《2016年全球汽车座椅产业研究报告》包含以下内容:

1、汽车座椅构成与功能

2、全球及中国汽车座椅市场规模与趋势

3、全球及中国汽车座椅产业竞争格局与趋势

4、全球及中国主要整车厂汽车座椅供应链分析

5、全球及中国汽车座椅厂家研究

汽车座椅行业表面看似乎没什么技术门槛,实际上汽车座椅行业也是资本密集型和技术密集型行业。首先由于汽车座椅体积大,不方便运输,通常汽车座椅企业都在整车厂附近设厂,整车厂每增加一个生产基地,就需要座椅企业跟进,需要足够的资金实力。其次汽车座椅需要满足三个条件:安全、舒适与轻量,这都需要深厚的技术积累,技术门槛很高。另外汽车座椅行业员工数量庞大,对管理要求也很高。

全球汽车座椅市场稳健成长,一是汽车座椅行业壁垒高,市场集中度高,竞争不激烈。面对整车厂,汽车座椅厂家的话语权比较充足,可以不断提高产品价格。二是消费升级,这在中国市场最为明显,消费者对汽车座椅的要求不断提高。2010年汽车座椅ASP为723美元,市场规模为540亿美元,2015年ASP为790美元,市场规模为701亿美元,预计2016年市场规模为729亿美元,2020年为843亿美元,ASP为865美元。

汽车座椅产业中,源自江森自控的Adient和Lear是第一阵营,两者合计在乘用车市场占有率大约为48%。Adient客户分布广泛,几乎所有车厂都是其客户,Lear客户集中在福特、通用、宝马、FCA四大客户上,市场集中在北美和欧洲,亚太布局远不如Adient。Adient在中国市场拥有绝对霸主地位,市场占有率40%。

源自丰田的丰田纺织和源自PSA的Faurecia属于第二阵营,丰田纺织近年来积极拓展丰田以外的客户,Faurecia的客户则集中在VW、PSA和Renault-Nissan,市场集中在欧洲。

在中国汽车座椅市场,美系、德系基本上由Adient和Lear垄断,日系中本田全部由TS供应,丰田绝大部分由丰田纺织供应,日产的供应商则比较多。自主汽车品牌也大多采用合资厂的座椅配套,长城、比亚迪、奇瑞和吉利汽车基本选择了部分自主、部分合资的模式。合资厂依靠规模效应和完整的供应链,价格具有很大优势,性能也更好,而自主品牌为了保证拥有足够的话语权,增加供应链弹性才保留了内部的座椅事业部。

长城汽车的座椅大部分是由其自己座椅事业部生产供应,少部分由长城与延峰江森的合资公司供应;比亚迪汽车座椅大部分由其十六事业部生产供应,还有一部分由泰极(Tachi-S)供应,泰极是合资公司,由三方共同出资。奇瑞汽车座椅目前主要由李尔和瑞泰供应,江森、全兴已经慢慢退出,瑞泰是奇瑞的子公司,已经包揽了奇瑞低端的所有座椅,而高端的座椅由李尔来供应。吉利汽车最为主要的座椅供应商是江森、浙江新岱美和浙江俱进,新岱美发展得越来越好,和韩国大世(Das)合作后,为新岱美在吉利站住脚提供了强有力的后盾,浙江俱进有吉利参股,又有日本泰极支持。

未来随着消费者需求升级,自主生产座椅的比例会逐渐降低,合资厂的比例会逐渐增加。

The report covers the following:

1. Composition and function of automotive seating

2. Size and Trends of global and Chinese automotive seating market

3. Competitive landscape and trends of global and China’s automotive seating industry

4. Automotive seating supply chain of major global and Chinese carmakers

5. Global and Chinese automotive seating manufacturers

Automotive seating industry, seemingly without technological barriers, is actually a capital-intensive business that does with high-tech expertise. First, automotive seating plants are usually adjacent to car factories, for the products are too large to be transported easily. Therefore, as carmakers add a new production base, automotive seating manufacturers need to follow up. In this case, substantial funds become a must. Second, safety, comfort, and light weight- three requirements on automotive seating- need rich technological accumulation and present high technological threshold. Moreover, a huge number of employees in automotive seating industry pose great challenges to managerial competencies.

Global automotive seating market has grown steadily on account of the two aspects. First, higher barriers in automotive seating industry lead to high market concentration and little competition. Automotive seating manufacturers have a greater say which enables them to raise prices constantly. Second, consumption is upgraded, a phenomenon starkly seen in China where consumers have higher requirements on automotive seating. Automotive seating saw an ASP of USD723 in 2010 with a market size of USD54 billion. The figures for 2015 were USD790 and USD70.1 billion. It is expected the market size will be valued at USD72.9 billion in 2016, and USD84.3 billion in 2020 when ASP arrives at USD865.

In automotive seating industry, Adient (a spin-off of Johnson Controls) and Lear are in the first camp, together holding about 48% of passenger car market. Adient has a broad customer base with almost all carmakers being its customers, while Lear provides products mainly for Ford, GM, BMW, and FCA and operates chiefly in North America and Europe but gets far less involved in the Asian-Pacific region. Adient seizes a dominant position in China with a market share of 40%.

Toyota Boshoku (a member of Toyota Group) and Faurecia (a subsidiary of PSA) fall into the second camp. Toyota Boshoku has been actively developing new customers outside Toyota in recent years. Faurecia serves mainly VW, PSA, and Renault-Nissan with its operations concentrated in Europe.

In the Chinese automotive seating market, almost all American cars and German cars are equipped with automotive seats from Adient and Lear, and among Japanese cars, all Honda cars carry automotive seats from TS, the majority of Toyota cars with automotive seats from Toyota Boshoku, and Nissan cars with automotive seats from a number of suppliers. Most of Chinese car brands use seats from joint ventures. Great Wall, BYD, Chery, and Geely adopt the model of partial own production and partial purchase from joint ventures. The joint ventures deliver cost-competitive products with better performance by relying on economy of scale and complete supply chain, while local brands retain their seating businesses just for enough say in negotiation with JVs and greater resilience in supply chain.

Most of Great Wall car seats come from its own seating business division and a few are provided by the joint venture between Great Wall and Yanfeng Johnson Controls. BYD’s car seats are largely supplied by its No. 16 business division and partly by Tachi-S, a three-party joint venture. Chery has low-end seats furnished by Wuhu Ruitai Auto Parts (a subsidiary of Chery) and high-end seats by Lear, making less and less purchase from Johnson Controls and GSK. Major suppliers of seats for Geely are Johnson Controls, Zhejiang Xindaimei Automotive Seating, and Zhejiang Jujin Automobile & Motor-cycle Accessories. Cooperation with South Korean Das provides solid support for Zhejiang Xindaimei Automotive Seating to gain a foothold in Geely. Zhejiang Jujin Automobile & Motor-cycle Accessories has investment from Geely and is also backed by Tachi-S.

As consumers pursue high-quality products, the ratio of home-grown seats will gradually fall, while that of JV seats will rise.

第一章、座椅简介

1.1、座椅构成

1.1.1、Cushion Frame

1.1.2、Back Frame

1.1.3、Head Restaint

1.1.4、Lever Control

1.1.5、Slide

1.1.6、Covering

1.1.7、Pad Foam

1.1.8、Recliner

1.1.9、Lumbar Support

1.2、汽车座椅骨架

1.3、汽车座椅电机

1.4、汽车座椅Covering

第二章、全球汽车座椅产业与市场

2.1、2013-2020年全球汽车座椅市场规模

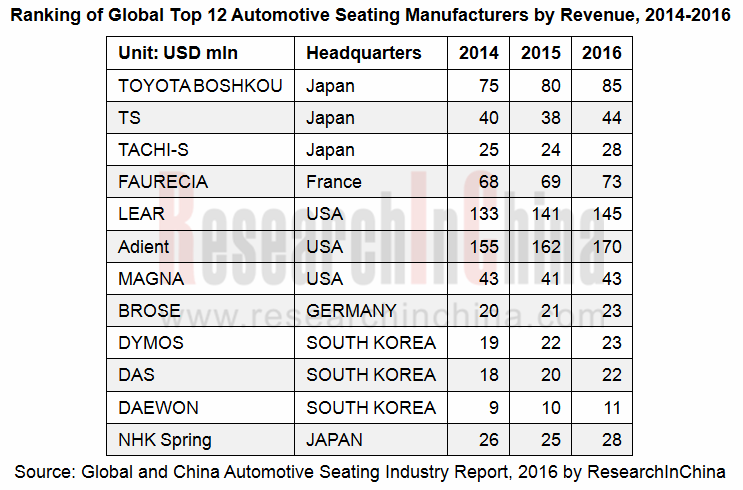

2.2、2014-2016年全球前12大汽车座椅厂家收入排名

2.3、2016年北美乘用车汽车座椅市场主要厂家市场占有率

2.4、2016年欧洲乘用车汽车座椅市场主要厂家市场占有率

2.5、2015 TOYOTA/HONDA/RENAULT-NISSAN座椅供应商分布

2.6、2015 VW/BMW/BENZ座椅供应商分布

2.7、2015 GM/FORD/HYUNDAI座椅供应商分布

第三章、中国汽车座椅产业与市场

3.1、2010-2020年中国汽车销量

3.2、中国汽车市场近况

3.3、中国汽车市场品牌结构

3.4、中国新能源车市场

3.5、2016年1-9月乘用车销量前十

3.6、2016年中国乘用车汽车座椅市场主要厂家市场占有率

3.7、2015 SAIC/FAW/CHANGAN座椅供应商分布

3.8、2015 DONGFENG座椅供应商分布

3.9、2015 BAIC座椅供应商分布

3.10、中国本土品牌汽车座椅供应策略

第四章、汽车座椅厂家研究

4.1、Adient

4.2、Lear

4.3、Toyota Boshoku

4.4、Faurecia

4.5、TS

4.6、TACHI-S

4.7、Magna

4.8、Brose

4.9、NHK Spring

4.10、Sitech

4.11、武汉新云鹤

4.12、GSK

4.13、DAS

4.14、Daewon

4.15、DYMOS

1 Brief Introduction to Automotive Seating

1.1 Structure

1.1.1 Cushion Frame

1.1.2 Back Frame

1.1.3 Head Restaint

1.1.4 Lever Control

1.1.5 Slide

1.1.6 Covering

1.1.7 Pad Foam

1.1.8 Recliner

1.1.9 Lumbar Support

1.2 Seat Frame

1.3 Seat Motor

1.4 Seat Covering

2 Global Automotive Seating Market and Industry

2.1 Global Automotive Seating Market Size, 2013-2020E

2.2 Ranking of Global Top 12 Automotive Seating Manufacturers by Revenue, 2014-2016

2.3 Market Share of Major Seating Manufacturers for Passenger Car in North America, 2016

2.4 Market Share of Major Seating Manufacturers for Passenger Car in Europe, 2016

2.5 Share of Automotive Seating Suppliers for Toyota/Honda/Renault-Nissan, 2015

2.6 Share of Automotive Seating Suppliers for VW/BMW/BENZ, 2015

2.7 Share of Automotive Seating Suppliers for GM/Ford/Hyundai, 2015

3 China Automotive Seating Market and Industry

3.1 China Automobile Sales Volume, 2010-2020E

3.2 Recent Developments of Chinese Automotive Market

3.3 Brand Structure of Chinese Automotive Market

3.4 China New Energy Vehicle Market

3.5 Top Ten Passenger Car Brands by Sales Volume, Jan.-Sep.2016

3.6 Market Share of Major Manufacturers in Chinese Passenger Car Seating Market, 2016

3.7 Share of Automotive Seating Suppliers for SAIC/FAW/CHANGAN, 2015

3.8 Share of Automotive Seating Suppliers for DONGFENG, 2015

3.9 Share of Automotive Seating Suppliers for BAIC, 2015

3.10 Automotive Seating Supply Strategies of Chinese Local Brands

4 Automotive Seating Manufacturers

4.1 Adient

4.2 Lear

4.3 Toyota Boshkou

4.4 Faurecia

4.5 TS

4.6 TACHI-S

4.7 Magna

4.8 Brose

4.9 NHK Spring

4.10 Sitech

4.11Wuhan New Yunhe Automotive Seating

4.12 GSK

4.13 DAS

4.14 Daewon

4.15 DYMOS