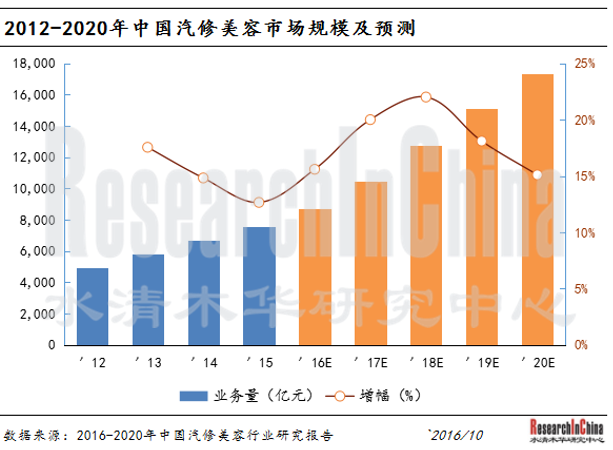

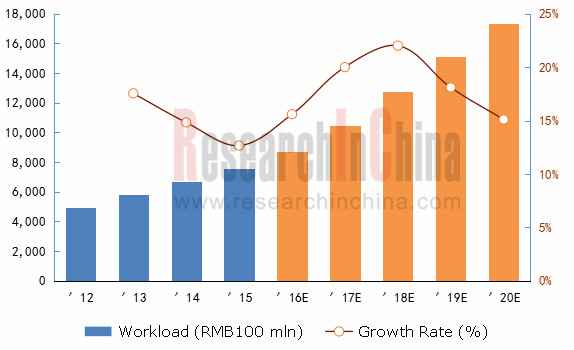

中国汽车市场规模庞大,对汽修美容市场需求量具有持续拉动作用。根据国家统计局统计数据,2015年末,中国汽车保有量达到了1.72亿辆,同比增长了11.7%。2015年中国汽修美容市场规模达到7,548亿元,同比增长12.66%。未来随着消费者养车意识提升、单车保有年龄逐步提升,预计2015-2020年汽修美容市场规模平均增速将增长到19.17%,2020年将达到17,364亿元。

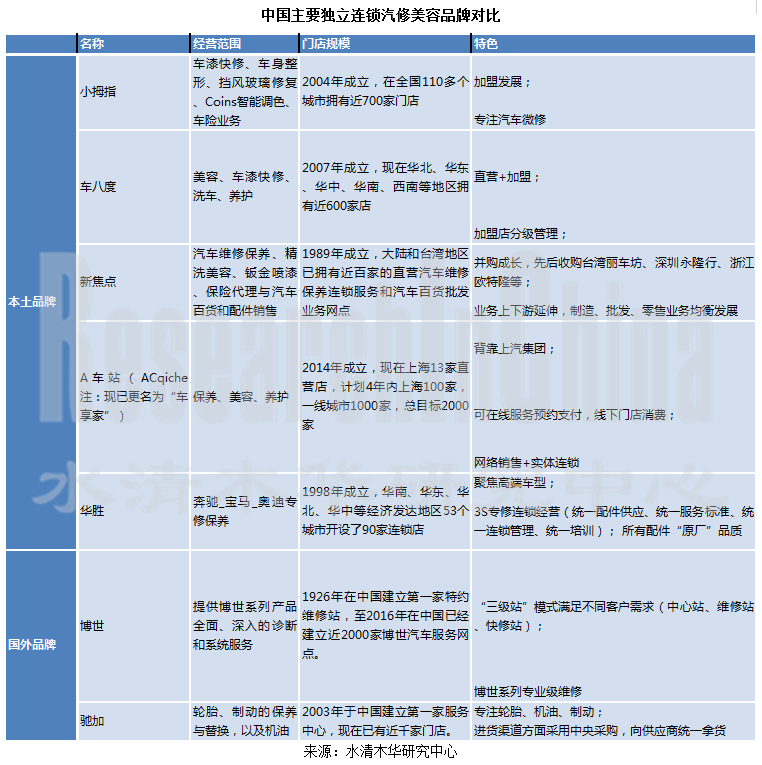

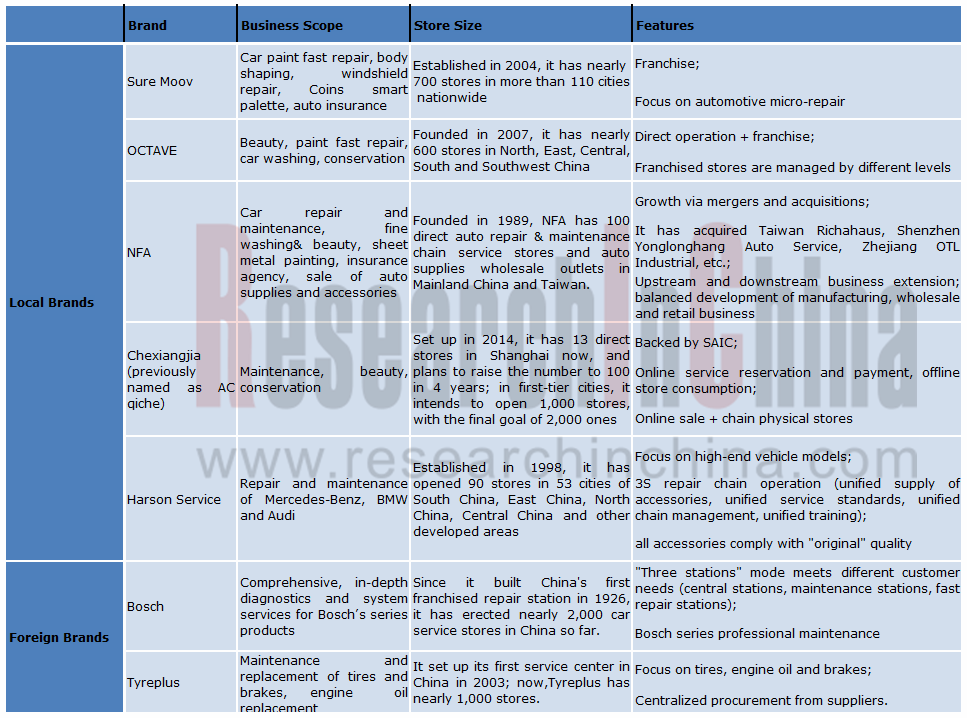

在竞争格局方面,中国汽车维修行业主要参与者包括 4S店、特约维修服务站、综合维修厂、快修连锁店、专项维修店以及大量的路边店。全国一二三类注册维修企业40多万家,从业人员近500万人,其中非4S店37万家以上,行业集中度极低。

中国汽车4S店虽然服务质量较高但收费也高,维修厂和路边维修店虽然收费低但服务质量参差不齐,无法让消费者放心;具有一定知名度的连锁店的收费位于4S店和路边维修店之间,具有明显的性价比优势。

就目前情况看,外资品牌博世、米其林,本土品牌华胜、小拇指、新焦点等已形成品牌连锁效应,客户口碑较好。其中博世、小拇指等已形成全国性布局,其他企业正在积极进行网点扩张和合理化布局。

博世车联是全球最大的独立汽车服务网络之一,隶属于博世集团,拥有95年的历史,在全球150多个国家拥有17,000多个维修站。其业务主要包括综合服务及快捷服务,服务范围分别为“整车维修,包含钣金&喷漆业务和快修服务”以及“汽车美容,汽车保养和轮胎服务”,该两类服务均采用加盟形式。截止目前,博世车联在中国拥有2000家加盟店。

新焦点于1989年成立,现为港交所上市公司(00360.HK),在大陆和台湾地区已拥有超过100家的直营汽车维修保养连锁服务和汽车百货批发业务网点。其国内汽修美容业务子公司主要包括新焦点爱义行、长春广达、上海新焦点以及新焦点永隆行,此外该公司还拥有纽福克斯光电这一汽车用品生产企业,拥有较为完备的汽车后市场产业链。

汽修美容行业巨大市场潜力吸引着各路资本争相进入该领域,不仅为市场注入充足的资本,同时也创新了各类经营模式,如淘宝、京东等互联网企业投入大量资金或收购或创立创新公司(Start-up),并以此为基础创立O2O经营模式;同时也有部分零部件厂商和经销商将产业链后移,进入汽修美容行业,例如以润滑油为主业的美孚1号以及以轮胎经销为主业的麦轮胎,这些企业大都以原产品为主业扩展至其他汽修美容业务。

《2016-2020年中国汽修美容行业研究报告》报告主要包括以下内容:

中国汽修美容行业概况(包括定义及分类,产业链,行业政策以及发展趋势等);

中国汽修美容行业概况(包括定义及分类,产业链,行业政策以及发展趋势等);

中国汽车后市场行业总体市场规模分析(包括汽车整车行业、二手车市场、汽车租赁、汽车保险等);

中国汽车后市场行业总体市场规模分析(包括汽车整车行业、二手车市场、汽车租赁、汽车保险等);

中国汽修美容行业总体市场规模分析(包括市场规模、投融资分析、竞争格局、渠道分析以及区域分析等);

中国汽修美容行业总体市场规模分析(包括市场规模、投融资分析、竞争格局、渠道分析以及区域分析等);

中国汽修美容创新经营模式分析(包括互联网+、零部件+等);

中国汽修美容创新经营模式分析(包括互联网+、零部件+等);

包括博世、米其林驰加、小拇指、车8度、车骑王子、安吉好途邦、新焦点快修店、华胜、淘宝汽车、车享家、有壹手等在内11家汽修美容连锁企业分析,包括公司简介、财务状况、服务设施、服务网络以及融资情况等。

包括博世、米其林驰加、小拇指、车8度、车骑王子、安吉好途邦、新焦点快修店、华胜、淘宝汽车、车享家、有壹手等在内11家汽修美容连锁企业分析,包括公司简介、财务状况、服务设施、服务网络以及融资情况等。

The huge Chinese automobile market always stimulates the demand for auto repair & beauty. According to the National Bureau of Statistics of China, the country's car ownership reached 172 million at the end of 2015, rising 11.7% over last year. Chinese auto repair & beauty market size amounted to RMB754.8 billion in 2015, jumping by 12.66% year on year. In future, the market size will show an annual growth rate of 19.17% during 2015-2020 with the consumers’enhanced maintenance awareness and longer ownership time, and the market scale will report RMB1.7364 trillion in 2020.

Chinese Auto Repair & Beauty Market Size, 2012-2020E

Source: ResearchInChina

As for the competitive landscape, the main participants in China's auto repair industry include 4S stores, franchised maintenance service stations, comprehensive repair workshops, fast repair chain stores, special repair shops and a large number of roadside shops. There are more than 400,000 registered maintenance &repairenterprises which are divided into three categories with nearly 5 million employees in China, embracing at least 370,000 non-4S stores. The industry features a low concentration rate.

In China, auto 4S stores charge very high although their service quality is excellent, while repair shops and roadside repair shops claim low fees but their services vary dramatically, which cannot make consumers feel assured. Well-known chain stores offer the prices between 4S stores and roadside repair shops, embodying obvious cost advantages.

Currently, foreign brands Bosch and Michelin, as well as local brands Harson Service, Sure Moov and NFA have forged brand chain effect and enjoy better reputation. Bosch and Sure Moovhave realized national layout, and other enterprises are actively expanding the network and making the layout rationally.

Under Bosch Group, Bosch Car Service is one of the largest independent automotive service networks in the world with a history of more than 95 years and boasting more than 17,000 service stations in over 150 countries. Its services consist mainly of comprehensive services and fast services, involving "vehicle maintenance inclusive of sheet metal & paint business and fast repair services" and "car beauty, car maintenance and tire services". The two types of services adopt franchise mode. Up to now, Bosch Car Service has opened 2,000 franchised stores in China.

Founded in 1989, NFA is listed on the Hong Kong Stock Exchange (00360.HK) and has more than 100 direct auto repair & maintenance chain service stores and auto supplies wholesale outlets in Mainland China and Taiwan. Its domestic auto repair & beauty subsidiaries contain New Focus Aiyihang, Changchun Quangda, Shanghai New Focus and New FocusYonglonghang. In addition, the company also operates New Focus Lighting & Power Technology (Shanghai) Co., Ltd. which involves in the production of automotive products. Therefore, the company holds a perfect aftermarket industrial chain.

Comparison between Major Independent Chain Auto Repair & Beauty Brands in China

Source: ResearchInChina

The enormous market potentials of the auto repair & beauty industry have attracted various investors to compete in the field, which not only injects adequate capital to the market, but also brings multiple innovative business models. For instance, Taobao, Jingdong (JD) and other Internet giantspump much capital in acquiring or creating start-ups, and then erect the O2O business model hereof. Meanwhile, some parts manufacturers and distributors move back into the downstream of the industry chain, so as to step in the auto repair & beauty industry; for example, Mobil No.1 keeps an eye on lubricating oil, and mailuntai.cn focuses on tire distribution; most of these companies expand the original product-based business to auto repair & beauty business.

The report highlights the following:

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

第一章 汽修美容行业基本情况

1.1 汽车后市场产业链

1.2 汽车后市场行业发展现状

1.3 行业相关政策

第二章 汽车后市场行业分析

2.1 整车产销量

2.2 汽车保有量

2.3 汽车后市场行业分析

2.3.1 二手车市场

2.3.2 汽车金融

2.3.3 汽车租赁市场

第三章 汽修美容行业分析

3.1 总体规模

3.2 投融资分析

3.3 竞争格局

3.4 渠道分析

3.5 区域分析

3.6 发展趋势

3.6.1 总体发展趋势

3.6.2 渠道发展趋势

第四章 互联网+汽修美容

4.1发展状况

4.2 经营模式

4.3 竞争格局

4.4 网络汽修美容平台

4.4.1 卡拉丁

4.4.2 京东汽车

4.4.3 e保养

4.4.4 摩卡i车

4.4.5 携车网

4.4.6 弼马温养车网

4.4.7 Home Car

4.4.8洗爱车

4.5 零部件厂商+互联网+汽修美容相关企业分析

4.5.1美孚 1号移动车养护

4.5.2 途虎养车网

4.5.3 麦轮胎

4.6 存在的问题

4.6.1 失败案例

4.6.2 反思

第五章 中国连锁汽修美容企业分析

5.1博世车联

5.1.1 公司简介

5.1.2 服务范围

5.1.3 经营模式

5.1.4 合作伙伴

5.1.5 最近发展状况

5.2驰加汽车服务中心

5.2.1 公司简介

5.2.2 服务范围

5.2.3 经营模式

5.2.4 合作伙伴

5.2.5 最近发展状况

5.3小拇指

5.3.1 公司简介

5.3.2 经营业绩

5.3.3 营收分布

5.3.4 主要业务

5.3.5 最新进展

5.4车八度

5.4.1 公司简介

5.4.2 主要业务

5.4.3 加盟政策

5.4.4 最新进展

5.5车奇士

5.5.1 公司简介

5.5.2 主要业务

5.5.3 门店网络

5.5.4 加盟政策

5.5.5 最近进展

5.6安吉好途邦

5.6.1 公司简介

5.6.2 主要业务

5.6.3 门店网络

5.6.4合作伙伴

5.7新焦点

5.7.1 公司简介

5.7.2 经营状况

5.7.3 营收结构

5.7.4新焦点爱义行

5.7.5 长春广达

5.7.6 上海新焦点

5.7.7 新焦点永隆行

5.8华胜

5.8.1 公司简介

5.8.2 三大业务对比

5.8.3 经营模式

5.8.4 华胜豪华车专修连锁

5.8.5 宜修中级车专修连锁

5.9 淘汽

5.9.1 淘汽档口

5.9.2 淘汽云修

5.10 车享家

5.10.1 公司简介

5.10.2 主要服务

5.10.3 经营网络

5.10.4 最近进展

5.11 有壹手

5.11.1 公司简介

5.11.2 主要服务

5.11.3 服务网络

5.11.4 经营模式

1 Basic Situation of Auto Repair & Beauty Industry

1.1 Automotive Aftermarket Industry Chain

1.2 Status Quo of Automotive Aftermarket

1.3 Policies on the Industry

2 Aftermarket Analysis

2.1 Vehicle Output and Sales

2.2 Vehicle Ownership

2.3 Aftermarket

2.3.1 Used Car Market

2.3.2 Automotive Finance

2.3.3 Car Rental Market

3 Auto Repair & Beauty Industry

3.1 Overall Size

3.2 Investment and Financing

3.3 Competitive Landscape

3.4 Channels

3.5 Regional Analysis

3.6 Development Trends

3.6.1 Overall Development Trend

3.6.2 Channel Development Trend

4 Internet + Auto Repair& Beauty

4.1 Development Situation

4.2 Business Model

4.3 Competitive Landscape

4.4 Online Auto Repair & Beauty Platform

4.4.1 kalading.com

4.4.2 JD Auto

4.4.3 ebaoyang.cn

4.4.4 mocar.cn

4.4.5 xieche.com

4.4.6 bimawen.com

4.4.7 Home Car

4.4.8 xiiche.com

4.5 Parts Manufacturers + Internet + Auto Repair & Beauty-related Enterprises

4.5.1 Mobil No.1

4.5.2 tuhu.cn

4.5.3 mailuntai.cn

4.6 Existing Problems

4.6.1 Failure Cases

4.6.2 Reflection

5 Auto Repair & Beauty Chain Enterprises in China

5.1Bosch Car Service

5.1.1 Profile

5.1.2 Scope of Services

5.1.3 Business Model

5.1.4 Partners

5.1.5 Recent Development

5.2 Tyreplus

5.2.1 Profile

5.2.2 Scope of Services

5.2.3 Business Model

5.2.4 Partners

5.2.5 Recent Development

5.3 Sure Moov

5.3.1 Profile

5.3.2 Operating Results

5.3.3 Revenue Distribution

5.3.4 Main Business

5.3.5 Recent Development

5.4 OCTAVE

5.4.1 Profile

5.4.2 Main Business

5.4.3 Franchise Policy

5.4.4 Recent Development

5.5 cheqishi.com

5.5.1 Profile

5.5.2 Main Business

5.5.3 Store Network

5.5.4 Franchise Policy

5.5.5 Recent Development

5.6 AnjiAutobund

5.6.1 Profile

5.6.2 Main Business

5.6.3 Store Network

5.6.4 Partners

5.7NFA

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 New FocusAiyihang

5.7.5 Changchun Quangda

5.7.6 Shanghai New Focus

5.7.7 New Focus Yonglonghang

5.8 Harson Service

5.8.1 Profile

5.8.2 Comparison between Three Businesses

5.8.3 Business Model

5.8.4 Harson Luxury Car Repair Chain

5.8.5 Easy Medium Car Repair Chain

5.9 Tqmall

5.9.1 Tqmall.com

5.9.2 yunqixiu.com

5.10 Chexiangjia

5.10.1 Profile

5.10.2 Main Services

5.10.3 Business Network

5.10.4 Recent Development

5.11 y1s.cn

5.11.1 Profile

5.11.2 Main Services

5.11.3 Service Network

5.11.4 Business Model