到2014年4月底Prada集团(分国家/地区)专卖店

图:2009-2014财年普拉达集团营业收入与净利润

表:2011-2014财年普拉达集团(分产品)销售净额及构成

表:2011-2014年普拉达集团(分品牌)销售净额及占比

表:2011-2014年普拉达集团(分地区)销售净额及构成

表:2012-2013财年普拉达集团(分渠道)销售净额及构成

图:2012-2014财年Prada集团在大中华区销售额及占比

图:截止2014年1月底Prada品牌(分国家/地区)专卖店

表:2011-2014年Prada品牌销售净额及营业利润

图:2006-2013财年Prada品牌(分渠道)营业收入及店面数量

表:2013-2014年普拉达中国大陆专卖店分布

图:2013财年Prada Men (分产品)营业收入构成

图:2006-2013财年MIUMIU品牌(分渠道)营业收入及店面数量

表:2013-2014年缪缪品牌在中国大陆专卖店分布

图:截止2014年1月底Church’s 品牌(分国家/地区)专卖店

图:2013-2017年中国大陆服饰类奢侈品消费总额及同比增长

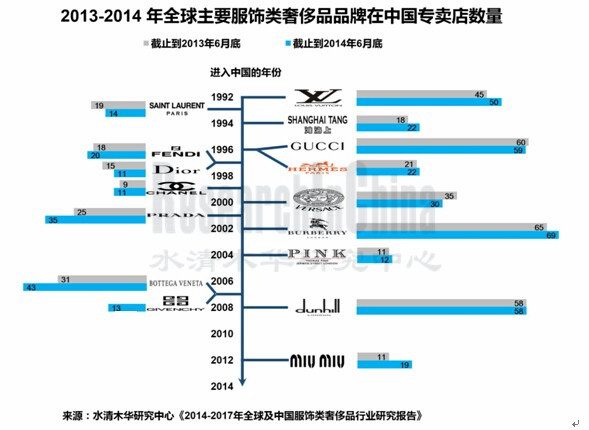

表:2013-2014年全球各主要服饰类奢侈品品牌在中国大陆门店数量

Global Total Consumption of Luxury Goods and YoY Growth, 2001-2014

Structure of Total Global Consumption of Luxury Goods, by Region, 2013

Total Consumption of Luxury Goods by Chinese Consumers, 2008-2014

Consumption of Luxury Goods by Chinese Consumers, by Region, 2009-2013

Main Reasons Why Chinese Consumers Buy Luxury Goods Abroad

Favorite Places to Buy Luxury Goods for Chinese Consumers

Number and Proportion of Tourists at the Top 10 Duty-Free Consumption Countries/Regions, 2012-2013

Number of Stores in China of Major Global Affordable Luxury Brands, 2014

Total Global Consumption of Luxury Goods and YoY Growth, 2013-2017E

Total Global Consumption of Luxury Goods by Chinese Consumers and YoY Growth, 2013-2017E Evolvement of Luxury Apparel Tax Policies in China

Tax Rates of Some Imported Luxury Apparel in China, 2014

Total Consumption of Luxury Apparel and YoY Growth in China, 2004-2014

Total Consumption of Luxury Apparel in Mainland China, by Category, 2013-2014

Number and Proportion of Stores in 15 Most-Distributed Cities of 50 Major Global Luxury Apparel Brands, by the End of June 2014

Structure of Multimillionaires in China, by Province/Municipality, 2013

Structure of the Rich in China, by City, 2013

Sales of Beijing Shin Kong Place, 2011-2013

Total Retail Sales of Social Consumer Goods in Beijing, 2006-2013

Per Capita Disposable Income of Urban Residents in Beijing, 2006-2013

Total Retail Sales of Consumer Goods in Shanghai, 2006-2012

Per Capita Disposable Income of Urban Residents in Shanghai, 2006-2013

Top10 Global Luxury Apparel Brands, by Brand Value, 2014

Ten Most-Wanted Luxury Brands for Chinese Luxury Consumers, by Gender, 2014

Total Consumption of Luxury Apparel in China, by Category, 2009-2017E

Distribution of Stores of Global Leading Luxury Apparel Brands in China, 2014

Total Consumption of Luxury Wristwatch and YoY Growth in China, 2009-2017E

Distribution of Stores of Global Leading Luxury Watch Brands in China, 2014

Total Consumption of Luxury Bag and Suitcase and YoY Growth, 2009-2017E

Structure of Chinese Luxury Bag and Suitcase Consumers, by Price Range, 2014

Total Consumption of Luxury Footwear and YoY Growth, 2009-2017E

Main Consuming Behaviors of Chinese Luxury Consumers, 2014

Categories and Key Characteristics of Chinese Luxury Consumers, 2014

Consumption of Chinese Luxury Consumers, by Category, 2013

Number of Multimillionaires and YoY Growth in China, 2009-2013

Annual Income Breakdown and Proportion of Luxury Consumption of Chinese Urban Households, 2010 & 2015

Purposes for Which Chinese Luxury Consumers Buy Luxury Goods, 2013

Major Considerations When Chinese Consumers Buy Luxury Goods, 2013

Information Sources of Luxury Goods for Chinese Consumers, 2013

Main Categories of Luxury Goods Purchased by Chinese Consumers, 2013

Transaction Volume of Chinese Online Luxury Goods Shopping Market, 2010-2017E

Classification of Luxury Shopping Websites Direct-Sale Websites of Major Luxury Brands

E-Commerce Business Models of Different Luxury Brands

Authorized Luxury Brands Being Sold by Glamour Sales

Number of Brands and Specific Brands of LVMH Group, by Business, 2014

Number of Exclusive Stores of LVMH Group, by Country/Region, 2011-2013

Number of Exclusive Stores of LVMH Group, by Business, 2011-2013

Revenue and YoY Growth of LVMH Group, 2008-2014

Revenue of LVMH Group, by Business, 2008-2014

Revenue Structure of LVMH Group, by Region, 2010-2014

Revenue Structure of LVMH Group, by Receipt Currency, 2012-2013

Operation of Fashion Clothing and Leather Goods Business of LVMH Group, 2011-2013

Exclusive Stores of Louis Vuitton in China, 2011-2014

Distribution of Fendi Boutiques in Mainland China, 2013-2014

Distribution of Dior Fashion and Accessory Exclusive Stores in Mainland China, 2013-2014

Distribution of Givenchy Stores in Mainland China, by the End of June 2014

Givenchy Counters in Mainland China, 2013-2014

Distribution of Thomas Pink Exclusive Stores in Mainland China, 2013-2014

Sales and Net Income of Richemont Group, FY2011-FY2014

Sales and Structure of Richemont Group, by Business, FY2012-FY2014

Sales and Structure of Richemont Group, by Product Line, FY2013-FY2014

Sales and Structure of Richemont Group, by Region, FY2013-FY2014

Sales and Structure of Richemont Group, by Channel, FY2012-FY2014

Dunhill Stores in Mainland China, by the End of June 2014

Number of Shanghai Tang Brand Stores in Mainland China, 2013-2014

Brand Layout of Kering Group, by Business, 2014

Revenue and Net Income of Kering Group, 2011-2014

Revenue Structure of Kering Group, by Business, 2011-2014

Revenue Structure of Kering Group, by Region, 2011-2013

Number of Direct-Sale Luxury Stores of Kering Group, by Region, 2012-2013

Revenue and Operating Profit from Luxury Business of Kering Group, 2011-2014

Structure of Revenue from Luxury Business of Kering Group, by Brand, 2013

Structure of Revenue from Luxury Business of Kering Group, by Business, 2013

Structure of Revenue from Luxury Business of Kering Group, by Region, 2013

Gucci Direct-Sale Stores, by Region, 2012-2013

Revenue and Operating Profit of Gucci, 2011-2014

Revenue Structure of Gucci, by Product, 2013

Revenue Structure of Gucci, by Region, 2013

Distribution of Gucci Exclusive Stores in China, 2011-2014

Saint Laurent Direct-Sale Stores, by Region, 2012-2013

Revenue and Operating Profit of Saint Laurent, 2011-2014

Revenue Structure of Saint Laurent, by Product, 2013

Revenue Structure of Saint Laurent, by Region, 2013

Distribution of Saint Laurent Exclusive Stores in China, 2014

Bottega Veneta Direct-Sale Stores, by Region, 2012-2013

Revenue and Operating Profit of Bottega Veneta, 2011-2014

Revenue Structure of Bottega Veneta, by Product, 2013

Revenue Structure of Bottega Veneta, by Region, 2013

Distribution of Bottega Veneta Exclusive Stores in China, 2013-2014

Distribution of Chanel Fashion and Glasses Boutiques in China, 2011-2014

Business Structure of Hermes, 2014

Distribution of Hermes Retail Stores, by Region/Country, 2013

Revenue and Net Income of Hermes, 2009-2014

Number of Hermes Exclusive Retail Outlets, 2008-2013

Revenue of Hermes, by Product, 2011-2014

Revenue and Structure of Hermes, by Region, 2011-2014

Hermes Exclusive Stores in Mainland China, 2011-2014

Number of Burberry Direct-Sale Stores and Flagship Stores, by Region, 2010-2014

Revenue and Net Income of Burberry, FY2010-FY2014

Revenue of Burberry, by Product, FY2010-FY2014

Revenue and Structure of Burberry, by Region, FY2010-FY2014

Revenue of Burberry, by Sales Mode, FY2010-FY2014

Distribution of Burberry Stores in Mainland China, 2013-2014

Distribution of Versace Stores in Mainland China, 2011-2014

Number of Stores of Prada Group, by Brand/Region, 2012-2014

Exclusive Stores of Prada Group, by Country/Region, by the End of April 2014

Revenue and Net Income of Prada Group, FY2009-FY2014

Net Sales and Structure of Prada Group, by Product, FY2011-FY2014

Net Sales and Structure of Prada Group, by Brand, FY2011-FY2014

Net Sales and Structure of Prada Group, by Region, FY2011-FY2014

Net Sales and Structure of Prada Group, by Channel, FY2012-FY2013

Sales and Structure of Prada Group in Greater China Region, FY2012-FY2014

Prada Brand Exclusive Stores, by Country/Region, by the End of January 2014

Net Sales and Operating Profit of Prada Brand, 2011-2014

Revenue and Number of Stores of Prada Brand, by Channel, FY2006-FY2013

Distribution of Prada Stores in Mainland China, 2013-2014

Revenue Structure of Prada Men, by Product, FY2013

Revenue and Number of Stores of MIUMIU Brand, by Channel, FY2006-FY2013

Distribution of MIUMIU Brand Stores in Mainland China, 2013-2014

Church's Brand Stores, by Country/Region, by the End of January 2014

Total Consumption of Luxury Apparel and YoY Growth in Mainland China, 2013-2017

Number of Stores in Mainland China of Major Global Luxury Apparel Brands, 2013-2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|