|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2016-2020年全球及中国车载镜头行业研究报告 |

|

字数:2.0万 |

页数:83 |

图表数:98 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2000美元 |

英文纸版:2200美元 |

英文(电子+纸)版:2300美元 |

|

编号:ZLC-036

|

发布日期:2016-09 |

附件:下载 |

|

|

|

随着全球ADAS市场进入高速成长期,车载摄像头需求量快速上升,2011-2015年市场规模年均复合增长率达31.3%。车载镜头是指安装在汽车上以实现各种功能的光学镜头,主要包括内视镜头、后视镜头、前视镜头、侧视镜头、环视镜头等。作为车载摄像头的主要部件,车载镜头市场也正在迅速发展。

2015年,全球车载镜头前装出货量约4,850万件。其中,前视车载镜头出货量达1,110万件,后视及环视出货量达3,740万件。预计未来几年,全球车载镜头前装出货量将受益于各项ADAS相关政策的推动,保持较快增长。到2020年,出货量将达13,620万件。

2015年,中国车载镜头前装市场规模达1,000万件,占全球市场的20.6%。其中,前视车载镜头前装市场规模123万件,后视及环视市场规模达877万件。2015年中国先后提出了“中国制造2025”及“互联网+”发展战略等利好政策,将拉动车载镜头需求量增长。预计到2020年,中国车载镜头前装市场规模将达3,865万件。

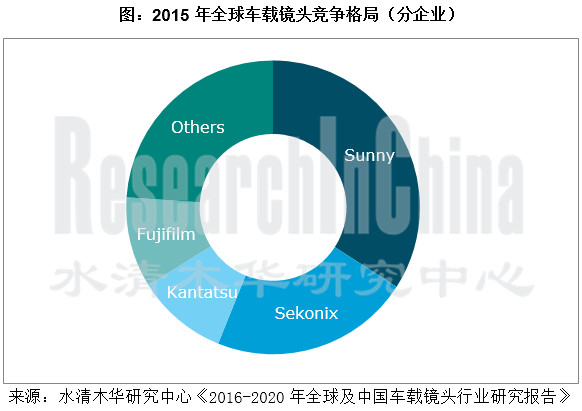

目前,涉足车载镜头行业的企业大多是传统的相机镜头生产商,包括Sekonix、Fujifilm、舜宇光学、大立光电、玉晶光、联合光电、先进光电等。其中,舜宇光学是全球最大的车载镜头供应商,客户包括Mobileye、Gentex、TRW、Valeo、Bosch、Continental、Delphi、Magna等。2015年,舜宇光学出货量达1,651.6万件,市场占有率达34.1%。

未来几年,全球及中国车载镜头市场将持续增长,主要受益于以下几点:

1、双目摄像头有望成主流拉动车载镜头需求增长

相较单目摄像头,双目摄像头具有精度高、没有识别率限制、无需维护样本数据库等特点。目前双目摄像头已成为日本、德国以及其他欧美厂商的研发重点,未来有望替代单目成市场主流。这意味着车载镜头的需求量将随之增长。

2、ADAS相关政策侧面推动车载镜头需求量增长

近年来,一些国家和地区颁布了一系列推动ADAS普及的相关政策:美国要求从2018年起所有汽车必须安装至少一个倒车后视摄像镜头;欧洲新车安全评价程序规定自2014年起,只有主动安全系统的权重从10%上升至20%,安装AEB的汽车才能达到5星评级;日本要求从2016年起,汽车必须安装自动紧急制动系统。

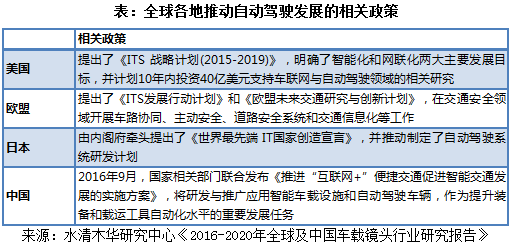

3、自动驾驶政策利好带动车载镜头发展

目前,包括美国、欧盟、日本和中国在内的国家/地区纷纷颁布了推动自动驾驶发展的相关政策,作为智能汽车之眼的车载摄像头将获利。因此,车载镜头作为车载摄像头的关键部件将迎来较快发展。

《2016-2020年全球及中国车载镜头行业研究报告》主要包括以下内容:

全球车载镜头前装市场规模、细分市场分析、竞争格局以及发展趋势分析; 全球车载镜头前装市场规模、细分市场分析、竞争格局以及发展趋势分析;

中国车载镜头前装市场规模及细分市场分析; 中国车载镜头前装市场规模及细分市场分析;

车载镜头产业链分析,包括对车载摄像头行业、ADAS市场的介绍,以及相关产业对车载镜头行业的影响分析; 车载镜头产业链分析,包括对车载摄像头行业、ADAS市场的介绍,以及相关产业对车载镜头行业的影响分析;

国内8家,国外5家车载镜头相关企业分析,包括对经营情况、车载镜头业务的分析。 国内8家,国外5家车载镜头相关企业分析,包括对经营情况、车载镜头业务的分析。

With the high-speed growth of the global ADAS market, the demand for automotive cameras jumped radically with the market size growing at a compound annual rate of 31.3% during 2011-2015. Automotive lens meansoptical lens mounted on vehicles in order to implement various functions, consisting mainly of endoscope lens, rear view lens, front view lens, side view lens, surround view lens, etc.. The market of automotive lens which is a major part of automotive cameras is growing rapidly.

In 2015, the global shipments of OEM automotive lens approximated 48.5 million pieces, embracing 11.1 million pieces of front view automotive lens and 37.4 million pieces of rear view and surround view lens. In the next few years, the global shipment of OEM automotive lens will benefit from ADAS-related policies, maintain quick growth and reach 136.2 million pieces by 2020.

China's automotive lens OEM market size reached 10 million pieces in 2015, accounting for 20.6% of the global market. Wherein, there were 1.23 million pieces offront view automotive lens and 8.77 million pieces of rear view and surround view lens. "Made in China 2025", "Internet +" development strategy and other favorable policies proposed by China in 2015 will stimulate the demand for automotive lens. By 2020, China's automotive lens OEM market size will report 38.65 million pieces.

At present, the companies involved in the automotive lens industry are mostly traditional camera lens vendors, including Sekonix, Fujifilm, Sunny Optical, Largan Precision, GSEO, Union Optech, AbilityOpto-Electronics Technology and so on. Sunny Optical is the world's largest supplier of automotive lenses, serving Mobileye, Gentex, TRW, Valeo, Bosch, Continental, Delphi, Magna, among others. In 2015, Sunny Optical realized the shipment of 16.516 million pieces and enjoyed the market share of 34.1%.

Competitive Landscape of Global Automotive Lens Market (by Company), 2015

Source: ResearchInChina

In the next few years, the global and Chinese automotive camera market will continue to grow thanks to the followings:

1, Binocular Cameras Are Expected to be the Mainstream and Drive the Demand forAutomotive Lens

Compared with monocular cameras, binocular cameras are featured with high resolution, unlimited recognition rate, no need of sample database maintenance and so forth. Currently, binocular cameras have become the R & D focus of Japanese, German and other European and American vendors, and will replace monocular cameras to be the market mainstream in the future, which means that the demand for automotive lens will grow.

2, ADAS-related Policies Boost the Demand for Automotive Lens to Grow

In recent years, some countries and regions have issued a series of policies to prompt the popularity of ADAS. The United States requires all cars to install at least one rear view camera from 2018 onwards. The European New Car Assessment Program (NCAP) stipulates that only the AEB-installed cars whose active safety systems occupy 20% instead of 10% can be rated as 5 stars since 2014. Japan commands that all cars must install automatic emergency braking systems from 2016 onwards.

3, Favorable Autonomous Driving Policies Drive the Development of Automotive Lens

Currently, the US, EU, Japan, China and other countries and regions have enacted policies to promote the development of autonomous driving, which will benefit smart car-use cameras. Therefore, automotive lens will see rapid development as a key component of automotive cameras.

The report highlights the followings:

Size, segments, competitive pattern and development trend of global automotive lens OEM market; Size, segments, competitive pattern and development trend of global automotive lens OEM market;

Size and segments of Chinese automotive lens OEM market; Size and segments of Chinese automotive lens OEM market;

Analysis on automotive lens industry chain, including introduction to automotive camera industry, ADAS market and impact of related sectors on automotive lens industry; Analysis on automotive lens industry chain, including introduction to automotive camera industry, ADAS market and impact of related sectors on automotive lens industry;

Operation, automotive lens business and the like of eight Chinese and five foreign automotive lens companies. Operation, automotive lens business and the like of eight Chinese and five foreign automotive lens companies.

第一章 简介

1.1 光学镜头

1.1.1 定义

1.1.2 主要参数

1.1.3 分类

1.1.4 产业链

1.2 车载镜头

1.2.1 应用及分类

1.2.2 技术特点

第二章 全球车载镜头前装市场发展现状

2.1 市场规模

2.2 细分市场

2.2.1 前视车载镜头

2.2.2 后视及环视车载镜头

2.3 竞争格局

2.4 发展趋势

2.4.1 双目摄像头发展将拉动车载镜头需求增长

2.4.2 自动驾驶政策利好将带动车载镜头发展

2.4.3 车载镜头后装市场需求量可观

2.4.4 车载镜头正在向高清化发展

2.4.5 环视摄像头代替后视摄像头

第三章 中国车载镜头前装市场及产业

3.1 市场规模

3.2 细分市场

3.2.1 前视车载镜头

3.2.2 后视及环视车载镜头

第四章 车载镜头产业链

4.1 车载摄像头

4.1.1 产业概述

4.1.2 竞争格局

4.1.3 相关法规

4.2 ADAS市场

4.2.1 简介

4.2.2 市场规模

4.3 相关产业对车载镜头行业的影响

4.3.1 政策推动ADAS行业发展利好车载镜头

4.3.2 ADAS系统渗透率上升推动车载镜头发展

第五章 国内主要企业

5.1 舜宇光学

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 研发支出

5.1.6 车载镜头主要客户

5.1.7 车载镜头主要产品

5.1.8 车载镜头出货量

5.1.9 车载镜头销售额

5.2 大立光电

5.2.1 公司简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 车载镜头业务

5.3 玉晶光电

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 车载镜头业务

5.4 联合光电

5.4.1 公司简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 毛利率

5.4.5 研发支出

5.4.6 产销

5.4.7 主要客户

5.4.8 车载镜头业务

5.5 先进光电

5.5.1 公司简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 研发支出

5.5.5 车载镜头业务

5.6 福光股份

5.6.1 公司简介

5.6.2 布局车载镜头领域

5.7 宇瞳光学

5.7.1 公司简介

5.7.2 车载镜头业务

5.8 今国光学

5.8.1 公司简介

5.8.2 经营情况

5.8.3 车载镜头业务

第六章 国外主要企业

6.1 SEKONIX

6.1.1 公司简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 车载镜头业务

6.1.5 威海世高光电子有限公司

6.2 FUJIFILM

6.2.1 公司简介

6.2.2 经营情况

6.2.3 营收构成

6.2.4 车载镜头业务

6.3 Sunex

6.3.1 公司简介

6.3.2 车载镜头业务

6.3.3 桑来斯光电科技(上海)有限公司

6.4 Universe Kogaku

6.5 KAVAS

1 Introduction

1.1 Optical Lens

1.1.1 Definition

1.1.2 Main Parameters

1.1.3 Classification

1.1.4 Industry Chain

1.2 Automotive Lens

1.2.1 Application and Classification

1.2.2 Technical Features

2 Status Quo of Global Automotive Lens OEM Market

2.1 Market Size

2.2 Market Segments

2.2.1 Front View Automotive Lens

2.2.2 Rear View and Surround View Automotive Lens

2.3 Competitive Pattern

2.4 Development Trend

2.4.1 Binocular Camera Development Will Drive Growth in Demand for Automotive Lens

2.4.2 Favorable Autonomous Driving Policies Will Promote the Development of Automotive Lens

2.4.3 Considerable Demand of Automotive Lens in Aftermarket

2.4.4 HD Development of Automotive Lens

2.4.5 Surround View Cameras Replace Rear View Cameras

3 Chinese Automotive Lens OEM Market and Industry

3.1 Market Size

3.2 Market Segments

3.2.1 Front View Automotive Lens

3.2.2 Rear View and Surround View Automotive Lens

4 Automotive Lens Industry Chain

4.1 Automotive Camera

4.1.1 Industry Overview

4.1.2 Competitive Pattern

4.1.3 Relevant Laws and Regulations

4.2 ADAS Market

4.2.1 Introduction

4.2.2 Market Size

4.3 Impact of Related Industries on Automotive Lens Industry

4.3.1 The Policy-promoted ADAS Industry Is Conducive to Automotive Lens

4.3.2 Higher Penetration of ADAS System Promotes the Development of Automotive Lens

5 Main Chinese Companies

5.1 Sunny Optical Technology (Group) Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R&D Costs

5.1.6 Main Automotive Lens Customers

5.1.7 Main Automotive Lens Products

5.1.8 Automotive Lens Shipment

5.1.9 Automotive Lens Sales

5.2 LarganPrecision Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Automotive Lens Business

5.3 Genius Electronic Optical (GSEO)

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Automotive Lens Business

5.4 Union Optech

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 R & D Costs

5.4.6 Production and Marketing

5.4.7 Main Customers

5.4.8 Automotive Lens Business

5.5 Ability Opto-Electronics Technology Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R & D Costs

5.5.5 Automotive Lens Business

5.6 RICOM

5.6.1 Profile

5.6.2 Layout in Automotive Lens

5.7 Dongguan YuTong Optical Technology Co., Ltd. (YTOT)

5.7.1 Profile

5.7.2 Automotive Lens Business

5.8 Kinko Optical Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Automotive Lens Business

6 Major Foreign Companies

6.1 SEKONIX

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Automotive Lens Business

6.1.5 WeihaiSEKONIX Electronics Co., Ltd.

6.2 FUJIFILM

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Automotive Lens Business

6.3 Sunex

6.3.1 Profile

6.3.2 Automotive Lens Business

6.3.3 SUNEX Optoelectronics Technology (Shanghai) Co., Ltd.

6.4 Universe Kogaku

6.5 KAVAS

图:光学镜头产业链

图:车载镜头在汽车上的应用

图:车载镜头分类

图:2014-2020年全球车载镜头前装出货量

图:2014-2020年全球车载镜头市场结构(按搭载位置分)

表:汽车前摄像头方案对比

图:前置ADAS摄像头路线图

图:2014-2020年全球汽车前视车载镜头前装出货量

图:日产环视摄像头安装位置

图:英菲尼迪环视摄像头安装位置

图:2014-2020E全球后视及环视车载镜头前装出货量

表:全球主要车载镜头生产商简介

表:2013-2015年全球主要车载镜头生产商营业收入对比

图:2015年全球车载镜头竞争格局(分企业)

图:双目摄像头发展方向

表:全球各地推动自动驾驶发展的相关政策

图:2013-2020E中国行车记录仪用镜头销量

图:2015-2020E中国车载镜头前装市场规模(数量)

图:2015-2020年中国车载镜头市场结构(按搭载位置分)

图:2015-2020年中国汽车前视车载镜头前装市场规模

图:2015年1-12月中国市场主要ADAS系统渗透率

表:2016年1-7月中国市场主要ADAS系统渗透率

表:2016年1-7月中国主动紧急制动AEB系统预装量

表:2016年1-7月中国市场主要ADAS系统渗透率(分价格)

图:2015-2020E中国后视及环视车载镜头前装市场规模

图:2016年7月中国市场在售车型ADAS各功能渗透率增长情况

表:2016年1-7月中国乘用车360度环视系统预装量

图:车载摄像头产业链

图:摄像头模组主要零部件结构图

图:2015 全球汽车摄像头模组供应商市场份额

图:2013-2020全球车载摄像头相关法规

图:车载摄像头的ADAS应用

表:车载摄像头的主要功能

图:2011-2020E全球ADAS市场规模

图:2011-2020E中国ADAS市场规模

表:全球各地推动ADAS普及的相关政策

图:舜宇光学营销网络

图:2011-2015年舜宇光学净资产

图:舜宇光学发展历程

图:2011-2015年舜宇光学经营业绩

图:2011-2015年舜宇光学营收构成(分产品)

图:2014-2015年舜宇光学营业收入(分地区)

图:2013-2016年舜宇光学营业收入构成(分产品)

图:2011-2015年舜宇光学毛利率

图:2013-2015年舜宇光学研发支出

图:舜宇车载主要客户

图:2015年舜宇光学车载镜头收入结构(分客户)

表:舜宇光学主要车载镜头技术规格

表:舜宇光学车载红外夜视镜头技术规格

图:2013-2016E舜宇光学车载镜头出货量

图:2013-2016年舜宇光学车载镜头销售额

图:2013-2016年舜宇光学车载镜头单价

图:2012-2015年大立光电营业收入及净利润

表:2014-2015年大立光电营业收入(分地区)

表:截至2015年底大立光电开发成功的技术及产品

表:大立光电车用光学镜头

图:2013-2015年玉晶光电营业收入及净利润

图:2013-2015年玉晶光电营业收入(分产品)

图:2013-2015年玉晶光电营业收入构成(分产品)

表:玉晶光电主要车载镜头参数

图:2013-2015年联合光电营业收入及净利润

图:2013-2015年联合光电营业收入(分类型)

图:2013-2015年联合光电营业收入构成(分类型)

图:2013-2015年联合光电营业收入(分地区)

图:2013-2015年联合光电毛利率

图:2013-2015年联合光电毛利率(分类型)

图:2013-2015年联合光电研发支出

表:联合光电募投项目

表:2013-2015年联合光电产销情况

表:2013-2015年联合光电前五名客户销售收入

表:联合光电车载镜头相关专利

表:联合光电主要车载镜头参数

表:联合光电车载后视镜头参数

图:2013-2016年先进光电营业收入及净利润

图:2013-2015年先进光电营业收入(分产品)

图:2013-2015年先进光电营业收入构成(分产品)

表:先进光电营业收入构成(分客户)

表:2013-2015年先进光电产能产量(分产品)

图:2013-2015年先进光电研发支出

图:先进光电主要汽车镜头品规格

表:宇瞳光学发展历程

表:宇瞳光学TY8052-HD车载高清镜头规格参数

表:宇瞳光学YT8037-A车载高清镜头规格参数

图:2012-2015年今国光学营业收入及净利润

图:今国光学主要车载镜头规格参数

图:2013-2015年SEKONIX经营业绩

图:2013-2015年SEKONIX销售额(分地区)

图:2013-2015年SEKONIX销售额构成(分地区)

图:SEKONIX汽车用镜头布局情况

图:FY2012-FY2016FUJIFILM营业收入及净利润

图:FY2012-FY2016FUJIFILM营业收入(分部门)

图:FY2012-FY2016FUJIFILM营业收入构成(分部门)

图:FUJIFILM车载镜头主要应用领域

图:Sunex主要客户

表:Sunex主要车载镜头规格参数

表:桑来斯光电科技(上海)有限公司主要信息

图:KAVAS产品组成

图:KAVAS主要客户

Optical Lens Industry Chain

Application of Automotive Lens in Automobile

Classification of Automotive Lens

Global Automotive Lens OEM Shipment, 2014-2020E

Global Automotive Lens Market Structure (by Mounted Position), 2014-2020E

Comparison between Front Automotive Camera Solutions

Roadmap of Front ADAS Cameras

Global Shipment of OEM Front View Automotive Lenses, 2014-2020E

Mounted Position of Nissan’s Surround View Cameras

Mounted Position of Infiniti’s Surround View Cameras

Global Shipment of OEM Rear View and Surround View Automotive Lenses, 2014-2020E

Introduction to Global Main Automotive Lens Vendors

Revenue of Global Main Automotive Lens Vendors, 2013-2015

Competitive Landscape of Global Automotive Lens Market (by Company), 2015

Binocular Camera Development Direction

Global Autonomous Driving Promotion Policies by Region

Sales Volume of Driving Recorder-use Lens in China, 2013-2020E

China’s Automotive Lens OEM Market Size, 2015-2020E

China’s Automotive Lens Market Structure (by Mounted Position), 2015-2020E

China’s Front View Automotive Lens OEM Market Size, 2015-2020E

Market Penetration of Major ADAS Systems in China, Jan-Dec 2015

Market Penetration of Major ADAS Systems in China, Jan-Jul 2016

Preinstalled Amount of AEB Systems in China, Jan-Jul 2016

Market Penetration of Major ADAS Systems in China, Jan-Jul 2016 (by Price)

China’s Rear View and Surround View Automotive Lens OEM Market Size, 2015-2020E

Penetration Growth of ADAS Functions of Vehicle Models for Sale in China, Jul 2016

Preinstalled Amount of Passenger Car 360° Surround View Systems in China, Jan-Jul 2016

Automotive Camera Industry Chain

Structure Diagram of Main Components of Camera Modules

Market Share of Global Automotive Camera Module Suppliers, 2015

Laws and Regulations on Automotive Camera in the World, 2013-2020E

ADAS Application of Automotive Cameras

Main Functions of Automotive Cameras

Global ADAS Market Size, 2011-2020E

China’s ADAS Market Size, 2011-2020E

Global ADAS Promotion Policies by Region

Marketing Network of Sunny Optical

Net Assets of Sunny Optical, 2011-2015

Development Course of Sunny Optical

Operating Results of Sunny Optical, 2011-2015

Revenue Structure of Sunny Optical (by Product), 2011-2015

Revenue of Sunny Optical (by Region), 2014-2015

Revenue Structure of Sunny Optical (by Product), 2013-2016

Gross Margin of Sunny Optical, 2011-2015

R & D Costs of Sunny Optical, 2013-2015

Main Customers of Sunny Optical

Automotive Lens Revenue Structure of Sunny Optical (by Customer), 2015

Technical Specifications of Main Automotive Lenses of Sunny Optical

Automotive IR Night Vision Lens Technical Specifications of Sunny Optical

Automotive Lens Shipment of Sunny Optical, 2013-2016E

Automotive Lens Revenue of Sunny Optical, 2013-2016

Automotive Lens Unit Price of Sunny Optical, 2013-2016

Largan’s Revenue and Net Income, 2012-2015

Largan’s Revenue (by Region), 2014-2015

Technologies and Products Successfully Developed by Largan, by the end of 2015

Largan’s Automotive Optical Lens

Revenue and Net Income of Genius Electronic Optical, 2013-2015

Revenue of Genius Electronic Optical (by Product), 2013-2015

Revenue Structure of Genius Electronic Optical (by Product), 2013-2015

Parameters of Main Automotive Lenses of Genius Electronic Optical

Revenue and Net Income of Union Optech, 2013-2015

Revenue of Union Optech (by Type), 2013-2015

Revenue Structure of Union Optech (by Type), 2013-2015

Revenue of Union Optech (by Region), 2013-2015

Gross Margin of Union Optech, 2013-2015

Gross Margin of Union Optech (by Type), 2013-2015

R & D Costs of Union Optech, 2013-2015

Fundraising and Investment Projects of Union Optech

Production and Marketing of Union Optech, 2013-2015

Revenue of Union Optech's Top 5 Customers, 2013-2015

Automotive Lens-related Patents of Union Optech

Main Automotive Lens Parameters of Union Optech

Automotive Rear View Lens Parameters of Union Optech

Revenue and Net Income of Ability Opto-Electronics Technology, 2013-2016

Revenue of Ability Opto-Electronics Technology (by Product), 2013-2015

Revenue Structure of Ability Opto-Electronics Technology (by Product), 2013-2015

Revenue Structure of Ability Opto-Electronics Technology (by Customer), 2013-2015

Capacity and Output of Ability Opto-Electronics Technology (by Product), 2013-2015

R & D Costs of Ability Opto-Electronics Technology, 2013-2015

Main Automotive Lens Specifications of Ability Opto-Electronics Technology

Development Course of YuTong Optical

TY8052-HD Automotive HD Lens Specifications of YuTong Optical

YT8037-A Automotive HD Lens Specifications of YuTong Optical

Revenue and Net Income of Kinko Optical, 2012-2015

Main Automotive Lens Specifications of Kinko Optical

SEKONIX’s Operating Results, 2013-2015

SEKONIX’s Revenue (by Region), 2013-2015

SEKONIX’s Revenue Structure (by Region), 2013-2015

SEKONIX’s Layout in Automotive Lens

FUJIFILM’s Revenue and Net Income, FY2012-FY2016

FUJIFILM’s Revenue (by Division), FY2012-FY2016

FUJIFILM’s Revenue Structure (by Division), FY2012-FY2016

Key Applications of FUJIFILM’s Automotive Lens

Sunex’s Main Customers

Main Specifications of Sunex’s Automotive Lens

Main Information of SUNEX Optoelectronics Technology (Shanghai) Co., Ltd.

Product Mix of KAVAS

Main Customers of KAVAS

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|