|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2018年中国汽车租赁行业研究报告 |

|

字数:1.7万 |

页数:68 |

图表数:50 |

|

中文电子版:7000元 |

中文纸版:3500元 |

中文(电子+纸)版:7500元 |

|

英文电子版:1800美元 |

英文纸版:1900美元 |

英文(电子+纸)版:2100美元 |

|

编号:HJ004

|

发布日期:2015-03 |

附件:下载 |

|

|

|

中国汽车租赁市场兴起于1990年北京亚运会,随后在北京、上海、广州及深圳等国际化程度较高的城市率先发展,到2000年左右,汽车租赁市场开始扩展到其他城市。经过十余年的发展,到2014年,中国汽车租赁车辆超过40万辆,市场规模接近400亿元。预计到2018年,中国汽车租赁市场的整体租车规模将达到75万辆,整体市场规模将超过600亿元。

不过,尽管中国汽车租赁行业发展迅速,但由于市场准入门槛低,相比于国外成熟市场,企业规模较小、行业集中度较低,整体仍然处于发展的初期。2014年中国汽车租赁的渗透率为0.5%,而同期美国、日本、韩国及巴西则分别为1.7%、2.6%、2.1%及1.5%。同时,2014年前三大汽车租赁公司合计占中国汽车租赁市场的12.6%,其中神州租车、一嗨租车、Avis分别占到了8.1%、2.9%、1.6%。

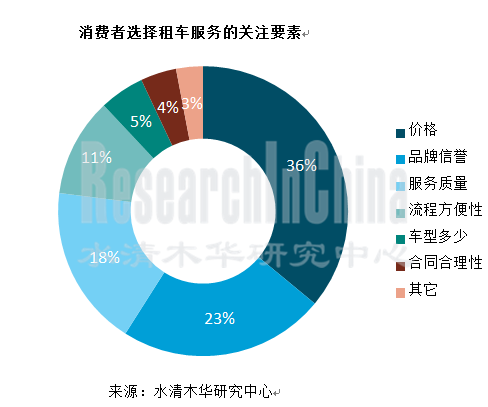

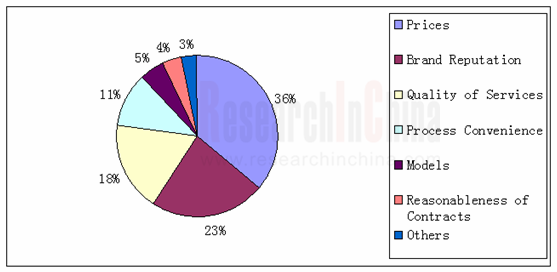

早期中国汽车租赁行业主要是面对外企、大型国企等企业用户,真正大规模投入个人业务只有不到10年时间,而国外租车市场约有50%的需求是来自于个人用户。中国个人业务的需求主要集中在节庆假日和旅游旺季,消费者在选择租车服务时主要关注的因素在于价格、品牌信誉、服务质量、流程方便性等,而车型的多少并不是关键的问题。

传统的汽车租赁行业属于重资产低利润,企业通过不断扩大车队规模、提高服务质量和经营效率来提升自身的竞争力,然而新兴的平台式互联网租车模式对传统经营模式造成了一定的冲击。政策上的放开,互联网租车和专车服务被定义为租车行业的创新服务,迫使老牌企业如神州已开始推出自己的专车和P2P租车服务,而滴滴专车、PP租车等新进企业也不断挑战原有的市场竞争格局。可以预见的是,在继续做好企业内部服务管控的同时,未来市场参与者将会在互联网用户入口上展开更加激烈的争夺。

水清木华研究中心《2014-2018年中国汽车租赁行业研究报告》主要内容包括:

中国汽车租赁行业发展概况(包括定义、分类、政策、产业发展等) 中国汽车租赁行业发展概况(包括定义、分类、政策、产业发展等)

中国汽车租赁市场分析(包括市场规模、渗透率、行业集中度、竞争格局等) 中国汽车租赁市场分析(包括市场规模、渗透率、行业集中度、竞争格局等)

中国汽车租赁细分市场分析(包括市场规模、竞争格局、增长动力等) 中国汽车租赁细分市场分析(包括市场规模、竞争格局、增长动力等)

中国汽车租赁行业企业(包括基本介绍、股权构成、发展历程、最新动向、服务比较、业务规模、运营网络、品牌战略、客户分析、成本分析、核心指标分析等) 中国汽车租赁行业企业(包括基本介绍、股权构成、发展历程、最新动向、服务比较、业务规模、运营网络、品牌战略、客户分析、成本分析、核心指标分析等)

Chinese car rental market emerged in 1990 when the Asian Games was held in Beijing. Afterwards, Beijing, Shanghai, Guangzhou and Shenzhen with higher internationalization level began to develop the market at first. Until 2000, the car rental market extended to other cities. Over more than a decade of development, China had more than 400,000 vehicles for lease by 2014 with the market size of nearly RMB40 billion, and the figures are expected to be 750,000 and over RMB60 billion by 2018.

Compared with foreign mature markets, the fast-growing car rental industry of China is featured with lower access threshold, more small-sized enterprises and lower industry concentration, meaning China’s car rental industry is still in its infancy. In 2014, the penetration rate of China car rental industry was 0.5%, lower than 1.7% in the United States, 2.6% in Japan, 2.1% in South Korea and 1.5% in Brazil. At the same time, the top three car rental companies accounted for 12.6% of Chinese car rental market together, wherein CAR Inc., eHi and Avis occupied 8.1%, 2.9% and 1.6% respectively.

China car rental industry targeted foreign companies and large state-owned enterprises in early time, but car rental services for individuals just sprang up in recent ten years. In foreign car rental markets, about 50% of the demand comes from individuals. Chinese individual customers usually desire cars during holidays and peak seasons, and they are more concerned about prices, brand reputation, quality of services and process convenience than models.

Concerns of Consumers for Car Rental

Source: ResearchInChina

The traditional car rental industry is involved with considerable assets and low profits; car rental companies enhance their competitiveness by expanding fleet size, improving services and operational efficiency. However, emerging platform-based Internet car rental models have exerted certain effect on the traditional business model. Relaxed policies as well as the Internet car rental and limousine services which are defined as innovative services have forced veterans such as CAR Inc. to launch their own limousine services and P2P services. Meanwhile, Didi Car, PP Car Rental and other new entrants continue to challenge the existing market competition pattern. It is foreseeable that market players will compete with each other intensely for the Internet users while consolidating their own services.

The report mainly covers the following aspects:

Overview of China car rental industry (including definition, classification, policies, industrial development, etc.) Overview of China car rental industry (including definition, classification, policies, industrial development, etc.)

Analysis on Chinese car rental market (including market size, penetration, industry concentration, competition pattern, etc.) Analysis on Chinese car rental market (including market size, penetration, industry concentration, competition pattern, etc.)

Analysis on Chinese car rental market segments (including market size, competition pattern, growth momentum, etc.) Analysis on Chinese car rental market segments (including market size, competition pattern, growth momentum, etc.)

Chinese car rental companies (including profile, equity structure, development course, the latest trends, services, business scale, operating network, brand strategies, customers, costs, core indicators, etc.) Chinese car rental companies (including profile, equity structure, development course, the latest trends, services, business scale, operating network, brand strategies, customers, costs, core indicators, etc.)

第一章 汽车租赁概述

1.1 定义

1.2 分类

第二章 汽车租赁产业与政策

2.1 汽车租赁产业

2.2 汽车租赁行业政策

2.2.1 汽车代驾服务

2.2.2 公务车改革

第三章 中国汽车租赁市场

3. 1 市场规模

3. 2 市场渗透率

3. 3 市场集中度

3. 4 竞争格局

第四章 中国汽车租赁细分市场

4.1 中国短租自驾市场

4.1.1 市场概述

4.1.2 增长动力

4.1.3 竞争格局

4.1.4 主要竞争因素

4.2 中国长期汽车租赁及融资租赁市场

4.2.1 市场概述

4.2.2 中国长期汽车租赁市场的增长动力

4.2.3 中国长期汽车租赁市场的竞争格局

4.2.4 中国融资租赁市场的增长动力

第五章 中国汽车租赁企业研究

5.1 神州租车

5.1.1 基本介绍

5.1.2 关联公司

5.1.3 发展历程和动向

5.1.4 品牌、服务及战略

5.1.5 客户研究

5.1.6 供应商和成本

5.1.7 核心指标

5.1.8 经营数据

5.2 一嗨租车

5.2.1 基本介绍

5.2.2 关联公司

5.2.3 发展历程和动向

5.2.4 品牌、业务及战略

5.2.5 客户研究

5.2.6 核心指标

5.2.7 经营数据

5.3 至尊租车

5.3.1 基本介绍

5.3.2 业务分析

5.4 瑞卡便利租车

5.4.1 基本介绍

5.4.2 业务分析

5.5 大方租车

5.5.1 基本介绍

5.5.2 业务分析

5.6 赢时通租车

5.6.1 基本介绍

5.6.2 业务分析

5.7 安飞士租车

5.7.1 基本介绍

5.7.2 业务分析

5.8 车速递

5.8.1 基本介绍

5.8.2 业务分析

5.9 中汽租赁

5.9.1 基本介绍

5.9.2 业务分析

5.10 元通租赁

5.10.1 基本介绍

5.10.2 业务分析

5.11 庞大欧力士

5.11.1 基本介绍

5.11.2 业务分析

5.12 友邻租车

5.12.1 基本介绍

5.12.2 业务分析

5.13 大众租车

5.13.1 基本介绍

5.13.2 业务分析

5.14 中进汽车租赁

5.14.1 基本介绍

5.14.2 业务分析

5.15 华晨租车

5.15.1 基本介绍

5.15.2 业务分析

5.16 首汽租赁

5.16.1 基本介绍

5.16.2 业务分析

1 Overview of Car Rental

1.1 Definition

1.2 Classification

2 Car Rental Industry and Policies

2.1 Car Rental Industry

2.2 Policies

2.2.1 Chauffeur Services

2.2.2 Official Vehicle Reform

3 Chinese Car Rental Market

3.1 Market Size

3. 2 Market Penetration

3. 3 Market Concentration

3. 4 Competition Pattern

4 Chinese Car Rental Market Segments

4.1 Chinese Short-term Self-drive Rental Market

4.1.1 Overview

4.1.2 Growth Momentum

4.1.3 Competition Pattern

4.1.4 Main Competitive Factors

4.2 Chinese Long-term Car Rental and Financing Market

4.2.1 Overview

4.2.2 Growth Momentum of Chinese Long-term Car Rental Market

4.2.3 Competition Pattern in Chinese Long-term Car Rental Market

4.2.4 Growth Momentum of Chinese Financial Leasing Market

5 Chinese Car Rental Companies

5.1 CAR Inc.

5.1.1 Profile

5.1.2 Associated Companies

5.1.3 Development Course and Trends

5.1.4 Brand, Services and Strategy

5.1.5 Clients

5.1.6 Suppliers and Costs

5.1.7 Core Indicators

5.1.8 Operating Data

5.2 eHi

5.2.1 Profile

5.2.2 Associated Companies

5.2.3 Development Course and Trends

5.2.4 Brand, Business and Strategy

5.2.5 Clients

5.2.6 Core Indicators

5.2.7 Operating Data

5.3 Top1 Car Rental

5.3.1 Profile

5.3.2 Business Analysis

5.4 Reocar.com

5.4.1 Profile

5.4.2 Business Analysis

5.5 Dafang Car Rental

5.5.1 Profile

5.5.2 Business Analysis

5.6 Yestock Rental Car

5.6.1 Profile

5.6.2 Business Analysis

5.7 AVIS

5.7.1 Profile

5.7.2 Business Analysis

5.8 CSD

5.8.1 Profile

5.8.2 Business Analysis

5.9 Zhongqi Car Rental

5.9.1 Profile

5.9.2 Business Analysis

5.10 Yuantong Car Rental

5.10.1 Profile

5.10.2 Business Analysis

5.11 Pang Da Orix

5.11.1 Profile

5.11.2 Business Analysis

5.12 U-Lin

5.12.1 Profile

5.12.2 Business Analysis

5.13 Dazhong Leasing Car

5.13.1 Profile

5.13.2 Business Analysis

5.14 CTC Car Rental

5.14.1 Profile

5.14.2 Business Analysis

5.15 Brilliance Auto Rental

5.15.1 Profile

5.15.2 Business Analysis

5.16 Shouqi Car Rental

5.16.1 Profile

5.16.2 Business Analysis

图:汽车消费市场消费链

图:2009-2018年中国汽车租赁市场规模

图:2009-2018年中国汽车租赁市场总车队规模

图:2014年各国汽车租赁市场渗透率

图:2014年各国汽车租赁市场前三大公司市场份额

图:2014Q3中国前十大汽车租赁公司车队规模

图:2013-2018年各国短租自驾市场年复合增长率

图:2010-2017年中国持照人数与车辆总数

图:2014年中国短租自驾市场份额

图:2014年中国长期租赁市场份额

表:神州租车关联核心公司

图:2011-2014H1神州租车前五大客户占总收入比例

图:2014年1至4季度神州租车手机客户端订单占总订单比例

图:神州租车整车厂商合作伙伴

图:2011-2014H1神州租车前五大供应商占总采购额比例

图:2013年神州租车五大供应商占购车总数量比例

图:2013年至2014上半年神州租车停运车队成本构成

图:2011-2014Q3神州租车短租自驾业务核心指标

图:2011-2014Q3神州租车总车队规模

图:2011-2014H1神州租车收入与毛利率

图:2011-2014H1神州租车各项业务收入与毛利率

图:2011-2014H1神州租车汽车租赁业务收入构成

图:2014年一嗨租车股权结构

表:一嗨租车关联核心公司

图:2011-2014H1一嗨租车移动APP下载量

图:2012-2014Q3一嗨租车整体业务单车日均收入

图:2012-2014H1一嗨租车汽车租赁业务核心指标

图:2012-2014H1一嗨租车汽车服务业务单车日均收入

图:2012Q1-2014Q3一嗨租车车队规模

图:2012Q1-2014Q2一嗨租车车队规模(按业务)构成

表:2014H1一嗨租车主要省市服务网络分布情况

图:2012至2014年9月一嗨租车净收入与净亏损

图:2012Q1-2014Q3一嗨租车(按业务)收入构成

图:2012-2014H1一嗨租车成本构成

表:至尊租车全国门店分布

图:瑞卡便利租车全国经营网点分布

图:大方租车全国门店分布

图:赢时通租车全国经营网点分布

图:安飞士租车全国经营网点分布

图:车速递全国门店分布

表:中汽租赁业务概况

图:2012-2014H1元通租赁营业收入和净利润

图:庞大欧力士全国经营网络分布

图:2012-2014H1庞大欧力士营业收入和净利润

表:巴士租赁业务介绍

图:巴士租赁主要企业客户

图:大众租车业务体系

表:中进汽车租赁业务概况

表:中进汽车租赁主要客户与合作伙伴

图:2011-2014H1华晨租车净利润

Consumption Chain of Automotive Consumer Market

Chinese Car Rental Market Size, 2009-2018E

Fleet Size of Chinese Car Rental Market, 2009-2018E

Global Car Rental Market Penetration by Country, 2014

Market Shares of Top Three Car Rental Companies by Country, 2014

Fleet Size of Top 10 Car Rental Companies in China, Q3 2014

CAGR of Short-term Self-drive Rental Market by Country, 2013-2018E

Number of Driving License Holders and Total Number of Vehicles in China, 2010-2017E

Chinese Short-term Self-drive Rental Market Share, 2014

Chinese Long-term Car Rental Market Share, 2014

Core Associated Companies of CAR Inc.

Revenue Percentage of CAR Inc. from Top 5 Clients, 2011-H1 2014

Proportion of Mobile APP Orders of CAR Inc. in Total Orders, Q1-Q4 2014

Vehicle Manufacturers Cooperating with CAR Inc.

Procurement Percentage of CAR Inc. from Top 5 Suppliers, 2011-H1 2014

Procured Vehicle Percentage of CAR Inc. from Top 5 Suppliers, 2013

Outage Fleet Cost Structure of CAR Inc., 2013-H1 2014

Core Indicators of Short-term Self-drive Rental of CAR Inc., 2011-Q3 2014

Fleet Size of CAR Inc., 2011-Q3 2014

Revenue and Gross Margin of CAR Inc., 2011-H1 2014

Revenue and Gross Margin of CAR Inc. by Business, 2011-H1 2014

Car Rental Revenue Structure of CAR Inc., 2011-H1 2014

eHi's Equity Structure, 2014

eHi's Core Associated Companies

Downloads of eHi's Mobile APP, 2011-H1 2014

Daily Revenue per Vehicle of eHi’s Overall Business, 2012-Q3 2014

Core Indicators of eHi’s Car Rental Business, 2012-H1 2014

Daily Revenue per Vehicle of eHi’s Car Service, 2012-H1 2014

eHi’s Fleet Size, Q1 2012-Q3 2014

eHi's Fleet Size Structure (by Business), Q1 2012- Q2 2014

eHi's Service Network in Major Provinces and Municipalities, H1 2014

eHi's Net Income and Net Loss, 2012-Sep 2014

eHi's Revenue Structure (by Business), Q1 2012-Q3 2014

eHi's Cost Structure, 2012-H1 2014

Distribution of Nationwide Stores of Top1 Car Rental

National Business Network of Reocar

Distribution of Nationwide Stores of Dafang Car Rental

National Business Network of Yestock Rental Car

National Business Network of AVIS

Distribution of Nationwide Stores of CSD

Business Overview of Zhongqi Car Rental

Revenue and Net Income of Yuantong Car Rental, 2012-H1 2014

National Business Network of Pang Da Orix

Revenue and Net Income of Pang Da Orix, 2012-H1 2014

Business Description of Bus Leasing

Major Corporate Clients of Bus Leasing

Business System of Dazhong Leasing Car

Business Overview of CTC Car Rental

Major Clients and Partners of CTC Car Rental

Net Income of Brilliance Auto Rental, 2011-H1 2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|