随着共享经济的蓬勃发展,以Zipcar、Uber、Getaround、Car2go等为代表的汽车共享企业迅速发展起来,推动了汽车共享在全世界范围内发展。

汽车共享在国外发展比较成熟,主要包括打车软件、P2P租车和分时租赁三种模式。其中,打车软件模式以Uber、Lyft、Ola Cabs为代表;P2P租车模式以Getaround、Turo、Flightcar为代表;分时租赁以Zipcar、Car2go、NriveNow、Autolib为代表。

其中,Uber是全球最大的打车软件企业,公司至今已获得了十几轮融资,目前估值已达600亿美元,已进入包括美国、中国、印度、新加坡、马来西亚等多个国家的共447个城市。

目前,中国的汽车共享市场还处于快速成长阶段,但已呈现出巨大的发展潜力。国家政府颁布了《关于促进绿色消费的指导意见》、《关于本市促进新能源汽车分时租赁业发展的指导意见》等一系列的法规政策以规范和鼓励汽车共享行业的发展。

在打车软件领域:中国打车软件市场已形成以滴滴出行、易到用车、优步、神州专车、51用车、嘀嗒拼车、天天用车为主的竞争格局。2015全年,中国打车软件市场订单量总计约20亿单。其中,滴滴出行订单量达14.3亿单,占比达71.5%;Uber次之,占比18.3%。

滴滴出行由滴滴打车和快的打车合并而来,综合了二者的优势,总计融资50多亿美元,估值达200亿美元,是中国本土最大的打车软件平台。截至2015年底,接入滴滴出行平台的司机数量超过1400万人,注册用户数达2.5亿人。

在P2P租车领域:随着PP租车在中国市场上线,凹凸共享租车、友友用车、宝驾租车、快快租车等P2P租车平台开始在中国涌现出来。

目前,P2P租车企业主要靠融资以获得资金来源,用于扩大经营范围和获得更多的用户。其中,PP租车融资金额相对最高,2015年9月,PP租车获得5亿元的融资,是P2P租车市场中最大的一笔融资。

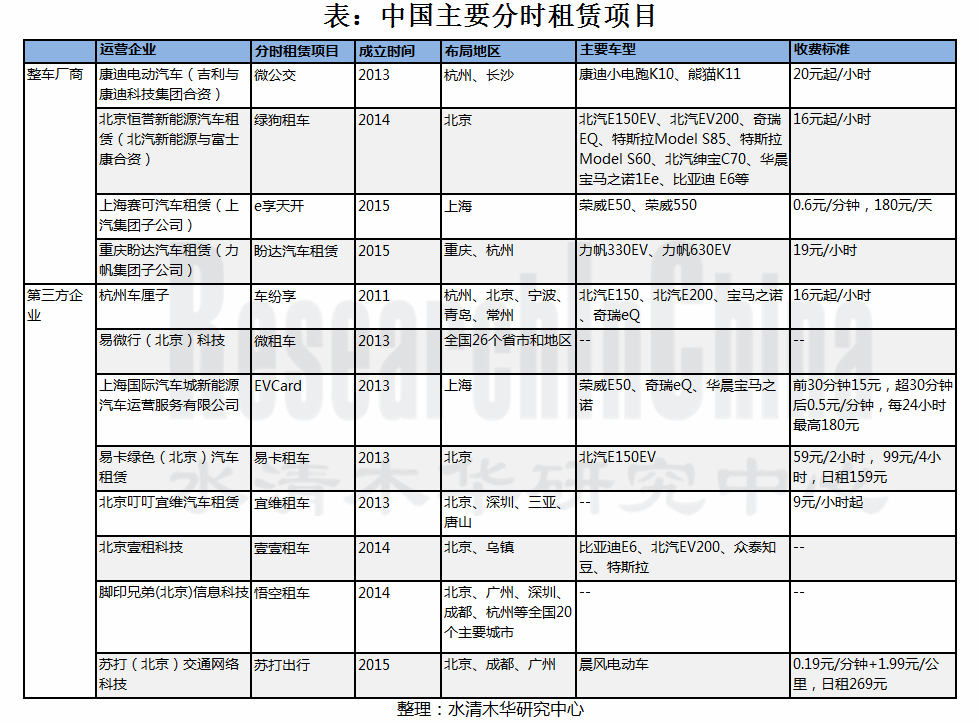

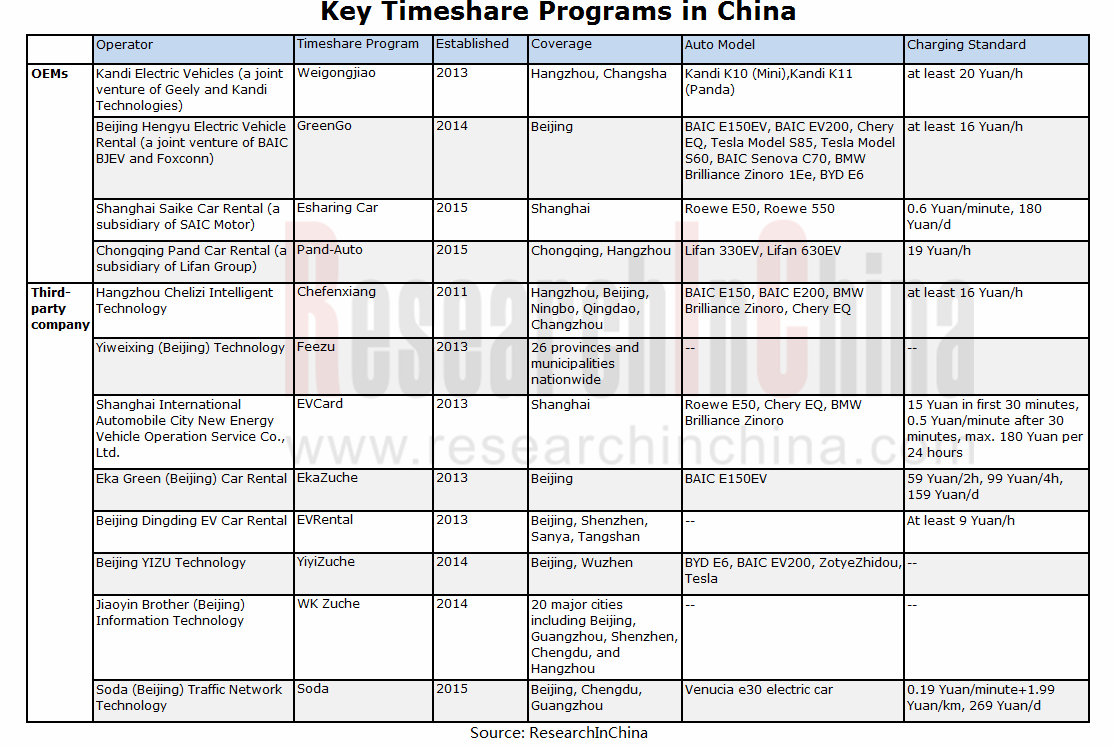

在分时租赁领域:近两年,随着新能源汽车分时租赁的日益升温,各地区积极布局新能源分时租赁行业。目前,国内已有北京、上海、杭州、深圳等十几个城市开展了新能源汽车分时租赁。

在利好政策的推动下,汽车厂商、车联网企业、互联网企业纷纷借势进入这一领域。此外,P2P租车企业——友友用车也于2015年10月宣布向分时租赁转型,并计划在2015年底运营车辆达到1000台,2016上半年达到6000台以上。

中国的分时租赁企业主要包括微租车、壹壹租车、EVCard、悟空租车、苏打出行、易卡租车等。此外,北汽新能源、上汽集团、吉利、力帆和首汽集团等汽车厂商分别推出了Greengo绿狗租车、E享天开、微公交、盼达汽车租赁和Gofun等分时租赁项目。

未来,中国汽车共享市场将依然由打车软件服务、P2P租车和分时租赁企业共同构成,形成互补。

打车软件市场将由以滴滴出行和Uber为代表的综合性移动出行平台占据;P2P租车市场进一步规范,在激烈竞争下最后将只剩下两三家企业寡头竞争;分时租赁市场将迎来全面开花,市场进一步成熟,各企业共同推动市场发展。

《2016-2020年中国汽车共享行业研究报告》主要包括以下内容:

全球汽车共享行业发展分析,包括发展历程、发展现状,以及打车软件、共享租车等细分市场的发展现状和竞争格局分析;

全球汽车共享行业发展分析,包括发展历程、发展现状,以及打车软件、共享租车等细分市场的发展现状和竞争格局分析;

中国汽车共享行业发展分析,包括打车软件、P2P租车、分时租赁等细分市场的发展现状和竞争格局分析,以及各细分市场未来的发展趋势分析;

中国汽车共享行业发展分析,包括打车软件、P2P租车、分时租赁等细分市场的发展现状和竞争格局分析,以及各细分市场未来的发展趋势分析;

全球11家,国内24家汽车共享相关企业分析,包括简介,融资情况以及发展动态。

全球11家,国内24家汽车共享相关企业分析,包括简介,融资情况以及发展动态。

With a boom in sharing economy, car sharing companies represented by Zipcar, Uber, Getaround, and Car2go have flourished, pushing forward the development of car sharing around the world.

Fully-developed car sharing in foreign countries is primarily divided into three models: car-hailing apps, P2P car rental, and timeshare rental with the first represented by Uber, Lyft, and Ola Cabs, the middle Getaround, Turo, and Flightcar, and the latter Zipcar, Car2go, NriveNow, and Autolib.

Uber, the world’s largest car-hailing app player, has so far obtained a dozen rounds of financing and now is valued at USD60 billion. The company has penetrated into a total of 447 cities in countries consisting of the United States, China, India, Singapore, Malaysia, etc.

The Chinese car sharing market is still in the phase of rapid growth but has showed huge potential. A series of laws & regulations and policies, including the Guidance on Promoting Green Consumption and the Guidance on Promoting the Development of New Energy Vehicle Timeshare Sector in Shanghai, have been introduced by the central government and local authorities so as to regulate and encourage the development of car sharing industry.

Car-hailing apps: A competitive landscape with DidiChuxing, YidaoYongche, Uber, ShenzhouZhuanche, 51 Yongche, Dida Pinche, and TiantianYongche as major players have taken shape in the Chinese car-hailing apps market. Orders for car-hailing services totaled about 2 billion in China in 2015, including 1.43 billion or 71.5% of the total amount from DidiChuxing, followed by Uber with a percentage of 18.3%.

DidiChuxing, a result of the merger between DidiDache and KuaidiDache, combines their own advantages. Having raised more than USD5 billion, it is the largest domestic car-hailing app platform in China valued at USD20 billion. The number of drivers connected to the platform had exceeded 14 million and registered users amounted to 250 million by the end of 2015.

P2P car rental: With PP Zuche rolling out its services in China, PP car rental platforms like Atzuche, UU Cars, Baojia, and KuaikuaiZuche have sprung up around China.

P2P car rental firms now rely heavily on financing for capital to expand business scope and grab customers. PP Zuche, with the largest amount of financing, got RMB500 million in financing in Sept 2015, the largest one in P2P car rental market.

Timeshare: With growing heat-up of new-energy vehicle timeshare, localities have been active in developing new energy vehicle timeshare rental sector. And, new energy vehicle timeshare programs are being carried out in dozens of cities including Beijing, Shanghai, Hangzhou, and Shenzhen.

Propelled by favorable policies, carmakers, telematics enterprises, and Internet firms have flooded into the field. In addition, P2P car rental company- UU Cars announced in Oct 2015 that it would transform to timeshare model, plan to put 1,000 vehicles into operation by the end of 2015 and raise the figure to more than 6,000 units in the first half of 2016.

Major timeshare rental companies include Feezu, YiyiZuche, EVCard, WK Zuche, Soda, and EkaZuche. In addition, BAIC BJEV have launched GreenGo timeshare program, SAIC Motor E-sharing car, GeelyWeigongjiao, LifanPand-Auto, and Shou Qi Group Gofun.

The Chinese car sharing market will still be complementarily composed of car-hailing app firms, P2P car rental companies, and timeshare enterprises in the future.

Car-hailing apps market will be dominated by comprehensive mobile platforms represented by DidiChuxing and Uber; P2P car rental market will be further regulated with only two to three players surviving fierce competition; blossoming timeshare market will grow more mature under the joint efforts of market participants.

China Car Sharing Industry Report, 2016-2020 highlights the followings:

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

第一章 汽车共享概述

1.1 定义

1.2 分类

1.3 运营模式

第二章 全球汽车共享行业发展概况

2.1 发展历程

2.2 发展现状

2.3 打车软件市场

2.4 共享租车市场

2.4.1 P2P租车市场

2.4.2 分时租赁市场

第三章 中国汽车共享行业发展概况

3.1 发展现状

3.2 打车软件市场

3.2.1 发展现状

3.2.2 竞争格局

3.2.3 滴滴出行 VS Uber

3.3 汽车租赁市场

3.4 P2P租车市场

3.4.1 发展现状

3.4.2 竞争格局

3.5 分时租赁市场

3.5.1 发展现状

3.5.2 竞争格局

3.6 汽车分享市场发展驱动力

3.6.1 中国交通面临“道路拥堵”问题

3.6.2 中国交通面临“打车难”问题

3.6.3 国家政策支持汽车共享行业发展

3.7 发展趋势

3.7.1 打车软件市场寡头竞争

3.7.2 P2P租车市场逐步规范

3.7.3 分时租赁市场全面开花

第四章 国外主要汽车共享企业

4.1 Uber

4.1.1 简介

4.1.2 发展历程

4.1.3 融资情况

4.1.4 在华发展

4.2 Lyft

4.2.1 简介

4.2.2 融资情况

4.2.3 在华发展

4.3 Zipcar

4.3.1 简介

4.3.2 发展历程

4.3.3 车队情况

4.4 Car2go

4.4.1 简介

4.4.2 发展历程

4.4.3 在华发展

4.5 Getaround

4.5.1 简介

4.5.2 融资情况

4.6 Turo

4.6.1 简介

4.6.2 融资情况

4.7 DriveNow

4.7.1 简介

4.7.2 发展动态

4.7.3 在华发展

4.8 Flightcar

4.8.1 公司简介

4.8.2 融资情况

4.9 Ola Cabs

4.9.1 简介

4.9.2 融资情况

4.9.3 发展动态

4.10 GrabTaxi

4.10.1 简介

4.10.2 融资情况

4.10.3 发展动态

4.11 Autolib

4.11.1 简介

4.11.2 发展动态

第五章 中国主要汽车共享企业

5.1 滴滴出行

5.1.1 简介

5.1.2 发展历程

5.1.3 融资情况

5.1.4 优惠政策

5.1.5 发展动态

5.2 易到用车

5.2.1 简介

5.2.2 发展历程

5.2.3 融资情况

5.2.4 发展动态

5.3 神州专车

5.3.1 简介

5.3.2 发展历程

5.3.3 融资情况

5.3.4 优惠政策

5.3.5经营情况

5.3.6发展动态

5.4 PP租车

5.4.1 简介

5.4.2 发展历程

5.4.3 融资情况

5.4.4 发展动态

5.5 友友用车

5.5.1 简介

5.5.2 融资情况

5.5.3 发展动态

5.6 宝驾租车

5.6.1 简介

5.6.2 融资情况

5.6.3 发展动态

5.7 凹凸共享租车

5.7.1 简介

5.7.2 融资情况

5.7.3 发展动态

5.8 快快租车

5.8.1 简介

5.8.2 融资情况

5.8.3 发展动态

5.9 微租车

5.9.1 简介

5.9.2 融资情况

5.9.3 发展动态

5.10 壹壹租车

5.10.1 简介

5.10.2 融资情况

5.10.3 发展动态

5.11 EVCard

5.11.1 简介

5.11.2 发展动态

5.12 悟空租车

5.12.1 简介

5.12.2 融资情况

5.13 苏打出行

5.13.1 简介

5.13.2 发展动态

5.14 微公交

5.14.1 简介

5.14.2 发展动态

5.15 易卡租车

5.15.1 简介

5.15.2 发展动态

5.16 宜维租车

5.16.1 简介

5.16.2 发展动态

5.17 车纷享

5.17.1 简介

5.17.2 发展动态

5.18 绿狗租车

5.18.1 简介

5.18.2 发展动态

5.19 e享天开

5.19.1 简介

5.19.2 发展动态

5.20 51用车

5.20.1 简介

5.20.2 融资情况

5.21 嘀嗒拼车

5.21.1 简介

5.21.2 融资情况

5.22 天天用车

5.22.1 简介

5.22.2 融资情况

5.23 其他

5.23.1 电老虎租车

5.23.2 易开租车

1. Overview

1.1 Definition

1.2 Classification

1.3 Business Model

2. Development of Global Car Sharing Industry

2.1 Development Course

2.2 Status Quo

2.3 Taxi-hailing Apps Market

2.4 Car Sharing Market

2.4.1 P2P Car Rental Market

2.4.2 Timeshare Rental Market

3. Development of China Car Sharing Industry

3.1 Status Quo

3.2 Taxi-hailing Apps Market

3.2.1 Current Development

3.2.2 Competitive Landscape

3.2.3 DidiChuxingVS Uber

3.3 Car Rental Market

3.4 P2P Car Rental Market

3.4.1 Current Development

3.4.2 Competitive Landscape

3.5 Timeshare Rental Market

3.5.1 Current Development

3.5.2 Competitive Landscape

3.6 Driving Force for the Development of Car Sharing Market

3.6.1 Problem of Road Congestion in Traffic in China

3.6.2 Problem of Difficult Hailing a Taxi in Traffic in China

3.6.3 National Policy Support for the Development of Car Sharing Industry

3.7 Development Trends

3.7.1 Oligopolistic Competition in Taxi-hailing Apps Market

3.7.2 Gradual Standardization of P2P Car Rental Market

3.7.3 Blooming of TimeshareRental Market

4. Major Overseas Companies

4.1 Uber

4.1.1 Profile

4.1.2 Development History

4.1.3Financing

4.1.4 Development in China

4.2 Lyft

4.2.1 Profile

4.2.2 Financing

4.2.3 Development in China

4.3 Zipcar

4.3.1Profile

4.3.2 Development History

4.3.3 Fleet

4.4 Car2go

4.4.1Profile

4.4.2 Development History

4.4.3 Development in China

4.5 Getaround

4.5.1 Profile

4.5.2 Financing

4.6 Turo

4.6.1 Profile

4.6.2 Financing

4.7 DriveNow

4.7.1 Profile

4.7.2 Dynamics

4.7.3 Development in China

4.8 Flightcar

4.8.1 Profile

4.8.2 Financing

4.9 Ola Cabs

4.9.1 Profile

4.9.2 Financing

4.9.3 Dynamics

4.10 GrabTaxi

4.10.1 Profile

4.10.2 Financing

4.10.3 Dynamics

4.11 Autolib

4.11.1 Profile

4.11.2 Dynamics

5. Major Chinese Companies

5.1 DidiChuxing (didichuxing.com)

5.1.1 Profile

5.1.2 Development History

5.1.3 Financing

5.1.4 Preferential Policy

5.1.5 Dynamics

5.2 YidaoYongche (yongche.com)

5.2.1 Profile

5.2.2 Development History

5.2.3 Financing

5.2.4 Dynamics

5.3 ShenzhouZhuanche (10101111.com)

5.3.1 Profile

5.3.2 Development History

5.3.3 Financing

5.3.4 Preferential Policy

5.3.5Operation

5.3.6Dynamics

5.4 PP Zuche(ppzuche.com)

5.4.1 Profile

5.4.2 Development History

5.4.3 Financing

5.4.4 Dynamics

5.5 UU Cars (uucars.com)

5.5.1 Profile

5.5.2 Financing

5.5.3 Dynamics

5.6 Baojia (baojia.com)

5.6.1 Profile

5.6.2 Financing

5.6.3 Dynamics

5.7 AT Zuche (atzuche.com)

5.7.1 Profile

5.7.2 Financing

5.7.3 Dynamics

5.8 KuaikuaiZuche (kuaikuaizuche.com)

5.8.1 Profile

5.8.2 Financing

5.8.3 Dynamics

5.9 Feezu (feezu.cn)

5.9.1 Profile

5.9.2 Financing

5.9.3 Dynamics

5.10 Yiyizuche (Yiyizuche.cn)

5.10.1 Profile

5.10.2 Financing

5.10.3 Dynamics

5.11 EVCard (evcardchina.com)

5.11.1 Profile

5.11.2 Dynamics

5.12 WK Zuche (wkzuche.com)

5.12.1 Profile

5.12.2 Financing

5.13 Soda (Sodacar.com)

5.13.1 Profile

5.13.2 Dynamics

5.14 Weigongjiao (wgjev.com)

5.14.1 Profile

5.14.2 Dynamics

5.15 Ekazuche (ekazuche.cn)

5.15.1 Profile

5.15.2 Dynamics

5.16 EVRental (evrental.cn)

5.16.1 Profile

5.16.2 Dynamics

5.17 Chefenxiang (ccclubs.com)

5.17.1 Profile

5.17.2 Dynamics

5.18 GreenGo (green-go.cn)

5.18.1 Profile

5.18.2 Dynamics

5.19 Esharing Car (esharingcar.com)

5.19.1 Profile

5.19.2 Dynamics

5.20 51yongche (51yche.com)

5.20.1 Profile

5.20.2 Financing

5.21 Dida Pinche (didapinche.com)

5.21.1 Profile

5.21.2 Financing

5.22 TiantianYongche (ttyongche.com)

5.22.1 Profile

5.22.2 Financing

5.23 Others

5.23.1 Dearho (Dearho.com)

5.23.2 Eakay (eakay.cn)