|

报告导航:研究报告—

制造业—工业机械

|

|

2016年全球及中国船用柴油机行业研究报告 |

|

字数:4.2万 |

页数:101 |

图表数:83 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2100美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2400美元 |

|

编号:ZHP039

|

发布日期:2016-06 |

附件:下载 |

|

|

|

船用柴油机是船舶的主要动力设备,按转速可分为低速、中速及高速柴油机,成本占比在10%左右。

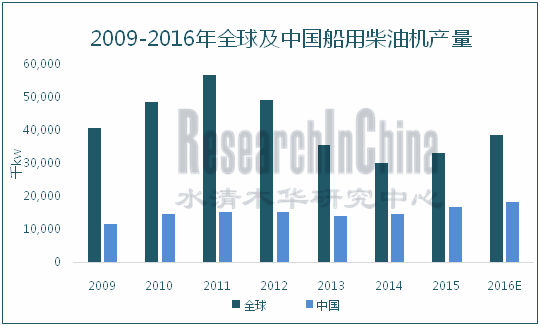

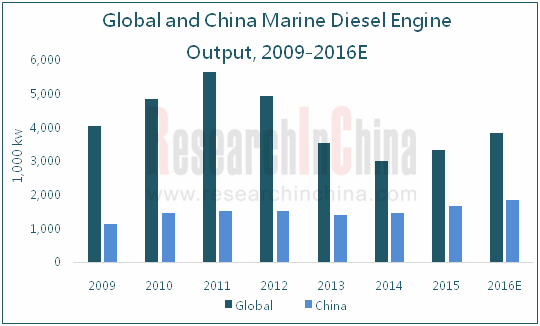

2015年,全球船用柴油机市场规模为3343万千瓦,同比增长10.2%。全球船用柴油机的生产主要集中在中日韩三国。其中,韩国主导低速机;中日两国主要是中速机。

2015年,受船舶开工量增长的带动,中国船用柴油机产量同比增长15.1%,达到1699万千瓦。其中,低、中、高速机的产量占比分别为41.2%、40.1%、18.7%。

中国船用柴油机的生产主要以专利授权的形式进行。其中,低速机品牌完全被曼恩、瓦锡兰及三菱重工占据;中速机品牌中,瓦锡兰、曼恩及卡特彼勒占据82%(2015年)的市场份额;高速机品牌主要包括MTU、Deutz、MWM、SACM、Pielstick、Ruston和Paxman。

由于中国船用柴油机市场起步晚,生产工艺及研发能力存在诸多不足,所以大部分技术含量较高的主机产品仍然需要依赖进口。2015年,中国进口船用柴油机10.7亿美元,出口9,495万美元,贸易逆差额高达9.7亿美元。

在中国的低速柴油机市场上,沪东重机、大连船柴及宜柴约占95.9%的市场份额;中速柴油机市场上,潍柴重机和中船动力占58.9%的市场份额;而高速柴油机生产商主要有潍柴重机、陕柴及河柴,其中潍柴重机的市场份额在26%左右。

为提高在船用柴油机市场上的竞争力,中国主要柴油机厂商纷纷积极进行新产品的研发。

沪东重机:中国生产规模最大的低速船用柴油机企业(国内市场占有率在65%左右),2013年控股中船三井(持股51%)。2016年4月,公司开发的船用高压供气系统成为国内首套正式通过认证的FGSS系统,打破了日本、韩国在该产品市场的垄断地位。

中船动力:2015年10月和曼恩MDT公司续签合同,继续下一个为期10年的四冲程中速机生产;2016年5月,公司生产制造的6S60ME低速柴油机启运。该型柴油机是最新设计的电控柴油机,也是中船动力建造的最大型柴油机,总重约390吨。

河柴重工:2015年12月,推出国内首款高压共轨高速大功率柴油机CHD622V20CR,填补了国内3500千瓦以上高速柴油机的空白。

宜柴:2015年8月,首台8S60ME-C8.2型柴油机完成台架试验,产品各项性能指标均满足设计要求。这是公司建厂以来生产的最大功率柴油机产品,额定功率达到14100KW。

水清木华研究中心《2016年全球及中国船用发动机行业研究报告》着重研究了以下内容:

全球船用发动机市场规模、竞争格局等情况; 全球船用发动机市场规模、竞争格局等情况;

中国船用发动机产业环境、政策环境、市场规模、进出口、竞争格局等情况; 中国船用发动机产业环境、政策环境、市场规模、进出口、竞争格局等情况;

中国船用柴油机细分市场(低速柴油机、中速柴油机、高速柴油机)市场现状、主要企业、竞争格局等情况; 中国船用柴油机细分市场(低速柴油机、中速柴油机、高速柴油机)市场现状、主要企业、竞争格局等情况;

全球7家、中国16家船用柴油机制造商经营情况、在华布局、研发能力、发展战略等情况。 全球7家、中国16家船用柴油机制造商经营情况、在华布局、研发能力、发展战略等情况。

A marine diesel engine is the major power equipment of a vessel, with the cost accounting for around 10% of the total. It can be divided into low-speed, medium-speed and high-speed marine diesel engines according to the rotational speed.

In 2015, the global marine diesel engine market size was 33.43 million kilowatts, up 10.2% from a year earlier. The globalmarine diesel engine production was mainly concentrated in China, Japan, and South Korea. And South Korea mainly produced low-speed marine diesel engines while China and Japan primarily focused on medium-speed engines.

In 2015, fuelled by the growing starts in vessels, the output of marine diesel engines in China rose by 15.1% year on year to 16.99 million kilowatts, with the output of low-speed, medium-speed, and high-speed engines accounting for 41.2%, 40.1%, and 18.7%, respectively.

In China, marine diesel enginesare mainlyproduced through patent licensing. Low-speed engines are absolutely dominated by MAN,Wartsila, and Mitsubishi Heavy Industries; in medium-speed engine market, Wartsila, MAN, and Caterpillar represented a combined market share of 82% (in 2015); high-speed engine brands primarily include MTU, Deutz, MWM, SACM, Pielstick, Ruston, and Paxman.

China's marine diesel engine market started late, so much so that it is poor in production technology and R&D capability. Therefore, most engine products with high technical content are still reliant on imports. In 2015, China imported USD1.07 billion worth ofmarine diesel engines and exported USD94.95 millionengines, with a trade deficit of as much as USD970 million.

In China’s low-speed diesel enginemarket, Hudong Heavy Machinery, Dalian Marine Diesel, and Yichang Marine Diesel Engine accounted for an aggregate market share of roughly 95.9%; in medium-speed diesel enginemarket, Weichai Heavy Machinery and CSSC Marine Powermade upa 58.9% market share; high-speed diesel engine manufacturers mainly include Weichai Heavy Machinery, Shaanxi Diesel Engine Heavy Industry, and Henan Diesel Engine Industry, of which Weichai Heavy Machinery has a market share of around 26%.

To improve the competitiveness in marine diesel engine market, major Chinese diesel engine manufacturers are working on new product development.

Hudong Heavy Machinery is the largest manufacturer of low-speed marine diesel engines in China (a roughly 65% share in domesticmarket). It gained a 51% stake in CSSC-MES Diesel in 2013. In April 2016, the company’s high-pressure marine air supply system became China’s first certified FGSS, thus breaking the monopoly of Japan and South Korea in the product market.

In October 2015, CSSC Marine Power renewed the contract with MAN Diesel & Turbofor another 10 years of production of four-stroke medium speed engines. In May 2016, the company’s 6S60ME low-speed diesel engine started operation. The latest designed model is the largest diesel engine constructed by CSSC Marine Power, which weighs approximately 390 tons.

Henan Diesel Engine Industry released the first domestic HPCR high-speed high-power diesel engine -- CHD622V20CR in December 2015, a move that helped fill the gap in the domestic 3500kw-above high-speed diesel engine market.

Yichang Marine Diesel Engine completed the bench test of its first 8S60ME-C8.2 diesel enginein August 2015, and the performance indicators of the product satisfied the design requirements.With a rated power of 14100KW, it could be the largest diesel engine product in power since the company’s founding.

The report highlights the followings:

Market size and competitive landscape of global marine diesel engine; Market size and competitive landscape of global marine diesel engine;

Industry environment, policy environment, market size, import and export, and competitive landscape of marine diesel engine in China; Industry environment, policy environment, market size, import and export, and competitive landscape of marine diesel engine in China;

Market status, major enterprises, and competitive landscape of the Chinese marine diesel engine market segments (low-speed diesel engine, medium-speed diesel engine, and high-speed diesel engine); Market status, major enterprises, and competitive landscape of the Chinese marine diesel engine market segments (low-speed diesel engine, medium-speed diesel engine, and high-speed diesel engine);

Operation, development in China, R&D capability, and development strategies of 7 global and 16 Chinese marine diesel engine companies. Operation, development in China, R&D capability, and development strategies of 7 global and 16 Chinese marine diesel engine companies.

第一章 船用柴油机简介

1.1 定义

1.2 分类及特点

1.2.1 分类

1.2.2 特点

第二章 全球船用柴油机发展现状

2.1 市场规模

2.2 竞争格局

2.2.1 分国家

2.2.2 分企业

第三章 中国船用柴油机发展环境

3.1 产业环境

3.2 政策环境

3.2.1 行业规划

3.2.2 贸易政策

第四章 中国船用柴油机市场现状

4.1 市场供需

4.1.1 市场供应

4.1.2 市场需求

4.2 进出口

4.2.1 进口

4.2.2 出口

4.3 竞争格局

4.3.1 区域格局

4.3.2 企业格局

第五章 中国船用柴油机细分市场

5.1 船用低速柴油机

5.1.1 市场现状

5.1.2 重点企业

5.2 船用中速柴油机

5.2.1 市场现状

5.2.2 重点企业

5.3 船用高速柴油机

5.3.1 市场现状

5.3.2 重点企业

第六章国 际船用柴油机重点企业研究

6.1 MAN Group

6.1.1 企业简介

6.1.2 经营情况

6.1.3 船用柴油机业务

6.1.4 在华发展

6.2 Wärtsilä

6.2.1 企业简介

6.2.2 经营情况

6.2.3 船用柴油机业务

6.2.4在华发展

6.3 Caterpillar

6.3.1 企业简介

6.3.2 经营情况

6.3.3 在华发展

6.4 Hyundai Heavy Industries

6.4.1 企业简介

6.4.2 经营情况

6.4.3 在华发展

6.5 Mitsubishi Heavy Industries

6.5.1 企业简介

6.5.2 经营情况

6.5.3 在华发展

6.6 Doosan Engine

6.6.1 企业简介

6.6.2 经营情况

6.6.3 在华发展

6.7 MTU

6.7.1 企业简介

6.7.2 在华发展

第七章 中国船用柴油机重点企业研究

7.1 沪东重机

7.1.1 企业简介

7.1.2 经营情况

7.1.3 主要子公司-中船三井

7.1.4 主要子公司——中船动力研究院

7.1.5 研发能力

7.2 大连船柴

7.2.1 企业简介

7.2.2 经营情况

7.2.3 研发能力

7.3 宜柴

7.3.1 企业简介

7.3.2 经营情况

7.3.3 研发能力

7.3.4 发展战略

7.4 潍柴重机

7.4.1 企业简介

7.4.2 经营情况

7.4.3 项目进展

7.5 陕柴重工

7.5.1 企业简介

7.5.2 经营情况

7.5.3 研发能力

7.5.4 发展战略

7.6 中船动力

7.6.1 企业简介

7.6.2 经营情况

7.6.3 子公司——安柴

7.6.4 发展战略

7.7 淄柴

7.7.1 企业简介

7.7.2 经营情况

7.7.3 研发能力

7.8 河柴重工

7.8.1 企业简介

7.8.2 经营情况

7.8.3 研发能力

7.9 其他

7.9.1 安泰动力

7.9.2 上海新中动力

7.9.3 熔安动力

7.9.4 中高柴油机重工有限公司

7.9.5 宁波中策动力机电集团有限公司

7.9.6 中基日造重工有限公司

7.9.7 玉柴船舶动力股份有限公司

7.9.8 南车资阳机车有限公司

第八章 中国船用柴油机行业发展趋势

8.1 存在的问题

8.2 发展趋势

第九章 总结与预测

9.1 市场

9.2 企业

9.2.1 全球

9.2.2 中国

1 Overview of Marine Diesel Engine

1.1 Definition

1.2 Classification & Features

1.2.1 Classification

1.2.2 Features

2 Development of Global Marine Diesel Engine

2.1 Market Size

2.2 Competitive Landscape

2.2.1 by Country

2.2.2 by Enterprise

3 Development Environment of Marine Diesel Engine in China

3.1 Industrial Environment

3.2 Policy Environment

3.2.1 Industrial Planning

3.2.2 Trade Policy

4 Marine Diesel Engine Market in China

4.1 Supply & Demand

4.1.1 Supply

4.1.2 Demand

4.2 Import & Export

4.2.1 Import

4.2.2 Export

4.3 Competitive Landscape

4.3.1 Regional Competition

4.3.2 Corporate Competition

5 Chinese Marine Diesel Engine Market Segments

5.1 Low-Speed Marine Diesel Engine

5.1.1 Status Quo

5.1.2 Key Players

5.2 Medium-Speed Marine Diesel Engine

5.2.1 Status Quo

5.2.2 Key Players

5.3 High-Speed Marine Diesel Engine

5.3.1 Status Quo

5.3.2 Key Players

6 Key Global Marine Diesel Engine Companies

6.1 MAN Group

6.1.1 Profile

6.1.2 Operation

6.1.3 Marine Diesel Engine Business

6.1.4 Development in China

6.2 Wärtsilä

6.2.1 Profile

6.2.2 Operation

6.2.3 Marine Diesel Engine Business

6.2.4 Development in China

6.3 Caterpillar

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Hyundai Heavy Industries

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Mitsubishi Heavy Industries

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 Doosan Engine

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 MTU

6.7.1 Profile

6.7.2 Development in China

7 Key Enterprises in China

7.1 Hudong Heavy Machinery

7.1.1 Profile

7.1.2 Operation

7.1.3 Major Subsidiary—CSSC-MES Diesel Co., Ltd.

7.1.4 Major Subsidiary—China Shipbuilding Power Engineering Institute Co. Ltd.

7.1.5 R&D Capability

7.2 Dalian Marine Diesel

7.2.1 Profile

7.2.2 Operation

7.2.3 R&D Capability

7.3 Yichang Marine Diesel Engine

7.3.1 Profile

7.3.2 Operation

7.3.3 R&D Capability

7.3.4 Development Strategy

7.4 Weichai Heavy Machinery

7.4.1 Profile

7.4.2 Operation

7.4.3 Project Progress

7.5 Shaanxi Diesel Engine Heavy Industry

7.5.1 Profile

7.5.2 Operation

7.5.3 R&D Capability

7.5.4 Development Strategy

7.6 CSSC Marine Power

7.6.1 Profile

7.6.2 Operation

7.6.3 Subsidiary—Anqing CSSC Marine Diesel Co., Ltd.

7.6.4 Development Strategy

7.7 Zibo Diesel Engine Parent Company

7.7.1 Profile

7.7.2 Operation

7.7.3 R&D Capability

7.8 Henan Diesel Engine Industry

7.8.1 Profile

7.8.2 Operation

7.8.3 R&D Capability

7.9 Others

7.9.1 Jiangsu Antai Power Machinery Co., Ltd.

7.9.2 Shanghai Xinzhong Power Machine Co., Ltd.

7.9.3 Hefei RongAn Power Machinery Co., Ltd.

7.9.4 ZGPT Diesel Heavy Industry Co. Ltd.

7.9.5 Ningbo C.S.I. Power & Machinery Group Co., Ltd.

7.9.6 ZhongJi Hitachi Zosen Diesel Engine Co., Ltd.

7.9.7 Yuchai Marine Power Co., Ltd

7.9.8 CSR Ziyang Locomotive Co., Ltd.

8 Development Trend of China Marine Diesel Engine Industry

8.1 Existing Problems

8.2 Development Trend

9 Summary and Forecast

9.1 Market

9.2 Enterprises

9.2.1 Global

9.2.2 China

表:船用柴油机的分类

图:2005-2016年全球船用柴油机市场规模

图:2005-2016年全球低速船用柴油机市场规模

图:2015年全球低速船用柴油机(分国家)市场份额

图:2009-2015年日本船用柴油机产量及金额

表:2009-2015年日本低速船用柴油机产量及产值

图:2015年日本船用柴油机(分功率)产量构成

表:2007-2015年全球主要低速船用柴油机品牌市场份额(按功率)

表:2007-2015年全球主要中速船用柴油机品牌市场份额(按功率)

图:2010-2016年全球造船三大指标

图:2010-2016年中国造船三大指标

表:2011年中国船舶协会与曼恩、瓦锡兰签订的谅解协议

表:船用柴油机氮氧化物排放标准

表:2010-2016年中国符合Tier标准的船用柴油机及设备研制情况

表:2007-2016年中国船用柴油机相关政策

表:2009-2016年中国船用柴油机产量

图:2010-2016年中国造船完工量

图:2008-2016年中国船用柴油机进口量及金额

图:2014-2015年中国船用柴油机TOP10进口来源国

图:2014-2015年中国船用柴油机进口TOP10省市

表:2008-2016年中国船用柴油机出口量及金额

图:2014-2015年中国船用柴油机出口TOP10省市

图:2015年中国船用柴油机Top10出口市场

表:中国船用柴油机重点地区及代表企业

表:2011-2016年中国船用低速柴油机产量

表:2014-2015年中国主要低速船用柴油机企业产量及市场份额

表:中国低速船用柴油机厂商及技术合作对象

表:2011-2016年中国船用中速柴油机产量

图:2015年中国船用中速柴油机市场竞争格局

表:2009-2015年中国主要中速船用柴油机企业产量

表:中国船用中速柴油机厂商及技术合作对象

表:2011-2016年中国船用高速柴油机产量

表:中国主要船用高速柴油机生产商及产品

图:2008-2015年曼恩订单额

图:2007-2015年曼恩营业收入和净利润

图:2013-2015年曼恩销售额(分业务)构成

表:2014-2015年曼恩(分地区)销售收入及占比

表:2013-2015年曼恩MDT公司主要经营指标

表:曼恩船用柴油机生产基地

图:2007-2015年瓦锡兰订单额及销售额

表:2009-2015年瓦锡兰(分业务)订单额及销售额

表:2009-2015年瓦锡兰(分地区)销售额

表:瓦锡兰船用柴油机及应用

表:瓦锡兰双燃料中速机型号及功率

图:2006-2015年瓦锡兰-现代50DF发动机装船量

表:2015年瓦锡兰在中国合资及独资公司

图:2013-2015年QMD营业收入及净利润

图:2008-2015年Caterpillar销售收入及增速

表:2011-2015年Caterpillar主要业务销售收入

表:2010-2015年卡特彼勒动力系统(分地区)销售收入

图:卡特彼勒在华布局

表:现代重工全球网络

图:2010-2015年现代重工销售额及净利润

图:2007-2015年现代重工发动机及机械事业部销售额及订单额

图:2007-2015年现代重工发动机及机械事业部(分地区)新接订单构成

表:2010-2015财年三菱重工主要经济指标

表:2014-2015财年三菱重工(分业务)营业收入

表:三菱重工船用柴油机主要技术合作方

图:三菱重工在华布局

图:Doosan Engine公司竞争优势

图:2011-2015年Doosan Engine公司营业收入及利润

图:2015年Doosan Engine在华机构

图:MTU 4000系列的排放水平

图:2007-2015年沪东重机柴油机产量

图:2009-2015年沪东重机营业收入及净利润

表:2009-2015年中船三井船用柴油机产量

图:2010-2015年大连船柴船用柴油机产量

图:2009-2015年大连船柴销售收入和利润总额

表:2007-2015年宜柴主要经营指标

表:2015年潍柴重机船用柴油机产品

图:2009-2016年潍柴重机营业收入和净利润

表:2011-2015年潍柴重机(分业务)营业收入及毛利率

表:陕柴重工主要船用柴油发动机产品

表:2007-2015年陕柴重工主要经营指标

图:2010-2015年中船动力营业收入和利润总额

表:2009-2015年中船动力船用柴油机产量

表:河柴重工船用柴油机产品

表:2012-2015年河柴重工主要经济指标

表:2010-2015年熔安动力柴油机交付量

表:主要制造商推出的船用气体发动机

表:世界主要制造商推出的船用中速双燃料发动机

表:曼恩、瓦锡兰、MTU船用柴油机在中国的授权生产商

表:2015年中国主要船用柴油机企业产量及产能

Classification of Marine Diesel Engines

Global Marine Diesel Engine Market Size, 2005-2016

Global Low-speed Marine Diesel Engine Market Size, 2005-2016

Global Low-speed Marine Diesel Engine Market Share (by Country), 2015

Japan’s Marine Diesel Engine Output and Revenue, 2009-2015

Japan’s Low-speed Marine Diesel Engine Output and Output Value, 2009-2015

Japan’s Marine Diesel Engine Output Structure (by Power), 2015

Market Share of Major Global Low-speed Marine Diesel Engine Brands (by Power), 2007-2015

Market Share of Major Global Medium-speed Marine Diesel Engine Brands (by Power), 2007-2015

Three Indicators of Global Shipbuilding, 2010-2016

Three Indicators of China’s Shipbuilding, 2010-2016

Memorandum of Understanding Signed between China Association of the National Shipbuilding Industry, MAN and Wärtsilä, 2011

NOx Emission Standards for Marine Diesel Engines

Development of Marine Diesel Engines Complying with Tier Standards in China, 2010-2016

Policies on Marine Diesel Engine in China, 2007-2016

China’s Output of Marine Diesel Engines, 2009-2016

Shipbuilding Completions in China, 2010-2016

Import Volume and Value of Marine Diesel Engines in China, 2008-2016

TOP 10 Import Sources of Marine Diesel Engines in China, 2014-2015

TOP 10 Importers (Provinces/Municipalities) of Marine Diesel Engines in China, 2014-2015

Export Volume and Value of Marine Diesel Engines in China, 2008-2016

TOP 10 Exporters (Provinces/Municipalities) of Marine Diesel Engines in China, 2014-2015

Top 10 Export Destinations of Marine Diesel Engines in China, 2015

Key Production Areas and Representative Companies of Marine Diesel Engines in China

China’s Output of Low-speed Marine Diesel Engines, 2011-2016

Output and Market Share of Major Low-speed Marine Diesel Engine Companies in China, 2014-2015

Low-Speed Marine Diesel Engine Manufacturers and Their Technical Copartners in China

China's Output of Medium-speed Marine Diesel Engines, 2011-2016

Competitive Landscape of China’s Medium-speed Marine Diesel Engine Market, 2015

Output of Major Medium-speed Marine Diesel Engine Companies in China, 2009-2015

Chinese Medium-speed Marine Diesel Engine Manufacturers and Technical Copartners

High-speed Marine Diesel Engine Output in China, 2011-2016

Major High-speed Marine Diesel Engine Manufacturers and Products in China

MAN's Order Value, 2008-2015

MAN's Revenue and Net Income, 2007-2015

MAN's Revenue Structure (by Business), 2013-2015

MAN's Revenue Breakdown (by Region), 2014-2015

Major Operating Indicators of MAN MDT, 2013-2015

Marine Diesel Engine Manufacturing Bases of MAN

Wärtsilä's Order Value and Revenue, 2007-2015

Wärtsilä's Order Value and Revenue (by Business), 2009-2015

Wärtsilä's Revenue (by Region), 2009-2015

Wärtsilä's Marine Diesel Engines and Applications

Wärtsilä's Dual-fuel Medium-speed Engine Models and Power

Loading Capacity of Wärtsilä – Hyundai 50DF Engine, 2006-2015

Wärtsilä's Joint Ventures and Sole Proprietorships in China, 2015

Revenue and Net Income of QMD, 2013-2015

Caterpillar's Revenue and Growth Rate, 2008-2015

Caterpillar's Revenue (by Business), 2011-2015

Caterpillar's Power System Revenue (by Region), 2010-2015

Caterpillar’s Presence in China

Global Network of Hyundai Heavy Industries

Revenue and Net Income of Hyundai Heavy Industries, 2010-2015

Revenue and Order Value of Engine and Machinery Division of Hyundai Heavy Industries, 2007-2015

New Order Structure of Engine and Machinery Division of Hyundai Heavy Industries (by Region), 2007-2015

Major Economic Indicators of Mitsubishi Heavy Industries, FY2010-FY2015

Revenue of Mitsubishi Heavy Industries (by Business), FY2014-FY2015

Major Technical Copartners of Mitsubishi Heavy Industries in Marine Diesel Engine

Presence of Mitsubishi Heavy Industries in China

Competitive Edges of Doosan Engine

Revenue and Profits of Doosan Engine, 2011-2015

Organizations of Doosan Engine in China, 2015

Emission Level of MTU 4000 Series

Diesel Engine Output of Hudong Heavy Machinery, 2007-2015

Revenue and Net Income of Hudong Heavy Machinery, 2009-2015

Marine Diesel Engine Output of CSSC-MES Diesel, 2009-2015

Marine Diesel Engine Output of Dalian Marine Diesel, 2010-2015

Revenue and Total Profit of Dalian Marine Diesel, 2009-2015

Major Operating Indicators of Yichang Marine Diesel Engine, 2007-2015

Marine Diesel Engines of Weichai Heavy Machinery, 2015

Revenue and Net Income of Weichai Heavy Machinery, 2009-2016

Revenue and Gross Margin of Weichai Heavy Machinery (by Business), 2011-2015

Key Marine Diesel Engines of Shaanxi Diesel Engine Heavy Industry

Major Operating Indicators of Shaanxi Diesel Engine Heavy Industry, 2007-2015

Revenue and Total Profit of CSSC Marine Power, 2010-2015

Marine Diesel Engine Output of CSSC Marine Power, 2009-2015

Marine Diesel Engines of Henan Diesel Engine Industry

Major Economic Indicators of Henan Diesel Engine Industry, 2012-2015

Diesel Engine Delivery of RongAn Power Machinery, 2010-2015

Marine Gas Engines Launched by World’s Major Manufacturers

Marine Medium-speed Dual-fuel Engines Launched by World’s Major Manufacturers

Marine Diesel Engine Manufacturers Authorized by MAN, Wärtsilä and MTU in China

Output and Capacity of Major Marine Diesel Engine Companies in China, 2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|