OBD(On-Board Diagnostic System)中文含义为车载诊断系统。OBD从发动机的运行状况随时监控汽车是否尾气超标,系统是否正常,根据故障码的提示,维修人员能迅速准确地确定故障的性质和部位。OBD以故障代码的方式将该信息储存在ECU内,ECU通过标准数据接口,保证对故障信息的访问和处理。

OBD车联网主要由三部分组成:OBD终端(硬件,插入OBD接口)、软件(手机APP)和云平台。

随汽车智能硬件、移动互联网的发展,汽车成为下一个快速增长的移动终端,车联网市场也因此迎来快速发展。目前,各方企业均大力布局车联网市场,抢占车联网入口,而基于OBD的车联网解决方案成为当前车联网的重要入口。

2006-2012年,部分车队管理及车辆追踪解决方案提供商(如Geotab、Xirgo、Scope Technologies、ATrack),汽车电子企业(Danlaw、TECHTOM等),保险公司(Progressive、State Farm、Allstate、Insurethebox)就推出了OBD车联网产品。2013-2014年,OBD智能硬件市场吸引了资本市场关注,汽车电子企业、初创公司、保险公司、移动运营商等纷纷参与进来。其中,初创公司Automatic Labs的OBD终端年出货量超过了百万台。

2012年之前,中国部分企业开发出了OBD终端,但因技术等原因,未能市场化。2012年开始,部分企业形成了OBD终端+APP+云平台的商业模式。2013年底到2014年初,受国外OBD智能硬件投资热潮影响,这种OBD车联网模式得到市场关注,各方企业开始对OBD车联网市场进行布局。

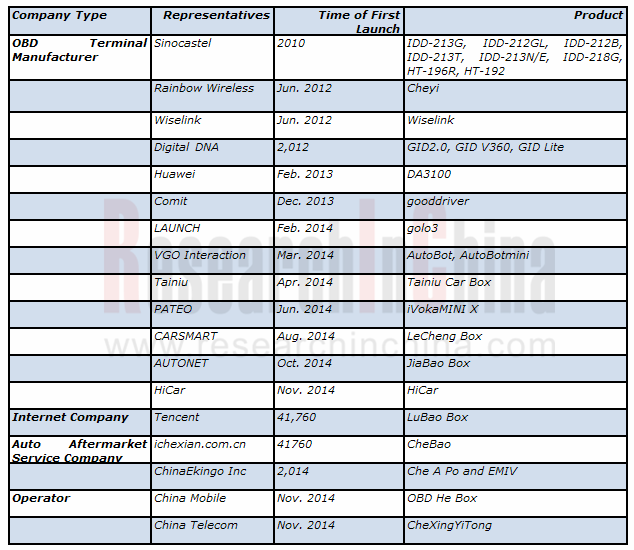

目前涉足OBD车联网(包括自主品牌OBD终端)的企业可以分为四类:传统的OBD终端厂商(部分车机厂商、车联网企业、初创公司等)、互联网企业、运营商、汽车后市场服务公司等。

除了大量企业进入OBD车联网市场外,2014年全球及中国OBD车联网市场呈现如下特点:

(1)除了应用于UBI、车队管理等外,OBD车联网服务功能进一步推展。2015年1月,Automatic与智能恒温器公司Nest进行合作,让Automatic OBD产品变成智能家居的控制器。同月,Zubie也与SmartHome Ventures所有的硬件和服务提供商PEQ达成数据交换合作。

(2)OBD车联网云平台将进一步开放,云平台不仅向软件开发商开放API(软件开发商可以使用平台收集的数据),同时也向其他竞争对手开放OBD终端设备接入接口,通过数据共享进一步利用大数据。如,2015年1月, Carvoyant 向Velio(OBD装置生产商)开放平台接口。

(3)语音识别技术将应用于OBD车联网中。目前部分OBD车联网企业在APP中增加了语音播报功能,如通易科技的优驾、百度地图版golo等,但语音识别在OBD车联网中的应用几乎空白。

(4)目前,OBD的重点在于对数据的分析,未来OBD终端有望进一步集成其他功能模块(空气净化模块、语音识别模块),朝多功能和智能的方向发展。

《2015年全球及中国OBD车联网行业研究报告》主要包括以下内容

1,车载诊断系统OBD概况(包括定义、组成、发展历程、接口及相关产品);

2,全球车联网市场(包括定义、发展概况、产业链、商业模式、盈利模式、市场规模、渗透率等);

3,全球OBD车联网市场(包括市场现状、商业模式、盈利模式、主要应用等);

4,中国OBD车联网市场(包括汽车销量、保有量、产业链、发展历程、市场现状等);

5,全球(12家)及中国(11家)OBD车联网企业(包括简介、经营业绩、营收构成、OBD车联网业务、最新动态等)。

OBD (on-board diagnostic system) is an electronics self diagnostic system, typically used in automotive applications. It can monitor whether the automobile exhaust exceeds the standard or the system is normal at any time from the running state of the engine, and according to the fault code, maintenance personnel can quickly and accurately determine the nature and location of a fault. The information is stored in the ECU in the form of fault code, and ECU ensures the fault information access and processing through standard data interface.

OBD telematics is mainly composed of three parts: OBD terminal (hardware and plug-in OBD interface), software (mobile phone APP) and cloud platform.

Along with the development of intelligent automobile hardware and mobile internet, the car becomes the next fast-growing mobile terminal and telematics market also ushers in rapid development. At present, the enterprises are aggressively engaged in telematics market layout and seizing the entrance to telematics, then OBD-based telematic solutions become an important entrance.

Part of the fleet management and vehicle tracking solution providers (such as Geotab, Xirgo, Scope Technologies and ATrack), automotive electronic enterprises (Danlaw, TECHTOM, etc.) and insurance companies (Progressive, State Farm, Allstate, Insurethebox) launched their OBD telematics products during 2006-2012. In 2013-2014, the OBD intelligentt hardware market attracted the attention of capital market; and automotive electronic enterprises, start-up companies, insurance companies, mobile operators, etc. were getting involved in it successively. Among them, the startup Automatic Labs recorded more than one million units in OBD terminal shipments each year.

Prior to 2012, some Chinese enterprises developed OBD terminal, but failed in marketization due to technology and other reasons. Some companies formed the “OBD terminal + APP + Cloud Platform” business model at the outset of 2012. From the end of 2013 to early 2014, influenced by the foreign OBD intelligent hardware investment boom, this OBD telematics mode gained market attention, and all enterprises started OBD telematics market layout.

Currently, enterprises involved in OBD telematics (including independent brand OBD terminal) fall into four types: traditional OBD terminal manufacturers (part of the vehicle manufacturers, telematics companies, start-ups, etc.), internet companies, operators, and auto aftermarket service companies.

China’s OBD Telematics Market Participants and Their Products, 2010-2014

Source: ResearchInChina

In addition to a large number of enterprises’ inburst, the global and Chinese OBD telematics market characterized the followings in 2014:

(1) The service function of OBD telematics was further promoted besides application in UBI, fleet management, etc. In January 2015, Automatic worked with the smart thermostats company -- Nest to make its OBD products turn into the smart home controller. In the same month, Zubie also reached data exchange cooperation with PEQ, a provider of all software and services for SmartHome Ventures.

(2) The cloud platform of OBD telematics will be further opened, with API available for software developers which can use the data collected by the platform as well as OBD terminal equipment access interface for other competitors to increase the use of big data through data sharing, e.g. Carvoyant opened platform interface to Velio (an OBD device manufacturer) in January 2015.

(3) The voice recognition technology will be applied to OBD telematics. So far, some OBD telematics companies have added the function of voice broadcast in APP, such as Comit’s gooddriver, Baidu map version golo, etc., but the application of speech recognition is almost blank in OBD telematics.

(4) Currently, OBD is focused on the analysis of data; in the future, OBD terminal is expected to further integrate other function modules (air purification module, voice recognition module) and become multi-functional and intelligent.

Global and China OBD Telematics Industry Report, 2014-2015 mainly covers contents below:

Overview of OBD (including definition, composition, development history, interface and related products);

Overview of OBD (including definition, composition, development history, interface and related products);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global telematics market (embracing definition, development situation, industry chain, business model, profit model, market size, penetration, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

Global OBD telematics market (covering market status, business model, profit model, major applications, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

China OBD telematics market (including car sales, ownership, industry chain, development history, market status, etc.);

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

12 global and 11 Chinese OBD telematics companies (including profile, operating performance, revenue structure, OBD telematics business, latest news, etc.)

第一章 车载诊断系统OBD概况

1.1 定义及组成

1.1.1 定义

1.1.2 组成

1.2 OBD发展历程

1.3 接口及相关产品

1.3.1 接口

1.3.2 基于OBD接口的产品

第二章 全球车联网市场

2.1 定义及发展概况

2.1.1 定义

2.1.2 发展概况

2.2 产业链

2.3 商业模式及盈利模式

2.3.1 商业模式

2.3.2 盈利模式

2.4市场规模及渗透率

2.4.1 汽车销量及保有量

2.4.2 车联网市场规模

2.4.3 渗透率

第三章 全球OBD车联网市场

3.1 市场现状

3.2 商业模式及盈利模式

3.3 主要应用

3.3.1 UBI市场

3.3.2 车队管理

3.3.3 4S店客户关系管理

3.3.4 故障诊断及维修

3.3.5 政府交通管理

3.3.6 车主应用

第四章 中国OBD车联网市场

4.1 中国汽车市场

4.1.1 汽车销量及保有量

4.1.2 中国车联网产业链

4.2 中国OBD车联网市场

4.2.1 发展历程

4.2.2 市场现状

第五章 全球OBD车联网主要企业

5.1 Danlaw Inc

5.1.1 公司简介

5.1.2 OBD车联网业务

5.1.3 最新动态

5.2 Geotab

5.2.1 公司简介

5.2.2 OBD车联网业务

5.2.3 与Telefónica推出合资品牌产品

5.3 Xirgo Technologies

5.3.1 公司介绍

5.3.2 OBD业务

5.3.3 与Progressive合作

5.4 TECHTOM

5.4.1 公司简介

5.4.2 OBD车联网业务

5.4.3 BrainPad 参股TECHTOM

5.5 ATrack Technology Inc

5.5.1 公司简介

5.5.2 OBD车联网业务

5.5.3 最新动态

5.6 Scope Technologies

5.6.1 公司简介

5.6.2 OBD车联网业务

5.7 Automatic Labs

5.7.1 公司简介

5.7.2 OBD车联网业务

5.7.3 最新动态

5.8 Zubie

5.8.1 公司简介

5.8.2 OBD车联网业务

5.8.3 最新动态

5.9 Carvoyant

5.9.1 公司简介

5.9.2 OBD车联网业务

5.10 Dash

5.10.1 公司简介

5.10.2 OBD车联网业务

5.11 Mojio

5.11.1 公司简介

5.11.2 OBD车联网业务

5.11.3 最新动态

第六章 中国OBD车联网主要企业

6.1深圳市元征科技股份有限公司

6.1.1 公司简介

6.1.2 经营业绩

6.1.3 营收构成

6.1.4 毛利率

6.1.5 研发支出

6.1.6 OBD车联网业务

6.1.7 最新动态

6.1.8 发展战略

6.2 北京车网互联科技有限公司

6.2.1 公司简介

6.2.2 经营业绩

6.2.3 营收构成

6.2.4 OBD车联网业务

6.3 华为投资控股有限公司

6.3.1 公司简介

6.3.2 经营业绩

6.3.3 OBD车联网业务

6.4 北京九五智驾信息技术股份有限公司

6.4.1 公司简介

6.4.2 经营业绩

6.4.3 商业模式及主要业务

6.4.4 营收构成

6.4.5 毛利率

6.4.6 OBD车联网业务

6.4.7 前五大客户

6.4.8 发展前景

6.5 深圳市航天无线通信技术有限公司

6.5.1 公司简介

6.5.2 OBD车联网业务

6.6北京开元智信通软件有限公司

6.6.1 公司简介

6.6.2 OBD车联网业务

6.7 江苏南亿迪纳数字科技发展有限公司

6.7.1 公司简介

6.7.2 OBD车联网业务

6.8 广州通易科技有限公司

6.8.1 公司简介

6.8.2 OBD车联网业务

6.9上海博泰

6.9.1 公司简介

6.9.2 OBD车联网业务

6.10 北京微格互动科技有限公司

6.10.1 公司简介

6.10.2 OBD车联网业务

6.11 彩虹无线(北京)新技术有限公司

6.11.1 公司简介

6.11.2 OBD车联网业务

1. Overview of OBD

1.1 Definition and Composition

1.1.1 Definition

1.1.2 Composition

1.2 Development History

1.3 Interface and Related Products

1.3.1 Interface

1.3.2 OBD Interface-based Products

2. Global Telematics Market

2.1 Definition and Development

2.1.1 Definition

2.1.2 Development

2.2 Industry Chain

2.3 Business Model and Profit Model

2.3.1 Business Model

2.3.2 Profit Model

2.4 Market Size and Penetration

2.4.1 Car Sales and Ownership

2.4.2 Market Size

2.4.3 Penetration

3. Global OBD Telematics Market

3.1 Market Status

3.2 Business Model and Profit Model

3.3 Major Applications

3.3.1 UBI Market

3.3.2 Fleet Management

3.3.3 4S Store Customer Relation Management

3.3.4 Fault Diagnosis and Maintenance

3.3.5 Government Traffic Management

3.3.6 Car Owner Application

4. China OBD Telematics Market

4.1 China Automobile Market

4.1.1 Car Sales and Ownership

4.1.2 Telematics Industry Chain

4.2 China OBD Telematics Market

4.2.1 Development Course

4.2.2 Market Status

5. Global OBD Telematics Leaders

5.1 Danlaw Inc

5.1.1 Profile

5.1.2 OBD Telematics Business

5.1.3 Latest News

5.2 Geotab

5.2.1 Profile

5.2.2 OBD Telematics Business

5.2.3 JV-branded Products Launched with Telefónica

5.3 Xirgo Technologies

5.3.1 Profile

5.3.2 OBD Business

5.3.3 Cooperation with Progressive

5.4 TECHTOM

5.4.1 Profile

5.4.2 OBD Telematics Business

5.4.3 BrainPad’s Participation in TECHTOM

5.5 ATrack Technology Inc

5.5.1 Profile

5.5.2 OBD Telematics Business

5.5.3 Latest News

5.6 Scope Technologies

5.6.1 Profile

5.6.2 OBD Telematics Business

5.7 Automatic Labs

5.7.1 Profile

5.7.2 OBD Telematics Business

5.7.3 Latest News

5.8 Zubie

5.8.1 Profile

5.8.2 OBD Telematics Business

5.8.3 Latest News

5.9 Carvoyant

5.9.1 Profile

5.9.2 OBD Telematics Business

5.10 Dash

5.10.1 Profile

5.10.2 OBD Telematics Business

5.11 Mojio

5.11.1 Profile

5.11.2 OBD Telematics Business

5.11.3 Latest News

6. Chinese OBD Telematics Leaders

6.1 LAUNCH Tech Company Limited

6.1.1 Profile

6.1.2 Operating Performance

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D Expenditure

6.1.6 OBD Telematics Business

6.1.7 Latest News

6.1.8 Development Strategy

6.2 Beijing Carsmart Technology Co., Ltd.

6.2.1 Profile

6.2.2 Operating Performance

6.2.3 Revenue Structure

6.2.4 OBD Telematics Business

6.3 Huawei Investment & Holding Co., Ltd.

6.3.1 Profile

6.3.2 Operating Performance

6.3.3 OBD Telematics Business

6.4 Beijing YESWAY Information Technology Co,Ltd.

6.4.1 Profile

6.4.2 Operating Performance

6.4.3 Business Model and Main Business

6.4.4 Revenue Structure

6.4.5 Gross Margin

6.4.6 OBD Telematics Business

6.4.7 Top 5 Clients

6.4.8 Prospects

6.5 Sinocastel Co.,Ltd

6.5.1 Profile

6.5.2 OBD Telematics Business

6.6 Beijing Wiselink Software Co., Ltd

6.6.1 Profile

6.6.2 OBD Telematics Business

6.7 Jiangsu Nanyi Digital DNA Science & Technology Co., Ltd.

6.7.1 Profile

6.7.2 OBD Telematics Business

6.8 Guangzhou Comit Technology Co., Ltd.

6.8.1 Profile

6.8.2 OBD Telematics Business

6.9 PATEO Corporation

6.9.1 Profile

6.9.2 OBD Telematics Business

6.10 VGO Interaction Technology Ltd.

6.10.1 Profile

6.10.2 OBD Telematics Business

6.11 Rainbow Wireless (Beijing) New Technology Co., Ltd.

6.11.1 Profile

6.11.2 OBD Telematics Business