|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2018-2022年中国自动化物流装备行业研究报告 |

|

字数:5.3万 |

页数:172 |

图表数:199 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:3300美元 |

英文纸版:3500美元 |

英文(电子+纸)版:3600美元 |

|

编号:CYH075

|

发布日期:2018-06 |

附件:下载 |

|

|

|

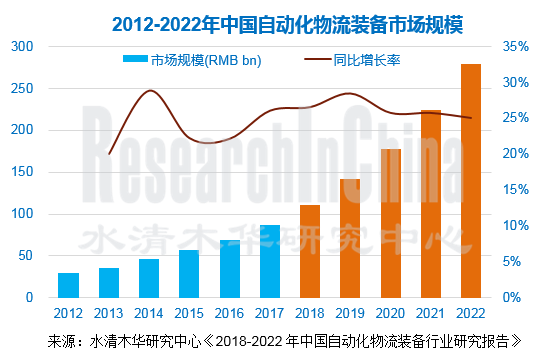

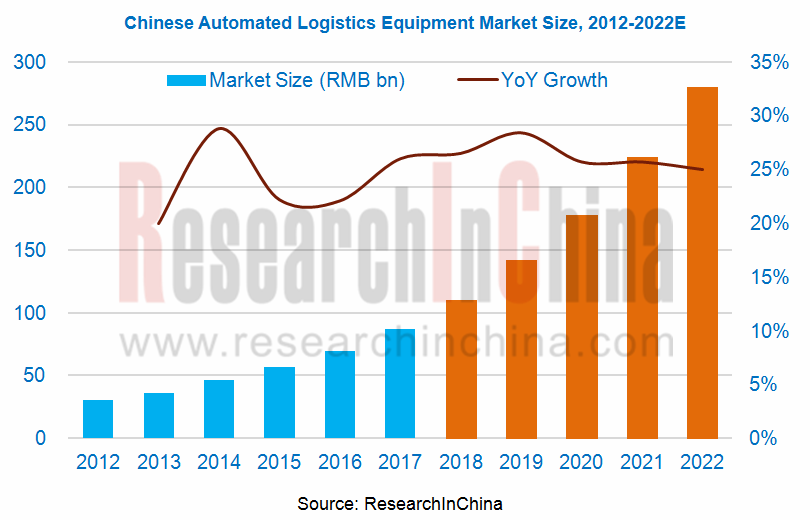

2017年是中国自动化物流装备市场发展普及快速的一年, 全年市场规模同比增长26.0%至872亿元,2018年有望突破1000亿元。在中国智能自动化装备政策红利以及智慧物流、电商物流以及冷链物流等新兴物流方式的快速发展的推动下,未来五年,其市场规模年均增速有望保持在25%左右,至2022年其市场规模将达到2797亿元。

细分产品方面,目前自动化分拣与输送装备市场普及度最高,2017年其市场规模占中国物流装备总规模的35.0%;其次为自动化立体仓库,占比约20%。未来,智能化、一体化等将是自动化物流装备产品的主要发展趋势,在技术创新的推动下,不断有各种新型物流装备产品的面世,如无人仓、无人港、无人机、物流机器人等领先的智能化产品的试验应用等。

近年来,电商、医药、服装、汽车、家电、新能源、食品、家居建材、烟草、军事等众多行业领域对物流装备需求旺盛。其中汽车是中国自动化物流装备需求最大的市场,2017 年占中国自动化物流装备总规模的18.8%至163.8亿元。在新能汽车生产线项目不断落地以及白车身自动化生产系改造项目的增加的拉动下,预计至2022年中国汽车市场自动化物流装备需求规模有望提升至521.1亿元。

企业格局方面,如日本大福、德国圣菲尔、荷兰范德兰德和美国德马泰克等外资企业在中国市场仍占据主导地位,在电商、机场等高端领域占据绝对优势,大部分外资企业属于系统集成商,可提供整体解决方案。而中国本土供应商以单体设备供应商居多,主要集中在烟草、医药、电力系统、服装和食品等下游物流行业,代表企业有东杰智能、天奇股份、软控股份、三丰智能、新松机器人等。

另外,值得注意的是,在自动化物流装备大好背景下,阿里巴巴、京东、苏宁等主要电商企业也纷纷跨界布局自动化物流及装备市场,如菜鸟网络推出“新物流”,京东物流提出“下一代物流”。2017年,京东首个全流程无人仓投入使用,顺丰建设大型物流无人机总部基地等,同时,以快仓、极智嘉(Geek+)、艾瑞思等为代表的AGV企业也加速布局,进一步加剧物流自动化装备市场竞争。

水清木华研究中心《2018-2022年中国自动化物流装备行业研究报告》着重研究了以下内容:

中国自动化物流装备系统市场规模、产品结构、需求结构、竞争格局等; 中国自动化物流装备系统市场规模、产品结构、需求结构、竞争格局等;

中国自动化物流装备自动化立体仓库、自动化输送设备、AGV、叉车等细分产品发展情况、市场规模、竞争格局等; 中国自动化物流装备自动化立体仓库、自动化输送设备、AGV、叉车等细分产品发展情况、市场规模、竞争格局等;

中国汽车、烟草、医药等主要下游行业对自动化物流装备产品发展情况、需求规模及企业格局等; 中国汽车、烟草、医药等主要下游行业对自动化物流装备产品发展情况、需求规模及企业格局等;

中国物流行业、智慧物流/电商物流和冷链物流等市场发展情况及趋势 中国物流行业、智慧物流/电商物流和冷链物流等市场发展情况及趋势

全球9家自动化物流装备企业经营情况及在华发展; 全球9家自动化物流装备企业经营情况及在华发展;

中国12家自动化物流装备企业经营情况及发展战略等。 中国12家自动化物流装备企业经营情况及发展战略等。

The year 2017 witnessed rapid expansion of automated logistics equipment market in China with the size soaring by 26.0% year-on-year to RMB87.2 billion and expected to exceed RMB100 billion in 2018. Propelled by favorable policies on intelligent automated equipment and swift growth of emerging logistics methods like smart logistics, E-commerce logistics and cold-chain logistics, the market is predicted to maintain an average annual rate of around 25% over the next five years, reaching RMB279.7 billion in 2022.

Product segment: automated sorting & conveying equipment get most popularized, accounting for 35.0% of the Chinese logistics equipment market in 2017, followed by automated stereoscopic warehouse (about 20%). Automated logistics equipment will become more intelligent and integrated, and various new logistics equipment, such as unmanned warehouse, unmanned port, UAV and logistics robot, will come into being thanks to technological innovation.

There comes the robust demand for logistics equipment from E-commerce, pharmaceuticals, clothing, automobile, home appliance, new energy, food, home building material, tobacco and military sectors in recent years. Automobile is the largest market for automated logistics equipment, occupying 18.8% (the equivalent of RMB16.38 billion) of total scale of the Chinese automated logistics equipment market. As more NEV production line projects are approved and more body-in-white production lines are transformed into automated production system, the demand for automated logistics equipment from the Chinese automobile market is expected to rise to RMB52.11 billion in 2022.

Pattern of Enterprises: foreign companies like DAIFUKU (Japan), Schaefer (Germany), Vanderlande (the Netherlands) and Dematic (the United States) are still dominant in China, particularly in high-end fields (E-commerce, airport, etc.). Most of these giants are system integrators that can provide total solutions. By contrast, local Chinese suppliers provide only equipment and focus on downstream industries like tobacco, pharmaceuticals, power system, clothing and food. Typical players are Shanxi Oriental Material Handling, Miracle Automation Engineering, Mesnac, Hubei Sanfeng Intelligent Conveying Equipment and SIASUN Robot & Automation.

In addition, amid bright prospects for automated logistics equipment, major E-commerce tycoons including Alibaba, JD and Suning have made their presence in automated logistics and equipment market, such as “new logistics” launched by Cainiao and “next-generation logistics” put forward by JD. In 2017, JD put the first whole-process unmanned warehouse into use; SF began construction of large logistics UAV headquarters base. Meanwhile, AGV firms represented by Quicktron, Geek+ and Aresbots stepped up their efforts in the field, further intensifying competition in automated logistics equipment market.

China Automated Logistics Equipment Industry Report, 2018-2022 by ResearchInChina underlines the followings:

Chinese automated logistics equipment system market (size, product mix, demand structure, competitive landscape, etc.); Chinese automated logistics equipment system market (size, product mix, demand structure, competitive landscape, etc.);

Chinese automated logistics equipment market segments (automated stereoscopic warehouse, automated conveying equipment, AGV and forklift) (development, market size, competitive landscape, etc.); Chinese automated logistics equipment market segments (automated stereoscopic warehouse, automated conveying equipment, AGV and forklift) (development, market size, competitive landscape, etc.);

Automated logistics equipment in major downstream sectors like automobile, tobacco, and pharmaceuticals in China (development, demand, corporate pattern, etc.); Automated logistics equipment in major downstream sectors like automobile, tobacco, and pharmaceuticals in China (development, demand, corporate pattern, etc.);

Development of and trends in logistics, smart/E-commerce logistics, and cold-chain logistics markets in China Development of and trends in logistics, smart/E-commerce logistics, and cold-chain logistics markets in China

Operation of nine global automated logistics equipment companies and their development in China; Operation of nine global automated logistics equipment companies and their development in China;

Operation and development strategies of twelve Chinese automated logistics equipment enterprises. Operation and development strategies of twelve Chinese automated logistics equipment enterprises.

第一章 概述

1.1 自动化物流系统

1.1.1 定义

1.1.2 产业链

1.2 自动化物流装备

1.2.1 定义与分类

1.2.2 发展历程

第二章 中国自动化物流装备行业发展概况

2.1 政策

2.2 市场规模

2.3 产品结构

2.4 市场需求

2.5 竞争格局

2.6 发展趋势

第三章 自动化物流装备细分产品发展情况

3.1自动化立体仓库

3.1.1 概述

3.1.2 自动化立体仓库VS普通仓库

3.1.3 市场规模

3.1.4 市场需求

3.1.5 竞争格局

3.2 自动搬运车(AGV)

3.2.1 市场规模

3.2.2 需求结构

3.2.3 竞争格局

3.2.4 发展趋势

3.3 自动化分拣设备

3.3.1 市场规模

3.3.2 产品结构

3.3.3 竞争格局

3.4 自动化输送设备

3.4.1 市场规模

3.4.2 需求结构

3.4.3 企业格局

3.5 码垛机器人

3.5.1 市场规模

3.5.2 竞争格局

3.6 叉车

3.6.1 产销量

3.6.2 产品格局

3.6.3 地区格局

3.6.4 竞争格局

3.6.5 发展趋势

第四章 自动化物流装备主要下游行业需求

4.1 汽车

4.1.1 发展概况

4.1.2 需求规模

4.1.3 企业格局

4.1.4 发展趋势

4.2 烟草行业

4.2.1 发展概况

4.2.2 需求规模

4.3 医药行业

4.3.1 发展概况

4.3.2 需求规模

4.3.3 发展趋势

第五章 中国物流系统市场发展情况

5.1 物流行业发展

5.2 智慧物流发展

5.2.1 发展概况

5.2.2 发展趋势

5.3 快递电商物流

5.3.1 发展概况

5.3.2 物流建设

5.4 冷链物流

5.4.1 发展概况

5.4.2 冷链物流相关设备发展

5.5 仓储与物流园区建设

5.6 发展趋势

第六章 全球主要自动化物流装备企业

6.1 大福(Daifuku)

6.1.1 企业简介

6.1.2 经营情况

6.1.3 在华发展

6.2 胜斐迩

6.2.1 企业简介

6.2.2 经营情况

6.2.3 在华发展

6.3 瑞仕格

6.3.1 企业简介

6.3.2 经营情况

6.3.3 仓储及配送解决方案

6.3.4 在华发展

6.4 德马泰克

6.4.1 企业简介

6.4.2 经营情况

6.4.3 在华发展

6.5 Muratec(Murata Machinery)

6.5.1 企业简介

6.5.2 经营情况

6.5.3 在华发展

6.6 TGW

6.6.1 企业简介

6.6.2 经营情况

6.6.3 在华发展

6.7 英特诺

6.7.1 企业简介

6.7.2 经营情况

6.7.4 在华发展

6.8 科纳普

6.8.1 企业简介

6.8.2 经营情况

6.8.3 在华发展

6.9 Vanderlande

6.9.1 企业简介

6.9.2 经营情况

6.9.3 在华发展

第七章 中国主要自动化物流装备企业

7.1 东杰智能

7.1.1 企业简介

7.1.2 经营情况

7.1.3 在建项目

7.1.4 发展前景

7.2 天奇股份

7.2.1 企业简介

7.2.2 经营情况

7.2.3 物流自动化装备业务

7.2.4 发展前景

7.3 今天国际

7.3.1 企业简介

7.3.2 经营情况

7.3.3 在建项目

7.4 软控股份

7.4.1 企业简介

7.4.2 经营情况

7.4.3 在建项目

7.4.4 物流自动化装备业务

7.5 安徽合力

7.5.1 企业简介

7.5.2 经营情况

7.5.3 物流自动化装备业务

7.6 诺力股份

7.6.1 企业简介

7.6.2 经营情况

7.6.3 在建项目

7.6.4 产销量

7.7 德马科技

7.7.1 企业简介

7.7.2 经营情况

7.8 永利股份

7.8.1 企业简介

7.8.2 经营情况

7.8.3 物流自动化装备业务

7.9 新松机器人

7.9.1 企业简介

7.9.2 经营情况

7.9.3 物流自动化装备业务

7.10 三丰智能

7.10.1 企业简介

7.10.2 经营情况

7.10.3 物流自动化装备业务

7.11 东方精工

7.11.1 企业简介

7.11.2 经营情况

7.11.3 智能仓储设备业务

7.12 昆船装备

1. Overview

1.1 Automated Logistics System

1.1.1 Definition

1.1.2 Industry Chain

1.2 Automated Logistics Equipment

1.2.1 Definition and Classification

1.2.2 Development History

2. Development of China’s Automated Logistics Equipment Industry

2.1 Policy

2.2 Market Size

2.3 Product Mix

2.4 Market Demand

2.5 Competitive Landscape

2.6 Development Trend

3. Development of Automated Logistics Equipment Product Segments

3.1 Automated Stereoscopic Warehouse

3.1.1 Overview

3.1.2 Automatic Stereoscopic Warehouse VS General Warehouse

3.1.3 Market Size

3.1.4 Market Demand

3.1.5 Competitive Landscape

3.2 Automated Guided Vehicle (AGV)

3.2.1 Market Size

3.2.2 Demand Structure

3.2.3 Competitive Landscape

3.2.4 Development Trend

3.3 Automated Sorter

3.3.1 Market Size

3.3.2 Product Mix

3.3.3 Competitive Landscape

3.4 Automated Conveyor

3.4.1 Market Size

3.4.2 Demand Structure

3.4.3 Corporate Competition

3.5 Palletizing Robot

3.5.1 Market Size

3.5.2 Competitive Landscape

3.6 Forklift

3.6.1 Output and Sales Volume

3.6.2 Product Competition

3.6.3 Regional Competition

3.6.4 Competition Pattern

3.6.5 Development Trend

4. Demand from Main Downstream Sectors of Automated Logistics Equipment

4.1 Automobile

4.1.1 Development

4.1.2 Demand

4.1.3 Corporate Competition

4.1.4 Development Trend

4.2 Tobacco

4.2.1 Development Overview

4.2.2 Demand

4.3 Pharmaceuticals

4.3.1 Development

4.3.2 Demand

4.3.3 Development Trend

5. Development of China’s Logistics Market

5.1 Development of Logistics Industry

5.2 Development of Intelligent Logistics

5.2.1 Development Overview

5.2.2 Development Trend

5.3 Express Delivery & E-commerce Logistics

5.3.1 Development Overview

5.3.2 Logistics Construction

5.4 Cold-chain Logistics

5.4.1 Development

5.4.2 Development of Cold-chain Logistics-related Equipment

5.5 Warehousing and Logistics Park Construction

5.6 Development Trend

6. Major Global Automated Logistics Equipment Suppliers

6.1 Daifuku

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 SSI Schaefer

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 Swisslog

6.3.1 Profile

6.3.2 Operation

6.3.3 Warehousing & Logistics Business

6.3.4 Development in China

6.4 DEMATIC

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Muratec (Murata Machinery)

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 TGW

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Interroll

6.7.1 Profile

6.7.2 Operation

6.7.4 Development in China

6.8 KNAPP AG

6.8.1 Profile

6.8.2 Operation

6.8.3 Development in China

6.9 Vanderlande

6.9.1 Profile

6.9.2 Operation

6.9.3 Development in China

7. Major Chinese Automated Logistics Equipment Suppliers

7.1 Shanxi Oriental Material Handling Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Projects under Construction

7.1.4 Development Prospects

7.2 Miracle Automation Engineering Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Automated Logistics Equipment Business

7.2.4 Development Prospects

7.3 New Trend International Logis-Tech Co., Ltd

7.3.1 Profile

7.3.2 Operation

7.3.3 Projects under Construction

7.4 MESNAC (002073)

7.4.1 Profile

7.4.2 Operation

7.4.3 Projects under Construction

7.4.4 Automated Logistics Equipment Business

7.5 Anhui Heli Co., Ltd. (600761)

7.5.1 Profile

7.5.2 Operation

7.5.3 Automated Logistics Equipment Business

7.6 Zhejiang Noblelift Equipment Joint Stock Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.5 Projects under Construction

7.6.4 Output and Sales Volume

7.7 Damon

7.7.1 Profile

7.7.2 Operation

7.8 YongLi (300230)

7.8.1 Profile

7.8.2 Operation

7.8.3 Automated Logistics Equipment Business

7.9 Siasun

7.9.1 Profile

7.9.2 Operation

7.9.3 Automated Logistics Equipment Business

7.10 Sanfeng Intelligent Conveying Equipment Co., Ltd. (300276)

7.10.1 Profile

7.10.2 Operation

7.10.5 Automated Logistics Equipment Business

7.11 Guandong Dongfang Precision Science & Technology (002611)

7.11.1 Profile

7.11.2 Operation

7.11.3 Intelligent Warehousing Equipment Business

7.12 KSEC Logistics & Information Industry Co. Ltd.

图:自动化物流系统细分结构

图:自动化物流系统构成

图:自动化物流系统产业链

图:自动化物流装备主要产品

图:自动化物流分类

图:中国自动化物流系统及设备发展历程

表:2008-2018年中国自动化物流装备行业相关政策

图:2012-2022年中国自动化物流装备市场规模

图:2013-2022年中国自动化物流装备系统(分设备)规模结构

图:中国自动化物流装备系统主要下游行业普及率

图:2013-2022年中国自动化物流装备(分下游)需求结构

图:中国自动化物流装备主要客户分布

表:2015-2017年全球TOP20自动化物流供应商销售额

表:2018年中国主要自动化物流装备生产商及业务领域

图:中国物流自动化设备细分行业龙头企业

表:中国自动化物流装备主要发展趋势

图:自动化立体仓库构成

表:自动化立体仓库分类

图:1975-2017年中国自动化立体仓库发展历程

图:自动化仓库VS普通仓库

表:自动化立体仓库与普通仓库固定投入及成本比较

表:自动化立体仓库与普通仓库成本比较

图:2012-2022年中国自动化立体仓库市场规模

表:立体仓库设备投资明细

表:中国自动化立体仓库(分行业)设备提供商

图:中国自动化立体仓库(分行业)主要企业

图:2011-2022年中国AGV每年新增量及同比增长率

图:2017年物流AGV市场(分行业)需求结构

图:全球主要国家汽车AGV使用密度

图:2016年中国AGV(分企业)市场份额

图:2017年中国AGV生产商TOP10

图:AGV相关供应商

图:AGV未来发展趋势

图:2013-2022年中国自动化分拣设备市场规模

图:中国主流快递企业日均快递分拣量

图:自动化分拣设备产品发展趋势

表:自动化分拣设备(分类别)企业分布

图:中国主要自动化分拣设备生产商

表:全球及中国主要供应商交叉带分拣机产品性能及客户

图:2013-2022年中国自动化输送设备市场规模

图:中国自动化输送设备(分行业)需求结构

表:码垛机器人VS机械式码垛机

图:2015-2020年中国搬运码垛机器人销量及保有量

图:2017年中国码垛机器人生产企业分布

图:2009-2017年中国叉车产量

图:2012-2022年中国叉车销量及同比增长率

图:2007-2017年中国叉车出口量在总销量中的比重

表:2010-2017年中国叉车销量(分产品)

表:2017年中国叉车(分地区)销售市场份额

表:2009-2016年中国两大叉车集团市场份额

图:2012-2022年中国汽车保有量

图:2012-2022年中国汽车产销量

图:2011-2017年中国新能源汽车产销量

图:汽车行业(分汽车制造工艺)物流装备应用占比

图:汽车涂装工艺主要流程

图:汽车自动化生产线流程

表:2013-2022年中国汽车行业自动化物流装备需求规模

图:中国汽车智能物流设备市场竞争格局

表:2011-2017年中国主要汽车物流自动化装备供应商该领域营业收入

表:2012-2022年中国汽车新增及改造汽车生产线

图:2014-2022年中国卷烟销量

表:烟草行业智能物流解决方案

表:2013-2022年中国烟草行业自动化物流装备需求规模

图:2010-2022年中国药品流通行业销售总额

图:2013-2022年中国医药物流对自动化物流装备需求规模

图:2010-2018年中国社会物流总额

图:2010-2022年中国智慧物流市场规模

图:2014-2022年中国网络零售总额及占比

图:2008-2017年中国社会物流总费用与GDP的比率

图:2010-2022年中国规模以上快递业务量

图:中国主要网络购物平台

图:2015-2018年中国电商物流运行指数

表:中国电商企业物流及配送方式对比、发展趋势

图:2017年中国主要电商自建物流企业

表:2018年中国主要电商物流建设情况

表:中国主要物流企业物流建设规划

表:2017中国主要物流企业建设情况

图:206-2017年中国主要物流企业(按业务量)市场份额

图:2015-2022年中国冷链物流市场规模预测

图:冷链客户分类

图:2010-2017年中国冷库总容量

图:2017年中国冷库容量结构,依储存商品分

图:2010-2017年中国冷库供求量(百万立方米)

图:2015-2022年中国冷藏车销售量预测

表:2014-2022年中国冷藏车保有量预测

表:2016-2017年中国商超百强冷柜需求量

图:2014-2017年中国制冰机销量

图:中国物流园区投资规模情况

表:中国10大国家智能化仓储物流示范基地

图:Daifuku(分地区)发展目标

图:Daifuku业务结构

图:2010-2017财年Daifuku净销售额与净利润

图:2014-2017财年Daifuku累计订单

表:2014-2017财年Daifuku(分行业)订单额及占比

表:2014-2017财年Daifuku(分行业)销售额及占比

图:2013-2017财年Daifuku(分地区)销售额构成

图:2014-2017财年Daifuku(分地区)订单

图:2013-2017财年Daifuku在华销售额和订单额

图:Daifuku在中国分布

图:2012-2017年胜斐迩营业收入

图:Swisslog业务及产品分布

表:2014-2017年Swisslog主要经营数据

图:2016-2017年Swisslog订单额、销售收入与营业利润率

表:2010-2017年Swisslog(分业务)订单额与销售额构成

图:2014年Swisslog及公司业务(分地区)销售额构成

图: Swisslog仓储与配送解决方案业务发展战略

图:2010-2014年Swisslog仓储与配送解决方案业务订单额与销售额

图:2013-2014年Swisslog仓储配送解决方案(分业务)营业收入构成

图:2014年Swisslog仓储与配送解决方案(分行业)订单

图:2014-2017年德马泰克营业收入

图:德马泰克中国区典型客户

图:德马泰克苏州工厂主要发展大事件

图:2012-2017年Muratec公司营业收入

图:Muratec物流解决方案

图:Muratec在华布局

表:2010-2017财年TGW公司经营情况

图:英特诺业务

图:英特诺全球布局

图:2010-2017年英特诺净销售额与净利润

图:2010-2017年英特诺(分产品)营业收入

表:2015-2017年英特诺(分地区)营业收入及构成

图:2012-2017年KNAPP营业收入

图:KNAPP部分客户

图:KNAPP在华主要子公司

图:Vanderlande主要业务

图:2012-2016年Vanderlande营业收入与EBIT

图:2012-2016年Vanderlande order book

图:东杰智能主要产品

图:2012-2018年东杰智能营业收入与净利润

表:2014-2017年东杰智能(分产品)营业收入及构成

图:2012-2017年东杰智能(分产品)毛利率

图:2012-2015年东杰智能(分地区)营业收入

图:2012-2014年东杰智能(分下游行业)营业收入构成

表:2012-2014年东杰智能(分产品)产能、产销量

表:2018年东杰智能主要在建项目

图:2017-2022年东杰智能营业收入与净利润

图:2010-2018年天奇股份营业收入与净利润

图:2015-2017年天奇股份(分产品)主营业务收入构成

图:2012-2017年天奇股份(分地区)主营业务收入

图:2012-2017年天奇股份(分产品)毛利率

图:2012-2017年天奇股份物流自动化装备系统(分产品)营业收入

表:2014-2017年天奇股份自动化物流装备子公司营业收入与净利润

图:天奇股份汽车物流装备业务主要客户

表:2014-2017年天奇股份自动化物流仓储业务布局大事件

图:2017-2022年天奇股份营业收入与净利润

图:今天国际主要解决方案

图:2017年今天国际主要子公司分布

图:2013-2018年今天国际营业收入与净利润

图:2013-2017年今天国际新增订单

图:2013-2017年今天国际在手订单

表:2017年今天国际(分应用)新增订单和在手订单

表:2016-2017年今天国际(分产品)营业收入及构成

表:2016-2017年今天国际(分地区)营业收入及构成

图:今天国际主要客户

表:2018年今天国际主要在建项目

图:2010-2018年软控股份营业收入与净利润

图:2013-2017年软控股份(分产品)主营业务收入与构成

图:2012-2017年软控股份(分地区)主营业务收入

图:2013-2017年软控股份(分产品)毛利率

表:2016年软控股份主要拟建项目

表:2010-2018年软控股份自动化物流系统发展历程

图:2012-2017年安徽合力营业收入与净利润

表:2014-2017年安徽合力(分产品)产销量

图:2013-2017年安徽合力(分产品)主营业务收入

图:2013-2017年安徽合力(分地区)主营业务收入

图:2012-2017年安徽合力(分产品)毛利率

图:诺力股份主要子公司

图:2011-2018诺力股份营业收入与净利润

图:2015-2017年诺力股份(分产品)主营业务收入

图:2013-2017年诺力股份(分地区)主营业务收入

图:2015-2017年诺力股份(分产品)毛利率

表:2018年诺力股份主要在建项目

表:2011-2017年诺力股份(分产品)产能、产销量

图:2011-2017年德马科技营业收入与净利润

图:德马科技(分行业)主要客户

表:2015-2016年德马科技(分产品)主营业务收入及构成

图:2011-2016年德马科技(分地区)主营业务收入

表:2015-2016年德马科技(分产品)毛利率

图:2012-2018年永利股份营业收入与净利润

表:2015-2017年永利股份(分产品)营业收入及构成

图:2013-2017年永利股份(分地区)营业收入

图:2015-2017年永利股份(分产品)毛利率

图:2012-2018年新松机器人营业收入与净利润

图:2014-2017年新松机器人(分产品)主营业务收入构成

图:2014-2017年新松机器人(分地区)主营业务收入构成

图:2013-2017年新松机器人(分产品)毛利率

图:新松智能物流解决方案

图:2011-2018年三丰智能营业收入与净利润

图:2012-2017年三丰智能(分产品)营业收入构成

图:2013-2017年三丰智能(分行业)营业收入构成

图:2014-2017年三丰智能(分地区)营业收入构成

图:2012-2017年三丰智能(分产品)毛利率

图:2012-2017年三丰智能智能输送成套设备业务收入

图:东方精工战略布局

图:2012-2018年东方精工营业收入与净利润

图:2014-2017年东方精工(分产品)主营业务收入构成

表:2013-2017年东方精工(分地区)主营业务收入及构成

表:东方精工智能包装物流系统布局大事件

表:2016-2017年嘉腾机器人和Ferretto公司主要经营数据

Subdivision of Automated Logistics System

Constitution of Automated Logistics System

Industrial Chain of Automated Logistics System

Main Automated Logistics Equipment Products

Classification of Automated Logistics

Policies on Automated Logistics Equipment in China, 2008-2018

Market Size of Automated Logistics Equipment in China, 2012-2022E

Market Size of Automated Logistics Equipment in China by Equipment Type, 2013-2022E

Penetration of China’s Automated Logistics Equipment and System in Downstream Sectors

Demand Structure of Automated Logistics Equipment in China by Application, 2013-2022E

Distribution of Major Automated Logistics Equipment Clients in China

Ranking of Top 20 Global Automated Logistics Suppliers by Sales, 2015-2017

Business Domains of Main Automated Logistics Equipment Manufacturers in China, 2018

Leading Enterprises in Automated Logistics Equipment Industry Segments in China

Major Development Trends in Automated Logistics Equipment in China

Classification of Automatic Stereo Warehouse

Development History of Automated Stereoscopic Warehouse in China, 1975-2017

Automated Warehouse VS Conventional Warehouse

Market Size of Automatic Stereo Warehouse in China, 2012-2022E

Automatic Stereo Warehouse Equipment Suppliers (by Sector) in China

Major Automatic Stereo Warehouse Enterprises in China by Sector

Annual Increment and YoY Growth of AGVs in China, 2011-2022E

Demand Structure of Logistics AGV Market by Sector, 2017

Usage Density of Automotive AGVs in Major Countries Worldwide

Market Share of AGVs in China by Enterprise, 2016

AGV Suppliers

Future Development Trend in AGVs

Market Size of Automated Sorters in China, 2013-2022E

Daily Sorting Quantity of Mainstream Express Enterprises in China, 2015

Development Trend in Automated Sorters

Major Automated Sorter Manufactures in China

Market Size of Automated Conveyors in China, 2013-2022E

Demand Structure of Automated Conveyors in China by Sector

Sales Volume and Ownership of Palletizing Robots in China, 2015-2020E

Distribution of Palletizing Robot Manufacturers in China, 2017

Output of Forklifts in China, 2009-2017

Sales Volume and YoY Growth of Forklifts in China, 2012-2022E

Proportion of Exported Forklifts in Total Sales Volume in China, 2007-2017

Sales Volume of Forklifts in China by Product, 2010-2017

Sales Volume Structure of Forklifts in China by Region, 2017

Market Share of Two Major Forklift Companies in China, 2009-2016

Ownership of Automobiles in China, 2012-2022E

Output and Sales Volume of Automobiles in China, 2012-2022E

NEV Production and Sales in China, 2011-2017

Percentage of Logistics Equipment Applied in Automotive Industry by Automobile Manufacturing Process

Main Flows of Automotive Coating Process

Flows of Automotive Automated Production Line

Demand for Automated Logistics Equipment in China’s Automobile Industry, 2013-2022E

Competitive Landscape of Automotive Intelligent Logistics Equipment Market in China

Revenue of Major Automotive Logistics Automation Equipment Suppliers, 2011-2017

New and Updated Automotive Production Lines in China, 2012-2022E

Cigarette Sales in China, 2014-2022E

Intelligent Logistics Solutions for the Tobacco Industry

Demand for Automated Logistics Equipment in China’s Tobacco Industry, 2013-2022E

Total Amount of Goods in China’s Drug Circulation, 2010-2022E

Automated Logistics Equipment Demand from Pharmaceutical Logistics in China, 2013-2022E

China’s Total Social Logistics, 2010-2018E

Market Size of Intelligent Logistics in China, 2010-2022E

Market Size and YoY Growth of Online Retails in China, 2014-2022E

Ratio of Total Social Logistics Costs to GDP in China, 2008-2017

Business Volume of Express Delivery Enterprises above Designated Size in China, 2010-2022E

Major Online Shopping Platforms in China

E-Logistic Index in China, 2015-2018

Development Trend and Distribution Modes of E-commerce Firms in China

Logistics Companies Established by Major E-Commerce Firms in China, 2017

Logistics Construction of Major E-commerce Firms in China, 2018

Logistics Construction Plan of Major Logistics Enterprises in China

Construction of Major Logistics Enterprises in China, 2017

Market Share of Major Logistics Enterprises in China by Business Volume, 206-2017

Market Size of Cold chain Logistics in China, 2015-2022E

Classification of Cold-Chain Clients

Total Capacity of Cold Storage in China, 2010-2017

Capacity Structure of Cold Storage in China by Storage Commodity, 2017

Demand for Cold Storage in China, 2010-2017

Sales Volume of Refrigerated trucks in China, 2017-2022E

Demand for Freezers from Top100 Supermarkets in China, 2016-2017

Ice Machine Sales in China, 2014-2017

Investment in Logistics Parks in China

Top10 National Intelligent Warehouse Logistics Demonstration Bases in China

Development Goals of Daifuku by Region

Business Structure of Daifuku

Revenue and Net Income of Daifuku, FY2010-FY2017

Order Value of Daifuku, FY2014- FY2017

Order Value of Daifuku by Sector and % of Total Revenue, FY2014-FY2017

Sales Value of Daifuku by Sector and % of Total Revenue, FY2014-FY2017

Revenue Structure of Daifuku by Region, FY2013-FY2017

Orders of Daifuku by Region, FY2014-2017

Net Sales and Orders of Daifuku in China, FY2013-FY2017

Presence of Daifuku in China

Revenue of SSI Schaefer, 2012-2017

Business and Product Distribution of Swisslog

Financials of Swisslog, 2014-2017

Order Value, Sales Revenue, and EBIT Margin of Swisslog, 2016-2017

Order Value and Sales Value of Swisslog by Business, 2010-2017

Revenue Structure of Swisslog by Region, 2014

WDS Business Development Strategy of Swisslog

WDS Order Value and Revenue of Swisslog, 2010-2014

WDS Revenue Structure of Swisslog by Business, 2013-2014

WDS Orders of Swisslog by Sector, 2014

Revenue of DEMATIC, 2014-2017

DEMATIC’s Typical Customers in China

Milestones of Dematic Logistics Systems Ltd Suzhou

Revenue of Muratec, 2012-2017

Logistics Solutions of Muratec

Business Layout of Muratec in China

Operation of TGW, FY2010-FY2017

Interroll’s Businesses

Interroll’s Global Layout

Revenue and Net Income of Interroll, 2010-2017

Revenue Breakdown of Interroll by Product, 2010-2017

Revenue Structure of Interroll by Region, 2015-2017

Revenue of KNAPP, 2012-2017

Clients of KNAPP

Major Subsidiaries of KNAPP in China

Main Business of Vanderlande

Revenue and EBIT of Vanderlande, 2012-2016

Order Book of Vanderlande, 2012-2016

Major Products of Shanxi Oriental Material Handling

Revenue and Net Income of Shanxi Oriental Material Handling, 2012-2018

Revenue Structure of Shanxi Oriental Material Handling by Product, 2014-2017

Gross Margin of Shanxi Oriental Material Handling by Product, 2012-2017

Revenue Breakdown of Shanxi Oriental Material Handling by Region, 2012-2015

Revenue Structure of Shanxi Oriental Material Handling by Application, 2012-2014

Projects under Construction of Shanxi Oriental Material Handling, 2018

Revenue and Net Income of Shanxi Oriental Material Handling, 2017-2022E

Revenue and Net Income of Miracle Automation, 2010-2018

Operating Revenue Structure of Miracle Automation by Product, 2015-2017

Operating Revenue Breakdown of Miracle Automation by Region, 2012-2017

Gross Margin of Miracle Automation by Product, 2012-2017

Logistics Automation Equipment Revenue of Miracle Automation by Product, 2012-2017

Revenue and Net Income of Automated Logistics Equipment Subsidiaries of Miracle Automation, 2014-2017

Miracle Automation’s Major Clients in Automotive Logistics Equipment

Major Events of Layout in Automated Logistics & Warehousing of Miracle Automation, 2014-2017

Revenue and Net Income of Miracle Automation, 2017-2022E

Major Solutions of New Trend International Logis-Tech

Major Subsidiaries of New Trend International Logis-Tech, 2017

Revenue and Net Income of New Trend International Logis-Tech, 2013-2018

New Orders of New Trend International Logis-Tech, 2013-2017

Orders in Hand of New Trend International Logis-Tech, 2013-2017

New Orders and Orders in Hand of New Trend International Logis-Tech by Application, 2017

Revenue Breakdown of New Trend International Logis-Tech by Product, 2016-2017

Revenue Breakdown of New Trend International Logis-Tech by Region, 2016-2017

Major Clients of New Trend International Logis-Tech

Projects under Construction of New Trend International Logis-Tech, 2018

Revenue and Net Income of MESNAC, 2010-2018

Operating Revenue Structure of MESNAC by Product, 2013-2017

Operating Revenue Breakdown of MESNAC by Region, 2012-2017

Gross Margin of MESNAC by Product, 2013-2017

Development History of MESNAC Automated Logistics System, 2010-2018

Revenue and Net Income of Anhui Heli, 2012-2017

Output and Sales Volume of Anhui Heli by Product, 2014-2017

Operating Revenue Breakdown of Anhui Heli by Product, 2013-2017

Operating Revenue Breakdown of Anhui Heli by Region, 2013-2017

Gross Margin of Anhui Heli by Product, 2012-2017

Key Subsidiaries of Noblelift Intelligent Equipment

Revenue and Net Income of Zhejiang Noblelift Equipment, 2011-2018

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Product, 2015-2017

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Region, 2013-2017

Gross Margin of Zhejiang Noblelift Equipment Joint Stock by Product, 2015-2017

Major Projects under Construction of Zhejiang Noblelift Equipment Joint Stock, 2018

Capacity, Output and Sales Volume of Zhejiang Noblelift Equipment Joint Stock by Product, 2011-2017

Revenue and Net Income of Damon, 2011-2017

Major Clients of Damon by Sector

Operating Revenue Structure of Damon by Product, 2015-2016

Operating Revenue Breakdown of Damon by Region, 2011-2016

Gross Margin of Damon by Product, 2015-2016

Revenue and Net Income of YongLi, 2012-2018

Revenue Structure of YongLi by Product, 2015-2017

Revenue Breakdown of YongLi by Region, 2013-2017

Gross Margin of YongLi by Product, 2015-2017

Revenue and Net Income of Siasun, 2012-2018

Operating Revenue Structure of Siasun by Product, 2014-2017

Operating Revenue Structure of Siasun by Region, 2014-2017

Gross Margin of Siasun by Product, 2013-2017

Siasun’s Intelligent Logistics Solutions

Revenue and Net Income of Sanfeng Intelligent Conveying Equipment, 2011-2018

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Product, 2012-2017

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Sector, 2013-2017

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Region, 2014-2017

Gross Margin of Sanfeng Intelligent Conveying Equipment by Product, 2012-2017

Intelligent Conveyor Revenue of Sanfeng Intelligent Conveying Equipment, 2012-2017

Strategic Layout of Guangdong Dongfang Precision Science & Technology

Revenue and Net Income of Guangdong Dong Fang Precision Science & Technology, 2012-2018

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Product, 2014-2017

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Region, 2013-2017

Major Events of Layout in Intelligent Packaging Logistics System of Guangdong Dong Fang Precision Science & Technology

Operating Data of Guangdong Jaten Robot & Automation and Ferretto, 2016-2017

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|