2014年开始,从乐视、阿里巴巴、腾讯、谷歌、百度等互联网巨头企业纷纷提出布局智能联网汽车领域,再到智车优行、小鹏汽车、蔚来汽车、威马汽车等新兴互联网造车企业的创立,互联网造车发展提速明显。2016年各种互联网造车发展的消息更是被大众所关注,先是传统车企高管跳槽互联网车企,紧接着是乐视超级汽车发布,以及蔚来汽车和江淮汽车签订代工协议等。

但截至目前,大部分互联网企业造车还停留在规划和概念阶段,只有部分互联网造车企业已取得一些实质性进展。具体有以下几个方面:

产品方面,大部分企业推出概念车,2016年7月,阿里巴巴与上汽合作发布可量产的互联网汽车荣威RX5,发布首月订单量达2.5万辆。

车厂布局方面,部分互联网造车企业自主生产厂已处于建设状态,如乐视汽车(浙江基地)、车和家(常州常武基地),威马汽车(温州基地)、凌云汽车(合肥基地)等;还有部分互联网造车企业已确定代工工厂,如蔚来汽车(确定江淮汽车代工)、小鹏汽车、智车优行等。

融资方面,大部分互联网造车企业已实现A轮融资,如乐视汽车(A轮10.8亿美元)、威马汽车(10.0亿美元)、车和家(7.8亿美元等;部分正进行B轮融资。

汽车生产制造资质方面,只有少部分互联网企业通过收购或合作等方式获取新能源汽车生产制造资质,如电咖汽车(通过与东南汽车合作);和谐富腾(通过控股绿野汽车),尚未出现单独获取新能源汽车生产制造资质的互联网造车企业。

短期看,受汽车基础制造及生产线布局等限制,互联网造车企业发展较为悲观,仍处于车联网产品、ADAS等互联网技术产品研发投入阶段。

但长远来看,根据互联网造车战略规划来看,互联网造车企业与传统车企发展方向不谋而合,电动化、智能化、互联网化的汽车产品发展将促使互联网企业的硬件化与传统车企的互联网化的互相融合,最后呈现融合发展趋势。主要因素有:(1)互联网+和新能源汽车等相关利好政策;(2)个性化、定制化汽车需求增加推动;(3)互联网造车企业互联网技术优势有利于提前布局互联网汽车。

水清木华研究中心《2016年中国互联网造车行业研究报告》主要包括三大板块,分别是:中国互联网造车行业政策、发展进程、发展途径、融资及发展趋势等;中国汽车智能化、电动化及互联网化发展现状及企业布局及发展趋势等和中国13家互联网造车企业、核心人才、融资、工厂、战略规划及发展布局等。

Starting in 2014, Internet giants like LeEco, Alibaba, Tencent, Google, and Baidu announced to set foot in the field of intelligent connected cars successively. Moreover, the emerging internet firms that venture into car manufacturing such as ZHICHEAUTO, Xiaopeng Motors, NextEV, and WM Motor were successively established, which obviously paces up the development of Internet giants' car manufacturing. In 2016, various news about Internet giants' car manufacturing aroused public concern. First, senior executives of traditional automakers left for internet companies that venture into car manufacturing, and then LeSEE was released and NextEV and JAC signed OEM agreements.

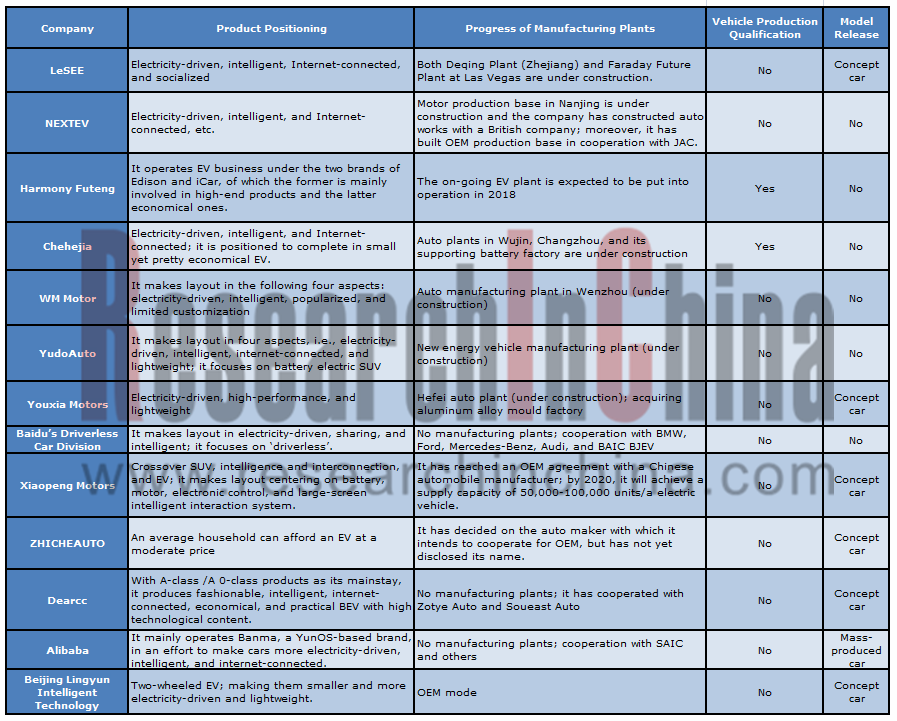

So far, however, the car manufacturing of most internet companies has been still in planning and conceptual phase, but only a few have made substantial progress, which is reflected in the following:

In terms of product, most players have launched concept cars. In July 2016, Alibaba and BAIC jointly rolled out Roewe RX5, a connected car model that can be mass produced, with the order volume of 25,000 units in the first month after the release.

As for the footprint of auto plants, some Internet giants that venture into car manufacturing has started construction of their independent manufacturing factories, such as LeSEE’s Zhejiang Base, Chehejia’sChangwu Base in Changzhou, WM Motor’s Wenzhou Base, and LingyunIntelligent’s Hefei Base; others have confirmed their OEM plants, including NextEV (with JAC), Xiaopeng Motors, and ZHICHEAUTO.

With regard to financing, most Internet giants that venture into car manufacturing have achieved A-round of financing, such as LeSEE (USD1.08 billion), WM Motor (USD1 billion), and Chehejia (USD780 million); only a few companies are conducting B round of financing.

In terms of automotive manufacturing qualification, only a small number of Internet firms have gained qualification for the production of new energy vehicles through M&A or cooperation, these companies including Dearcc (cooperation withSoueast Motor) and Harmony Futeng (through the holding of Zhejiang Green Field Motor). As yet, there has been no individual Internet company that has obtained the qualification for manufacturing new energy vehicles.

In the short run, restricted by basic manufacturing of automobiles and layout of production line, the development of Internet giants that venture into car manufacturing is pessimistic, and they still need to put fund into the development of telematics products, ADAS, and other Internet technological products.

But in the long run, according to the strategic planning for Internet giants' car manufacturing, Internet giants that venture into car manufacturing happen to share the development direction with traditional car makers. Development of electricity–driven, intelligent, and internet-connected auto products helps make it possible to mutually fuse Internet companies’ hardware-oriented development with internet-connection of traditional auto makers, at length leading to a gradual fusion development. This mainly comes out of the following factors: (1) favorable polices on Internet Plus and new energy vehicles; (2) the increase in demand for personalized and customized automobiles; (3) With Internet technical superiority, Internet giants that venture into car manufacturing could easily make layout in Internet-connected vehicles in advance.

The report mainly includes three sections:

(1)Industry policies, development history, development path, financing, and development trend, etc. of China’s Internet giants' car manufacturing industry;

(2)Current situation, enterprise presence, and development trend, etc. of intelligent, electricity-driven, and Internet-connected automobiles in China

(3)Core talents, financing, plants, strategic planning, and development layout, etc. of 13 Chinese Internet giants that venture into car manufacturing

Development History of Major Internet Giants That Venture into Car Manufacturing in China

第一章 互联网造车概况

1.1 定义

1.2 分类

1.3 特点

1.4 优劣势

第二章 互联网造车市场发展情况

2.1 概述

2.2 政策

2.3 发展路径

2.4 融资

2.5 产品定位

2.6 盈利模式

2.7 销售渠道

2.8 发展趋势

2.8.1 推动汽车产业变革

2.8.2 互联网造车未来将实现融合性发展趋势

2.8.3 电动化、智能化、互联网化等是汽车产品主要发展方向

第三章 中国汽车智能化、电动化、互联网化发展情况

3.1 电动汽车

3.1.1 发展现状

3.1.2 企业格局

3.2 互联网化

3.2.1 概述

3.2.2 发展现状

3.2.3 企业布局

3.3 智能汽车

3.3.1 概况

3.3.2 发展现状

3.3.3 企业布局

3.3.4 发展趋势

第四章 互联网造车企业

4.1 乐视超级汽车

4.1.1 企业简介

4.1.2 核心人员

4.1.3 融资

4.1.4 产品

4.1.5 工厂

4.1.6 战略布局

4.1.7 发展动态

4.2 蔚来汽车

4.2.1 企业简介

4.2.2 核心人员

4.2.3 融资

4.2.4 工厂

4.2.5 产品

4.2.6 最新动态

4.3 和谐富腾

4.3.1 企业简介

4.3.2 核心人员

4.3.3 融资

4.3.4 产品

4.3.5 战略

4.4 车和家

4.4.1 企业简介

4.4.2 核心人员

4.4.3 融资

4.4.4 产品

4.4.5 工厂

4.4.6 战略

4.5 威马汽车

4.5.1 企业简介

4.5.2 核心人员

4.5.3 融资

4.5.4 工厂

4.5.5 战略

4.6 云度新能源

4.6.1 企业简介

4.6.2 核心人员

4.6.3 战略

4.6.4 产品

4.6.5 工厂

4.6.6 最新动态

4.7 百度无人车

4.7.1 企业简介

4.7.2 核心人员

4.7.3 合作伙伴

4.7.4 战略规划

4.7.5 无人车测试

4.8 小鹏汽车

4.8.1 企业简介

4.8.2 核心人才

4.8.3 产品

4.8.4 融资

4.8.5 战略规划

4.9 智车优行

4.9.1 企业简介

4.9.2 核心人员

4.9.3 合作伙伴

4.9.4 融资

4.9.5 产品

4.9.6 战略规划及进展

4.10 电咖汽车

4.10.1 企业简介

4.10.2 核心人员

4.10.3 产品

4.10.4 合作伙伴

4.10.5 战略定位

4.11 阿里巴巴

4.11.2 企业简介

4.11.3 核心人员

4.11.4 产品

4.11.5 合作伙伴

4.11.6 战略定位

4.12 游侠汽车

4.12.1 企业简介

4.12.2 产品

4.12.3 合作伙伴

4.12.4 工厂

4.12.5 战略布局

4.13 凌云汽车

4.13.1 企业简介

4.13.2 经营情况

4.13.3 融资

4.13.4 产品

4.13.5 战略规划

1 Overview of Internet Giants' Car Manufacturing

1.1 Definition

1.2 Classification

1.3 Characteristics

1.4 Advantages and Disadvantages

2 Development of Internet Giants' Car Manufacturing Market

2.1 Overview

2.2 Policy

2.3 Development Path

2.4 Financing

2.5 Product Positioning

2.6 Profit Model

2.7 Sales Channel

2.8 Development Trend

2.8.1 Boosting Transformation of Automobile Industry

2.8.2 Internet Giants' Car Manufacturing Leans to Fusion Development

2.8.3 Automobiles will Develop towards Electricity-Driven, Smart, and Internet-connected Cars

3 Chinese Automobiles will Develop towards Electricity-Driven, Smart, and Internet-connected Cars

3.1 Electric Vehicle

3.1.1 Current Situation

3.1.2 Corporate Competition

3.2 Internet-Connected

3.2.1 Overview

3.2.2 Current Situation

3.2.3 Enterprises’ Layout

3.3 Smart Cars

3.3.1 Overview

3.3.2 Current Situation

3.3.3 Enterprises’ Layout

3.3.4 Development Trend

4 Internet Giants That Venture into Car Manufacturing

4.1 LeSEE

4.1.1 Profile

4.1.2 Core Talents

4.1.3 Financing

4.1.4 Products

4.1.5 Plants

4.1.6 Strategic Layout

4.1.7 Dynamics

4.2 NextEV

4.2.1 Profile

4.2.2 Core Talents

4.2.3 Financing

4.2.4 Plants

4.2.5 Products

4.2.6 Dynamics

4.3 Harmony Futeng

4.3.1 Profile

4.3.2 Core Talents

4.3.3 Financing

4.3.4 Products

4.3.5 Strategy

4.4 Chehejia

4.4.1 Profile

4.4.2 Core Talents

4.4.3 Financing

4.4.4 Products

4.4.5 Plants

4.4.6 Strategy

4.5 WM Motor

4.5.1 Profile

4.5.2 Core Talents

4.5.3 Financing

4.5.4 Plants

4.5.5 Strategy

4.6 YudoNew Energy Vehicle (Yundo Auto)

4.6.1 Profile

4.6.2 Core Talents

4.6.3 Strategy

4.6.4 Products

4.6.5 Plants

4.6.6 Dynamics

4.7 Baidu’s Driverless Car Division

4.7.1 Profile

4.7.2 Top Management Team

4.7.3 Partners

4.7.4 Strategic Planning

4.7.5 Driverless Car Testing

4.8 Xiaopeng Motors

4.8.1 Profile

4.8.2 Core Talents

4.8.3 Products

4.8.4 Financing

4.8.5 Strategic Planning

4.9 ZHICHEAUTO

4.9.1 Profile

4.9.2 Core Talents

4.9.3 Partners

4.9.4 Financing

4.9.5 Products

4.9.6 Strategic Planning and Development

4.10 Beijing Dearcc Auto Technology

4.10.1 Profile

4.10.2 Core Talents

4.10.3 Products

4.10.4 Partners

4.10.5 Strategic Positioning

4.11 Alibaba

4.11.1 Profile

4.11.2Core Talents

4.11.3 Products

4.11.4 Partners

4.11.5 Strategic Positioning

4.12 Youxia Motors

4.12.1 Profile

4.12.2 Products

4.12.3 Partners

4.12.4 Plants

4.12.5 Strategic Layout

4.13 Beijing Lingyun Intelligent Technology

4.13.1 Profile

4.13.2 Operation

4.13.3 Financing

4.13.4 Products

4.13.5 Strategic Planning