|

|

|

报告导航:研究报告—

金融与服务业—交通物流

|

|

2018-2022年中国冷链物流行业报告 |

|

字数:5.8万 |

页数:170 |

图表数:181 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:3200美元 |

英文纸版:3400美元 |

英文(电子+纸)版:3500美元 |

|

编号:ZJF116

|

发布日期:2018-05 |

附件:下载 |

|

|

|

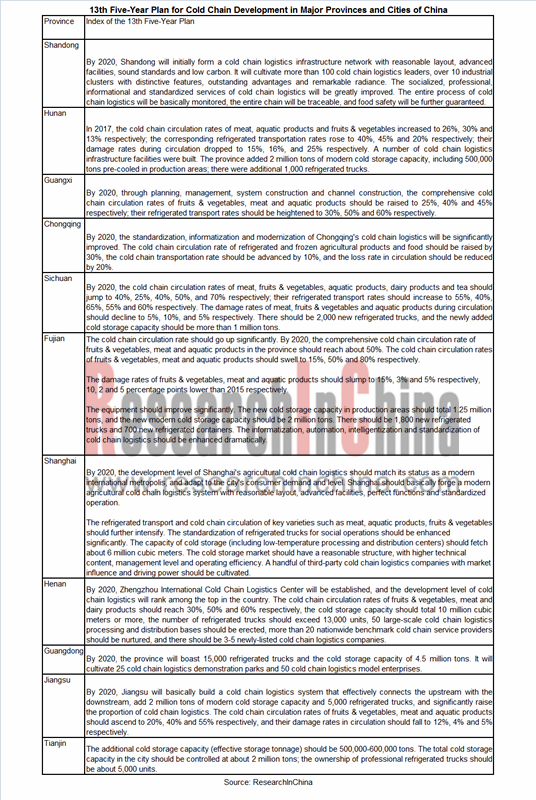

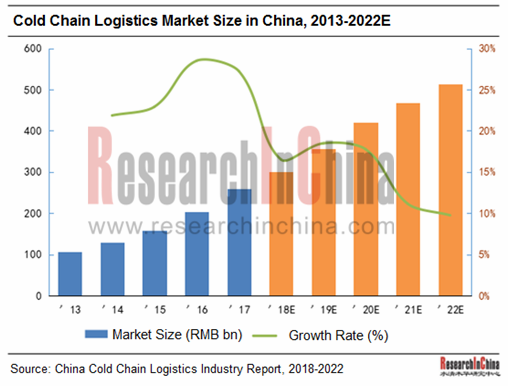

得益于中国经济发展,城镇化进程的不断推进,居民食品消费结构不断调整,市场对食品冷链的需求不断提升,同时各级政府加大了冷链基础设施建设的投入,推动了冷链物流快速发展。2017年,冷链物流行业的市场规模增长到2,588亿元,较2010年年均复合增长20.5%。未来随着冷链政策及标准趋于清晰,生鲜电商的崛起和金融创新的持续深入,将进一步带动冷链物流行业的发展。到2022年,中国冷链物流行业市场规模将达到5,129亿元,2017-2022年间的年均复合增长率将达到14.7%。

中国冷链物流的需求主要来自五类农产品:肉类、水产品、速冻食品、果蔬以及乳制品。根据统计,2017年中国冷链流通量为41,763万吨,同比增长13.8%,预计2022年规模将达到61,808万吨,较2017年年均增长8.2%。其中,依冷链流通量计算,果蔬冷链是目前市场规模最大的细分市场,水产品冷链需求增长较快,随着冷链技术成熟度的持续提高,这两类产品将保持较大的市场份额。此外,医药类产品将成为冷链物流重要增长点,尤其是疫苗、血液制品以及诊断试剂等产品。

行业竞争方面,在冷链物流各产业链中:

物流运营-多数冷链物流运营企业通常兼具冷库运营和冷链运输运营双重功能,例如鲜易控股,太古冷链,郑明物流等企业不仅运营的冷库容量在国内排名靠前,同时拥有强大的运输能力。 物流运营-多数冷链物流运营企业通常兼具冷库运营和冷链运输运营双重功能,例如鲜易控股,太古冷链,郑明物流等企业不仅运营的冷库容量在国内排名靠前,同时拥有强大的运输能力。

冷库运营-中国冷库市场较为分散,市场集中度较低,地域属性较高。根据统计数据,2017年前十名冷库运营企业冷库容积为2,771万立方米,占据约23.2%的市场份额其中具备代表性的企业包括河南鲜易、太古冷链、招商美冷等,这些企业在全国各地拥有较大的冷库网络。 冷库运营-中国冷库市场较为分散,市场集中度较低,地域属性较高。根据统计数据,2017年前十名冷库运营企业冷库容积为2,771万立方米,占据约23.2%的市场份额其中具备代表性的企业包括河南鲜易、太古冷链、招商美冷等,这些企业在全国各地拥有较大的冷库网络。

冷藏车-冷藏车第一梯队中,福田、江淮以及东风占有了近60%的市场,第二梯队品牌,一汽、庆铃、冰熊、中集、康飞、飞驰以及江铃占据了27%的市场份额。其他份额则其他特种车改装厂和小型企业占据。 冷藏车-冷藏车第一梯队中,福田、江淮以及东风占有了近60%的市场,第二梯队品牌,一汽、庆铃、冰熊、中集、康飞、飞驰以及江铃占据了27%的市场份额。其他份额则其他特种车改装厂和小型企业占据。

冷藏设备-大型冷冻冷藏设备市场呈现出烟台冰轮和大冷股份双寡头格局,雪人股份则瞄准了冷链物流市场,进行产业链延伸。 冷藏设备-大型冷冻冷藏设备市场呈现出烟台冰轮和大冷股份双寡头格局,雪人股份则瞄准了冷链物流市场,进行产业链延伸。

水清木华研究中心《2018-2022年中国冷链物流行业研究报告》报告主要包括以下内容:

冷链物流行业概况(包括定义、分类、组成结构、产业链、市场特点、经营模式、行业政策等); 冷链物流行业概况(包括定义、分类、组成结构、产业链、市场特点、经营模式、行业政策等);

中国冷链物流市场总体情况(包括市场规模、市场需求、竞争格局、市场结构、发展前景等以及长三角、珠三角以及京津冀重点地区分析); 中国冷链物流市场总体情况(包括市场规模、市场需求、竞争格局、市场结构、发展前景等以及长三角、珠三角以及京津冀重点地区分析);

冷流物流细分市场分析(包括果蔬、肉类、速冻米面、水产品、奶制品等冷链市场的特点及需求等); 冷流物流细分市场分析(包括果蔬、肉类、速冻米面、水产品、奶制品等冷链市场的特点及需求等);

冷库市场分析,包括市场概况、总体容量、区域分析、竞争格局以及市场预测; 冷库市场分析,包括市场概况、总体容量、区域分析、竞争格局以及市场预测;

冷藏车市场分析,包括市场概况、总体规模、区域分析、竞争格局以及市场预测; 冷藏车市场分析,包括市场概况、总体规模、区域分析、竞争格局以及市场预测;

制冷设备市场分析,包括市场概况、总体规模、区域分析、竞争格局; 制冷设备市场分析,包括市场概况、总体规模、区域分析、竞争格局;

冷链运营企业分析,共计20家,包括企业简介、经营业绩、营收构成、冷链业务、发展战略等; 冷链运营企业分析,共计20家,包括企业简介、经营业绩、营收构成、冷链业务、发展战略等;

冷藏车厂商分析,共计12家,包括企业简介、经营业绩、营收构成、冷藏车业务、发展战略等。 冷藏车厂商分析,共计12家,包括企业简介、经营业绩、营收构成、冷藏车业务、发展战略等。

冷制冷设备厂商分析,共计5家,包括企业简介、经营业绩、营收构成、冷链设备业务、发展战略等。 冷制冷设备厂商分析,共计5家,包括企业简介、经营业绩、营收构成、冷链设备业务、发展战略等。

The market demand for food cold chain is on a steady rise in the wake of rapid development of China’s economy, the accelerated process of urbanization as well as the changes in the structure of residents’ food consumption. In the meantime, the governments at all level have been investing more in construction of cold chain infrastructure, being conductive to the fast development of cold chain logistics. In 2017, the market size of cold chain logistics in China rose to RMB258.8 billion, showing a CAGR of 20.5% during 2010-2017. As the cold chain policy and standards grow clear in China, the rising of fresh food e-businesses and the deepening of financial innovation will facilitate progresses in the cold chain logistics industry in the future. Till 2022, China’s cold chain logistics market will be worth RMB512.9 billion, remaining a CAGR of 14.7% between 2017 and 2022.

In China, the demand for cold chain logistics comes mainly from agricultural products including meat, aquatic products, quick-frozen food, fruits & vegetables, and dairy products. In 2017, cold chain circulation transport in China reached 417.63 million tons, an upsurge of 13.8% from a year earlier, and it is expected to report 618.08 million tons in 2022, with an estimated AAGR at 8.2% during 2017-2022. If based on cold chain circulation transport, fruits & vegetables cold chain is the biggest market segment for the moment, while the demand for cold chain of aquatic products is growing rapidly. With the growing maturity of cold chain technologies, these two kinds of products will seize more market shares. Additionally, pharmaceuticals, particularly vaccines, blood products and diagnostic reagents will be a key growth engine of cold chain logistics.

Competition in the industrial chains of cold chain logistics is presented as follows:

Logistics operation: a majority of cold chain logistics enterprises are generally engaged in both cold storage operation and cold chain transportation and they have strong competences, such as Xianyi Holding, Swire Cold Chain Logistics, and Zhengming Modern Logistics.

Cold storage operation: Chinese cold storage market is scattered with a low concentration degree and featured with strong regionality. In 2017, the top ten cold storage enterprises boasted cold storage volume of 27.71 million cubic meters together, accounting for 23.2% of market shares. The representative players consist of Xianyi Holding, Swire Cold Chain Logistics, and China Merchants Americold, all of which are in possession of a grand cold storage network nationwide.

Refrigerated truck: Of the first echelon of refrigerated trucks, Foton, JAC and Dongfeng Motor sweep nearly 60% market shares together. The brands in second echelon are composed of FAW, Qingling Motors, Henan Bingxiong Special Vehicle Manufacturing, China International Marine Containers (Group) Ltd (CIMC), KF Mobile Systems, Zhenjiang Speed Automobile Group, and Jiangling Motors Co., Ltd. (JMC), holding 27% market shares in all. The remaining shares go to other special vehicle refitting factories and small firms.

Refrigerating equipment: the large freezing and refrigerating equipment market is a duopoly and firmly occupied by Yantai Moon Co., Ltd and Dalian Refrigeration Co., Ltd, while Fujian Snowman Co., Ltd targets the cold chain logistics market and extends industrial chains.

China Cold Chain Logistics Industry Report, 2018-2022 by ResearchInChina highlights the followings:

Cold chain logistics industry (definition, classification, composition structure, market features, business model, industrial policies, etc.);

Cold chain logistics market in China (market size, demand, competitive landscape, market structure, development prospects as well as analysis of cold chain logistics in key areas like the Yangtze River Delta, the Pearl River Delta and the Beijing-Tianjin-Hebei region);

Cold Chain logistics market segments (features, demand, etc. of cold chain markets like fruits & vegetables, meat, quick-frozen rice and flour products, aquatics and dairy products);

Cold storage market (overview, total capacity, regional analysis, competitive pattern and predictions);

Refrigerated truck market (overview, overall size, regional analysis, competitive landscape and forecasts);

Refrigerating equipment market (overview, overall size, regional analysis and competitive landscape);

20 cold chain operation enterprises (profile, business performance, revenue structure, cold chain business, development strategies, etc.);

12 refrigerated truck manufacturers (profile, business performance, revenue structure, refrigerated truck business, development strategies, etc.);

5 refrigerating equipment manufacturers (profile, business performance, revenue, cold chain equipment business, development strategies, etc.).

PART I 行业纵览

第一章 冷链物流简介

1.1 定义

1.2 分类

1.2.1 冷库分类

1.2.2 冷藏车分类

1.3 主要特点

1.4 发展概况

第二章 主要行业政策分析

2.1 政策环境

2.2 冷链行业相关标准

2.2.1 冷链物流基础标准

2.2.2 冷库及冷冻冷藏设备类标准

PART II 市场总体概况

第三章 冷链发展概况

3.1 发展现状

3.2 总体市场规模

3.3 市场预测

3.4 市场结构

第四章 重点地区冷链发展概况

4.1长三角冷链物流发展概述

4.1.1 经济运行情况

4.1.2 该地区近期主要冷链政策

4.1.3 冷链物流发展现状与需求

4.2 珠三角冷链物流发展概述

4.2.1 经济运行情况

4.2.2 冷链物流发展现状与需求

4.3 京津冀地区冷链物流发展综述

4.3.1 经济运行情况

4.3.2 冷链物流发展现状与需求

PART III 冷链运营市场分析

第五章 冷链物流细分行业

5.1 肉类冷链

5.1.1 主要特点

5.1.2 肉类行业现状

5.1.3 肉类冷链需求分析

5.2 水产品冷链

5.2.1 水产品冷链主要特点

5.2.2 水产行业现状

5.2.3 水产冷链需求分析

5.3 速冻米面

5.3.1 速冻米面冷链主要特点

5.3.2 速冻米面行业现状

5.3.3 速冻米面冷链需求分析

5.4 果蔬冷链

5.4.1 果蔬冷链主要特点

5.4.2 果蔬行业现状

5.4.3 果蔬冷链需求分析

5.5 奶制品冷链

5.5.1 奶制品冷链主要特点

5.5.2 奶制品行业现状

5.5.3 奶制品冷链需求分析

5.6 医药冷链

5.6.1 医药冷链主要特点

5.6.2 医药冷链发展现状

5.6.3 医药冷链需求分析

5.7 生鲜电商的冷链需求

5.7.1 商业模式

5.7.2 市场规模

第六章 冷库市场

6.1 总体概况

6.2 冷库容量

6.3 区域市场分析

6.4 竞争格局

6.5 冷库市场规模预测

第七章 冷链运营企业

7.1 鲜易控股

7.1.1 公司简介

7.1.2 业务介绍

7.1.3 河南众品食业股份有限公司

7.1.4 河南鲜易供应链有限公司

7.1.5 阿里巴巴与众品食业签署战略合作协议

7.2 郑明物流

7.2.1 公司简介

7.2.2 冷链业务

7.3 山东盖世

7.3.1 公司简介

7.3.2 冷链物流业务

7.3.3 盖世“十三五”规划

7.4 沈阳副食集团

7.4.1 公司简介

7.4.2 冷链物流业务

7.5 镇江恒伟

7.5.1 公司简介

7.5.2 冷链运输服务

7.5.3 仓储冷藏服务

7.6 太古冷链

7.6.1 公司简介

7.6.2 主要业务

7.6.3 冷库业务分布

7.6.4 广东太古冷链物流有限公司

7.6.5 2020年规划

7.7 招商美冷

7.7.1 公司简介

7.7.2 冷链网络

7.7.3 康新物流

7.7.4 天津二期冷库项目进展情况

7.8 上海领鲜

7.8.1 公司简介

7.8.2 输配送网络

7.8.3 冷库运营

7.9 希杰荣庆

7.9.1 公司简介

7.9.2 主要业务

7.9.3 冷链物流战略

7.9.4 CJ荣庆中国总部项目太仓奠基

7.10 光明地产

7.10.1 公司简介

7.10.2 经营状况

7.10.3 营收结构

7.10.4 毛利率分析

7.11 锦江国际

7.11.1 公司简介

7.11.2 经营状况

7.11.3 营收结构

7.11.4毛利率分析

7.11.5 冷链物流发展状况

7.11.6 上海新天天大众冷链物流有限公司

7.12 中外运

7.12.1 公司简介

7.12.2 经营状况

7.12.3 营收结构

7.12.4中外运冷链物流

7.12.5 中外运普菲斯

7.13 成都银犁

7.13.1 公司简介

7.13.2 主要业务

7.13.3 成都银犁冷链物流中心项目进展

7.14 海航冷链

7.14.1 公司简介

7.14.2 经营状况

7.14.3 毛利率分析

7.14.4 冷链物流业务

7.14.5 仓储业务

7.14.6 主要设施

7.14.7 北京冷链物流中心启动

7.15 北京二商

7.15.1 公司简介

7.15.2 二商西冷

7.15.3 二商福岛

7.15.4 北京三新冷藏储运有限公司

7.16 湖南红星

7.16.1 公司简介

7.16.2 冷链物流业务

7.17 天津水产集团

7.17.1 公司简介

7.17.2 冷链物流业务

7.18 辽渔集团

7.18.1 公司简介

7.18.2 冷冻冷藏业务

7.19 杭州五丰

7.19.1 公司简介

7.19.2 冷链业务

7.20 武汉万吨

7.20.1 公司简介

7.20.2 业务介绍

PART IV 冷链设备市场分析

第八章 冷藏车市场分析

8.1 总体市场销售情况

8.2 区域分布

8.3 竞争格局

第九章 中国冷藏车厂商分析

9.1 北汽福田

9.1.1 公司简介

9.1.2 经营状况

9.1.3 营收构成

9.1.4 毛利率

9.1.5 北汽福田推出风景G7国五面包冷藏车

9.2 江淮汽车

9.2.1公司简介

9.2.2经营状况

9.2.3产能分布

9.2.4 冷藏车业务

9.3 东风汽车

9.3.1公司简介

9.3.2 经营状况

9.3.3 产销情况

9.3.4 产能分布

9.3.5 冷藏车业务

9.4 重庆庆铃

9.4.1公司简介

9.4.2经营状况

9.4.3 冷藏车业务

9.5 一汽解放

9.5.1公司简介

9.5.2 冷藏车业务

9.5.3 生产基地

9.6 河南冰熊

9.6.1 公司简介

9.6.2 冷藏车业务

9.6.3 生产基地

9.7 中集车辆

9.7.1 公司简介

9.7.2 冷藏车业务

9.8 镇江康飞

9.8.1 公司简介

9.8.2 冷藏车业务

9.9 镇江飞驰

9.9.1 公司简介

9.9.2 冷藏车业务

9.10 江铃汽车

9.10.1 公司简介

9.10.2江铃股份

9.10.3 冷藏车业务

9.10.4产能分布

9.11 新飞专用车

9.11.1 公司简介

9.11.2 冷藏车销量

9.12 郑州红宇

9.12.1 公司简介

9.12.2 冷藏车业务

第十章 制冷设备市场分析

10.1 市场总体情况

10.2 区域分布

10.3 竞争格局

第十一章 制冷设备生产商分析

11.1 大冷股份

11.1.1 公司简介

11.1.2经营状况

11.1.3 营收构成

11.1.4 毛利率

11.1.5 主要产品

11.1.6 资源整合

11.2 冰轮环境

11.2.1 公司简介

11.2.2 经营状况

11.2.3 营收构成

11.2.4 毛利率

11.2.5 主要产品

11.3 广州拜尔

11.3.1 公司简介

11.3.2 主要业务

11.4 凯雪冷链

11.4.1 公司简介

11.4.2 经营状况

11.4.3 营收结构

11.4.4 毛利率分析

11.4.5 主要产品及客户

11.5 铁龙物流

11.5.1 公司简介

11.5.2 营业状况

11.5.3 营收结构

11.5.4 毛利率分析

11.5.5 冷链业务

PART I Industry Overview

1. Introduction to Cold Chain Logistics in China

1.1 Definition

1.2 Classification

1.2.1 Classification of Cold Storage

1.2.2 Classification of Refrigerated Trucks

1.3 Features

1.4 Development Overview

2. Major Industry Policies

2.1 Policy Environment

2.2 Relevant Standards for Cold Chain Industry

2.2.1 Basic Standards for Cold Chain Logistics

2.2.2 Standards for Cold Storage and Freezing Equipment

PART II Market Overview

3. Development of Cold Chain

3.1 Current Situation

3.2 Overall Market Size

3.3 Market Prediction

3.4 Market Structure

4. Development of Cold Chain Logistics in Key Regions

4.1 Yangtze River Delta Region

4.1.1 Economic Operation

4.1.2 New Policy of the District

4.1.3 Development of and Demand for Cold Chain Logistics

4.2 Development of Cold Chain Logistics in Pearl River Delta Region

4.2.1 Economic Operation

4.2.2 Development of and Demand for Cold Chain Logistics

4.3 Development of Cold Chain Logistics in Beijing-Tianjin-Hebei Region

4.3.1 Economic Operation

4.3.2 Development of and Demand for Cold Chain Logistics

PART III Cold Chain Operation Market

5. Cold Chain Logistics Industry Segments

5.1 Meat Products

5.1.1 Features of Meat Products Cold Chain Logistics

5.1.2 Industry Status Quo

5.1.3 Demand for Cold Chain Logistics

5.2 Aquatic Products

5.2.1 Features of Aquatic Products Cold Chain Logistics

5.2.2 Industry Status Quo

5.2.3 Demand for Cold Chain Logistics

5.3 Quick-frozen Flour Food

5.3.1 Features of Quick-frozen Flour Food Cold Chain Logistics

5.3.2 Industry Status Quo

5.3.3 Demand for Cold Chain Logistics

5.4 Fruits & Vegetables

5.4.1 Features of Fruit & Vegetable Cold Chain Logistics

5.4.2 Industry Status Quo

5.4.3 Demand for Cold Chain Logistics

5.5 Dairy Products

5.5.1 Features of Dairy Product Cold Chain Logistics

5.5.2 Industry Status Quo

5.5.3 Demand for Cold Chain Logistics

5.6 Pharmaceuticals

5.6.1 Features of Medicine Cold Chain Logistics

5.6.2 Status Quo of Medicine Cold Chain Logistics

5.6.3 Demand for Cold Chain Logistics

5.7 Demand of E-commerce for Fresh Food Cold Chain

5.7.1 Business Model

5.7.2 Market Size

6. Cold Storage Market

6.1 Overview

6.2 Capacity of Cold Storage

6.3 Analysis of Regional Markets

6.4 Competitive Landscape

6.5 Cold Storage Market Size Forecast

7. Cold Chain Operators

7.1 Xianyi Holdings

7.1.1 Profile

7.1.2 Business

7.1.3 Henan Zhongpin Food Share Co., Ltd.

7.1.4 Henan Xianyi Supply Chain Co., Ltd.

7.1.5 Alibaba and Zhongpin Corporation Signed Strategic Cooperation Agreement

7.2 ZM Logistics

7.2.1 Profile

7.2.2 Cold Chain Business

7.3 Shandong Gaishi Farming Co., Ltd.

7.3.1 Profile

7.3.2 Cold Chain Logistics Business

7.3.3 Gaishi’s “the 13th Five-Year” Plan (2016-2020)

7.4 Shenyang Nonstaple Food Group

7.4.1 Profile

7.4.2 Cold Chain Logistics Business

7.5 Zhenjiang Hengwei Supply Chain Management Co., Ltd.

7.5.1 Profile

7.5.2 Cold Chain Transportation Service

7.5.3 Cold Storage Service

7.6 Swire Cold Chain Logistics Co. Ltd.

7.6.1 Profile

7.6.2 Main Business

7.6.3 Cold Storage Business Distribution

7.6.4 Guangdong Swire Cold Chain Logistics Co. Ltd.

7.6.5 Planning for 2020

7.7 CMAC

7.7.1 Profile

7.7.2 Cold Chain Network

7.7.3 Kangxin Logistics Co., Ltd.

7.7.4 Tianjin Phase II Cold Storage Base Project Progress

7.8 Shanghai Speed Fresh Logistics Co., Ltd.

7.8.1 Profile

7.8.2 Distribution Network

7.8.3 Cold Storage Operation

7.9 CJ Rokin Logistics and Supply Chain Co., Ltd.

7.9.1 Profile

7.9.2 Main Business

7.9.3 Cold Chain Logistics Strategy

7.9.4 Ground Breaking for CJ Rokin’s Taicang-based Headquarters

7.10 Bright Real Estate Group Co., Ltd

7.10.1 Profile

7.10.2 Operation

7.10.3 Revenue Structure

7.10.4 Gross Margin

7.11 Shanghai Jin Jiang International Industrial Investment Co., Ltd

7.11.1 Profile

7.11.2 Operation

7.11.3 Revenue Structure

7.11.4 Gross Margin

7.11.5 Cold Chain Logistics Development

7.11.6 Shanghai Xintiantian Dazhong Cold Logistics Co., Ltd.

7.12 Sinotrans Ltd.

7.12.1 Profile

7.12.2 Operation

7.12.3 Revenue Structure

7.12.4 Sinotrans Cold Chain Logistics

7.12.5 SinoTransPFS

7.13 Chengdu Silverplow Low-temperature Logistics

7.13.1 Profile

7.13.2 Main Business

7.13.3 Progress of Cold Chain Logistics Center

7.14 HNA Cold Chain

7.14.1 Profile

7.14.2 Operation

7.14.3 Gross Margin

7.14.4 Cold Chain Logistics Business

7.14.5 Warehousing Business

7.14.6 Main Facilities

7.14.7 Beijing Cold Chain Logistics Center Is Launched

7.15 Beijing Er Shang Group

7.15.1 Profile

7.15.2 Beijing Er-shang Group Xijiao Food Freezing Factory

7.15.3 Beijing Er Shang-Fukushima Machinery Electric

7.15.4 Beijing Sanxin Refrigeration Logistics Co., Ltd.

7.16 Hunan Hongxing Frozen Food

7.16.1 Profile

7.16.2 Cold Chain Logistics Business

7.17 Tianjin Fisheries Group

7.17.1 Profile

7.17.2 Cold Chain Logistics Business

7.18 Liaoning Dalian Ocean Fishery Group

7.18.1 Profile

7.18.2 Refrigeration Business

7.19 Hangzhou NF United Meat Co., Ltd.

7.19.1 Profile

7.19.2 Cold chain Business

7.20 Wuhan Wandun Cold Storage Logistics Co., Ltd

7.20.1 Profile

7.20.2 Business

PART IV Cold Chain Equipment Market Analysis

8. Refrigerated Truck Market

8.1 Overall Market Sales

8.2 Regional Distribution

8.3 Competition Pattern

9. Refrigerated Truck Manufacturers

9.1 BeiQi Foton Motor Co., Ltd.

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 BeiQi Foton Motor launched View G7 refrigerated vans in line with the national V emission standard

9.2 Anhui Jianghuai Automobile Co., Ltd. (JAC)

9.2.1 Profile

9.2.2 Operation

9.2.3 Capacity Distribution

9.2.4 Refrigerated Truck

9.3 Dongfeng Automobile Co., Ltd.

9.3.1 Profile

9.3.2 Operation

9.3.3 Production and Sales

9.3.4 Capacity Distribution

9.3.5 Refrigerated Truck

9.4 Qingling Motors

9.4.1 Profile

9.4.2 Operation

9.4.3 Refrigerated Truck

9.5 FAW Jiefang

9.5.1 Profile

9.5.2 Refrigerated Truck

9.5.3 Manufacturing Bases

9.6 Henan Bingxiong Special Vehicle Manufacturing Co., Ltd.

9.6.1 Profile

9.6.2 Refrigerated Truck

9.7 CIMC Vehicles (Group) Co., Ltd.

9.7.1 Profile

9.7.2 Refrigerated Truck

9.8 KF Mobile Systems

9.8.1 Profile

9.8.2 Refrigerated Truck

9.9 Zhenjiang Speed Automobile Group Co., Ltd.

9.9.1 Profile

9.9.2 Refrigerated Truck

9.10 Jiangling Motors Co., Ltd. (JMC)

9.10.1 Profile

9.10.2 Jiangling Holdings Limited

9.10.3 Refrigerated Truck

9.10.4 Capacity Distribution

9.11 Henan Xinfei Special Purpose Vehicle Co., Ltd.

9.11.1 Profile

9.11.2 Sales Volume of Refrigerated Truck

9.12 Zhengzhou Hongyu Special Vehicle Co., Ltd.

9.12.1 Profile

9.12.2 Refrigerated Truck

10. Refrigeration Equipment Market

10.1 Overview

10.2 Regional Distribution

10.3 Competitive Landscape

11. Refrigeration Equipment Manufacturers

11.1 Dalian Refrigeration Co., Ltd

11.1.1 Profile

11.1.2 Operation

11.1.3 Revenue Structure

11.1.4 Gross Margin

11.1.5 Main Products

11.1.6 Integration of Resources

11.2 Yantai Moon Co., Ltd

11.2.1 Profile

11.2.2 Operation

11.2.3 Revenue Structure

11.2.4 Gross Margin

11.2.5 Main Products

11.3 Guangzhou Baier Cold-Chain Polyurethane Technology Co., Ltd.

11.3.1 Profile

11.3.2 Main Business

11.4 Zhengzhou Kaixue Cold Chain Co., Ltd.

11.4.1 Profile

11.4.2 Operation

11.4.3 Revenue Structure

11.4.4 Gross Margin

11.4.5 Main Products and Customers

11.5 China Railway Tielong Container Logistics Co., Ltd

11.5.1 Profile

11.5.2 Operation

11.5.3 Revenue Structure

11.5.4 Gross Margin

11.5.5 Cold Chain Business

冷链物流基本示意图

适用冷链的食品分类及适宜温度

冷库分类

新国标对运输易腐食品以及生物制品的冷藏车分类

国内外冷链发展情况对比

中国冷链物流各产业链代表企业

近年中国冷链物流相关行业政策

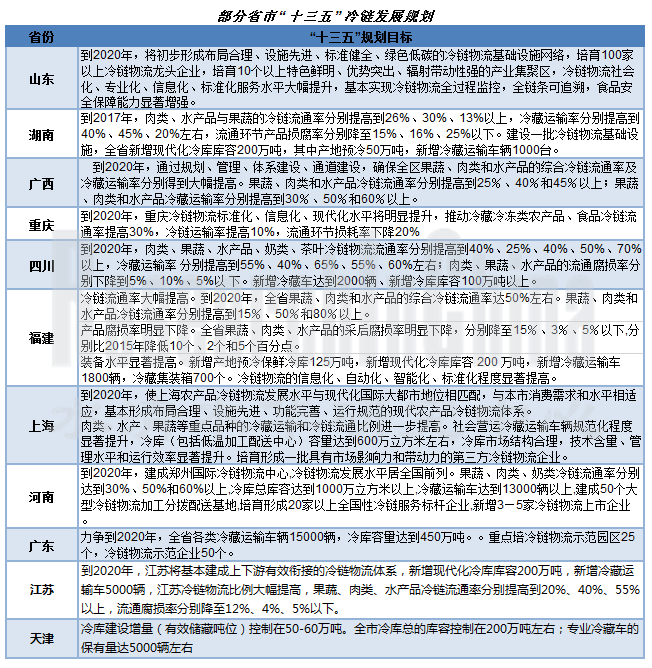

主要省市“十三五”冷链发展规划

冷链物流基础标准

中国冷库相关标准

中国冷冻冷藏设备类标准

中国与发达国家冷链建设对比

2010-2017年中国冷链物流市场规模

2015-2022年中国冷链物流市场规模预测

2011-2022年中国冷链流通量

2011-2022年中国冷链流通市场结构

2010-2017年长三角地区两省一市GDP及同比增速

2011-2017年长三角地区两省一市主要冷链产品产量

2011-2017年长三角地区两省一市冷链需求量

2010-2017年广东省GDP

2011-2017年广东省农副产品产量

2011-2017年广东省冷链需求

2010-2017年京津冀地区GDP及同比增速

2011-2017年京津冀地区冷链需求

各冷链品类情况概要

各类肉品冷链情况概要

2010-2017年中国肉产量

2011-2022年中国肉类冷链流通及运输量

冷冻水产品冷链流通过程

2010-2017年中国水产品产量

2011-2022年中国水产品冷链流通及运输量

速冻米面食品冷链物流图

2007-2017年中国速冻米面产量

2011-2022年中国速冻米面冷链流通量

果蔬产品冷链物流图

2010-2017年中国水果产量

2010-2017年中国蔬菜产量

2011-2022年中国果蔬冷链流通及运输量

不同种类乳制品流通特点

2010-2017年中国牛奶产量

2010-2017年中国奶制品产量

2010-2017年中国冷冻饮品产量

2007-2022年中国奶制品冷链需求

药品温度分类和冷链药品范围

冷链药品根据药品温空条件分类

医药冷链物流相关政策及发展历程

2010-2017年中国医药行业市场规模

2010-2017年中国生物制药冷链市场规模

中国生鲜电商产业链

2017年中国生鲜电商产业链图谱

2017中国生鲜电商行业供应链分析

中国生鲜电商行业周期

2013-2020年中国生鲜电商交易规模总额及增长率

冷库种类

中国部分产品冷链流通率及运输率

2010-2017年中国冷库总容量

2017年中国冷库容量结构,依温度分

2017年中国冷库容量结构,依使用者分

2017年中国冷库容量结构,依储存商品分

2010-2017年中国冷库供求量(百万立方米)

2017年中国主要省份冷库容量分布

2017年中国冷库运营企业TOP10

2015-2022年中国冷库容量需求预测表

鲜易控股三大产业业务介绍

众品产地物流中心

众品销地物流中心

众品公司主要加工及制造基地分布图

河南鲜易供应链股份有限公司业务据点

郑明物流冷链服务项目及范围

郑明物流最后一公里冷链配送业务

盖世集团主要业务

沈阳副食集团主要冷库分布基地

恒伟股份运输服务网络

恒伟股份主要冷库情况

太古冷链仓储及处置业务

太古冷链增值业务

太古冷链主要冷库区域分布情况

太古冷链主要已建冷库项目容量以及投资情况

广东太古冷库设施概况

招商美冷冷链网络

招商美冷国内主要冷库列表

康新物流营运网络情况

领鲜物流的输配送网络

领鲜物流主要冷藏库

荣庆集团主要合作伙伴

荣庆集团主要业务

2009-2017年光明地产营业收入及净利润

2015-2017年光明地产主要产品收入结构

2015-2017年光明地产主要地区收入结构

2015-2017年光明地产毛利率

2009-2017年锦江国际营业收入与净利润

2009-2017年锦江国际主要业务收入结构

2009-2017年锦江国际毛利率

2007-2017锦江国际低温物流主营业务收入、成本及毛利率

新天天基本资料

新天天冷链配套设备

新天天冷链物流路线安排

新天天主要客户

2009-2017年中外运营业收入与净利润

2009-2015年中外运主要业务收入结构

2016-2017年中外运主要业务收入结构

2009-2017年中外运主要业务地区结构

中外运上海冷链物流中心

中外运普菲斯在华冷库分布

中外运普菲斯在华冷库详情

海航冷链重点客户

2012-2017H1年海航冷链营业收入及净利润

2012-2017年海航冷链毛利率

海航冷链“轴与辐条”模式运输网络

海航冷链主要仓储分布

海航冷链配备的主要专业冷藏车辆

二商西冷主要冷库

二商福岛冷藏及冷冻陈列柜

北京三新主要运输线路

湖南红星冷冻食品有限公司主要合作客户

辽宁省大连海洋渔业集团公司航运公司船只情况

杭州联合肉类冷藏有限公司冷库

武汉万吨冷链物流有限公司主营业务介绍

2014-2017年中国冷藏车销量

2017-2022年中国冷藏车销售量预测

2014-2022年中国冷藏车保有量预测

2017年中国冷藏车地区保有量分布

2017年中国冷藏车销售排名

中国主要冷藏车厂商配套情况

2009-2017年福田汽车营业收入与净利润

2015-2017年福田汽车主营业务收入(分产品)构成

2009-2017年福田汽车营业收入(分区域)构成

2015-2017年福田汽车毛利率

2010-2017年江淮营业收入及净利润

2010-2017年江淮毛利率

2017年江淮主要产品收入及占比

2017年江淮主要卡车产能分布

2011-2017年东风集团营业收入及净利润

2011-2017年东风汽车毛利及毛利率

2015-2017年东风汽车主要业务营业收入

2017年东风汽车产销量

东风集团卡车产能分布

东风汽车天锦冷藏车部分车型性能参数

2010-2017年庆铃汽车营业收入及净利润

2010-2017年庆铃汽车毛利率

2015-2017年江淮汽车主要产品收入

庆铃冷藏车主要底盘性能参数

一汽解放冷藏车主要性能参数

一汽集团主要卡车生产基地

冰熊车辆主要冷藏保温汽车生产基地

中集车辆半挂冷藏车主要技术参数

中集车辆改装冷藏车主要技术参数

镇江康飞主要冷藏车产品一览

镇江飞驰汽车集团有限责任公司销售网络

镇江飞驰部分冷藏运输车技术指标

2010-2017年江铃股份营业收入及净利润

2010-2017年江铃股份毛利率

2015-2017年江铃股份主要产品收入及占比

江铃汽车主要冷藏车一览

2017年江铃集团主要卡车产能分布

新飞主要冷藏保温汽车一览

郑州红宇专用汽车有限责任公司冷藏车主要参数

2016-2017年中国商超百强冷柜需求量

2016-2017年中国商超百强冷柜需求分类

2014-2017年中国制冰机销量

2017年中国主要地区冷柜销售分布

2017年中国主要地区制冰机销售分布

2017年中国商业冷柜厂商主要梯队及市占率

2009-2017年大冷股份营业收入与净利润

2009-2017年大冷股份营业收入(分区域)构成

2009-2017大冷股份毛利率

2012-2017年大冷股份工商业用制冷主机产销量及库存量

2014-2016年大冷股份主要资源整合事件

2009-2017年冰轮环境营业收入与净利润

2009-2017年冰轮环境营业收入(分业务)构成

2009-2017年冰轮环境主要业务毛利率

2012-2017年冰轮环境工商业制冷主机产销及库存量

拜尔不同冷藏车厢类型

2012-2017年凯雪冷链营业收入及净利润

2015-2016年凯雪冷链主要产品收入结构

2017年凯雪冷链主要产品收入结构

2012-2017年凯雪股份毛利率

凯雪冷链主要产品系列

凯雪冷链主要合作伙伴

2009-2017年铁龙物流营业收入及净利润

2012-2017年铁龙物流主要业务收入结构

2009-2017年铁龙物流毛利率

铁龙物流特种集装箱业务类型

Cold Chain Logistics

Food Suitable for Cold Chain and Optimum Temperature

Classification of Cold Storage Facilities

Classification of Refrigerated Trucks Transporting Perishable Food and Biological Products by New National Standard

Comparison between Domestic and Overseas Cold Chain Logistics Development

Representative Enterprise in Cold-chain Industry Chain in China

Policies for Cold Chain Logistics Industry in China

13th Five-Year Plan for Cold Chain Development in Major Provinces and Cities of China

Basic Standards for Cold Chain Logistics

Standards for Cold Storage Facilities in China

Standard for Freezing Equipment in China

Cold Chain Construction in China VS Developed Countries

Market Size of Cold Chain Logistics in China, 2010-2017

Market Size of Cold Chain Logistics in China, 2015-2022E

Cold Chain Circulation in China, 2011-2022E

Cold Chain Circulation Market Structure in China, 2011-2022E

GDP and YoY Growth of Two Provinces and One Municipality in Yangtze River Delta Region, 2010-2017

Output of Major Cold Chain Products of Two Provinces and One Municipality in Yangtze River Delta Region, 2011-2017

Cold Chain Demand from Two Provinces and One Municipality in Yangtze River Delta Region, 2011-2017

Guangdong’s GDP, 2010-2017

Guangdong’s Output of Agricultural and Sideline Products, 2011-2017

Guangdong’s Demand for Cold Chain, 2011-2017

GDP and YoY Growth of Beijing-Tianjin-Hebei Region, 2010-2017

Cold Chain Demand from Beijing-Tianjin-Hebei Region, 2011-2017

Overview of Cold Chain Products

Overview of Meat Products Cold Chain Logistics

Output of Meat Products in China, 2010-2017

Cold Chain Circulation and Transport Volume of Meat Products in China, 2011-2022E

Cold Chain Logistics Process of Frozen Aquatic Products

Output of Aquatic Products in China, 2010-2017

Cold Chain Circulation and Transport Volume of Aquatic Products in China, 2011-2022E

Cold Chain Logistics Process of Quick-frozen Flour Food

China’s Output of Quick-frozen Flour Food, 2007-2017

Cold Chain Circulation Volume of Quick-frozen Flour Food in China, 2011-2022E

Cold Chain Logistics Process of Fruits and Vegetables

Output of Fruits in China, 2010-2017

Output of Vegetables in China, 2010-2017

Cold Chain Circulation and Transport Volume of Fruits and Vegetables in China, 2011-2022E

Circulation Diagram of Dairy Products by Type

Output of Liquid Milk in China, 2010-2017

Output of Dairy Products in China, 2010-2017

Output of Frozen Drinks in China, 2010-2017

Demand for Dairy Product Cold Chain in China, 2007-2022E

Drug Classification by Temperature and Cold Chain Drug Range

Classification of Cold Chain Drugs by Temperature and Air Conditions

Polices on Pharmaceuticals Cold Chain Logistics and Their Development Courses in China

China Biopharmaceutical Market Size, 2010-2017

Chinese Biopharmaceutical Cold Chain Market Size, 2010-2017

Fresh Food Ecommerce Industry Chain in China

Fresh Food Ecommerce Industry Chain Map in China, 2017

Fresh Food E-commerce Industry Supply Chain in China, 2017

Fresh Food E-commerce Industry Cycle in China

Total Transaction Size and YoY Growth in Fresh Food E-commerce Market in China, 2013-2020E

Cold Storage Classification

Cold Chain Circulation Rate and Refrigerated Transport Rate of Some Commodities in China

Total Capacity of Cold Storage in China, 2010-2017

Capacity Structure of Cold Storage in China by Temperature, 2017

Capacity Structure of Cold Storage in China by User, 2017

Capacity Structure of Cold Storage in China by Storage Commodity, 2017

Demand for Cold Storage in China, 2010-2017

Cold Storage Capacity Distribution in Major Provinces of China, 2017

Top 10 Cold Storage Operators in China, 2017

Cold Storage Capacity Demand in China, 2015-2022E

Three Industrial Businesses of Xianyi Holdings

Zhongpin’s Logistics Centers in Places of Production

Zhongpin’s Logistics Centers in Places of Sales

Distribution of Zhongpin’s Major Processing and Manufacturing Bases

Business Presence of Henan Xianyi Supply Chain Co., Ltd.

Cold Chain Service Projects and Scope of ZM Logistics

Last Kilometer Cold Chain Distribution Business of ZM Logistics

Main Business of Gaishi Group

Distribution of Main Cold Storage Facilities of Shenyang Nonstaple

Transportation Service Network of Hengwei Supply Chain Management

Main Cold Storage Facilities of Hengwei Supply Chain Management

Storage & Handling Business of Swire

Swire’s Cold Chain Value-added Service

Distribution of Swire’s Main Cold Storage Facilities by Region

Swire’s Main Existing and Ongoing Cold Storage Capacity and Investment Situation

Guangdong Swire Cold Chain Logistics’ Facilities

Cold Chain Network of CMAC

Main Cold Storage Facilities of CMAC

Operation Network of Kangxin Logistics Co., Ltd.

Distribution Network of Speed Fresh Logistics

Main Cold Storage Facilities of Speed Fresh Logistics

Major Partners of CJ Rokin

Principal Business of CJ Rokin

Revenue and Net Income of Bright Real Estate, 2009-2017

Revenue Structure of Bright Real Estate by Product, 2015-2017

Revenue Structure of Bright Real Estate by Region, 2015-2017

Gross Margin of Bright Real Estate, 2015-2017

Revenue and Net Income of Jinjiang International, 2009-2017

Revenue Structure of Jinjiang International Industrial Investment by Sector, 2009-2017

Gross Margin (%) of Jinjiang International, 2009-2017

Operating Revenue, Costs and Gross Margin of Low Temperature Logistics Business of Jinjiang International Industrial Investment, 2007-2017

Major Cold Chain Equipment Matching of Xintiantian

Cold Chain Logistics Routes of Xintiantian

Major Customers of Xintiantian

Revenue and Net Income of Sinotrans, 2009-2017

Revenue Structure of Sinotrans by Product, 2009-2015

Revenue Structure of Sinotrans by Product, 2016-2017

Revenue Structure of Sinotrans by Region, 2009-2017

Shanghai Cold Chain Logistics Center of Sinotrans

Distribution of SinotransPFS’ Facilities in China

SinotransPFS’ Facilities in China

Key Customers of HNA Cold Chain

Revenue and Net Income of HNA Cold Chain, 2012-2017H1

Gross Margin of HNA Cold Chain, 2012-2017

“Hub and Spoke” Transport Network of HNA Cold Chain

Main Warehouses of HNA Cold Chain

Main Refrigerated Trucks of HNA Cold Chain

Main Cold Storage Facilities of Beijing Er-shang Group Xijiao Food Freezing Factory

Chilling and Freezing Showcase of Beijing Er Shang-Fukushima Machinery Electric

Main Transport Routes of Beijing Sanxin Refrigeration Logistics

Major Partners of Hunan Hongxing Frozen Food

Ships of Liaoning Dalian Ocean Fishery Group

Cold Storage of Hangzhou NF United Meat Cold Store

Operating Business of Wuhan Wandun Cold Storage Logistics Co., Ltd.

Sales Volume of Refrigerated Trucks in China, 2014-2017

Sales Volume of Refrigerated Trucks in China, 2017-2022E

Ownership of Refrigerated Trucks in China, 2014-2022E

Ownership of Refrigerated Trucks by Region in China, 2017

Ranking List of Refrigerated Truck Sales in China, 2017

Supporting of Major Refrigerated Truck Companies in China

Revenue and Net Income of BeiQi Foton Motor, 2009-2017

Operating Revenue of BeiQi Foton Motor by Product, 2015-2017

Revenue of BeiQi Foton Motor by Region, 2009-2017

Gross Margin of BeiQi Foton Motor, 2015-2017

JAC’s Revenue and Net Income, 2010-2017

JAC’s Gross Margin, 2010-2017

JAC's Revenue Structure and Gross Margin by Product, 2017

Truck Capacity Distribution of JAC, 2017

Dongfeng Motor's Revenue and Net Income, 2011-2017

Dongfeng Motor's Gross Profit and Gross Margin, 2011-2017

Dongfeng Motor's Revenue Breakdown by Business, 2015-2017

Production and Sales Volume of Dongfeng Group, 2017

Truck Capacity Distribution of Dongfeng Motor

Performance Parameters of Tianjin Refrigerated Truck Models of Dongfeng Motor

Qingling Motors’ Revenue and Net Income, 2010-2017

Qingling Motors’ Gross Margin, 2010-2017

Qingling Motors’ Revenue Breakdown by Product, 2015-2017

Performance Parameters of Qingling Motors’ Refrigerated Truck Chassis

Performance Parameters of FAW Jiefang’s Refrigerated Trucks

Main Truck Production Bases of FAW Group

Bingxiong's Main Refrigerated and Insulated Truck Production Bases

Technical Parameters of CIMC Vehicles’ Semi-trailers

Technical Parameters of CIMC Vehicles’ Refitted Semi-trailers

List of KF Mobile Systems’ Refrigerated Trucks

Marketing Network of Zhenjiang Speed

Technical Indicators of Some Refrigerated Trucks of Zhenjiang Speed

Jiangling Motors’ Revenue and Net Income, 2010-2017

Jiangling Motors’ Gross Margin, 2010-2017

Jiangling Motors’ Revenue Structure by Product, 2015-2017

Main Refrigerated Trucks of JMC

Truck Capacity Distribution of Jiangling Motors, 2017

Main Refrigerated and Insulated Trucks of Xinfei Special Purpose Vehicle

Main Parameters of Hongyu’s Refrigerated Trucks

Demand of Top 100 Refrigerators of Supermarkets and Department Stores in China, 2016-2017

Classification of Demand for Top 100 Refrigerators of Supermarkets and Department Stores in China, 2016-2017

Sales Volume of Ice Machines in China, 2014-2017

Sales Distribution of Refrigerators in Major Regions in China, 2017

Sales Distribution of Ice Machines in Major Regions in China, 2017

Major Echelon and Market Occupancy of Commercial Cabinet Manufacturers in China, 2017

Revenue and Net Income of Dalian Refrigeration, 2009-2017

Revenue of Dalian Refrigeration by Region, 2009-2017

Gross Margin of Dalian Refrigeration, 2009-2017

Output, Sales Volume and Inventory of Commercial Refrigeration Machine of Dalian Refrigeration, 2012-2017

Major Resources Integration Events of Dalian Refrigeration, 2014-2016

Revenue and Net Income of Yantai Moon, 2009-2017

Revenue Structure of Yantai Moon by Business, 2009-2017

Gross Margin of Yantai Moon by Main Business, 2009-2017

Output, Sales Volume, Inventory of Commercial Refrigeration Machine of Yantai Moon, 2012-2017

Baier’s Various Refrigerator Van Types

Revenue and Net Income of Kaixue Cold Chain, 2012-2017

Revenue of Kaixue Cold Chain by Product, 2015-2016

Revenue of Kaixue Cold Chain by Product, 2017

Gross Margin of Kaixue, 2012-2017

Main Product Series of Kaixue Cold Chain

Major Partners of Kaixue Cold Chain

Revenue and Net Income of CRT, 2009-2017

Revenue of CRT by Business, 2012-2017

Gross Margin of CRT, 2009-2017

Special Container Business Types of CRT

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|